Top forex brokers

This may be the first question you would ask, as indeed forex market, FX or currency market is the largest global non-centralized exchange where trading process performed electronically via networks.

Top forex bonus list

While main forex participants are international banks and financial institutions operating huge volumes through a need to exchange currencies, presented as currency pairs, and assist international business with the conversion which is known as the interbank market. Further on, you should also check the necessary conditions and select offer suitable for you and trading strategy you deploy.

Brokers

Regulated forex brokers

When viewing the forex broker or a trading platform, it is the paramount priority to choose from the hundreds the most reliable one and the best forex provider, as it will determine the whole trading experience. Indeed, doing research and compare the vast number of forex brokers with many aspects to consider, maybe not an easy choice, as well time-consuming. So here we are ready to assist your selection and answer the most common questions.

Can I trade forex without a broker?

This may be the first question you would ask, as indeed forex market, FX or currency market is the largest global non-centralized exchange where trading process performed electronically via networks. While main forex participants are international banks and financial institutions operating huge volumes through a need to exchange currencies, presented as currency pairs, and assist international business with the conversion which is known as the interbank market.

Therefore, in order to trade fx you should be authorized dealer to do so, as well as operate a quite sufficient amount so before forex brokers were introduced to retail traders and global community it was not possible for trade markets. For this reason, forex trading brokers are the companies or agent if you like that gives retail forex traders access through its platform to operate forex market and trade various markets including commodity futures, indices, bonds, etc.

Do I need license to trade forex?

So this is another pleasant and great opportunity which is given by forex brokers, as you may access trading without financial or dealer license. Moreover, there are hundreds of opportunities with a relatively small investment which allows you to trade forex, do technical analysis and analyze markets almost instantly.

Are forex brokers regulated?

And now we will check the most crucial question if forex broker can be regulated, since the market is decentralized, and is it safe to trade forex? Obviously, this is the biggest trump you may fall as a retail trader if you choose a non-reliable, mainly non-regulated or offshore firm without a proper license you may easily fall into a scam and lose money.

So due to increasing demand and mainly that traders got no easy access to trading or financial education, the world countries established particular organizations or authorities in order to oversee the market proposals and regulate forex broker firms. So yes, forex brokers are regulated while holding a license from a local authority alike world known FCA in the UK, ASIC in australia, commodity futures trading commission CFTC in the USA, MAS in singapore and more.

What does a regulated broker mean?

The whole concept of regulation is to oversee forex business in a particular country or region, protect clients and ensure safe conditions while trading forex. So in simple words, regulated broker means a safe and legit broker that is compliant to various rules and criteria set by the international authority with the purpose to provide secure trading and good customer service. So its trading environment and provided services like technical analysis, education and tools are also aligned to the best practices.

In addition to its constant check on the service providing, authorities protecting clients throughout compensation schemes and other security checks, however, these conditions may vary from the regulator to another.

How do I know if my forex broker is regulated?

In order to check if broker is regulated or not, you should verify this information through the official brokers’ website first, as regulated companies always provide its licenses. And the next step is to verify a license through the official regulatory website. However, in our forex broker review you will find all the necessary information and license check as well.

It is a fact, unscrupulous brokers may easily fake information and assure you of its license while its not true, so always verify information through the official source. As well, adhere to trade with brokers regulated in serious jurisdictions, not the offshore once, as they luck of strong regulation, requirements and necessary safety measures. Read more by the link why avoid brokers from st vincent & the grenadines.

How to choose best forex broker?

Security of funds is always first in forex trading, for that reason, we recall your attention to open an account with regulated brokers only. Making it simple, regulated broker means that you will trade forex with proper security of funds and investment itself, so first of all good broker is a sharply regulated broker.

Further on, you should also check the necessary conditions and select offer suitable for you and trading strategy you deploy.

For this reason, we assist your selection and provide an assortment of efficient regulated brokers with updated on a weekly basis in-depth forex broker list. A professional detailed analysis with trading fees account overview, platform breakdowns while sorted by regulation, country or trading conditions, along with traders comments so smarter decision is easier now.

The best 10 ECN forex brokers for traders – review & comparison

| broker: | review: | regulation: | spreads: | min. Deposit: | account: |

|---|---|---|---|---|---|

| 1. Blackbull markets | ➜ read the review | FSPR, FSCL | starting 0.0 pips + negotiable commission per 1 lot | $200 |

Are you searching for a reliable ECN forex broker? – then you are right on this website. We show your the best 10 ECN providers for private traders. With more than 7 years in financial trading, we tested each one separately. Inform yourself in the next sections how the ECN forex broker is working and why it is so important to choose one. Should you invest your money there? – find out in this review.

What is an ECN forex broker? – how does it work?

