Crypto currency trading exchanges

As you’ve learned already, there are advantages and a few disadvantages when it comes to cryptocurrency exchange platforms.

Top forex bonus list

However, some of the shortcomings are only specific to certain platforms. With that in mind, it’s best to check out the best cryptocurrency exchanges to find one that you can deal with. When it comes to crypto exchanges, there’s no specific platform that fits everyone. We all have unique preferences that makes a particular crypto exchange suitable for us. With that in mind, we will take a look at some of the top cryptocurrency exchanges in 2021. Hold up?

Top 10 best cryptocurrency exchanges in 2021

When it comes to crypto exchanges, there’s no specific platform that fits everyone. We all have unique preferences that makes a particular crypto exchange suitable for us. With that in mind, we will take a look at some of the top cryptocurrency exchanges in 2021. Hold up?

Do you know what a cryptocurrency exchange is? If not, then stop here and check out our post on what is a crypto exchange. Don’t worry, we won’t start without you, and it’s a short read.

Now that you are all caught up, let’s get down to business, shall we?

Summary top 10 best crypto exchanges

As you’ve learned already, there are advantages and a few disadvantages when it comes to cryptocurrency exchange platforms. However, some of the shortcomings are only specific to certain platforms. With that in mind, it’s best to check out the best cryptocurrency exchanges to find one that you can deal with.

Additionally, most people think that trading fees, a wide selection of services and good support are important factors when choosing an exchange.

Here’s a short summary:

- Binance: worldwide the biggest exchange with high liquidity, good services and low fees.

- Bitvavo (europe only): for europeans the best exchange to exchange fiat for crypto as cheap as possible.

- Kucoin: one of the biggest exchanges worldwide, 1 on 4 traders bought their crypto here.

- Bybit: the biggest derivatives exchange in the world (very risky).

- Kraken: kraken has a big brand awareness.

- Coinbase pro: coinbase has also a big brand awareness and is having an IPO in 2021.

- Bitmex: the most populair derivatives exchange, but lost from bybit after big lawsuits.

- Huobi: all-in-one platform like binance.

- Phemex: upcoming derivatives exchange and is currently trending.

- Bitfinex: one of the oldest exchanges.

#1 binance

The company was launched back in 2017 through an ICO. And ever since then, it rose quickly to fame due to its unique features. Changpeng zhao is currently the CEO of binance. He is a well-known crypto personality in the crypto-world. The headquarters of this company can be found in malta.

Key features of binance

- Binance earn: earn a passive income by using your crypto funds to generate more coins.

- Peer to peer trading service: binance offers a space where buyers and sellers can connect directly and trade. It also facilitates several payment options for users.

- Wire transfers and creditcard: with the wire transfers, you can now buy cryptocurrencies directly from your bank account.

- Binance launchpad: invest in new crypto startups that are audited by the binance team.

- Crypto loans: binance offers users loans in USDT and BUSD while using ETH and BTC as collateral.

Unique selling point

Aside from the fact that you can trade on your smartphone, binance offers different ways to earn money through the exchange. From futures, staking, P2P trading, spot trading to binance smart pool, you name it!

The binance exchange platform offers a flat-rate fee of 0.1%. You will also get a 25% discount when you hold binance coin during trades. On top of that we’re sharing a lifetime 20% commission cashback with our readers. If you’d like to learn more about creating an account on binance, check out our binance review.

21 best US customer friendly crypto exchanges in 2021!

This is a curated list of over 20+ best US customer-friendly crypto exchanges in the blockchain industry. Exchanges listed here are all available for US customers.

Unfortunately in the land of the free, a lot of you are not actually able to trade on many of the most popular global cryptocurrency exchanges.

This is because the united states is quite strict when it comes to investment regulations and due to regulatory overhead most exchanges either don’t care to deal with them or simply don’t have the means to do so. Leaving US customers scratching their heads as how to lawfully participate in the cryptocurrency economy.

Here are the best US customer friend crypto exchanges that you can use today in 2020.

Note that some of the exchanges listed here may not offer official statements about whether US citizens are welcome or not! – please read the terms and do your own research!

Check our new pillar post that ranks US exchanges based on readers’ votes!

Spot/margin trading exchanges

Margin trading allows you to borrow either bitcoin or dollars at an interest rate to increase the size of your trading account. Although this activity can be highly risky, it is the quickest way to make huge trading returns.

Kraken

Kraken is a bitcoin and cryptocurrency trading platform based in the US. The exchange is one of few in the world offering margin, and futures trading up to 50x for US customers. The kraken exchange offers a number of other services as well from institutional account management to OTC desk, and more. And with a decent exchange volume, kraken is the best option for any customers living in the US looking to trade bitcoin using margin.

| Trading fees | 0.16% – 0.26% + discounts |

|---|---|

| withdrawal limits | without KYC: $5,000 USD / with KYC: $1,000,000 USD / 24 hours |

Bitflyer

Bitflyer is one the largest & leading crypto exchanges by volume in the world, not only it has the largest volume in japan, and with global volumes reaching over 250 billion in 2017, but it also has licensed operations in europe, and the US.

| Trading fees | 0.20% + discounts |

|---|---|

| withdrawal limits | unlimited |

Altcoin trading exchanges

Altcoin trading can be one of the most profitable concepts in cryptocurrency, there are thousands of different projects to choose from and quite a few exchanges as well. To have access to as many coins as possible we suggest registering on each exchange below. These are the best crypto exchanges for altcoin trading.

Kucoin

Kucoin is one the best altcoin exchanges for trading right now, the platform offers a variety of coins to choose from with high liquidity, as well as the option fo purchase bitcoin with a credit card. Kucoin does not offer KYC option for US customers, however, they do not seem to restrict the use either, meaning anyone can freely use their platform with the 2BTC withdraw limit.

| Trading fees | spot: 0.1% – 0.1% / futures: 0.02% – 0.06% + discounts |

|---|---|

| withdrawal limits | without KYC: 5 BTC / with KYC: 100 BTC / 24 hours |

Bittrex

Bittrex is one of the oldest US-based exchanges that can proudly say they have never been hacked. This platform provides a large variety of coins to choose from and a reputable trading engine.

| Trading fees | 0.2% – 0.2% + discounts |

|---|

Bithoven

Bithoven stands as a reliable cryptocurrency trading exchange with a simple interface. The platform has partnered with bitgo, which assumably gives them guaranteed security over funds, of up to 100 million. The exchange has plenty of altcoins to choose from and leverage up to 20x. The platform also offers margin trading, however, this service is restricted from US customers.

| Trading fees | 0.2% – 0.2% |

|---|---|

| withdrawal limits | unlimited |

Probit

Probit is a korean based global cryptocurrency exchange offering a variety of lesser-known altcoins to trade with. The platform requires no KYC from citizens outside of korea and is also available for US customers.

| Trading fees | 0.2% – 0.2% + discounts |

|---|---|

| withdrawal limits | without KYC: $10.000 USD / with KYC: $100,000 USD / 24 hours |

Qtrade

Qtrade is a unique altcoin exchange that lists only selected original dev coins with special capabilities and features. The platform is one of those places not many know yet it has some of the most advanced coins you can trade with.

| Trading fees | 0% – 0.5% |

|---|

VCC exchange

VCC exchange is a vietnamese based advanced altcoin trading exchange. The platform offers a variety of cryptocurrencies, and requires KYC for withdrawals.

| Trading fees | 0.20% – 0.20% |

|---|---|

| withdrawal limits | 80 BTC / 24 hours |

Livecoin

Livecoin is a small-cap altcoin exchange providing countless coins to choose from. This exchange was founded back in the day in 2013 meaning they have a quite track record behind. The exchange also supports fiat currencies such as USD, EUR, and russian ruble.

| Trading fees | 0.18% – 0.18% + discounts |

|---|---|

| withdrawal limits | no limits |

Beaxy

Beaxy is newer all in one cryptocurrency exchange, providing great tools and features. They have everything from advanced order types to portfolio management, this exchange could be good if there was some liquidity available.

| Discount link | get a 20% discount on beaxy trading fees! |

Fiat to crypto exchanges

Many of the exchanges from the above categories can also be used for purchasing your first bitcoins. However here are some of the best crypto exchanges, which are more focused on dealing with cash, and therefore better to be used for either buying your first bitcoins or selling your coins for cash.

