Forex broker free money

Forex brokers that accept mobile money in ghana have an advantage because even those who operate bank accounts also have access to mobile money.

Top forex bonus list

Mobile money usage in ghana is driven by telecom companies such as airtel/tigo, MTN and glo. In kenya on the other hand, the most popular mobile money payment system is vodafone’s M-pesa. Some EU brokerages have been able to adapt to the situation by creating international divisions to handle clients from outside the EU. Africa represents a huge opportunity for forex brokers because the penetration of forex trading on the continent is relatively low. However, there is a large unbanked population in the african market. For the unbanked, mobile money represents one of the major means of transaction. This has led to a slight increase in the number of forex brokers that accept mobile money for transactions. Kenya and ghana are two countries where the use of mobile money is very high.

Forex brokers that accept mobile money

This article describes forex brokers who accept the use of mobile money for forex deposits and withdrawals. But what is mobile money all about?

Mobile money refers to money stored in an account that is operated by telecom companies, in which the user’s mobile phone and other telephony details such as the phone number are integral components of the transaction process. This is possible because phone numbers are unique in themselves, and every phone device comes with a unique international mobile equipment (IMEI) number. The unique nature of phone numbers can be enhanced by subjecting each user to biometric registration, in which physical traits that cannot be replicated in any other human being such as the fingerprint, are captured and assigned to the phone number. That way, a user can perform financial transactions over a mobile network using the phone number as a unique identification number, just the way every bank customer would have a unique bank account number, cheque books or savings passbooks of years gone by.

The mobile money payment channel is very common in africa, where it is used as a tool for financial inclusion. Many african countries and indeed countries of the middle east have large unbanked populations. Accessing services such as a forex trading account require financial inclusion, where a user of the financial system can be identified and the individual’s financial history can be profiled, in compliance with international laws against money laundering.

What forex brokers accept mobile money

The number of forex brokers that accept mobile money for deposits and withdrawals is still relatively low. Despite this fact, there are already a couple of solid forex brokers who work with mobile money.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.

Between 74-89% of retail investor accounts lose money when trading cfds.

You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

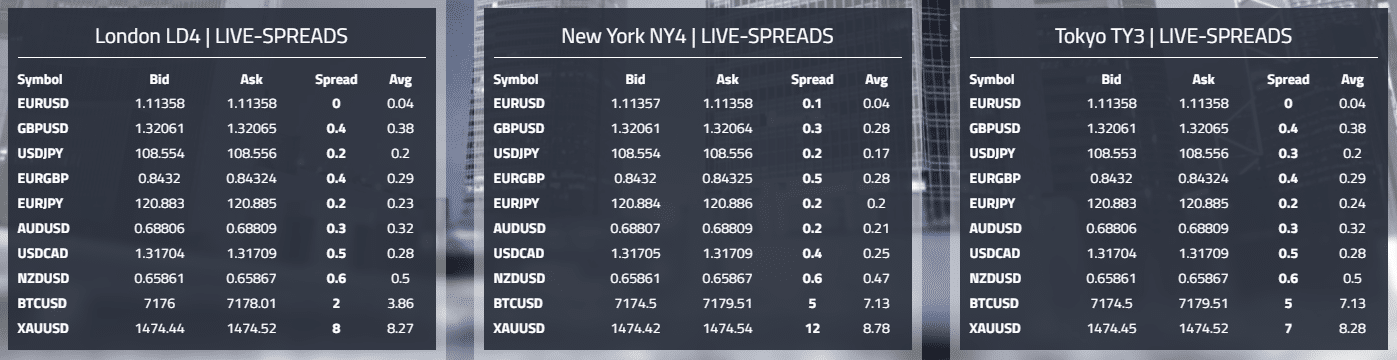

¹ variable spreads vary according to the current market conditions, recorded for EUR/USD on 06.05.2020 at 10:42 GMT+1.

Forex brokers and mobile money

With the passage of the european securities and markets authority (ESMA) rules of 2018, it has become very expensive for traders to open and operate trading accounts with UK and EU forex brokers. This has led to a mass migration of traders to so-called offshore locations and loss of business for many of these EU brokers. The loss of business has hit many of them so badly, that their loud protests have caught the attention of the european commission, which has instituted a process to review the mifid II protocols that ESMA derives its regulatory powers from.

