Crypto currency trader

I have tested 40+ crypto brokers. You can find the best cryptocurrency brokers below.

Top forex bonus list

This is by far the easiest way to get started with cryptocurrencies. This is a key detail that distinguishes cryptocurrencies from other prominent trading markets like forex, futures, and equity. Cryptocurrency brokers operate during the weekends as well.

Best cryptocurrency brokers for 2021

Daniel ‘harris’ major

I have tested 40+ crypto brokers. You can find the best cryptocurrency brokers below. This is by far the easiest way to get started with cryptocurrencies.

Cryptocurrency trading has become really popular in the past years. It’s growing more ever year.

Many big trading brokers have already added some of these cryptocurrencies. Everybody can sign up and start trading bitcoin or other crypto coins. This is the easiest and probably the simplest way to invest in cryptocurrency.

After trying out most brokers, here are the best cryptocurrency brokers:

Best cryptocurrency brokers (non-US traders only)

Plus500 – top rated trading platform

Plus500 is a big name in the trading industry. They have a really low minimum deposit requirement and a great trading site.

Buy/sell cfds on bitcoin in addition to buying stocks, commodities, forex etc (traded only through cfds). Plus500 is the most complete trading platform.

- Trade cfds on bitcoin & many other cryptos

- Minimum deposit is only $100

- Regulated and trusted platform

- Very fast signup process

- Live chat

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Plus500 disclaimer: 76.4% of retail CFD accounts lose money.

IQ option – lowest minimum deposit ($10)

If you don’t want to make a huge initial investment, then IQ option is the best broker for you. The minimum deposit requirement is only $10. This is by far the lowest in the industry.

- You can trade many cryptocurrencies

- Minimum deposit is only $10

- Best trading platform

- Multiple account currencies

- Free demo account

- Regulated by CYSEC (#247/14)

Etoro – top crypto broker

Etoro is a really popular trading site. They have been around since 2006. Etoro is regulated by CYSEC, FCA and ASIC.

Buy/sell bitcoin on etoro in addition to buying stocks, commodities, forex etc. Etoro is the most complete trading platform.

- Trade bitcoin & many other cryptos

- Minimum deposit is $200

- Regulated and trusted platform

- Australian traders are also accepted

- Great support team

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Etoro disclaimer: 71% of retail CFD accounts lose money.

Highlow – best all-round crypto broker

Due to regulation highlow stopped accepting traders from the EU and UK.

Highlow is an australian trading broker (AFSL no.364264). What I like most about this broker is the intuitive platform. It is so easy to use. Especially new traders will like the clean layout.

I’ve been using highlow for a few years now and I never had a problem. Highlow publishes their number of trades on the homepage. There are millions of trades on this broker each month.

I use the main platform which is web based. This means, that you don’t have to download any software. This platform is stable and safe (they use SSL).

I have also tried the ios app and the android app. They are great, but I just don’t like trading on smartphones in general.

The payouts on highlow are amazing (up to 200%, which is more than on other brokers).

Highlow is a great broker for cryptocurrencies (but only if you are not from EU,UK, US). They have a good reputation, great support team and awesome promotions for new traders.

- Trade bitcoin & other cryptos

- Minimum deposit is only $50

- Regulated and trusted platform

- Fastest signup process (no questionnaires)

- Multiple account currencies

- Free demo account (no registration needed)

Nadex – US traders welcome

Nadex is a CFTC regulated broker. In fact, this is probably the only US broker that has this regulation.

Only US traders are allowed on nadex. Non-US traders check out the next broker.

Update OCTOBER 2019: looks like nadex removed crypto trading. After contacting them I found out that they will add it back soon. Register on nadex now and get updated when they add it.

Recently, nadex started offering bitcoin trading.

- Trade bitcoin, forex or binary options

- Minimum deposit is $250

- CFTC regulated broker

- Great support team

- Many payment methods (even paypal)

Crypto brokers with most cryptocurrencies

Here are the most popular cryptocurrencies offered by cryptocurrency brokers:

- Etoro – bitcoin, ethereum, litecoin, dash, ethereum classic, NEO and ripple.

- Plus500 – bitcoin, ethereum, litecoin, bitcoin cash, ripple, IOTA.

- Avatrade – bitcoin, ethereum, ethereum classic, ripple, dash, bitcoin cash litecoin, monero and NEO.

Lowest minimum deposit brokers

These are the best brokers with low minimum deposit requirements:

- Etoro – $200

- Plus500 – $100

- Avatrade – $100

This is really important because the crypto market itself is unregulated. Depositing on a regulated broker means that your money is safe.

We’ve also looked at the support team and the payment methods. You can deposit easily using multiple payment methods on the brokers below.

Top rated brokers that have cryptocurrencies

While we are all familiar with the broad definition of a broker, is there something more to it when it comes to cryptocurrencies?

Simply put, a cryptocurrency broker refers to a website that traders will visit to trade cryptocurrencies at a set price. In many ways, they are similar to forex brokers whose services are a lot more familiar to the general public.

Etoro disclaimer: 71% of retail CFD accounts lose money.

You still can’t decide which broker is best for you?

How to choose your cryptocurrency broker

Is leverage really necessary? Cryptocurrency markets are volatile in nature with prices fluctuating immensely thereby generating high profits even in the absence of leverage. But for some traders, the desire for more earnings justifies the use of leverage.

Before choosing your broker, settle yourself on whether the already immense profits that come from a cryptocurrency market are enough for you or you would like to use leverage to enhance them even further, bearing in mind, of course, that will also significantly increase the risk factor to your funds.

Negative balance protection: it is always advisable to trade with a broker that affords the negative balance protection facility. That way, you will never be at risk of losing more than what you invested in case you sustain very heavy losses.

How suitable is the required capital for you? This is another subjective part to your decision. Do you prefer trading with a small capital or bigger one to help you zero in on bigger returns? Find out what size trades your broker is offering before you open an account.

Narrow spreads for the win: let us be honest, it is only fair that your broker gets a cut from the money you generated having provided you with the essential facilities for it and all. But let us be honest, you definitely want every last dime for yourself.

A spread refers to the difference between the buying price and selling price of a trade and it varies with each broker. The spread is what counts as fees for your broker so the smaller it is, the lower the cost will be on your part.

Lets go into what aspects you as a trader must consider when choosing a broker to trade cryptocurrencies.

Which cryptocurrencies are you interested in trading?

Make sure you have decided on which cryptocurrencies you want to trade in before signing up with your broker.

If your choice is a prominent cryptocurrency like bitcoin (official site), litecoin (official site), or ethereum(official site), there will be a relatively broad availability of brokers that have trading options for those. However, less prevalent examples like monero, IOTA, or zcash may be a little harder to come by.

So study the cryptocurrencies being offered by a broker before you sign up for an account.

Pros and cons of cryptocurrency brokers

Here are some features that these broker have or don’t:

pros

- Signup up with a crypto broker is probably the fastest way to get started with cryptocurrency trading

- If you are less tech-savvy then a broker is safer for you

- You can start buying cryptocurrency while traditional exchanges don’t always accept this payment method

- Most of the time you can’t withdraw cryptocurrencies from a broker. You have to exchange it back to fiat money (USD/EUR etc.)

Cryptocurrency brokers – what to look for

Here are some of the more understated details about your cryptocurrency broker that could make your trading experiences so much more efficient and successful.

1. What are the weekend hours like?

This is a key detail that distinguishes cryptocurrencies from other prominent trading markets like forex, futures, and equity. Cryptocurrency brokers operate during the weekends as well.

There is virtually no difference in purchasing bitcoin at the end of the week as opposed to the middle of the week during peak hours.

But there is a catch. While digital currency exchanges are available during the weekend, your broker may not (why is the stock market closed on the weekend?). So in effect, if there is considerable movement within your relevant cryptocurrency market during a weekend when your broker is not operating, you may not have the ability to respond in any way.

2. How is it hedging?

Your broker is probably not keen on revealing if it is hedging cryptocurrency traders but it is important information for you to know.

Why is it so important for you to know?

Because, as a trader, you want to be absolutely in the clear regarding the policies for risk management being followed by your broker. Let us not forget that cryptocurrency markets are extremely volatile and an unhedged broker is more easily prone to major losses incurred by its clients. Naturally, those costs will warrant compensation via fatter spreads and additional costs for traders. It will be best to sign up with a broker that will not withhold the relevant information from you.

More great features you could be interested in

Commissions and trading on margin – an important thing to note while trading cryptocurrencies is that their prices tend to be more similar to equities than they are to real currencies. So your broker could be charging you commissions in addition to a wide spread on each trade. That, of course, raises the cost probably a bit much for your liking.

