Crypto currency trading strategy

Bitcoin’s clever protocol anticipates this and adjusts it hashing difficulty to the number of miners.

Top forex bonus list

Overall then this may effect may be nullified. Another kind of arbitrage is with stable coins. Stable coins have their value fixed to some underlying asset. Most are pegged to a fiat currency such as the USD dollar so that there’s a 1:1 ratio between the coin and the underlying fiat currency.

5 profit making cryptocurrency trading strategies

In this article, we will look at five easy cryptocurrency trading strategies.

1. Bitcoin-altcoin ratios

When looking at a crypto currency chart, remember that half and probably a lot more of the price action has nothing at all to do with that crypto asset, or even crypto currencies in general. It has far more to do with the underlying fiat currency.

Let’s take the pair BTCUSD as an example. If the US dollar rallies against other currencies then all things equal we’ll likely see a big drop in bitcoin versus the US dollar for the simple reason that dollars are a more expensive asset at that point in time.

There may be little change in the number of bitcoin buyers and sellers, but the drop happens anyway because if it didn’t it would open an opportunity for risk free profit.

Precious metals traders have been dealing with that problem for years. One useful chart that they use is the gold-silver ratio chart. This plots the price of gold against the price of silver. When the ratio is high it means that gold is expensive relative to silver. And when it’s low the opposite is true.

You can use any coin ratio but since many people liken bitcoin to digital gold and litecoin to digital silver, let’s stick with that. So think of the litecoin-bitcoin ratio as the digital equivalent of the silver to gold ratio.

With ratio trading, you calculate the mean line then trade towards that line. When the litecoin-bitcoin ratio is high, above the mean line, that might be a time to switch out of litecoin and into bitcoin. When it’s low, that’s a time to start switching out of bitcoin and into litecoin.

Ratio trading can be a very profitable strategy if it’s performed consistently and over the long haul.

The great thing about using such ratio charts is that they eliminate many unrelated variables. You’re comparing like with like.

The slight problem though is that gold and silver have very long trading histories, going back thousands of years. Crypto currencies have only been around a few years. That means these historical ranges have not yet had a time to establish themselves. However ranges and mean lines will always exist, but prepare for them to evolve a little as the technology matures.

Remember that at some point in time you might want to change back into a fiat currency and at that time, the crypto to fiat exchange rate becomes relevant again.

2. Cross crypto arbitrage

Crypto currencies trade relative to their underlying fiat currency in much the same way as fiat currencies trade relative to one another.

Most exchanges and brokers will list a crypto asset against a range of other major fiat currencies. These cross rates can create a trading opportunity known as arbitrage. Arbitrage simply means the chance to make a risk free profit.

BTCUSD is trading at $6500 / $6505

BTCGBP is trading at £5300 / £5305

GBPUSD is trading at 1.2000 / 1.2010

You do the calculation and see that BTCGBP is cheap relative to BTCUSD. From the exchange rate, it should really be trading at £5416/£5420.

The arbitrage trade is then placed to buy the lower priced asset and sell the higher priced asset.

Sell BTCUSD at $6500

buy BTCGBP at £5305

You then wait for the price gap to close so that there’s no price differential. If it adjusts to the correct exchange rate, and say BTCUSD stays fixed, BTCGBP should rise to £5416/£5420. Let’s assume this happens 1 hour later. You then unwind the trade.

Buy BTCUSD at $6505, profit -$5

sell BTCGBP at £5416, profit +£111

Assuming you sell your pounds for dollars your total profit is then $97.4. This is a very simplified example but it demonstrates how arbitrage works.

Remember, when doing arbitrage the profits can be small so trading fees like spreads and swaps are very important.

When markets are working efficiently, arbitrage opportunities are seldom and the gaps are slim. They’re quickly found and traded away. Crypto currency markets are getting much more efficient than they were a few years back, because there are far more people trading them now.

3. Stable coin arbitrage

Another kind of arbitrage is with stable coins. Stable coins have their value fixed to some underlying asset. Most are pegged to a fiat currency such as the USD dollar so that there’s a 1:1 ratio between the coin and the underlying fiat currency.

Some stable coins are specifically designed to be arbitraged. Any deviation away from the peg creates an arbitrage opportunity. This means arbitrage traders can move the price back to the peg and make a profit for their efforts.

DAI is one example. The ratio is 1 dollar to 1 DAI. Unlike tether for example, another stable coin, DAI doesn’t rely on any central backing for its peg to be maintained. The DAI token is backed, or collateralized by ethereum.

DAI can be generated or borrowed by depositing some coins into a vault. On doing this you’ll get back a certain dollar amount of DAI, and at an exchange rate of 1 dollar to 1 DAI. The exact collateral you need to deposit varies from time to time.

As a simple example, suppose DAI is trading at $1.11. This is too high. You have 10 ethereum coins in your crypto wallet and the price of one ETH is $100. You could generate DAI at a cost of $1. You’d then sell your DAI on the exchange at a rate of $1.1.

When enough people do this, the external supply of DAI increases and so the price should adjust downwards. At that time you buy back your DAI tokens at $1 and redeem your ETH from the vault. Of course, if ETH is no longer $100 this could make the actual dollar profit smaller or bigger. But if you planned on holding your ethereum anyway, this wouldn’t matter. You’ve pocketed a bit of income.

Grid trading

Definitive guide

This ebook is a must read for anyone using a grid trading strategy or who's planning to do so. Grid trading is a powerful trading methodology but it's full of traps for the unwary. This new edition includes brand new exclusive material and case studies with real examples.

The other way to arbitrage stable coins is simply to buy or sell the coins directly on an exchange. With tether for example, you could sell when it’s above $1 and buy when it’s below. Then wait for the gap to close before closing the position to take profits.

As with all arbitraging, the profits are meagre and trading costs can be high. This isn’t a strategy you’d want to sit at your desk doing all day long. It works better when automated with software and that’s how most arbitragers do business.

Take note that currency pegs can break down. The breaking of the EURCHF peg is one that took many traders by surprise and even bankrupted a couple of brokers.

4. Trading the bitcoin/altcoin adoption curve

Blockchain and crypto currencies are new technology. Just like the train, the automobile and the internet these technologies historically evolve into what’s known as the s-curve adoption model.

The s-curve is highly typical of new technological breakthroughs so the relationship is a fairly strong one. Pioneers are first in, next early adopters cause the curve to rise. Then there’s a rapid rise as the majority see the potential of the new technology. This flattens as the technology becomes more mainstream, widespread and accepted.

While there is no guarantee that history will repeat, the adoption curve model is one of the strongest long-term buy and sell signals for bitcoin that we currently have. Those who’ve bought at the base of the curve and sold at the top would have made a tidy profit.

Trading the adoption curve is a strategy for the long haul. There certainly can be some ups and down and large deviations from the s-curve. However, over the long-run, history tends to repeat this kind of price progression where innovative technologies merge into mainstream use.

5. Bitcoin and altcoin halving events

Finally, there are the bitcoin halving events. Bitcoin and other crypto assets are unique in that their supply follows a known-in-advance set of rules that are programmed into the protocol.

With bitcoin for example, each halving event, cuts the supply of bitcoin in half.

Bitcoin supply currently comes from miners. Miners are computers that validate new blocks on the blockchain by solving a hard computational hashing problem. By doing this, the miners maintain the network and keep it secure. Miners are rewarded with new bitcoin. This is the block reward and is where the supply of new bitcoin comes from.

The next halving event is 13 th may 2020 and it will cut the issuance of new bitcoins from 12.5 to 6.25 bitcoins for each new block.

Halving events create a speculative fever because many bitcoin hodlers expect the price to skyrocket afterwards. These people have already bought in so that we can expect that some of the halving is already priced into bitcoin. This is our old friend “buy the rumor, sell the fact” at work.

If history is to go by, then the volatility of bitcoin will increase sharply after the halving event. Previous halving events created dramatic price gains in the following months.

On the other hand, there are some complex dynamics at play. Halving may cause some miners to give up because the rewards are less than running costs of the expensive mining rigs that are necessary these days to mine bitcoin. This will cut supply further and fewer miners will arguably make the network less secure, which could hit the demand side.

Bitcoin’s clever protocol anticipates this and adjusts it hashing difficulty to the number of miners. Overall then this may effect may be nullified.