Coinmetro

Coinmetro is hands down the most affordable place to purchase bitcoin and other cryptocurrencies. The exchange is designed to suit for all levels of trades, from newbies with a one-click buy button to pro trading screens. The platform is available for the US citizens, except for hawaii, washington and new york states.

| Trading fees | 0% – 0.1% + discounts |

|---|

CEX.IO

CEX.IO is one of the oldest bitcoin exchanges around, it’s global, stable and offers both simple, easy to use interfaces for both buying and trading bitcoin and few other cryptocurrencies.

| Trading fees | 0.16% – 0.25% + discounts |

|---|---|

| withdrawal limits | 2 BTC / 24 hours |

Binance.Us

Binance.Us is a branch focused on becoming a new home for cryptocurrency trading services within the united states. The platform offers a variety of crypto pairs trading against USD and the possibility to purchase bitcoin with a credit card.

| Trading fees | 0.1% – 0.1% + discounts |

|---|---|

| withdrawal limits | $7,500,000 USD / 24 hours |

Binance jersey

Binance jersey is fiat focused crypto exchange built on top of technology developed by binance, the leading and most known crypto exchange on the market.

| Trading fees | 0.1% – 0.1% + discounts |

|---|---|

| withdrawal limits | 10,000 GBP / 24 hours |

Coinbase

Coinbase has the largest hot wallet in the industry, operating in over 30 countries and securing more than 20 million customers worldwide. This exchange was founded in 2012 by brian amstrong and is widely known as one of the easiest exchanges for purchasing and trading your bitcoins.

| Trading fees | 0.50% – 0.50% + discounts |

|---|---|

| withdrawal limits | initially $25,000 USD (can be increased) / 24 hours |

| discount link | earn up to $158 worth of crypto! |

Gemini

Gemini is based in the US and was founded by cameron and tyler winklevoss. The exchange is an excellent way to purchase, store and sell bitcoin. And the number of coins these two owns makes it quite literally the most secure exchange around.

| Trading fees | 1.49% premium / activetrader: 0.35% – 0.25% + discounts |

|---|---|

| withdrawal limits | $100,000 USD / 24 hours |

Coinmama

Coinmama is one of the great choices for purchasing your first bitcoin or ethereum. This exchange has been around since 2013 offers a simple user experience and is, therefore, one of the most reliable old dogs still around.

| Trading fees | 2% + 3.90% when buying, and 0.9% when selling / 5% for cards. |

|---|---|

| Exchange limits | $12,000 USD / 24 hours |

Coindeal

Coindeal is a US-based crypto exchange offering easy to use platform with a variety of altcoins and fiat currencies to choose from. The exchange has fast verifications and many methods for depositing and withdrawing funds. On top of this, users can also purchase bitcoin with a credit card.

| Trading fees | 0.29% – 0.39% + discounts |

|---|---|

| withdrawal limits | €100,000 EUR / 24 hours |

Paybis

Paybis is an instant cryptocurrency exchange founded in 2014. The exchange provides support for a variety of payment methods including credit card, skrill, neteller, payeer and advanced cash. The exchange also has one of the highest purchasing limits.

| Trading fees | fixed |

|---|---|

| buying limits | $500,000 USD per week. |

Bitquick

Bitquick is owned and operated by athena team, one of america’s most trusted ATM operators. The platform lets users purchase bitcoin from other users through escrow with physical cash.

| Trading fees | 2% |

|---|---|

| exchange limits | without ID scan: $400.00 USD |

Peer to peer exchanges

Peer to peer stands for exchanges that do not hold user’s funds but rather connect buyers and sellers.

Paxful

Paxful is a peer to peer exchange connecting buyers and sellers with over 300 payment methods to choose from. You can buy bitcoins with bank transfer, gift cards, paypal, cash and much more.

Best crypto exchanges

Best places to buy and sell cryptocurrency

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

Investing or trading in bitcoin or other cryptocurrencies can be intimidating at first. There is frequently news about scams and people losing money. While this is true, and many scams have happened and continue to happen, it has never been so simple to invest in cryptocurrency. So much has advanced in the last few years that have made crypto trading safe and easy.

The foremost concern when trading and purchasing bitcoin, or other cryptocurrencies, is safety and security. Whether you intend to purchase and hold long term, want to trade frequently, are interested in anonymity or privacy, or simply want ease of use, the following exchanges are the best for any use case you may have.

This list covers the best exchanges for certain types of traders as well as the best exchanges within each type of exchange. There are a number of ways to go about investing in bitcoin or other cryptocurrencies. To learn more about how the different exchange types differ, please read on after the list of exchanges. Once you have decided on an exchange, it is important to also practice safe storage. You can see the best storage methods on our best bitcoin wallets article.

Best crypto exchanges

- Coinbase and coinbase pro: best overall

- Cash app: best for beginners

- Binance: best for altcoins

- Bisq: best decentralized exchange

Coinbase and coinbase pro: best overall

The most widely known and used cryptocurrency exchange in the united states is coinbase. Coinbase was founded in 2012, not very long after the release of bitcoin’s code in 2009, and is a fully regulated and licensed cryptocurrency exchange. Coinbase currently has licenses to operate in over 40 U.S. States and territories.

Solid variety of altcoin choices

Extremely simple user interface

High fees when not using coinbase pro

User does not control wallet keys

Those interested in altcoin trading won't find as many as some other exchanges

Fees: between $0.99 and $2.99 depending on the dollar value of the purchase.

While the cryptocurrency industry has been fraught with fraudulent coins and shady exchanges, coinbase has largely avoided any controversy. Coinbase offers an extremely easy-to-use exchange, greatly lowering the barrier to entry for cryptocurrency investment, which is typically seen as confusing and convoluted.

Coinbase also offers insured custodial wallets for investors and traders to store their investments. It is important to note that, should your account be compromised from your own doing, this insurance does not apply. These custodial accounts are very convenient for newer users just getting their feet wet, but the private keys to the coins within them are owned by coinbase, and not the investor.

Additionally, coinbase also offers the free coinbase pro version that has a different, but cheaper, fee structure and significantly more options in terms of charts and indicators. Coinbase pro is a perfect next step for those who have learned the ropes using coinbase. Coinbase pro helps round out the overall offering by adding features that the more advanced user would want.

Cash app: best for beginners

Cash app is a peer-to-peer money transfer system much like venmo. This type of service allows users to split food, pay rent to a roommate, or even shop online at a retailer that supports cash app. Cash app can essentially act as a bank account and users can have their own cash app debit cards. This service is very convenient by itself, but cash app has even more features.

Peer-to-peer money transfer like venmo or zelle

Ability to withdraw bitcoin

Extremely simple user interface that is great for beginners

Only allows bitcoin investment at this time

3% charge when sending money via a linked credit card

Withdrawal limit of $2,000 worth of bitcoin every 24 hours

Fees: cash app charges a service fee for each transaction. It also charges a fee determined by price volatility. These fees change depending on the market’s activity.

Cash app also allows its users to invest in stocks, etfs, and cryptocurrency in a similar fashion that robinhood does. The mobile-first interface that this exchange uses is very easy to figure out and use, making it ideal for a first-time investor.

Aside from offering a payment system like venmo and an investment platform like robinhood, cash app differs in the user’s ability to withdraw cryptocurrency investments to your own wallet. This is the main reason that we chose cash app over robinhood as the best option for beginners looking to buy bitcoin.

The ability to withdraw cryptocurrency from an exchange is extremely important in the cryptocurrency community. With robinhood, you can invest and trade cryptocurrency but you cannot withdraw and spend it how you wish. Many in the crypto-community refer to this concept as “not your keys, not your coin.” this means that if you do not hold the private keys to the wallet that the coins are stored in, they are effectively not owned by you.

Binance: best for altcoins

The binance exchange is an exchange founded in 2017 with a strong focus on altcoin trading. Binance offers nearly 600 different trading pairs between different cryptocurrencies. It does offer some fiat/crypto pairs, but most of its pairs are between cryptocurrencies.

Lower fees than other commonly used exchanges

Large variety of cryptocurrencies and trading pairs

Geared for more advanced users

Binance US has fewer trading pairs than its international counterpart, though it still has over 100 trading pairs

13 U.S. States, like new york, are not supported by binance US

Fees: 0.1% for the taker side and 0.1% for the maker side. This scales down with trade volume to 0.02% for both sides of the trade. Using binance’s native cryptocurrency, BNB, lowers fees by 25%.

