Crypto currency trading platforms

With 200+ trading platforms to choose from, there is no denying that even the experts find it tough picking the right one.

Top forex bonus list

Selecting the right trading tool is a major milestone towards becoming a successful trader. Well, it doesn’t stop at that. Others have been hacked and compromised in various ways.

What traders need to know about today’s cryptocurrency trading platforms

As a beginner, trading or investing in cryptocurrencies can seem intimidating. Every once in a while, you’ll come across news of people losing money in mega scams. The cryptocurrency space is undoubtedly one of the most viable investments yet quite challenging at the same time. But it is also important to mention that a lot has been going on to protect digital assets investors.

Whether you wish to go long or short term, when investing in any cryptocurrency, the most important concern is safety and security. Speaking of security, your best shot at safeguarding your investment is by choosing the right trading platform.

IMAGE: UNSPLASH

Unlike a few years ago when bitcoin was still gaining traction, today, dozens of decent trading tools are available for your choosing. Primexbt, for example, offers a bitcoin-based multi-asset trading platform serving clients in 150+ countries. The 2020 ADVFN international financial awards and forex awards winner in the best platform for margin trading and best crypto and forex broker categories is among the fairly few well-known secure and private crypto trading tools today.

However, with multiple players comes the challenge of choice. So, how do you know if a platform is right for you? Read along as we unpack the most sought-after things in crypto trading tools.

Basics of A cryptocurrency platform

Initially, cryptocurrency trading platforms were tools of exchange between one crypto for another. For instance, one would typically trade bitcoin for ethereum or the vice versa. But their purpose has evolved to include the trading fiat currencies and cryptos, cryptos for gift cards, and so on. In short, a cryptocurrency platform is a tool that allows for the trade of digital assets for a range of other assets.

Now, not all trading platforms operate in the same way – primexbt and coinbase could be trading similar assets but one could be a market maker while the other is a matching platform. A market maker essentially takes commissions from the bid-ask spreads while a matching platform simply charges fees on transactions.

Most crypto trading platforms are decentralized, meaning they are not operated by a central party. Centralized are, however, regulated and controlled by an appointed authority. There are pros and cons to each and in the end, it boils down to individual preferences.

Contrary to what most people would imagine that crypto exchange has to be virtual, they also take a brick and mortar shape. As an online platform, crypto exchanges trade electronically transferred assets for digital assets. But as a brick and mortar, it exchanges digital assets for traditional payment methods.

Most exchanges operate in less regulated regions, typically outside the western countries. However, they still handle fiat and other assets from western countries. Users can use credit and debit cards, bank wires, and other forms of payment to either deposit or withdraw cash from exchanges. But just like their forex counterparts, regulatory bodies all around the world are starting to formulate jurisdictions around governing cryptocurrency exchanges.

How to choose A cryptocurrency exchange

With 200+ trading platforms to choose from, there is no denying that even the experts find it tough picking the right one. Selecting the right trading tool is a major milestone towards becoming a successful trader.

You must first exercise extreme caution. As cliche as that sounds, it is the first thing to do when venturing into any investment. Exchanges have in the past gone under with investor funds: remember mt gox, one of the earliest crypto exchanges that collapsed with millions of investors’ money? There was another that even had the CEO buried with the system’s password, leaving thousands of investors in limbo.

Well, it doesn’t stop at that. Others have been hacked and compromised in various ways.

To guarantee the safety of your investment, you might want to, first of all, look up the physical address for that particular exchange. While the absence of a physical address isn’t much of a red flag anymore considering the rise of remote working, it sounds like a good first reference point. And even in the absence of a physical address, it pays to know where an exchange is based to foster transparency. You will also be able to understand the jurisdiction under which the exchange operates as some exchanges do not permit users from certain regions.

Additionally, look out for the chargeable fees or commissions. This does not mean that you should only go for “affordable” exchanges at the expense of other equally important features. As a general rule, strive to balance between affordability and security. For instance, primexbt stores all customer assets in a cold storage wallet and executes all transactions manually after a careful risk score assessment, money laundering evaluation, among other checks to boost the platform’s security.

On affordability, the tool seems to be walking the talk too. In a 2019 statement, the platform announced a material reduction to its trading costs: “we are delighted to offer new reduced fees to primexbt platform users. We believe that traders should focus on trading opportunities rather than on costs. Oftentimes, amazing profit opportunities are being missed only due to unreasonably high fees. And we don’t want that – we are here to provide the best possible trading environment for our customers.”

Lastly, you’ll need to look out for the available payment methods. While a platform may have top-notch security coupled with affordability, it serves you no good if you’ll cross worlds just to deposit or withdraw money. Ensure that the exchange you choose offers convenient methods of payment that are not just available in your area, but also be secure, affordable, and reliable.

If you are interested in even more business-related articles and information from us here at bit rebels, then we have a lot to choose from.

Best crypto exchanges 2021

Summary

Crypto exchanges are the easiest options if you want to buy, sell or exchange cryptocurrencies. Multiple cryptocurrency exchanges have gained popularity in recent years with every exchange having its own set of pros and cons. It is important to look at every exchange’s security steps, fee structures, supported cryptocurrencies and ease of use before deciding which cryptocurrency would suit your requirements the best.

Pros and cons of crypto exchanges

- Easy and user-friendly trading platforms

- Fast account opening processes that require minimal information and take only a few minutes

- Support for multiple cryptocurrencies means that you are not limited in your choices

- Support for multiple deposit and withdrawal options including debit/credit cards and paypal etc. By some crypto exchanges provides further flexibility

If you want to buy cryptocurrency, you can buy and sell them via a secure exchange. You create an account on the exchange’s website and buy and sell via this account. Your cryptocurrency can be store in a digital wallet on the exchange’s website. This is called a hot wallet. The most secure way to store your cryptocurrency is in a cold wallet. This is a piece of hardware which looks similar to a flash drive. What makes it secure is that it is not connected to the internet.

4 easy steps to buy cryptocurrency

- Create an account on a crypto exchange ie. Paxful

- Select the cryptocurrency you want to buy

- Add your wallet address

- Complete the purchase

There are many different cryptocurrency exchanges available. Each exchange offers something different, so it really depends on what you are looking for.

We have a reviewed a number bitcoin and cryptocurrency exchanges, which details fees, limits, payment methods, supported countries, customer support, security and most importantly privacy.

Warning – all bitcoins and crypto currencies should be stored in a hardware wallet. This is a secure way to store your cryptos. You should not stores these in any exchanges.

Top crypto exchanges

Coinbase

Coinbase is one of the best crypto exchanges in the world. The reason for this is its exemplary security record. The fact that it hasn’t been a victim of a serious hack is enough to get people to trust its security measures. To top it off, its online platform is very user-friendly and doesn’t complicate things for new users. There aren’t multiple interfaces or screens to confuse you. Coinbase has a very simple procedure to verify user identity. It has a few simple steps and the whole thing is over within minutes. Although the security offered by coinbase is its marquee feature, it does elevate the fees it charges. To maintain the high levels of security they provide, coinbase charges some of the highest rates in the market for crypto exchanges. The fees charged by this crypto exchange can go as high as 3.99% depending on the country you are trading from. Also, coinbase is very strict when it comes to accepting cryptocurrencies. It only deals in the most trustworthy cryptocurrencies and even the likes of tether, monero, and tron fail to live up to their standards. Another issue with coinbase is that, as of now, it is available in a limited number of countries.

