Forex account

The other way to avoid inadvertently connecting with a fraudulent broker is to proceed very carefully when considering a specialized forex brokerage.

Top forex bonus list

Only open an account with a U.S. Broker with a membership in the national futures association (NFA). Use the NFA's background affiliation information center to verify the brokerage and its compliance record. Photographer is my life / getty images

Why you need a forex account to trade

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/business-financial-and-forex-concept--hipster-young-woman-freelancer-using-the-technology-laptop-and-smart-phone-mobile-showing-trading-graph-with-the-stock-exchange-trading-graph-screen-background-826586048-59f958c59abed50010a7d3e4.jpg)

Photographer is my life / getty images

A foreign exchange account, or forex account, is used to hold and trade foreign currencies. Typically, you open an account, deposit money denominated in your home country currency, and then buy and sell currency pairs.

Your purpose, of course, is to make money on your trades. Unfortunately, the majority of beginning forex traders lose money; they generally spend less than four months reaching the point where they have lost so much that they will close their trading account.

It doesn't mean that the forex market is a scam, as some critics have maintained, but forex scams do abound. Making money on highly leveraged currency trades is harder than it looks and, at a minimum, requires developing expertise that many novice traders fail to acquire.

How you open a forex trading account

The requirements for opening a forex account have become simpler since the growth of online forex trading. Today, opening a forex account is almost as simple as opening a bank account.

First, of course, you'll need to find a forex broker. All retail forex trading goes through and is managed by a brokerage. Some may be specialized forex brokers, or they might be the same brokerage you use for stock market investing and trading.

You'll need to fill out a brief questionnaire about your financial knowledge and trading intentions. You'll also need to provide an ID, and the minimum deposit your forex account institution requires. That's it. You're now free to trade.

Incidentally, many forex brokers will take your credit or debit card in lieu of cash. So, you really don't need to deposit any money at all—not that this is a good idea. If you don't have the cash now, how will you pay for losses later? Credit card debt carries high-interest rates.

Forex brokers

One of the aspects of currency trading that makes it riskier than trading in the stock market is that the entire currency trading industry is either lightly regulated or—as with some trades—not regulated at all. A consequence of that is that unless you look carefully into the reputation of the forex broker you select, you may be defrauded. There are two ways of avoiding this.

The first is to avoid specialized forex traders entirely and to trade with a general stock brokerage active in the U.S. And therefore regulated by the U.S. Securities and exchange commission (SEC).

The other way to avoid inadvertently connecting with a fraudulent broker is to proceed very carefully when considering a specialized forex brokerage. Only open an account with a U.S. Broker with a membership in the national futures association (NFA). Use the NFA's background affiliation information center to verify the brokerage and its compliance record.

Even then, it's a good idea to choose a large, well-known forex broker like forex capital markets (FXCM). FXCM—like almost all of the largest U.S. Forex brokers—offers a free practice account where you can try out potential trades without risking your capital. Some other well-known U.S. Forex brokers are citifx PRO, an affiliate of citibank, and thinkorswim. Don't be put off by the cute name, thinkorswim is a division of tdameritrade.

Before finalizing your search, compare commission rates between brokers. Transaction costs are an important factor in the profitability of trading activity.

FOREX trading accounts

Choose an account type that best suits your trading style.

FOREX.Com account

- Advanced trading platforms with customizable interfaces

- Trade forex, equities and more, all on one account

- Fast, reliable trade executions

Metatrader account

- Dedicated FX trading platform

- Exclusive in-platform market news and analysis

- Trades execute at the best available price

DMA account

- Trade on prices as low as 0.1 on all major FX pairs

- Get commission discounts as low as $20/m traded

- Split the spread and place orders within the top of book spreads

What information do I need when opening an account?

We will need you to provide us with your name and address to establish your identity. Typically, we can verify your identity instantly. For more information, see our account document faqs.

What markets does FOREX.Com offer?

You can trade over 80 currency pairs at FOREX.Com. View our full range of markets.

When is forex market open for trading?

You can trade forex at FOREX.Com 24 hours a day, five days a week. For details, read our forex trading times article.

Is there a charge for central clearing?

We provide central counterparty clearing through an omnibus segregated clearing account (OSCA) free of charge as standard to all clients. If you wish to open an individual segregated clearing account (ISCA), fees apply:

- For an individual these charges are: £13,000 account opening fee, plus account maintenance and transaction charges

- For a corporate entity these charges are: £200,000 account opening fee, plus account maintenance and transaction charges

Try a demo account

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

Try a demo account

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

It's your world. Trade it.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

Welcome to forex.Com

Securely access and manage your account 24 hours a day, 7 days a week. Don't already have an account? Open one now.

The UK and EU have agreed a last-minute brexit deal.

Visit our dedicated coverage for the latest market analysis.

Trade on our other platforms

Desktop platform

The FOREX.Com desktop platform is our most advanced platform designed for active currency traders.

DOWNLOAD by clicking download, you acknowledge that you have read and agree to the software license agreement. -->

Mobile platforms

Stay connected to the markets with our powerful and easy to use, FOREX.Com iphone and android apps.

Have questions? We’ve got answers.

Why do I receive an “authorization failed” message when trying to log in?

Can I download FOREX.Com desktop on a mac?

Can I download metatrader on a mac?

Get started with FOREX.Com today

*based on CFD spreads and financing competitor comparison, 28/06/2019 and 25/07/2019.

Try a demo account

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

It's your world. Trade it.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

Fxpro demo trading account

To access the fxpro demo accounts, you need to complete the registration form and provide us with some information, however, you do not need to upload verification document(s) or fund until you are ready to trade live.

A real account will be automatically created upon completion but to activate it, we will need to verify your identity and may need to confirm some additional details with you. In the meantime however, you can immediately open a demo from the ‘accounts’ page in fxpro direct, allowing you to utilise risk-free trading and bringing you one step closer to the start of your trading journey.

- Real-time pricing

- Up to 100k in virtual funds

- Available for all platforms

- 8 base currencies

- Top up via fxpro direct

- 180-day life span

Open a demo account

Opening a demo account through our fxpro mobile app is the perfect option, as after completing the registration, you can immediately start using the demo account, within the very same app!

Alternatively, you can open a demo account from your fxpro direct portal, for any of our platforms and account types. Please click here for a full comparison.

Compliment your demo account trading with our exclusive content & trader tools including:

- Educational material

- Fxpro.News

- Calculators

- Economic calendar

What is demo trading?

A trading demo or simulation essentially allows you to experience the market and platform features, using virtual funds and therefore without risk.

Why open a demo with fxpro?

New to trading? Our free demo forex accounts will allow you to practise and hone in your trading skills risk-free until you feel confident enough to trade live.

