Crypto coin trading bots

Instead, they can realign and specify the weightings of each crypto asset’s value from their portfolio.

Top forex bonus list

The shrimpy trading bot would periodically buy or sell these assets to maintain the desired asset levels, i.E. Automatically rebalance them. This is a great strategy to capitalize on sudden crypto rallies. Thanks to the effectiveness of this tool, users no longer have to rely on the buy and hold strategy. Moreover, cryptohopper was the first platform to automatize the process of receiving crypto signals, i.E. Technical analysts who closely follow the market to spot promising crypto assets and earn money by sharing their predictions with subscribed traders.

The best crypto trading bots

Crypto trading bots are gaining traction among crypto investors these days, and no wonder! After all, they’re helping crypto investors bolster their trading strategy and generate high returns on their crypto investments.

Who wouldn’t want to cut down on the time they spend in front of their monitors, carefully eyeing the market, ready to jump at the prospect of any potentially lucrative price movements.

Trading bots generally follow a set of rules and trading strategies chosen and configured by the trader. They track changes in prices, demand, and volume. They can send you trade signals or execute orders automatically.

In our guide, we’ll discuss the importance of these crypto bots in more depth, their pros and cons, and review the most sought-for software on the market right now.

Disclaimer: we may receive a commission for purchases made through the links on our site. However, this does not impact our reviews and comparisons. Learn more about our affiliate disclosure.

Best crypto trading bots: reviews 2021

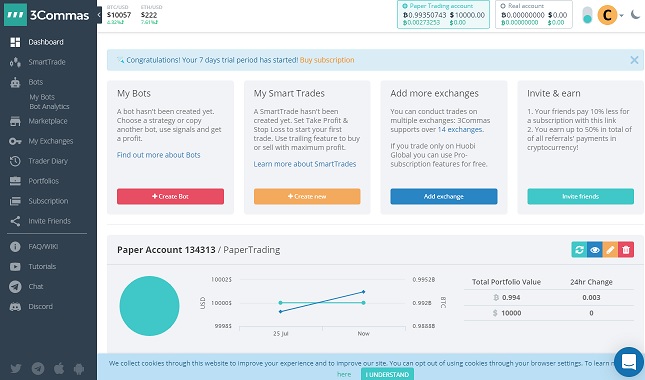

1. 3commas

- Website:3commas.Io

- Supported exchanges: binance, FTX, bybit, bitmex, deribit, bittrex, binance DEX, binance jersey, binance US, bitfinex, bitstamp, CEX.Io, coinbase pro, gate.Io, exmo, hitbtc, huobi, huobi russia, kraken, kucoin, OKEX, poloniex, and yobit.

The first type of crypto trading bot is the technical bot that uses various indicators and signals to predict and help you capitalize on the next cryptocurrency market movement. The most popular technical bot is 3commas.

Users can access this cloud-based platform on their computers or smartphones without having to download it. On 3commas, you can customize the algorithmic trading bots based on your trading strategy – use the long bot for bull markets, the short one for bear markets, or a composite one as a mix of the two.

One of their most attractive features is the social copy trading feature. Aimed primarily at beginners, copy trading gives you insight into the trading strategies of other users, lets you monitor and copy them, and later on extend them to fit your own portfolio.

Moreover, 3commas is popular for its smart trade feature called trailing stop tool that keeps your position open even if you reach the desired target gain so that you can make a profit if there’s a sudden price increase. If the price starts falling, the trailing stop automatically closes your position.

With their take profit and stop-loss orders, you can simultaneously set the selling price point for when you want to make a profit and when you want to stop losses.

Pricing

3commas offers several packages for purchase. If you’re only interested in spot and futures, the starter package costs $14.50 per month or $174 per year. For more experienced traders the monthly price of the advanced package is $24.50 or $294 per year.

There’s also a pro package for $49.50 per month or $594 for the whole year. This package supports margin trading, includes composite bots, bitmex and binance futures bots, and a GRID bot. This package also features a selection of free trading courses.

Novices can try out their paper trading feature during a three-day free trial to familiarize themselves with the bots and plan out their strategy.

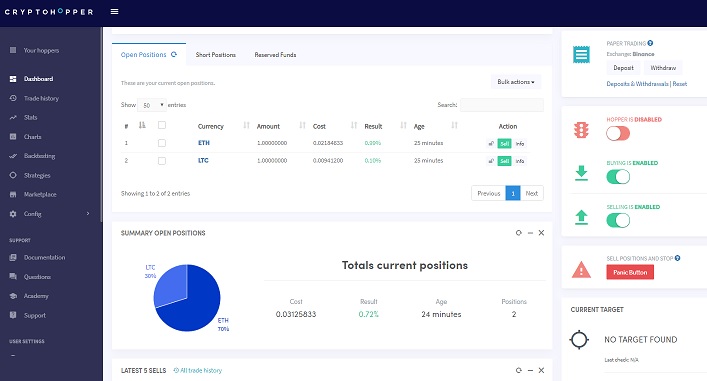

2. Cryptohopper

- Website:cryptohopper.Com

- Supported exchanges: 13 exchanges incl. Hitbtc, OKEX, bitpanda pro, kucoin, bitvavo, binance, binance US, coinbase pro, bittrex, poloniex, bitfinex, huobi, and kraken.

Cryptohopper is another cloud-based crypto trading bot that’s used by thousands of traders around the globe.

The platform is suitable for both beginners and seasoned traders. It has a range of advanced trading features such as backtesting, trailing stop-loss, stop-buy, stop-short, and dollar cost averaging. It features its own tutorial section with extensive educational materials, video courses, and a learning academy to help new users make the most out of crypto trading.

They can customize their own trading strategy with cryptohopper’s strategy designer that allows traders to choose out of its list of 30 technical indicators and 90 candlestick patterns. If you want to try their services but don’t want to risk losing your funds from the start, you can try the simulated paper-trading feature.

Moreover, cryptohopper was the first platform to automatize the process of receiving crypto signals, i.E. Technical analysts who closely follow the market to spot promising crypto assets and earn money by sharing their predictions with subscribed traders.

Now, when technical analysts or “signalers” working for cryptohopper send out trade signals, the hopper bot picks them up and executes a buying/selling order (provided you subscribe to one/some of them first). As a result, traders can spend less time on the trading terminal

Pricing

Cryptohopper offers a free pioneer package for all users that gives you access to 20 positions, manual trading, and portfolio management.

However, if you want to get a real taste of crypto trading with a trading bot, we recommend upgrading to one of these packages:

Explorer starter package.

For $19 per month, you get 80 positions, maximum of 2 triggers, maximum of 15 selected coins, one simulated trading bot, and paper trading.

Adventure medium package.

For $49 per month, you get 200 positions, 5 triggers, 50 selected coins, one simulated trading bot, exchange arbitrage, and paper trading.

Hero pro package.

For $99 per month, you get 500 positions, 10 triggers, 75 selected coins, technical analysis, market arbitrage, and algorithm intelligence (BETA).

3. Haasonline

- Website:haasonline.Com

- Supported exchanges: 20+ exchanges incl. Binance, binance futures, binance.Us, bitfinex, bitmex, bitpanda pro, bitstamp, bittrex, cex.Io, coinbase pro, deribit, gemini, hitbtc, huobi global, ionomy, kraken, kraken futures, kucoin, okcoin, OKEX, OKEX futures, and poloniex.

Haasonline was launched in 2014 by stephen de haas. Unlike many other platforms that avoid revealing the identity of their founders, the haasonline team is known for its transparency and active social media presence.

Until 2020, users had to download and install the haasonline trade server (HTS) and set up an account. This was time-consuming and required some technical background on the part of the user which is why the platform launched its cloud version this year and simplified the whole signing up process.

Haasonline belongs to the group of market-making bots. What these bots do is they place buy and sell orders in an attempt to score a quick and easy profit for you. For example, if your target crypto asset is trading for $100, the haasbot will create a $90 buy order and a $110 sell order. In case one of the orders gets executed, you’ll earn $10.