Some EU brokerages have been able to adapt to the situation by creating international divisions to handle clients from outside the EU. Africa represents a huge opportunity for forex brokers because the penetration of forex trading on the continent is relatively low. However, there is a large unbanked population in the african market. For the unbanked, mobile money represents one of the major means of transaction. This has led to a slight increase in the number of forex brokers that accept mobile money for transactions. Kenya and ghana are two countries where the use of mobile money is very high.

Forex brokers that accept mobile money in ghana have an advantage because even those who operate bank accounts also have access to mobile money. Mobile money usage in ghana is driven by telecom companies such as airtel/tigo, MTN and glo. In kenya on the other hand, the most popular mobile money payment system is vodafone’s M-pesa.

Mobile money as a funding method

To be able to get registered on a mobile money network, the user must have a phone number, with a registered SIM card matched to the user by means of biometrics. This provides an infallible means of identification, allowing the user to perform transactions on the mobile phone.

Forex brokers that accept mobile money in ghana are then able to accept deposits in the local currency, the ghana cedis (GHS). Withdrawals are also conducted in the local currency. Users have the option of operating forex accounts in the local currency (if the broker allows it), or they can still maintain foreign currency accounts, in which case the appropriate conversion rates and charges are applied.

Since the mobile money registration process also incorporates biometric registration, all data can be harmonized and checked by the brokerage’s compliance department to ensure that appropriate know-your-customer (KYC) protocols are followed.

Benefits of using a forex broker that accepts mobile money

The benefits of using an FX broker that accepts mobile money are as follows:

- A) very fast deposits and withdrawals: transaction times are very fast, as transfers are processed in a matter of minutes.

- B) it is a cashless method which allows the user to transact without carrying money.

- C) the convenience of this transaction method is virtually unrivalled. A country like ghana has mobile money outlets on virtually every street. You can simply walk into a vendor’s shop, deposit ghana cedis with the vendor, have your mobile money wallet funded and you proceed to fund your forex account.

- D) no need to fill any forms and there is no waiting time. You can do your forex account funding anytime, including weekends and holidays.

Drawbacks of using a forex broker that accepts mobile money

What are the drawbacks of using forex brokers that accept mobile money?

- A) initial sign-up processes can be a hassle. There are instances of registration failure due to problems with the internet network.

- B) forex brokers that accept mobile money are relatively few. This narrows the user’s choice of brokers.

Choosing a forex broker that accepts mobile money

Presently, the number of forex brokers accept mobile money in ghana and around africa are few. However, this could change quickly as more brokers are entering the african market. For a user, make sure to use online forums and other information sources to get a first-hand account on the experience others have had with the mobile money transaction process. You can also check the table above to see some of the most popular FX brokers that are accepting mobile money.

Forex trading without deposit | no deposit bonus explained

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

Free real money forex no deposit

Among forex brokers, there is a tough competition going on as to who will get the most number of novice traders. The race for new clients is so important to forex brokers that they are willing to sponsor their new clients by giving them access to take part in live forex trades without making any deposit. This is called the fore no deposit account.

With this development, it is now possible to actually trade the forex market without making any financial commitments at all. The normal trend was to sign up with a broker and make some deposits in your real account before you can start trading the forex market, but things has changed and broker have devised new ways of getting new clients every day. Once you sign up with the broker, you get real money in your account with which you can trade the forex market with.

In as much as this is basically to encourage people to trade the forex market, it is also important t know that there are terms and conditions attached to the forex no deposit accounts. These terms and conditions help the forex broker stay safe and not exposed to huge risks seeing as they are the ones sponsoring their new clients with their no deposit accounts. Some of the terms and conditions are

1. The trader must register with the broker and trade with the platform offered by the broker. This is the main reason why brokers go as far as offering traders the opportunity to trade the forex market without any deposit.

2. Once the client registers with the broker and is set to trade, the broke gives the trader access to an account with a certain amount of real money with which the trader can trade the live forex market on the condition that the trader does not withdraw the money. The money is there and can be traded with but the trader does not have the ability to make withdrawals from the no deposit account until some conditions are met.