Currently, binance dominates the global exchange space, making up a significant portion of crypto trading volume daily. The exchange does not currently allow for US dollar deposits but it does allow you to directly purchase a select number of cryptocurrencies with a credit or debit card. Deposits using over 20 other fiat currencies are allowed, including the euro.

Binance is best suited to people who would like to trade or invest in lesser-known altcoins. For example, coinbase only offers 22 different cryptocurrencies to trade while binance has over 150. Binance is the ideal exchange for anyone who would like to trade altcoins or anyone who wants more advanced charting than most other exchanges.

Bisq: best decentralized exchange

The premise of bitcoin itself is that it grants open and free access to a unit of account. Banking products, like a checking or savings account, are only accessible if you have a legally provable government-issued identification. With bitcoin, this isn’t necessary. It can be accessed regardless of nationality or location, and without any identification.

Decentralized, non-KYC platform

26 different payment options, including zelle

Mobile app for both android and ios

Transaction speed is dependent on the payment method and can be slow, in some cases

Trading volumes can be low

Not really designed for active trading

Fees: trading fees are payable in BTC or BSQ (the network’s native cryptocurrency). When paying for the fees using bitcoin, the cost to trade one bitcoin is 0.20% on the maker side and 0.60% on the taker side. When paying the fees in BSQ, the fee to trade one bitcoin is 0.10 on the maker side and 0.30% on the taker side.

While many argue that this opens up possibilities for criminal activity (the same could be said about criminal activity using cash), it also immediately grants units of account to individuals in countries with less-developed banking systems. There are millions of people in the world that do not have access to bank accounts or means to trade because their countries may not have the proper financial infrastructure, or the individuals may not have government-issued identification. Bitcoin, used in tandem with a decentralized exchange like bisq, can be a good solution in these cases.

Bisq is a downloadable software and peer-to-peer decentralized bitcoin and crypto exchange. This means that bisq has no central point of failure and cannot be taken down, much like bitcoin itself. Bisq is non-custodial, which means that no one other than the user touches or controls the user’s funds. This differs from centralized exchanges, like coinbase, as coinbase controls the user’s funds in a custodial account that the user does not have the private keys to. In that scenario, coinbase holds the right to seize your funds if it deems your account activity suspicious, whether or not the activity is actually illegal in your location.

Bisq is instantly accessible to anyone with a computer or smartphone as there is no registration process or KYC (know your customer) rule. This makes it ideal for those looking for privacy, dissidents living within an oppressive regime, or anyone who does not have any government-issued identification.

Bisq offers trading of several different fiat currencies including USD, as well as bitcoin and a number of other cryptocurrencies. Bisq’s decentralized and peer-to-peer characteristics can mean low trading volumes and slower transactions, but for some, this is well worth it.

Understanding the types of crypto exchanges

To choose the best exchange for your needs, it is important to fully understand the types of exchanges.

Centralized exchange

The first and most common type of exchange is the centralized exchange. Popular exchanges that fall into this category are coinbase, binance, kraken, and gemini. These exchanges are private companies that offer platforms to trade cryptocurrency. These exchanges require registration and identification, also known as the know your customer, or know your client, rule.

The exchanges listed above all have active trading, high volumes, and liquidity. That said, centralized exchanges are not in line with the philosophy of bitcoin. They run on their own private servers which creates a vector of attack. If the servers of the company were to be compromised, the whole system could be shut down for some time. Worse, sensitive data about its users could be released.

The larger, more popular centralized exchanges are by far the easiest on-ramp for new users and they even provide some level of insurance should their systems fail. While this is true, when cryptocurrency is purchased on these exchanges it is stored within their custodial wallets and not in your own wallet that you own the keys to. The insurance that is provided is only applicable if the exchange is at fault. Should your computer and your coinbase account, for example, become compromised, your funds would be lost and you would unlikely have the ability to claim insurance. This is why it is important to withdraw any large sums and practice safe storage.

Decentralized exchange

Decentralized exchanges work in the same manner that bitcoin does. A decentralized exchange has no central point of control. Instead, think of it as a server, except that each computer within the server is spread out across the world and each computer that makes up one part of that server is controlled by an individual. If one of these computers turns off, it has no effect on the network as a whole because there are plenty of other computers that will continue running the network.

This is drastically different from one company controlling a server in a single location. Attacking something that is spread out and decentralized in this manner is significantly more difficult, making any such attacks unrealistic and likely unsuccessful.

Due to this decentralization, these types of exchanges cannot be subject to the rules of any regulatory body, as there is no specific person or group running the system. The individuals who participate come and go, so there is no one or no group that a government or regulatory body can realistically pursue. This means that those trading on the platform do not have to declare their identification and are free to use the platform in any manner they choose, whether legal or not.

Methodology

Investopedia is dedicated to helping those interested in cryptocurrency investment make informed and safe decisions. We are committed to providing our readers with unbiased reviews of the top bitcoin exchanges for investors of all levels. The landscape of cryptocurrency can be quite intimidating so we have chosen exchanges that we believe are trustworthy, secure, easy to use, and have had a long-standing and proven level of quality.

List of the best decentralized cryptocurrency exchanges (DEX)

Cryptocurrency trading is one of the essential niches in the industry. Each crypto holder has interacted with crypto exchanges at least once. If we look deeper into the current trading situation, we may discover several vital issues that bother traders – availability, transparency, and security. Centralized exchanges (cexs) provide decent platforms in terms of UX/UI, enhanced trading features, and so on.

Still, they are intermediaries between users and blockchain. Most of the regular exchanges are custodial, which means they store users’ funds on their servers. It is not as safe as it seems, yet centralized crypto platforms try to provide top-notch security solutions. A perfect alternative to cryptocurrency trading platforms are decentralized crypto exchanges (dexs) that are currently seizing the moment of popularity.

Changelly continues to provide educational articles about the crypto and blockchain industries. We are going to explain what DEX is and what should be taken into consideration when trading crypto via DEX. We’ve also collected the top ten dexs for advanced and robust trading. Let’s cover them all.

What is DEX?

As we mentioned above, DEX stands for a decentralized crypto exchange. DEX is a platform that allows two independent parties to make cryptocurrency transactions without third-party interference or, in other words, in a peer-to-peer (P2P) way. For flawless interaction with a DEX, you need to obtain a digital wallet.

The lack of intermediary is increasing the security of a transaction process as well as the user’s anonymity. However, some decentralized exchanges require KYC and collect personal information (e.G., IDEX, binancedex, etc.)

As there is no central authority in dexs, it is more difficult to manipulate the market.

The most popular dexs are built upon the ethereum blockchain. As time goes by, other distributed ledgers like TRON, binancechain, EOS, and many others, manage to provide an appropriate environment for decentralized crypto swaps.

Centralized exchange vs. Decentralized exchange

| CEX | DEX | |

| security | to protect users from any kind of fraud, centralized exchanges offer 2fa, cold storage, white lists, and so on. Still, there is always a possibility of hacks; | following the crypto motto code is law, dexs do not have access to users’ funds. The transactions are made directly between two parties and reflected in a blockchain; |

| trading features | such veterans of the cryptocurrency industry as bitfinex, hitbtc, and bittrex provide a wide variety of trading instruments and tools like margin trading, OTC, dark pools, etc. | Dexs are relatively new to the market. The functionality of such exchanges is not as enhanced as on centralized ones. Dexs usually provide a limited number of trading pairs and most of the time assets traded on a DEX are built on the same blockchain; |

| liquidity | giant cexs provide a considerable amount of liquidity to digital assets; | attracting liquidity is a big pain of decentralized exchanges. As most dexs are sharpened to crypto-assets of a particular blockchain, the choice of trading assets is limited; |

| fees | centralized exchanges charge higher fees; | on the contrary, dexs offer lower commission fees as there is no need to pay salaries to a large number of workers. |

#1. Uniswap

The new york-based team behind the uniswap DEX introduced a liquidity protocol of the same name built on the ethereum blockchain. Uniswap is a liquidity pool and decentralized exchange for ERC-20 tokens, which provides efficient and robust trading without third-party interference.

Uniswap has recently launched uniswap V2 with significant security and usability improvements. From now on, the direct token-to-token swaps are possible (without an intermediate ETH step). As there is no need to pay gas anymore, the transaction fees will be reduced. The interface of uniswap V2 remains the same as the initial V1 platform’s design.