You can also make use of it as an experienced trader if you want to test different trading strategies.

Demo faqs

Although demo accounts present real market conditions and prices, please keep in mind that they are simulations and cannot always reasonably reflect all of the market conditions as during highly volatile or illiquid periods (e.G. Market openings, news announcements) they may not behave in the same manner as live accounts.

Margin and leverage settings may vary between your demo and live account and you should not expect any success with the demo account to be replicated in your live trading.

For this reason, it is strongly recommended that demo accounts are viewed solely as a learning tool for inexperienced traders or a place for testing new trading strategies.

Best managed forex accounts

Jay hawk

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Some knowledge of the forex market’s intricacies is necessary before you can successfully operate as a trader.

Even with the best forex broker for beginners and access to the best forex trading courses, it could take an extended period of time of study and preparation to develop a viable and consistently profitable trading strategy.

You can participate in the forex market without actively trading by funding a managed forex account, similar to how you might invest in mutual funds to gain access to the stock market.

A managed forex account allows you to indirectly take part in the forex market by employing market professionals to trade your money for you.

Best managed forex accounts:

Table of contents [ hide ]

What’s a managed forex account?

Unlike a regular forex trading account, where you make all the trading decisions and actively buy and sell currency pairs, a managed forex account consists of a trading account where a trader or money manager trades on your behalf.

This type of account has higher costs and fees than a standard forex trading account and requires a higher minimum deposit in most cases.

A money manager deals with market logistics very similarly in a forex managed account compared to traditional equity and bond investment accounts. Nevertheless, the account remains completely under your control, and the money manager’s only access to your account is the ability to trade in it.

The money manager cannot make deposits or withdraw funds from the account. Remember, making a profit in a managed account is not guaranteed due to the volatility in the forex market, so all managed accounts should provide a disclaimer stating that you can lose money.

Most clients give their money manager complete control over transactions made in their managed forex account, although you can often instruct the money manager on the strategies and trading signals you would like them to consider as they trade on your behalf. This effectively takes you out of the trading picture so you can avoid the emotions and psychological issues that accompany winning and losing trades.

Remember, not all forex brokers are created equal, so carefully consider your needs and broker features before you open an account. Furthermore, if you wish to have someone else manage your forex trading account, be sure they have adequate training and infrastructure at their disposal as well as a respectable track record as a trader.

Keep in mind that once you open a managed account, account managers will generally have minimum time and deposit requirements and sometimes charge penalties for early fund withdrawal. Minimum deposits for these accounts can also be considerably higher than for a standard forex account.

Is a managed forex account right for me?

How involved do you want to be in the forex market? If you want full personal involvement and complete control over your forex positions and capital, then a managed account might not be for you.

On the other hand, if you prefer to have a professional trade for you and risk your money according to their established trading methods and/or software, then a managed forex account may be best. When you open your managed account, the trader you hire should screen you to determine your risk tolerance level and take note of specific strategy instructions you may have.

Managed forex accounts are great for you if…

Many people simply don’t have the time, experience or disposition to trade in the forex market. Paying attention is a full-time commitment, but career or family obligations can distract and divert your attention. A managed forex account gives you the freedom to pursue other activities that you otherwise might not be able to.

- Prefer to let someone else do the trading

If you have ever traded in the forex market, you have an idea of the directional uncertainty most traders suffer and the notable volatility currency pairs can exhibit. Know your limitations if you have a problem taking losses and opt to employ a trading professional instead.

- Don’t have the psychological make-up of a trader

Some people lack the psychological personality types best suited for trading. For example, if you can never admit when you’re wrong, holding onto a losing position could wipe out your entire trading account. Another example would be a predisposition to overtrading because you find trading exciting. However, trading excess can also take its toll financially, physically and mentally. Rather than risk trading yourself, you may want to find a good account manager.

They might not be a fit if…

If you have trading experience and prefer to stay in complete control of your trading account and the allocation of your assets, then you would probably not be happy with a managed forex account.

- You lack enough risk capital

Minimum deposits for a pooled managed account usually start at $2,000 and individually-managed accounts start with a $10,000 deposit. This could deter some traders from opting for a managed account.

- You don’t want to go through the process required for opening a managed forex account

Getting a decent account manager requires some research and considerably more paperwork than trading your own account. It also involves signing a limited power of attorney agreement (LPOA) that is a legal document and shows that you have authorized the account manager to trade on your behalf.

Keep in mind that you can still lose money in a managed account, depending on the money manager, risk level, market activity and other conditions of your agreement. You should, therefore, check track records and testimonials for any account managers you consider and make sure that they have a good reputation within the trading community.

Features of a great managed forex account

A great managed forex trading account will show consistent overall profitability, as well as a low maximum drawdown level. The maximum drawdown level indicates the maximum loss of capital experienced in the trading account from its peak over the history of the account.

The maximum drawdown formula

(equity high net value – equity low net value) / equity high net value

As an example of maximum drawdown, let’s assume you begin your account with $10,000, which then increases to $20,000, decreases to $9,000, increases to $21,000, falls to $6,000 and then increases to $22,000.

In this case, the equity high net value would be $22,000, while the equity low net value would be $6,000. This would give you a maximum drawdown of: ($22,000 – $6,000) / $22,000 = 72%, which would be considered high. The wide swings in the account’s value reflect the high maximum drawdown and suggest a risky investment.

The lower the maximum drawdown over time, the less risk the funds in the account have been exposed to. When you consider different account managers, the maximum drawdown level of the account statements they provide as evidence of their track record carries considerable weight.

Ideally, a time frame of three to five years for an account under management would give you a clear indication of the managed account’s maximum drawdown.

Other features of managed accounts

- What kind of return on investment (ROI) can you expect on your money?

- The type of managed account model to be used:

- Percentage allocation management module (PAMM),

- Lot allocation management module (LAMM), or

- Multi-account management module (MAMM)

- The type of trading and trading system the manager employs

- Are derivatives part of the trading strategy?

- Which type of signal or automated trading software will be used, if any, and what risk parameters does the software employ?

The way to find the best forex broker for managed accounts is to find an account manager you want to work with and then ask them which well-regulated broker he prefers to use.

If you already have a broker in mind, he may even have account managers they can recommend. Look over the account management agreement, past account statements showing an acceptable performance and the manager’s prospectus for their managed accounts, if any.

Get a sense of minimum deposit, drawdown policy, withdrawal limitations and penalties, profit-sharing parameters and risk levels for their different managed accounts. A prospectus should also include contact and background information for the manager who oversees your account.

The best forex brokers with managed accounts

To keep your money safe, decide on an established forex broker to open a managed forex account and look for an individual account manager or group you feel is qualified to trade your account.