3. For the trader to withdraw some real money from his or her no deposit account, the trader must have accumulated some trade points and made some profits. Form the profit made, the trader is expected to make some deposit to his account, which will serve as a trade capital, after which the trader can freely withdraw the rest of the profit made.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

Forex broker free money

Deposit bonus – A bonus on funding a live account. The bonus credited on percentage of the deposit amount.

No deposit bonus – free bonus on account registration for the new clients to trade live without any risk.

Tradable bonus: A deposit bonus that can be lost and traded as the part of your trading equity.

Volume bonus – most common type of deposit bonus, it allows you to increase your trading volume. Often the bonus can be cashed on trading lot requirement.

Forex gift – A gift for the clients for completing certain requirements, everything from bonus to latest gadget

Freebies – free stuff by forex brokers like ebook, courses, trading materials etc.

Rebate – cash-back withdrawable bonus on each lot traded.

Demo contest – contests held on demo account, win cash/tradable money with no-risk involve!

Live contest – contest held on live account, deposit requires. Win bigger cash/prizes.

Refer – a-friend– refer your friend to your broker, when your friend deposit you will get a special bonus

Free signals – get free trading signals from the broker.

Free VPS – get access to an optimized forex virtual private server for free on maintaining a certain amount of trading balance.

Binary options – binary bets trading on forex instruments

Forum posting: get a small trading bonus for each of your post in forms.

3 affiliate IB: receive a commission from your fellow traders, specially design for the marketers.

Draw bonus: the winners chosen by a draw

Seminars webinars: find the schedule to participate in the online/offline events.

Expos events: inviting to attend the forex events & expos globally.

How forex brokers make money

When trading forex, most people don’t think about how brokers make their money. However, this is a fundamental thing to understand before depositing, as you should understand where money flows throughout the system. Nobody cares about your account more than you do, so keep that in mind when figuring out who you should trust. In this article, I’ll take a look at how forex brokers make money, and what their role is in facilitating liquidity.

Understanding how forex brokers make their money can help you choose the right broker. Most brokers have a handful of charges that they use to profit from their clients. Getting familiar with these options will help you know where your money is going.

The main source of income are broker fees

Some forex brokers will charge a commission per trade, while others will charge the spread between the bid/ask prices. The main way that forex brokers make money is by keeping the spread or charging a set fee per round turn. Some brokers even charge both, but that’s becoming less common these days as the commoditization of the business demands lower pricing. Unfortunately, some less than scrupulous forex brokers have previously mentioned that they have commission free trades, but what they typically do is charge more in the spread to make up the difference.

Sometimes the spread is fixed, sometimes it is variable. In a variable spread liquidity pool, the amount of the spread will depend on how many orders are out there. When there is a major announcement such as the nonfarm payroll numbers coming out of the united states, the spread will typically widen. Because of this, in a volatile market you may end up paying more in spread than you anticipate. This is the major advantage for a fixed spread, because at least you’ll know what you’re going to be charged to facilitate buying and selling.

Compare brokers

Our forex broker ratings are based on real-life testing of over 10 criteria, including regulation, trading platforms, assets offered, customer service and more.

Compare brokers

Our forex broker ratings are based on real-life testing of over 10 criteria, including regulation, trading platforms, assets offered, customer service and more.

Compare brokers

Our forex broker ratings are based on real-life testing of over 10 criteria, including regulation, trading platforms, assets offered, customer service and more.

Compare brokers

Our forex broker ratings are based on real-life testing of over 10 criteria, including regulation, trading platforms, assets offered, customer service and more.

Alternate sources of income

Some forex brokers will charge extra for “bells and whistles” when it comes to customer service and education. For example, some will offer signals, some will offer in-depth analysis, and some will even offer private educational classes and webinars for those who are willing to pay more or have a larger account. That being said, if you understand trading and proper money management techniques, these things are very rarely needed.

Some myths

Some of the prevailing myths that endure for many years is that brokers are out there “stop loss hunting”, meaning that they are moving the prices on their servers to wipe out a bunch of traders in one shot. This is because the marketplace was previously full of unscrupulous dealers that would do such things. As a general rule, if you stick with a regulated broker, you won’t run into this issue.