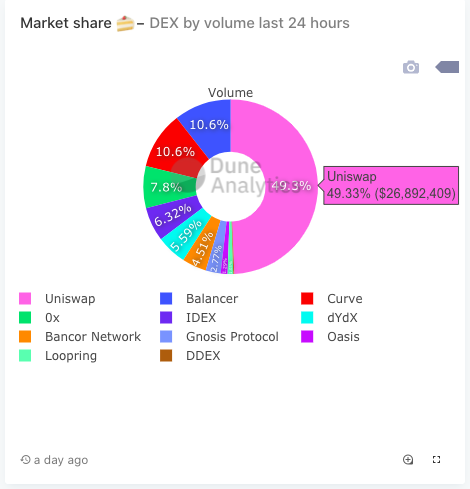

According to dune analytics, uniswap takes 49,9% of dexs’ market share by volume for the last 24h and the last week.

#2. Kyber network

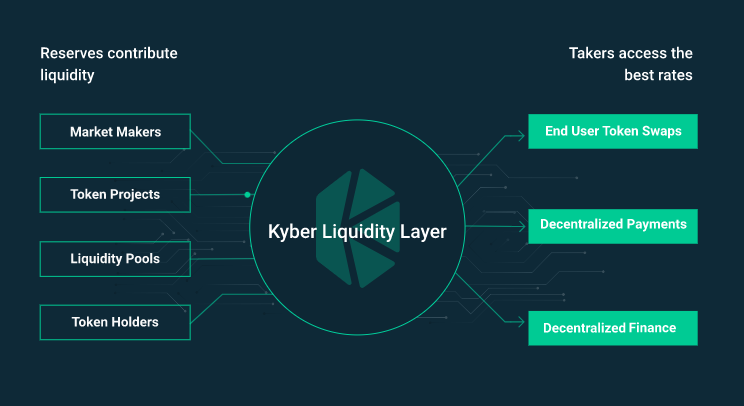

A famous ‘fully on-chain liquidity protocol’, kyber network, allows for instant ERC-20 tokens swaps. In simple terms, kyber network aggregates liquidity from multiple platforms and provides it to a single network so that users can seamlessly transfer their tokens in just one transaction.

Kyber network is an important part of the ethereum and crypto communities. It aims at showing the benefits of decentralization by providing transparency and trust between traders.

Kyber is not a regular decentralized exchange, but a protocol that can be implemented to any blockchain that supports a smart contract feature. With that in mind, various decentralized applications (dapps), dexs (uniswap, oasis), and digital wallets (coinbase wallet, trust wallet) use the kyber protocol for better performance.

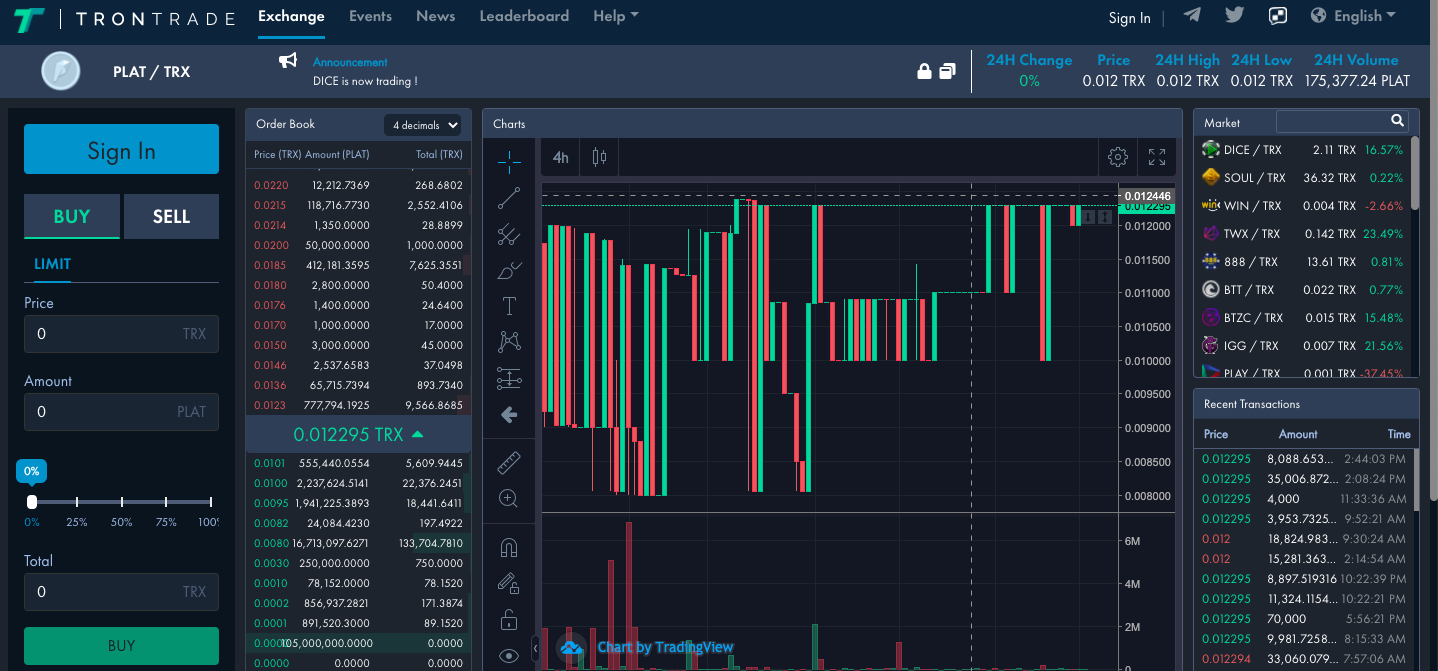

#3. Trontrade

How to buy a tron coin in a simple yet decentralized manner? Just visit trontrade – a decentralized exchange for TRX and tron-based tokens. Intuitive UX and smart design will provide every user with an efficient trading experience.

Trontrade is the first decentralized exchange that supports TRC-10 tokens. The platform is community-focused and provides 24/7 customer support. There is no need to create an account within the exchange. All you need is a decent TRON wallet that will help you to interact with the DEX.

#4. IDEX

IDEX is the first and well-known ethereum decentralized exchange that provides a wide range of trading pairs. Besides various ERC-20, there are USDT, USDC, TUSD, and DAI markets. The platform’s design is quite native, so it is easy to get used to it. IDEX charges 0.2% for market takers and 0.1% for market makers. Take into consideration that users have to pay gas fees in order to place their transactions on the blockchain.

If you have any questions regarding withdrawals, deposits, staking, and others, IDEX has a decent FAQ and guidelines sections. However, IDEX obliges users to pass strict KYC (know-your-customer) procedure, which raises concerns around exchange’s decentralization. Still, IDEX is more secure than most of the centralized trading platforms.

IDEX is going to introduce IDEX 2.0 which will offer greater scalability, better security features, and a lack of gas fees.

Please pay close attention to the announcement! IDEX has recently posted a scam alert tweet about a fraudulent mobile application on google play.

SCAM ALERT: A fraudulent IDEX app is currently listed on google play. Please be aware that we are working on getting it removed and encourage users to avoid downloading and interacting with the scam. Pic.Twitter.Com/fnixdqjz6e