The brokers listed below all permit managed accounts, though doing your own research makes sense if you want to get a good return from their manager’s activities.

Based in cyprus, FXTM is regulated by the cyprus securities and exchange commission (cysec), the U.K. Financial conduct authority (FCA) and the international financial services commission (IFSC) in belize. FXTM offers clients a PAMM managed account and also offers copy trading.

Hotforex

Headquartered in mauritius, hotforex is regulated by cysec, the FCA, the south african financial conduct services authority (FSCA) and the dubai financial services authority. Hotforex offers clients a PAMM account with a search engine to customize your managed accounts’ performance by filtering strategies, current ranking, PAMM strategy name, maximum drawdown and minimum deposit.

Alpari international

One of the largest brands in the industry, mauritius-based alpari has oversight from cysec and the belize international financial services commission.

This broker has over 20 years of experience and offers a long list of PAMM accounts that you can choose from. Alpari’s list of PAMM accounts has both conservative and aggressive account managers and includes both maximum drawdown and capitalization information for each manager.

Final thoughts

If you want to participate and make money in the forex market but you don’t want to trade yourself, then a managed forex account could be a perfect fit.

Keep in mind that, in addition to significantly higher minimum deposit requirements, you can be charged anywhere from 15% to 40% (or more) of your profits. You may also have to pay brokerage and additional manager fees, depending on the account specifics.

On the other hand, if you lack sufficient risk capital for a managed account or prefer to trade your own money, then you may be better off trading in a regular forex trading account, especially if you already have a viable trading strategy.

In addition to privacy, trading in a standard forex account gives you much more flexibility and has significantly lower costs than a managed forex account.

Forex trading account types

| account type | cent | mini | standard | VIP |

| min. Spread | 2.4 | 1.4 | 0.4 | 0.4 |

| personal education: | - | - | + | + |

| recommended deposit: | $100 | $500 | $5 000 | $50 000 |

| minimum deposit: | $10 | $100 | $2 000 | $10 000 |

| account currency | USD | USD, EUR, GBP | USD, EUR, GBP | USD, EUR, GBP |

| max. Leverage: | 1:500 | 1:500 | 1:500 | 1:500 |

| min. Volume lot: | 0.0001 | 0.01 | 0.01 | 0.01 |

| lot size | 1 000 | 100 000 | 100 000 | 100 000 |

| gold and silver: | + | + | + | + |

| shares | - | - | + | + |

| max. Lot size: | ∞ | ∞ | ∞ | ∞ |

| margin call | 55% | 10% | 10% | 10% |

| stop out: | 20% | 5% | 5% | 5% |

| VPS by request | $25/mon | $25/mon | $25/mon | free |

| priority execution | - | - | - | + |

| personal manager: | - | - | + | + |

| swap free: | - | +* | +* | +* |

| open | open | open | open |

* upon the client's request (for muslims only)

Forex account types

Paxforex broker is a fast growing forex trading company with a highly experienced management board, committed to offering our clients the highest quality forex service, technology, support, and terms of business within the forex trading industry.

At paxforex we provide you with the flexibility to choose among 5 different forex trading account types. Our objective is to meet your individual needs while offering a professional and personal service irrespective of the forex type of account you may choose. Each forex account type gives the forex investor full access to the highly accredited metatrader4 trading platform, which includes unlimited charts and technical indicators, automated trading, mobile trading software and access to detailed forex account information. Our clients often start trading from mini forex trading account to feel all features.

All clients are assisted directly by our traders, who can be conveniently contacted via email, telephone and chat services. Regular intra-day market updates as well as a strategic outlook on the main currency pairs are delivered free of charge.

Forex mini account

Forex account designed for new forex traders. Allowing to trade forex without exposing clients to high risk. The minimum deposit is 100 USD. Has competitive forex spreads.

Standard forex account

Forex account funded at 2000 USD and up to 9 999 USD and is appropriate for experienced as well as professional forex traders with a distinctive knowledge of the forex. Has lowest forex spreads, allowing to trade forex, gold, silver.

VIP forex account

Forex account funded at 10 000 USD and more. It is designed for experienced and professional forex traders who are ready to trade significant volumes. Has lowest forex spreads, allowing trading forex, gold, silver, plus direct access to their own personal account manager, through phone, chat or email.

Cent forex account

Designed for newcomers who wants to get an expirience of real money trading with lowest risks. Cent forex account is a perfect way to adjust your own trading strategy, or expert advisor testing with the broker trading conditions.

Islamic forex account

Paxforex introduces special accounts - islamic swap-free accounts. Rather than swap, a settled financing charge (commission) is applicable on the account and it bases on the asset traded and the amount of lots only, not on the interest rate. This account was initiated specifically for clients of muslim beliefs who cannot earn or pay any interest due to sharia law.

You can start with forex trading mini account to taste real trading and then move on and achieve better and better results.

- Accounts

- Account types

- Deposit funds

- Withdraw funds

- Forex

- Stocks

- Indices

- Spot metals

- Promotions

- Platforms

- Metatrader4

- Mobile trading

- MT4 multiterminal

- MT4 reviews

- MT4 guide

- Trading tools

- Education guides

- Educational videos

- Forex calculator

- Forex glossary

- Market analytics

- Forex news /blogs

- Daily trading analysis

- Fundamental analysis

- Economic calendar

- Partnership

- CPA plan

- Hybrid plan

- Revenue share plan

- Copy trading system

- Multi-level system

- Refer A friend

- Become A partner

- About us

- Contact us

- About paxforex

- Reviews & feedback

- FAQ

- Phone: +44 203 504 0303

- FAX: +44(0)844 507 0446

Risk warning: please note that trading in leveraged products may involve a significant level of risk and is not suitable for all investors. You should not risk more than you are prepared to lose. Before deciding to trade, please ensure you understand the risks involved and take into account your level of experience. Seek independent advice if necessary.