CEX IO

CEX.IO is right up there with coinbase when it comes to user-friendliness. You can get started with this crypto exchange within minutes thanks to its excellent support section. It offers multiple types of accounts and each of them come with its own set of benefits. CEX.IO has put in place stringent security measures too. It has 2-factor authentication and also maintains a level 2 DSS certificate. This is not all, though. This crypto exchange goes beyond the 2FA and sends users notifications via email about every log-in attempt. The fee charged by CEX.IO on trades is also comparatively lower than other crypto exchanges.

While CEX.IO accepts multiple payment methods and fiat currencies for buying cryptocurrencies, you aren’t offered many cryptocurrencies. There is a small pool of cryptocurrencies that can be bought on this platform. So, if you want to buy a new or relatively unknown cryptocurrency then CEX.IO is not the platform for you. Also, even though the security measures are quite good, they aren’t fool-proof. This platform, like all crypto exchangers, remains a huge target for hackers. You can use CEX.IO for buying and exchanging cryptocurrencies but never for storing your cryptocurrency or even fiat money.

Paxful

Paxful is another well-known crypto exchange. It has been in the crypto trading industry since 2015. What separates paxful from other crypto exchanges is that it isn’t just an exchange, it is a marketplace where buyers and sellers convene to trade bitcoins. The paxful website is clutter-free and creating an account on it is pretty straight-forward. You can buy bitcoins using a variety of payment methods on this platform. From credit cards to bank transfers and from debit cards to paypal, there are multiple deposit options on paxful. From a security perspective too, this crypto exchange is an excellent choice. It has multiple levels of security available that ensures user privacy and prevents cyberattacks.

The main concern that people have with paxful is that sellers can scam the buyers on this platform if they aren’t careful. Also, withdrawing money can be an issue for some people who aren’t familiar with the withdrawal guidelines of this crypto exchange. Both these issues can be easily handled, though. Paxful recommends sellers to its buyers who have an impeccable reputation. You should buy from them to avoid scams. Similarly, the withdrawal guidelines state that you need to provide extra identification if you are withdrawing a large sum of money.

Blockfi

Blockfi has emerged as a strong cryptocurrency exchange and broker in recent years. The company, established in 2017, has relied on competitive pricing, intuitive trading platforms and multiple crypto products to become a viable options for individuals looking to do cryptocurrency trading.

Blockfi charges no transaction fee for both crypto-to-fiat and crypto-to-crypto transactions made via the platform. Blockfi earns its commission by keeping the offered price for the transaction around 1% higher than the actual market rate. This is made possible by the fact that blockfi works as a crypto broker in normal trading transactions. Blockfi has a very secure platform and uses an NYDFS regulated service gemini as its custodian. Blockfi has multiple products as well including crypto interest accounts and crypto-backed loans along with crypto trading for its users – something that sets it apart from the other crypto exchanges.

There are a few areas where blockfi loses its edge against the competitors though. One such aspect is the withdrawal fee structure. Blockfi charges a withdrawal fee for every second monthly withdrawal from the account with the fees depending on the crypto being withdrawn. Similarly, blockfi also offers only seven mainstream cryptocurrencies for trading and this limits the trading possibilities for traders looking to invest in newer and upcoming cryptocurrencies.

Etoro

Etoro is a reputable name in the fintech industry. It has made a name for itself in the crypto exchange and trading industry as well. Etoro offers a variety of crypto currencies and various payment methods to buy them on its platform. The website of this crypto exchange is intuitively designed and keeps things simple for the traders. It also offers a mobile trading app that can be used for trading on the go. Creating an account with etoro is simple as well and only takes a few minutes.

Etoro allows you to copy the trades being made by other traders. While this is a good strategy for novice traders who don’t know how crypto trading works, they need to have enough balance to copy the trades. The fee charged by etoro for crypto trading isn’t that high. In fact, US residents don’t even have to pay a withdrawal fee when withdrawing money from their accounts. However, account holders of other countries have to pay a $5 withdrawal fee. Also, the amount needed to open an account is different for people living in the US and other countries.

Binance

Binance is among the popular names in the crypto exchange market. They have earned a reputation for being the go-to exchange for all types of cryptocurrencies. Their high trading volumes are a testament to this fact and also indicate that people have enormous trust in this platform. The simple reason for this is that binance offers trading of over 100 cryptocurrencies. You can get competitive prices for every type of cryptocurrency on this platform that you won’t find anywhere else. Another major factor that has made binance popular among the people is the fees it charges. The rate of 0.1% charged by this platform for crypto trades of any quantity is the lowest among the top crypto exchanges.

There is no denying the popularity and trustworthiness of binance. Its commitment to security is evident from its use of 2-factor authentication. However, the security record of binance is a bit chequered and it has had issues with hacking in the past. To add to this, the website of this platform is geared towards experienced crypto traders. If you are a beginner and don’t know your way around crypto trading then this isn’t the right crypto exchange for you.

Kraken

Kraken is the crypto exchange that offers the most cryptocurrencies to you. You have 150 different crypto coins and tokens that you can buy or sell on this platform. This variety of cryptocurrencies makes kraken a good option for both experienced and novice crypto traders. Also, you can use various payment methods and fiat currencies for buying the cryptocurrency you want. Another reason why budding crypto enthusiasts will find this exchanger easy to use is its mobile app. The intuitive interface and user-friendly design of the kraken app makes trading a simple exercise even for the uninitiated. Kraken has a flawless security record too.

Kraken has been trying to improve its services ever since it entered the crypto exchange industry. However, there are some areas that still need some improvement. For instance, customer support offered by kraken is a bit of a hit and miss. While there is a well-stocked help section, the customer support isn’t as helpful as it should be. Security is another aspect in which kraken has made significant strides in the past few years. Still, the threat of cyberattacks looms over the platform every day. Fortunately, kraken is well-aware of that and is doing its best to maintain the highest standards of security.

Coinmama

Coinmama is a popular crypto exchange that is available in most countries of the world. People in more than 188 countries have access to this crypto exchange and can use it for buying cryptocurrencies. The website of this platform is designed keeping novices in mind. You won’t see any graphs, statistics, and complicated calculations here that might scare you away. It offers you simple guidelines on how you can get started. You have various cryptocurrencies available and you can pay for them using a variety of payment options. The transactions are conducted safely and your cryptocurrency is transferred to you private wallet.

Although coinmama has one of the most user-friendly platforms for buying cryptocurrencies, it charges a premium fee from its customers for using it. You will have to pay 5.5% fee to coinmama for each transaction you make. That’s not all. You will also have to pay an extra 5% in fees if you want to use your credit card for buying cryptocurrency. It doesn’t matter which cryptocurrency you are buying, the 5% extra fees will remain the same.

Uphold

Uphold is a diverse crypto exchange that deals not just in cryptocurrency but also in etfs, stocks, precious metals and forex. Uphold implements an ‘anything-to-anything’ trading system and this means that you can easily exchange not just one cryptocurrency with another but can also exchange between different asset classes (crypto to stocks and vice versa etc.). Uphold works as a broker in transactions and therefore, it doesn’t deduct any transaction fee, deposit fee or withdrawal fee but rather charges a spread over the market rate of the offered trades. The spread is usually around 0.8 to 1.2% for cryptocurrencies. Uphold has an excellent trading platform that is easy to understand while its signup process is so simple that an uphold account can be created within five minutes at the very most.

Uphold has a few things that it can improve upon though. For starters, uphold doesn’t offer live call support and this can hinder quick resolution of problems. Secondly, uphold also has a very under developed education section that can help users in understanding its products and how they can maximize their profits.