Similarly to 3commas and cryptohopper, haasonline also offers copy trading and the option to subscribe to technical analysts’ signals. It has advanced backtesting that makes it possible to go 56 weeks back to track the accuracy of some trading strategies.

Pricing

On haasonline, you can subscribe to a 3-month, 6-month, or 12-month trading plan and choose between a beginner, simple, or advanced account. Unlike other platforms, haasonline only accepts BTC payments.

The beginner plan costs 0.073 BTC per year. You get 10 trading bots, access to 11 insurances, 10 safeties, over 20 indicators, restricted core features, chat and ticket support, and a $100 VPS credit.

The simple plan costs 0.127 BTC annually with 20 trading bots, access to 13 insurances, 20 safeties, over 40 indicators, unlimited trades, no fees, restricted core features, chat and ticket support, a $100 VPS credit, and a visual editor.

Finally, the advanced plan costs 0.208 BTC per year offering unrestricted trading bots, insurances, safeties, indicators, and core features, unlimited trades, zero fees, chat and ticket support, a $100 VPS credit, and a visual editor.

4. Shrimpy

- Website:shrimpy.Io

- Supported exchanges: binance, binance US, bittrex, kucoin, coinbase pro, poloniex, kraken, bibox, gemini, huobi, hitbtc, bitmar, bitstamp, OKEX, and bitfinex.

Shrimpy was founded in 2018 by matthew wesly and michael mccarty whose vision was to create a platform that would encourage more people to join the crypto market by allowing them to make crypto trades easily and effectively.

Shrimpy became famous for its automated trading tools and interface and the immediate support it got for leading crypto exchanges. However, what really sets this platform apart is the portfolio auto-rebalancing tool. Although this tool is frequently used in the stock market, shrimpy was the first to introduce it to the crypto market.

Instead, they can realign and specify the weightings of each crypto asset’s value from their portfolio. The shrimpy trading bot would periodically buy or sell these assets to maintain the desired asset levels, i.E. Automatically rebalance them. This is a great strategy to capitalize on sudden crypto rallies. Thanks to the effectiveness of this tool, users no longer have to rely on the buy and hold strategy.

Shrimpy has two main portfolio rebalancing types: time (periodic) and threshold rebalancing. If you choose the first one, shrimpy will rebalance your portfolio daily, weekly, or monthly depending on your preference to achieve your desired crypto weightings. Threshold rebalancing means that when one of your cryptos deviates from the desired percentage by a predetermined amount (e.G. 10%), shrimpy will get you back on track and rebalance your portfolio.

To explore the potential of your strategy, you can use their backtesting services. You can emulate the strategies of other traders with their social services or simply observe them with shrimpy’s insights.

Pricing

Shrimpy offers a monthly membership for its services. The hodler account is free but this subscription allows you to create a portfolio, monitor and track your performance, and link the portfolio to support exchanges.

The professional account costs $19 per month or $13 if you subscribe for one year. Upgrading to a professional account really pays off because you’re allowed to use all trading tools and services including portfolio management and tracking, index builder, rebalancing, backtesting, and social features, and advanced account setting (IP whitelisting).

There’s also enterprise pricing for businesses and crypto companies looking for more customization on shrimpy’s services. You just need to contact their team to agree on the terms and conditions.

Crypto trading bot in 2021 | best 12 bitcoin trading bots

Nowadays, lots of teams provide paid and free crypto trading bots for bitcoin and other cryptocurrency. It’s a hassle for a crypto trader like you and me to choose between these services

When should you use a crypto trading bot?

Many functions that a well-executed bot can conduct for you are rebalancing, portfolio management, data collection, smart order routing, etc.

What exactly can you improve with trading bots? Let’s take a look.

#1 repetitive tasks

Repetitive tasks consume a lot of time and effort. A crypto trading bot will allow you to virtually “copy and paste” specific tasks to conduct trades with ease. One of the best ways where bots can help with repetition is in periodic rebalances. If you want to conduct hourly rebalances, then you’ll need to, as the name suggests, rebalance your portfolio every hour. So, you have two options:

- Set the alarm every hour to rebalance the portfolio and lose your sanity in the process.

- Create a trading bot and program it to rebalance your portfolio every hour till the end of time.

#2 timing

Timing and achieving a high degree of accuracy in your trading is essential for trading. Every single trade that you make can have an enormous impact on your potential earning. Let’s take an example. Suppose the price of bitcoin is going down, and you want to sell your position the moment BTC hits the $8,750 support line. If you were to do this manually, you’d have to patiently and carefully observe the price chart, and even then, you may not pull the trigger at the right time. The bot can be easily programmed to monitor the market and execute a trade at the correct times.

#3 complications can be simplified

Consider the example of “smart order routing.”

- The idea is to route trades through numerous trading pairs.

- Every single trading pair needs to be carefully determined as per its timing, asset quantity, and trading price.

- This entire route needs to be finished within a specific time-limit before the market conditions change.

It seems pretty easy-to-understand, right? However, the execution of this trade could be nearly impossible. This is just one of the many examples of the several complexities that should be factored in while training. Some strategies could be almost impossible to implement.

Trading bots could be used to automate these complicated and seemingly impossible strategies with ease.

Crypto trading bot discounts and coupon codes ��

If you are looking for a free trading bot , try poinex , they only charge trading fee, not month on month fixed pricing.

Try altrady and get 40% discount (annual plan) and 10% (monthly plan) using coupon code COINMONKS

Try botcrypto , A simple yet powerful trading bot

Get 25$ credit which you can use for fees when you join mudrex

Try coinrule and get 7 days of free trial and 25% for 3 months using this link .

The best crypto trading bot in 2021

#1 quadency — A smarter way to trade and manage your crypto

The best part of quadency is the backtesting feature, with which you can do it based on data and numbers instead of shooting it in the dark. It’s also the most important feature for a crypto trading bot; it’s always nice to know the performance upon history data before using your money with the crypto trading bot.

4 best cryptocurrency arbitrage bot platforms for 2021

Crypto arbitrage or bitcoin arbitrage is the process of buying cryptocurrencies from one exchange at low prices and selling them in another exchange where the prices are high. Users can do it manually which take time while use of automated cryptocurrency arbitrage bot platforms are the process more efficient and profitable. It works just like a stock market, where people try to make a profit out of the volatility of the price differences in the bitcoin exchanges.

How does crypto arbitrage work?

Arbitrage trading works on the price differences between the exchange markets. For example, in the large exchanges, you will find high trade volumes and lower prices of bitcoins. Again, in the small crypto exchanges, the supply is less while the prices are high. Traders take advantage of this situation and buy cryptos in bulk from large exchanges at low prices and sell them at high prices in the smaller exchanges thus earning massive profits.

However, the recent ‘bull market’ has caused an increase in the overall volume of crypto trades in all exchanges that an increase in share prices resulting in massive sales even in small exchanges.

Barriers to bitcoin arbitrage

Arbitrage trading has limitations such as:

- Verification of transactions can take some time. The prices of the cryptocurrencies may change during this time.

- The verification process may be cumbersome especially if you are trading large volumes of crypto.

- Exchange fees may be too high and may leave no profits in the end.

- You need to make large volumes of trading in both the exchanges to make profits.

- Traders should make a thorough check of the exchanges with which they are trading. Often exchanges with low prices have trust issues and are unable to satisfy their customers.

Now that we have learned about crypto arbitrage trading, let us have a look into some of the best crypto arbitrage trading platforms:

Best cryptocurrency arbitrage bots

Bitsgap

Bitsgap is another arbitrage trading tool that allows you to make profits through arbitrage trading of bitcoins and other cryptos in exchanges. Key features include:

- All trades depend on the available funds in your account.

- Bitsgap provides arbitrage trading in both cryptocurrencies and fiat currency.

- Arbitrage fees are included in the profits.

- Supports most of the popular cryptocurrencies.

- It is AI-integrated and fully automated to facilitate your trading.

- You can create your account with fiat currency like USD and EUR or cryptocurrency.

- The smart API protects your funds and helps you to build a smart portfolio in the trading platform.