Another similarity with equities is that the margin conditions with cryptocurrencies are significantly more than they are with forex or cfds. Consequently, leverage is usually up to 10x. How considerable the margin rate will be for traders is down to what trading strategies and risk management they subscribe to.

Authenticity of market data – aside from merely evaluating how it influences spreads, market data for cryptocurrency CFD prices can be a good indicator of how the quality of the product will be in the future.

One of the more recent examples of this is BTC-e which was an immensely popular platform for trading bitcoin before it was shut down by feds. BTC-e was the first bitcoin exchange to incorporate forex trades and so made their exchange accessible via MT4 and supplied cryptocurrency liquidity for brokers.

But once it was shut down, every broker that depended squarely upon BTC-e was left with no hedging options or market data to put a price on its crypto cfds.

Are short sales available? For many traders, shorting is a crucial strategy option, the lack of which can be a deal breaker with a potential broker. Many brokers tend to offer ‘long’ only since there are only a few hedging solutions when opening short trades.

As you see, investing in cryptocurrencies can be a truly lucrative venture for you but only if you get it right.

And a lot of that is down to which broker you decide to trade with.

Ready to start trading?

Trade with the cryptocurrency brokers listed above to make sure that your money is safe, you pick a broker with a stellar reputation and you keep the fees low. Excel at trading bitcoin by creating your own trading strategy.

These cryptocurrency brokers make it really easy to trade bitcoin and other coins. You don’t have to be a trading expert. It helps if you know what a blockchain is or how the ledger and transactions work, but this is all optional.

Sign up now and see for yourself how easy it is to get started.

Cryptocurrency traders could ‘lose all their money,’ UK watchdog warns

Most popular today

More on:

Cryptocurrency

Sales from the crypto: 2 NYC bars could make history by selling for bitcoin

Cryptocurrency market value tops $1 trillion as bitcoin surges

Bitcoin hits new record above $35,000 following massive drop

Jack dorsey rails against feds’ proposed cryptocurrency rules

Britain’s financial watchdog issued a dire warning to cryptocurrency traders monday as bitcoin took investors on another wild ride.

The UK’s financial conduct authority said consumers who invest in the red-hot cryptocurrency market “should be prepared to lose all their money” because there are so many risks involved.

Firms promoting crypto investments may overstate the returns that traders will reap and understate the risks of the market, and investors who buy in are unlikely to have access to consumer protections if something goes wrong, regulators said.

“consumers should be aware of the risks and fully consider whether investing in high-return investments based on cryptoassets is appropriate for them,” the agency, known as the FCA, said in the warning. “they should check and carefully consider the cryptoasset business involved.”

Officials also noted that there’s no guarantee digital currencies can be converted back into cash and that their prices are known to swing wildly.

Monday offered yet another example of that volatility as the price of bitcoin — the world’s largest cryptocurrency — plummeted after a record-breaking rally last week.

Bitcoin was trading at $33,554.28 as of 9:51 a.M., down nearly 15 percent from a day earlier and about 20 percent from the all-time high of $41,962.36 that it reached on friday, according to coindesk data.

Bitcoin has been volatile of late. Getty images

Other popular coins also suffered heavy losses — ethereum, the second-largest cryptocurrency by market value, was recently down about 20 percent at $1,031.48, while XRP was off about 15 percent at roughly 28 cents.

Institutional investors have helped drive up bitcoin’s price in recent weeks amid growing perceptions that it offers protection against inflation and could even become an alternative to gold.

But the FCA cast cryptocurrencies broadly as risky, “speculative” investments that could empty retail traders’ pockets given how loosely regulated they are.

“investing in cryptoassets, or investments and lending linked to them, generally involves taking very high risks with investors’ money,” the agency warned. “… as with all high-risk, speculative investments, consumers should make sure they understand what they’re investing in, the risks associated with investing, and any regulatory protections that apply.”

Lowest trading costs for popular crypto markets*

Last updated:

Pricing delayed by 15 minutes. For live market pricing login.

Last updated:

| market‡ | spread† | margin rates | overnight finance (long) | overnight finance (short) |

|---|---|---|---|---|

| bitcoin ($) | from 35 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (£) | from 45 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (€) | from 55 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (AUD) | from 55 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin cash ($) | from 2 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| ethereum ($) | from 1.2 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| litecoin ($) | from 0.5 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| ripple ($) | from 0.6 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

† may change due to market conditions

‡ trading hours on cryptocurrencies are 22:00 sun - 22:00 fri

Lowest costs on your crypto trading compared to global competitors

We’re proud to offer the lowest costs on your crypto trading among these global competitors*, with market-leading pricing on bitcoin, ethereum, litecoin and ripple markets.

*table is for comparative purposes only and features representative spreads from global competitors on their websites and platforms, and is correct to the best of our knowledge, as of 23/01/2020 11.00am BST. Trading costs are based on a bitcoin ($) price of 9,000 and a 1 CFD trade, representing a total notional volume of $9,000. Plus 500 costs include the cost of reopening trades due to forced expiration dates. Positive numbers imply charges to client accounts; negative numbers imply credit received by clients.

Why trade cryptos as cfds with FOREX.Com?

Take advantage of crypto volatility

A trading partner you can trust

Trading vs. Owning crypto

| cfds | owning crypto | |

|---|---|---|

| profit from rising crypto prices | ✔ | ✔ |

| profit from falling crypto prices (go short)** | ✔ | |

| trade on margin | ✔ | |

| trade on volatility - no need to own the asset or have an exchange account | ✔ | |

| no exchange fees or complicated digital wallets | ✔ | |

| lock in profits and cap losses with risk management tools | ✔ |

**shorting only available on BTC and ETH.

Please be aware that owning cryptos does not have the same associated cost as trading it, and in some instances, it may be more costly to trade it.

Cryptocurrencies available for trading

Bitcoin

Ethereum

Litecoin

Ripple

How to trade thematic indices

Latest research

- NIO rides TSLA’s coattails to a record high: room to run? January 11, 2021 6:39 PM

- Currency pair of the week: XAU/USD (gold) january 11, 2021 2:14 PM

- Top UK ipos to watch out for in 2021 january 11, 2021 1:05 PM

read latest research

Trade cryptos on metatrader 5

Cryptocurrencies aren’t available on MT4, but they are on MT5. With improved charting, exclusive indicators and the ability to trade 500+ markets including cryptocurrencies, stocks, FX pairs, indices and commodities all on one platform, metatrader 5 offers next-generation trading and tools.

The FOREX.Com advantage

Trade with confidence and benefit from the reliability of a trusted broker with a proven record of stability, security and strength.

Have questions? We've got answers.

What is the minimum trade size for cryptocurrencies

How does FOREX.Com price cryptocurrencies?

Start trading cryptocurrencies with FOREX.Com today.

Try a demo account

It's your world. Trade it.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Cryptocurrency traders could ‘lose all their money,’ UK watchdog warns

Most popular today

More on:

Cryptocurrency

Sales from the crypto: 2 NYC bars could make history by selling for bitcoin

Cryptocurrency market value tops $1 trillion as bitcoin surges

Bitcoin hits new record above $35,000 following massive drop

Jack dorsey rails against feds’ proposed cryptocurrency rules

Britain’s financial watchdog issued a dire warning to cryptocurrency traders monday as bitcoin took investors on another wild ride.

The UK’s financial conduct authority said consumers who invest in the red-hot cryptocurrency market “should be prepared to lose all their money” because there are so many risks involved.

Firms promoting crypto investments may overstate the returns that traders will reap and understate the risks of the market, and investors who buy in are unlikely to have access to consumer protections if something goes wrong, regulators said.

“consumers should be aware of the risks and fully consider whether investing in high-return investments based on cryptoassets is appropriate for them,” the agency, known as the FCA, said in the warning. “they should check and carefully consider the cryptoasset business involved.”

Officials also noted that there’s no guarantee digital currencies can be converted back into cash and that their prices are known to swing wildly.

Monday offered yet another example of that volatility as the price of bitcoin — the world’s largest cryptocurrency — plummeted after a record-breaking rally last week.

Bitcoin was trading at $33,554.28 as of 9:51 a.M., down nearly 15 percent from a day earlier and about 20 percent from the all-time high of $41,962.36 that it reached on friday, according to coindesk data.

Bitcoin has been volatile of late. Getty images

Other popular coins also suffered heavy losses — ethereum, the second-largest cryptocurrency by market value, was recently down about 20 percent at $1,031.48, while XRP was off about 15 percent at roughly 28 cents.

Institutional investors have helped drive up bitcoin’s price in recent weeks amid growing perceptions that it offers protection against inflation and could even become an alternative to gold.