Bittrex

Bittrex is a seattle based crypto exchange established in 2014 that focuses a lot on security. Bittrex secures the funds of its users by keeping around 90% of all the user funds in cold storage and by offering two-factor authentication for all user accounts. Bittrex has developed a strong reputation for its security with its track-record proof that no hacker has been able to penetrate its system. Bittrex has other advantages as well including its fast processing speeds for trades and its support for over 190 cryptocurrencies (this is more than most cryptocurrency exchanges). Bittrex also has an uncomplicated fee structure and an easy to use platform making it an attractive option for new users who are new to cryptocurrency trading.

For all its advantages, bittrex also has a few cons. Firstly, bittrex has a higher transaction fee than most cryptocurrencies. It charges 0.25% of the transaction’s value which is higher than poloniex and kucoin. Secondly, bittrex has a reputation for poor customer support with most users complaining that the customer service takes too long to even the most basic queries and problems.

Changelly

If you need your transaction executed fast then changelly is for you. They offer fast and anonymous transfers with no 3rd party holding. This is basically a conversion transaction simple selection your input and output transaction and then the amount.

Top 9 cryptocurrency trading platforms

Elaborating a bit on the concept of cryptocurrency and the blockchain effect before we move onto the central theme. As put in words by daniel gasteiger on the topic ‘blockchain demystified’ at tedxlausanne,‘A blockchain is nothing but a database, a database that is public, therefore not owned by anybody. Distributed hence not stored centrally on one computer but on many computers across the world. Constantly synchronized to keep the transactions up to date and secured overall by the art of cryptography to make it tamper proof and hacker proof. These four features make this technology exceptional.’ daniel’s strong belief in the solidarity of the concept of cryptocurrency motivated him to leave his full-fledged career of 20 years in financial services to focus on the concept of blockchain. Looking to know more about how to formulate cryptocurrency strategies? Read our blog on cryptocurrencies trading strategy with data extraction technique.

Why is cryptocurrency trading popular?

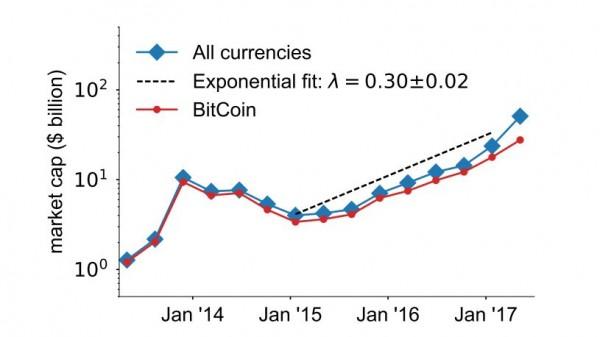

- The concept of universal money that can be traded worldwide, which is surging in value and price every day is the most lucrative aspect for traders. At the very initial stages 1 bitcoin was traded at 0.003$, it was cheaper than 1 cent! The currency quickly surged in value to be worth many hundreds of US dollars. As of today, 1 bitcoin is equal to 9881 US dollars.

- Cryptocurrency is based on knowledge sharing on a distributed platform. The entire transactional history is for everyone to see. One blockchain is one thread of transaction. One unit or one block stores many transactions. The size of the block is 1MB and generally stores around 1000 to 2000 transactions. The data entered cannot be altered, nor can it be removed, enabling a system of complete transparency and trust. The entire money flow for the working model is beyond the traditional practices of controlling tax rates, credit usage, and money supply in the market.

- Those who believe in cryptocurrency claim it to be the next big thing in the history of mankind. The mere fact that cryptocurrency is beyond the control of any government body gets it a lot of eyeballs. Imagine a universal currency beyond the control of liquidity, inflation and government subsidy. This would mean that the commercial activity of economies working on cryptocurrency shall be privatized absolutely.

- Strictly speaking, there’s so much to be tested and validated in this field, yet cryptocurrency is the most lucrative form of currency thought of till date. It has not been banned in most countries but most countries maintain a strict no regulation and no involvement stand on it. Considering the same, cryptocurrency traders are always looking for the most reliable broking and cryptocurrency trading platform.

9 best cryptocurrency exchanges

Etoro

Etoro is a social trading and multi-asset brokerage platform with offices in cyprus, israel and the united kingdom. The platform allows users to watch trading strategies of others and copy them. The company’s products openbook and webtraders allow traders to learn from each other. The features are user-friendly and simple to use while the fees depend on market dynamics.

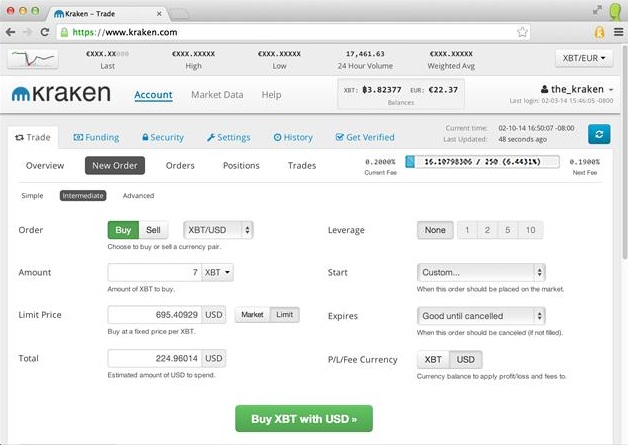

Kraken

Kraken’s innovative features claim to cater to the demand of fast execution, outstanding support and high security. The organisation is based in san francisco, USA. Kraken is operational worldwide with a pre-validation for those countries where it is not eligible. The platform accepts both cryptocurrency and fiat and transaction is completed by a wire transfer which should be completed at the bank. The platform does not accept debit, credit or cash.

The fee goes as low as 0% and depends on how much you trade. The trade volume for the period of past 30 days is considered for calculating the charge.

Poloniex

Poloniex is an asset exchange based in the US. Trading on poloniex is secure and allows traders to explore new and trendy coins which are up for speculation. It offers high volume margin trading and lending service for major crypto assets. Reportedly, the largest user base for trading on this site comes from russia (6.06%) and US (24.84%). A differentiating factor about the site is that it does not support fiat currency.

Poloniex is popular as a cryptocurrency trading platform with users seeking to convert cryptocurrencies, margin trade and lend. Services are accessible across the globe. Fees is dependent on the maker-the one whose name is already listed and taker-the one who makes an order. Makers are so named because they maintain the liquidity in the market. Every 24 hours the platform calculates the fees based on the volume traded between market and the taker for last 30 days and the fees is updated dynamically.

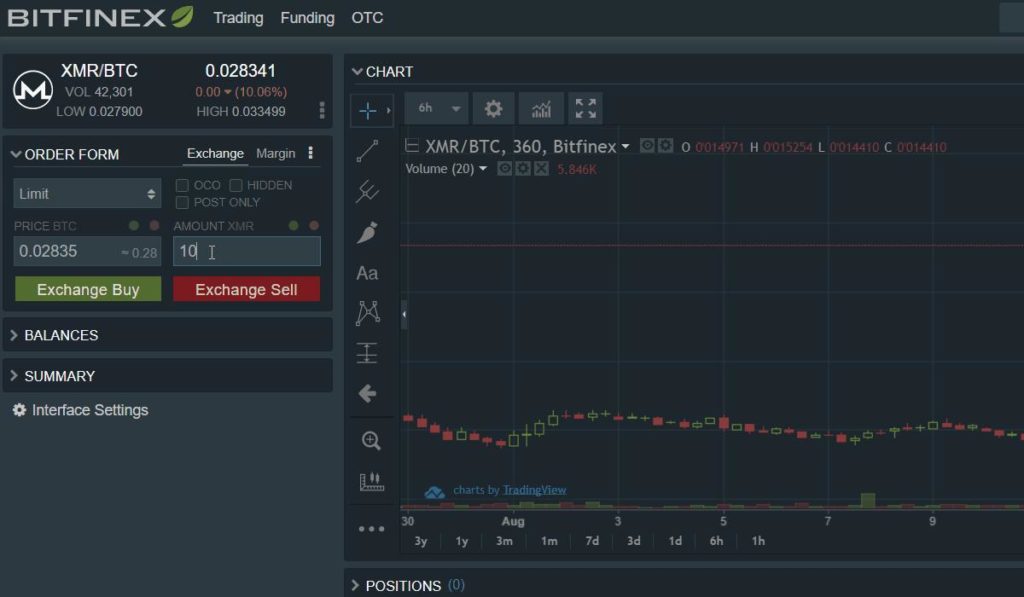

Bitfinex

Bitfinex, a popular cryptocurrency trading platform, is perfectly suited for trading most cryptocurrencies like bitcoin, bcash, ethereum, iota, NEO, litecoin, EOS, dash, ripple, bitcoin gold, monero, zcash, ethereum classic, omisego, ETP, santiment, qtum, eidoo, streamr, and aventus.