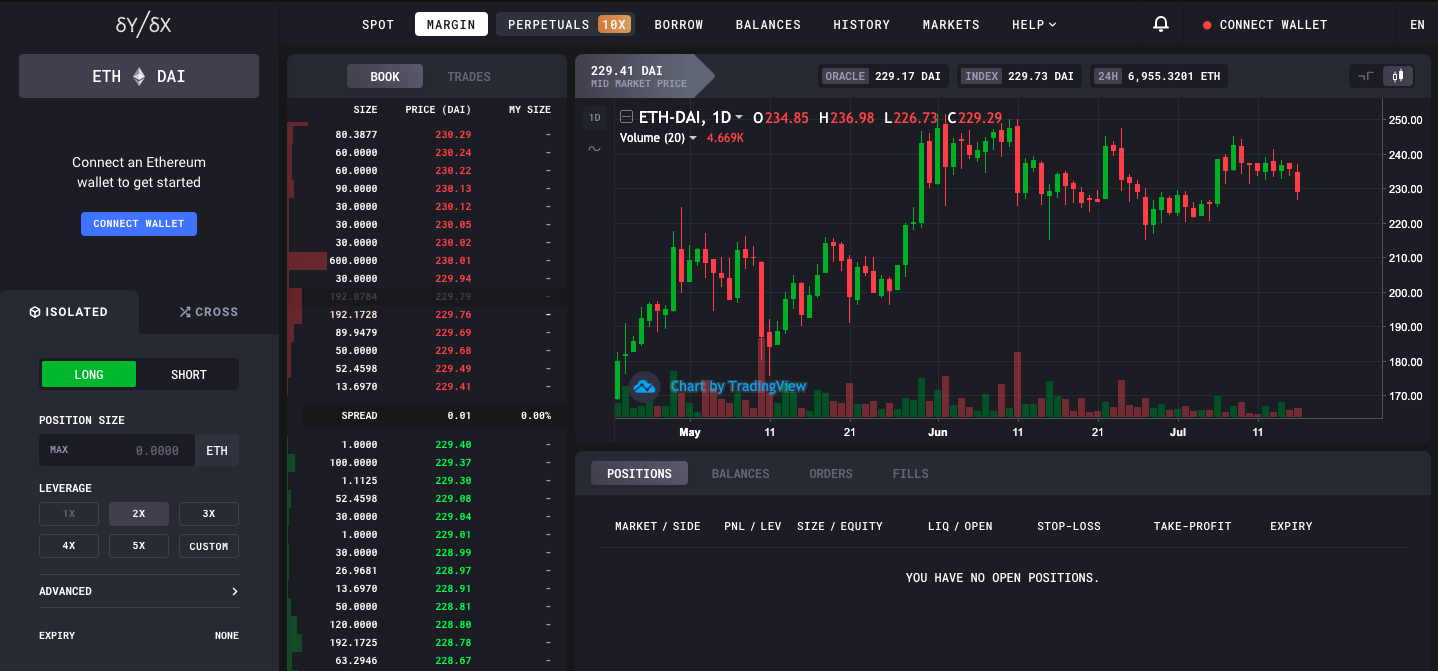

#5. Dydx

A self-proclaimed “the most powerful open trading platform for crypto assets,” dydx is seriously going to conquer the market of decentralized exchanges. Dydx is another ethereum based DEX that provides such a rare for decentralized platforms options as margin trading and derivatives. Dydx enables margin trading with an up to 4x leverage.

In april 2020, dydx introduced perpetual contract markets that would allow you to trade any of non-ethereum based assets. This is a truly impressive solution as traders can trade a BTC-USDC pair with up to 10x leverage now. Dydx also offers a lending option in order to attract more liquidity to the exchange. Dydx’s design is smart and neat. Thereby, traders can enjoy flawless trading experience.

#6. Bancor network

When you examine the bancor DEX, the first thing that comes to mind is simplicity. UX/UI are intuitive, while the team behind the project offers instant support. Just like many other decentralized exchanges, bancor is built upon the ethereum blockchain.

What differs it from the rest of the dexs is an opportunity to exchange digital assets of different distributed ledgers. Due to a genuine bancor protocol, users can seamlessly exchange, for example, ETH to EOS and vice versa.

#7. Bisq

Bisq is one of the best decentralized bitcoin exchanges and also a trading protocol, desktop application, and free software. The platform allows you to sell and buy BTC in exchange for national currency or other digital assets. Bisq supports many payment options, so it won’t be a problem to purchase crypto in a truly decentralized way.

Being built upon the tor network, bisq has the same censorship resistance as the main chain. Transaction details are available only for counterparts. It seems that the main disadvantage of the bisq DEX is the complexity of trading processes. Therefore, the exchange perfectly works for professional traders rather than crypto novices. Note also that transactions may take a long processing time, so if you want instant crypto swaps, you should probably keep on searching for it.

#8. Oasis

Oasis DEX runs on the ethereum blockchain allowing to exchange any of ERC-20 tokens.

To work on this exchange, you need to obtain an ethereum wallet like mist, metamask, etc. The DEX will detect the network and connect to it automatically while the system will check the synchronization.

You can buy or sell the following tokens on the oasisdex exchange: ETH, MKR, DGD, REP, ICN, 1ST, SNGLS, VSL, PLU, and DAI. Just like other dexs, oasis doesn’t support fiat.

The main advantage of this token exchange platform is its high security. Among other benefits of oasisdex are the ability to expand trading pairs to all tokens built on the ERC20 protocol, lack of commission fees for deposit and withdrawal, and quick transactions.

#9. Newdex

Newdex is the best decentralized exchange built on the EOS blockchain. Launched in 2018, newdex has managed to attract EOS side chains (sister chains), thereby building a large network of interchangeable crypto assets.

How many cryptocurrency exchanges are there?

Jump to page contents

Recently similar guides

Recommended wallets

Recommended exchanges

Jump to page contents

Cryptocurrency exchanges oversee the trading and sometimes valuing of cryptocurrencies, and form an integral part of the industry. There are various types of exchanges, with some being centralised and others decentralised, but their role is almost always the same. The difference lies in the way that transactions are carried out.

Your capital is at risk

80.5% of retail CFD accounts lose money

Your capital is at risk

What is the exact number of exchanges today?

Since crypto regulation in many countries is still either limited or non-existent, there are no rules about setting up a cryptocurrency exchange. Whilst a reputable exchange invests in powerful servers and security features, you can technically create your own exchange online in a surprisingly simple way. Although, creating your exchange is no guarantee that potential investors will use it.

It is difficult to determine the exact number of exchanges at any one moment since these do not need to register with any centralised authority. We estimated 504 cryptocurrency exchanges as of to date, but this can change at any moment. 259 of these exchanges are tracked on coinmarketcap, while others are still in their start-up period.

According to CMC, we have 18,998 markets in which we can trade crypto. This means that there are 18,998 different trading pairs (ex. USD/BTC or XRP/ETH etc etc.) available on 259 exchange platforms. If we do some simple maths, we can note that on average, an exchange platform has 73 markets for its users to trade in.

Because they are so ‘easy’ to create, many exchanges are set up and then close after little or no interest. Those who are interested in creating an exchange may also opt for a white-label solution. This means that you can buy the architecture of an internationally know exchange and then re-brand it completely and put it on the market. Crypto users today are more aware of potential frauds so they normally opt for the bigger, more reputable exchanges.

Which are some of the most reputable exchanges?

In order to make the list of reputable cryptocurrency exchanges, a platform needs to operate in a safe and secure environment. There are many ways to achieve this, such as by abiding by industry best practices, complying with regulation, and implementing a strong firewall.

Some of the best exchanges also decide to be based in countries that are creating cryptocurrency legislation. By doing this, they can attract cautious traders who prefer dealing with a company that operates within a regulatory framework.

Etoro is a great example of a cryptocurrency exchange but there are other popular exchanges such as binance, which relocated to malta after the country passed several industry regulations. Binance is one of the largest cryptocurrency exchanges by trading volume, and has a great reputation with its customers. Although it was successfully hacked in 2019, no users lost their funds, and this gave the platform a significant boost in its overall reputation.

Coinbase, an american company licensed to carry out money-based transactions, is another of the most reputable exchanges. The company also has an office in the UK, where it received an e-money license from the FCA, which means that it needs to adhere to strict compliance conditions which make its operations safer. Coinbase is probably best known for allowing the purchase of bitcoin and altcoins with paypal, apart from also accepting card payments and bank transfers.

Whilst bitmex has not registered with any legislative board so far, the hong kong-based platform has a strong reputation for safety. Specialising in futures and perpetual contract trading, the P2P exchange is best-suited for experienced traders. Newbie investors should have a look at these exchanges instead.

Best crypto exchanges

Best places to buy and sell cryptocurrency

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

Investing or trading in bitcoin or other cryptocurrencies can be intimidating at first. There is frequently news about scams and people losing money. While this is true, and many scams have happened and continue to happen, it has never been so simple to invest in cryptocurrency. So much has advanced in the last few years that have made crypto trading safe and easy.

The foremost concern when trading and purchasing bitcoin, or other cryptocurrencies, is safety and security. Whether you intend to purchase and hold long term, want to trade frequently, are interested in anonymity or privacy, or simply want ease of use, the following exchanges are the best for any use case you may have.

This list covers the best exchanges for certain types of traders as well as the best exchanges within each type of exchange. There are a number of ways to go about investing in bitcoin or other cryptocurrencies. To learn more about how the different exchange types differ, please read on after the list of exchanges. Once you have decided on an exchange, it is important to also practice safe storage. You can see the best storage methods on our best bitcoin wallets article.