But the FCA cast cryptocurrencies broadly as risky, “speculative” investments that could empty retail traders’ pockets given how loosely regulated they are.

“investing in cryptoassets, or investments and lending linked to them, generally involves taking very high risks with investors’ money,” the agency warned. “… as with all high-risk, speculative investments, consumers should make sure they understand what they’re investing in, the risks associated with investing, and any regulatory protections that apply.”

Top 10 online cryptocurrency trading brokers

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

- World's leading social trading platform

- Proven track record of security

- Unlimited daily withdrawals

- Min. Deposit of $200 to get started

- Instant trade execution

With over 30 years of trading experience and trades in over 50 countries, city index is a leader in spread betting, CFD and forex trading. Trade in 12,000+ global markets including bitcoin, indices, shares, forex and much more.

- Trade on 12,000+ markets including bitcoin

- Trade anytime, anywhere. Across all devices

- Risk management & transparent pricing

- Fast execution on every trade

Thanks to an excellent reputation, high trading standards, and multilingual customer care, avatrade has become one of the industries leading brokers. Offering highly competitive spreads on a wide variety of trading investments.

- Get up to

14,000 bonus - No commission/no exchange fees

- Trade a wide variety of crypto cfds

With markets.Com get ZERO commission trading on cryptocurrency, forex and commodity cfds with one of the most sophisticated trading platforms in the industry.

- No commission trading

- Use paypal to trade bitcoin futures

- Advanced innovative trading platforms

Easymarkets was formed by bankers and forex experts and has been serving the forex market for 16 years, with transparent pricing, fixed spreads and no commissions on deposits or withdrawals. Now with cryptocurrency cfds!

- Demo account is unlimited

- Trade bitcoin with no slippage - ever!

- No commissions or sneaky fees

T&C's apply to each of the offers above, click "visit site" for more details.

Risk warning: users should be aware that all investment markets carry inherent risks, and past performance does not assure future results. Trading of any kind is a high-risk activity, and you could lose more than you initially deposited. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 73-89% of retail investor accounts lose money when trading cfds. Please be sure you thoroughly understand the risks involved and do not invest money you cannot afford to lose. Your capital is at risk. Advertiser disclosure: topbrokers.Trade is an independent professional comparison site funded by referral fees. The compensation topbrokers.Trade receives is derived from the companies and advertisements featured on the site. Due to this compensation, we can provide our users with a free comparison tool. Unfortunately we are unable to list every broker or exchange available, however, we do our best to review as many as possible.

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

With over 30 years of trading experience and trades in over 50 countries, city index is a leader in spread betting, CFD and forex trading. Trade in 12,000+ global markets including bitcoin, indices, shares, forex and much more.

Thanks to an excellent reputation, high trading standards, and multilingual customer care, avatrade has become one of the industries leading brokers. Offering highly competitive spreads on a wide variety of trading investments.

How to get started in cryptocurrency trading

As the trade volumes are reaching billions of dollars a day and the market caps are hitting tens of billions of dollars, it is no wonder that cryptocurrencies fuel the modern day gold rush. Today is an age of digital currencies, with hundreds of cryptocurrencies birthed within the decade. There are already more than a thousand cryptocurrencies in the market, and almost daily a new initial coin offering (ICO) appears.

What is cryptocurrency?

Today, the most famous cryptocurrency is bitcoin. Its inventor attempted to build a “peer-to-peer electronic cash system”. Many have tried this system many times before. However, the main difference between bitcoin and the previous efforts, like digicash, was that it was to be entirely decentralized. Since no overarching entity is controlling the currency, the notion of “trust” would be eliminated from the system.

To combat “double spending”, the major problem in all the digital cash systems at that point, satoshi nakamoto, bitcoin’s inventor, proposed the blockchain technology. The blockchain technology is a revolutionary technology that records all the transactions made with this currency.

For any single balance, transaction, or change to the network to take place, there needs to be a consensus amongst those who validate the network – the miners. Since the invention of bitcoin, many programmers have attempted to use the model and change it to provide what they consider a more functional form of digital cash.

The other kinds of cryptocurrencies include monero, new economy movement, litecoin, and ether. Many of these cryptocurrency efforts tailor their currency for an individual and particular purpose. Some of the most common purposes are speed, privacy, and price.

What are cryptocurrencies used for?

Since cryptocurrency is such a new technology, it may be that people have not used it yet for its eventual use. Still, today people utilize it for many various purposes. These purposes include, but aren’t limited to the following: trading, remittances, payment for goods and services, investment, gambling, private monetary transactions, and as a hedge against national currencies which are suffering from rapid devaluation (greece, venezuela for example).

As the whole cryptocurrency space begins to expand, it’s likely that we will see some additional applications joining the list of purposes for the crypto currency. There are already young services such as steemit, which aims to revolutionize the way people pay for content on social media, in addition to services like musicoin which attempts to find a more equitable way to pay artists without the need for a middleman.

What is the difference between bitcoin and ethereum?

All cryptocurrencies have their own characteristics. However, recently one coin has come to challenge bitcoin more than ever before. Ethereum is the new player on the market. The reasons that it is a challenge to bitcoin are easy to understand.

Ethereum emerged as an effort to try to correct some of the main criticisms made towards bitcoin – especially regarding security.

What ethereum has accomplished to do was to provide transactions that are safer, more flexible contracts that are compatible with any wallet, with short block times for negotiating (where the confirmations are easier). Also, ethereum is available more than bitcoin. Whereas more than two-thirds of bitcoin has already been mined, access to ethereum is still widely available. Another main difference between these two cryptocurrencies is that ethereum allows for different developers to raise funds for their projects. It can, therefore, be in itself a kickstarter for some projects.

One of the main advantages to ethereum is that it’s a more secure, easy to use, flexible, and transact coin. In addition to this advantage, it has brought innovations in terms of entrepreneurship and investment. And this is posing a serious challenge to bitcoin’s market cap.

What is the difference between a cryptocurrency exchange and a cryptocurrency broker?

You can invest in cryptocurrency in two ways. First, cryptocurrency can be bought and sold at a cryptocurrency exchange and stored in a digital wallet. The second method would be to invest in crypto as a CFD with regulated cryptocurrency brokers. With CFD cryptocurrency trading, the digital currency is treated as a speculative investment and traded as a contract for difference (or CFD), through brokers.

Platforms that allow traders to buy and sell cryptocurrencies are cryptocurrency exchanges. Dues to the fact that it is a very recent – and booming – market, the majority of these platforms are relatively new. But, of course, one of the essential questions that people ask is how to know if a particular platform is safe or not.

The only way that you can find out is to check if the exchange provides transparent data of the coins that are in cold storage. What this means is, whether it has the reserves that it requires to provide liquidity to its activities. You can find check this easily by checking whether an exchange is regulated or not.

Trade cryptocurrency online using CFD services

If you are interested in trading because of the opportunity to profit from the incredible volatility of cryptocurrency, your best option is to use an online trading platform that allows CFD services. Currently, there are very few CFD platforms that allow this kind of trade, so to see available options refer to our recommendations above.

CFD brokers are a great option if you want to trade cryptocurrencies with the option to accept multiple forms of payment. If you want to buy cryptocurrency with paypal, you can, and these forums also accept major credit cards and wire transfers as well. Furthermore, if you choose to trade through a forex or CFD platform, you will pay the lowest commissions possible. That is in comparison to other investment alternatives. CFD and forex companies use an exchange rate that is an aggregate of different crypto exchanges.

Trading cryptocurrencies – getting started with cfds (contracts for differences)

Cryptocurrency cfds allow you to trade digital coins without actually owning any. Crypto cfds were generated to give traders exposure to the cryptocurrency market without the need for ownership.

Contracts for differences, also known as “cfds,” represent a contract between trader and exchange. Cfds declare that the difference between the price on entry and the price on exit will be a trader’s profit or loss. Basically, cfds are an agreement held between two parties that simulate an actual asset.

How to make money trading crypto

There are several ways to make money cryptocurrency trading. The most popular is trading bitcoin against the US dollar, known in market terms as the BTC/USD pair. The first method is to find a top cryptocurrency broker and to invest in a digital currency in the same way that you would do with a physical currency – by buying low and selling high. Since cryptocurrency is highly volatile, you should be able to identify the dip with studying and market research.

Read on to learn how to find the best cryptocurrency brokers. Be sure to review the platforms we suggest above, all are fully-registered and come highly recommended. For additional information regarding trading cryptocurrency as a CFD, check out our guide on “the basics of cfds“. It’s important that you remember that leverage works both ways and it will magnify the gains and losses.