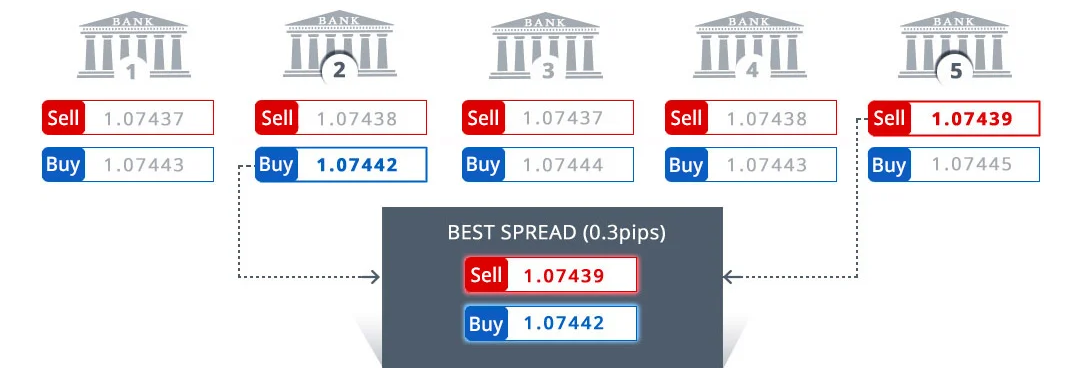

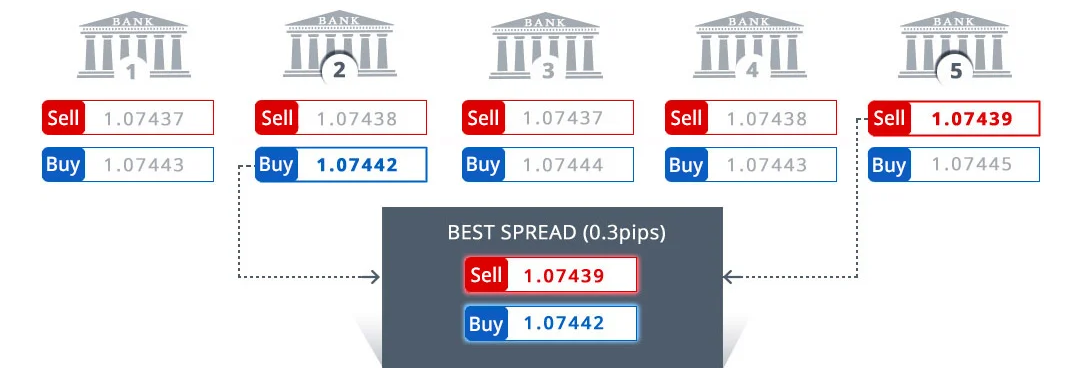

ECN means “electronic communication network”. It is well-known in the trading industry and every successful trader knows this term. A forex broker can be a market maker or an ECN broker to provide currency trading. Traders want to buy and sell currencies and the broker is delivering the liquidity for it. But where does the liquidity come from? – see the picture below.

ECN forex broker liquidity system

The ECN forex broker gives you direct access to the currency market. Traders buy and sell into the network and get the best prices through different liquidity providers. The liquidity providers are competing versus each other to give you the best price and execution. For example, if you open a very large position the order can be executed by different liquidity providers.

Advantages of ECN trading:

- No requotes: you will get an instant execution of your order on the best prices.

- High liquidity (deep pool): ECN forex brokers offer very high liquidity by different providers.

- Low costs: ECN trading ist most of the time very cheap with low trading fees.

- No conflict of interest: the broker is not trading against you.

- Raw spreads: the broker is offering the real and raw market spreads.

- No slippage: ECN prevents slippage

ECN liquidity providers

Liquidity providers are most of the time big banks or even forex brokers by themself. If you ask your broker the support team can tell you the exact liquidity provider. Often you will see the logos on their webpage. ECN liqduity providers have the license to give liquidity in forex. So it is not possible for everyone to do it.

ECN forex liquidity provider

The network is also called the “interbank market”. This is the top-level foreign exchange market where the banks trade different currencies. The brokers are dealing directly with each other. On electronic brokering platforms over 1,000 banks are connected.

Popular liquidity providers:

- Goldman sachs

- J.P. Morgan

- Deutsche bank

- Saxo bank

- Barclays

- UBS

- HSBC

Benefit from raw ECN spreads

ECN spreads are the best spreads for traders. Some brokers provide a 0.0 pip spread execution with high liquidity which you can see in the market-depth. Note that the spread is always depending on the market situation. Sometimes there can be less liquidity and the spread can be higher. Market news is a good example of it because a lot of traders are canceling their limit orders before the market news.

- Raw and direct spreads

- Starting from 0.0 pips

- The spread is always depending on the market situation

In the picture below you will see some raw spreads:

Use the best technology – equinix servers

Some ECN forex brokers offering you access to the most important exchange servers in new york, london, and tokyo. The servers are called “equinix servers” and they are made for fast and big execution. Market makers, hedge funds, and institutional investors using the servers too. No matter which trading software you are using the execution will be very fast.

Example of equinix servers:

- New york (NY4)

- London (LD5)

- Tokyo (TY3)

Advantages:

- Deep pool liquidity (liquidity providers compete for the best price)

- Depth of markets

- Low latency

- Georpahic advantage = fast execution

ECN means trading without conflict of interest – no dealing desk

ECN forex brokers are without a dealing desk. No dealing desk brokers do not manipulate charts or spreads because it is not possible. The orders go directly to the exchange servers. On the internet, you will often find some cases where users are saying the broker manipulate the chart, spreads, or execution. This can be possible but from our experience, it is very rare.

It is always depending on the broker when the execution is made. There are good and bad ECN providers. That is why we recommend our ECN forex broker list above. When you are trading with a market maker broker you are trading versus other traders on the broker’s platform or versus the broker. So this is not the best opportunity for you. To be 100% sure that the broker will not cheat you should choose an ECN broker.

Minimum deposit and account size for ECN traders

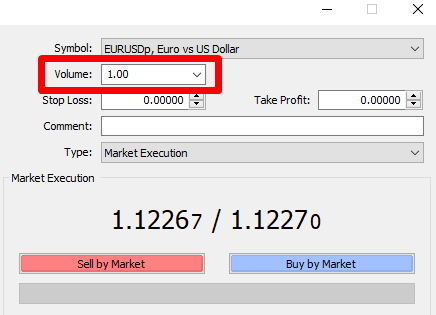

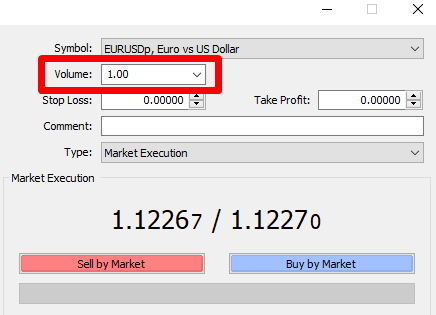

ECN trading is possible with a low minimum amount of money. As you saw in the table above the forex broker superforex is offering an ECN account with only $1 deposit. The minimum trading volume is 0.01 lot. This means the volume of 1,000 units of the base currency of the currency pair. For example, if you are trading 1 lot on the EUR/USD chart you trade the position size of 100,000€.