Bitfinex allows both traditional orders like limit, market, stop and algorithmic trades like iceberg, OCO and post only.

A bitfinex has three wallets for three different purposes, viz. Exchange, margin and funding. Fee charge is same as kraken, trading is either zero-fee or a small fee depending on the trader's trading activity in the last 30 days. The trading fee has a distinction of a "maker" fee or a "taker" fee.

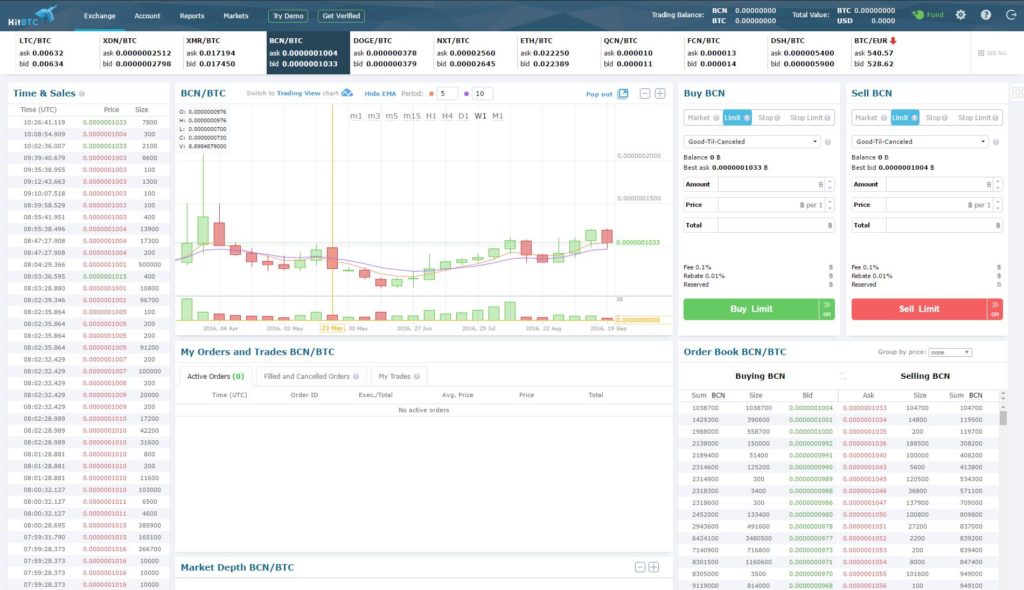

Hitbtc

Hitbtc is a global trading platform that has been operational since 2013, supporting multiple currency forms. The trading platform has markets for trading digital assets, tokens and icos.

Hitbtc offers fees on every market trade while letting you trade a variety of cryptocurrencies and fiat currencies – including bitcoin, dogecoin, litecoin, the euro, USD, and a surprising range of lesser-known cryptocurrencies. You can check out the fees details here.

The platform is quite popular among developers who want to test their codes since the platform allows demo trading as well.

Bittrex

Bitrex provides comprehensive vetting of new cryptocurrency tokens and places a strong emphasis on user security. Hence has the reputation for being a secure wallet with a good security module.This cryptocurrency trading platform trades vastly in altcoin. Trading fees at the platform are is listed here. The minimum transaction fee of the blockchain governs the charge for deposit and withdrawal.

Bitmex

Bitmex is a derivatives exchange that offers leveraged contracts that are bought and sold in bitcoin. This is a cryptocurrency trading platform that provides trading in bitcoin derivatives. The derivative traded is a perpetual swap contract, which is a derivative product similar to a traditional futures contract. Swap contracts trade like spots, tracking the underlying assets.

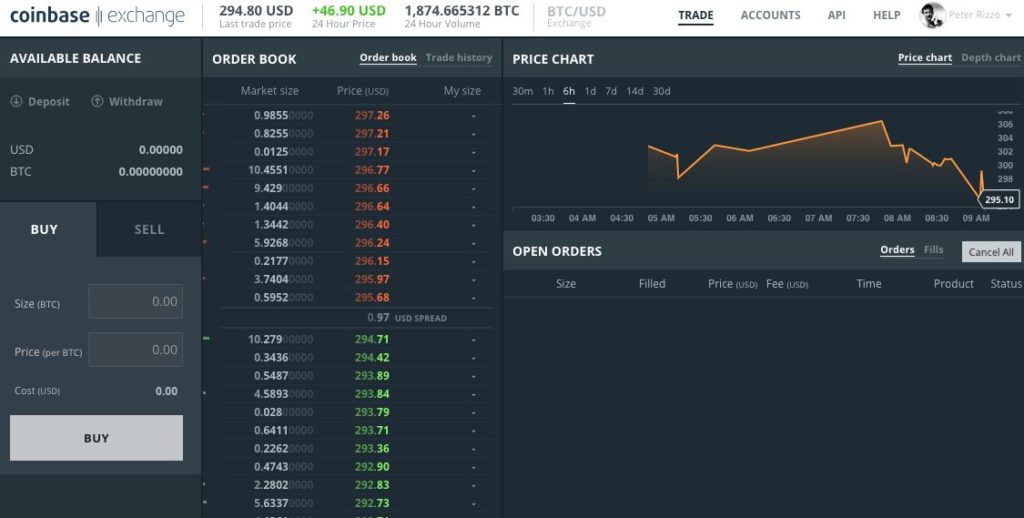

Coinbase

Coinbase, headquartered in san francisco, is an online bitcoin broking exchange which caters to US, canada, europe, UK, australia, singapore. Up to 150 US dollars and pounds can be bought on coinbase on a daily basis. Coinbase offers very high limits. Limits depend on your account level, which is determined by how much information you have verified.

Localbitcoins

Localbitcoins is the portal that exchanges trades between person to person where you interact with the seller directly. On this platform, people from different countries can exchange their local currency to bitcoins. The site is suggested for casual traders seeking more privacy. The site uses an escrow system and the transfer of bitcoin is made after funds are received in the sellers account. Registering, buying and selling is completely free on localbitcoins while local bitcoin users who create advertisements are charged as mentioned here.

A concise tabular comparison of all the popular bitcoin exchanges and their features:

Looking for more guidance on how to get started? Read our blog to know how one of the EPAT participants started cryptocurrency trading.

Next step

If you want to learn a simple strategy to fetch data from various cryptocurrency platforms you can check our post on 'cryptocurrencies trading strategy with data extraction technique'. This strategy will help you make to fetch data with a minute resolution using python library.

Disclaimer: all data and information provided in this article are for informational purposes only. Quantinsti® makes no representations as to accuracy, completeness, currentness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.