How to choose the best cryptocurrency trading broker online

Because there’s so much competition in the market as well as having countless cryptocurrency brokers to choose from, it can be difficult to know which option will be best for you. Here are a few key points we suggest keeping in mind when deciding how to best invest:

Regulation

Each country has its own regulatory body. The regulatory body develops rules, services and programs to protect the integrity of the market. The regulators protect traders, and investors as well as the cryptocurrency brokers themselves. Their main obligation is to help members meet regulatory responsibilities. Due to potential safety concerns regarding deposit, you should exclusively open accounts with regulated firms.

Customer service

Cryptocurrency trading takes place 24 hrs a day, so customer support should be available at all times. Ideally, you will want to speak with a live support person rather than a time-consuming auto-attendant. Give a call to the customer service centre to get an idea of the type of customer service provided. Check on wait times and find out the representative’s ability to answer questions regarding spreads and leverage, trade volume, and company details.

Account types

Your ideal cryptocurrency trading broker should be able to offer either multiple account options or an element of customizability. Look for cryptocurrency brokers that offer competitive spreads and easy deposits/withdrawals.

Currency pairs

Cryptocurrency brokers can provide a selection of cryptocurrency pairs. However, it is most important is that they provide the variety of pairs that interest you. While there are many digital currencies available for trading, there are only a few get the majority of the attention, and as the result, trade with the highest liquidity.

Platform type

The trading platform is the investor’s portal to the markets. With that in mind, look for a platform that’s easy to use, straightforward and offers an advanced collection of analytical and technical and tools. These features will help to enhance your trading experience.

Here at topbrokers.Trade, we take pride in providing the best possible trading brokers comparison, reviews and ratings. These reviews enable you to select the best trading platform for your needs. We don’t just help you to pick a great place to trade, but also do everything that we can, to show you how to get started. For more information on cryptocurrencies, please see our tutorial: the basics of cryptocurrency

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

7 cryptocurrency trading bots for beginners

Trading bots are computer programs configured to complete buy-and-sell orders automatically. These bots are gaining popularity by the day, and among their best features are good profits, security, user-friendliness, speed, and many others. Bots are also independent of decisions based on human emotions.

The upsurge in the number of companies offering trading bot services makes them a perfect item of discussion. The main reason behind the use of trading bots is the crypto market volatility. Since the crypto market is a 24-hour economy, market trends change in seconds. Automated trading allows the crypto traders to react to any changes even when they are away from their trading platforms.

As a trader, you might often wonder what bot is the best for use. Keep on reading to know the seven best trading bots as listed below.

Shrimpy

This web-based platform was launched in 2018. It works by automating functions to allow traders to manage their portfolio, analyze the market, and execute their strategies.

Anyone can start using shrimpy by signing up from the website and connecting their exchange account to shrimpy. Although it’s a new product in the market, it’s rapidly gaining popularity among new and seasoned traders due to the excellent services.

Shrimpy supports an extensive list of crypto exchanges, along with an endless list of cryptocurrencies. Some of the exchanges supported are bittrex, kucoin, coinbase pro, bitmart, bitstamp, gemini, huobi, bibox, binance, and bitfinex.

Shrimpy also comes with the best pricing plans for new and even experienced crypto users. Its paid plan allows traders to access almost all service functionalities, including unlimited exchanges, custom portfolios, and rebalancing.

Shrimpy’s plans start as low as $8.99 per month. The subscription gives full access to the features above and features a full social trading platform with complete portfolio backtesting.

Shrimpy has a simple, very clean, and easy to use interface. Setting up trading bots is easy. The functionalities are quite easy to use, so the platform is generally user-friendly.

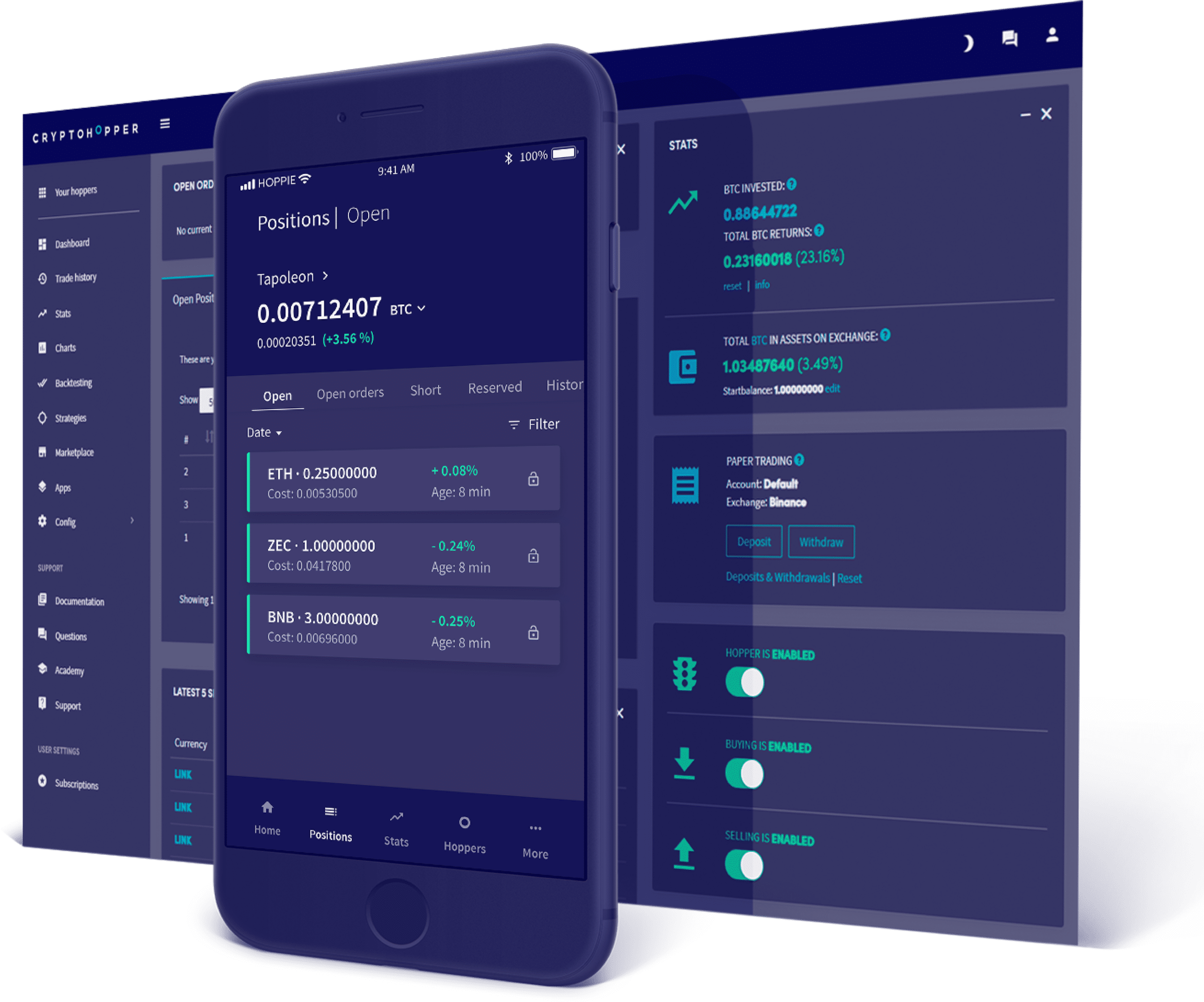

Cryptohopper trading bot

The cryptohopper domain and platform was registered in 2017 and is owned and operated by cryptohopper BV, a netherland based company. The platform serves as a web-based platform and comes with a user-friendly interface that operates 24/7. It is a platform that allows for both algorithmic and social trading.

The technology involved allows for full automatic tradings by integrating the API to the crypto exchanges. The services are easy to use on any internet-enabled device.

The platform incorporates configurable and savable templates, a bot backtesting tool, and customizable technical indicators. Cryptohopper is compatible with several exchanges, i.E., kraken, coinbase pro, cryptopia, huobi, binance, kucoin, poloniex, bitfinex, and bittrex.

Cryptotrader

Cryptotrader is a project run by algocraft limited and allows users to use their strategies to automated trading via the scripting language based on coffee-script . Members of the platform can trade bitcoins and other cryptos without other software, and the bot operates 24/7.

The platform is web-based, and the vpncloud hosts the automated bots. It allows its users to use backtesting and live testing strategies.

Cryptotrader platform provides an API that can link with different exchanges and give developers full trading algorithms writing rights. Crypto exchanges supported in the platform include coinbase, huobi, binance, bitfinex, bitstamp, bittrex, kraken, and poloniex. It operates on subscription. Therefore, a trader can choose a paid plan that best suits their needs.

Zignaly

Zignaly , a spain-based platform, was founded in 2018. It’s a trading terminal that allows bitcoin and other cryptos. The platform excels at both manual and automated trading.

