Bonus 2021

A new game releases every month! Every month, you can look forward to a new game release along with a FREE bonus attached to that game.

Top forex bonus list

- Free spins (if any),

- Any amounts in your cashable credit account which comprise of winnings from bonus credit,

- Any amounts in your cashable credit account which comprise of winnings from deposits,

- Any deposited amounts in your cashable credit account, and

- Any bonus amounts in your bonus credit account.

WITH UP TO 100 FREE SPINS!

The bonus boss is welcoming you with up to 100 free spins in the spinfather!

18+. New players only. Available via feature game. Free spins (18p) locked to the spinfather. Expires 7 days after registration. Winnings paid as bonus credit (40x WR). Max withdrawal from bonus winnings is £50. T&cs apply, begambleaware.Org

Verification pending

You can almost hit the reels!

The boss needs to verify some details before you're let loose on his reels. Why not register a card while you wait?

Wheel of fortune

Your bonus awaits

18+. New players only. Welcome bonus expires after 7 days. Up to 10 (20p) free spins on super win 7s for 10 days, min deposit £10. Winnings paid as bonus credit. Expire 00:00 every day. Max withdrawal from free spins and welcome bonus winnings £200. Up to 200% deposit match of first deposit (min £10). Max £100 awarded as bonus credit. 20x wagering on bonus credit. Withdrawing unspent qualifying deposit will exclude the player from these promotions. T&cs apply begambleaware.Org

Scratch card

Your bonus awaits

Bonus ball bonanza

Your bonus awaits

REFER A FRIEND

SHARE THE BOSS BONUSES!

18+. Referred friends must deposit and wager through £10 for award of up to £5 bonus. Expires after 7 days. Bonuses subject to 40x wagering requirement. Max withdrawal from bonus winnings £50. The referred player withdrawing unspent deposit will exclude the referrer from this promotion. T&cs apply, begambleaware.Org

DEPOSIT BONUS

UP TO 300% DEPOSIT BOOST & UP TO 100 FREE SPINS AWAIT!

Unlock your BOSS deposit bonuses when you deposit today!

18+. New players only. Min deposit £10. Deposit bonuses expire after 30 days. First deposit: up to 200% (max bonus £100), up to 50 free spins (15p) locked to supernova crush. Second deposit: up to 100% (max bonus £200), up to 50 free spins (20p) locked to coins of fortune. Winnings paid as bonus credit (40x WR). Withdrawing qualifying deposit excludes player from promotion. T&cs apply, begambleaware.Org

Great games, great rewards.

A new game releases every month! Every month, you can look forward to a new game release along with a FREE bonus attached to that game.

Boss bonuses

We reward you just for playing!

If the best casino bonuses and promotions are what you’re looking for as we move into 2021, then look no further than bonus boss. As a top UK casino, we have incredible bonuses that include free spins with no deposit , and an up to 300% deposit boost! There's something for everyone at bonus boss, from an unbeatable casino welcome bonus , to an amazing refer a friend offer. So what are you waiting for? Grab a boss bonus and play today!

Unlock an up to £5 FREE BONUS when you refer your friends to bonus boss!

18+. Referred friends must deposit and wager through £10 for award of up to £5 bonus. Expires after 7 days. Bonuses subject to 40x wagering requirement. Max withdrawal from bonus winnings £50. The referred player withdrawing unspent deposit will exclude the referrer from this promotion. T&cs apply, begambleaware.Org

UP TO 300% DEPOSIT BOOST & UP TO 100 FREE SPINS AWAIT!

18+. New players only. Min deposit £10. Deposit bonuses expire after 30 days. First deposit: up to 200% (max bonus £100), up to 50 free spins (15p) locked to supernova crush. Second deposit: up to 100% (max bonus £200), up to 50 free spins (20p) locked to coins of fortune. Winnings paid as bonus credit (40x WR). Withdrawing qualifying deposit excludes player from promotion. T&cs apply, begambleaware.Org

Play on bonus boss for your chance to win some BOSS BONUSES!

18+. 40x wagering requirement. Max withdrawal from bonus winnings without depositing is £50. Specific T&cs apply to each bonus. Begambleaware.Org.

Bonus boss likes to keep things FRESH, with monthly new releases!

18+. Winnings awarded as bonus credit with 40x wagering requirement. Max withdrawal from bonus winnings is £50. Specific T&cs apply to each bonus. Begambleaware.Org.

WELCOME, WITH UP TO 100 FREE SPINS!

18+. New players only. Available via feature game. Free spins (18p) locked to the spinfather. Expires 7 days after registration. Winnings paid as bonus credit (40x WR). Max withdrawal from bonus winnings is £50. T&cs apply, begambleaware.Org

WELCOME, WITH UP TO 100 FREE SPINS!

Activation

Online slots and casino games

The best casino bonuses

Security and privacy

Helpful links

Promotional terms and conditions

Section 6: valid stakes, bets or wagers

You may stake up to the amount of the balance available in your account. We do not offer accounts with a credit facility.

Winnings which are generated from promotional free spins will go into your bonus credit account.

When a bet or stake is placed and confirmed, the corresponding amount is deducted from your account balance.

Game specific rules will be made available to you when you start playing a game. These rules can be located on the website and within each game. These are referred to as the rules of the games. It is your responsibility to read and understand these game specific rules before you start playing.

It is your responsibility to check that the bet instructions you have submitted are correct before committing to play.

Winnings from deposits will go into your cashable credit account.

All bonuses (including winnings from promotional free spins) will be credited to your bonus credit account and are subject to the bonus credit wagering requirement. Winnings from bonus credit will also be credited to your bonus credit account.

Once your bonus credit wagering requirement balance is £0, any remaining bonus credit will automatically be transferred as winnings to your cashable credit account.

If your bonus credit account balance is £0, you should contact us to remove any remaining wagering requirements from your account. You can contact our customer support team on 01384 885046.