Another myth is that brokers are traders themselves. In all honesty, they very rarely are. They are simply filling orders for traders. In fact, you’d be surprised how little somebody running a forex desk for a brokerage knows about actual trading. They worry about order flow, system analysis, statistical analysis, and that everybody gets what they asked for in an ordered manner.

It’s also thought that forex brokers go out of their way to take money from the clients. Nothing could be further from the truth. This is because most client accounts are closer to $1000 in value than they are $10,000. Despite the advertisements that you see of people in the caribbean on a beach, or perhaps getting off of their private jet, most retail forex traders do not have that much money in their account. Statistically speaking, most forex traders will lose a large percentage of their account within 90 days, so the forex broker doesn’t need to cheat them. This is especially true when a forex broker is well-capitalized. For example, brokers in the united states need to have a minimum of $20 million in the bank. The purpose of this capital requirement is to absorb losses for traders, and to have the ability to pay when that trader cashes out. This makes the counterparty risk very low. Unfortunately, there are forex brokers out there that used to be capitalized with as little as $10000, making them an accident just waiting to happen. Once you understand how forex brokers make money, you’ll also understand the need for using a regulated broker, and you’ll be in a stronger position to trade the markets safely and intelligently.

How do forex brokers make their money?

Like it or not, forex brokers are an integral part of any trader’s life. That’s why it’s important to understand how they operate, how they make their money and how to protect against bad broker practices such as stop-hunting.

In the following lines, we’ll dig deeper into what forex brokers are, what their main types are and how they make their profit. We’ll also explain whether forex brokers trade against their traders, and if so, how to identify such a broker.

What are forex brokers?