The platform is cloud-based, which automatically updates without you having to do it manually. Any changes you make in your system are automatically updated into the cloud, and you can get access to the information from any device.

A trader gets external signals from the systems signal providers. The signals help to analyze the market and make strategies based on market conditions. This means that a trader doesn’t need to devote all of his time to trading. However, there is not much information about the reliability and safety of the platform. The price of zignaly’s beta plan is $9 per month .

Kryll

Kryll was launched in 2018 through an ICO but was introduced to the public in january 2018. Kryll’s block-like strategy structure makes it easy for traders to use trade as their primary income mode.

Although it has gained popularity in the past two years and has received positive reviews from users and critics, it’s still less popular than its competitors. The exchanges supported in this platform include binance, bittrex, liquid, kucoin, poloniex, coinbase pro (GDAX), hitbtc, and bitstamp. However, kryll is still trying to make more exchanges compatible with its system.

Kryll is user-friendly so that even beginners can easily use it.

3commas

3commas is best for the more experienced crypto traders since its user interface is a little complicated. The interface can be accessed anywhere using a desktop, phone, or any other internet-connected device.

This cloud-based platform incorporates a smart trading terminal, reliable trading bots, copy trading, and portfolio management. The platform supports 23 different exchanges, including binance, bitfinex, and others.

3commas allows the user to do either manual or automated trading. Its pricing plan for starters is $14.5 per month , and you can change your plan as you progress.

Haasbot

Haasbot platform was founded in 2014 and had a transparent team. The platform offers a wide range of services, including technical indicators and backtesting of real-time and historical safety and insurance.

The platform requires users to install the software on their laptops, which comes with an excellent interface and customizable dashboards that appeal to them. Haasbot supports both linux and windows OS, and a user can trade at any time.

Haasbot is compatible with 20 exchanges, including bitfinex, bitstamp, binance, and bitmex. Plan payments are made in bitcoins, and the prices range from 0.04 BTC for a 3-month plan to 0.32BTC for a 12-month advance payment plan.

Bottomline

Crypto trading bots are a must-have tool for any trader who would like to make significant trades. These programs help you trade, even while you are away, and make wise investment decisions that are not clouded by emotions.

There are several trading bots available in the market, all of which come with different features. If you are looking for one, you may find it challenging to choose the best. Luckily for you, we’ve rounded up the seven best bots you can use to give you a headstart.

World class automated crypto trading bot

Copy traders, manage all your exchange accounts, use market-making and exchange/market arbitrage and simulate or backtest your trading.

Fast automated trading, and portfolio management for bitcoin, ethereum, litecoin, and 100+ other cryptocurrencies on the world’s top crypto exchanges.

Automate

your trading

And take your emotion out of the equation

Invest in all cryptocurrencies that your exchange offers. At the same time, you’ll also gain access to an expert suite of tools like our trailing features that help you buy/sell better than before.

Trades opened on cryptohopper

Manage all your exchange accounts in one place

Connect your exchange.

Your exchange is where your funds are located. With cryptohopper you can manage all your exchange accounts and trade from one place.

Signals. Templates. Strategies

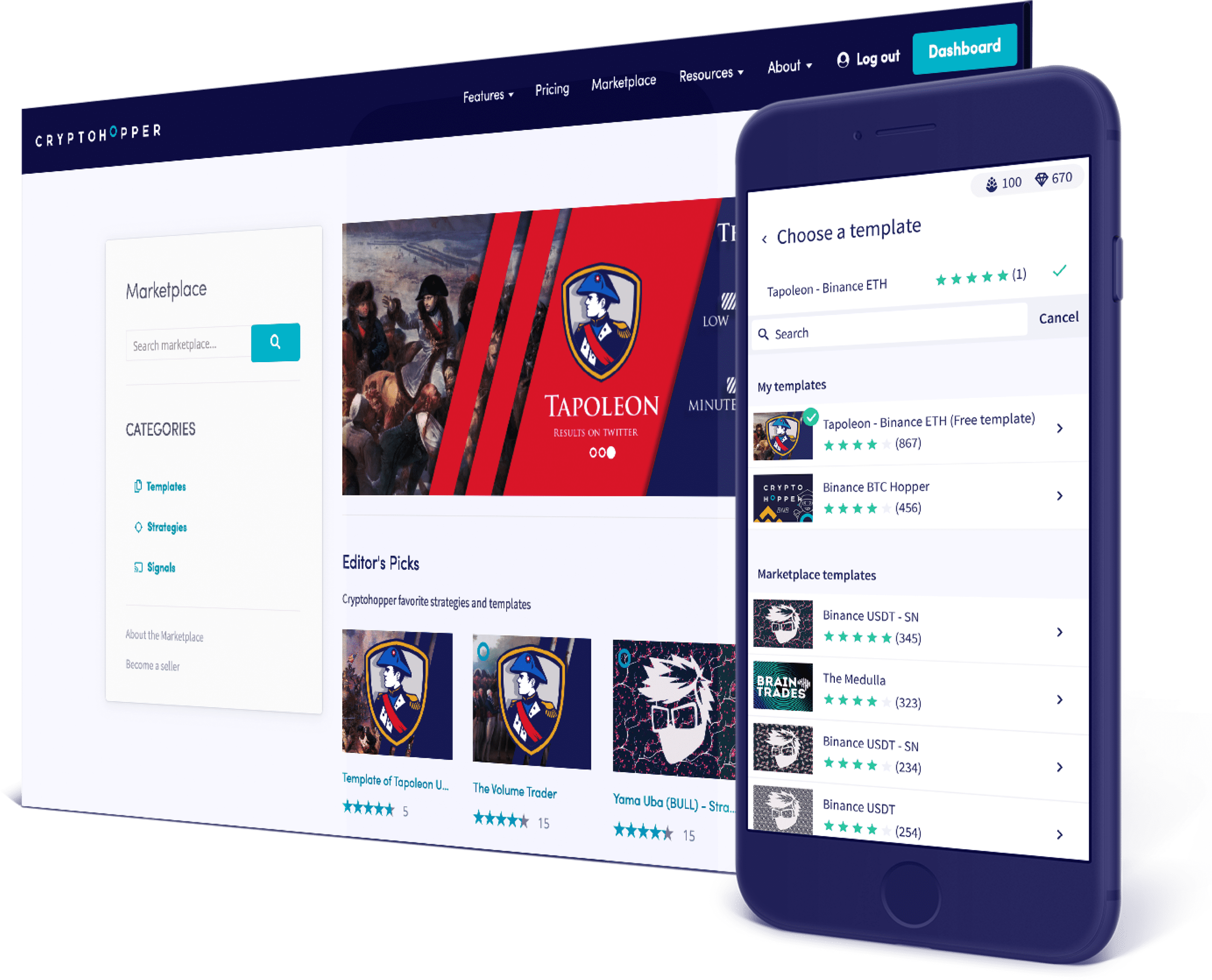

Social trading platform

(check out the marketplace!)

Join the social trading revolution. Subscribe to trading signals, discuss trading strategies on our internal chat, and buy strategies and bot templates from our marketplace. You don't need to be an expert to trade like one.