In the event that you withdraw cashable credit before you have met your bonus credit wagering requirement (i.E. Before your bonus credit wagering requirement balance is £0) your bonus credit and bonus credit wagering requirement will be reduced by the same percentage that you have withdrawn from your cashable credit. By way of example only: you have made a first deposit of £10, credited to your cashable credit account, and received a first deposit match bonus of £10, credited to your bonus credit account; your bonus credit wagering requirement balance is £400 (i.E. 40 x bonus of £10); you play through your £10 deposit once on a slots game and win £50. Your bonus credit wagering requirement balance is unchanged (as you have not yet staked any bonus credit); you are free to withdraw the £50 winnings, stored in your cashable credit account, but you choose to only withdraw £25 (i.E. 50%); as your bonus credit wagering requirement balance is not yet £0, you will forfeit 50% of your bonus credit (reducing it to £5) and your bonus credit wagering requirement balance will be reduced by 50% (reducing it to £200).

If bonus abuse is discovered we may at our discretion remove rewards as outlined in section 7b.

In the event that you stake both cashable credit and bonus credit, any winnings will be applied proportionately to your cashable credit and bonus credit accounts and your bonus credit wagering requirement balance will be reduced only by the amount of bonus credit used. By way of example only: you have deposited £5, credited to your cashable credit account, and have received a first deposit match bonus of £5, credited to your bonus credit account; your bonus wagering requirement is £200 (i.E. 40 x bonus of £5); you elect to stake £10 on a slots game; as you do not have enough cashable credit to cover your stake, the remaining £5 (50%) will be deducted from your bonus credit and your bonus credit wagering requirement balance will be reduced by £5 to £195; you win £50; £25 of your winnings (i.E. 50%) will be credited to your cashable credit account; and £25.00 of your winnings (i.E. 50%) will be credited to your bonus credit account.

When betting on our betting and gaming products, the percentage of your stake that will contribute to the bonus credit wagering requirement is as follows:

When playing with bonus credit winnings from casino games, the wagering contribution taken from the remaining bonus wagering will be the contribution % of the casino game that the winnings came from, regardless of which game in being played. For example, if you win £10 on roulette, then play with that £10 in a slots game, the wagering contribution for the slots play will be 10% (the casino game wagering contribution).

Stakes from your account will be made in this order:

- Free spins (if any);

- Any amounts in your cashable credit account which comprise of winnings from bonus credit;

- Any amounts in your cashable credit account which comprise of winnings from deposits;

- Any deposited amounts in your cashable credit account; and

- Any bonus amounts in your bonus credit account.

By placing a real money bet, you warrant that you are legally able to do so within your jurisdiction and that you accept that we are unable to provide any warranties as to the legality or otherwise of your participation in real money play. It is your responsibility to determine if remote gambling is legal in your jurisdiction.

In the event of a disconnection from the service whilst you are using our betting and gaming products, you are advised to log back in as quickly as possible. If you experience disconnection difficulties on a regular basis, please consult your service provider as to what measures can be initiated to help reduce this risk. We shall not be responsible for any damages, liabilities or losses suffered as result of the disconnection of players during play.

Section 7: bonuses

Section 7a: general rules applicable to bonuses

We offer a number of opportunities for players to qualify for bonus credit which is added to a player’s bonus credit account. This includes, for new players, the introductory free spins, deposit activated free spins and the deposit match bonuses. Other bonuses are available from time to time. All bonuses can be used to win real money.

All bonuses will be subject to successful verification of your identity (name, address and date of birth). No bonuses can be used until the process is complete.

Bonuses will be added to your bonus credit account. All bonuses are subject to the bonus wagering requirement and specific game stake contribution % as stated in section 6 term 39. Winnings arising out of bonus credit will also be credited to your bonus credit account. Once your bonus credit wagering requirement balance is £0, any remaining bonus credit will automatically be transferred as winnings to your cashable credit account.

When you download a game with a free bonus attached, the bonus can be claimed only once. There will be no bonuses for subsequent downloads of the same game by you.

You may receive regular updates by text message advising you of bonuses received depending on your account settings.

From time to time we may offer bonuses that, if not used, expire after a certain time period. Please note that if the bonus is not used within this time period, it will disappear from your account.

If you sign up to a promotion offering a free bonus or free spins without the need to make a deposit the maximum withdrawal that you can make is £50 on bonus boss if you are a UK player and £50/ 50 euros/ $50 or other currency equivalent if you are a non-UK player. This withdrawal limit applies to each promotion of this type providing you have made at least one deposit on your respective account. If you have not made any deposits then this withdrawal limit is applied throughout the lifetime of your respective account for funds won from promotions of this type.

Furlough extended until march, job retention bonus scrapped

The furlough scheme has been extended until the end of march 2021, with the government continuing to cover 80% of employees’ wages at firms affected by coronavirus restrictions, the chancellor rishi sunak has announced.

In a statement to the house of commons this afternoon, sunak said employers will only be required to cover national insurance and pension contributions for employees who have been furloughed under the extended coronavirus job retention scheme, which has essentially reverted back to the scheme that was in place between march and august 2020.

Our highest priority remains the same – to protect jobs and livelihoods” – rishi sunak

However, he noted that the level of wage support offered to employers would be reviewed in january, when organisations may be asked to contribute more depending on how the economy is recovering.

Sunak clarified that the support will also apply to employers in scotland, wales and northern ireland, as there had been confusion surrounding whether the extended CJRS was available to devolved nations when it was announced alongside england’s 28-day lockdown last weeked.

“our highest priority remains the same – to protect jobs and livelihoods,” said sunak.

The planned job support scheme will essentially be replaced by the furlough scheme for the time being.

He added that the job retention bonus –a £1,000 one-off payment to firms that had retained previously-furloughed staff until the end of january 2021 – would be scrapped for now and replaced with a new “retention incentive” that would be deployed at an “appropriate time”.