Only time will tell what the next halving event brings. One thing is clear though, it will create some interesting trading opportunities.

Price action trading

Definitive guide

Price action trading with candlesticks gives a straightforward explanation of the subject by example. It includes data insights showing the performance of each candlestick strategy by market, and timeframe.

Really great information! Thanks for sharing this article!

Day trading cryptocurrency – how to make $500/day with consistency

Would you like to learn day trading cryptocurrency and make a consistent $500 per day? We often hear about all the money you can make by day trading stocks. But what about crypto day trading? In today’s lesson, you’ll learn how to day trade cryptocurrency using our favorite crypto analysis tools.

Our team at trading strategy guides is lucky to have over 50 years of combined day trading experience. We’re going to share with you what it takes to day trade for a living, and hopefully, by the end of this trading guide, you’ll know if you have what it takes to succeed in this business.

First and foremost, when day trading, it’s essential to have a structured approach and a rule-based strategy. The same as swing trading or positional trading you are not going to trade every day, and you’re not going to make money every day. So, you need a day trading cryptocurrency strategy to protect your balance.

The high volatility nature of bitcoin and other cryptocurrencies has made the crypto market like a roller-coaster. This is the perfect environment for day trading because during the day you’ll have enough up and down swings to make a decent profit.

Moving forward, we’re going to teach you what you need to learn how to day trade cryptocurrency and we’re going to share some out-of-the-box rule-based day trading strategies.

How to day trade cryptocurrency

The crypto market’s unique characteristics require you to have a firm understanding of how it works. Otherwise, your experience can be like skydiving without a parachute.

The good news is that we’re going to provide you with everything you need to survive crypto day trading.

Day trading the cryptocurrency market can be a very lucrative business because of the high volatility. Since the crypto market is a relatively new asset class, it has led to significant price swings.

Before day trading bitcoin or any other altcoins, it’s prudent to wait until we have a high reading of volatility. The good news is that even when we have a low reading of volatility relative to other asset classes, this volatility is still high enough that you can generate a modest profit on your trades.

Crypto day trading also requires the right timing and good liquidity to make precise entries.

A lot of the cryptocurrencies and crypto exchanges are very illiquid and don’t have the liquidity to offer instant execution that you might find when trading forex currencies.

Before day trading bitcoin or any other alt coins, it’s also important to check how liquid the cryptocurrency you wish to trade is. You can do so by simply verifying the 24-hour volume of the crypto trade.

Coinmarketcap is a good free resource to read and gauge the market volume of any particular coin.

Note* always remember that not having enough liquidity could lead to substantial slippage and subsequent to bigger losses.

As previously stated, crypto day trading doesn’t require trading every single day. We only like day trading cryptocurrencies when all the conditions align in our favor. In this case, avoid trading on weekends and limit trading only on the highest-volume days.

Put your seatbelt on because next, we’re going to reveal how professional traders are day trading cryptocurrencies.

Crypto day trading strategy

The idea behind crypto day trading is to look for trading opportunities that offer you the potential to make a quick profit. If day trading suits your own personality, let’s dive in and get through a step-by-step guide on how to day trade cryptocurrency.

Now, before we go any further, we always recommend taking a piece of paper and a pen and note down the rules of this scalping strategy.

In this article, we’re going to look at the 'buy' side.

Step #1: pick up coins with high volatility and high liquidity

As previously discussed, the number one choice you need to make is to pick coins that have high volatility and high liquidity. If you’re not day trading bitcoin, which is the most liquid coin out there, and you like the altcoins, try to pick those coins that have good liquidity and volatility.

There are more than 1600 coins on the market and growing. By following only the top cryptocurrencies, you’ll reduce your area of selection.

Day trading smaller cryptocurrencies can also be a very lucrative business, but there are higher risks. Remember, crypto prices can crash just as fast as they have risen.

Moving forward, you’re going to learn how you can make money crypto day trading.

Step #2: apply the money flow index indicator on the 5-minute chart

This specific day trading strategy uses one simple technical indicator, namely the money flow index. We use this indicator to track the activity of the smart money and to gauge when the institutions are buying and selling cryptocurrencies.

The preferred settings for the MFI indicator are 3 periods.

We’re also going to alter the default buying and selling levels from 80 to 100 and respectively from 20 to 0.

How to use the IMF indicator will be outlined during the next step.

Step #3: wait for the money flow index to reach the 100 level

An MFI reading of 100 shows the presence of the big sharks stepping into the markets. When buying, smart money can’t hide their footsteps. They inevitably leave tracks of their activity in the market and we can read that activity through the MFI indicator.

Technical indicators aren’t always right, so in order to fine-tune our day trading strategy, we’ve added a few more conditions. Namely, during the current day, we need to skip the first two MFI readings of 100 and study the crypto price reaction.

The price needs to hold up during the first and second 100 MFI reading.

If the price drops after the first two MFI 100 readings, then this suggests that most likely we’re going to have a down day.

Let’s now determine the appropriate place to go buy bitcoin and what are the technical conditions that need to be satisfied.

Step #4: buy if MFI = 100 and if the subsequent candle is bullish

We can now wait for the third MFI reading above 100. It doesn’t necessarily have to be the third MFI = 100 reading, you can take every other MFI = 100 readings. If your time doesn’t allow you to catch the third 100 reading on the MFI indicator, you can simply pick the next one as long as all the other technical conditions are satisfied.

Next, we also need the candlestick when we got the MFI = 100 reading to be a bullish candle. The close of this candle needs to be near the upper end, giving us a candle with very small wicks.

This brings us to the next important thing that we need to establish when day trading cryptocurrency, which is where to place our protective stop loss and where to take profits.

Step #5: hide your protective stop loss below the low of the day. Take profit during the first 60 minutes after you opened the trade.

The obvious place to hide your protective stop loss is below the low of the day. A break below it will signal a shift in the market sentiment, and it’s best to get out of the trade. This can also signal a reversal day.

We’re more flexible when it comes to our exit strategy. However, the only rule you need to abide by is to take profits during the first 60 minutes or the first hour after your trade got triggered. Holding the trade longer than one hour will result in a lower success rate. At least that’s what our backtested results showed us.

Conclusion – crypto day trading

If you took the time to read the whole day trading crypto guide, then you should be able to buy and sell bitcoin and alts and make some daily profits. If you are interested in learning how to day trade cryptocurrency, be sure to equip yourself with enough information before diving into the market.

Crypto day trading can be a great way to grow your crypto portfolio and it’s a very lucrative alternative to the holding mentality that it’s crippling the crypto community.

Making a living day trading cryptocurrency can be a lot easier due to the high volatility nature of the crypto market. High volatility suits day trading very well, so you have the right environment to succeed. You may also be interested in reading our guide on the best cryptocurrencies investments for 2019.

Feel free to leave any comments below, we do read them all and will respond.

Also, please give this strategy a 5 star if you enjoyed it!

Please share this trading strategy below and keep it for your own personal use! Thanks, traders!

Cryptocurrency day trading – tips and strategies

Day trading is a strategy followed by traders in various markets, including cryptocurrencies. As a day trader, you will enter and leave your position within the same day. You do not keep up a single trade for longer than an entire day and make profits using the changes in cryptocurrency values that occur every few hours. Day traders often make use of trusted cryptocurrency trading platforms such as btcrevolution.De to earn their profits. As a day trader, even if you have fallen into a familiar routine, you will be on the lookout for strategies that could help improve your skills as a trader and bring you more significant profits.

Trade using well-known cryptocurrencies

The most popular names in the cryptocurrency universe such as bitcoin, ethereum and litecoin will be the currencies that give you the most profits. The smaller coins might seem more affordable to you, but it is wiser to invest in cryptocurrencies with bigger market caps. Massive transactions using these currencies take place each day, and the changes in their values can be severely unpredictable. They can hit their highest when you least expect it, but remember that this volatility also leads to significant risks.

Ensure sufficient funds in your account

An efficient trader will only trade using a small percentage of their crypto account each time. This helps ensure that they do not suffer severe damages if a deal doesn’t turn out to be profitable. Since the amount required for various trades is exceptionally high, it is crucial that you keep your account filled with the necessary amount.