ECN forex position size

In addition, you can use a leverage of up to 500. The most ECN forex brokers are offering maximum leverage of 100 – 500 (1:100, 1:500). The currency market is moving very slow that is why most traders are trading large positions to make a profit.

- 0,01 = 1,000 units of the base currency

- 0,10 = 10,000 units of the base currency

- 1,00 = 100, units of the base currency

For depositing or withdrawing money you can use different payment which are provided by your broker. Often there are electronic methods and the classic bank transfer. You can capitalize your trading account instant and start trading.

Popular payment methods of ECN brokers

Trading high volume and profit from lower trading costs

The most ECN forex brokers in our list above are offering you different account types. If you deposit more money and trade higher volume in the market you can get better trading conditions and pay fewer fees. Also, you can negotiate with the broker if you are a high-frequency trader. The broker only earns money by the trading commission.

Trading commissions:

The broker will charge you a commission for each trade. Pay attention to the fees because it means that you pay a commission if you open and close the trade. When you open the trade you buy on the market and if you close the trade you sell. You made 2 trades by closing and opening the position.

Also, VIP accounts or professional accounts are offered. Just read through our full reviews to find out what’s the best account type for you.

Conclusion: ECN is the best way to trade forex

On this page, we showed you how the “electronic communications network (ECN)” is working and why you should use it. An ECN forex broker is the best way to trade currencies because you will get the best possible trading conditions from liquidity providers.

Also, there is no conflict of interest between the trader and the broker. The broker is only earning money by trading commissions. For high volume traders like scalpers or professional traders, it is important to get the best liquidity. With ECN trading there is a big pool of liquidity by different providers.

Start trading with 0.0 pip raw spreads and a low trading commission. We can truly recommend using a real ECN forex broker. Read our full reviews of the presented companies and start trading transparently with a reliable provider.

Our recommended ECN forex brokers:

ECN trading is necessary for every successful trader. Invest by using the best trading conditions.

Top 10 best scalping forex brokers 2021

Top rated:

Would you like to give scalping a go, or are you a veteran just looking for the best scalping forex brokers?

We have searched for, and compiled a list of the top 10 brokers for scalping 2020 (even encouraging it, in some cases).

To understand this all better, let’s see what scalping is, and what features and services should be offered by a forex broker to be one of the best.

Table of contents

What is scalping?

Scalping is a trading technique which focuses on profiting from the subtlest price variations of a financial asset.

The scalper, is the trader who, more than anyone else, can achieve returns regardless of the general trend of the underlying asset. An index which loses an overall 2% value in one day could mean quite a few percentage points of profits for a good scalper.

A scalper doesn’t care for the trend direction of the financial asset, as long as it keeps moving.

But now, let’s see the list of the best forex brokers for scalping. At the bottom of the post you can find other useful information on how scalping works.

Best forex brokers for scalping 2020

This is why we have prepared a ranking of the 10 best broker for scalping. These brokers, besides not forbidding it, favour it through several services aimed at excelling in the above-mentioned features.

1. Pepperstone

Operating since 2010, pepperstone has quickly become one of the best forex brokers in australia and in the world (as its many awards can prove). The ECN access through ctrader with DMA (direct market access), the low commission fees, and the reduced spreads make pepperstone ideal for scalping thus our best scalping broker.

These features are great for making scalping very accessible to traders. Another key attraction is the fact that pepperstone manage to keep trading costs low. This is achieved through having a very competitive spread that starts from 0 pips as well as an active trader program to help in further reductions. With a minimum deposit starting at just $200 and a range of social trading features that can help you decide on markets as well as trading availability through all the major trading platforms of MT4, MT5, and ctrader. It becomes quite clear why pepperstone is a favored choice among a huge proportion of scalpers.

2. IC markets

Ranked as one of the top 10 best forex brokers in the world, IC markets is one of the fastest growing brokers in australia. The cysec and ASIC regulated broker is headquartered in sydney, and it has offices all over the world, including vietnam and china. Its high financial leverage, low spreads, the absence of a withdrawal commission fee, the multitude of available trading platforms (including ctrader), make IC markets perfect for scalping.

Much of this favorable nature for scalping is driven by keeping costs low with a very competitive spread that starts at only 0.1 pips and of course their lightning fast execution meaning you never miss a move. The fact that IC markets boast a no minimum deposit policy also keeps them as a good choice for new traders and scalpers alike. With markets available on indices, commodities, stocks, futures, bonds, and crypto, there is also certainly no shortage of trading opportunities.

3. Admiral markets

Next on our listing of top scalping brokers is admiral markets. They are a top market maker broker also hugely popular for scalping and particularly well-regulated by both the FCA and cysec. Scalpers are in for a treat here with more than 4,000 assets available for trading. This selection includes bonds, and even etfs and cryptos among others. Admiral markets continues to present value too through an accessible prime or standard account with minimum deposits of just $100 and spreads at great value from 0 pips on a standard account.

Trading and scalping with admiral markets takes place through the top trusted platforms of MT4, MT5, and webtrader, all of which are available. The broker also provides well for the future development of scalpers with a detailed education section offering a lot of free lessons and support on scalping and other techniques.

4. Fxpro

Fxpro is one of the most famous non-dealing desk forex brokers. An english broker famous all over the world for its quality of execution, innovation, and platforms, make this the perfect candidate for scalping. Through the development of several technologies, fxpro has always welcomed traders looking to easily automate their strategies (see calgo algorithmic trading, fxpro library, fxpro quant strategy builder, and fxpro VPS).

Another very welcoming factor for all levels of scalper is the fact you need only have a minimum deposit of $100 to get started. This, combined with the low costs that are supported by the 0 pips spreads that the broker offers, are both very important points for any scalper given the margins involved. If you open an MT4 account, you will also have access to fixed spreads. These may not suit everyone but do help you maintain an accurate trading cost.

5. Octafx

Operating since 2011, octafx has been awarded the “best ECN broker in asia – 2014” by the global banking and finance review, and the “best broker in central asia – 2014” by the forex report magazine. The broker offers a wide range of assets, is highly liquid and ideal for scalping. They also offer great promotions, such as their trading contests, carried out through their demo accounts, which do however include real money prizes. Their 50% bonus on deposits is also extremely appealing as is the low minimum deposit of just $100 to start trading.