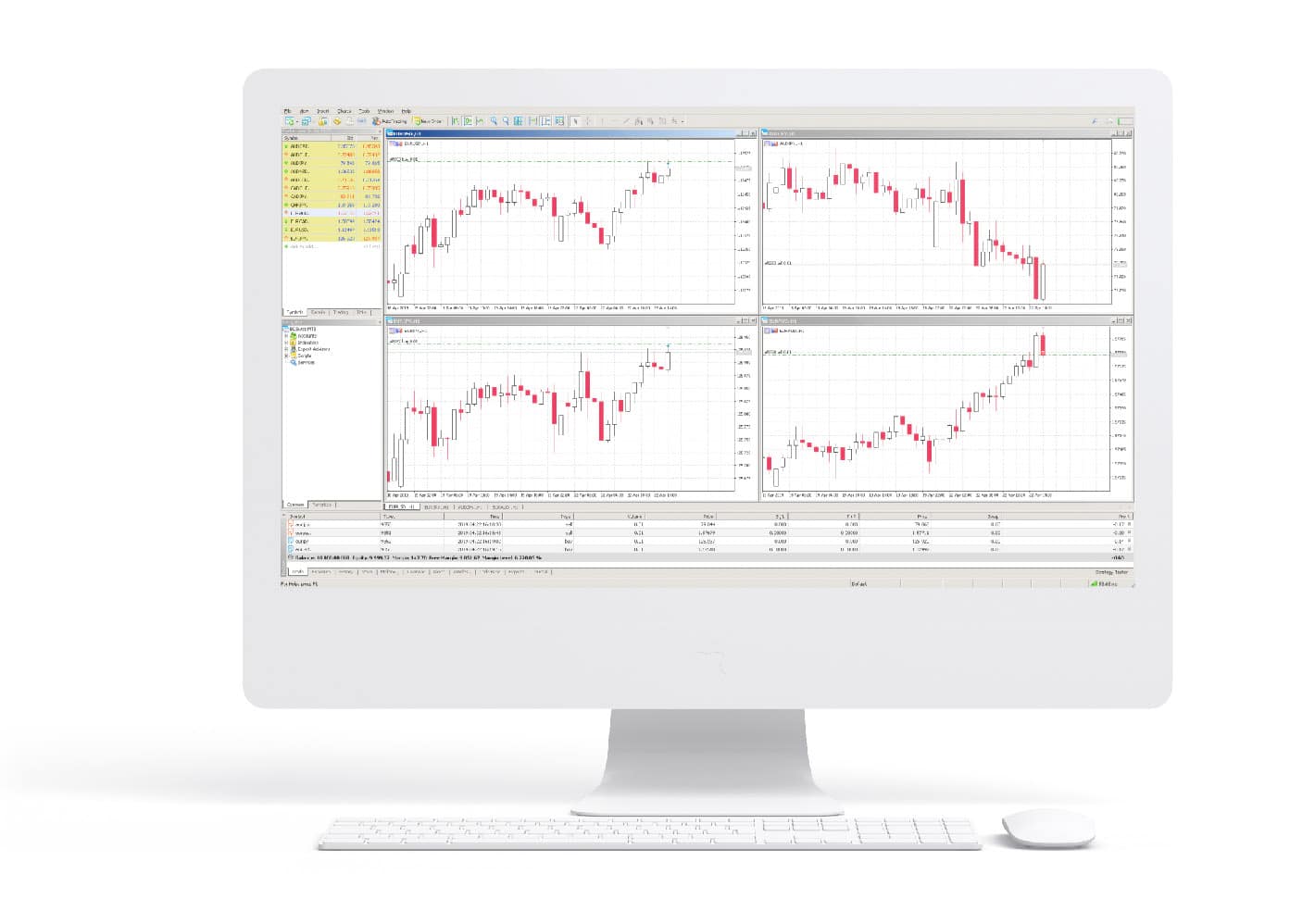

A forex broker is a company that provides traders with access to the foreign exchange market. In essence, forex brokers are a middleman between forex traders and the market. They offer a range of services, including trading platforms , which are used to buy and sell foreign currencies.

Once you send an order through your trading platform, your broker tries to match the order either with its internal pool of traders or forwards it to external liquidity providers to find the best opposite order. Each time you place a sell order, it has to be matched with a corresponding buy order, and vice-versa.

Forex brokers, also known as retail forex brokers, account for a relatively small amount of the daily forex market turnover. According to a BIS research, retail forex makes up around 5% of the total $5 trillion market.

Hey , we hope you are enjoying the course. We wanted to let you know that we've just launched something massive!

My broker consultation is a free, zero obligation, service designed to help you find your ideal broker and secure you a trading rebate (cashback).

Main types of brokers

There are two main types of forex brokers: dealing desk (DD) brokers and no dealing desk (NDD) brokers. NDD brokers can be further divided into STP, ECN and ECN+STP brokers. All mentioned types of brokers have their own advantages and disadvantages, which are explained below.

- Dealing desk

Dealing desk or DD brokers, also called market makers, provide liquidity to their clients and create the market for them. They’re called market makers because they’re the main source of liquidity for their traders. Most of the time, dealing desk brokers take the opposite side of their client’s position. If you’re selling, they’re buying from you, and vice-versa.

Since dealing desk brokers create the market for their clients, they have the full discretion to set both bid and ask prices of a currency pair. Dealing desk brokers don’t have necessarily to provide interbank rates, but the large competition among brokers makes sure that the offered rates don’t differ much from interbank rates. Also, dealing desk brokers often offer fixed spreads.

- No dealing desk

No dealing desk brokers don’t pass their clients’ orders through a dealing desk.

They simply act as a middleman between their clients and other liquidity provider, either internal or external ones. Once you place a trade with a no dealing desk broker, the broker will first try to match your order with its internal liquidity pool. If there are no matching orders, the broker will forward your order to external liquidity providers, which can include banks, mutual funds, hedge funds, other brokers etc.

Since no dealing desk brokers don’t know at which price your order will be filled, they usually offer variable spreads with a small markup that compensates them for their services.

The following graphic summarises the main difference between DD and NDD brokers pretty well.

No dealing desk brokers are further divided into stps, ecns and a combination of both (ECN+STP.)

- STP – straight through processing (STP) brokers, as their name suggests, forward your order immediately to external liquidity providers which have access to the interbank market. Once they find the best matching order, they’ll add their spread and fill your order at the external provider’s price + the broker’s spread.

- ECN – electronic communication network (ECN) brokers are true NDD brokers as they represent the bridge between retail traders and the interbank market. ECN brokers simply provide a sophisticated network that connects various market participants together, such as hedge funds, banks, other brokers and retail traders. All mentioned market participants trade directly with each other, and the ECN broker charges a small commission for its services.

- ECN+STP – finally, some brokers offer a combination of STP and ECN services. Those brokers are called ECN+STP brokers.