The employment support scheme for the self-employed is being made more generous and will be worth 80% of profits, instead of 40%.

Covid-19 latest

His announcement came just hours after the bank of england launched a £150bn stimulus package designed to lower borrowing costs to help struggling businesses and individuals.

Pressure on the government to extend support for employers has mounted over recent weeks, as coronavirus infections have risen and restrictions were reintroduced in parts of the UK.

The level of financial support offered to employers has gradually fallen since the CJRS was introduced in march, with the government covering 60% of furloughed employees’ wages in october. That changed on saturday when the prime minister announced the lockdown that started in england today, together with an extension of the CJRS “until december”.

In fact, the CJRS has not been extended, but restarted, with the rate of support last seen in august and eligibility applied to all staff, not just those previously furloughed between march and june.

Under the government’s tiered approach to lockdown and the postponed job support scheme, workers in areas subject to the most stringent tier 3 measures receive 67% of their normal salary up to a maximum of £2,100 a month.

Labour’s shadow chancellor anneliese dodds criticised the government’s slow response to the economic fallout of the local lockdowns imposed under the tier system and the uncertainty this had created for businesses, and noted the government hadn’t acted when wales implemented a two-week ‘firebreak’ lockdown.

She also referred to the extensions as the fourth major change to furlough in six weeks.

Sunak responded: “it is not a weakness to be agile and fast-moving in the face of a crisis, but rather a strength.”

Confusion, but relief

Responding the the announcement, CIPD chief executive peter cheese said the frequent changes to the support on offer had left employers confused and many job had been lost unnecessarily.

“employers have been left confused by the government’s plans to protect jobs over the last few weeks, with many redundancies triggered over the uncertainty around the end of the furlough scheme and the introduction of two new job support schemes,” he said.

“jobs have already been lost unnecessarily through short-term thinking because of the lack of longer term certainty of support, and it is crucial policy makers try and look further ahead and work with employers to help them plan forwards and protect employment as much as possible.

“we would also urge government to provide more support for those people who do lose their jobs with funding for training, coaching and support to find alternative work.”

Musab hemsi, a partner at law firm lexleyton said the news would come as a relief to many struggling organisations, but more information was still required to enable firms to plan effectively.

“it will give business leaders the financial assurance and time they need to plan and weigh up their options as they look beyond this lockdown with a view to reopening, in some capacity, for the festive period,” said hemsi.

“now that businesses have this commitment from the chancellor, a period of stability is sorely needed. UK companies have been through a turbulent period and government support has at times been changed at the last minute and announced without sufficient information for businesses. We need to see a treasury direction – ideally this week – to enshrine the new plan and give employers the information they need. From here, businesses should have a solid foothold to firm up their plans for the remainder of the year and looking ahead to 2021.”

A ‘good move’

Neil carberry, chief executive of the recruitment and employment confederation, said: “businesses want support that is stable across the crisis, rather than changing week-to-week. So the extension of the furlough scheme to the end of march is a good move.

“but there is more to do. The fight against the virus is being compromised by the failure to fund statutory sick pay for every worker if they need to self-isolate. The vast majority of businesses supplying temporary workers, who are vital to sectors like education, logistics and care, are ineligible for SSP support -–and a stand-off over who pays could lead to greater economic damage, as work gets shelved.

“we need to keep hiring demand as high as we can. Lowering the cost of labour by reducing employers national insurance contributions, the biggest business tax, is one measure which will help.”

Jonathan geldart, director general of the institute of directors, said extending furlough was the right call and would give directors more confidence about keeping staff through the winter. But he added that the government was “still failing to fix major gaps” in the support. “many self-employed, including small company directors, continue to be left out in the cold. Grant funding through local authorities could help address this issue.

“it’s clear that the government needs to now reinstate and extend insolvency protections to prevent company collapses,” he said, adding that the chancellor should look to marry defensive measures like furlough with policies to get firms on the front foot to encourage job creation and investment through the tax system.”

Chase is introducing new spending bonuses for 1Q 2021 [targeted]

Some links to products and travel providers on this website will earn traveling for miles a commission that helps contribute to the running of the site. Traveling for miles has partnered with cardratings for our coverage of credit card products. Traveling for miles and cardratings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

Updated 31 january 2020: the chase disney card is also offering a spending bonus

The last quarter of this year saw chase offering a variety of targeted spending bonuses across its co-branded card portfolio, and now the bank appears set to introduce a new wave of targeted spending bonuses for the first quarter of 2021.

Of the three major US card issuers, chase has probably been the one that has gone furthest to ensure that its cards remain relevant during a year that has been like no other that most of us can remember. The additional spending bonuses that we’ve seen offered on the bank’s own cards, the enhanced (temporary) benefits we’ve seen on the sapphire cards, and the bonuses offered on chase’s cobranded cards, have certainly made sure that I’ve been using my chase credit card collection a lot more than I would otherwise had done (given the year we’ve had) so it was great to see frequent miler report that a new set of bonuses are coming our way for 1Q 2021.

New chase spending bonuses

Ordinarily, if you want to see what bonuses chase has targeted you for you should head over to chase.Com/mybonus, enter your name, your zip code and the last 4 digits of your chase credit card and the site will show you if you have any promotions waiting for you. However, right now all that site will show you are the promotions that are set to end tomorrow, 31 december 2020 and they’re not much use to anyone anymore.

The guys at frequent miler (together with one of the site’s readers), however, have been playing around with some of the urls that chase uses for its promotions and they’ve uncovered a number of promotions that are set to launch from friday, 1 january 2021.

Be aware that although there are links available to the registration pages for these new offers, you may have to wait until friday (and use the chase.Com/mybonus website) to register for these offers as chase may not yet have finished targeting cardholders.