The information on this website is not intended to be addressed to the public of iraq, syria, north korea, u.S citizens, or any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

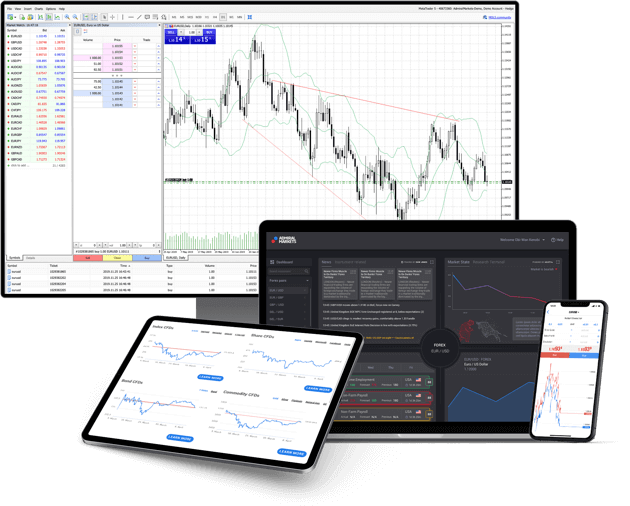

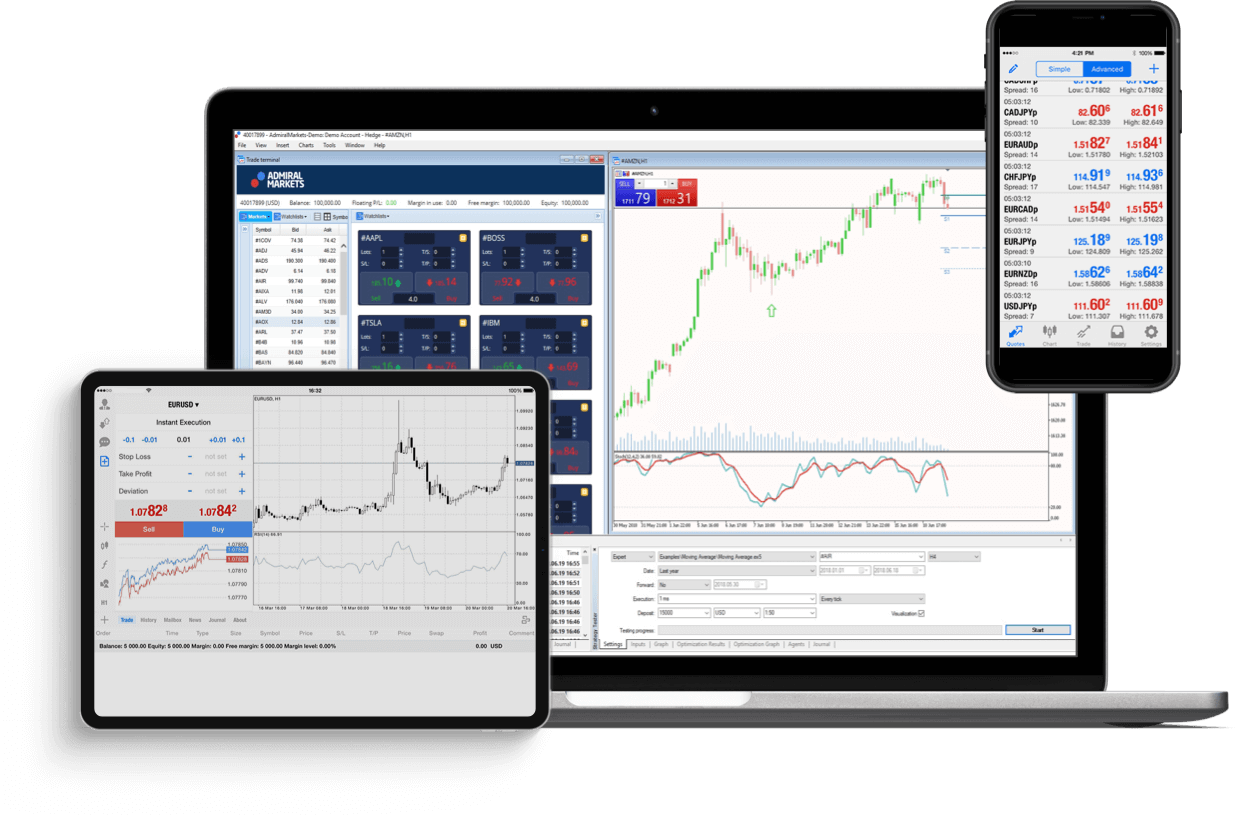

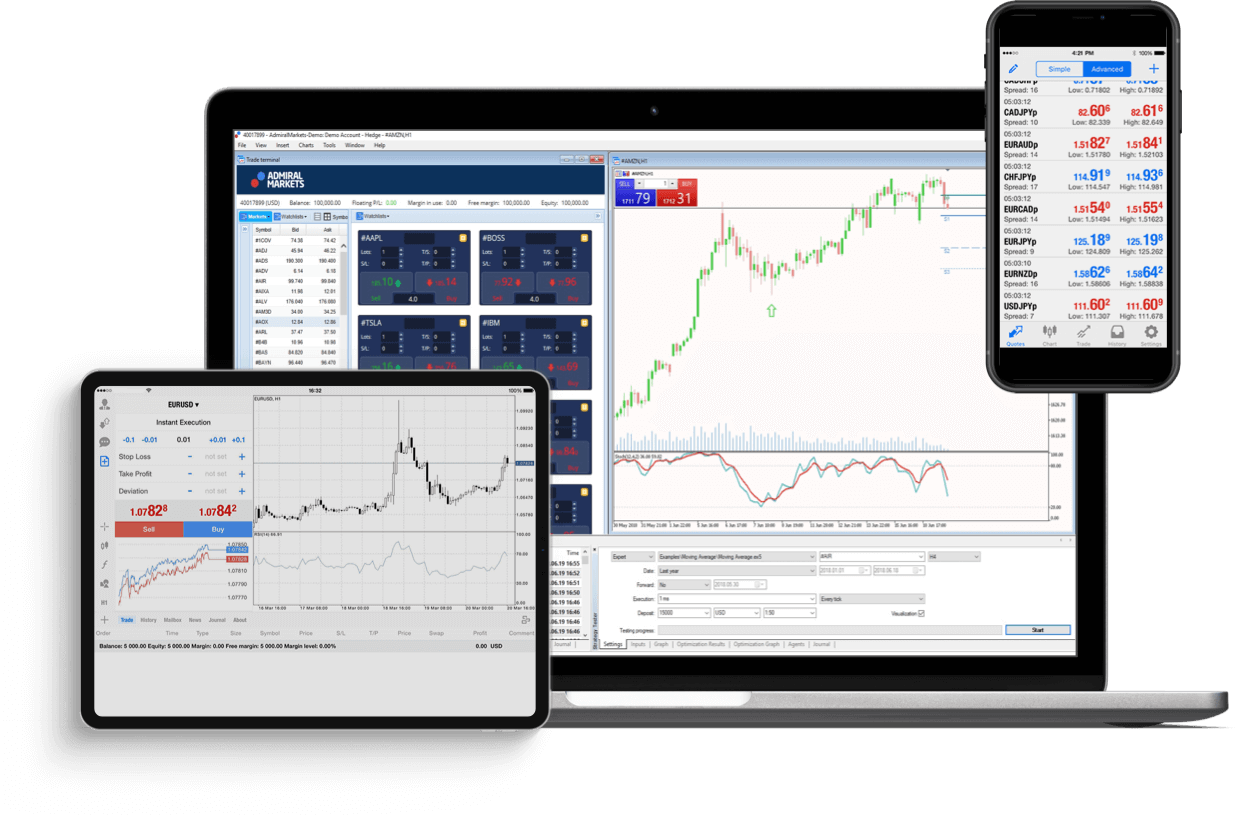

Trade with comfort on any device

Whether it`s windows or mac, android or ios, it doesn`t matter – we`ve got you covered!