Here’s a table to make the difference between the main types of brokers crystal clear.

How do forex brokers make money

Now that you know what forex brokers are and their main types, let’s take a look at how they make their money. In essence, the major source of a broker’s income is the spread, followed by other sources of revenue such as commissions/fees, trading platforms and additional services.

- Spread – the spread is the difference between the bid and ask prices of currency pairs. Whenever you go long on a currency pair, you’ll get the ask price. Similarly, if you decide to close your long position or want to go short on a currency pair, you’ll get the bid price. This difference between the bid and ask price is your broker’s profit. While some dealing desk brokers offer fixed spreads, most of the time spreads are variable and depend on the current market conditions. If there are important and unexpected news in the market, spreads can widen significantly and increase your trading costs. During normal market conditions, spreads tend to be quite low with most brokers, reaching around 1 pip for most major pairs. For day traders, the new york / london session overlap usually has the lowest spreads during the day.

- Commissions/fees – besides the spread, some brokers may also charge you a fixed commission or fee per trade. This is especially true with ECN brokers. However, commissions and fees tend to be quite low due to the high competition among forex brokers. For example, a broker may charge you a $1 commission for a pre-specified lot size, such as 1 lot or 10 lots.

- Trading platforms – the next major income for forex brokers are trading platforms . While many brokers offer free in-house developed and third-party trading platforms, some of them may also charge you for additional features. If you’re a professional trader, you may look at the offer of forex trading platforms provided by your broker and look for features that could help you in your daily trading. The main point to consider is that the offered feature increases your profitability and efficiency more than the cost of the service. Beginner traders, on the other hand, are likely fine with the range of features offered with free trading platforms.

- Additional services – finally, some brokers may offer additional paid services. For a small cost, you may get access to a larger range of tradable instruments, professional market research, trading signals and market depth information, to name a few.

Do all brokers make money when you lose?

As we already said earlier, some brokers take the opposite side of your trade as they are creating the market for you. Those brokers are called market makers . However, is it bad or illegal to be a market maker? Many traders have this question, so let’s cover it briefly.

Absolutely not! Market makers provide a service that people need.

There’s nothing wrong with being a market maker and taking the opposite side of a trader’s position. Market makers operate in the following way:

The transaction is fully legal. If you don’t agree with the offered exchange rate or transaction costs, you could always look for other brokers as this is a very competitive business. In addition, since most traders lose money while trading, a market maker doesn’t have to cheat you to make an extra profit from you.

Naturally, the problems start if a market maker decides to cheat you, either because of greed or fear. There is a certain conflict of interest involved in a market maker’s transaction, since your profits are the broker’s losses and vice versa.

Stop-hunting has been a very popular practice among market makers to make extra profits by artificially moving exchange rates to hit levels where a large number of stop-loss orders are placed. Fortunately, stop-hunting has become increasingly rare, especially among regulated market makers.

Being a market maker is simply a service that traders need and an operational type of forex brokers – there’s nothing wrong in being an honest market maker per se.

Still, not all brokers make money when you lose. If you don’t like the idea of having a conflict of interest with your broker, you can always look for no-dealing desk brokers (stps, ecns or a combination of both.)

What to look for in a forex broker?

When opening a trading account with a forex broker, there are certain things you need to pay attention to. We recommend you read our guide to choosing broker . We’ve also listed the most important below.

- Regulation – always open an account with a regulated broker . Brokers are regulated and licensed by the country’s regulatory authority where they’re registered. Regulation ensures that the broker adheres to and enforces strong industry standards and that your funds are safe. Regulated brokers are happy to list their license number and regulatory authority on their website.

- Broker type – is the broker a dealing desk broker or a straight through processing / electronic communication network broker? You should know the type of your broker in advance to avoid any surprises down the road.

- Trading costs – trading costs are an important consideration when choosing a forex broker. Due to the high competition, most brokers offer very tight spreads, especially on major pairs. Are the spreads fixed or variable ? Are there any additional commissions or fees on opening trades? If you’re a day trader or scalper, trading costs can easily eat up a significant portion of your profits.

- Trading tools – what trading tools does the broker offer ? Besides free trading platforms (such as metatrader), most brokers offer free market analysis, market sentiment indicators and webinars nowadays.