Best cryptocurrency trading platforms 2021

Best cryptocurrency trading platforms 2021. Before you start a crypto investment, you need a crypto trading platform. Crypto trading platforms are simply a place or platform where crypto traders buy, sell, or exchange different cryptocurrencies for profits. If you want to trade cryptos professionally, you need a trading platform that has all the trading tools and would require you to verify your ID before opening an account. On the other hand, if you want to trade on a part-time basis, there are also cryptocurrency trading platforms you can leverage without opening an account. Find best cryptocurrency trading platforms below

Best cryptocurrency trading platforms

- Coinbase and coinbase pro

- Cash app

- Bitbuy

- Binance

- Bisq

- Coinhouse

- Localcryptos

- Switchere

- Kraken

- Poloniex

How to choose best cryptocurrency trading platforms

- Reputation: one of the best ways to determine a real or genuine crypto trading platform is to research its reputation. You can research a platform’s reputation by perusing other users’ review and comment on the platform. Plus, you can ask questions on crypto forums like bitcointalk, bitcoingarden, altcointalk, cryptocurrency forum and others. There are equally high-quality platforms like reddit, quora, and others to get such information.

- Fees: any platform you intend settling for should have their fees displayed on their website. Before creating an account with them, ensure you understand their deposit, withdrawal, and transaction fees. Note that; no two platforms have the same fees!

- Payment methods: payment method is another item to check before joining any crypto trading platform. Do they accept paypal, credit/debit cards or wire transfer? You might want to look out for a platform that has limited payment options; remember that buying cryptos using credit/debit card comes with lots of risks and ID verification. Also, buying cryptos with wire transfer method takes time for banks to process your transaction. Put all these into consideration before trading.

- Verification requirements: so many trading platforms require users to verify their identity. This is to forestall scams and fraud of all kinds. Ensure you settle for a platform that verifies user ID.

- Geographical restrictions: some trading features offered by some cryptocurrency trading platforms are only accessible in certain countries. Therefore, ensure the platform you intend settling for allows full access to their trading features in your country.

How to invest in bitcoin

Investing in BTC is similar to investing in stocks, except far more volatile because of the daily swings in BTC. Here are the steps to invest in stocks from the beginning:

- Open a brokerage account at a firm that allows crypto investments

- Deposit funds from your bank into the brokerage account.

- Buy a stock using deposited funds (cash balance).

- Later sell the stock for a gain or loss. Funds are returned to your cash balance.

4 best cryptocurrency arbitrage bot platforms for 2021

Crypto arbitrage or bitcoin arbitrage is the process of buying cryptocurrencies from one exchange at low prices and selling them in another exchange where the prices are high. Users can do it manually which take time while use of automated cryptocurrency arbitrage bot platforms are the process more efficient and profitable. It works just like a stock market, where people try to make a profit out of the volatility of the price differences in the bitcoin exchanges.

How does crypto arbitrage work?

Arbitrage trading works on the price differences between the exchange markets. For example, in the large exchanges, you will find high trade volumes and lower prices of bitcoins. Again, in the small crypto exchanges, the supply is less while the prices are high. Traders take advantage of this situation and buy cryptos in bulk from large exchanges at low prices and sell them at high prices in the smaller exchanges thus earning massive profits.

However, the recent ‘bull market’ has caused an increase in the overall volume of crypto trades in all exchanges that an increase in share prices resulting in massive sales even in small exchanges.

Barriers to bitcoin arbitrage

Arbitrage trading has limitations such as:

- Verification of transactions can take some time. The prices of the cryptocurrencies may change during this time.

- The verification process may be cumbersome especially if you are trading large volumes of crypto.

- Exchange fees may be too high and may leave no profits in the end.

- You need to make large volumes of trading in both the exchanges to make profits.

- Traders should make a thorough check of the exchanges with which they are trading. Often exchanges with low prices have trust issues and are unable to satisfy their customers.

Now that we have learned about crypto arbitrage trading, let us have a look into some of the best crypto arbitrage trading platforms:

Best cryptocurrency arbitrage bots

Bitsgap

Bitsgap is another arbitrage trading tool that allows you to make profits through arbitrage trading of bitcoins and other cryptos in exchanges. Key features include:

- All trades depend on the available funds in your account.

- Bitsgap provides arbitrage trading in both cryptocurrencies and fiat currency.

- Arbitrage fees are included in the profits.

- Supports most of the popular cryptocurrencies.

- It is AI-integrated and fully automated to facilitate your trading.

- You can create your account with fiat currency like USD and EUR or cryptocurrency.

- The smart API protects your funds and helps you to build a smart portfolio in the trading platform.

Arbitrage.Expert/automated crypto arbitrage

Automated cryptocurrency trading bots are the software which executes automated buy and sell orders with the goal of making profit. Similarity, automated trading with the software bot especially made for the purpose of arbitrage are know as automated crypto arbitrage trading. One example of such platform is arbitrage.Expert website. This platform uses an advanced version of algorithmic arbitrage trading bot. Features include:

- Arbitrage bots help to do crypto trades taking leverage of the price differences prevalent in different crypto exchanges.

- Do trade with the help of API tools without withdrawing the funds.

- Faster trades with arbitrage bots.

Gimmer

Gimmer is another arbitrage trading bot in the crypto trading market. GMR is the official token of this platform and is available on the exchange platforms and it supports multiple cryptocurrencies. Here are some of the key features of gimmer:

- The automated bots are integrated with all the major trading exchanges.

- Users get access to a basic level of automated trading bot for free.

- Gimmer will study your profile and let you know about the risks involved while you are investing in the exchanges.

- Free back testing tool that enables you to test your trading strategy to understand the pros and cons before you implement it in the market.

- You can also earn cryptos buy renting your automated bot to other crypto traders.

- Multiple safety protocols to safeguard your hard-earned money.

- You can choose your trading bots if you are looking for more investment opportunities.

- Exchange information and ideas in the social network of traders and learn more about arbitrage trading.

- Practice arbitrage trading with the help of the simulator mode.

- Hosts lightweight dapps that are fast, secure, and affordable.

Multitrader.Io

Multitrader is one of the finest crypto trading platforms. It uses arbitrage trading bots that make the work automatic and easy. At present, multitrader is working with 21 crypto exchanges and constantly looking out for trading opportunities. Key features of multitrader platform includes:

- A user-friendly interface where traders can analyze the progress.

- Uses statistical calculations and order book matching to search for potential opportunities in arbitrage trading.

- It provides cloud-based solutions.

- You can review the trades with the help of bots.

- Users can get periodical reports on their trades.

Fxdailyreport.Com

Over the last few years, cryptocurrency trading has become one of the most attractive niches in forex trading. Other than it being extremely profitable, the lack of regulation is its biggest appeal. Still, cryptocurrencies like bitcoin, ethereum ripple, dash, and litecoin are dynamic, unstable instruments that need to be handled cautiously and in the most optimal way. To achieve this, you need to choose a trustworthy, well-established broker to carry out your cryptocurrency trading.

This is crucial to getting on the right track from the beginning when trading cryptocurrencies. When choosing a broker, it is important to note that not all are the same. A broker that meets the needs of another trader may not meet yours. Here are a few tips to help you choose the best forex broker for cryptocurrency trading:

- Regulation and reputation

To avoid dealing with an unprofessional broker and being scammed, you need to make sure all your crypto trades are made solely with a regulated broker. When choosing a forex broker to work with, make sure they are regulated within your jurisdiction to legally offer you their services. Regulated forex brokers are under constant supervision of the regulatory body. If you are in the UK, make sure to trade with a broker that is regulated by the FCA. If in europe, ensure they are regulated by the cysec. In case you are in australia, they should be regulated by the ASIC.