The costs too are kept low, with variable spreads from 0 pips perfect for scalping. Fixed spreads from 2 pips, or 0.2 pips with a $500 minimum deposit to open an MT5 account may also be attractive to many scalpers with this helping calculate costs at the same time as keeping them low.

6. Avatrade

Avatrade is next on our list of top brokers for scalping and the irish-based broker does not disappoint here. A favorite among european-based scalpers, the broker is globally operated and regulated. In fact, it is the perfect place for scalping with fixed spreads since that is what they offer at avatrade.

The great value fixed spread starts from just 1.3 pips on forex with scalpers and traders alike attracted by this and the low barrier of a $100 minimum deposit, great for a top broker. Once you are inside, you also have a great selection of markets that includes 60 forex pairs all available for scalping. With all of the trading taking place through MT4, or MT5, traders know they can trust this broker. A further attraction, particularly for new traders, is the avaprotect feature that temporarily shields you from losses. An amazing feature from any top broker.

7. Vantage FX

Vantagefx is the next top scalping broker to make the selection. They have already been around for a number of years and gained a strong popularity among all types of forex traders. A strong degree of this support may have been garnered through the comprehensive regulation the broker has in place from ASIC, the FCA, and CIMA.

Scalpers will also be very much attracted by the ECN execution style that provides for maximum speed and efficiency through the 2 account types. Both the raw ECN, and pro ECN have competitive spreads that start from 0 pips and a respective minimum deposit of $500, and $20,000 for the big hitters. The range of markets with more than 150 available in cfds and 40 forex pairs is also of great appeal for scalping through either the MT4, or MT5 trusted trading platforms available.

8. FP markets

FP markets are another top australian broker and one of our best selections if you want to get started forex scalping. The broker have been around for many years since their foundation in 2005 and are a very well trusted market maker broker that are already popular for scalping. They boast regulation from both ASIC, and cysec.

One of the major points that helps to attract traders for scalping is the very low spreads on offer. These start from just 0 pips across the board and are perfect for limiting your scalping costs, a key to your success. The ECN/STP execution offered is also fast and highly efficient, another very appealing aspect of FP markets. The low minimum deposit of just $100 can also be of great support in getting started if you are new to scalping, and you can’t go wrong with the experience of MT4, MT5, and webtrader platforms all being available.

9. Hotforex

Hotforex are next on the list of our top scalping brokers and they are something of a household name among all traders in the industry. Perfect for scalpers and others from top to bottom thanks to their variety of deposit methods and base currencies making it so easy to get started. The amazingly low $5 minimum deposit is also perfect for new scalpers.

The minimum deposit here for an ideal scalping account is $200 which is still competitive in the sector. This is well balanced by the fantastic value spreads that start from 0 pips. You can also try it out first with a free unlimited demo account. Making it most suited to those new to scalping is the negative balance protection available globally as well as the very well supported range of video tutorials, webinars, and more to help you keep growing in scalping and forex trading.

How does scalping work?

The old (and correct) adage “let profits run, cut losses short” isn’t particularly relevant to scalping, at least as regards letting profits run. The scalper takes advantage of the market’s micro-oscillations, which have a set duration in time, from a few seconds to a few minutes, which is why it bears slim profits.

People who use this technique settle for small, yet fast, profits, continuously opening new positions on the market, trying to exploit its many oscillations, cutting losses to a minimum.

To take advantage of the continuous price variations, scalpers must dedicate several hours of activity to graphs, keeping a steady and constant focus and carrying out many operations. It isn’t rare to see scalpers performing even more than 100 operations in just a day’s trading.

How does the scalper trader earn?

As we’ve already mentioned, given the nature of scalping, the profits earned with just one operation are quite slim, ranging from a couple of pips to a few tens, at most.

So, for scalping to produce real profits, traders must focus on two things:

- Finding many trading opportunities throughout the day;

- Having a high percentage of trades closed with profits.

Other categories of professional traders, generally speaking, aim at having a good risk/returns ratio (from 1:2 up), which allows them to sustain even smaller percentages of success, even below 50%, still generating profits. However, this isn’t the case for scalpers. Taking profits after such short times, the risk/returns value tends to be quite low, which forces scalpers to keep an extremely high percentage of winning trades to constantly generate profits.

This activity isn’t for anyone. Besides having solid technology assets (such as PC, monitors, etc.) and a fast, stable connection, scalping requires extremely high self-discipline and concentration.

Furthermore, obviously, it is necessary to work with a good scalping forex broker, preferably one from the list below.

How much money does scalping require?

In addition to the high psychological capital, scalping normally requires a certain amount of financial resources. Having to profit from small market investments (a few pips or points at a time), to have noteworthy profits, the investment volume must be kept high.

Therefore, scalpers must have an appropriately funded account, or else work on a high financial leverage, which however does notably increase risks.

The best financial assets for scalping

High liquidity assets are among the preferred scalping markets, to avoid that the lack of buyers and sellers increases the spread between purchase and sell price to an excessive amount, making profits harder to achieve over the short term.

Highly capitalized and traded assets are therefore favoured, such as indexes, forex trades, and other assets which tend to have a good quantity of variations over the trading day.

The forex broker features for scalping

Given this peculiar activity, it is necessary to find a broker presenting the following basic features:

- Availability of high liquidity assets (high capitalized assets, index and exchange rates);

- Possibility to analyze markets with several indicators, possibly customizable;

- “market depth” visibility;

- Direct market visibility, not an “artificial” version of it (dealing desk);

- Exclusive intermediation activity, possibly directly on the market;

- Swift order execution;

- High financial leverage;

- Bare-boned brokerage fees;

- Easy trading platforms, fast and intuitive.

Given the peculiarities of scalping, not all forex brokers encourage it. Some even forbit it.