- Customer service – last but not least, a broker should offer world-class customer support , reachable around the clock. If your trading platforms stops working or you are unable to open, manage or close trades, the first step you need to do is to contact your broker’s support.

Understanding your broker is a crucial part of your trading success

As a trader, you’ll be dealing with your forex broker on a daily basis, paying transaction costs and contacting their customer support from time to time.

There are two types of brokers out there: dealing desk broker (DD) and no dealing desk broker (NDD). Dealing desk brokers are also known as market makers , as they create the market for their clients and often take the opposite side of the trade. While there is nothing wrong with (regulated) market makers, some of them are notorious for bad broker practices such as stop-hunting.

If you don’t like the idea of being in a conflict of interest with your broker, you can look for no dealing desk broker which forward their clients’ orders to third-party liquidity providers. Whichever broker you choose, make sure to do your analysis and to pick the right broker for your trading needs.

Hey , we hope you are enjoying the course. We wanted to let you know that we've just launched something massive!

My broker consultation is a free, zero obligation, service designed to help you find your ideal broker and secure you a trading rebate (cashback).

How to get money back from forex scam – can you even get it back?

How to get money back from forex

Forex trading is one of the most famous forms of trading on the internet. There was a time in the past when you had to go to money exchanges to get a different currency for the currency you had. However, you can now trade fiat currencies from the comfort of your home, thanks to the online trading industry. When you trade online, you sign up with an online broker first. This broker gives you access to the forex market where you can see all the available currency pairs that you can trade. You can pick any currency pair and trade it with real money. You deposit this money into your online account through bank wire transfer, credit card, or some other method.

If you feel that you have been scammed by a forex broker trading scheme then you are welcome to visit our investment and trading scams page, for more information or visit our contact page to get help.

However, the fame of online trading has attracted many black sheep in the industry. You now have many online forex brokers that are not brokers at all. They are scammers in disguise you want to snatch away your money. Millions of people lose their money in the hands of these fake online brokers. And if you are one of them, you are also wondering how to get money back from forex scam. Can you get it back?

How to get money back from forex scam – getting it back is possible

If you are lucky enough, you can get your money back. Saying that you can’t get your money back at all would be wrong. As you continue to read, you will find out some methods that you can use to get the money back that you have lost in the hands of an online scammer. It won’t be wrong to say here that you have to be very lucky to get the money back. Even if you involve the police or some other intelligence agency, the chances of you getting the money back are very thin. You have to keep in mind that many of these online scammers have created their system after proper research.

They know how to deceive you and escape the system. They scam you, take your money, and disappear to never show up again. Not to mention, you never really know their real identities, and that’s why catching them becomes nearly impossible. However, things have changed in recent years. Today, the chances of you getting the money back have increased tremendously. Let’s discuss three methods that can help you get your money back from an online scam broker.

Methods to get your money back from forex scam

· calling your local police – very little chance

The first on the list of how to get money back from forex scam is the police. Yes, whenever you are scammed or you find yourself involved in a scenario where you have been deceived, you should get in touch with your police. That’s actually the best course of action you can take. However, your local police have some limitations. It cannot catch the thieves that are outside its domain of operation. So, if the broker is located in your country, there is still some chance that the police will get it. However, if the broker is located in some other country, you have nearly no chance of getting the money back from the scam.

· getting in touch with a regulatory authority – 50/50 chance

Now, you will be lucky if you sign up with a broker and get scammed, and then find out that the broker was regulated. If the broker that scammed you is regulated, you have some chance that you can get your money back. You just have to go on the website of the broker and find out which regulatory authority regulates it. After that, you just need to get in touch with the regulatory authority. You might find a contact form on their website or a phone number that you can call. You should immediately inform them about the mishap. You should tell them the name of the broker clearly.

If they have already gotten some complaints against the same broker, the chances are very high that they might even seal the website of that broker. However, such a perfect scenario does not happen every day. Why? Well, why will a scammer get regulated? Yes, in most cases, you are scammed by forex scams that are not regulated in the first place.

· getting help from money-back – very high chance

When you get in touch with money-back to file a complaint against an online forex scam, your chances of getting the money are very high. In fact, when you search how to get money back from forex scam after some years, money-back might be the only name you will find in your search results. Money-back has started only four years ago with its services. It has already served clients from many countries of the world with their issues with online brokers. The company has already dealt with more than a thousand cases successfully, which means the people who filed the complaint against the broker with money-back got their money back.