- An efficient trading platform

It is important to note that cryptocurrency trading is more volatile than forex. Therefore, it demands that the platform is superbly responsive to be able to make moves in time. A good broker’s platform should be efficient to use. To beat the competition, the best cryptocurrency brokers work to attract clients by creating an intuitive trading platform that is suitable for both experienced and new traders. They offer technical analysis tools and basic risk management features like take profit or stop loss. Other sites also offer additional features, including price alerts, social trading networks or advanced educational centers. The crypto trading platform should allow you to trade in the market manage your accounts, perform technical analysis, and receive the latest news on all cryptocurrencies.

Top recommended crypto forex brokers in 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: 0 spread: non-spread, fee 0.1% per trade leverage: non-leverage regulation: - | visit broker | ||

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $50 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

- Transparent fees and commissions

All brokers, whether trading crypto coins or forex, charge commissions and offer margin accounts to traders. A reliable forex broker for crypto coins should inform you precisely the type of fees and commissions they charge as well as the risks involved. The common fees and charges made by brokers include:

• wallet fees

• transaction fees

• trading fees

- Competitive technology

The last thing you want as a crypto trader is to get margin called simply because you could not log in to close an order. The cryptocurrency trading market is a 24/7 global market. The prices keep moving and are not limited to your time zone. Hence, when choosing a broker, you need to choose one whose platform offers full-time access.

For instance, when trading cryptocurrencies, mobile apps are a necessity as you may need to make or break deal-critical decisions throughout the day. If possible, consider using a reputable broker with a mobile app so that you are able to make successful trading decisions even while in transit.

- Access to crowd wisdom

Today, there are some broker platforms that let you leverage the wisdom of seasoned cryptocurrency traders. This feature can go a long way in improving your returns on investment. Such a trading platform lets you observe the hottest trading trends of other seasoned and successful traders in the market.

Digital currencies trading keeps growing in popularity by the day. More and more people, be it speculators or beginner traders want to be able to make key decisions on time, every minute. Therefore, they need to have a setup ready as soon as they are verified by a broker. When choosing a cryptocurrency broker to trade with, consider one that can quickly get you started so that you can begin trading with minimal downtime.

- User-friendly platform

This is one of the most important features to consider when choosing a trading platform to trade with. Digital money trading can be unclear, especially when a technical language is used. Also, because digital money works a little bit differently from any traditional money system. A good broker should be able to understand blockchain and cryptography terms. They should make an effort to explain it in their platform to make it easy to understand by a layman.

They should include clear notifications about the spreads offers, leverage available, deposit methods, the minimum cryptocurrency deposit to trade and the least amount that can be placed in a trade. Make sure you are able to establish all these details before registering with a broker.

- High-quality customer service

Cryptocurrency trading occurs 24/7. This demands the need for round the clock customer support. Better still, live support is highly preferred over auto attendants taking into consideration the intricacies involved in trading digital currencies.

- Deposits and withdrawals

Make sure to choose a broker that allows deposits and withdrawals through multiple platforms such as wire transfer, credit/debit card e-payment among others.

- Good financial backing

A good FX broker for cryptocurrency should have a sound financial backing. This ensures that your digital coins are safe and that the forex broker will not go bankrupt soon after signing up with them.

Cryptocurrency trading is a risky investment. New and fraudulent forex brokers for cryptocurrency trading are emerging every month, launching with crafty marketing campaigns intended to prey on an innocent investor. Therefore, ensure you proceed with caution. Cryptocurrencies are extremely volatile instruments to trade. So, ensure you are in the know of any breaking news, regulatory matters, and rumors which all dictate the market behavior. Above all, make sure you are working with a reputable, reliable and experienced broker.

While it would be easier to point a finger and tell you the best crypto broker, we know and understand that each client has different preferences. Be knowledgeable about all your options and think about how you can spot a broker that is safe now, and in the long-run.

Best cryptocurrency trading platforms 2021

Best cryptocurrency trading platforms 2021. Before you start a crypto investment, you need a crypto trading platform. Crypto trading platforms are simply a place or platform where crypto traders buy, sell, or exchange different cryptocurrencies for profits. If you want to trade cryptos professionally, you need a trading platform that has all the trading tools and would require you to verify your ID before opening an account. On the other hand, if you want to trade on a part-time basis, there are also cryptocurrency trading platforms you can leverage without opening an account. Find best cryptocurrency trading platforms below

Best cryptocurrency trading platforms

- Coinbase and coinbase pro

- Cash app

- Bitbuy

- Binance

- Bisq

- Coinhouse

- Localcryptos

- Switchere

- Kraken

- Poloniex

How to choose best cryptocurrency trading platforms

- Reputation: one of the best ways to determine a real or genuine crypto trading platform is to research its reputation. You can research a platform’s reputation by perusing other users’ review and comment on the platform. Plus, you can ask questions on crypto forums like bitcointalk, bitcoingarden, altcointalk, cryptocurrency forum and others. There are equally high-quality platforms like reddit, quora, and others to get such information.

- Fees: any platform you intend settling for should have their fees displayed on their website. Before creating an account with them, ensure you understand their deposit, withdrawal, and transaction fees. Note that; no two platforms have the same fees!

- Payment methods: payment method is another item to check before joining any crypto trading platform. Do they accept paypal, credit/debit cards or wire transfer? You might want to look out for a platform that has limited payment options; remember that buying cryptos using credit/debit card comes with lots of risks and ID verification. Also, buying cryptos with wire transfer method takes time for banks to process your transaction. Put all these into consideration before trading.

- Verification requirements: so many trading platforms require users to verify their identity. This is to forestall scams and fraud of all kinds. Ensure you settle for a platform that verifies user ID.

- Geographical restrictions: some trading features offered by some cryptocurrency trading platforms are only accessible in certain countries. Therefore, ensure the platform you intend settling for allows full access to their trading features in your country.

How to invest in bitcoin

Investing in BTC is similar to investing in stocks, except far more volatile because of the daily swings in BTC. Here are the steps to invest in stocks from the beginning:

- Open a brokerage account at a firm that allows crypto investments

- Deposit funds from your bank into the brokerage account.

- Buy a stock using deposited funds (cash balance).

- Later sell the stock for a gain or loss. Funds are returned to your cash balance.

Fxdailyreport.Com

Over the last few years, cryptocurrency trading has become one of the most attractive niches in forex trading. Other than it being extremely profitable, the lack of regulation is its biggest appeal. Still, cryptocurrencies like bitcoin, ethereum ripple, dash, and litecoin are dynamic, unstable instruments that need to be handled cautiously and in the most optimal way. To achieve this, you need to choose a trustworthy, well-established broker to carry out your cryptocurrency trading.

This is crucial to getting on the right track from the beginning when trading cryptocurrencies. When choosing a broker, it is important to note that not all are the same. A broker that meets the needs of another trader may not meet yours. Here are a few tips to help you choose the best forex broker for cryptocurrency trading:

- Regulation and reputation

To avoid dealing with an unprofessional broker and being scammed, you need to make sure all your crypto trades are made solely with a regulated broker. When choosing a forex broker to work with, make sure they are regulated within your jurisdiction to legally offer you their services. Regulated forex brokers are under constant supervision of the regulatory body. If you are in the UK, make sure to trade with a broker that is regulated by the FCA. If in europe, ensure they are regulated by the cysec. In case you are in australia, they should be regulated by the ASIC.

- An efficient trading platform

It is important to note that cryptocurrency trading is more volatile than forex. Therefore, it demands that the platform is superbly responsive to be able to make moves in time. A good broker’s platform should be efficient to use. To beat the competition, the best cryptocurrency brokers work to attract clients by creating an intuitive trading platform that is suitable for both experienced and new traders. They offer technical analysis tools and basic risk management features like take profit or stop loss. Other sites also offer additional features, including price alerts, social trading networks or advanced educational centers. The crypto trading platform should allow you to trade in the market manage your accounts, perform technical analysis, and receive the latest news on all cryptocurrencies.