If you’ve been targeted for one or more of the new offers, this is what you can expect:

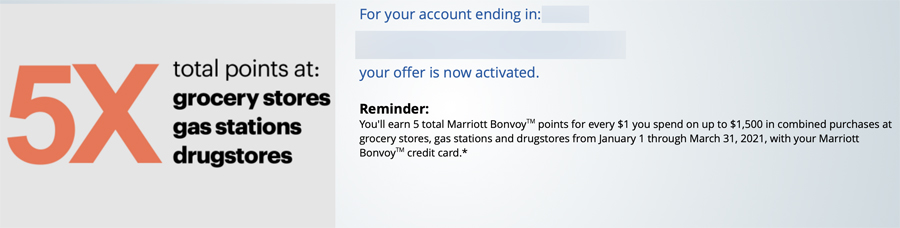

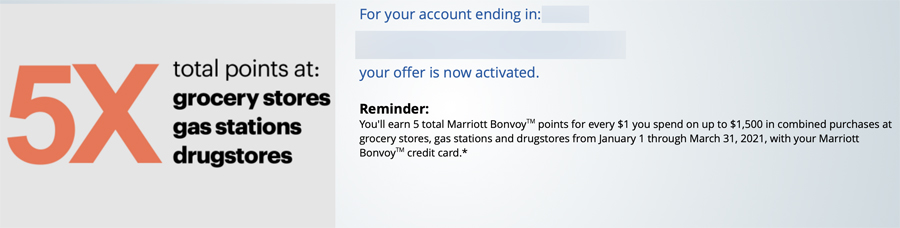

Marriott, ritz-carlton, IHG, disney & united co-branded cards

Earn 5 points per dollar on up to $1,500 in combined spending at grocery stores, gas stations, & at drugstores.

It’s important to note that what’s being offered is a total of 5 points per dollar and not an additional 5 points per dollar so bear that in mind when deciding if you should take chase up on this promotion (assuming you’re targeted).

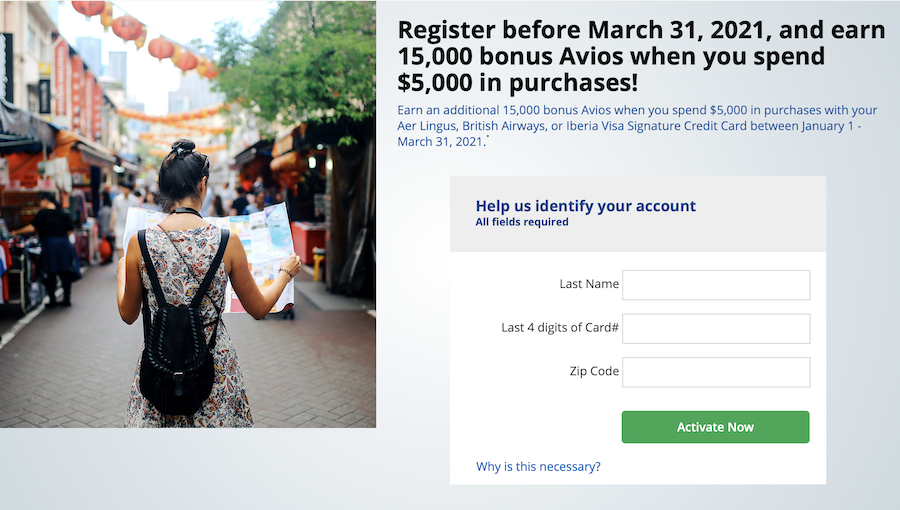

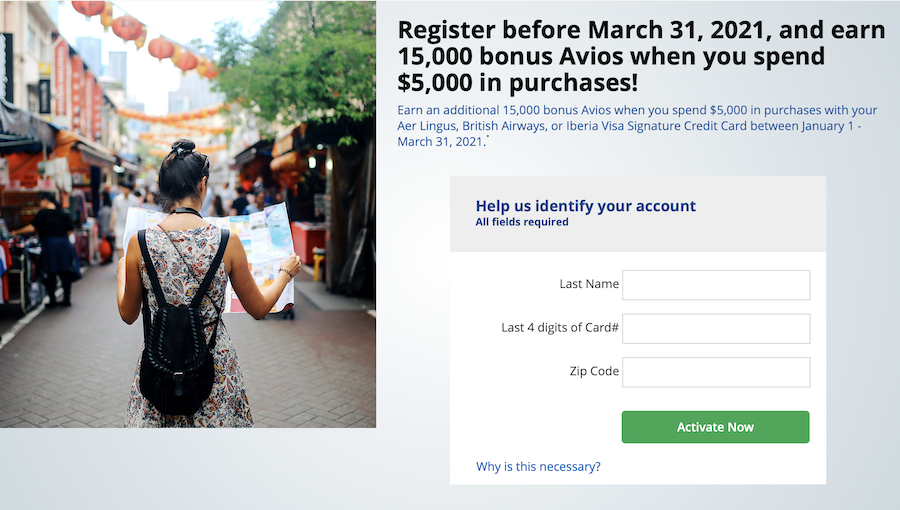

Avios-earning credit cards (BA, iberia & aer lingus)

Earn 15,000 bonus avios when you spend $5,000 on your avios-earning chase credit card by 31 march 2021.

In the case of this promotion, the avios that are being offered are in addition to the avios a cardholder would earn in the normal course of spending so if any cardholders have any british airways, iberia, or aer lingus spending that they’ll be doing in 1Q, the bonus avios could be earned alongside the solid earnings the cards offer for spending with their respective airlines.