Fxdailyreport.Com

Many forex traders prefer to work with ECN brokers because it means more liquidity, faster execution, and accurate pricing. According to some experts, true ECN forex brokers are the real future as far as forex trading is concerned. If you are new to forex trading, this may be confusing to you. Read on to learn more about ECN forex brokers, the advantages of trading with them, and a few top true ECN forex brokers.

ECN translates to electronic communication network and it enables forex trading. In this electronic system, the orders entered by the market makers are distributed to several third parties. The orders may be executed in part or full.

The ECN network connects liquidity providers (for example, major banks) and retail traders through an online broker. The ECN network makes use of a sophisticated technological system referred to as financial information exchange protocol (FIX protocol). The ECN brokerage makes money by charging a commission on each trade. So, for higher returns, the network has to encourage trades to do more transactions.

True ECN forex brokers

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: $100 spread: starting 0 pip leverage: 500:1 regulation: FCA UK, FSA (seychelles), cysec | visit broker |

Advantages of trading forex with top true ECN forex brokers

There are many advantages of trading with ECN brokers. Some of the key advantages are as follows:

Anonymity is guaranteed

If you choose to trade forex on an online platform provided by an ECN broker, you can be sure of the fact that others will not get to know as to who you are. Anonymity enables you to execute trades using neutral prices which reflect the true market conditions. The client’s trading direction – based on certain strategies, tactics, or market positions – will not bias the broker.

Instantaneous execution of trades

As trading takes place on the basis of prices, you get the best executable prices and the order gets confirmed immediately. Further, there are no re-quotes because ECN brokers are no-dealing desk brokers.

This type of broker does not offer fixed spreads. They offer variable spreads. This is because ECN forex brokers do not have any control over the bid/ask spread. Therefore, they cannot offer the same spreads at all times.

If you follow a risk management system or trading model of your own, you can connect the same to ECN brokers’ data feed. This means that you will have access to the best bid/ask prices and certain other data.

Access to liquidity providers around the globe

With ECN brokers, you get access to global liquidity providers such as leading world banks and other financial institutions.

Finally, an ECN forex broker only matches the trades between the participants. They cannot trade against their clients. This is something very important. Many people are people worried about brokers, especially the market makers, trading against them.

There are not many drawbacks as far as ECN brokers are concerned. They charge a fixed fee as commission, but it is cheaper and more transparent compared to that charged by the market maker. Another disadvantage is that it is difficult to calculate stops and targets on an ECN platform. This is because the prices keep changing and they offer variable spreads. The possibility of slippage is also there, particularly when sessions overlap.

Tips on how to choose a true ECN forex brokers

Now that you know a little bit about forex trading with ECN brokers, you might want to know how you can choose a true ECN broker. It is highly recommended that long-term traders should consider working with ECN brokers as they do not trade against customers. As with anything else in life, all brokers are not the same you can find out if the broker is really an ECN broker or not by asking the following simple questions:

Does the broker make any mention of a dealing desk anywhere on their website?

Does the broker change the spreads during news announcements? You may have to open a demo account and a real account in order to find this out. A true ECN broker will never change the spreads during news reports.

Is the broker offering fixed spreads or variable spreads? True ECN forex brokers never offer fixed spreads. They offer only variable or floating spreads.

What about negative slippage? The answer to this question is a no in the case of true ECN brokers.

Having understood how to identify true ECN brokers, here are some of the recommended true ECN forex brokers you can consider working with:

The best 10 ECN forex brokers for traders – review & comparison

| broker: | review: | regulation: | spreads: | min. Deposit: | account: |

|---|---|---|---|---|---|

| 1. Blackbull markets | ➜ read the review | FSPR, FSCL | starting 0.0 pips + negotiable commission per 1 lot | $200 |

Are you searching for a reliable ECN forex broker? – then you are right on this website. We show your the best 10 ECN providers for private traders. With more than 7 years in financial trading, we tested each one separately. Inform yourself in the next sections how the ECN forex broker is working and why it is so important to choose one. Should you invest your money there? – find out in this review.

What is an ECN forex broker? – how does it work?

ECN means “electronic communication network”. It is well-known in the trading industry and every successful trader knows this term. A forex broker can be a market maker or an ECN broker to provide currency trading. Traders want to buy and sell currencies and the broker is delivering the liquidity for it. But where does the liquidity come from? – see the picture below.

ECN forex broker liquidity system

The ECN forex broker gives you direct access to the currency market. Traders buy and sell into the network and get the best prices through different liquidity providers. The liquidity providers are competing versus each other to give you the best price and execution. For example, if you open a very large position the order can be executed by different liquidity providers.

Advantages of ECN trading:

- No requotes: you will get an instant execution of your order on the best prices.

- High liquidity (deep pool): ECN forex brokers offer very high liquidity by different providers.

- Low costs: ECN trading ist most of the time very cheap with low trading fees.

- No conflict of interest: the broker is not trading against you.

- Raw spreads: the broker is offering the real and raw market spreads.

- No slippage: ECN prevents slippage

ECN liquidity providers

Liquidity providers are most of the time big banks or even forex brokers by themself. If you ask your broker the support team can tell you the exact liquidity provider. Often you will see the logos on their webpage. ECN liqduity providers have the license to give liquidity in forex. So it is not possible for everyone to do it.

ECN forex liquidity provider

The network is also called the “interbank market”. This is the top-level foreign exchange market where the banks trade different currencies. The brokers are dealing directly with each other. On electronic brokering platforms over 1,000 banks are connected.

Popular liquidity providers:

- Goldman sachs

- J.P. Morgan

- Deutsche bank

- Saxo bank

- Barclays

- UBS

- HSBC

Benefit from raw ECN spreads

ECN spreads are the best spreads for traders. Some brokers provide a 0.0 pip spread execution with high liquidity which you can see in the market-depth. Note that the spread is always depending on the market situation. Sometimes there can be less liquidity and the spread can be higher. Market news is a good example of it because a lot of traders are canceling their limit orders before the market news.

- Raw and direct spreads

- Starting from 0.0 pips

- The spread is always depending on the market situation

In the picture below you will see some raw spreads:

Use the best technology – equinix servers

Some ECN forex brokers offering you access to the most important exchange servers in new york, london, and tokyo. The servers are called “equinix servers” and they are made for fast and big execution. Market makers, hedge funds, and institutional investors using the servers too. No matter which trading software you are using the execution will be very fast.