Easy. Effective. Worldclass

Use expert tools

without coding skills

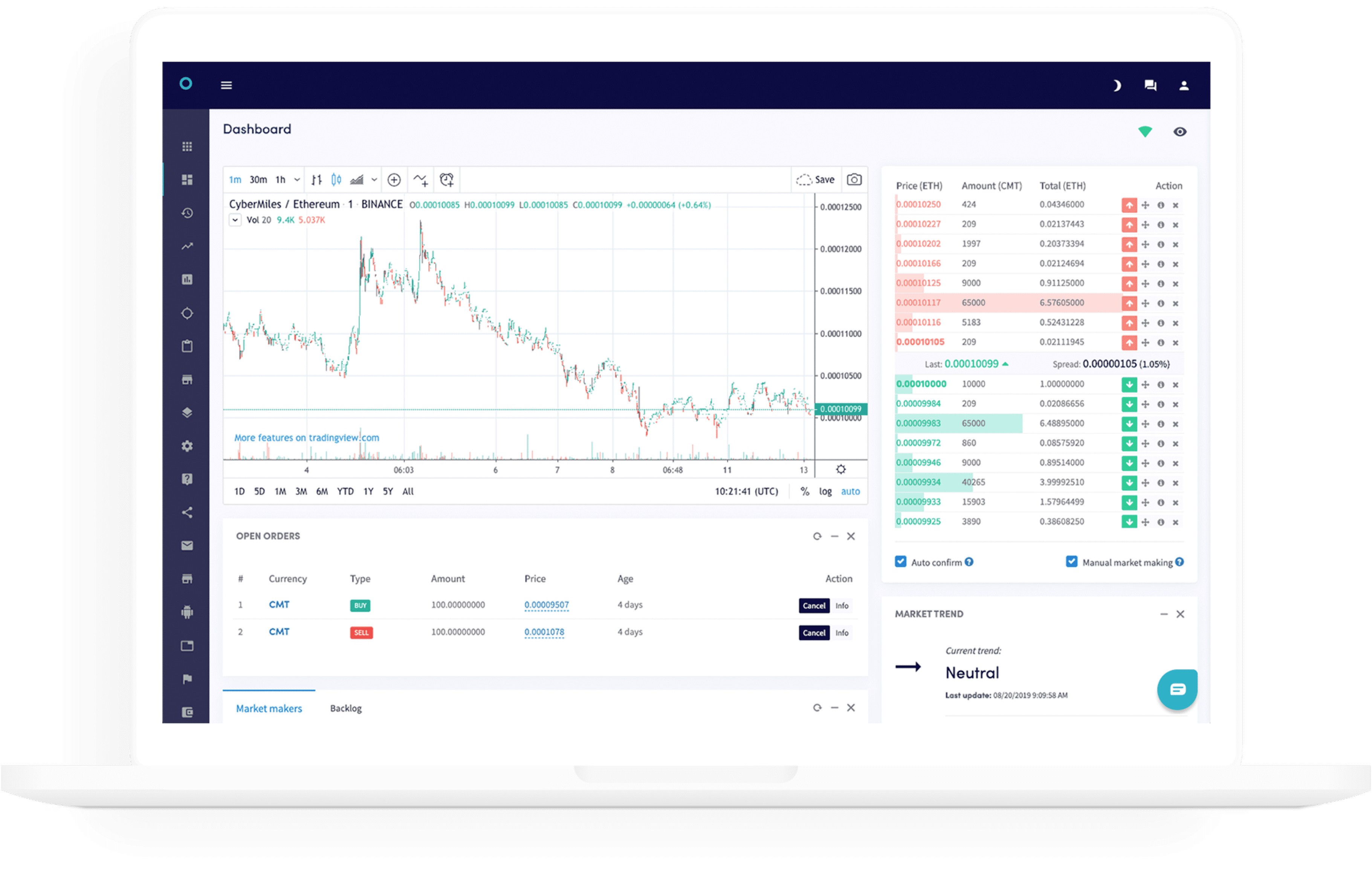

Market-making

Market makers are the best friend of every exchange or crypto project. Now you can trade easily on the spread as well, and make the markets. A win-win for everybody. Read more

Exchange/market arbitrage

Want to benefit from price differences of exchanges and/or between pairs? Our arbitrage tool is your new best friend. Read more

Strategy designer

Create your own technical analysis to get the best buy and sell signals from your strategy. Popular indicators and candle patterns are: RSI, EMA, parabolic sar, CCI, hammer, hanged man, but we have many more. Your hopper will scan the markets 24/7 searching for opportunities for you. Read more

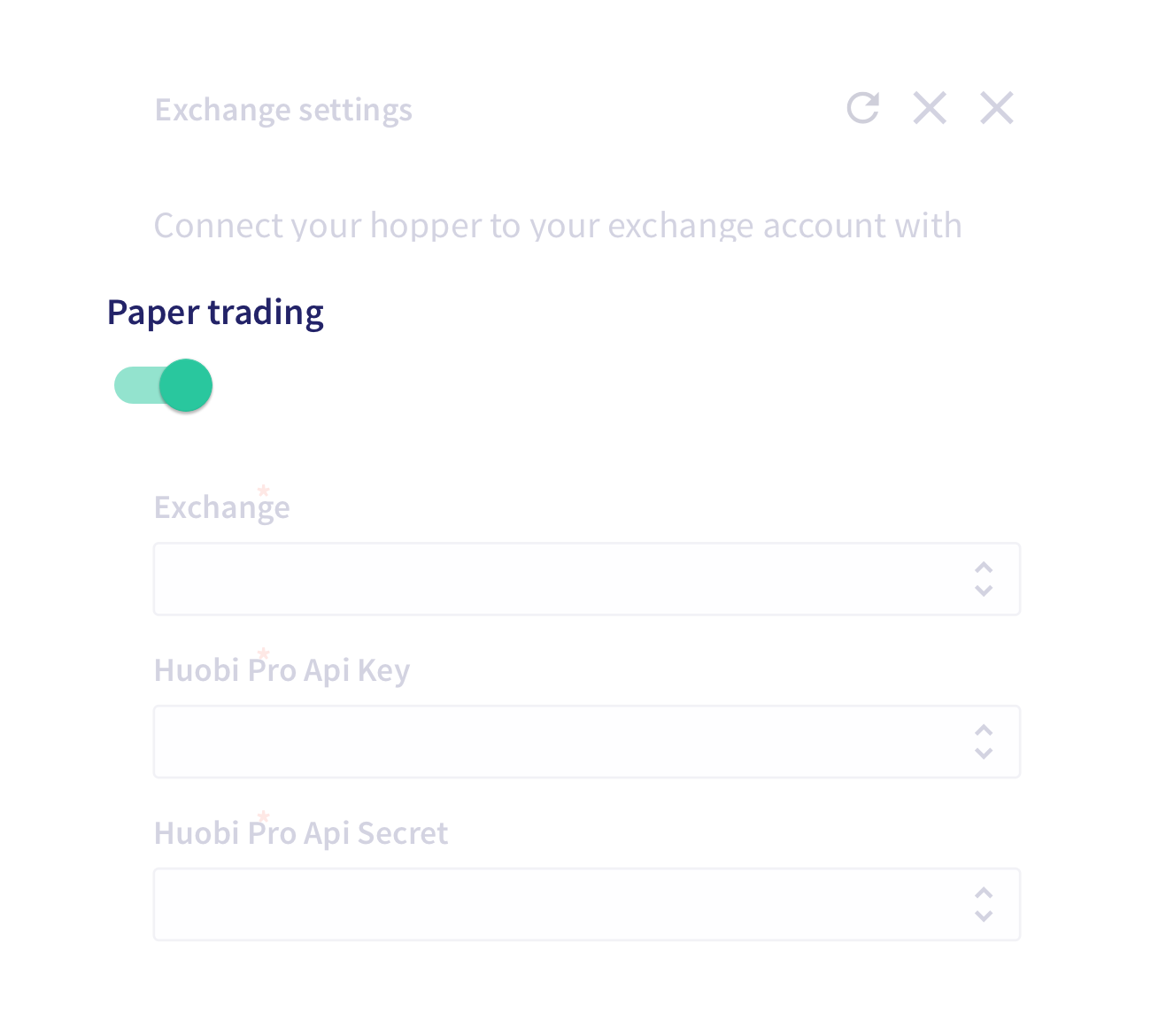

Simulate your trading without fear (or money.)

Practice daring new strategies risk-free while mastering cryptohopper’s tools. Even backtest your bot and your strategies, so you can keep tweaking until it is effective.

What succesful cryptocurrency traders say about cryptohopper

Average score from the google play store (21 nov. 2019)

Meyer family | 11 nov 2019

"I'm very satisfied with cryptohopper and highly recommend it for day trading. It took me a while to get a strategy that worked for me, but it appears to have been well worth it. I recommend paper trading and backtesting extensively before using any real money. Once you master the initial learning curve, you will feel much more secure and confident that you can weather any trend or market. It will also be a valuable asset during the next alt-season and halvening events. Thank you cryptohopper team!"

Roshywall gurgel | 7 nov 2019

"great app. I don't understand cryptocurrencies very well but from what I saw in the demo you can profit. I will definitely buy the basic version to upgrade and profit."

"good service, powerful features, effective, affordable. Highly recommend. ��"

Soflow will | 24 oct 2019

"very easy to use and incredibly affordable. Get the free trail to test it and learn the ropes, then upgrade. I upgraded twice after one week and i still use both subscriptions. Awesome selection of options. Unlimited strategies, lots of free built-ins. Spend time to learn the fundamentals of technical analysis - you'll be glad you did. Crypto hopper will soon become your best friend. And weapon of choice!"

Chika moronu | 23 oct 2019

"took a while to get used to the settings, but once I got the hang of it, the app has been great"

Damion la bagh | 21 sep 2019

"the cryptohopper experience is simply amazing. Great instructions to help you on your way and s great community. The website is beautifully designed with full functionality. The app on the other hand is nice but it's not as full featured. It has the things you need to monitor your hoppers and basically interact but doesn't have the nice graphs, charts or settings to create new strategies like the website does. So one is still dependant on a laptop or computer to get everything set up 1st before"

Mitchell kemp | 3 sep 2019

Galen grassi | 6 sep 2019

"so far for a begginer I'm enjoying this, got a lot to learn but it's a good platform with useful tutorials to assist you along.. I would recommend cryptohopper."