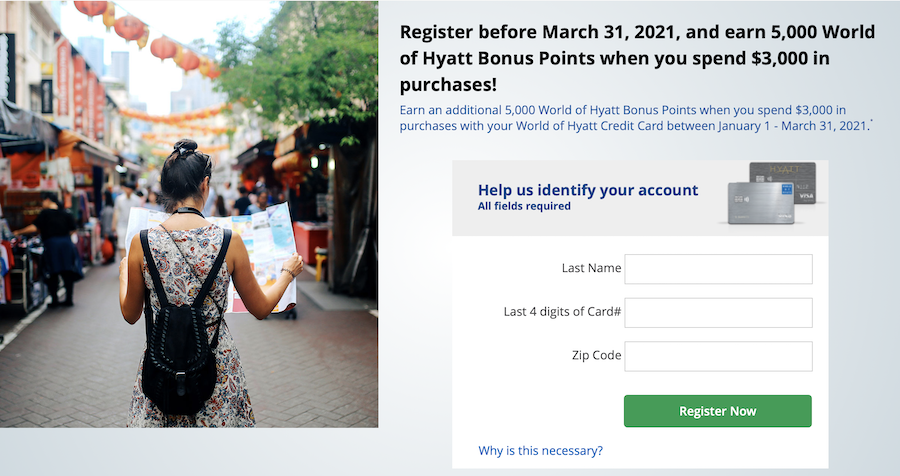

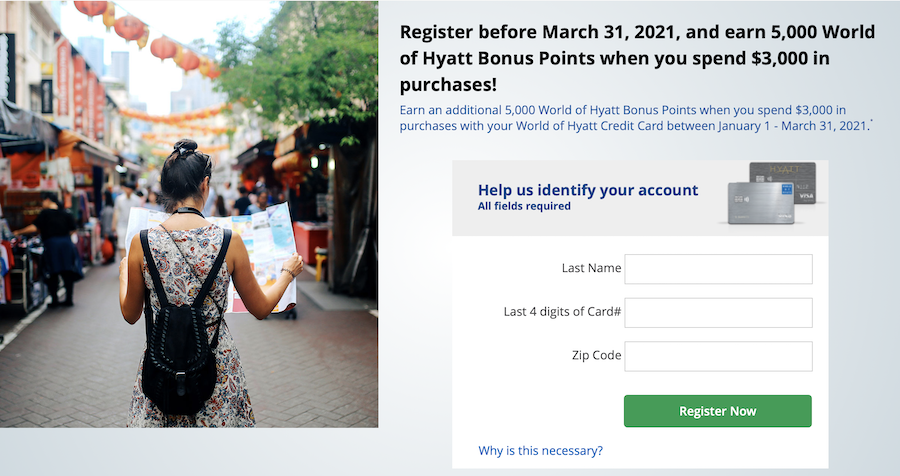

Hyatt co-branded credit cards

Earn 5,000 bonus world of hyatt points when you spend $3,000 on your hyatt co-branded credit card by 31 march 2021.

As with the promotion that’s being targeted at the avios-earning credit cards, the world of hyatt points that this promotion is offering are in addition to the points a cardholder would earn in the normal course of spending.

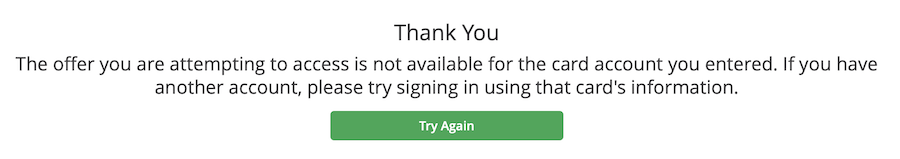

You may not be able to register yet

As I mentioned earlier, although there are links available to the registration pages for these new offers, you may have to wait until friday (and use the chase.Com/mybonus website) to register as chase may not yet have finished targeting cardholders.

So far, I have been able to register my ritz-carlton credit card for the 1Q bonuses…

…but my IHG rewards credit card and my world of hyatt credit card are both currently giving me a message that indicates that I haven’t been targeted.

Hopefully, come friday this will change – I’m very keen to combine the spending I’m putting on my world of hyatt credit card (as I aim to earn the card’s welcome bonus) with the bonus points that th1q hyatt card promotion appears to be offering.

Bottom line

If you hold a chase co-branded credit card there’s a good chance that you’re about to be targeted for a first-quarter spending bonus. Don’t forget to compare the special bonuses that chase is offering to the value you can get from the other cards in your portfolio as the 1Q bonuses may not be the best deals open to you (cards like amex’s blue cash prefered card still offer a considerably better return at US supermarkets that any of the chase co-branded cards) and don’t forget to visit chase.Com/mybonus on friday if the links above don’t lead you to a targeted offer.

Have you been targeted for any of these bonus offers?

A favorite card with A fantastic welcome bonus

25,000 bonus points after spending $3,000 within the first 3 months + an additional 25,000 bonus points after spending $6,000 (in total) within the first 6 months of account opening.

Our favorite benefits:

- 4 points/dollar at hyatt properties worldwide

- 2 points/dollar at fitness clubs and gyms

- World of hyatt discoverist status for as long as you hold the card

- 5 elite night credits every year

- 2 elite night credits for every $5,000 spent on the world of hyatt credit card

- A free night certificate valid at category 1 – 4 properties every year

Regarding comments

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser or any other advertiser. It is not the bank advertiser’s responsibility or any other advertiser’s responsibility to ensure all posts and/or questions are answered.

3 COMMENTS

The disney card is getting the same 5% cash back offer as well.

Thanks! Post now updated to reflect this.

I want a disney debit card

LEAVE A REPLY cancel reply

Search the site

Subscribe

Credit card news & offers

Why the marriott bonvoy brilliant card is A must-have card if you pay MVCI fees/dues

The best cards to use for grocery spending (right now)

ENDING: get A huge 140,000 points bonus with the IHG rewards club premier card

Deals

7-day american airlines fare sale – europe roundtrip from under $500

FLASH SALE: save 40% on alaska airlines fares (today only)

TODAY ONLY: american airlines sale for US beach locations – roundtrip fares from $83!