Set up stock-loss orders

Stock-loss orders refer to orders placed to buy or sell when particular security or currency reaches a specific price. This helps traders limit their losses and set a clear target to quit before they encounter damages that would be difficult to fix. Setting up the cost of your coin as the minimum that you are willing to trade for it ensures that even if you do not acquire profits, you will get back the money you had spent initially.

Consider your risks

As an efficient day trader, you must not run behind massive profits that peek over the horizon. Instead, stick with trades that you know will give you relatively smaller but ensured profits.

It is necessary for you to always be on top of your game as a day trader and be supplied with the latest news and information regarding the trading climate. Always keep an eye out for extreme changes that occur in the market.

Summing up

Day traders must be skilled at identifying trades that will provide them with definite profits. These trades conducted within a day might not bring immense amounts in profits but will ensure steady earnings for the trader.

Analysis report of 2020 strategies and trends in crypto-currencies, exchanges and trading

Scope of the study

This study analyzes the current status of cryptocurrencies and exchanges, along with detailed analysis of trends in trading, its structural complexity explained in simple terms, risks and opportunities.

About this report

II. Cryptocurrency overview (currency and market)

III. Top virtual currencies being traded today

IV. State of crypto exchanges

V. Trading and investment strategies

- Spot (what is, risks and opportunities)

- Leverage trading (what is, risks and opportunities)

- Arbitrage (what is, risks and opportunities)

- Bitcoin futures (what is, risks and opportunities)

VI. Outlook for 2020 (conclusion)

VII. References / appendix

Summary

Cryptocurrency is an innovation of financial technology that is designed to not only become an alternative to cash but also act as other financial instruments such as investments. Cryptocurrency adoption as an investment asset lies in the current standing of the market, different virtual currency it offers, availability of exchanges, and strategies used to grow the asset.

Cryptocurrency overview

Cryptocurrency is a virtual currency that uses an encrypted algorithm, which secures the processes involved in generating coins and conducting transactions. This new currency does not have any physical representation; that is why all transactions are conducted via the internet. The first cryptocurrency, bitcoin, was developed in 2009. All the virtual currencies that emerged after bitcoin are referred to as alternate coins or altcoins. Cryptocurrency is an innovative concept that is an alternative to fiat currency used in the monetary system.

The cryptocurrency market is currently at US$ 268 billion, with an all-time high of US$ 744 billion in 2018. Major drivers for market growth are the transparency of distributed ledger technology, high remittances in developing countries, high cost of cross-border remittance, fluctuations in monetary regulations, and growth in venture capital investments.¹ now, trading and investments also drive the growth of the market.

Top virtual currencies being traded today

With over 2,000 cryptocurrencies in existence as of january 2020, getting a whole list of these virtual currencies can be challenging. However, these are the top cryptocurrencies being traded today:

Bitcoin

Bitcoin aims to become a global, peer-to-peer, digital cash detached from any form of regulation and fully decentralized.⁴ bitcoin is one of the most invested cryptocurrency because it has the highest liquidity⁵ in the crypto market, making it the best cryptocurrency to buy if you are a beginner. The demand and mass adoption of bitcoin is expected to go up in the years to come.⁶ as this demand increases, the price is expected to grow exponentially as there will only be 21 million coins⁷ available.

Ethereum

Ethereum was launched in 2016 is currently the second-largest digital currency by market cap after bitcoin. However, the currency still lags behind the dominant cryptocurrency by a significant margin. As of january 2020, ether’s market capitalization is around 1/10 the size of bitcoins.⁸ ether is currently sought after by developers looking to develop and run applications inside ethereum, and by investors looking to purchase other digital currencies using ether.⁹

Litecoin

Launched in 2013, litecoin was one of the cryptocurrencies who followed the footsteps of bitcoin and was often coined as the “silver to bitcoin’s gold.” although litecoin can be compared to bitcoin in many aspects, it has a faster block generation rate, offering a faster transaction time.¹⁰ as of january 2020, litecoin has a value of $46.92 per token, with a market cap of US$ 3 billion, making it the sixth-largest cryptocurrency in the world.¹¹

State of crypto exchanges

There are around 306 exchanges being tracked globally today, with a combined market cap of US$ 358 billion.¹² these exchanges allow consumers to purchase, sell, and trade cryptocurrencies, whether through fiat currency like dollars, euros, or yen, or another cryptocurrency like bitcoin or ether. Not every exchange supports every cryptocurrency and many investors use more than one platform.

Trading and investment strategies

Spot trading

Spot trading refers to the buying or selling of cryptocurrencies for immediate settlement.¹⁴ during spot trading, these trades must be booked on the same spot and not a date in the future. Spot trading isn’t a complicated method. It occurs in the spot market and is characterized by the immediate or near-immediate delivery of the virtual currency.

One of the advantages of spot trading is it is low-risk.¹⁵ most of the exchanges used for spot trading are accurate and transparent. The fear of illegal transactions can be avoided. Although it may seem like an excellent method of trading, spot trading also has its drawbacks. More substantial capital is also needed if traders intend to do this strategy for a long time.

Leverage trading

Leverage trading is a method of trading cryptocurrencies using borrowed funds to amplify the profits. When compared to spot trading, margin accounts allow traders to access higher amounts of capital provided by a third party. Leverage trading allows traders to realize more substantial profits on successful trades by increasing the trade results.¹⁶

Unlike regular spot trading, leverage trading presents the possibility of losing much more money than the initial investment, and because of this, it is considered a high-risk trading method.¹⁷ relying on the amount of leverage involved in a trade, even a small drop in the market price, will cause substantial losses for traders. Thus, it is vital that investors who decide to use this method of trading employ proper risk management strategies and utilize risk mitigation tools, like stop-limit orders.

Arbitrage trading

Arbitrage is a form of trading that takes advantage of price discrepancies of the same cryptocurrency from different exchanges. It is an investment strategy that guarantees a positive payoff in some contingency with no possibility of a negative payoff and no net investment.¹⁸ these discrepancies occur when multiple exchanges are differently pricing a coin.

Arbitrage trading works due to existing market efficiencies in the crypto market. The primary factors behind these inefficiencies are the supply and demand, and a change in either of them can affect the coin’s price. This strategy is considered risk-free¹⁹. It focuses on spotting the differences in price that can occur when there are discrepancies in the levels of supply and demand across all exchanges.

Traders can use an automated trading system as part of an arbitrage trading. Automated trading systems rely on algorithms to spot price differentials on different exchanges. It allows traders to jump on the arbitrage opportunity before it becomes common knowledge, and the market adjusts the inefficiencies. The most common type of crypto arbitrage trading is triangular arbitrage, which takes advantage of price differentials among three different coins.

Sample of triangular arbitrage

- Trade 1: 1.00 BTC to 57.238 ETH at the price of ETH/BTC: 0.01741.

- Trade 2: 57.238 ETH to 8,307,402 MFT at the price of MFT/ETH: 0.00000689.

- Trade 3: 8,307,402 MFT back to 1.0799 BTC at the price of MFT/BTC: 0.00000013.

- Starting capital: 1.00 BTC

- Ending capital: 1.0799 BTC

- Returns (%): 7.99%

The most crucial part of arbitrage trading is speed. In just a split second, the market price can move, losing the arbitrage opportunity. This is the reason why it is more common for traders to rely on automated systems for arbitrage trading.

Bitcoin futures

With cash-settled bitcoin futures, investors are allowed to gain exposure to bitcoin without holding the cryptocurrency itself. This type of investment strategy works the same with a futures contract for a commodity or stock. Bitcoin futures allow investors to speculate on the future of bitcoin.²⁰ through this type of strategy, investors can take cash instead of bitcoin when the contract is settled.

Bitcoin futures are traded on an exchange regulated by commodity futures trading commission²¹, which can provide confidence to large institutional investors to participate. Since the futures are settled in cash, investors are not required to have a bitcoin wallet. There is no physical exchange of bitcoin in any transaction made on bitcoin futures.²²

Outlook for 2020

With the increasing number of cryptocurrencies and exchanges, an increase in trading and investment opportunities are arising for traders and investors. There are different types of strategies that can be taken advantage of, and choosing the right one will help increase the profitability of the cryptocurrency investment. Understanding what the strategies and risks are will help grow an investor’s assets exponentially and in effect grow the cryptocurrency market as a whole.