Top recommended crypto forex brokers in 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: 0 spread: non-spread, fee 0.1% per trade leverage: non-leverage regulation: - | visit broker | ||

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $50 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

- Transparent fees and commissions

All brokers, whether trading crypto coins or forex, charge commissions and offer margin accounts to traders. A reliable forex broker for crypto coins should inform you precisely the type of fees and commissions they charge as well as the risks involved. The common fees and charges made by brokers include:

• wallet fees

• transaction fees

• trading fees

- Competitive technology

The last thing you want as a crypto trader is to get margin called simply because you could not log in to close an order. The cryptocurrency trading market is a 24/7 global market. The prices keep moving and are not limited to your time zone. Hence, when choosing a broker, you need to choose one whose platform offers full-time access.

For instance, when trading cryptocurrencies, mobile apps are a necessity as you may need to make or break deal-critical decisions throughout the day. If possible, consider using a reputable broker with a mobile app so that you are able to make successful trading decisions even while in transit.

- Access to crowd wisdom

Today, there are some broker platforms that let you leverage the wisdom of seasoned cryptocurrency traders. This feature can go a long way in improving your returns on investment. Such a trading platform lets you observe the hottest trading trends of other seasoned and successful traders in the market.

Digital currencies trading keeps growing in popularity by the day. More and more people, be it speculators or beginner traders want to be able to make key decisions on time, every minute. Therefore, they need to have a setup ready as soon as they are verified by a broker. When choosing a cryptocurrency broker to trade with, consider one that can quickly get you started so that you can begin trading with minimal downtime.

- User-friendly platform

This is one of the most important features to consider when choosing a trading platform to trade with. Digital money trading can be unclear, especially when a technical language is used. Also, because digital money works a little bit differently from any traditional money system. A good broker should be able to understand blockchain and cryptography terms. They should make an effort to explain it in their platform to make it easy to understand by a layman.

They should include clear notifications about the spreads offers, leverage available, deposit methods, the minimum cryptocurrency deposit to trade and the least amount that can be placed in a trade. Make sure you are able to establish all these details before registering with a broker.

- High-quality customer service

Cryptocurrency trading occurs 24/7. This demands the need for round the clock customer support. Better still, live support is highly preferred over auto attendants taking into consideration the intricacies involved in trading digital currencies.

- Deposits and withdrawals

Make sure to choose a broker that allows deposits and withdrawals through multiple platforms such as wire transfer, credit/debit card e-payment among others.

- Good financial backing

A good FX broker for cryptocurrency should have a sound financial backing. This ensures that your digital coins are safe and that the forex broker will not go bankrupt soon after signing up with them.

Cryptocurrency trading is a risky investment. New and fraudulent forex brokers for cryptocurrency trading are emerging every month, launching with crafty marketing campaigns intended to prey on an innocent investor. Therefore, ensure you proceed with caution. Cryptocurrencies are extremely volatile instruments to trade. So, ensure you are in the know of any breaking news, regulatory matters, and rumors which all dictate the market behavior. Above all, make sure you are working with a reputable, reliable and experienced broker.

While it would be easier to point a finger and tell you the best crypto broker, we know and understand that each client has different preferences. Be knowledgeable about all your options and think about how you can spot a broker that is safe now, and in the long-run.

Best cryptocurrency brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best crypto platform for most people is definitely etoro.

Many people believe that cryptocurrencies are the future of finance. When you’re ready to leap into crypto, choosing a broker to trade or invest in cryptocurrencies is one of the most important steps to your success in the crypto market.

Get started now with benzinga’s picks for the best cryptocurrency brokers to choose the right one for you.

Best crypto brokers and trading platforms:

- Best for social trading: etoro

- Best for ease-of-use: gemini

- Best for new investors: coinbase

- Best for gold investments: itrustcapital

- Best for high volume forex traders: cryptorocket

- Best for accessibility: altrady

- Best for multiple exchanges: voyager

Best crypto brokers

Since different brokers have different strengths, you need to figure out what kind of broker best suits your cryptocurrency interests. Some brokers provide a social trading platform where you copy other cryptocurrency traders’ trades in your own account. Others can offer the ability to make transactions in a broader selection of altcoins.

Choosing the best crypto broker depends largely on addressing your needs as an investor or trader. The following list crypto brokers been selected for different reasons to meet the needs of differing cryptocurrency trading and investing styles.

Commissions

Account minimum

1. Best for social trading: etoro

Etoro fundamentally changed the way many people trade and invest with its social trading platform. Social trading involves mirroring another trader or investor’s transactions in a special social trading account. While you make the same amount proportionally as the trader you’re copying, you also take the same percentage of losses the trader takes in their account.

In addition to its regular crypto trading platform, etoro offers an advanced cryptocurrency exchange platform called etorox. This platform is designed for algorithmic traders and institutional grade investors. It offers traders access to tight-dealing spreads, and its algox application programming interface (API) can be used to create custom automated trading tools.

Commissions

Account minimum

2. Best for ease-of-use: gemini

Stay on top of market trends, build your crypto portfolio and execute your trading strategy with gemini’s easy-to-use tools. The gemini app is available on all the major app stores, and it puts the industry’s best crypto exchange and wallet in your hands.

Gemini’s app is easy to use. You can track asset prices and real-time market prices and set price alerts so you can act fast on price movements for individual assets. You can also schedule recurring buys on bitcoin and other cryptocurrencies.

Invest with peace of mind with gemini’s solid cybersecurity and custody solutions. Create a free account and make your 1st buy in as little as 3 minutes.

Commissions

Account minimum

3. Best for new investors: coinbase

Coinbase is 1 of the largest and oldest cryptocurrency exchanges. It currently services 35 million customers worldwide. Coinbase has extensive educational resources and an intuitive interface ideal for new traders and investors.

The exchange also provides clients with a hosted wallet and offers global customer support. Coinbase is an excellent choice for those new to the cryptocurrency market who do not wish to use social trading services.

Commissions

Account minimum

4. Best for gold investments: itrustcapital

Itrustcapital is 1 of the few cryptocurrency brokers that lets you trade and hold physical gold in your individual retirement account (IRA). You can also trade bitcoin (BTC), ethereum (ETH), litecoin (LTC) and bitcoin cash (BTH) in your IRA. Itrustcapital provides you with a personal wallet by curv for your crypto transactions.

While itrustcapital has no minimum trade or account size, the company charges account holders a flat fee of $29.95 per month. This amount includes all IRA fees, asset custody charges and access to its trading platform, although all cryptocurrency trades carry an additional 1% transaction charge based on the trade size.

If you’re planning for your retirement and want to add physical gold to your cryptocurrency portfolio as an inflation hedge, then itrustcapital is a solid choice.

5. Best for high volume forex traders: cryptorocket

Cryptorocket offers straight through processing (STP) to its trading clients. This means you deal directly with the crypto and forex markets and not through intermediaries or market makers. This broker model is ideal for high volume forex traders who tend to be sensitive to dealing spreads.

In addition to the 35 crypto pairs offered, you can trade 55 fiat currency pairs, 64 major stocks and 11 indices. If you are based in a jurisdiction with relatively lax retail forex trading regulatory oversight, you may even be able to take advantage of cryptorocket’s 500:1 maximum leverage ratio for forex trades.

Cryptorocket also supports the popular 3rd-party metatrader4 trading platform.