Invest from just €1

Sign up for unlimited access to 4,000+ stocks from the new york stock exchange, nasdaq, FTSE and more - all without paying markups, rollovers, management or ticket fees.*

Some of the trademarks reflected on this page might be under trademark protection. Admiral markets does not have any direct relationship with the owners of these trademarks.

How it works

Register

Sign up with your name and email address to start trading

Start investing from €1, and start trading from just €100

Trade

Log in and start trading more than 8,000 instruments!

Trading

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs or bonds. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

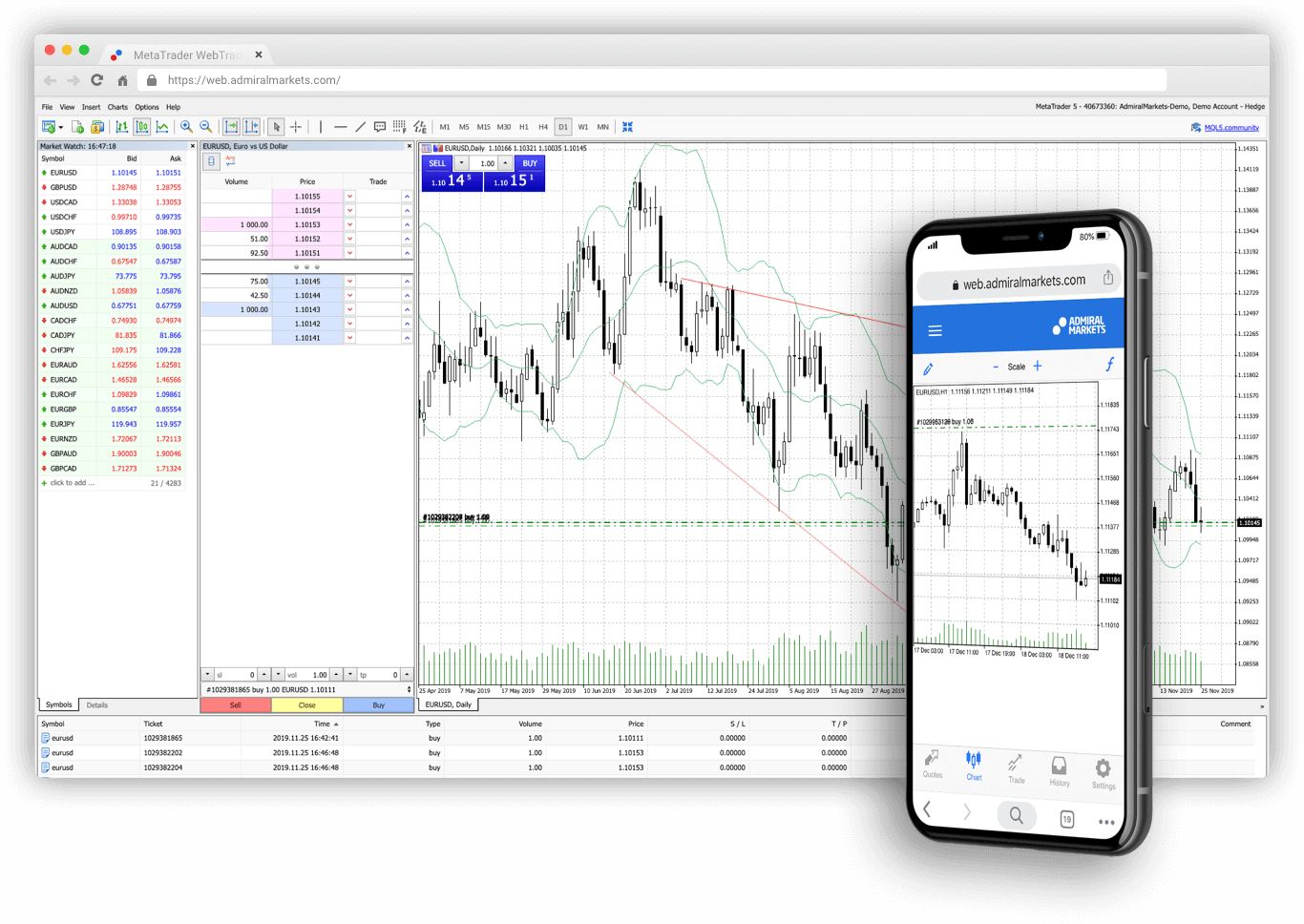

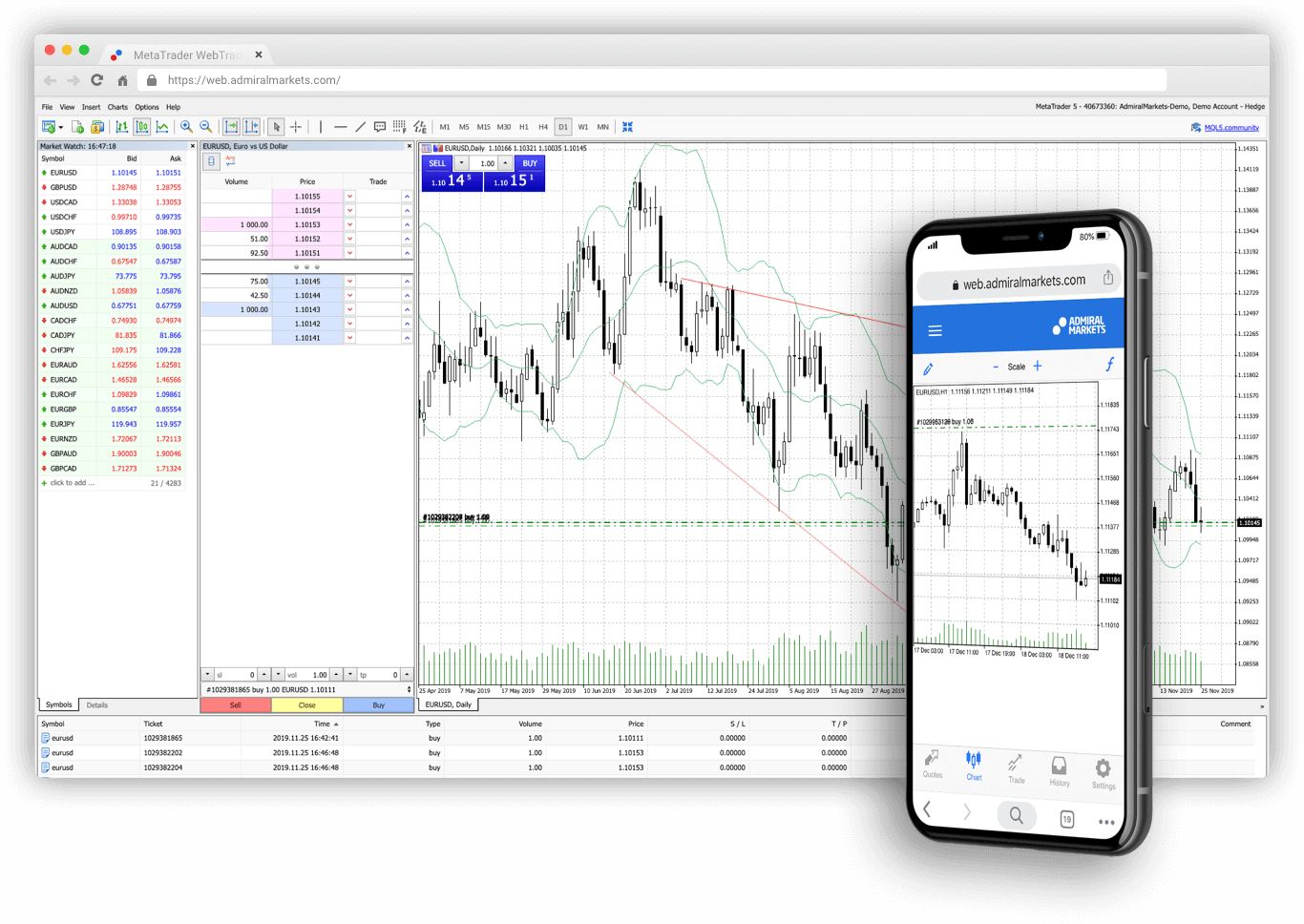

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs or bonds. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Trade and invest in 8,000+ markets today

Forex

47 cfds on currency pairs

Indices

20 index cfds, including cash cfds and index futures

Shares

3000+ share cfds, as well as the ability to invest in thousands of shares

Commodities

Cfds on metals, energies and agriculture commodities

Bonds

US treasuries and germany bund cfds

380+ ETF cfds, plus hundreds of etfs available through invest.MT5

Top trading conditions

Trade our best conditions yet, including some of the market`s most competitive spreads!

- Leverage up to:

- Retail clients: 1:30 - 1:20

- Forex typical spreads from 0.5 pips (EURUSD), micro lots and fractional shares

- Commission-free stocks and funds via cfds

- Free real-time charts, market news and research

- 4,000+ cfds on currencies, energies, metals, agricultures, indices, bonds, etfs & stocks.

- 4,500+ single shares and etfs

try it on demo

Why choose admiral markets?

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

Try demo trading

Not sure how to start? We`ve got you! Start practicing trading with virtual funds on the admiral markets demo trading account.

Get in touch

More questions? Contact us today!

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Contract specifications

- Margin requirements

- Volatility protection

- Invest.MT5

- Admiral markets card

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

All references on this site to ‘admiral markets’ refer jointly to admiral markets UK ltd, admiral markets cyprus ltd and admiral markets PTY ltd. Admiral markets’ investment firms are fully owned by admiral markets group AS.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Search results

Think BIG. Trade forex. As your trusted partner, forexmart is highly committed to providing superb trading software and giving exceptional trading experience.

As your trusted forex trading partner, forexmart is highly committed to offering the top-of-the-line trading software, giving exceptional trading experience, protecting your account against any fraudulent activity, and equipping you with significant trading knowledge.

Think BIG. Trade forex. As your trusted partner, forexmart is highly committed to providing superb trading software and giving exceptional trading experience.

Forexmart is strongly committed to being your dependable forex trading partner.

Transferring and sending funds into your trading account have never been this easy and safe.