This report was conducted by prance gold holding’s research unit.

Prance gold is a cutting edge end-to-end company that pushes the boundaries of traditional business models by offering digital asset holders an opportunity to grow their cryptocurrency portfolio.

Cryptocurrency trading strategies

Cryptocurrency presents a great opportunity for investment as many see digital currencies as the future of our money system. Those who invested in bitcoin or other cryptocurrencies when they were still young have already made a great deal of profit. The only caveat is that cryptocurrencies are incredibly volatile. As such, there is great potential for profit but also a high level of risk. With the right trading strategies in mind, you can reduce your risk and maximize your profits. Here are some of the most popular crypto trading strategies.

Remember not to invest more than you can lose

The golden rule of cryptocurrency trading is to never invest more than you can afford to lose. This is actually the same hard and fast rule you should follow with any risky or volatile investment. If you cannot afford to lose the funds, then you may be out of luck when the market turns. Remember that in addition to losses from market drops, there are other potential risks unique to crypto investing, such as hacks. While you can minimize those risks, the best strategy is to only invest what you can afford to lose.

This will stop you from financially ruining yourself. It will also reduce the pressure when trading, letting you take your time to make a smart decision.

Research before investing in an ICO

Investing in a cryptocurrency during its ICO can be one of the best ways to make a profit. This is because, during icos, cryptocurrencies tend to sell for significantly less than they will later on. Most icos offer steep discounts, particularly in the first round of funding. The issue, however, is that there are thousands of icos and many of them will just waste your money.

Because of this, you should only invest in icos if you have done a great deal of research. Only invest in icos if the coin has a legitimate use that there is a demand for and the team seems reliable with a strong track record. The best strategy is to choose an ICO with a team that has experience and a project with a great deal of community support. Ideally, there will be a good legal framework in place between contributors/investors and developers and the funds will go into an escrow wallet.

Research before any investment

While research is particularly important before an ICO, you should also do a similar amount of research before purchasing any cryptocurrency. Choose cryptos that serve a strong purpose and disrupt an industry. They should have a truly useful technology. Opt for cryptocurrencies that experts predict will do well in the future. Of course, you should also research the crypto’s price history so you can see its potential and make sure you buy it low.

Stay up to date with news and trends

Many of the cryptocurrency trading strategies overlap with those associated with traditional assets. One of these would be the idea of doing your research in general and staying up-to-date with news and trends. If you want to be serious about investing in and actively trading cryptocurrencies, you need to read the cryptocurrency news regularly, ideally daily. This can be as simple as following a few major crypto news websites and at least reading the headlines, but the more research you do, the better equipped you will be to make decisions.

Balance your portfolio

As with more traditional investment strategies, a smart strategy for cryptocurrency trading is to balance your portfolio. In the case of crypto, this can be as simple as dividing the amount you want to invest up into several different coins. For this to work best, choose coins that have different utilities. In other words, invest an equity coin, a security coin, and a privacy coin. This will reduce your risk since the profits from one coin can help balance out the losses from another.

You can go with a balanced portfolio that has an equal proportion of each crypto or an unbalanced one. With an unbalanced portfolio, you still diversify, but purchase more of the cryptos that you think will do well.

Dollar cost averaging

One strategy is called dollar cost averaging. This involves buying a set amount of crypto at specific intervals when the price is moving down or up. The idea is that you average out all your purchases within the intervals, which are typically months. That lets you get an average price that tends to be better than the one you would have gotten if you bought the crypto in a lump sum.

Don’t be afraid to HODL

In the crypto world, HODL refers to holding onto your cryptocurrencies instead of selling them. This is a good strategy when the crypto is not doing as well as you would like. When you HODL a cryptocurrency, you are going with a long-term strategy that lets you weather the market ups and downs to maximize success.

Consider trading bots

Trading bots can be an incredibly useful tool for cryptocurrency investing, just as they are with other types of investments. If you are a beginner in the world of crypto investing, look for a trading bot that has been programmed by an expert with experience. If you are an advanced trader, you can program your own bot to follow your trading strategy. The great thing about a bot is that it will be able to trade at any time, including when you are asleep, at your traditional job, or on vacation.

Conclusion

For the best results in your cryptocurrency trading, you will want to use a combination of the above strategies. Remember that because cryptocurrencies are volatile, you should never risk more than you can afford to lose.

5 profit making cryptocurrency trading strategies

In this article, we will look at five easy cryptocurrency trading strategies.

1. Bitcoin-altcoin ratios

When looking at a crypto currency chart, remember that half and probably a lot more of the price action has nothing at all to do with that crypto asset, or even crypto currencies in general. It has far more to do with the underlying fiat currency.

Let’s take the pair BTCUSD as an example. If the US dollar rallies against other currencies then all things equal we’ll likely see a big drop in bitcoin versus the US dollar for the simple reason that dollars are a more expensive asset at that point in time.

There may be little change in the number of bitcoin buyers and sellers, but the drop happens anyway because if it didn’t it would open an opportunity for risk free profit.

Precious metals traders have been dealing with that problem for years. One useful chart that they use is the gold-silver ratio chart. This plots the price of gold against the price of silver. When the ratio is high it means that gold is expensive relative to silver. And when it’s low the opposite is true.

You can use any coin ratio but since many people liken bitcoin to digital gold and litecoin to digital silver, let’s stick with that. So think of the litecoin-bitcoin ratio as the digital equivalent of the silver to gold ratio.

With ratio trading, you calculate the mean line then trade towards that line. When the litecoin-bitcoin ratio is high, above the mean line, that might be a time to switch out of litecoin and into bitcoin. When it’s low, that’s a time to start switching out of bitcoin and into litecoin.

Ratio trading can be a very profitable strategy if it’s performed consistently and over the long haul.

The great thing about using such ratio charts is that they eliminate many unrelated variables. You’re comparing like with like.

The slight problem though is that gold and silver have very long trading histories, going back thousands of years. Crypto currencies have only been around a few years. That means these historical ranges have not yet had a time to establish themselves. However ranges and mean lines will always exist, but prepare for them to evolve a little as the technology matures.

Remember that at some point in time you might want to change back into a fiat currency and at that time, the crypto to fiat exchange rate becomes relevant again.

2. Cross crypto arbitrage

Crypto currencies trade relative to their underlying fiat currency in much the same way as fiat currencies trade relative to one another.

Most exchanges and brokers will list a crypto asset against a range of other major fiat currencies. These cross rates can create a trading opportunity known as arbitrage. Arbitrage simply means the chance to make a risk free profit.

BTCUSD is trading at $6500 / $6505

BTCGBP is trading at £5300 / £5305

GBPUSD is trading at 1.2000 / 1.2010

You do the calculation and see that BTCGBP is cheap relative to BTCUSD. From the exchange rate, it should really be trading at £5416/£5420.

The arbitrage trade is then placed to buy the lower priced asset and sell the higher priced asset.

Sell BTCUSD at $6500

buy BTCGBP at £5305

You then wait for the price gap to close so that there’s no price differential. If it adjusts to the correct exchange rate, and say BTCUSD stays fixed, BTCGBP should rise to £5416/£5420. Let’s assume this happens 1 hour later. You then unwind the trade.

Buy BTCUSD at $6505, profit -$5

sell BTCGBP at £5416, profit +£111

Assuming you sell your pounds for dollars your total profit is then $97.4. This is a very simplified example but it demonstrates how arbitrage works.

Remember, when doing arbitrage the profits can be small so trading fees like spreads and swaps are very important.

When markets are working efficiently, arbitrage opportunities are seldom and the gaps are slim. They’re quickly found and traded away. Crypto currency markets are getting much more efficient than they were a few years back, because there are far more people trading them now.

3. Stable coin arbitrage

Another kind of arbitrage is with stable coins. Stable coins have their value fixed to some underlying asset. Most are pegged to a fiat currency such as the USD dollar so that there’s a 1:1 ratio between the coin and the underlying fiat currency.

Some stable coins are specifically designed to be arbitraged. Any deviation away from the peg creates an arbitrage opportunity. This means arbitrage traders can move the price back to the peg and make a profit for their efforts.

DAI is one example. The ratio is 1 dollar to 1 DAI. Unlike tether for example, another stable coin, DAI doesn’t rely on any central backing for its peg to be maintained. The DAI token is backed, or collateralized by ethereum.