6. Best for accessibility: altrady

Altrady is built by crypto traders for crypto traders. It makes cryptocurrency trading accessible for beginner, intermediate and advanced traders.

You can get the tools that professional crypto traders use without the expensive price tag. Altrady’s platform is intuitive and easy-to-use. Its crypto trading software platform adapts to your needs.

It combines 10 connected exchanges. It also offers immediate price alerts, portfolio manager, break-even calculator, and customizable trading pages by allowing traders to manipulate widgets to create preferred layout in order to trade comfortably, limit ladder order, gain quick access to market tabs, and integrated market scanners.

Commissions

Account minimum

7. Best for multiple exchanges: voyager

Voyager connects to more than a dozen of the most trusted and secure crypto exchanges so you have access to the largest crypto trading market available anywhere. Voyager gives you faster, more reliable execution, plus:

- Access to multiple exchanges: voyager partnered with over a dozen of the most trusted and secure crypto exchanges and liquidity providers. Voyager’s exchange connectivity offers you competitive prices on your trades and faster, more reliable execution.

- Commission-free trading: voyager operates commission free to save you money. You save money on trades through its extensive crypto market and best execution technology. Voyager achieves price improvement on over 90% of customer orders.

Start trading at a better price today! Download the voyager app today.

Crypto advantages vs. Disadvantages

Trading and investing in cryptocurrencies often carry a considerable degree of risk, as you may have observed given the volatility of bitcoin and some other digital currencies. Despite the disadvantages currently associated with cryptos versus fiat currencies (like lower liquidity and minimal payment options), the advantages of holding cryptocurrencies will increase as they become a more common form of payment.

Here’s a quick shot of crypto advantages and disadvantages.

Advantages

- Security. Technology advances typically lead to increased intrusion into your privacy. In contrast, all identities and transactions are strictly secured in the digital currency environment. While most cryptocurrency transactions are very secure, you still could be vulnerable to cybercriminal actions, like hacking.

- Low transaction fees. Because of the elimination of intermediaries like financial institutions, cryptocurrency transaction fees are generally quite low.

- Decentralized. The lack of a central exchange or authority overseeing cryptocurrencies is one of their defining characteristics. Many people consider this among the biggest advantages of cryptocurrencies and blockchain technology.

- High potential returns. You only have to look at a long-term bitcoin price chart to get an idea of the returns you can make investing wisely in digital currencies. The crypto world is still developing and expanding, so investing in the right digital currency now could translate into considerable returns in the future.

Disadvantages

- Acceptance. Because digital currencies have not yet become mainstream, most businesses will not accept them as payment for goods or services. This situation will eventually change as public perception makes digital currencies more acceptable as forms of payment. For example, paypal has recently allowed customers to hold bitcoin balances and has plans to allow payments using that cryptocurrency by early 2021.

- Volatility. The market volatility observed in some digital currencies can lead to large gains or large losses. Trading and investing in crypto is not for everyone, especially those with a low pain threshold or aversion to risk.

- Taxes. The internal revenue service (IRS) states on its official website that “virtual currency transactions are taxable by law just like transactions in any other property.” that IRS web page also links to a guide about how existing general tax principles apply to transactions made using digital currencies.

- Illegal activities. Due to the fact that digital currency transactions generally provide identity security, many people operating outside the law are thought to use digital currency for illegal activities. These activities could include money laundering, “dark web” transactions, and drug and human trafficking.

Cryptocurrency vocabulary

Like many other financial markets, the cryptocurrency market has evolved its own jargon. Some of the key terms used by market operators are defined below.

- Block. A collection of transactions permanently recorded on a digital ledger that occur regularly in every time period on a blockchain.

- Blockchain. A constantly growing list of blocks in a peer-to-peer network that records transactions.

- Cryptocurrency exchanges. Also called digital currency exchanges, these generally consist of online businesses that allow customers to exchange cryptocurrencies for fiat currencies or other cryptocurrencies.

- Cryptocurrency wallet. A secure digital account used to send, receive and store digital currencies. Crypto wallets can either be cold wallets that are used for storing cryptos in an offline environment or hosted wallets that are hosted by 3rd parties. Hosted wallets store your private keys and provide security for your digital currency balances.

- Distributed ledger. A network of decentralized nodes or computers that connect to a network where transaction data is stored. Distributed ledgers do not have to involve cryptocurrencies and can be either private or permissioned.

- Fork. Also known as a “chain split,” a fork is a split that creates an alternate version of a blockchain that then leaves 2 blockchains running simultaneously. For example, bitcoin and bitcoin cash came about due to a fork in the original bitcoin blockchain. Another type of fork is known as a “project” or “software fork.” this occurs when cryptocurrency developers take the source code of an existing altcoin project and create a new project. For example, litecoin is a project fork of bitcoin.

- ICO. An initial coin offering (ICO) occurs when a new digital currency or token is sold, typically at a discount, to its first set of investors. An ICO lets issuing cryptocurrency companies raise funds from the public to support their coin’s development and maintenance.

- Mining. A computationally-intensive process performed within a cryptocurrency network where blocks are added to the blockchain by verifying transactions on its distributed ledger. Miners are rewarded with digital coins as compensation for their successful computational efforts.

Are you ready for the future?

Digital currency and the blockchain appear to be the future of finance. Despite their current typical volatility and lack of widespread acceptance as a payment method, cryptocurrencies seem destined to become increasingly used for online payments. They could therefore make an interesting long-term investment, especially if you have a strong appetite for risk.

Where we will be in 20 years is anyone’s guess, but cryptocurrencies and blockchain technology show growing promise as forces to be reckoned with in the financial world. Get started today with 1 of our recommended crypto brokers.

Try gemini

Gemini builds crypto products to help you buy, sell, and store your bitcoin and cryptocurrency. You can buy bitcoin and crypto instantly and access all the tools you need to understand the crypto market and start investing, all through one clear, attractive interface. Gemini crypto platform offers excellent account management options. You can manage your account at a glance, view your account balance 24-hour changes and percent changes. Get started with gemini now.

So, let's see, what we have: as a beginner, trading or investing in cryptocurrencies can seem intimidating. Every once in a while, you’ll come across news of people losing money in at crypto currency trading platforms

Contents

- Top forex bonus list

- What traders need to know about today’s cryptocurrency trading platforms

- Basics of A cryptocurrency platform

- How to choose A cryptocurrency exchange

- Best crypto exchanges 2021

- Summary

- 4 easy steps to buy cryptocurrency

- Top crypto exchanges

- Top 9 cryptocurrency trading platforms

- Best cryptocurrency trading platforms 2021

- Best cryptocurrency trading platforms

- How to invest in bitcoin

- 4 best cryptocurrency arbitrage bot platforms for 2021

- How does crypto arbitrage work?

- Barriers to bitcoin arbitrage

- Best cryptocurrency arbitrage bots

- Fxdailyreport.Com

- Top recommended crypto forex brokers in 2021

- Best cryptocurrency trading platforms 2021

- Best cryptocurrency trading platforms

- How to invest in bitcoin

- Fxdailyreport.Com

- Top recommended crypto forex brokers in 2021

- Best cryptocurrency brokers

- Best crypto brokers and trading platforms:

- Best crypto brokers

- Commissions

- Account minimum

- 1. Best for social trading: etoro

- 2. Best for ease-of-use: gemini

- 3. Best for new investors: coinbase

- 4. Best for gold investments: itrustcapital

- 5. Best for high volume forex traders: cryptorocket

- 6. Best for accessibility: altrady

- 7. Best for multiple exchanges: voyager

- Crypto advantages vs. Disadvantages

- Cryptocurrency vocabulary

- Are you ready for the future?

No comments:

Post a Comment