Arbitrage.Expert/automated crypto arbitrage

Automated cryptocurrency trading bots are the software which executes automated buy and sell orders with the goal of making profit. Similarity, automated trading with the software bot especially made for the purpose of arbitrage are know as automated crypto arbitrage trading. One example of such platform is arbitrage.Expert website. This platform uses an advanced version of algorithmic arbitrage trading bot. Features include:

- Arbitrage bots help to do crypto trades taking leverage of the price differences prevalent in different crypto exchanges.

- Do trade with the help of API tools without withdrawing the funds.

- Faster trades with arbitrage bots.

Gimmer

Gimmer is another arbitrage trading bot in the crypto trading market. GMR is the official token of this platform and is available on the exchange platforms and it supports multiple cryptocurrencies. Here are some of the key features of gimmer:

- The automated bots are integrated with all the major trading exchanges.

- Users get access to a basic level of automated trading bot for free.

- Gimmer will study your profile and let you know about the risks involved while you are investing in the exchanges.

- Free back testing tool that enables you to test your trading strategy to understand the pros and cons before you implement it in the market.

- You can also earn cryptos buy renting your automated bot to other crypto traders.

- Multiple safety protocols to safeguard your hard-earned money.

- You can choose your trading bots if you are looking for more investment opportunities.

- Exchange information and ideas in the social network of traders and learn more about arbitrage trading.

- Practice arbitrage trading with the help of the simulator mode.

- Hosts lightweight dapps that are fast, secure, and affordable.

Multitrader.Io

Multitrader is one of the finest crypto trading platforms. It uses arbitrage trading bots that make the work automatic and easy. At present, multitrader is working with 21 crypto exchanges and constantly looking out for trading opportunities. Key features of multitrader platform includes:

- A user-friendly interface where traders can analyze the progress.

- Uses statistical calculations and order book matching to search for potential opportunities in arbitrage trading.

- It provides cloud-based solutions.

- You can review the trades with the help of bots.

- Users can get periodical reports on their trades.

Best crypto trading bots in 2021 to make money (reviewed)

The high volatility in the crypto market attracted a lot of traders to cryptocurrency space. The more prices swing, the more people buy it and sell it at a high rate.

Therefore it makes more profits for the traders and higher fees for the exchange. It has led to the extensive use of trading bots, which we discussed in a previous post.

How does crypto trading bots work?

Cryptocurrency trading bot is a software program that integrates with different financial exchanges, usually by using the apis offered by the same exchanges. After that, these bots place both buy and sell orders for the user, based on the models and algorithms used when creating the bot.

Usually, these programs depend on multiple variables, such as volume, current orders, prices, volatility. In addition, custom bots can be further configured to be more complex and use prediction models or machine learning to increase profit.

Bots can catch the price movement that humans are prone to missing due to uninterrupted activity. The ability to watch all trading pairs, and the lack of emotions.

In the past, these tools were only accessible to large traders who could afford a 24,000 terminal. But with the advent of cryptocurrencies, many new platforms have entered the market. Each offering trading bots at competitive prices.

There are different types of crypto bots out there, but we have selected the best crypto trading bots based on the criteria below.

Evolution of crypto trading bot platforms

There used to be no trading bot creation platforms, so you had to code an algorithm yourself. This required traders to split their attention between learning trading, programming, and staying on top of the market.

Today there are amazing platforms that offer better user experience and save you the effort and time and allow you to use this technology formerly exclusive to large trading firms only.

You can become a better trader as you are creating the bot, backtesting, and learning about what works and does not in minutes.

Some platforms also allow you to copy trading bots created by someone else that is easy to use and launch. However, that comes with limited transparency and flexibility when it comes to adjusting the algorithms.

Crypto trading bot features

Historical data from exchanges and beyond

In order to create a strategy, you want to make sure that the platform offers enough flexibility when it comes to featured assets and exchanges.

You also want to make sure that historical data for backtesting is available and coming from a credible source.

Backtesting

Before you automate a trading strategy you might want to do thorough testing to ensure that the algorithm is rock solid and can be deployed with the real assets.

This will advance your trading skills greatly and make you less dependent on others. Results that are detailed, but easily digestible are imperative.

Trading indicators, candlestick patterns, and more

You need all indicators, candlestick patterns, price action, market caps, and dominance.

What is equally important is how you can combine them. It’s one thing being able to trade with RSI and it’s another to be able to combine BTC dominance with the price of stocks AND RSI.

User interface

UI/UX experience is essential, especially if it is designed for an entry-level individual without an extensive background in trading.

Trading strategy

Most professional traders rely on different trading strategies. Therefore, we must look at what strategies can the bot implement? What sort of order types it supports, and how much you can customize it?

Ease of use

Most bots include pre-preprogrammed strategies set up and ready to go. In addition, other bots allow the user to program them and create custom trading strategies. The right platform will depend on the coding experience of the end-user.

Cloud-based

The convenience and speed that come with cloud-based platforms are hard to overstate. The good thing is that most crypto bot platforms today are cloud-based, unlike their legacy market predecessors.

Security

Best crypto trading bots offer multiple authentication methods such as two factor authentication, API key encryption mechanisms. While choosing a trading bot, we should check for the protection methods. Other than that, privacy policies related to the user's trading data is increasingly important.

Pricing

Trading bots offer different pricing plans, such as subscription-based, one-time payment, trade volume. All these factors have to be taken into account while choosing a platform.

Software quality

Software quality is essential for bot performance. Glitches or bugs can be very problematic and wipe out your positions. While choosing a bot, one must test its features and read reviews by existing users.

Reputation

Researching forums, sites, and review platforms is critical. Good standing with the trading community is always a plus.

Exchange compatibility

Best crypto trading bots platforms support multiple exchanges. Therefore, while choosing a bot, always check if it supports the cryptocurrency exchange you use.

Support and knowledge base

As some tools are more complex than other having onboarding calls, responsive chats and educational content is more of a necessity than a perk.

So, without further a due in no particular order, let's list best trading bots.

Related resources

Best crypto trading bot platforms

Haasonline

Haasonline created by the company haas online software, founded by stephan de hass in january 2014. It quickly became one of the most experienced companies in regards to cryptocurrency trading bots.

Haasonline offer bots that are fully customizable, written in the C# programming language.

In addition, haasonline can automate altcoin trades and places no restrictions for altcoin pairs.

It is available for windows and linux, offering to make trades on a 24/7 basis. The bot itself makes use of over 50 technical indicators that become the basis for any trading decisions made by the program.

For the user, haasonline offers insurance services that cover partially lost due to technical malfunction.

The bot is currently compatible with over twenty of the largest and most popular cryptocurrency exchanges, which include major players such as binance, bitfinex, bitmex, coinbase pro, gemini, huobi, kraken, kucoin, and poloniex.

Use coupon "coincodecap"- get 15% discount

Haasonline trading bots

Within the server, you can find over 50 technical indicators, crypto bots, and different types of “insurances” for your bots.

It supports arbitrage, margin, and leverage trading as well as custom charting functionality. Instead of marketplace haasonline has a community library of scripts and 20+ supported exchanges.

When it comes to actual bot creation the platform is very different from a regular crypto trading bot platform. The interface inside the platform looks more like that of conventional trading software, rather than a simple to use tech.

On top of that as of now, there is no free trial and if you want to get a feel of the platform the only option is to try the demo servers.

All of this makes the platform quite complicated for novice traders and there is no surprise they want to launch a cloud solution. While it’s been a few months since the announcement the cloud version is not yet available.

Free trial and pricing

With no free tier and the most feasible option starting at 0.018 BTC there is a high barrier to purchase a platform that can’t be tested.

Conclusion

Server, complexity, pricing, lack of free trial — all of it makes it harder for haasonline to compete with newer more flexible, and transparent platforms out there. Being a leader and offering more than any other platform in the past it is harder for haasonline to compete with its rivals.

Also read our haasonline review.

CLEO.One

CLEO.One is a trading bot creation platform that caters to both novice and advanced traders.

With an emphasis on helping with developing trading skills needed for long term profitability.

It has a simple promise of providing strategy testing and automation and it is very transparent about the offer.