Example of equinix servers:

- New york (NY4)

- London (LD5)

- Tokyo (TY3)

Advantages:

- Deep pool liquidity (liquidity providers compete for the best price)

- Depth of markets

- Low latency

- Georpahic advantage = fast execution

ECN means trading without conflict of interest – no dealing desk

ECN forex brokers are without a dealing desk. No dealing desk brokers do not manipulate charts or spreads because it is not possible. The orders go directly to the exchange servers. On the internet, you will often find some cases where users are saying the broker manipulate the chart, spreads, or execution. This can be possible but from our experience, it is very rare.

It is always depending on the broker when the execution is made. There are good and bad ECN providers. That is why we recommend our ECN forex broker list above. When you are trading with a market maker broker you are trading versus other traders on the broker’s platform or versus the broker. So this is not the best opportunity for you. To be 100% sure that the broker will not cheat you should choose an ECN broker.

Minimum deposit and account size for ECN traders

ECN trading is possible with a low minimum amount of money. As you saw in the table above the forex broker superforex is offering an ECN account with only $1 deposit. The minimum trading volume is 0.01 lot. This means the volume of 1,000 units of the base currency of the currency pair. For example, if you are trading 1 lot on the EUR/USD chart you trade the position size of 100,000€.

ECN forex position size

In addition, you can use a leverage of up to 500. The most ECN forex brokers are offering maximum leverage of 100 – 500 (1:100, 1:500). The currency market is moving very slow that is why most traders are trading large positions to make a profit.

- 0,01 = 1,000 units of the base currency

- 0,10 = 10,000 units of the base currency

- 1,00 = 100, units of the base currency

For depositing or withdrawing money you can use different payment which are provided by your broker. Often there are electronic methods and the classic bank transfer. You can capitalize your trading account instant and start trading.

Popular payment methods of ECN brokers

Trading high volume and profit from lower trading costs

The most ECN forex brokers in our list above are offering you different account types. If you deposit more money and trade higher volume in the market you can get better trading conditions and pay fewer fees. Also, you can negotiate with the broker if you are a high-frequency trader. The broker only earns money by the trading commission.

Trading commissions:

The broker will charge you a commission for each trade. Pay attention to the fees because it means that you pay a commission if you open and close the trade. When you open the trade you buy on the market and if you close the trade you sell. You made 2 trades by closing and opening the position.

Also, VIP accounts or professional accounts are offered. Just read through our full reviews to find out what’s the best account type for you.

Conclusion: ECN is the best way to trade forex

On this page, we showed you how the “electronic communications network (ECN)” is working and why you should use it. An ECN forex broker is the best way to trade currencies because you will get the best possible trading conditions from liquidity providers.

Also, there is no conflict of interest between the trader and the broker. The broker is only earning money by trading commissions. For high volume traders like scalpers or professional traders, it is important to get the best liquidity. With ECN trading there is a big pool of liquidity by different providers.

Start trading with 0.0 pip raw spreads and a low trading commission. We can truly recommend using a real ECN forex broker. Read our full reviews of the presented companies and start trading transparently with a reliable provider.

Our recommended ECN forex brokers:

ECN trading is necessary for every successful trader. Invest by using the best trading conditions.

Fxdailyreport.Com

Many forex traders prefer to work with ECN brokers because it means more liquidity, faster execution, and accurate pricing. According to some experts, true ECN forex brokers are the real future as far as forex trading is concerned. If you are new to forex trading, this may be confusing to you. Read on to learn more about ECN forex brokers, the advantages of trading with them, and a few top true ECN forex brokers.

ECN translates to electronic communication network and it enables forex trading. In this electronic system, the orders entered by the market makers are distributed to several third parties. The orders may be executed in part or full.

The ECN network connects liquidity providers (for example, major banks) and retail traders through an online broker. The ECN network makes use of a sophisticated technological system referred to as financial information exchange protocol (FIX protocol). The ECN brokerage makes money by charging a commission on each trade. So, for higher returns, the network has to encourage trades to do more transactions.

True ECN forex brokers

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: $100 spread: starting 0 pip leverage: 500:1 regulation: FCA UK, FSA (seychelles), cysec | visit broker |

Advantages of trading forex with top true ECN forex brokers

There are many advantages of trading with ECN brokers. Some of the key advantages are as follows:

Anonymity is guaranteed

If you choose to trade forex on an online platform provided by an ECN broker, you can be sure of the fact that others will not get to know as to who you are. Anonymity enables you to execute trades using neutral prices which reflect the true market conditions. The client’s trading direction – based on certain strategies, tactics, or market positions – will not bias the broker.

Instantaneous execution of trades

As trading takes place on the basis of prices, you get the best executable prices and the order gets confirmed immediately. Further, there are no re-quotes because ECN brokers are no-dealing desk brokers.

This type of broker does not offer fixed spreads. They offer variable spreads. This is because ECN forex brokers do not have any control over the bid/ask spread. Therefore, they cannot offer the same spreads at all times.

If you follow a risk management system or trading model of your own, you can connect the same to ECN brokers’ data feed. This means that you will have access to the best bid/ask prices and certain other data.

Access to liquidity providers around the globe

With ECN brokers, you get access to global liquidity providers such as leading world banks and other financial institutions.

Finally, an ECN forex broker only matches the trades between the participants. They cannot trade against their clients. This is something very important. Many people are people worried about brokers, especially the market makers, trading against them.

There are not many drawbacks as far as ECN brokers are concerned. They charge a fixed fee as commission, but it is cheaper and more transparent compared to that charged by the market maker. Another disadvantage is that it is difficult to calculate stops and targets on an ECN platform. This is because the prices keep changing and they offer variable spreads. The possibility of slippage is also there, particularly when sessions overlap.