Forexmart is regulated by cyprus securities and exchange commission (cysec). With licence number 266/15.

Verify your forexmart account to access all our services. Please take note this process can only be done on our website. If you do not verify your account, you may not be able to fully access our services.

Start your forex trading experience with forexmart. We offer two types of live accounts. To discover contract specification, please visit this page. Enjoy competitive rates, glitch-free trading platforms, and instant trade executions on both account types.

No need to open a live account to learn forex. Using our demo account, you can practice forex trading in a risk-free environment - for free!

Start your forex trading experience with forexmart. Experience instant trade executions and glitch-free trading platforms.

Start your forex trading experience with forexmart. Enjoy competitive rates, glitch-free trading platforms, and instant trade executions.

Metatrader 4 enables you to track few charts simultaneously, trade directly from the chart, and place multiple orders.

Forexmart offers a wide array of financial instruments, as well as cfds on spot metals and shares.

Trade stocks like you have never done before. Go short or long on positions with more than 200 well-known US and UK shares.

With forexmart for partners, enjoy timely payments, competitive rates, and limitless commissions per client.

Earn commissions and reap rewards when referring clients through your affiliate link.

Gain as your clients trade. Be our partner today and earn up to 50% revenue share.

Let people do the work for you. As they generate profit, you earn money too.

Whether launching a website or improving a site, we got you covered. Our promotional materials can be integrated into any website.

Capitalize on the website trafic. Gain profit without monitoring your clients and their trades.

Capitalize on the website trafic. Gain profit without monitoring your clients and their trades.

Be an official forexmart representative. Expand your client network with our latest trading technology and competitive rates.

Let people do the work for you. All you need to do is to promote our services to potential clients and make them trade in the company. When they generate profit, you earn money too.

Integrate our eye-catching, sophisticated banner on your website, blog, or personal site to advertise our offerings.

Forexmart offers several informers that can be embedded on any customer or partner website.

VPS specifications, to apply for VPS, please contact support department via support@forexmart.Com. To claim a FREE VPS, clients just need to deposit a minimum of 500 USD in their account (or equivalent in other currency). Clients have to trade at least 0,5 round turn lots each month to maintain the VPS.

Forexmart is more than pleased to assist you 24 hours a day, five days a week.

Know more about forex trading, as well as our products and services in this section.

Forex glossary the most important terms related to forex trading are presented in this glossary

Readable and downloadable list of all legal documentations

Start your forex trading experience with forexmart. Experience instant trade executions and glitch-free trading platforms.

Privacy policy documentation

The risk disclosure notice, 'the notice' is provided to the customer in accordance with law 144 (I) of 2007 as amended.