CLEO trading bots

CLEO.One has a dashboard for strategy creation and testing using more data than any other platform. You are empowered to create, test, and trade strategy-based bots and so become a better trader by creating your own bots.

With CLEO.One you get the functionality of a programable without learning how to code.

There is also a selection of free strategies that were already tested and paper-traded for inspiration, which can be deployed as bots in a matter of minutes.

You can also take free strategies as templates and adjust them to make it more profitable. Detailed analytics and statistics will come in handy.

Smart trade functionality is also available with CLEO.One. It was recently enhanced with conditional entry and exit making it the most powerful automated trading solution.

Free trial and pricing

CLEO.One has a trail account, a free account for binance users, and a starter account from $69 per month.

Conclusion

There is something about CLEO.One’s approach to trading through testing that really attracts traders that seek transparent and flexible solutions.

It allows you to be in control and have the visibility across all the trading bots, strategies and positions.

If you have that curiosity in testing your strategies and want to be able to tweak bots before testing them and test them before launching, then you will definitely find CLEO.One as a great learning tool that has the potential to generate passive income you desired.

Also read our CLEO review.

3commas

3commas is among the most respected trading bots in the market. It is a russian made software solution, the name alluding to the billion-dollar club. The company is a crypto trading terminal that features algorithmic trading and portfolio management. It features a smarttrade terminal that allows users to execute orders and trades and stop-loss/profit positions. To date, the service has over 33,000 active users and a daily trade volume, which regularly exceeds $10 million.

The platform has a 24/7 dedicated support staff for the platform's help desk center, their twitter and telegram. They are very active within the facebook groups and offer support in there too.

The user UI/UX for the platform is intuitive, and it is ideal for beginners. 3commas supports integration with several cryptocurrency exchanges, including bittrex, bitfinex, binance, bitstamp, kucoin, poloniex, hitbtc, CEX.Io, coinbase pro, okex, huobi, yobit, and GDAX.

3commas trading bots

When it comes to bot selection — it is wide when it comes to types: from, gorgon bot, to advanced bot and DCA bot.

- DCA or dollar cost averaging can be an effective strategy itself while it is more effective when adjusted and used with caution depending on market conditions (like any other strategy). 3commas offers a few predefined conditions for the entry like quickfingers luc or “open new trade asap”.

- The same applies to grid bot that is based on a range trading, but, again, it can turn ugly if market conditions change fast and currency switches from ranging to downtrend. There is also an option to use AI strategies.

- There are also a few technical analysis start conditions like RSI-& or ULT-7–14–28 and if that is what you’re looking for in a crypto bot you should be pretty happy with 3commas.

- When creating a strategy you can select a coin, amount to trade, and basic parameters like “number of grids to trade.” experienced traders might find it somewhat limited, random, and confusing. So there is no way you can actually optimize and improve the performance of the bot if that is your goal.

- 3commas provide quite ambitious stats on their bots profits with no other data available. It makes it hard to compare different bots against each other.

- Paper trading and backtesting is available, but with out-of-the-box bots and a 3-day free trial there is not much to analyze and adjust.

They also provide a marketplace full of trading signals, but again very little transparency or metrics to evaluate different signal providers against each other.

You are unable to see how many other users already use these signals, return since inception, risk and reward ratios, or any performance statistics that actually matter.

Free trial and pricing

You can try 3commas for free for 3 days and continue using based on a monthly fee starting from $29 monthly fee or $174 per year.

There is also an education program 3 commas sells for $197 to explain how to leverage the functionality of the platform.

It comes with coaching, but the application of the knowledge is quite impractical outside the platform.

Conclusion

3commas cater to crypto traders who are comfortable running bots with limited control. They have quite a few bots to offer with an overwhelming choice of exchanges and assets.

However, more experienced traders might find this combination rather a pandora box than a toolkit for success and better trading.

Crypto trading bots: how to start bot trading crypto? - #cryptotrading

Whether you want to automate your DCA or your TA strategy, there are trading bots for it.

Whether you want to hedge with derivatives, run a short term speculation or just buy and hold, there is a crypto bot that can make the work easier.

Trading bots for DCA strategies

DCA, or dollar cost averaging, is a long-term bullish position. If you think the price of an asset will grow at some point within the next 1-10 years, you are long-term bullish.

If you want to put your money where your bullish sentiment is, but you do not want to waste time trying to get the perfect entry price^TM, you want DCA.

With DCA, you scale into your position by making small regular purchases. You can use the same step-by-step method to exit the market as well.

More on the method: ATNET glossary > DCA

How does a bot help: to make sure you still buy even if the price is moving up (too expensive!1) or moving down (going to zero!1)

Where to get the bot: independent reserve

How much does the bot cost: nada

Trading bots for TA strategies

TA, or technical analysis, has a number of pattern trading strategies that can be executed pretty much automatically.

Especially with short term techniques like scalping, the human factors of emotions, stress and mental fatigue can work very much against you.

Examples of TA classics that can be automated

- Scalping the bollinger bands: buying at the bottom line touch, selling the top line touch.

- MACD crosses: buy on bullish cross, sell on bearish cross on shorter timeframes.

- RSI, oscillators and their derived transformations: buy on oversold or other bullish signal, sell on overbought or other bearish signal on shorter timeframes.

Short term trading is mentally draining to most people. With an automated strategy you can still participate in the market with limited babysitting of your positions.

More on the method: ATNET glossary > TA

How does a bot help: automation will minimise the time spent on sitting at your desk watching charts.

Where to get the bot: coinrule

How much does the bot cost: free for volumes below 3K USD per month, or 25% off with this link.

Crypto bots for lending strategies

Margin lending on spot crypto exchanges can become a race to the bottom pretty quickly. With perpetual swap funding the situation is different, the interest rate has a function in stabilising the market.

With plain margin funding, the rate level can get suppressed very quickly whenever there’s a bunch of people submitting offers just below the market.

If you submit your lending offers manually, you will tend to do that, because you want to make sure your offer gets filled. This behavior presses the lending rates down and effectively lowers your lending profits.

Bitfinex recently rolled out the “lending PRO” interface that is available in the web interface from the top menu under “lending”.

You can set your minimum acceptable rate there, let’s say 0.009 per 3 days at BTC lending market. Your lending wallet balance will be automatically offered when the rates are above that level.

You will not be tempted to get “at least something” when the rates have momentarily dropped to ridiculously low levels just during the two minutes you are checking them.

More on the method: ATNET strategy > lending

How does a bot help: automatically offers your lending wallet balance for the best possible rate as long as the current rate gets above your minimal required rate.

Where to get the bot: bitfinex

How much does the bot cost: nada

Posted in crypto trading 101

tagged as #TRADING-TECHNIQUE #TECHNICAL-ANALYSIS #MOBILE-TRADING #CRYPTO-TRADING-STRATEGY #CUSTODIAL-TRADING #DCA #SCALPING #BITFINEX #INDEPENDENT-RESERVE

3 best crypto grid trading bots (that actually work)

Disclosure: this post may contain affiliate links, which means we may receive a commission if you click a link and purchase something that we recommended. Read about affiliate disclosure here.

Are you looking to start with grid trading bots?

Well, there are only a few grid bots which are quite remarkable, and in the past few months, I had to chance to explore many of them. I infact used all of them to run a grid bot, and here is one of my trade results with grid auto trading bot:

Do notice the frequency of trade (time-stamp).

Now, I feel confident enough to share some of the insights from my learnings, and exploration of these grid trading bots.

However, if you are new here, I highly recommend reading about best crypto trading bots.

Now, moving on to grid trading bots…

Grid trading works best in the ranging sideways market and using a bot you could execute your strategy even when you are sleeping. Grid trading gives you profit with ups and downs of the price fluctuations in the market, and works best when any particular pair is in a range with no clear up or down trend in a longer period.

Disclaimer: trading is a skill, and using a bot doesn’t guarantee you would make money. You should rather invest time learning the basics, and then use a bot to automate your strategy. It took my more than a year to get results, so do not RUSH!

Disclosure: this article contains affiliate links, but every word is unbiased, and based on real-experience.