DAI can be generated or borrowed by depositing some coins into a vault. On doing this you’ll get back a certain dollar amount of DAI, and at an exchange rate of 1 dollar to 1 DAI. The exact collateral you need to deposit varies from time to time.

As a simple example, suppose DAI is trading at $1.11. This is too high. You have 10 ethereum coins in your crypto wallet and the price of one ETH is $100. You could generate DAI at a cost of $1. You’d then sell your DAI on the exchange at a rate of $1.1.

When enough people do this, the external supply of DAI increases and so the price should adjust downwards. At that time you buy back your DAI tokens at $1 and redeem your ETH from the vault. Of course, if ETH is no longer $100 this could make the actual dollar profit smaller or bigger. But if you planned on holding your ethereum anyway, this wouldn’t matter. You’ve pocketed a bit of income.

Scalping

Daily pips

Essential for anyone serious about making money by scalping. It shows by example how to scalp trends, retracements and candle patterns as well as how to manage risk. It shows how to avoid the mistakes that many new scalp traders fall into.

The other way to arbitrage stable coins is simply to buy or sell the coins directly on an exchange. With tether for example, you could sell when it’s above $1 and buy when it’s below. Then wait for the gap to close before closing the position to take profits.

As with all arbitraging, the profits are meagre and trading costs can be high. This isn’t a strategy you’d want to sit at your desk doing all day long. It works better when automated with software and that’s how most arbitragers do business.

Take note that currency pegs can break down. The breaking of the EURCHF peg is one that took many traders by surprise and even bankrupted a couple of brokers.

4. Trading the bitcoin/altcoin adoption curve

Blockchain and crypto currencies are new technology. Just like the train, the automobile and the internet these technologies historically evolve into what’s known as the s-curve adoption model.

The s-curve is highly typical of new technological breakthroughs so the relationship is a fairly strong one. Pioneers are first in, next early adopters cause the curve to rise. Then there’s a rapid rise as the majority see the potential of the new technology. This flattens as the technology becomes more mainstream, widespread and accepted.

While there is no guarantee that history will repeat, the adoption curve model is one of the strongest long-term buy and sell signals for bitcoin that we currently have. Those who’ve bought at the base of the curve and sold at the top would have made a tidy profit.

Trading the adoption curve is a strategy for the long haul. There certainly can be some ups and down and large deviations from the s-curve. However, over the long-run, history tends to repeat this kind of price progression where innovative technologies merge into mainstream use.

5. Bitcoin and altcoin halving events

Finally, there are the bitcoin halving events. Bitcoin and other crypto assets are unique in that their supply follows a known-in-advance set of rules that are programmed into the protocol.

With bitcoin for example, each halving event, cuts the supply of bitcoin in half.

Bitcoin supply currently comes from miners. Miners are computers that validate new blocks on the blockchain by solving a hard computational hashing problem. By doing this, the miners maintain the network and keep it secure. Miners are rewarded with new bitcoin. This is the block reward and is where the supply of new bitcoin comes from.

The next halving event is 13 th may 2020 and it will cut the issuance of new bitcoins from 12.5 to 6.25 bitcoins for each new block.

Halving events create a speculative fever because many bitcoin hodlers expect the price to skyrocket afterwards. These people have already bought in so that we can expect that some of the halving is already priced into bitcoin. This is our old friend “buy the rumor, sell the fact” at work.

If history is to go by, then the volatility of bitcoin will increase sharply after the halving event. Previous halving events created dramatic price gains in the following months.

On the other hand, there are some complex dynamics at play. Halving may cause some miners to give up because the rewards are less than running costs of the expensive mining rigs that are necessary these days to mine bitcoin. This will cut supply further and fewer miners will arguably make the network less secure, which could hit the demand side.

Bitcoin’s clever protocol anticipates this and adjusts it hashing difficulty to the number of miners. Overall then this may effect may be nullified.

Only time will tell what the next halving event brings. One thing is clear though, it will create some interesting trading opportunities.

Ebook trader's pack

4x popular ebooks

Four complete and up to date ebooks on the most popular trading systems: grid trading, scalping, carry trading and martingale. These ebooks explain how to implement real trading strategies and to manage risk.

Really great information! Thanks for sharing this article!

Best trading strategy for cryptocurrency traders

Todays article we are bringing the focus back to our more traditional approach with the best trading strategy for cryptocurrency. Thank you for all the great comments shares and overall positive sentiment about my last article on asteroids and the unfathomable wealth opportunity.

It was a totally different tone and so we were a little nervous about releasing it, but again thank you for the positive messages, here is a link if you missed the release.

Cryptocurrency trading can be a bit technical for a new trader, but with the right information on the crypto market, it is a very smooth process. In the cryptocurrency market, the most important thing to do is to avoid losing money. This can be done only when the best trading strategy for cryptocurrency trading and investing.

Crypto trading is the buying and selling of the digital currency. This trading is usually done on a different trading platform, known as cryptocurrency exchanges. These platforms allow an individual to know the trends in the market, which will, in turn, help in knowing the best time to carry out the trade. The market comprises of buyers and sellers who are usually referred to as bulls and bears respectively. These two parties entirely control the crypto market, with each always trying to dominate. That said; let us now get into the details on best trading strategy for cryptocurrency traders.

Best trading strategy for cryptocurrency overview of the options

An individual can trade cryptocurrencies using fiat currency or other cryptocurrencies. The most traded pair is the crypto-fiat pair. For every pair, there is a specific rate at which it is sold and this price changes depending on several factors controlling the market. This price action can be determined by factors such as

Bitcoin’s trend: the crypto market is largely dominated by bitcoin. All the altcoins usually follow bitcoins trend. If bitcoin’s prices fall, the same happens for altcoins. With altcoins, one has first to buy bitcoin then trade the bitcoin with fiat currency; this is one of the significant reasons behind bitcoins dominance.

Mining cost: the blockchain technology allows people to mine new coins by validating the coins. This mining requires a lot of electricity and expensive machinery. If the cost of mining increases, the prices also tend to increase with it. This raise occurs to ensure that miners do not go at a loss.

Government interference: cryptocurrency prices are also controlled by decisions made by various governments on how they ought to operate. When a government endorses cryptocurrencies, investors comfortably trade the coins and thus increasing their prices.

Forking: whenever a coin faces disputes that lead to the breaking of a new coin from the currency in question, the price of this the original coin is greatly affected. This scenario happened to bitcoin when a bitcoin fork took place, giving rise to bitcoin cash: the prices fell drastically.

The above factors come in handy when learning the best trading strategy for cryptocurrency trading.

Basic cryptocurrency trading strategies

Having a good cryptocurrency trading strategy is all a crypto traders needs to make the most out of buying and selling of bitcoins and other digital coins. Different types of traders use different approaches. We have day traders, swing traders, and long-run traders. However, some basic strategies work for all these traders.

The following are essential facts that inform the kind of trading strategies to use in crypto trading:

- The crypto market is very volatile: by this, we mean that the prices change very fast with any small changes in the market. With the fast-changing prices, a trader should only invest money they can afford to lose. Several factors can affect the market prices to change in less than an hour drastically: investing a lot of money may bring a lot of losses in the long run.

- Make choices based on research: there are more than 1600 cryptocurrencies in the world today. It is therefore vital for a beginner to critically look into a coin before investing in it. There has been a lot of scam cases lately cryptocurrencies, some of which have never been heard of.

- Short-term trading: prices in the crypto market change with every passing hour. If for instance, you notice that the prices have drastically shot up, don’t wait for another hour to see the next movement. Make your trade immediately before the trend changes. A downward movement follows every upward trend. More so, short term trading works well for day traders.

- Using a stop: due to the market vitality, long-term trading may not be profitable when it comes to trading cryptocurrency. However, if one decided to try long-term trading, they need to use stop losses. A stop loss is a set price that determines the value at which you can sell your coin incase the prices drop. Putting a stop loss allows a trader to avoid losing a lot of money in the case of a massive drop.

Basics of technical analysis of price action

Market analyzation is a very crucial part of crypto trading. It is only in analyzing the market will a profitable trade be made this is simlar to the forex market. In cryptocurrency trading, there are two types of market analysis: we have technical analysis and fundamental analysis. Technical analysis involves the study of price charts for different coins, while fundamental analysis focuses on explaining the reasons behind the subject market trend.