The terms and conditions lays out the framework of the service agreement and the nature of the investment services provided by the company.

The complaint handling procedure outlines the processes when contending with complaints received by clients.

Some conflicts of interests cannot be resolved altogether. Hence, the company has taken a transparent, fair approach of resolving such instances.

When opening a trading account, prospective clients are classified as retail client, professional clients, or eligible counterparty.

The fund encompasses clients, as well investment and ancillary services offered by the company.

Under the CIF licence, the company offers investment and ancillary services.

You signify your agreement with and understanding of the following terms and conditions relative to both this website and any material in it.

Employment details and account confirmation updates

Check all your current trades and pending orders. For closed and canceled deals, go to history of trades.

View all closed and canceled deals for a particular time period by providing the necessary details below.

Find out the margin size and point cost for each leverage and lot size. Bear in mind leverage size does not influence point cost. Also, trading with forexmart depends on specific lots.

Change personal information of personal account.

Change personal account password.

Upload documents in verifying personal user account.

Metatrader 4 account information.

Deposit, withdrawal, transfer between accounts and transaction history

Deposit, withdrawal, transfer between accounts and transaction history

Deposit, withdrawal, transfer between accounts and transaction history

Deposit, withdrawal, transfer between accounts and transaction history

Partnership commisions page

Partnership clicks statistics

Partnership referral statistics

Partnership referral statistics

Full name: juan carlos valerón santana date of birth: june 17, 1975 place of birth: arguineguín, spain height: 1.84 m (6 ft 1 ? 2 in) playing position: attacking midfielder

We want nothing but the best for all our clients – and that includes prioritizing your funds and interests.

The main goal of forexmart is to uphold the interests of all clients. As we constantly work on providing best products and services, institutions and organizations objectively recognize our company ‘s achievements and growth in the industry.

Start your forex trading experience with forexmart. We offer two types of live accounts. To discover contract specification, please visit this page. Enjoy competitive rates, glitch-free trading platforms, and instant trade executions on both account types

Forexmart is much thrilled to give away VIP passes to watch UD las palmas play against the best european football teams at gran canaria stadium. All active forexmart clients are qualified to join the raffle.

The cost per action (CPA) partnership enables all our affiliates to reap a one-time commission for each client‘s first deposit. All commissions will be credited within one month, depending on the amount of the client‘s initial deposit.

Forexmart has available downloadable logoes in PNG and PDF formats.

Conversion of currency echange with back data historical exchange rates of data.

Conversion of currency pair , get current quote value of PIP and margin based from currency pair, leverage ,volume and account currency

Know the nuts and bolts of the market,find a reputable broker,create a demo account ,go live

Sign in to client cabinet | forexmart

Sign in partner cabinet | forexmart

Forgot password? | forexmart

SMS security | forexmart

Transfer money from your bank account to ours directly. As you deposit in your local currency, the receiving bank will convert the funds to your preferred currency.

Entrust your funds with one of the world‘s leading online payments. Deposit money to your tradingaccount using your visa credit/debit card.

Skrill (moneybookers) enables you to transfer funds to your trading account and receive money via email.

Being an independent money transfer business, neteller offers a quick, easy method of depositing or withdrawing into your trading account.

Webmoney is a global e-wallet providing an avenue for making deposits or withdrawals into your trading account.

Webmoney is a global e-wallet providing an avenue for making deposits or withdrawals into your trading account.

Paypal is the faster, safer way to send money, make an online payment, receive money or set up a merchant account.

Hipay wallet is the e-wallet solution of hi-media payments and allows your online shop users a convenient, fast and secure payment.

Payco, having the lowest transaction fee worldwide, provides the most flexible, safest way of transferring and receiving money online, and paying bills.

With SOFORT banking online shopping payments has never been easier! You can use your own online banking login details – convenient and secure.

Buy online and offline, pay bills and translate money to close at any time.

Megatransfer is a worldwide, online payment that is efficient, convenient, and innovative.

Transfer between accounts | forexmart

Mail support - compose | forexmart

Mail support - my mail | forexmart

Rebate system let‘s make our partnership more effective and rewarding. Forexmart is much delighted to unveil our rebate system, another great opportunity to earn higher commission.

Rebate system let‘s make our partnership more effective and rewarding. Forexmart is much delighted to unveil our rebate system, another great opportunity to earn higher commission.

Rebate system let‘s make our partnership more effective and rewarding. Forexmart is much delighted to unveil our rebate system, another great opportunity to earn higher commission.

Entrust your funds with one of the world‘s leading online payments. Deposit money to your tradingaccount using your visa credit/debit card.

Skrill (moneybookers) enables you to transfer funds to your trading account and receive money via email.

Being an independent money transfer business, neteller offers a quick, easy method of depositing or withdrawing into your trading account.

Paxum offers a fast, efficient, and affordable payment solution to deposit or withdraw money with ease.

Paypal is the faster, safer way to send money, make an online payment, receive money or set up a merchant account.

ECN technology using your favorite trading platform.

Forexmart announces official partnership with RPJ racing.

Forexmart's analytical reviews provide up-to-date technical information about the financial market. These reports range from stock trends, to financial forecasts, to global economy reports, and political news that impact the market.

Forexmart's forex economic calendar is a real-time, customizable, and multifunctional, forex tool that allows traders to be updated with the latest and most relevant market events. All information that could be potentially impact your trading will be listed and analyzed here.

Forexmart cements new partnership with HKM zvolen.

Forexmart team - are professionals in the financial field working tirelessly to help customers safely and conveniently perform operations on the forex market.

Trade anytime and anywhere through our forexmart mobile application, designed to support your trading needs.

Forexmart goes beyond finance into the realm of sports.

Forexmart offers several informers that can be embedded on any customer or partner website.

Moneyfall contest registration

Moneyfall contest ratings chart

Moneyfall contest winners chart

Forexmart contest - money fall general provisions,participants,participants,results publishing,results publishing,results publishing and language

Forexmart places greater importance on our valuable partner - you. We offer two types of bonus schemes: 30% bonus and no deposit bonus. You can monitor the amount of bonus credited into your account. Remember, any bonus cannot be used in conjunction with other types of bonuses.

Forexmart places greater importance on our valuable partner - you. We offer two types of bonus schemes: 30% bonus and no deposit bonus. You can monitor the amount of bonus credited into your account. Remember, any bonus cannot be used in conjunction with other types of bonuses.

Trade with more capital and gain more profit. When a trader opens a forexmart account and makes a deposit, he has the opportunity to get 50% of the total amount of money deposited. For example, if he deposits $100, we will deposit $50 bonus in his account. Thus, his total balance will be $150. Our system will generate the right amount of bonus for your account. Remember, bonus comes from our company and is not considered an e-currency.