Those who are into scalp trading, can also take advantage of grid bots to automate their trading strategy. Here I have compiled a list of best available grid auto bots, with my remark and experience. Some of them are free, and a few of them are paid.

My suggestion is to try one or two at a time, and see which one fits your style of trading.

3 best automated grid trading bots:

1. Bituniverse

Bituniverse is a free trading bot which offers various kind of grid bots. What I like about bituniverse (apart from being free is), it offers many advanced features that no other similar tool offers.

- Stop loss feature

- Use AI strategy to auto-set your grid

- Manual grid setting (the one I recommend)

- Leveraged GRID bot

- Margin GRID bot

Getting started is also easy, and it works with all popular exchanges.

Overall, for many who are looking to start for free, bituniverse grid bot is the best available option. You connect with your exchange using API key, and since your crypto assets are not stored on bituniverse, you are safe. They do have a few additional products, which I have not tested, and I suggest not to try anything apart from manual bot trading on bituniverse. Once I have more details, I will write a separate article for the same.

2. 3commas grid bot

I have been a user of 3commas for a long time, and I really like their interface, and mobile app to track the performance or stop the bot. I have talked about 3commas in depth here on my 3commas review, which you must check out.

3commas offers paper trading which is idle for those who want to test grid bot before actually putting in the real money. It also works with all popular cryptocurrency exchanges, and their free tutorials and guides will help you to master the art of grid trading.

3commas also offers AI-based grid trading, where you let their AI decide the upper and lower limit for the grid. Or, you can set a manual upper and lower limit for grid size.

Here are some of my results after using grid bots:

It definitely lacks the feature of stop-loss, or auto grid resizing, which may make a lot of difference for many novices. Unlike others, 3commas is not free, and cost about $49/month for grid bot trading. However, you get 3 days trial, which is good enough for you to test out the system. Either way, in my experience 3commas, is a solid choice for a majority of intermediate and experienced traders.

3. Quadency

Quadency is another popular crypto trading bot, which offers grid bot as a free feature. However, their bot is different than above 2, as you can’t set the upper and lower limit manually.

To be honest, I could not find much detail on how quadency sets the price for grid, but what I like about them is; it gives you the control on what to do when exit price is reached. Here are 4 options:

- Recreate grid around exit price and continue trading

use this option if you have sufficient balance in quote and base to re-create the grid at the point where the price exits the grid. Note – this involves cancelling all open orders and close open positions with a market order. - Cancel all orders and stop bot

use this option if you want to cancel all remain open orders and stop the bot. This option will not close any open positions. A position is open if the bot has bought quantity but has not sold the same amount or conversely if it has sold but has not bought back the same amount. - Cancel all orders, close all positions and stop bot

use this option if you want to close all positions in addition to cancelling any remaining open orders. - Do nothing

use this option if you would rather wait for all open orders to eventually get filled. As the price reenters the grid, the bot will resume trading. However, if the price never re-enters the grid, the orders will remain open indefinitely until manually cancelled.

You can read more about quadency grid bot feature here.

There are a few more options like pionex which is primarily an exchange, but offers bot trading. Though I have not done the diligence of this exchange, so I would not trust this with my money, as it requires us to deposit the fund. Rest other options listed above, let you connect with an exchange using API, and thus your funds are more or less the safe.

Conclusion: which grid bot to use?

Well, bituniverse should be your first choice as it is free.

If you are fairly new, then use 3commas, as they offer 3 days trial and their help guide is good enough to get started.

As it is, I will keep an eye on more new bots which are coming in the market, and will include which is worthy enough to be listed here on our coinsutra resources.

Now, it is your turn to let me know how your experience has been with grid trading. Also, if you know of any other grid trading bot, do let me know via comment section below.

Harsh agrawal is the crypto exchanges and bots experts for coinsutra. He founded coinsutra in 2016, and one of the industry’s most regarded professional blogger in fintech space.

An award-winning blogger with a track record of 10+ years. He has a background in both finance and technology and holds professional qualifications in information technology.

An international speaker and author who loves blockchain and crypto world.

After discovering about decentralized finance and with his background of information technology, he made his mission to help others learn and get started with it via coinsutra.

Join us via email and social channels to get the latest updates straight to your inbox.

8 best cryptocurrency trading bots [free, paid, open-source] for 2021

Cryptocurrency trading bot (software) automates the process of trading on exchanges. We listed 8 best crypto trading bots for automated trading including free, open-source, API, subscription-based crypto trading bots.

Cryptocurrency trading is an emerging business and with more and more crypto traders flocking the market, the growth of digital currency exchange has risen to a whole new level. However, many new investors especially the novice find it extremely difficult to evaluate the cryptocurrency market conditions and to cope up with the volatile nature of the market.

The cryptocurrency trading bots is relatively a new concept and have made crypto trading easy and popular especially among the novice traders.

Cryptocurrencies can be traded directly from crypto exchange platforms or through the help of crypto trading bots. Due to the volatile nature of the crypto market, many investors are gradually relying on the trading bots to do the job for them.

What is crypto trading bot?

A crypto trading bot automates the process of cryptocurrency trading and trades on behalf of the trader. It is a computer algorithm that scans and tracks your trade pattern and executes the task at your command. For that, you need to have some coding skills and you can program your very own customized trading bot. However, if you do not have the required expertise, the market offers some of the best trading bots and you can subscribe to one of them.

How does a free cryptocurrency trading bot works?

The free bitcoin signal robot is an automated trading software that will understand and manage your trades on your behalf. The software is almost free and will double your crypto returns in no time.

You can start your crypto trading with as little as $100. You start by choosing a trading broker and install the bitcoin trading software on your computer. You can customize the settings and you are ready to go.

Advantages of cryptocurrency trading bots

- A crypto trading bot completely automizes the trading process thereby eliminating delay in decision making and makes trading faster and at favorable trading prices.

- The crypto bots track the chart patterns regularly and you do not have to be present all the time for trading. They will do the job for you in your absence.

- Manual traders also use bitcoin price prediction tools for analysis to execute profitable trading. These subscriptions are mostly paid and required recurring payments.

Features of a good cryptocurrency trading bot

- One of the most important features of a good trading bot is its reliability. Look for bots that are used frequently by users and have positive feedback.

- When you are choosing a trading bot you are doing it at your own risk. You are giving authority to your bot to take control of your funds and trade with it in the market. So, you need to be cautious and completely sure before choosing a trading bot. So, it is advisable to do complete research before choosing a trading bot.

- Whether the trading bot is profitable or not depends on its prior performance in the market. So, while choosing a trading bot find out whether the trading bot is profitable or not.

- The cryptocurrency market is based on mutual trust and transparency. So, before you choose a trading bot to look into the profile and history of its developers. See if they are popular in the community or not.

- The main purpose of using crypto trading bot is to automate the process of crypto trading and make it easy for users. Look for trading bots that have a user-friendly interface and you must be able to control the software entirely.

Best crypto trading bots

Trading with bots is not secure if you started with a scam website. There are many bot platforms are available in the market. We tried to shortlist few reliable, and trusted players of the market in this article. Let us now look into the top 5 crypto trading bots in the industry.

3commas is also comparatively a new trading bot in the market. One of its unique features is to trail the crypto market and close the trade at the right time to maximize your profitability. The bot quickly adapts to the changing pattern of the volatile crypto market and ensures a maximum return to your investment.

- Automizes trading maximizes profit and avoids loss from trading.

- The bot is hosted online and is available from anywhere and any device having an internet connection.

- The bot has partnered with 13 popular crypto exchanges including binance, kucoin, bittrex, etc.

- 3commas is available in 3 package plans starting from $22 to $75 per month. However, users can use the bot for free if they have an account at the huboi exchange.