Best crypto exchanges

- Coinbase and coinbase pro: best overall

- Cash app: best for beginners

- Binance: best for altcoins

- Bisq: best decentralized exchange

Coinbase and coinbase pro: best overall

The most widely known and used cryptocurrency exchange in the united states is coinbase. Coinbase was founded in 2012, not very long after the release of bitcoin’s code in 2009, and is a fully regulated and licensed cryptocurrency exchange. Coinbase currently has licenses to operate in over 40 U.S. States and territories.

Solid variety of altcoin choices

Extremely simple user interface

High fees when not using coinbase pro

User does not control wallet keys

Those interested in altcoin trading won't find as many as some other exchanges

Fees: between $0.99 and $2.99 depending on the dollar value of the purchase.

While the cryptocurrency industry has been fraught with fraudulent coins and shady exchanges, coinbase has largely avoided any controversy. Coinbase offers an extremely easy-to-use exchange, greatly lowering the barrier to entry for cryptocurrency investment, which is typically seen as confusing and convoluted.

Coinbase also offers insured custodial wallets for investors and traders to store their investments. It is important to note that, should your account be compromised from your own doing, this insurance does not apply. These custodial accounts are very convenient for newer users just getting their feet wet, but the private keys to the coins within them are owned by coinbase, and not the investor.

Additionally, coinbase also offers the free coinbase pro version that has a different, but cheaper, fee structure and significantly more options in terms of charts and indicators. Coinbase pro is a perfect next step for those who have learned the ropes using coinbase. Coinbase pro helps round out the overall offering by adding features that the more advanced user would want.

Cash app: best for beginners

Cash app is a peer-to-peer money transfer system much like venmo. This type of service allows users to split food, pay rent to a roommate, or even shop online at a retailer that supports cash app. Cash app can essentially act as a bank account and users can have their own cash app debit cards. This service is very convenient by itself, but cash app has even more features.

Peer-to-peer money transfer like venmo or zelle

Ability to withdraw bitcoin

Extremely simple user interface that is great for beginners

Only allows bitcoin investment at this time

3% charge when sending money via a linked credit card

Withdrawal limit of $2,000 worth of bitcoin every 24 hours

Fees: cash app charges a service fee for each transaction. It also charges a fee determined by price volatility. These fees change depending on the market’s activity.

Cash app also allows its users to invest in stocks, etfs, and cryptocurrency in a similar fashion that robinhood does. The mobile-first interface that this exchange uses is very easy to figure out and use, making it ideal for a first-time investor.

Aside from offering a payment system like venmo and an investment platform like robinhood, cash app differs in the user’s ability to withdraw cryptocurrency investments to your own wallet. This is the main reason that we chose cash app over robinhood as the best option for beginners looking to buy bitcoin.

The ability to withdraw cryptocurrency from an exchange is extremely important in the cryptocurrency community. With robinhood, you can invest and trade cryptocurrency but you cannot withdraw and spend it how you wish. Many in the crypto-community refer to this concept as “not your keys, not your coin.” this means that if you do not hold the private keys to the wallet that the coins are stored in, they are effectively not owned by you.

Binance: best for altcoins

The binance exchange is an exchange founded in 2017 with a strong focus on altcoin trading. Binance offers nearly 600 different trading pairs between different cryptocurrencies. It does offer some fiat/crypto pairs, but most of its pairs are between cryptocurrencies.

Lower fees than other commonly used exchanges

Large variety of cryptocurrencies and trading pairs

Geared for more advanced users

Binance US has fewer trading pairs than its international counterpart, though it still has over 100 trading pairs

13 U.S. States, like new york, are not supported by binance US

Fees: 0.1% for the taker side and 0.1% for the maker side. This scales down with trade volume to 0.02% for both sides of the trade. Using binance’s native cryptocurrency, BNB, lowers fees by 25%.

Currently, binance dominates the global exchange space, making up a significant portion of crypto trading volume daily. The exchange does not currently allow for US dollar deposits but it does allow you to directly purchase a select number of cryptocurrencies with a credit or debit card. Deposits using over 20 other fiat currencies are allowed, including the euro.

Binance is best suited to people who would like to trade or invest in lesser-known altcoins. For example, coinbase only offers 22 different cryptocurrencies to trade while binance has over 150. Binance is the ideal exchange for anyone who would like to trade altcoins or anyone who wants more advanced charting than most other exchanges.

Bisq: best decentralized exchange

The premise of bitcoin itself is that it grants open and free access to a unit of account. Banking products, like a checking or savings account, are only accessible if you have a legally provable government-issued identification. With bitcoin, this isn’t necessary. It can be accessed regardless of nationality or location, and without any identification.

Decentralized, non-KYC platform

26 different payment options, including zelle

Mobile app for both android and ios

Transaction speed is dependent on the payment method and can be slow, in some cases

Trading volumes can be low

Not really designed for active trading

Fees: trading fees are payable in BTC or BSQ (the network’s native cryptocurrency). When paying for the fees using bitcoin, the cost to trade one bitcoin is 0.20% on the maker side and 0.60% on the taker side. When paying the fees in BSQ, the fee to trade one bitcoin is 0.10 on the maker side and 0.30% on the taker side.

While many argue that this opens up possibilities for criminal activity (the same could be said about criminal activity using cash), it also immediately grants units of account to individuals in countries with less-developed banking systems. There are millions of people in the world that do not have access to bank accounts or means to trade because their countries may not have the proper financial infrastructure, or the individuals may not have government-issued identification. Bitcoin, used in tandem with a decentralized exchange like bisq, can be a good solution in these cases.

Bisq is a downloadable software and peer-to-peer decentralized bitcoin and crypto exchange. This means that bisq has no central point of failure and cannot be taken down, much like bitcoin itself. Bisq is non-custodial, which means that no one other than the user touches or controls the user’s funds. This differs from centralized exchanges, like coinbase, as coinbase controls the user’s funds in a custodial account that the user does not have the private keys to. In that scenario, coinbase holds the right to seize your funds if it deems your account activity suspicious, whether or not the activity is actually illegal in your location.

Bisq is instantly accessible to anyone with a computer or smartphone as there is no registration process or KYC (know your customer) rule. This makes it ideal for those looking for privacy, dissidents living within an oppressive regime, or anyone who does not have any government-issued identification.

Bisq offers trading of several different fiat currencies including USD, as well as bitcoin and a number of other cryptocurrencies. Bisq’s decentralized and peer-to-peer characteristics can mean low trading volumes and slower transactions, but for some, this is well worth it.

Understanding the types of crypto exchanges

To choose the best exchange for your needs, it is important to fully understand the types of exchanges.

Centralized exchange

The first and most common type of exchange is the centralized exchange. Popular exchanges that fall into this category are coinbase, binance, kraken, and gemini. These exchanges are private companies that offer platforms to trade cryptocurrency. These exchanges require registration and identification, also known as the know your customer, or know your client, rule.

The exchanges listed above all have active trading, high volumes, and liquidity. That said, centralized exchanges are not in line with the philosophy of bitcoin. They run on their own private servers which creates a vector of attack. If the servers of the company were to be compromised, the whole system could be shut down for some time. Worse, sensitive data about its users could be released.

The larger, more popular centralized exchanges are by far the easiest on-ramp for new users and they even provide some level of insurance should their systems fail. While this is true, when cryptocurrency is purchased on these exchanges it is stored within their custodial wallets and not in your own wallet that you own the keys to. The insurance that is provided is only applicable if the exchange is at fault. Should your computer and your coinbase account, for example, become compromised, your funds would be lost and you would unlikely have the ability to claim insurance. This is why it is important to withdraw any large sums and practice safe storage.

Decentralized exchange

Decentralized exchanges work in the same manner that bitcoin does. A decentralized exchange has no central point of control. Instead, think of it as a server, except that each computer within the server is spread out across the world and each computer that makes up one part of that server is controlled by an individual. If one of these computers turns off, it has no effect on the network as a whole because there are plenty of other computers that will continue running the network.

This is drastically different from one company controlling a server in a single location. Attacking something that is spread out and decentralized in this manner is significantly more difficult, making any such attacks unrealistic and likely unsuccessful.

Due to this decentralization, these types of exchanges cannot be subject to the rules of any regulatory body, as there is no specific person or group running the system. The individuals who participate come and go, so there is no one or no group that a government or regulatory body can realistically pursue. This means that those trading on the platform do not have to declare their identification and are free to use the platform in any manner they choose, whether legal or not.

Methodology

Investopedia is dedicated to helping those interested in cryptocurrency investment make informed and safe decisions. We are committed to providing our readers with unbiased reviews of the top bitcoin exchanges for investors of all levels. The landscape of cryptocurrency can be quite intimidating so we have chosen exchanges that we believe are trustworthy, secure, easy to use, and have had a long-standing and proven level of quality.