Why is the success rate of money-back so high in getting the money back from online scam brokers? Well, the company has been formed by a team that consists of professionals lawyers, psychologists, and industry experts. They have come together to form a team that not only knows how the laws that govern the online trading industry but also the tactics that make these online scammers give money back to the traders immediately.

Final thoughts

Just a few years ago, you could not have gotten your money back from the online scammers. If you searched for how to get money back from forex scam, you would have landed on the website of your local police after all. However, local police are usually not able to do anything when the scammer is located on the other side of the world. That’s where you need only digital police like money-back. These scammers are ready to give traders their money back instantly when they hear a lawyer on the phone, and when they know they will lose millions when the case goes inside the court. So, choose your online broker wisely, and your well-wishers even more wisely.

If you feel that you have been scammed by a forex broker trading scheme then you are welcome to visit our investment and trading scams page, for more information or visit our contact page to get help.

Forex broker free money

Deposit bonus – A bonus on funding a live account. The bonus credited on percentage of the deposit amount.

No deposit bonus – free bonus on account registration for the new clients to trade live without any risk.

Tradable bonus: A deposit bonus that can be lost and traded as the part of your trading equity.

Volume bonus – most common type of deposit bonus, it allows you to increase your trading volume. Often the bonus can be cashed on trading lot requirement.

Forex gift – A gift for the clients for completing certain requirements, everything from bonus to latest gadget

Freebies – free stuff by forex brokers like ebook, courses, trading materials etc.

Rebate – cash-back withdrawable bonus on each lot traded.

Demo contest – contests held on demo account, win cash/tradable money with no-risk involve!

Live contest – contest held on live account, deposit requires. Win bigger cash/prizes.

Refer – a-friend– refer your friend to your broker, when your friend deposit you will get a special bonus

Free signals – get free trading signals from the broker.

Free VPS – get access to an optimized forex virtual private server for free on maintaining a certain amount of trading balance.

Binary options – binary bets trading on forex instruments

Forum posting: get a small trading bonus for each of your post in forms.

3 affiliate IB: receive a commission from your fellow traders, specially design for the marketers.

Draw bonus: the winners chosen by a draw

Seminars webinars: find the schedule to participate in the online/offline events.

Expos events: inviting to attend the forex events & expos globally.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

So, let's see, what we have: find out what are the best forex brokers that accept mobile money as a deposit and withdrawal method. At forex broker free money

Contents

- Top forex bonus list

- Forex brokers that accept mobile money

- What forex brokers accept mobile money

- Forex brokers and mobile money

- Mobile money as a funding method

- Benefits of using a forex broker that accepts mobile money

- Drawbacks of using a forex broker that accepts mobile money

- Choosing a forex broker that accepts mobile money

- Forex trading without deposit | no deposit bonus explained

- No deposit bonus in a glance

- How to start forex trading without deposit: tips & recommendations

- Start forex trading without deposit: introduction to best no deposit bonuses

- No deposit bonus as an alternative – is it worth it?

- Free real money forex no deposit

- Forex broker free money

- How forex brokers make money

- The main source of income are broker fees

- Alternate sources of income

- Some myths

- How do forex brokers make their money?

- What are forex brokers?

- Main types of brokers

- How do forex brokers make money

- Do all brokers make money when you lose?

- What to look for in a forex broker?

- Understanding your broker is a crucial part of your trading success

- How to get money back from forex scam – can you even get it back?

- How to get money back from forex

- How to get money back from forex scam – getting it back is possible

- Methods to get your money back from forex scam

- · calling your local police – very little chance

- · getting in touch with a regulatory authority – 50/50 chance

- · getting help from money-back – very high chance

- Forex broker free money

- List of the best 23 forex brokers | trusted reviews

- Strict criteria for the forex broker review

- How does a forex broker work?

- Warning: only trade with regulated and licensed forex brokers

- How risky is forex trading?

- How to deposit and withdrawal money:

- Not every country is available for forex trading

- Review conclusion: start trading with a reliable forex broker

No comments:

Post a Comment