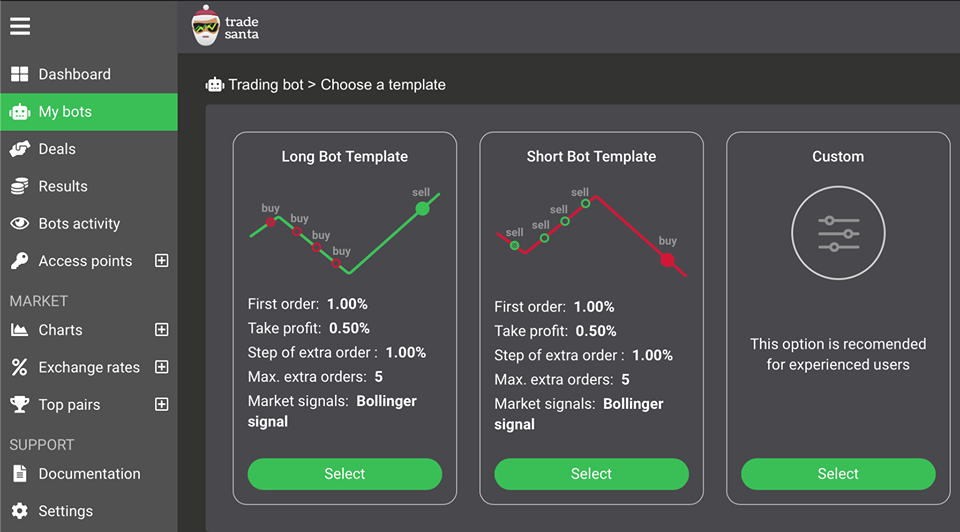

Tradesanta

Tradesanta is a popular cloud-based trading bot software that allows users to make a profit at the time of market fluctuation. It provides automated trading with the help of algorithms and there are tools like filters, signals which are very much helpful to take decision. It automatically executes orders on behalf of the users without accessing your funds. These bots are basically computer programs which are fast, works 24×7 with different market analysis and calculations. Tradesanta offers free and paid both plans. In a free plan, users can create up to 2 bots and trade up to volume $3k. For paid plans payment can be made through bitcoin, ethereum, and tether.

- Streamlined process, multiple tools, and user-friendly interface;

- Top cryptocurrency exchanges are integrated such as binance, huobi, bittrex, bitmex, bitfinex, and many more.

- Users will get flexible telegram notifications.

- Bot templates are available to launch your trade bot in a minute.

- Fee as well as paid plans available

- Telegram community with 24/7 support

Cryptohopper

Cryptohopper is considerably new in the market but has already gained immense popularity due to its wide range of features and technical leverage over other bots. Few highlighted features are:

- One of the main limitations of earlier crypto trading bots is that they could only operate when the PC is on. Cryptohopper uses cloud-based technology wherein, you can run and trade with your bot on a cloud and use it any time of the day even when you are offline.

- Cryptohopper allows you to run your bot in autopilot mode and set your trading signals. This is extremely useful for new users who often fail to set their own trading signals.

- Cryptohopper is enriched with other special features like technical analysis which helps you to customize your bot’s settings and templates through which you can design a new setting for your bot.

- Cryptohopper offers several plans to choose from starting from $19 to $99 a month.

- You can trade on multiple exchange platforms like binance, huboi, kucoin, bittrex, coinbase, etc.

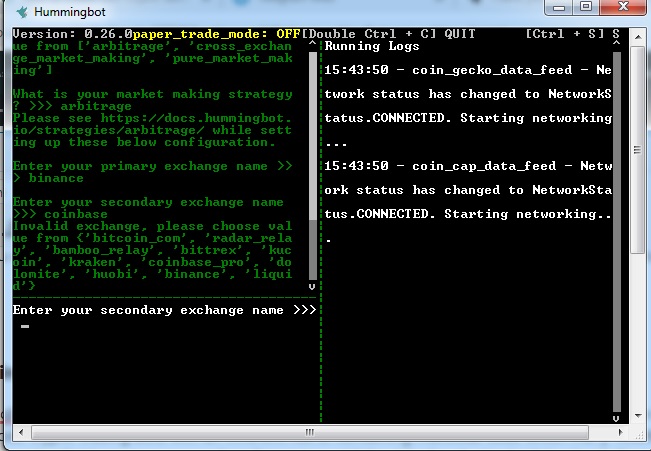

Hummingbot

Hummingbot, is an opensource cryptocurrency trading bot solution backed by coinalpha. Unlike the other closed source code crypto trading bots with an inherent risk of containing malicious code which ma7y results to loss of the funds, hummimgbot is open source code software to avoid the risk of such attacks. It is a local client software, private keys, and API keys are stored locally.

- Open source code licensed under apache 2.0.

- Supports both centralized and decentralized exchanges like binance, coinbase, 0X, huobi, bittrex, kucoin, and more.

- Uses local software client which means pct keys and API keys are secure.

- Partnership with projects and exchanges to offer incentives to the users

Disadvantages:

- Difficult to understand, not for beginners.

Zignaly is still at its initial stage of development. However, users can use the free beta version of the bot. The final version of the app will be launched soon and users can avail of its services in exchange for fees.

Even at its basic level, zignaly has a handy interface and has been designed exclusively for the users.

- Zignaly is integrated with tradingview which allows it to trade on the binance trading exchange. Currently, it is working only with binance and hopes to integrate with other trading platforms in the future.

- Zignaly shares developer details openly in their community forums thus building a sense of trust and transparency among its users.

- The developers are always available in case there is any query from the customers.

- Traders here can customize their trading strategies and allows flexibility to its traders.

Wunderbit trading

Wunderbit is a trading platform which allows users to start trading and investing in cryptocurrency automatically. Users can copy and trade the best crypto traders with transparent track records or create fully automated trading bot using tradingview. Below are some remarkable features of the platform:

- Trading terminal: if it offers multi-exchange crypto trading terminal with strategy automation so that users can create orders: adding take profit and stop loss to any order on exchanges. Currently, supporting binance, kraken, kucoin, and bittrex exchange.

- Trading bots: with the help of tradingview’s pineeditor you can create any trading strategy for popular crypto pairs, backtesting any idea, and instantly see how profitable your strategy is.

- Social trading: investor can choose a trader of his choice to manage their investments for a commission which will be taken from profitable trades only.

- Free: all trading tools available are absolutely free of charge for users. Traders can start trading without any monthly subscription.

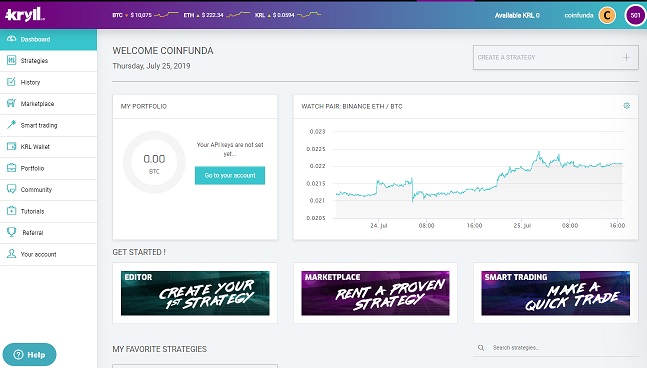

Launched in 2018, kryll.Io is one of the most advanced crypto trading bots and helps its traders to deal with the volatility of the market. Kryll.Io helps traders to create their very own trading strategy and predict the right moment to invest their funds.

- Io comes with a flexible editor and advanced features.

- Create your very own basic or advanced trading strategies with the drag and drop editor and that too can be done without any coding knowledge.

- The app comes with additional features like market indicators, risk analysis tools, and notification blocks.

- AI-based tools such as sentiment analysis and market trend prediction done by deep learning.

- Fees as low as 1% per month.

- Users can earn through affiliate programs by referring their friends and relatives.

- The publisher mode allows users to publish their trading strategies on the community and earn passive revenue.

Gunbot is a popular trading bot with over 6000 traders using its services daily. The app is available for windows, linux, and mac operating systems. It offers paid plans in BTC. Few important features are listed below:

- The app is available on multiple trading exchanges including binance and GDAX.

- Users can run it effectively in their local pcs without any trouble.

- Gunbot supports 32 different trading strategies including bollinger band, step gain, and ping pong.