Crypto traders widely use technical analysis. This is so because it usually gives a clear picture of the trend in the crypto market. In addition, one can study the trends for a specific coin and predict the incoming trend. It uses the previous market price action movements and trading volume to determine the next price.

Candlesticks charts

Under technical analysis, there is a price chart filled with chart patterns including triangles, rectangles, and curves. The commonly used chart pattern is the candlesticks pattern. These candlesticks are of two types: green and red signifying buyers and sellers, respectively.

If a red candle stick forms on the chart, it means that the sellers are dominating the market and prices will eventually fall. So, bed candlestick opens at a high price and closes at a low one.

On the other hand, the green candlestick represents the buyers (bulls) in the market. This candlestick indicates that the buyers are dominating the market, and the price is likely to go up.

Candlesticks form patterns, which, will tell you if the price is likely to go up or down. Nevertheless, the essential thing to know is that if there has been a consistent upward trend, then a downtrend is impending. The reverse is true.

Indicators

The trading chart also has some indicators that also help in analyzing the market. We have mathematic indicators such as relative strength index (RSI), moving average (MA), moving average convergence divergence (MACD) and parabolic SAR, among others.

Date and time

The chart is a graph of prices against time. One chooses the time span in which they want to analyze the specific coin. Day traders usually uses one hour chart to analyze. In this chart, the length of one candlestick is proportional to one hour. So, in a case where you are analyzing bitcoin’s price in the past 24 hours, you will have 24 candlesticks.

Best trading strategy for cryptocurrency and mistakes to avoid

Day trading can be a very profiting venture since one is playing as per the rules of cryptocurrencies; changing daily. Below are some of the tips that will help any beginner to trade successfully.

Work with a plan: this law applies everywhere: you cannot do anything well without a plan. It is important to first know the profit you want to make before you decided to enter the market. Know when to enter, where to place your stop loss or take profit among others

Entering and exiting the market: the point of entrance and exit in the market determines your net profit. Your entry point is the current price of the coin when you decide to buy it while the exit point is the price at which you are aiming to trade your coin.

The entrance should be lower than the existing to make maximum profit. Hence look for a point where the margin will be considerable.

Always use a stop loss and take profit. As mentioned earlier, a stop loss will help reduce the losses in case the price drops lower than you anticipated. On the other hand, putting a take profit enables you to make more profit peradventure the prices hit the point.

In doing this, it is vital to make use of the resistance and support levels. The resistance level is a level that marks the highest price the coin has reached over a period of time. On the other hand, the support level is the lowest price that the coin has reached severally.

Focus on bitcoins trend: bitcoin’s dominance in the market makes all the altcoins follow its trend. However, there are instances where some big investors manipulate bitcoins price, and consequently, the altcoins trend differently.

Basics of trading cryptocurrency

The text below is an advertorial article that was not written by cryptonews.Com journalists.

Trading is a common economic concept that involves the exchange of goods and services between trading parties. However, trading in cryptocurrency is a bit different from trading in any other asset. Primarily, a cryptocurrency refers to a digital asset that’s secured by cryptography, making it nearly impossible to counterfeit or double-spend. Moreover, due to this digital asset’s volatile nature, cryptocurrency has been a popular asset for trading.

Thus, if you want to become a successful crypto trader, keep reading this article to learn about the basics of trading cryptocurrency.

1. Pick A reliable crypto exchange

Before getting started with the trading, the first thing you should do is select a good crypto exchange. It’s a business that allows you to make cryptocurrency trades for other assets, such as traditional fiat currencies or other digital currencies.

Typically, choosing the right crypto exchange is one of the important things a new trader should do. When you use the wrong platform, it may lead to trading problems, lost money, and wasted efforts. Because of this, it’s important to find the appropriate one for your needs. For example, you should consider in the selection process whether you simply want to invest on a long-term basis or trade in and out of positions regularly. That way, you’ll get the perfect platform to get started with your crypto trading journey.

2. Choose the cryptocurrency you want to trade

Of course, you need to decide which cryptocurrency you may want to trade in. Unfortunately, selecting a digital currency for the trading may not be easy since there are plenty of cryptocurrencies to choose from. But, if you’re new to this trading market, you may consider trading in one of the well-known cryptocurrencies with high market cap, such as bitcoin, ethereum, and XRP.

3. Make A great trading strategy

Trading cryptocurrency isn’t just about exchanging a certain digital currency for another valuable asset. It’s also about generating more money as a result of your trading efforts. However, just like other forms of trading, dealing with cryptocurrency can be challenging.

Thus, if you want to ensure a successful trading experience with higher returns on your investment, you should have a solid trading strategy in place. And, as you consider your strategy, the following are a few things to keep in mind:

- Perform your own research – when trading cryptocurrency, it’s essential to do your own research about the digital assets you’re buying to make sure they fit with your investment goals. The more you conduct your research, the more you familiarize yourself with the cryptocurrency you’re dealing with. As a result, you’ll know which one can provide you with higher returns.

On the other hand, if you want to master the art of trading crypto with minimal research, then, playing a crypto trading game can be an excellent idea. It allows you to make trades at no risks for fun, while winning real cash prizes. Plus, you’ll get to know the cryptocurrencies right before entering the real trading platform. - Only invest what you can afford to lose – given the cryptocurrency’s volatile nature, the risk of losing of money is much higher compared to traditional trading of assets. Since these digital currencies can be affected by bugs and hacks, resulting in a decrease of their value, you may lose everything you invest. As such, it’s best to only invest the money you can afford to lose. That way, you can minimize the losses, but maximize your returns.

- Take profits at intervals – if you’re going to study the crypto market, you’ll find out that the values increase or decrease anytime. Hence, if you’re trading on a short-term basis and experience an increase in value, you may definitely want to know whether the value will increase more. However, the values of cryptocurrencies are volatile, and nobody knows if they’ll go up or down. This is one of the reasons why you should take profits at regular intervals. Doing so can make sure you’ll get steady returns.

- Stay updated – another important component of your trading strategy is to stay updated with the changing crypto market and the news regarding the digital currencies. When you know what’s going on with the crypto you’re trading, you can ensure to make the most informed decisions as much as possible.

Indeed, there are still many things to learn about cryptocurrencies and trading them. While they’re considered a popular asset in financial market, trading digital currencies should be done with utmost caution to avoid significant losses.

Therefore, if you’re new to crypto trading, keep the tips mentioned above to ensure a successful trading experience from beginning to end.