Tips on how to choose a true ECN forex brokers

Now that you know a little bit about forex trading with ECN brokers, you might want to know how you can choose a true ECN broker. It is highly recommended that long-term traders should consider working with ECN brokers as they do not trade against customers. As with anything else in life, all brokers are not the same you can find out if the broker is really an ECN broker or not by asking the following simple questions:

Does the broker make any mention of a dealing desk anywhere on their website?

Does the broker change the spreads during news announcements? You may have to open a demo account and a real account in order to find this out. A true ECN broker will never change the spreads during news reports.

Is the broker offering fixed spreads or variable spreads? True ECN forex brokers never offer fixed spreads. They offer only variable or floating spreads.

What about negative slippage? The answer to this question is a no in the case of true ECN brokers.

Having understood how to identify true ECN brokers, here are some of the recommended true ECN forex brokers you can consider working with:

25 best UK forex brokers for 2021

The forexbrokers.Com annual forex broker review (five years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. How we test.

Trading forex (currencies) in the united kingdom (UK) is popular among residents. Before any fx broker can accept UK forex and CFD traders as clients, they must become authorised by the financial conduct authority (FCA), which is the financial regulatory body in the UK. The FCA's website is FCA.Org.Uk. We recommend UK residents also follow the FCA on twitter, @thefca.

The FCA was formed out of the financial services act of 2012, effectively replacing its predecessor, the financial services authority (FSA). For a historical breakdown, here's a link to financial conduct authority webpage on wikipedia.

Best UK forex brokers for 2021

To find the best forex brokers in the UK, we created a list of all FCA authorised brokers, then ranked brokers by their trust score. Here is our list of the top UK forex brokers.

- IG - best overall broker 2021, most trusted

- Saxo bank - best for research, trusted global brand

- CMC markets - best web platform, most currency pairs

- Interactive brokers - great for professionals and institutions

- City index - excellent all-round offering

- XTB - best customer service, great trading platform

- FOREX.Com - great all-round offering

- Etoro - best copy trading platform

Best forex brokers UK comparison

Compare UK authorised forex and cfds brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by the firm's forexbrokers.Com trust score.

| Forex broker | accepts GB residents | authorised or regulated by the FCA | average spread EUR/USD - standard | minimum initial deposit | trust score | overall | visit site |

|---|---|---|---|---|---|---|---|

| IG | yes | yes | 0.745 | £250.00 | 99 | 5 stars | visit site |

| saxo bank | yes | yes | 0.800 | $10,000.00 | 99 | 5 stars | visit site |

| CMC markets | yes | yes | 0.740 | $0.00 | 99 | 5 stars | N/A |

| interactive brokers | yes | yes | N/A | $0 | 94 | 4.5 stars | N/A |

| city index | yes | yes | 1.100 | £50.00 | 93 | 4.5 stars | N/A |

| XTB | yes | yes | 0.860 | $0.00 | 92 | 4.5 stars | visit site |

| FOREX.Com | yes | yes | 1.400 | $100.00 | 93 | 4.5 stars | N/A |

| etoro | yes | yes | 1.00 | $200 | 91 | 4 stars | visit site |

| swissquote | yes | yes | N/A | $1000.00 | 99 | 4 stars | N/A |

| FXCM | yes | yes | 1.400 | £300 | 92 | 4 stars | N/A |

| avatrade | yes | 0.910 | $100.00 | 93 | 4 stars | visit site | |

| FP markets | yes | 1.140 | $100 AUD | 81 | 4 stars | visit site | |

| plus500 | yes | yes | 0.600 | €100 | 98 | 4 stars | visit site |

| pepperstone | yes | yes | 1.160 | $200.00 | 90 | 4 stars | visit site |

| IC markets | yes | 0.800 | $200 | 83 | 4 stars | visit site | |

| tickmill | yes | yes | 0.530 | $100.00 | 81 | 4 stars | visit site |

| fxpro | yes | yes | 1.510 | $100.00 | 89 | 4 stars | visit site |

| vantage FX | yes | yes | 1.350 | $200 | 79 | 3.5 stars | N/A |

| moneta markets | yes | yes | 1.300 | $200.00 | 79 | 3.5 stars | N/A |

| HYCM | yes | yes | 2.00 | $100 | 84 | 3.5 stars | visit site |

| eightcap | yes | $100 | 69 | 3.5 stars | N/A | ||

| VT markets | yes | 1.30 | $200 | 79 | 3.5 stars | N/A | |

| blackbull markets | yes | 0.76 | $200 | 70 | 3.5 stars | N/A | |

| octafx | yes | 1.100 | $5 | 59 | 3.5 stars | N/A | |

| hotforex | yes | yes | 1.20 | $50 | 83 | 4 stars | N/A |

| easymarkets | yes | 0.900 | $100.00 | 81 | 3.5 stars | N/A |

How to verfiy FCA authorisation

To identify if a forex broker is licensed to operate in the united kingdom (UK), the first step is to identify the register number from the disclosure text at the bottom of the broker's UK homepage. For example, here's the key disclosure text from IG's website,

Both IG markets ltd (register number 195355) and IG index ltd (register number 114059) are authorised and regulated by the financial conduct authority."

Next, look up the firm on the FCA website to validate the register number is, in fact, legitimate. Here is the official FCA page for IG markets limited.

Summary

To recap, here are the best UK online forex brokers.

More forex guides

Methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

IG - 76% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

OANDA - cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Plus500uk ltd is authorised and regulated by the financial conduct authority (FRN 509909).

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

MT4 forex brokers - metatrader4 brokers 2021

Metatrader trading platform created by the leading and prominent software developer metaquotes was created and elaborated to give traders the possibility to speculate online and raise funds from the price increases and decreases of the world currencies. Such fluctuations of currencies are called foreign exchange - forex. Nowadays mt4 forex brokers dominate on global currency markets due to the platform’s highest stability and reliability. Besides, mt4 brokers are so popular due to the platform’s user-friendly interface and the availability of a browser usage. Being at the same time a powerful tool which can be adjusted to a trader’s needs, the software thus is in high demand among both novice traders and professionals. Despite the presence of a newer version of the platform the majority of currency traders, especially novices, still prefer the older version of metatrader - MT4, besides the newer one is not yet so widely supported by the dealing centers. Read our detailed analysis "what forex platform to choose: MT4 or MT5" to decide which version suits your trading needs and skills. Best mt4 brokers are presented in the list below for your choice. Be aware that mt4 brokers list is being continuously updated in correspondence with the updates of the brokers’ trading conditions. Our best mt4 broker comparison tool will help you to find the one and only mt4 broker best suitable exactly for you.