Recent comments

- Ziggy on virgin atlantic isn’t devaluing delta awards as badly as first suggested

- Ziggy on virgin atlantic isn’t devaluing delta awards as badly as first suggested

- The jetset boyz on british airways makes real improvements to short-haul economy class catering

- James lovejoy on virgin atlantic isn’t devaluing delta awards as badly as first suggested

- John ( jack) steffek on amazing. Marriott just lost 122 properties in north america (including a major hawaii resort)

Miles & points on sale

United mileage sale: buy miles with A 100% bonus

Ends tonight: buy hilton points & book luxury 5-night stays for just $1,900

LAST CHANCE: save 25% on world of hyatt points (stack with 25% off award bookings)

Air fare deals

7-day american airlines fare sale – europe roundtrip from under $500

FLASH SALE: save 40% on alaska airlines fares (today only)

TODAY ONLY: american airlines sale for US beach locations – roundtrip fares from $83!

Related posts

Why the marriott bonvoy brilliant card is A must-have card if.

The best cards to use for grocery spending (right now)

ENDING: get A huge 140,000 points bonus with the IHG rewards.

Don’t forget to register for (and use) the freedom flex 1Q.

Disclaimers & disclosures

Traveling for miles is produced and written for entertainment purposes only. The contributors to this site are not investment advisors, financial planners, nor legal or tax professionals. All articles here represent an opinion and are general in nature and should not be relied upon for individual circumstances.

Advertiser disclosure: some links to products and travel providers on this website will earn traveling for miles a commission that helps contribute to the running of thesite. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. Traveling for miles has partnered with cardratings for our coverage of credit card products. Traveling for miles and cardratings may receive a commission from card issuers.

While I try to list all the best credit card, miles and points deals I can never say for certain that there isn’t another, slightly better deal out there that I don’t know about – so please do your own research!

Editorial disclosure: the editorial content on the pages of traveling for miles is not provided by any airline, hotel group, bank or credit card company and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Regarding comments: responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser or any other advertiser. It is not the bank advertiser’s responsibility or any other advertiser’s responsibility to ensure all posts and/or questions are answered.

Best brokerage account bonuses in january 2021

Brokerages are aggressively competing for your money. One way they do so is by offering competitive bonuses that you can add right to your brokerage account. It's important to know the best offers so that you can decide whether it's a good time to open a brokerage account and take advantage of what is often risk-free cash.

Popular searches

Here bankrate tracks the best brokerage account bonuses to help you compare active offers.

Best brokerage account bonuses in january 2021

- Ally invest: $50 to $3,500

- Merrill edge: $150 to $900

- Charles schwab: $100 to $500 (personally referred friend offer)

- E-trade: $50 to $2,500

Ally invest: $50, $200, $300, $600, $1,200, $2,500 or $3,500 bonus

New ally invest clients can earn up to a $3,500 cash bonus if they open a new account by march 31, 2021. The qualifying deposit must contain funds from outside of ally financial, and a person can only get the offer on one new ally invest securities LLC account. As an extra incentive, ally will credit your transfer fees from another brokerage, up to $150 as long as you bring at least $2,500 over to the new account.

Ally invest checks your deposit 60 days after your account is opened to determine the total qualifying deposit. You'll receive your cash bonus within 10 business days after this review.

To receive a cash bonus, you must:

- Deposit at least $10,000 in a new ally invest account.

- Be a U.S. Resident.

- Not be an existing ally invest account holder or a former ally invest account holder (which includes former tradeking securities LLC account holders). You’re not eligible to receive the cash bonus if you closed one of these ally invest accounts within the past 90 days.

You must use the "open account" button associated with this offer on ally invest's site for opening your account to be eligible for this offer.

Here are the bonus tiers for this offer:

- To receive the $50 bonus, deposit or transfer $10,000-$24,999.

- To receive the $200 bonus, deposit or transfer $25,000-$99,999.

- To receive the $300 bonus, deposit or transfer $100,000-$249.999.

- To receive the $600 bonus, deposit or transfer $250,000-$499,999.

- To receive the $1,200 bonus, deposit or transfer $500,000-$999,999.

- To receive the $2,500 bonus, deposit or transfer $1 million -$1,999,999.

- To receive the $3,500 bonus, deposit or transfer $2 million or more.

Once you receive your bonus, both the cash bonus and your qualifying deposit (minus any trading losses that are incurred) can't be withdrawn for 300 days. A withdrawal may cause ally invest to revoke your bonus.

Read bankrate’s ally invest review to learn more.

Merrill edge: $150, $225, $375 or $900 bonus

When you open a merrill edge IRA or cash management account and make a qualifying deposit within 45 days of opening you can earn up to a $900 bonus. You need to use offer code 900ME during the account opening. This can be done while applying online or using it when speaking to a merrill edge financial adviser on the phone or at select bank of america branches. This offer expires april 15, 2021.

To receive a cash reward, you must:

- Enroll for the offer at the time of account opening.

- Deposit net new assets of at least $20,000 into your merrill edge account within 45 days of opening the account.

- You must be enrolled in the preferred rewards program within 90 days of making the deposit.

- Maintain that balance for at least 90 days.

The offer limits you to one IRA - rollover, traditional, roth and sole-proprietor SEP only - and one cash management account. Each account holder can't have more than two enrolled accounts.

Assets from bank of america, merrill lynch, pierce, fenner & smith incorporated (MLPF&S), U.S. Trust, or 401(k) accounts administered by MLPF&S aren't qualifying net new assets.

You'll receive your cash reward two weeks after the initial 90-day period, assuming you meet eligibility requirements.

Business/corporate accounts, investment club accounts, partnership accounts and certain types of fiduciary accounts held at merrill edge aren't eligible for this offer. The offer also doesn't apply to accounts, which include iras or cmas, held with other business units of MLPF&S.