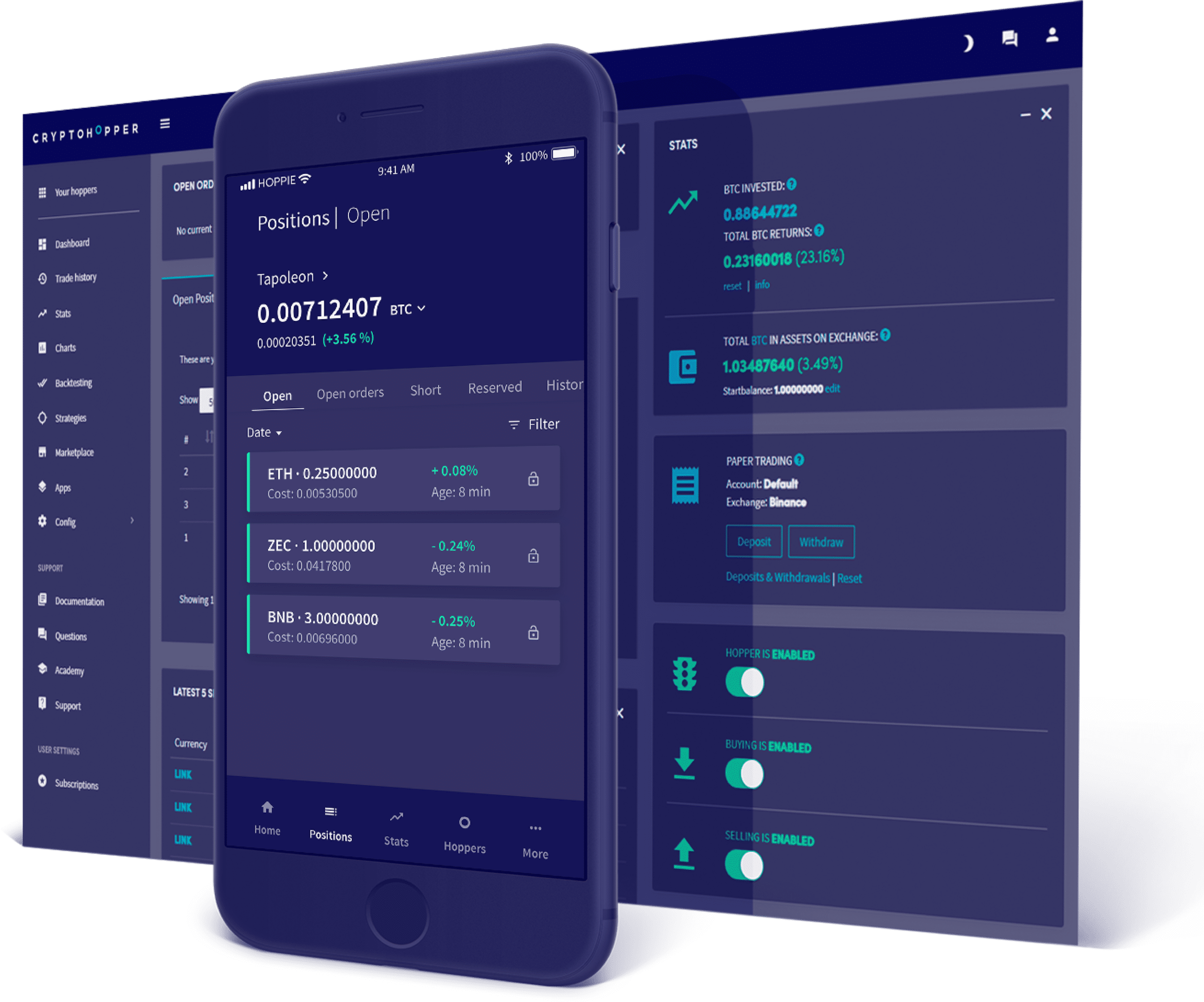

World class automated crypto trading bot

Copy traders, manage all your exchange accounts, use market-making and exchange/market arbitrage and simulate or backtest your trading.

Fast automated trading, and portfolio management for bitcoin, ethereum, litecoin, and 100+ other cryptocurrencies on the world’s top crypto exchanges.

Automate

your trading

And take your emotion out of the equation

Invest in all cryptocurrencies that your exchange offers. At the same time, you’ll also gain access to an expert suite of tools like our trailing features that help you buy/sell better than before.

Trades opened on cryptohopper

Manage all your exchange accounts in one place

Connect your exchange.

Your exchange is where your funds are located. With cryptohopper you can manage all your exchange accounts and trade from one place.

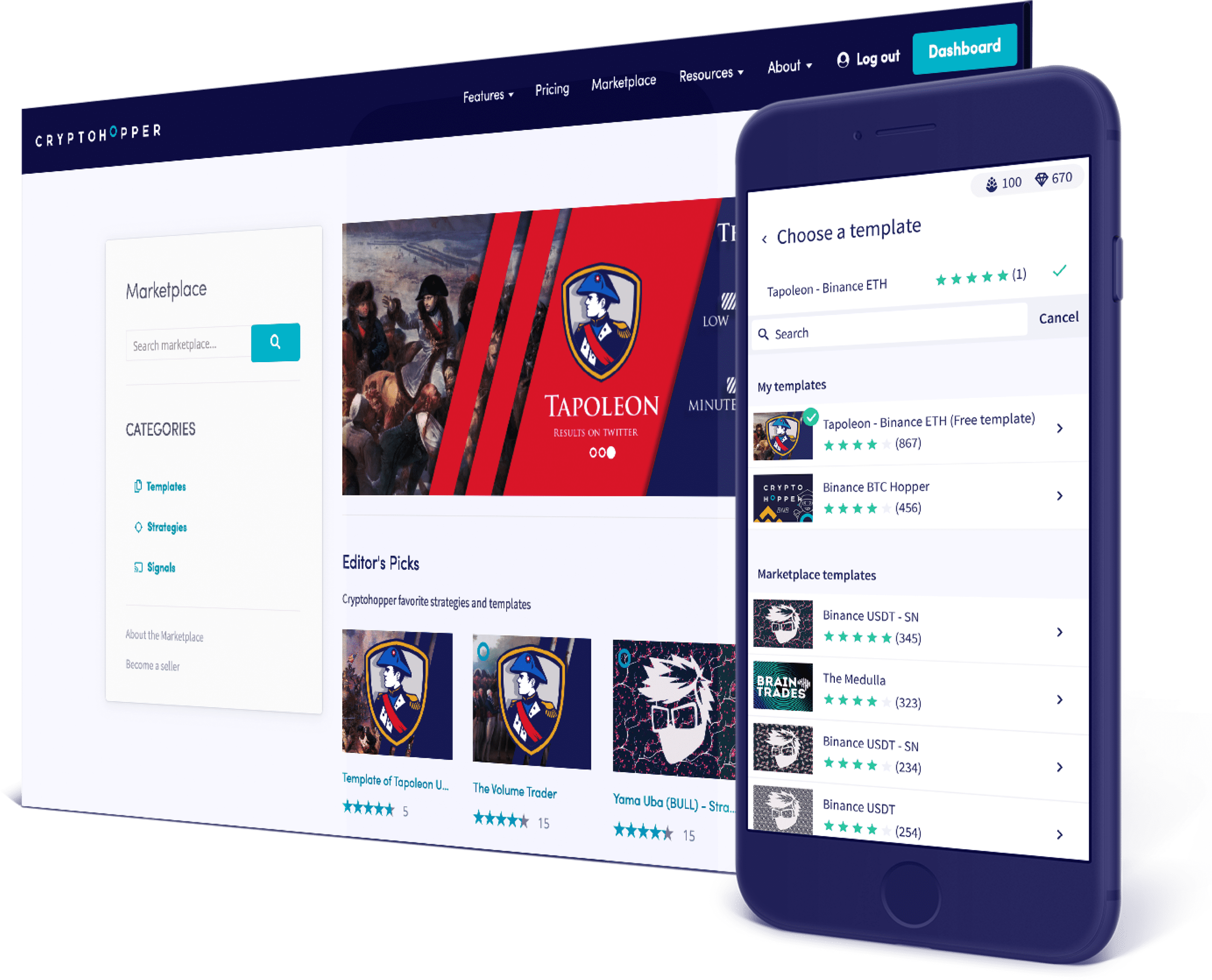

Signals. Templates. Strategies

Social trading platform

(check out the marketplace!)

Join the social trading revolution. Subscribe to trading signals, discuss trading strategies on our internal chat, and buy strategies and bot templates from our marketplace. You don't need to be an expert to trade like one.