9 best zero-fee cryptocurrency trading exchanges in 2021

This is a curated list of zero-fee (no commission) cryptocurrency trading exchanges. Each exchange listed here provides some type of services specifically designed in such a way that they don’t have to include any fees whatsoever.

Crypto exchanges earn through commission fees. However, the new concept of no-fee trading has arrived, this simply means exchanges have found alternative ways to generate returns, such as monthly plans, higher withdrawal fees, and other alternative methods.

Below you can find list of all the best zero-fee, no commission crypto trading exchanges.

This article is depreciating, please check our updated pillar post!

Note that each exchange has its specific terms, and/or method for zero-fee trading, and other fees may still apply.

Spot/margin trading exchanges

Margin trading allows you to borrow either bitcoin or dollars at an interest rate to increase the size of your trading account. Although this activity can be highly risky, it is the quickest way to make huge trading returns.

Here is a list of the best crypto exchanges for spot/margin trading with zero-fees.

Phemex

Phemex is a quite fresh global cryptocurrency derivatives exchange offering bitcoin, ethereum, XRP, litecoin, and EOS perpetual contracts, with up to 100x leverage. Phemex also provides couple of different monthly plans that have different fee structures, with premium paying customers for example paying zero spot trading fees.

Blade

Blade is a new perpetual trading cryptocurrency exchanges, specially designed for no-fee trading, the platform is funded by some of the known institutions and offers multiple cryptos to trade with, using up to 150x leverage and zero trading fees.

Traditional trading exchanges

There are many international online trading brokerage exchanges that accept bitcoin and offer the ability to trade forex, stocks, and cfds on a wide array of financial assets across the global markets.

Here’s a list of traditional exchanges for stock trading using bitcoin and without fees involved.

Etoro

Etoro is the world’s leading social trading platform. This exchange is more focused on the traditional side, yet they do include cryptocurrencies such as BTC, ETH, LTC, and XRP. The unique thing about this platform is that you can copy-trade other profitable traders possibly making a great passive income. On top of that, etoro lets users trade a wide range of stocks using bitcoin with no commissions needed.

Altcoin trading exchanges

Altcoin trading can be one of the most profitable concepts in cryptocurrency, there are thousands of different projects to choose from and quite a few exchanges as well. To have access to as many coins as possible we suggest registering on each exchange below. These are the best crypto exchanges for altcoin trading.

Many of these exchanges can be used to purchase your first bitcoins as well.

Kucoin

Kucoin is a great alternative to binance, offering a wide variety of coins to choose from, they as well have the option fo purchase with a credit card, and all in all are a great exchange to anyone looking to buy, sell or trade lots of different altcoins. On top of all that, kucoin has no KYC requirements, and with its instant exchange feature, users can swap coins with zero-fees.

Txbit

Txbit.Io is altcoin focused crypto exchange based in the netherlands. This exchange offers a variety of coins to trade and a reward program that gives 50% of the trading fees to anyone running a solaris masternode on the platform. Txbit.Io also offers different monthly plans for those that want to trade without commissions.

Fiat to crypto exchanges

Many of the exchanges from the above categories can also be used for purchasing your first bitcoins. However here are some of the best crypto exchanges, which are more focused on dealing with cash, and therefore better to be used for either buying your first bitcoins or selling your coins for cash.

Coinmetro

Coinmetro is hands down the most affordable place to purchase bitcoin and other cryptocurrencies. The exchange is designed to suit all levels of traders, from newbies with a one-click buy button to pro trading screens. Coinmetro also has in build instant swap feature that lets users switch from one coin to another with no fees involved.

Wazirx

Wazirx is a cryptocurrency exchange based in india, the platform offers seamless fiat to crypto conversions, and automated P2P matching engine that doesn’t require any fees from its customers.

Amplify

Amplify is a simple to use cryptocurrency exchange platform that doesn’t require any commissions from trading, however it has a heavy price for withdrawals with EUR currency starting from 25€ per withdrawal.

Newton

Newton is a canadian based cryptocurrency exchange offering a zero-fee trading experience for canadians. The platform lets users purchase and trade bitcoin, all with zero commissions, funding, and network fees.

4 best cryptocurrency arbitrage bot platforms for 2021

Crypto arbitrage or bitcoin arbitrage is the process of buying cryptocurrencies from one exchange at low prices and selling them in another exchange where the prices are high. Users can do it manually which take time while use of automated cryptocurrency arbitrage bot platforms are the process more efficient and profitable. It works just like a stock market, where people try to make a profit out of the volatility of the price differences in the bitcoin exchanges.

How does crypto arbitrage work?

Arbitrage trading works on the price differences between the exchange markets. For example, in the large exchanges, you will find high trade volumes and lower prices of bitcoins. Again, in the small crypto exchanges, the supply is less while the prices are high. Traders take advantage of this situation and buy cryptos in bulk from large exchanges at low prices and sell them at high prices in the smaller exchanges thus earning massive profits.

However, the recent ‘bull market’ has caused an increase in the overall volume of crypto trades in all exchanges that an increase in share prices resulting in massive sales even in small exchanges.

Barriers to bitcoin arbitrage

Arbitrage trading has limitations such as:

- Verification of transactions can take some time. The prices of the cryptocurrencies may change during this time.

- The verification process may be cumbersome especially if you are trading large volumes of crypto.

- Exchange fees may be too high and may leave no profits in the end.

- You need to make large volumes of trading in both the exchanges to make profits.

- Traders should make a thorough check of the exchanges with which they are trading. Often exchanges with low prices have trust issues and are unable to satisfy their customers.

Now that we have learned about crypto arbitrage trading, let us have a look into some of the best crypto arbitrage trading platforms:

Best cryptocurrency arbitrage bots

Bitsgap

Bitsgap is another arbitrage trading tool that allows you to make profits through arbitrage trading of bitcoins and other cryptos in exchanges. Key features include:

- All trades depend on the available funds in your account.

- Bitsgap provides arbitrage trading in both cryptocurrencies and fiat currency.

- Arbitrage fees are included in the profits.

- Supports most of the popular cryptocurrencies.

- It is AI-integrated and fully automated to facilitate your trading.

- You can create your account with fiat currency like USD and EUR or cryptocurrency.

- The smart API protects your funds and helps you to build a smart portfolio in the trading platform.

Arbitrage.Expert/automated crypto arbitrage

Automated cryptocurrency trading bots are the software which executes automated buy and sell orders with the goal of making profit. Similarity, automated trading with the software bot especially made for the purpose of arbitrage are know as automated crypto arbitrage trading. One example of such platform is arbitrage.Expert website. This platform uses an advanced version of algorithmic arbitrage trading bot. Features include:

- Arbitrage bots help to do crypto trades taking leverage of the price differences prevalent in different crypto exchanges.

- Do trade with the help of API tools without withdrawing the funds.

- Faster trades with arbitrage bots.

Gimmer

Gimmer is another arbitrage trading bot in the crypto trading market. GMR is the official token of this platform and is available on the exchange platforms and it supports multiple cryptocurrencies. Here are some of the key features of gimmer:

- The automated bots are integrated with all the major trading exchanges.

- Users get access to a basic level of automated trading bot for free.

- Gimmer will study your profile and let you know about the risks involved while you are investing in the exchanges.

- Free back testing tool that enables you to test your trading strategy to understand the pros and cons before you implement it in the market.

- You can also earn cryptos buy renting your automated bot to other crypto traders.

- Multiple safety protocols to safeguard your hard-earned money.

- You can choose your trading bots if you are looking for more investment opportunities.

- Exchange information and ideas in the social network of traders and learn more about arbitrage trading.

- Practice arbitrage trading with the help of the simulator mode.

- Hosts lightweight dapps that are fast, secure, and affordable.

Multitrader.Io

Multitrader is one of the finest crypto trading platforms. It uses arbitrage trading bots that make the work automatic and easy. At present, multitrader is working with 21 crypto exchanges and constantly looking out for trading opportunities. Key features of multitrader platform includes:

- A user-friendly interface where traders can analyze the progress.

- Uses statistical calculations and order book matching to search for potential opportunities in arbitrage trading.

- It provides cloud-based solutions.

- You can review the trades with the help of bots.

- Users can get periodical reports on their trades.