Here are the bonus tiers:

- To receive the $150 cash reward, deposit $20,000 to $49,999.99.

- To receive the $225 cash reward, deposit $50,000 to $99,999.99.

- To receive the $375 cash reward, deposit $100,000 to $199,999.99.

- To receive the $900 cash reward, deposit $200,000 or more.

Read bankrate’s merrill edge review to learn more.

Charles schwab: $100, $200, $300 or $500 (if you’re referred by a friend)

Schwab is offering personally referred friends the opportunity to earn up to $500 when they use a referral code, given to you by a current schwab customer, and open an eligible account at schwab.

To receive the bonus award, you must:

- Receive a referral code from a friend or family member.

- Be a new schwab client and make a qualifying net deposit within 45 days of both becoming a schwab customer and opening an eligible retail brokerage account.

You're limited to one per account and only one account per client when you receive a referral.

Schwab retail brokerage accounts and iras are eligible for this offer. This includes accounts that are enrolled in schwab-sponsored investment advisery programs, such as schwab intelligent portfolios, schwab managed portfolios, schwab managed account select and connection and schwab private client.

You'll receive your bonus approximately a week or two after the 45-day period ends if you made a qualifying deposit when becoming a new schwab customer and enrolling in the referral offer.

Schwab may charge back its bonus award if taxable accounts aren't kept at schwab for at least one year.

Here are the bonus tiers for this offer:

- To receive a $100 bonus, deposit $1,000-$24,999.

- To receive a $200 bonus, deposit $25,000-$49,999.

- To receive a $300 bonus, deposit $50,000-$99,999.

- To receive a $500 bonus, deposit $100,000 or more.

Read bankrate’s charles schwab review to learn more.

E-trade: $50, $100, $150, $200, $300, $600, $1,200 or $2,500 bonus

You can earn a cash bonus if you open a retirement or brokerage account and fund it with $5,000 or more within 60 days of account opening. Your account must be opened by jan. 31, 2021.

To receive a cash bonus, you must:

- Use promo code WINTER21 when opening the account.

- Open your new account with funds or securities from accounts outside of E-trade. You need to also keep the new account (minus any trading losses) for at least 12 months to keep the cash bonus.

Here are the cash bonus tiers for this offer:

- To receive a $50 bonus, deposit or transfer $5,000-$9,999.

- To receive a $100 bonus, deposit or transfer $10,000-$19,999.

- To receive a $150 bonus, deposit or transfer $20,000-$24,999.

- To receive a $200 bonus, deposit or transfer $25,000-$99,999.

- To receive a $300 bonus, deposit or transfer $100,000-$249,999.

- To receive a $600 bonus, deposit or transfer $250,000-$499,999.

- To receive a $1,200 bonus, deposit or transfer $500,000-$999,999.

- To receive a $2,500 bonus, deposit or transfer $1 million or more.

Read bankrate’s E-trade review to learn more.

Christmas bonus: DWP urged to increase £10 sum to £130 in 2021 - 'people deserve better'

CHRISTMAS BONUS payments have meant many britons have received a one-off tax-free £10 payment this festive season.

Universal credit: DWP rollout 'confirm your identity' service

However, a new petition criticising the government campaigns for an increase to the sum. The christmas bonus is intended to provide a one-off sum of extra money to the millions of people who are in receipt of benefits and payments from the department for work and pensions (DWP). It is paid to those who receive these payments in the qualifying week, which is usually the first full week of december.

READ MORE

2020 marks 48 years since the christmas bonus payment was first introduced, and understandably there have been many changes to life as we know it since then.

The pensioners' payments and social security act of 1979 established the christmas bonus permanently, however, the sum does not rise.

This, a new petition has said, represents a particular problem, and the government has been urged to reconsider their approach to the sum.

The petition has been published on parliament’s official website, and is entitled ‘increase the DWP christmas bonus for benefit claimants in line with inflation’.

Christmas bonus: DWP urged to increase sum to £130 in 2021 after this year’s ‘measly’ payment (image: getty)

We will use your email address only for sending you newsletters. Please see our privacy notice for details of your data protection rights.

It reads: “the christmas bonus was introduced in 1972.

“since then, inflation has lowered the cost of the pound significantly, yet the £10 number remained the same.

“with inflation taken into account, the bonus should actually be around £130.

“we want the government to account for inflation in these payments.”

To receive the christmas bonus under current rules, a person must be present, or ordinarily resident in the UK, channel islands, isle of man, gibraltar, switzerland or any european economic area (EEA) country during the qualifying week.

Related articles

It should be provided automatically to those who are eligible to receive it.

However, the petition also went on to raise other issues with the sum as it currently stands.

It continued: “the DWP christmas bonus for benefit claimants is a measly £10 - hardly enough to cover the costs associated with holidays.

“it is almost insulting to be presented with an amount of money this small.

Christmas bonus: state pensioners are some of the britons receiving a christmas bonus (image: EXPRESS)

READ MORE

“this is the equivalent of 76p before inflation, when many to us are already living hand to mouth and in constant fear of getting our benefits reassessed or revoked.

“disabled and low-income people deserve better.”

The petition was created this morning by an individual named magnus kai gorny, and will run for six months, until june 30, 2021.

At 10,000 signatures, the government will be required to look at the petition with a formal response issued.

If it were to climb above 100,000 signatures, the petition would be considered for debate in parliament.

The debate surrounding the christmas bonus has been a lengthy one, and similar issues were raised with the sum last year.

Related articles

Sara willcocks, head of communications at the charity turn2us, also urged the government to increase the sum.

She said: “in 1972, £10 could go a long way and would have been enough to help see a family through the festive period.

“today it’s barely enough to buy a joint of meat - let alone a full christmas dinner.

“we urge the government to not just keep the christmas bonus, but to increase it, at least in line with the rate of inflation, and to remember the reason why it was established in the first place.”