Best cryptocurrency brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best crypto platform for most people is definitely etoro.

Many people believe that cryptocurrencies are the future of finance. When you’re ready to leap into crypto, choosing a broker to trade or invest in cryptocurrencies is one of the most important steps to your success in the crypto market.

Get started now with benzinga’s picks for the best cryptocurrency brokers to choose the right one for you.

Best crypto brokers and trading platforms:

- Best for social trading: etoro

- Best for ease-of-use: gemini

- Best for new investors: coinbase

- Best for gold investments: itrustcapital

- Best for high volume forex traders: cryptorocket

- Best for accessibility: altrady

- Best for multiple exchanges: voyager

Best crypto brokers

Since different brokers have different strengths, you need to figure out what kind of broker best suits your cryptocurrency interests. Some brokers provide a social trading platform where you copy other cryptocurrency traders’ trades in your own account. Others can offer the ability to make transactions in a broader selection of altcoins.

Choosing the best crypto broker depends largely on addressing your needs as an investor or trader. The following list crypto brokers been selected for different reasons to meet the needs of differing cryptocurrency trading and investing styles.

Commissions

Account minimum

1. Best for social trading: etoro

Etoro fundamentally changed the way many people trade and invest with its social trading platform. Social trading involves mirroring another trader or investor’s transactions in a special social trading account. While you make the same amount proportionally as the trader you’re copying, you also take the same percentage of losses the trader takes in their account.

In addition to its regular crypto trading platform, etoro offers an advanced cryptocurrency exchange platform called etorox. This platform is designed for algorithmic traders and institutional grade investors. It offers traders access to tight-dealing spreads, and its algox application programming interface (API) can be used to create custom automated trading tools.

Commissions

Account minimum

2. Best for ease-of-use: gemini

Stay on top of market trends, build your crypto portfolio and execute your trading strategy with gemini’s easy-to-use tools. The gemini app is available on all the major app stores, and it puts the industry’s best crypto exchange and wallet in your hands.

Gemini’s app is easy to use. You can track asset prices and real-time market prices and set price alerts so you can act fast on price movements for individual assets. You can also schedule recurring buys on bitcoin and other cryptocurrencies.

Invest with peace of mind with gemini’s solid cybersecurity and custody solutions. Create a free account and make your 1st buy in as little as 3 minutes.

Commissions

Account minimum

3. Best for new investors: coinbase

Coinbase is 1 of the largest and oldest cryptocurrency exchanges. It currently services 35 million customers worldwide. Coinbase has extensive educational resources and an intuitive interface ideal for new traders and investors.

The exchange also provides clients with a hosted wallet and offers global customer support. Coinbase is an excellent choice for those new to the cryptocurrency market who do not wish to use social trading services.

Commissions

Account minimum

4. Best for gold investments: itrustcapital

Itrustcapital is 1 of the few cryptocurrency brokers that lets you trade and hold physical gold in your individual retirement account (IRA). You can also trade bitcoin (BTC), ethereum (ETH), litecoin (LTC) and bitcoin cash (BTH) in your IRA. Itrustcapital provides you with a personal wallet by curv for your crypto transactions.

While itrustcapital has no minimum trade or account size, the company charges account holders a flat fee of $29.95 per month. This amount includes all IRA fees, asset custody charges and access to its trading platform, although all cryptocurrency trades carry an additional 1% transaction charge based on the trade size.

If you’re planning for your retirement and want to add physical gold to your cryptocurrency portfolio as an inflation hedge, then itrustcapital is a solid choice.

5. Best for high volume forex traders: cryptorocket

Cryptorocket offers straight through processing (STP) to its trading clients. This means you deal directly with the crypto and forex markets and not through intermediaries or market makers. This broker model is ideal for high volume forex traders who tend to be sensitive to dealing spreads.

In addition to the 35 crypto pairs offered, you can trade 55 fiat currency pairs, 64 major stocks and 11 indices. If you are based in a jurisdiction with relatively lax retail forex trading regulatory oversight, you may even be able to take advantage of cryptorocket’s 500:1 maximum leverage ratio for forex trades.

Cryptorocket also supports the popular 3rd-party metatrader4 trading platform.

6. Best for accessibility: altrady

Altrady is built by crypto traders for crypto traders. It makes cryptocurrency trading accessible for beginner, intermediate and advanced traders.

You can get the tools that professional crypto traders use without the expensive price tag. Altrady’s platform is intuitive and easy-to-use. Its crypto trading software platform adapts to your needs.

It combines 10 connected exchanges. It also offers immediate price alerts, portfolio manager, break-even calculator, and customizable trading pages by allowing traders to manipulate widgets to create preferred layout in order to trade comfortably, limit ladder order, gain quick access to market tabs, and integrated market scanners.

Commissions

Account minimum

7. Best for multiple exchanges: voyager

Voyager connects to more than a dozen of the most trusted and secure crypto exchanges so you have access to the largest crypto trading market available anywhere. Voyager gives you faster, more reliable execution, plus:

- Access to multiple exchanges: voyager partnered with over a dozen of the most trusted and secure crypto exchanges and liquidity providers. Voyager’s exchange connectivity offers you competitive prices on your trades and faster, more reliable execution.

- Commission-free trading: voyager operates commission free to save you money. You save money on trades through its extensive crypto market and best execution technology. Voyager achieves price improvement on over 90% of customer orders.

Start trading at a better price today! Download the voyager app today.

Crypto advantages vs. Disadvantages

Trading and investing in cryptocurrencies often carry a considerable degree of risk, as you may have observed given the volatility of bitcoin and some other digital currencies. Despite the disadvantages currently associated with cryptos versus fiat currencies (like lower liquidity and minimal payment options), the advantages of holding cryptocurrencies will increase as they become a more common form of payment.

Here’s a quick shot of crypto advantages and disadvantages.

Advantages

- Security. Technology advances typically lead to increased intrusion into your privacy. In contrast, all identities and transactions are strictly secured in the digital currency environment. While most cryptocurrency transactions are very secure, you still could be vulnerable to cybercriminal actions, like hacking.

- Low transaction fees. Because of the elimination of intermediaries like financial institutions, cryptocurrency transaction fees are generally quite low.

- Decentralized. The lack of a central exchange or authority overseeing cryptocurrencies is one of their defining characteristics. Many people consider this among the biggest advantages of cryptocurrencies and blockchain technology.

- High potential returns. You only have to look at a long-term bitcoin price chart to get an idea of the returns you can make investing wisely in digital currencies. The crypto world is still developing and expanding, so investing in the right digital currency now could translate into considerable returns in the future.

Disadvantages

- Acceptance. Because digital currencies have not yet become mainstream, most businesses will not accept them as payment for goods or services. This situation will eventually change as public perception makes digital currencies more acceptable as forms of payment. For example, paypal has recently allowed customers to hold bitcoin balances and has plans to allow payments using that cryptocurrency by early 2021.

- Volatility. The market volatility observed in some digital currencies can lead to large gains or large losses. Trading and investing in crypto is not for everyone, especially those with a low pain threshold or aversion to risk.

- Taxes. The internal revenue service (IRS) states on its official website that “virtual currency transactions are taxable by law just like transactions in any other property.” that IRS web page also links to a guide about how existing general tax principles apply to transactions made using digital currencies.

- Illegal activities. Due to the fact that digital currency transactions generally provide identity security, many people operating outside the law are thought to use digital currency for illegal activities. These activities could include money laundering, “dark web” transactions, and drug and human trafficking.

Cryptocurrency vocabulary

Like many other financial markets, the cryptocurrency market has evolved its own jargon. Some of the key terms used by market operators are defined below.

- Block. A collection of transactions permanently recorded on a digital ledger that occur regularly in every time period on a blockchain.

- Blockchain. A constantly growing list of blocks in a peer-to-peer network that records transactions.

- Cryptocurrency exchanges. Also called digital currency exchanges, these generally consist of online businesses that allow customers to exchange cryptocurrencies for fiat currencies or other cryptocurrencies.

- Cryptocurrency wallet. A secure digital account used to send, receive and store digital currencies. Crypto wallets can either be cold wallets that are used for storing cryptos in an offline environment or hosted wallets that are hosted by 3rd parties. Hosted wallets store your private keys and provide security for your digital currency balances.

- Distributed ledger. A network of decentralized nodes or computers that connect to a network where transaction data is stored. Distributed ledgers do not have to involve cryptocurrencies and can be either private or permissioned.