Easy. Effective. Worldclass

Use expert tools

without coding skills

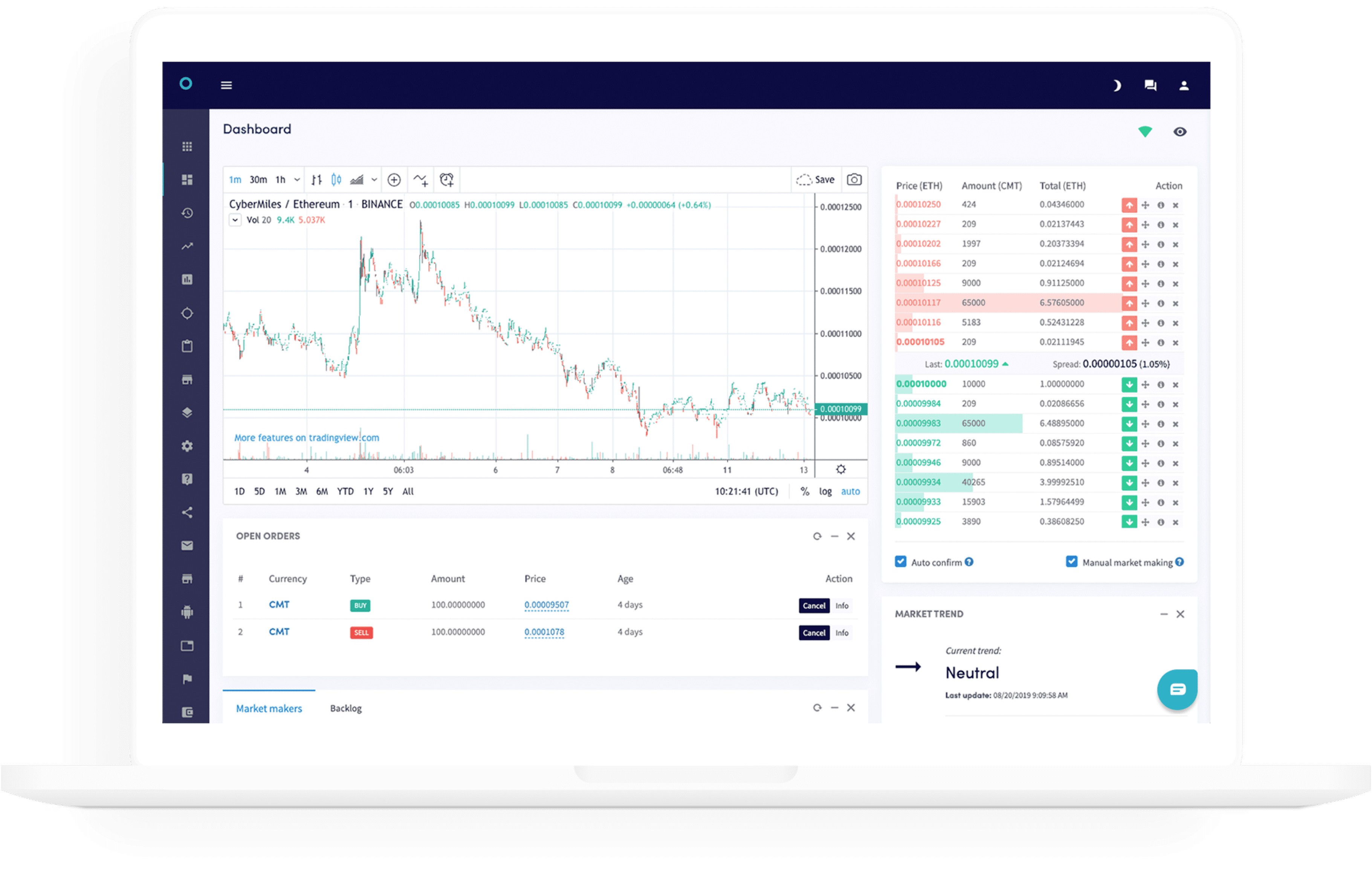

Market-making

Market makers are the best friend of every exchange or crypto project. Now you can trade easily on the spread as well, and make the markets. A win-win for everybody. Read more

Exchange/market arbitrage

Want to benefit from price differences of exchanges and/or between pairs? Our arbitrage tool is your new best friend. Read more

Strategy designer

Create your own technical analysis to get the best buy and sell signals from your strategy. Popular indicators and candle patterns are: RSI, EMA, parabolic sar, CCI, hammer, hanged man, but we have many more. Your hopper will scan the markets 24/7 searching for opportunities for you. Read more

Simulate your trading without fear (or money.)

Practice daring new strategies risk-free while mastering cryptohopper’s tools. Even backtest your bot and your strategies, so you can keep tweaking until it is effective.

What succesful cryptocurrency traders say about cryptohopper

Average score from the google play store (21 nov. 2019)

Meyer family | 11 nov 2019

"I'm very satisfied with cryptohopper and highly recommend it for day trading. It took me a while to get a strategy that worked for me, but it appears to have been well worth it. I recommend paper trading and backtesting extensively before using any real money. Once you master the initial learning curve, you will feel much more secure and confident that you can weather any trend or market. It will also be a valuable asset during the next alt-season and halvening events. Thank you cryptohopper team!"

Roshywall gurgel | 7 nov 2019

"great app. I don't understand cryptocurrencies very well but from what I saw in the demo you can profit. I will definitely buy the basic version to upgrade and profit."

"good service, powerful features, effective, affordable. Highly recommend. ��"

Soflow will | 24 oct 2019

"very easy to use and incredibly affordable. Get the free trail to test it and learn the ropes, then upgrade. I upgraded twice after one week and i still use both subscriptions. Awesome selection of options. Unlimited strategies, lots of free built-ins. Spend time to learn the fundamentals of technical analysis - you'll be glad you did. Crypto hopper will soon become your best friend. And weapon of choice!"

Chika moronu | 23 oct 2019

"took a while to get used to the settings, but once I got the hang of it, the app has been great"

Damion la bagh | 21 sep 2019

"the cryptohopper experience is simply amazing. Great instructions to help you on your way and s great community. The website is beautifully designed with full functionality. The app on the other hand is nice but it's not as full featured. It has the things you need to monitor your hoppers and basically interact but doesn't have the nice graphs, charts or settings to create new strategies like the website does. So one is still dependant on a laptop or computer to get everything set up 1st before"

Mitchell kemp | 3 sep 2019

Galen grassi | 6 sep 2019

"so far for a begginer I'm enjoying this, got a lot to learn but it's a good platform with useful tutorials to assist you along.. I would recommend cryptohopper."

so, let's see, what we have: 5 profit making cryptocurrency trading strategies in this article, we will look at five easy cryptocurrency trading strategies. 1. Bitcoin-altcoin ratios when looking at a crypto currency at crypto currency trading strategy

Contents

- Top forex bonus list

- 5 profit making cryptocurrency trading strategies

- 1. Bitcoin-altcoin ratios

- 2. Cross crypto arbitrage

- 3. Stable coin arbitrage

- Grid trading

- 4. Trading the bitcoin/altcoin adoption curve

- 5. Bitcoin and altcoin halving events

- Price action trading

- Day trading cryptocurrency – how to make $500/day with consistency

- How to day trade cryptocurrency

- Crypto day trading strategy

- Step #1: pick up coins with high volatility and high liquidity

- Step #2: apply the money flow index indicator on the 5-minute chart

- Step #3: wait for the money flow index to reach the 100 level

- Step #4: buy if MFI = 100 and if the subsequent candle is bullish

- Step #5: hide your protective stop loss below the low of the day. Take profit during the...

- Conclusion – crypto day trading

- Cryptocurrency day trading – tips and strategies

- Trade using well-known cryptocurrencies

- Ensure sufficient funds in your account

- Set up stock-loss orders

- Consider your risks

- Summing up

- Analysis report of 2020 strategies and trends in crypto-currencies, exchanges and trading

- Scope of the study

- About this report

- Summary

- Cryptocurrency overview

- Top virtual currencies being traded today

- Bitcoin

- Ethereum

- Litecoin

- State of crypto exchanges

- Trading and investment strategies

- Spot trading

- Leverage trading

- Arbitrage trading

- Bitcoin futures

- Outlook for 2020

- Cryptocurrency trading strategies

- Remember not to invest more than you can lose

- Research before investing in an ICO

- Research before any investment

- Stay up to date with news and trends

- Balance your portfolio

- Dollar cost averaging

- Don’t be afraid to HODL

- Consider trading bots

- Conclusion

- 5 profit making cryptocurrency trading strategies

- 1. Bitcoin-altcoin ratios

- 2. Cross crypto arbitrage

- 3. Stable coin arbitrage

- Scalping

- 4. Trading the bitcoin/altcoin adoption curve

- 5. Bitcoin and altcoin halving events

- Ebook trader's pack

- Best trading strategy for cryptocurrency traders

- Best trading strategy for cryptocurrency overview of the options

- Basic cryptocurrency trading strategies

- Basics of technical analysis of price action

- Best trading strategy for cryptocurrency and mistakes to avoid

- Basics of trading cryptocurrency

- 1. Pick A reliable crypto exchange

- 2. Choose the cryptocurrency you want to trade

- 3. Make A great trading strategy

- World class automated crypto trading bot

- Manage all your exchange accounts in one place

- Social trading platform

- Use expert tools without coding skills

- Market-making

- Exchange/market arbitrage

- Strategy designer

- Simulate your trading without fear (or money.)

- What succesful cryptocurrency traders say about cryptohopper

No comments:

Post a Comment