- To avail the services of gunbot, users have to pay a one-time lifetime charge of 0.05BTC to 0.125BTC depending on the features they use. The lite version is available at lesser fees.

- The app comes with customer support and will resolve your issues within a day. However, users are advised to turn off their bot in case the market is too volatile to avoid the risk of losses.

Conclusion

Cryptocurrency trading bots are useful for automated trading and can be very profitable if used carefully. There are some trading software such as the bitcoin era platform which can be used for trading purposes. It is very much recommended to use any platform with proper knowledge and research and choose only reputed and secure bot software.

Best crypto trading bots in 2021 to make money (reviewed)

The high volatility in the crypto market attracted a lot of traders to cryptocurrency space. The more prices swing, the more people buy it and sell it at a high rate.

Therefore it makes more profits for the traders and higher fees for the exchange. It has led to the extensive use of trading bots, which we discussed in a previous post.

How does crypto trading bots work?

Cryptocurrency trading bot is a software program that integrates with different financial exchanges, usually by using the apis offered by the same exchanges. After that, these bots place both buy and sell orders for the user, based on the models and algorithms used when creating the bot.

Usually, these programs depend on multiple variables, such as volume, current orders, prices, volatility. In addition, custom bots can be further configured to be more complex and use prediction models or machine learning to increase profit.

Bots can catch the price movement that humans are prone to missing due to uninterrupted activity. The ability to watch all trading pairs, and the lack of emotions.

In the past, these tools were only accessible to large traders who could afford a 24,000 terminal. But with the advent of cryptocurrencies, many new platforms have entered the market. Each offering trading bots at competitive prices.

There are different types of crypto bots out there, but we have selected the best crypto trading bots based on the criteria below.

Evolution of crypto trading bot platforms

There used to be no trading bot creation platforms, so you had to code an algorithm yourself. This required traders to split their attention between learning trading, programming, and staying on top of the market.

Today there are amazing platforms that offer better user experience and save you the effort and time and allow you to use this technology formerly exclusive to large trading firms only.

You can become a better trader as you are creating the bot, backtesting, and learning about what works and does not in minutes.

Some platforms also allow you to copy trading bots created by someone else that is easy to use and launch. However, that comes with limited transparency and flexibility when it comes to adjusting the algorithms.

Crypto trading bot features

Historical data from exchanges and beyond

In order to create a strategy, you want to make sure that the platform offers enough flexibility when it comes to featured assets and exchanges.

You also want to make sure that historical data for backtesting is available and coming from a credible source.

Backtesting

Before you automate a trading strategy you might want to do thorough testing to ensure that the algorithm is rock solid and can be deployed with the real assets.

This will advance your trading skills greatly and make you less dependent on others. Results that are detailed, but easily digestible are imperative.

Trading indicators, candlestick patterns, and more

You need all indicators, candlestick patterns, price action, market caps, and dominance.

What is equally important is how you can combine them. It’s one thing being able to trade with RSI and it’s another to be able to combine BTC dominance with the price of stocks AND RSI.

User interface

UI/UX experience is essential, especially if it is designed for an entry-level individual without an extensive background in trading.

Trading strategy

Most professional traders rely on different trading strategies. Therefore, we must look at what strategies can the bot implement? What sort of order types it supports, and how much you can customize it?

Ease of use

Most bots include pre-preprogrammed strategies set up and ready to go. In addition, other bots allow the user to program them and create custom trading strategies. The right platform will depend on the coding experience of the end-user.

Cloud-based

The convenience and speed that come with cloud-based platforms are hard to overstate. The good thing is that most crypto bot platforms today are cloud-based, unlike their legacy market predecessors.

Security

Best crypto trading bots offer multiple authentication methods such as two factor authentication, API key encryption mechanisms. While choosing a trading bot, we should check for the protection methods. Other than that, privacy policies related to the user's trading data is increasingly important.

Pricing

Trading bots offer different pricing plans, such as subscription-based, one-time payment, trade volume. All these factors have to be taken into account while choosing a platform.

Software quality

Software quality is essential for bot performance. Glitches or bugs can be very problematic and wipe out your positions. While choosing a bot, one must test its features and read reviews by existing users.

Reputation

Researching forums, sites, and review platforms is critical. Good standing with the trading community is always a plus.

Exchange compatibility

Best crypto trading bots platforms support multiple exchanges. Therefore, while choosing a bot, always check if it supports the cryptocurrency exchange you use.

Support and knowledge base

As some tools are more complex than other having onboarding calls, responsive chats and educational content is more of a necessity than a perk.

So, without further a due in no particular order, let's list best trading bots.

Related resources

Best crypto trading bot platforms

Haasonline

Haasonline created by the company haas online software, founded by stephan de hass in january 2014. It quickly became one of the most experienced companies in regards to cryptocurrency trading bots.

Haasonline offer bots that are fully customizable, written in the C# programming language.

In addition, haasonline can automate altcoin trades and places no restrictions for altcoin pairs.

It is available for windows and linux, offering to make trades on a 24/7 basis. The bot itself makes use of over 50 technical indicators that become the basis for any trading decisions made by the program.

For the user, haasonline offers insurance services that cover partially lost due to technical malfunction.

The bot is currently compatible with over twenty of the largest and most popular cryptocurrency exchanges, which include major players such as binance, bitfinex, bitmex, coinbase pro, gemini, huobi, kraken, kucoin, and poloniex.

Use coupon "coincodecap"- get 15% discount

Haasonline trading bots

Within the server, you can find over 50 technical indicators, crypto bots, and different types of “insurances” for your bots.

It supports arbitrage, margin, and leverage trading as well as custom charting functionality. Instead of marketplace haasonline has a community library of scripts and 20+ supported exchanges.

When it comes to actual bot creation the platform is very different from a regular crypto trading bot platform. The interface inside the platform looks more like that of conventional trading software, rather than a simple to use tech.

On top of that as of now, there is no free trial and if you want to get a feel of the platform the only option is to try the demo servers.

All of this makes the platform quite complicated for novice traders and there is no surprise they want to launch a cloud solution. While it’s been a few months since the announcement the cloud version is not yet available.

Free trial and pricing

With no free tier and the most feasible option starting at 0.018 BTC there is a high barrier to purchase a platform that can’t be tested.

Conclusion

Server, complexity, pricing, lack of free trial — all of it makes it harder for haasonline to compete with newer more flexible, and transparent platforms out there. Being a leader and offering more than any other platform in the past it is harder for haasonline to compete with its rivals.

Also read our haasonline review.

CLEO.One

CLEO.One is a trading bot creation platform that caters to both novice and advanced traders.

With an emphasis on helping with developing trading skills needed for long term profitability.

It has a simple promise of providing strategy testing and automation and it is very transparent about the offer.

CLEO trading bots

CLEO.One has a dashboard for strategy creation and testing using more data than any other platform. You are empowered to create, test, and trade strategy-based bots and so become a better trader by creating your own bots.

With CLEO.One you get the functionality of a programable without learning how to code.

There is also a selection of free strategies that were already tested and paper-traded for inspiration, which can be deployed as bots in a matter of minutes.

You can also take free strategies as templates and adjust them to make it more profitable. Detailed analytics and statistics will come in handy.

Smart trade functionality is also available with CLEO.One. It was recently enhanced with conditional entry and exit making it the most powerful automated trading solution.

Free trial and pricing

CLEO.One has a trail account, a free account for binance users, and a starter account from $69 per month.

Conclusion

There is something about CLEO.One’s approach to trading through testing that really attracts traders that seek transparent and flexible solutions.

It allows you to be in control and have the visibility across all the trading bots, strategies and positions.

If you have that curiosity in testing your strategies and want to be able to tweak bots before testing them and test them before launching, then you will definitely find CLEO.One as a great learning tool that has the potential to generate passive income you desired.

Also read our CLEO review.

3commas

3commas is among the most respected trading bots in the market. It is a russian made software solution, the name alluding to the billion-dollar club. The company is a crypto trading terminal that features algorithmic trading and portfolio management. It features a smarttrade terminal that allows users to execute orders and trades and stop-loss/profit positions. To date, the service has over 33,000 active users and a daily trade volume, which regularly exceeds $10 million.