- Fork. Also known as a “chain split,” a fork is a split that creates an alternate version of a blockchain that then leaves 2 blockchains running simultaneously. For example, bitcoin and bitcoin cash came about due to a fork in the original bitcoin blockchain. Another type of fork is known as a “project” or “software fork.” this occurs when cryptocurrency developers take the source code of an existing altcoin project and create a new project. For example, litecoin is a project fork of bitcoin.

- ICO. An initial coin offering (ICO) occurs when a new digital currency or token is sold, typically at a discount, to its first set of investors. An ICO lets issuing cryptocurrency companies raise funds from the public to support their coin’s development and maintenance.

- Mining. A computationally-intensive process performed within a cryptocurrency network where blocks are added to the blockchain by verifying transactions on its distributed ledger. Miners are rewarded with digital coins as compensation for their successful computational efforts.

Are you ready for the future?

Digital currency and the blockchain appear to be the future of finance. Despite their current typical volatility and lack of widespread acceptance as a payment method, cryptocurrencies seem destined to become increasingly used for online payments. They could therefore make an interesting long-term investment, especially if you have a strong appetite for risk.

Where we will be in 20 years is anyone’s guess, but cryptocurrencies and blockchain technology show growing promise as forces to be reckoned with in the financial world. Get started today with 1 of our recommended crypto brokers.

Try gemini

Gemini builds crypto products to help you buy, sell, and store your bitcoin and cryptocurrency. You can buy bitcoin and crypto instantly and access all the tools you need to understand the crypto market and start investing, all through one clear, attractive interface. Gemini crypto platform offers excellent account management options. You can manage your account at a glance, view your account balance 24-hour changes and percent changes. Get started with gemini now.

Lowest trading costs for popular crypto markets*

Last updated:

Pricing delayed by 15 minutes. For live market pricing login.

Last updated:

| market‡ | spread† | margin rates | overnight finance (long) | overnight finance (short) |

|---|---|---|---|---|

| bitcoin ($) | from 35 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (£) | from 45 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (€) | from 55 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (AUD) | from 55 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin cash ($) | from 2 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| ethereum ($) | from 1.2 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| litecoin ($) | from 0.5 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| ripple ($) | from 0.6 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

† may change due to market conditions

‡ trading hours on cryptocurrencies are 22:00 sun - 22:00 fri

Lowest costs on your crypto trading compared to global competitors

We’re proud to offer the lowest costs on your crypto trading among these global competitors*, with market-leading pricing on bitcoin, ethereum, litecoin and ripple markets.

*table is for comparative purposes only and features representative spreads from global competitors on their websites and platforms, and is correct to the best of our knowledge, as of 23/01/2020 11.00am BST. Trading costs are based on a bitcoin ($) price of 9,000 and a 1 CFD trade, representing a total notional volume of $9,000. Plus 500 costs include the cost of reopening trades due to forced expiration dates. Positive numbers imply charges to client accounts; negative numbers imply credit received by clients.

Why trade cryptos as cfds with FOREX.Com?

Take advantage of crypto volatility

A trading partner you can trust

Trading vs. Owning crypto

| cfds | owning crypto | |

|---|---|---|

| profit from rising crypto prices | ✔ | ✔ |

| profit from falling crypto prices (go short)** | ✔ | |

| trade on margin | ✔ | |

| trade on volatility - no need to own the asset or have an exchange account | ✔ | |

| no exchange fees or complicated digital wallets | ✔ | |

| lock in profits and cap losses with risk management tools | ✔ |

**shorting only available on BTC and ETH.

Please be aware that owning cryptos does not have the same associated cost as trading it, and in some instances, it may be more costly to trade it.

Cryptocurrencies available for trading

Bitcoin

Ethereum

Litecoin

Ripple

How to trade thematic indices

Latest research

- NIO rides TSLA’s coattails to a record high: room to run? January 11, 2021 6:39 PM

- Currency pair of the week: XAU/USD (gold) january 11, 2021 2:14 PM

- Top UK ipos to watch out for in 2021 january 11, 2021 1:05 PM

read latest research

Trade cryptos on metatrader 5

Cryptocurrencies aren’t available on MT4, but they are on MT5. With improved charting, exclusive indicators and the ability to trade 500+ markets including cryptocurrencies, stocks, FX pairs, indices and commodities all on one platform, metatrader 5 offers next-generation trading and tools.

The FOREX.Com advantage

Trade with confidence and benefit from the reliability of a trusted broker with a proven record of stability, security and strength.

Have questions? We've got answers.

What is the minimum trade size for cryptocurrencies

How does FOREX.Com price cryptocurrencies?

Start trading cryptocurrencies with FOREX.Com today.

Try a demo account

It's your world. Trade it.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

So, let's see, what we have: compare the best cryptocurrency brokers. Start trading bitcoin (BTC), bitcoin cash (BCH) ethereum and other coins. Choose safe and legit crypto brokers. At crypto currency trader

Contents

- Top forex bonus list

- Best cryptocurrency brokers for 2021

- Best cryptocurrency brokers (non-US traders only)

- Plus500 – top rated trading platform

- IQ option – lowest minimum deposit ($10)

- Etoro – top crypto broker

- Highlow – best all-round crypto broker

- Nadex – US traders welcome

- Crypto brokers with most cryptocurrencies

- Lowest minimum deposit brokers

- Top rated brokers that have cryptocurrencies

- How to choose your cryptocurrency broker

- Which cryptocurrencies are you interested in trading?

- Pros and cons of cryptocurrency brokers

- Cryptocurrency brokers – what to look for

- More great features you could be interested in

- Ready to start trading?

- Cryptocurrency traders could ‘lose all their money,’ UK watchdog warns

- Sales from the crypto: 2 NYC bars could make history by selling for bitcoin

- Cryptocurrency market value tops $1 trillion as bitcoin surges

- Bitcoin hits new record above $35,000 following massive drop

- Jack dorsey rails against feds’ proposed cryptocurrency rules

- Lowest trading costs for popular crypto markets*

- Lowest costs on your crypto trading compared to global competitors

- Why trade cryptos as cfds with FOREX.Com?

- Trading vs. Owning crypto

- Cryptocurrencies available for trading

- How to trade thematic indices

- Trade cryptos on metatrader 5

- The FOREX.Com advantage

- Have questions? We've got answers.

- Start trading cryptocurrencies with FOREX.Com today.

- Try a demo account

- Cryptocurrency traders could ‘lose all their money,’ UK watchdog warns

- Sales from the crypto: 2 NYC bars could make history by selling for bitcoin

- Cryptocurrency market value tops $1 trillion as bitcoin surges

- Bitcoin hits new record above $35,000 following massive drop

- Jack dorsey rails against feds’ proposed cryptocurrency rules

- Top 10 online cryptocurrency trading brokers

- How to get started in cryptocurrency trading

- What is cryptocurrency?

- What are cryptocurrencies used for?

- What is the difference between bitcoin and ethereum?

- What is the difference between a cryptocurrency exchange and a cryptocurrency broker?

- Trade cryptocurrency online using CFD services

- Trading cryptocurrencies – getting started with cfds (contracts for differences)

- How to make money trading crypto

- How to choose the best cryptocurrency trading broker online

- 7 cryptocurrency trading bots for beginners

- Shrimpy

- Cryptohopper trading bot

- Cryptotrader

- Zignaly

- Kryll

- 3commas

- Haasbot

- Bottomline

- World class automated crypto trading bot

- Manage all your exchange accounts in one place

- Social trading platform

- Use expert tools without coding skills

- Market-making

- Exchange/market arbitrage

- Strategy designer

- Simulate your trading without fear (or money.)

- What succesful cryptocurrency traders say about cryptohopper

- Best cryptocurrency brokers

- Best crypto brokers and trading platforms:

- Best crypto brokers

- Commissions

- Account minimum

- 1. Best for social trading: etoro

- 2. Best for ease-of-use: gemini

- 3. Best for new investors: coinbase

- 4. Best for gold investments: itrustcapital

- 5. Best for high volume forex traders: cryptorocket

- 6. Best for accessibility: altrady

- 7. Best for multiple exchanges: voyager

- Crypto advantages vs. Disadvantages

- Cryptocurrency vocabulary

- Are you ready for the future?

- Lowest trading costs for popular crypto markets*

- Lowest costs on your crypto trading compared to global competitors

- Why trade cryptos as cfds with FOREX.Com?

- Trading vs. Owning crypto

- Cryptocurrencies available for trading

- How to trade thematic indices

- Trade cryptos on metatrader 5

- The FOREX.Com advantage

- Have questions? We've got answers.

- Start trading cryptocurrencies with FOREX.Com today.

- Try a demo account

No comments:

Post a Comment