Forexmart 30% bonus and no deposit bonus

Trade with more capital and gain more profit. When a trader opens a forexmart account and makes a deposit, he has the opportunity to get 30% of the total amount of money deposited. For example, if he deposits $100, we will deposit $30 bonus in his account. Thus, his total balance will be $130. Our system will generate the right amount of bonus for your account. Remember, bonus comes from our company and is not considered an e-currency.

Forexmart 30% bonus and no deposit bonus

Get a chance to win $1,000 by forexmart’s chance bonus offer

We fund traders worldwide

Do you have what it takes to get funded?

Become a funded trader at city traders imperium.

We’re funding traders who want to leverage their trading skills and maximise their earning potential.

Pass our evaluation and start trading our fully funded account with potential growth up to $2,000,000.

Do you have the right trading strategy, discipline, and mindset to be our next 7 figure trader?

WHY CTI'S FUNDED TRADER PROGRAM

City traders imperium's mission is to find the top 1% of high-performance traders and start the world’s largest online trading floor.

This mission is much bigger than a chieving financial freedom , s elling generic online courses, or attaining material wealth.

Each and every one of us has a purpose in life. A purpose so powerful that it resonates deep within our entire conscious and subconscious being. The personal dream is a life mission that very few people manage to discover within themselves.

It’s a calling that is beyond material possessions and financial freedom. It provides a reason to rise after each failure and disaster. It stimulates the feelings of joy and gratitude with pain and fear within one experience.

It all boils down to this one question you need to ask yourself:

“why do you want to be a funded trader?”

Join our elite group of the most committed, disciplined funded traders who are all simultaneously taking the CTI funded trader program that will bring the best high-performance funded trader that you know you are.

Unleash the inner trader and choose one of our forex funded accounts. Do you have what it takes to successfully complete the CTI funded trader program challenge and trade up to $2,000,000 of our capital RISK-FREE?

Fxdailyreport.Com

So you have thought about it, and you have finally decided you are to start investing in forex trading? Well, forex trading can be a fascinating business, and nowadays, there is much puff about it online.

But how exactly can you get started with forex trading?

Decide on the best forex broker

This is the first and most important step in opening any forex account. You can choose the best forex broker by looking for such factors as the credibility of a broker, their trade execution, low spreads, regulation, trading platforms and styles, account types, and leverage options, among other factors.

However, deciding on the best broker doesn’t stop here. It is extremely important that you play with multiple forex demo accounts offered by different brokers. Opening demo accounts with various trading platforms will give you the chance to learn forex trading properly before investing your hard-earned money. Again, you should consider making paper trade until you start making consistent profits before committing real money. Often, newbies jump into the forex trading market and end up losing significant amounts of capital because of leverage.

So, again, it is strongly advisable to open multiple demo accounts with different brokers before opening a live account. This will not only help you choose the best broker, but it will also help you get ready for real trading.

After choosing your forex broker, the next thing is often a standard bureaucratic process which is just like opening an account at a bank:

Choose your preferred forex account type

Standard accounts are the most common. Since they need sufficient up-front capital for you to trade on full lots, many brokers often offer better perks and more services for investors with a standard forex account. However, most forex brokers require a standard account to have at least $2,000 or sometimes $5,000-$10,000 as the starting minimum balance.

Mini trading accounts allow investors to make transactions by using mini lots. You can open this type of account with as low as $250-$500, with leverage of, sometimes, up to 400:1. However, it comes with relatively small rewards.

In managed accounts, the broker (or hired account manager) makes the buy and sell decisions. You will set your objectives (like your profit goals, and risk management) and your account manager will work to meet the objectives. This account type requires large minimum deposits.

Again, regardless of the type of account you decide to open, it is wise to begin free demo accounts first to familiarize yourself with various trading aspects.

Registration

You will be required to give a lot of personal information during the forex account registration process. Various countries have different regulations on forex trading to protect investors, and so brokers will ask you for some personal information to comply with the law. Here is what is typically required;

• your name

• contact information-your address, phone number, and email

• date of birth

• tax ID or social security number

• your national ID number

• employment status

• the type of currency you want to use

• net worth

• annual income

• country of citizenship

• your trading account password

• trading experiences and objectives, etc.

It is highly unlikely to find a broker that does not ask for this information, and in case you find one, be suspicious.

After giving all the required information for processing, the broker will typically require you to send them some verification documents like copies of your national ID, and perhaps a utility statement so that they can verify your address and name.

In the final steps opening a forex account, you should see risk disclosures (which you need to take very seriously). Forex trading can be a very dangerous business, and brokers are required to remind you this.

Activate your account and start trading

After your broker has received the required paperwork and information, you will receive an email directing you on how to complete your account activation. After completing this step, you will receive another email with instructions on funding your forex account, your username, and password.

Then all that is left is just logging in to your account and start trading!

So, let's see, what we have: trading foreign currency in the forex market can be risky. Here is what you need to get started and open an account. At forex account

Contents

- Top forex bonus list

- Why you need a forex account to trade

- How you open a forex trading account

- Forex brokers

- FOREX trading accounts

- Try a demo account

- Try a demo account

- Welcome to forex.Com

- Trade on our other platforms

- Have questions? We’ve got answers.

- Why do I receive an “authorization failed” message when trying to log in?

- Can I download FOREX.Com desktop on a mac?

- Can I download metatrader on a mac?

- Get started with FOREX.Com today

- Try a demo account

- Fxpro demo trading account

- Open a demo account

- Best managed forex accounts

- Best managed forex accounts:

- What’s a managed forex account?

- Is a managed forex account right for me?

- Features of a great managed forex account

- The best forex brokers with managed accounts

- Final thoughts

- Forex trading account types

- Forex account types

- Forex mini account

- Standard forex account

- VIP forex account

- Cent forex account

- Islamic forex account

- Trade with comfort on any device

- Invest from just €1

- How it works

- Register

- Trade

- Trading

- Metatrader: the #1 tool for traders and investors worldwide

- Trade with admiral markets mobile app

- Metatrader webtrader platform

- Metatrader: the #1 tool for traders and investors worldwide

- Trade with admiral markets mobile app

- Metatrader webtrader platform

- Trade and invest in 8,000+ markets today

- Top trading conditions

- Why choose admiral markets?

- We are global

- We are regulated

- Funds are secured

- Start from €1

- We are global

- We are regulated

- Funds are secured

- Start from €1

- Try demo trading

- Get in touch

- Search results

- We fund traders worldwide

- Do you have what it takes to get funded?

- WHY CTI'S FUNDED TRADER PROGRAM

- Fxdailyreport.Com

No comments:

Post a Comment