The platform has a 24/7 dedicated support staff for the platform's help desk center, their twitter and telegram. They are very active within the facebook groups and offer support in there too.

The user UI/UX for the platform is intuitive, and it is ideal for beginners. 3commas supports integration with several cryptocurrency exchanges, including bittrex, bitfinex, binance, bitstamp, kucoin, poloniex, hitbtc, CEX.Io, coinbase pro, okex, huobi, yobit, and GDAX.

3commas trading bots

When it comes to bot selection — it is wide when it comes to types: from, gorgon bot, to advanced bot and DCA bot.

- DCA or dollar cost averaging can be an effective strategy itself while it is more effective when adjusted and used with caution depending on market conditions (like any other strategy). 3commas offers a few predefined conditions for the entry like quickfingers luc or “open new trade asap”.

- The same applies to grid bot that is based on a range trading, but, again, it can turn ugly if market conditions change fast and currency switches from ranging to downtrend. There is also an option to use AI strategies.

- There are also a few technical analysis start conditions like RSI-& or ULT-7–14–28 and if that is what you’re looking for in a crypto bot you should be pretty happy with 3commas.

- When creating a strategy you can select a coin, amount to trade, and basic parameters like “number of grids to trade.” experienced traders might find it somewhat limited, random, and confusing. So there is no way you can actually optimize and improve the performance of the bot if that is your goal.

- 3commas provide quite ambitious stats on their bots profits with no other data available. It makes it hard to compare different bots against each other.

- Paper trading and backtesting is available, but with out-of-the-box bots and a 3-day free trial there is not much to analyze and adjust.

They also provide a marketplace full of trading signals, but again very little transparency or metrics to evaluate different signal providers against each other.

You are unable to see how many other users already use these signals, return since inception, risk and reward ratios, or any performance statistics that actually matter.

Free trial and pricing

You can try 3commas for free for 3 days and continue using based on a monthly fee starting from $29 monthly fee or $174 per year.

There is also an education program 3 commas sells for $197 to explain how to leverage the functionality of the platform.

It comes with coaching, but the application of the knowledge is quite impractical outside the platform.

Conclusion

3commas cater to crypto traders who are comfortable running bots with limited control. They have quite a few bots to offer with an overwhelming choice of exchanges and assets.

However, more experienced traders might find this combination rather a pandora box than a toolkit for success and better trading.

Nexfolio – the most awaited best AI crypto trading bot

“nexfolio is an ai crypto trading bot. It makes use of AI algorithms to predict future trends in the volatile crypto market. With the aid of AI. Trade signals, and other popular algorithms, the bot analyzes the fluctuations and places trade orders at the right time.”

Trading bots at a glance

Ai crypto trading bot trades on behalf of a crypto trader. They are automated computer protocols programmed with algorithms, candlestick patterns, and indicators to trade on the financial markets. Trading bots make the trading process a hassle-free and streamlined experience for crypto traders.

About nexfolio

Automation and artificial intelligence form the base for nexfolio, and the bot is suited for both novice and experienced traders. Nexfolio is designed with proven trading strategies after gathering requirements from multiple traders across the globe.

Nexfolio supports bitcoins as well as other cryptocurrencies. It needs little human attention, such as setting up stop loss and profit percentages, allocating the funds, and others.

Nexfolio bot interacts with the crypto exchanges directly, and places buy/sell orders automatically on behalf of the trader. It analyzes the ups and downs in the market and comes up with the best decision that brings higher profits.

Looking for profitable trading? Why don’t you make use of an automated and AI crypto trading bot #nexfolio

Why prefer ai crypto trading bots?

- Quick order execution

- Good execution speed is essential to achieve optimal trading. In many cases, traders are incapable of reacting quickly to the fluctuations in the coins’ prices.

- And, crypto exchange’s downtime and delay in transaction processing further exacerbate these problems.

- Trade without break

- It is difficult for traders to dedicate their entire time trading in the cryptocurrency markets.

- Spending as much time as possible always results in achieving the best trades.

- But doing so requires 24/7 monitoring of crypto exchanges across the globe.

So, to overcome all the challenges mentioned above, crypto traders are switching to trading bots.

Features of nexfolio crypto trading bot

- Crypto portfolio management

- Automated signal trading

- Fixed sell functionality

- Money & risk management

- Editable stop-loss & profit percentages, and a lot more

How does ai crypto trading bot work?

There are three moving parts that contribute to the working of the trading bot:

Signal generators

This is where trade predictions are made. Once predictions are made, the generated data will move into the signal generator, and then a trade signal (either buy or sell) pops up.

Signal generators work well in trading bots that are programmed with technical indicators.

Risk allocation

The function of this part is to consider the buy or sell signal and then decide how much assets to buy or how much assets to sell.

Order execution

In this part, the planned trade order is executed with respect to the market conditions (to get a favorable price).

Nexfolio bot vs. Humans

- Longevity: nexfolio crypto trading bot operates on a 24/7 * 365 basis, whereas we (humans) need some time to sleep and rest.

- Speed: nexfolio’s order execution speed is faster than the average human being’s thinking and reaction time.

- Emotionless: nexfolio is not driven by greed or fear (or does not pay heed to the volatility). They do what they are programmed to do.

- Capacity: nexfolio is designed to process tbs of data within seconds. But, traders can only do these things in their imagination.

Welcome to join the nexfolio community!

Have queries in trading? We’re ready to answer you.

So, let's see, what we have: crypto trading bots are all the hype right now. Properly configured bots can give you some really impressive results, these are our top picks at crypto coin trading bots

Contents

- Top forex bonus list

- The best crypto trading bots

- Best crypto trading bots: reviews 2021

- Crypto trading bot in 2021 | best 12 bitcoin trading bots

- Nowadays, lots of teams provide paid and free crypto trading bots for bitcoin and other...

- When should you use a crypto trading bot?

- #1 repetitive tasks

- #2 timing

- #3 complications can be simplified

- Crypto trading bot discounts and coupon codes ��

- The best crypto trading bot in 2021

- #1 quadency — A smarter way to trade and manage your crypto

- 4 best cryptocurrency arbitrage bot platforms for 2021

- How does crypto arbitrage work?

- Barriers to bitcoin arbitrage

- Best cryptocurrency arbitrage bots

- Best crypto trading bots in 2021 to make money (reviewed)

- How does crypto trading bots work?

- Evolution of crypto trading bot platforms

- Crypto trading bot features

- Historical data from exchanges and beyond

- Backtesting

- Trading indicators, candlestick patterns, and more

- User interface

- Trading strategy

- Ease of use

- Cloud-based

- Security

- Pricing

- Software quality

- Reputation

- Exchange compatibility

- Support and knowledge base

- Best crypto trading bot platforms

- Crypto trading bots: how to start bot trading crypto? - #cryptotrading

- Trading bots for DCA strategies

- Trading bots for TA strategies

- Crypto bots for lending strategies

- 3 best crypto grid trading bots (that actually work)

- 3 best automated grid trading bots:

- Conclusion: which grid bot to use?

- 8 best cryptocurrency trading bots [free, paid, open-source] for 2021

- What is crypto trading bot?

- How does a free cryptocurrency trading bot works?

- Advantages of cryptocurrency trading bots

- Features of a good cryptocurrency trading bot

- Best crypto trading bots

- Conclusion

- Best crypto trading bots in 2021 to make money (reviewed)

- How does crypto trading bots work?

- Evolution of crypto trading bot platforms

- Crypto trading bot features

- Historical data from exchanges and beyond

- Backtesting

- Trading indicators, candlestick patterns, and more

- User interface

- Trading strategy

- Ease of use

- Cloud-based

- Security

- Pricing

- Software quality

- Reputation

- Exchange compatibility

- Support and knowledge base

- Best crypto trading bot platforms

- Nexfolio – the most awaited best AI crypto trading bot

- Trading bots at a glance

- About nexfolio

- Why prefer ai crypto trading bots?

- Features of nexfolio crypto trading bot

- How does ai crypto trading bot work?

No comments:

Post a Comment