Read our extended forex guide to find out how to choose the best forex broker 2021.

Start forex trading now! Open forex account with the best forex brokers 2021.

Convert popular currencies

Forex forecasts

Cryptocurrencies trading forecasts

Data from cryptocompare shows that bitcoin trading volumes on the eight major exchanges tracked on the coindesk 20 have passed $11 billion, a new all-time high.

Bitcoin and other digital coins tanked on monday wiping off some $170 billion from the entire cryptocurrency market. The market capitalization or value of the.

Bitcoin fell more than 5% on friday, a day after topping $40,000 for the first time. The world's most popular digital currency slid to as low as $36,618.36 on bitstamp.

HF affiliates is one of the leading partnership programs in the industry featuring competitive commissions, marketing tools and exceptional support. With the best commission structure and tailor-made products, we can help you achieve your expectations with high revenue share, multi-tier affiliate tracking system, no set-up fees to join and an auto-rebate system.

One of the world's largest investment banks has theorised that cryptocurrency bitcoin could reach as high as US$146,000 ($188,430), but it won’t happen in 2021.

These off the mark 2020 bitcoin price predictions prove that forecasting BTC's value is as futile as picking lottery numbers. Pundits and crypto analysts love to issue bitcoin.

Bitcoin (BTC) returned to hitting records on dec. 30 after a fresh rebound took it above its $28,400 all-time high. Data from cointelegraph markets and tradingview.

A variety of web terminals and specialized software makes a choice of a trading platform a difficult one for a novice trader. What should be this vital decision based on? To begin with, it is necessary to highlight the main criteria that high-quality software must meet for making money on financial markets.

Top 10 forex platforms 2021

Automated trading systems are an opportunity to create passive earnings in the financial markets for all users. Successful and proven strategies are integrated into the algorithm of advisers, which will make it possible to earn on the pricing of assets without delving into the subtleties of technical analysis. We present the top 10 forex advisors including equilibrium, excalibur, night owl.

Trade on the go,

like a pro.

Welcome to fxpro, the world’s #1 broker! 1

With 15+ years of excellence and innovation, we provide high-quality access to financial markets, through our advanced execution model. Discover the world of online trading with cfds on 260+ instruments in 6 asset classes.

Invest in #US30 (dow jones industrial average), EURUSD , gold and apple from a single account

Trade cfds on a wide range of instruments, including popular FX pairs, futures, indices, metals, energies and shares and experience the global markets at your fingertips.

Trade on mobile

Trade the CFD market on the go with our mobile application and benefit from ultra-low latency trading infrastructure, award-winning order execution and deep liquidity.

Available for ios and android devices.

Secure fxpro wallet MT4, MT5 & ctrader accounts variety of payment methods latest economic events

Multiple payment options

We provide our clients with a wide range of flexible payment options including bank transfer, credit/debit cards, E-wallets and more 2 . Detailed information is available on our funding page.

Tight spreads and no commission

Tap into the world's markets and explore endless trading opportunities with the world's best broker 1 - all with tight spreads and no commission 3 .

Browse the full rangeof platforms

At fxpro we understand that different clients have different needs. Therefore, we offer a wide selection of trusted, award-winning platforms and account types to choose from.

So, let's see, what we have: read our regulated forex brokers reviews with trading conditions, user's reviews and rating. Choose your broker from our regulated forex broker list. At top forex brokers

Contents

- Top forex bonus list

- Brokers

- Regulated forex brokers

- Can I trade forex without a broker?

- Do I need license to trade forex?

- Are forex brokers regulated?

- What does a regulated broker mean?

- How do I know if my forex broker is regulated?

- How to choose best forex broker?

- The best 10 ECN forex brokers for traders – review & comparison

- What is an ECN forex broker? – how does it work?

- ECN liquidity providers

- Benefit from raw ECN spreads

- Use the best technology – equinix servers

- ECN means trading without conflict of interest – no dealing desk

- Minimum deposit and account size for ECN traders

- Trading high volume and profit from lower trading costs

- Conclusion: ECN is the best way to trade forex

- Top 10 best scalping forex brokers 2021

- What is scalping?

- Best forex brokers for scalping 2020

- 1. Pepperstone

- 2. IC markets

- 3. Admiral markets

- 4. Fxpro

- 5. Octafx

- 6. Avatrade

- 7. Vantage FX

- 8. FP markets

- 9. Hotforex

- How does scalping work?

- How does the scalper trader earn?

- How much money does scalping require?

- The best financial assets for scalping

- The forex broker features for scalping

- Fxdailyreport.Com

- True ECN forex brokers

- The best 10 ECN forex brokers for traders – review & comparison

- What is an ECN forex broker? – how does it work?

- ECN liquidity providers

- Benefit from raw ECN spreads

- Use the best technology – equinix servers

- ECN means trading without conflict of interest – no dealing desk

- Minimum deposit and account size for ECN traders

- Trading high volume and profit from lower trading costs

- Conclusion: ECN is the best way to trade forex

- Fxdailyreport.Com

- True ECN forex brokers

- 25 best UK forex brokers for 2021

- Best UK forex brokers for 2021

- Best forex brokers UK comparison

- How to verfiy FCA authorisation

- Summary

- More forex guides

- Methodology

- Forex risk disclaimer

- MT4 forex brokers - metatrader4 brokers 2021

- Convert popular currencies

- Forex forecasts

- Cryptocurrencies trading forecasts

- Top 10 forex platforms 2021

- Trade on the go, like a pro.

- Invest in #US30 (dow jones industrial average), EURUSD , gold and apple from a single account

- Trade on mobile

- Browse the full rangeof platforms

No comments:

Post a Comment