Cryptocurrency trading: exchange vs brokerage

Nowadays, everyone who knows at least something about finance has heard of cryptocurrencies. In 2017, this industry exploded in popularity, and the crypto market began attracting the attention of more and more traders throughout the world. With extreme volatility and virtually unlimited profit potential, people started going absolutely crazy about it. As a result, a lot of tools, products, and services appeared in the market that opened the door to earning with cryptocurrencies.

There are however two ways of trading cryptocurrencies: over an exchange or with a broker. These two do have some differences, which are not very clear to the general public. The following will look into the basic things a trader has to deal with when trading cryptos over an exchange or on the online broker trading platform. This will help you to finally understand which kind of trading is better: with an exchange or with a broker.

Signing up and verification

Exchange

In some of the largest crypto exchanges the signup process is closed, but where it’s still available, the process is as simple as registration on other websites. What you need to do is to provide your email, create a password, confirm your email address, and that’s it! You are signed up. After you have signed up you need to go through the verification process in order to enable depositing and withdrawing funds from your account. To get this done, you will have to upload or send your photo ID colored copy and provide a photo of you with your ID near you. The exchanges respond to such verification request within between a few hours and a few days. There are some cases when you don’t have to get verified once signed up. For example, with binance, one of the most popular crypto exchanges out there, you can deposit to and withdraw from your account right away, although only 2 BTC per 24 hours. With your transactions growing bigger, you will still have to get verified.

Broker

Signing up with a broker is not a very difficult thing either, it is mostly the same as on an exchange. However, in order to deposit funds and start trading, verifying your account is mandatory. As a rule, you will be required to submit scan copies of one or two docs, those being your ID and proof of address. Different requirements can be in place for different jurisdictions. The verification process as such runs quite faster than on an exchange, being complete within just 30 minutes or even without verification (15-days period of verification). After your account has been successfully verified and your trading account open, you can easily deposit funds and start trading.

Deposits and withdrawals

Exchange

Depositing fiat money to crypto exchanges is often a hassle. As such, you cannot deposit USD or EUR on binance, and must use cryptocurrencies instead, which means you have to buy some crypto first before that. There are many ways to buy digital currencies out there, but such transactions are often paired with high fees and commissions. If you need to run multiple transactions when making a deposit, you should bear in mind that you will have to pay a fee each and every time; this way, you may lose up to 15% when depositing.

Withdrawing funds from exchanges in fiat currencies is again a piece of hassle. Of course, you can use e-wallets and online exchanges, but this again involves commissions. Withdrawing to a bank account can be an issue, too, as not all banks accept money from crypto exchanges because of the origin of such money and transactions.

Broker

Unlike currency exchanges, depositing with a broker is a breeze. A broker’s client has a large number of ways to make a deposit, including credit cards, popular e-wallets, etc. You can deposit US dollars, euros, and sometimes other currencies. This simplifies the whole process a lot, while, as a rule, there are no deposit fees whatsoever.

As for withdrawals, broker terms are usually still much more attractive than those of a crypto exchange. Instead of paying 5% or 6%, you just have to pay a fee of between 0% and 3%, which depends on your withdrawal method.

Trading

Exchange

Trading on a crypto exchange is not rocket science. You just need to select the desired trading instrument, open your trade and watch the price chart. You can place by and sell orders, as well as stop limit orders. In this aspect, crypto exchange features are somewhat limited compared to those of a broker platform.

One of the advantages of an exchange is that you can choose among a lot of different digital coins to trade. Binance, for instance, offers 120 cryptocurrencies for trading, which gives you a nice set of diversification options when selecting your trading strategy.

Broker

Using a broker platform, you get extensive feature set that will help you to work out your strategies and risks more precisely. As such, you will be able to put additional indications on the chart and use the in-built tech analysis tools. However, the broker platform will not offer you such an impressive number of cryptos to trade as an exchange. Each broker has different cryptocurrency offerings, but, most likely, you will find only the most popular cryptos out there.

Among the absolutely positive things about the brokers are the relatively tight spreads. The spreads in the cryptocurrency market may reach a few hundreds of dollars, but on the trading platforms, you will get the tightest spreads possible. As such, the BTC/USD spread is as low as 0.1 pips in R trader, which is one of the tightest in the industry.

Another advantage is that the broker platforms have much more features to offer. Unlike the exchanges, you can put multiple charts in your window, track the quote flow, use indicator sets and other extensions, etc.

As such, there is a strategy builder feature in R trader, which allows creating automatic trading strategies without any coding background. Using strategy builder, you will be able to create trading robots that could drastically raise your performance.

Safety & security

Exchange

Crypto exchanges are relatively unsafe. You can, of course, create a very strong password and even enable 2-factor authentication, but, unluckily, this cannot guarantee 100% safety of funds. Besides, each crypto exchange security level is different, and one can’t tell what is going to happen going forward. Lately, news on hacking and robbing client funds appear everywhere. This year, in the course, if bitgrail and coincheck (both very large exchanges) hack the investors lost around $700M. There are even some cases when the crypto exchange owners do frauds and then try to get away with the client money. In this light, crypto trading is overall riskier than other types of trading, as the crypto market is not regulated and, thus, is very vulnerable.

Broker

Trading cryptocurrencies with a regulated broker guarantee some degree of safety to the clients. First, if a broker is regulated with a reliable authority, such as cysec, FCA, SEC, etc, this means the company is at least not a scam. Second, a regulated broker’s business is strictly audited, and the client has a right to file a complaint whenever the broker is thought to breach the rules. Third, regulated brokers, as a rule, are members of investor compensation schemes, the object of which is to secure claims of clients against brokerage houses that are unable to meet obligations due to financial circumstances or bankruptcy. Finally, unlike exchanges, brokers keep the client money on the bank accounts, which works as an additional guarantee.

In conclusion, one should say that cryptocurrencies are high risk and very volatile assets, which can bring both quick profits and quick losses. When choosing a trading method for cryptos, one should study all pros and cons carefully. You have to understand very well which companies or exchanges you are going to use when trading cryptocurrencies. Both broker and exchange trading have their advantages and disadvantages, so your final decision will depend upon your goals and personal preferences.

This article was written by dmitriy gurkovskiy, a chief analyst at roboforex

so, let's see, what we have: top 10 crypto exchanges of 2021 ranked by fees, liquidity, pros, cons and usp's. Select the best exchange to trade or buy crypto. At crypto currency trading exchanges

Contents

- Top forex bonus list

- Top 10 best cryptocurrency exchanges in 2021

- Summary top 10 best crypto exchanges

- #1 binance

- 21 best US customer friendly crypto exchanges in 2021!

- Spot/margin trading exchanges

- Altcoin trading exchanges

- Fiat to crypto exchanges

- Peer to peer exchanges

- Spot/margin trading exchanges

- Best crypto exchanges

- Best places to buy and sell cryptocurrency

- Best crypto exchanges

- Coinbase and coinbase pro: best overall

- Cash app: best for beginners

- Binance: best for altcoins

- Bisq: best decentralized exchange

- Understanding the types of crypto exchanges

- Methodology

- List of the best decentralized cryptocurrency exchanges (DEX)

- What is DEX?

- Centralized exchange vs. Decentralized exchange

- #1. Uniswap

- #2. Kyber network

- #3. Trontrade

- #4. IDEX

- #5. Dydx

- #6. Bancor network

- #7. Bisq

- #8. Oasis

- #9. Newdex

- How many cryptocurrency exchanges are there?

- Jump to page contents

- Recently similar guides

- Recommended wallets

- Recommended exchanges

- Jump to page contents

- What is the exact number of exchanges today?

- Which are some of the most reputable exchanges?

- Best crypto exchanges

- Best places to buy and sell cryptocurrency

- Best crypto exchanges

- Coinbase and coinbase pro: best overall

- Cash app: best for beginners

- Binance: best for altcoins

- Bisq: best decentralized exchange

- Understanding the types of crypto exchanges

- Methodology

- 9 best zero-fee cryptocurrency trading exchanges in 2021

- Spot/margin trading exchanges

- Traditional trading exchanges

- Altcoin trading exchanges

- Fiat to crypto exchanges

- 4 best cryptocurrency arbitrage bot platforms for 2021

- How does crypto arbitrage work?

- Barriers to bitcoin arbitrage

- Best cryptocurrency arbitrage bots

- Cryptocurrency trading: exchange vs brokerage

- Signing up and verification

- Deposits and withdrawals

- Trading

- Safety & security

No comments:

Post a Comment