Check if you can claim the job retention bonus from 15 february 2021

Find out if you’re eligible to claim the job retention bonus and what you need to do to claim it. You will be able to claim it between 15 february 2021 and 31 march 2021.

This guidance was withdrawn on 5 november 2020

The job retention bonus will no longer be paid in february, as the coronavirus job retention scheme has been extended until the end of march 2021. Further details about the extension are available.

You cannot claim the job retention bonus until 15 february 2021. This guidance will be updated by the end of january 2021 with how to access the online claim service on GOV.UK.

The job retention bonus is a £1,000 one-off taxable payment to you (the employer), for each eligible employee that you furloughed and kept continuously employed until 31 january 2021.

You’ll be able to claim the bonus between 15 february 2021 and 31 march 2021. You do not have to pay this money to your employee.

Who can claim

You can claim the bonus if you’re an employer who has furloughed employees and made an eligible claim for them through the coronavirus job retention scheme. Your employee must have been eligible for the coronavirus job retention scheme grant for you to be eligible for the bonus.

You can still claim the bonus if you make a claim for that employee through the job support scheme. Guidance on the job support scheme will be published soon.

If you have repaid coronavirus job retention scheme grant amounts to HMRC

You cannot claim the bonus for any employees that you have not paid using the coronavirus job retention scheme grant because you have repaid all the grant amounts you claimed for them. This applies regardless of the reason why you repaid the grant amounts.

Employees you can claim for

You can claim for employees that:

- You made an eligible claim for under the coronavirus job retention scheme

- You kept continuously employed from the end of the claim period of your last coronavirus job retention scheme claim for them, until 31 january 2021

- Are not serving a contractual or statutory notice period for you on 31 january 2021 (this includes people serving notice of retirement)

- You paid enough an amount in each relevant tax month and enough to meet the job retention bonus minimum income threshold

If HMRC are still checking your coronavirus job retention scheme claims, you can still claim the job retention bonus but your payment may be delayed until those checks are completed.

HMRC will not pay the bonus if you made an incorrect coronavirus job retention scheme claim and your employee was not eligible for the coronavirus job retention scheme.

Employees who have been transferred to you under TUPE or due to a change in ownership

You may be eligible to claim the job retention bonus for employees of a previous business which were transferred to you if:

- TUPE rules applied

- The PAYE business succession rules applied

- The employees were associated with the transfer of a business from the liquidator of a company in compulsory liquidation where TUPE would have applied if the company was not in compulsory liquidation

To claim the job retention bonus for employees that have been transferred to you, you must have furloughed and successfully claimed for them under the coronavirus job retention scheme, as their new employer. The employees must also meet all the relevant eligibility criteria for the job retention bonus.

This means that you will not be able to claim the job retention bonus for any employees who are transferred to you after the coronavirus job retention scheme closes on 31 october 2020.

Claiming for an individual who’s not an employee

You can claim the job retention bonus for individuals who are not employees, such as office holders or agency workers, as long as you claimed a grant for them under the coronavirus job retention scheme and the other job retention bonus eligibility criteria are met.

The minimum income threshold

To be eligible for the bonus you must make sure that your employees have been paid at least the minimum income threshold.

To meet the minimum income threshold you must pay your employee a total of at least £1,560 (gross) throughout the tax months:

- 6 november to 5 december 2020

- 6 december 2020 to 5 january 2021

- 6 january to 5 february 2021

You must pay your employee at least one payment of taxable earnings (of any amount) in each of the relevant tax months.

The minimum income threshold criteria apply regardless of:

- How often you pay your employees

- Any circumstances that may have reduced your employee’s pay in the relevant tax periods, such as being on statutory leave or unpaid leave

We will check that your employees have been paid at least the minimum income threshold by checking information you’ve submitted through full payment submissions via real time information (RTI).

What payments are included in the minimum income threshold

Only payments recorded as taxable pay will count towards the minimum income threshold. Taxable pay is reported to HMRC as a single figure through full payment submissions via real time information (RTI).

If you are making redundancies

If you make redundancies, you must comply with the normal rules for redundancy, which include using fair redundancy criteria. These rules apply even if this means that fewer of your employees are eligible for the job retention bonus.

Get ready to claim

You cannot claim the bonus until 15 february 2021. This guidance will be updated by the end of january 2021 with details on how to access the online claim service on GOV.UK.

Before you can claim the bonus, you will to need to have reported all payments made to your employee between 6 november 2020 and 5 february 2021 to HMRC through full payment submissions via real time information (RTI).

There are some steps you need to take now to make sure you’re ready to claim.

- Still be enrolled for PAYE online

- Comply with your PAYE obligations to file PAYE accurately and on time under real time information (RTI) reporting for all employees between 6 april 2020 and 5 february 2021

- Keep your payroll up to date and make sure you report the leaving date for any employees that stop working for you before the end of the pay period that they leave in

- Use the irregular payment pattern indicator in real time information (RTI) for any employees not being paid regularly

- Comply with all requests from HMRC to provide any employee data for past coronavirus job retention scheme claims

Using an agent to do PAYE online and claim the job retention bonus

If you use an agent who is authorised to do PAYE online for you, they will be able to claim the job retention bonus on your behalf.

This guidance will be updated by the end of january 2021 with details on how agents can claim the bonus for you.

Tax treatment of the job retention bonus

You must include payments you receive under the scheme as income when you calculate your taxable profits for income tax and corporation tax purposes.

Businesses can deduct employment costs as normal when calculating taxable profits for income tax and corporation tax purposes.

Individuals with employees that are not employed as part of a business (such as nannies or other domestic staff) will not have to pay tax on grants received under the scheme.

When the government ends the scheme

You will have until 31 march 2021 to make a job retention bonus claim after which the scheme will close. No further claims will be accepted after this date.

You will not be able to claim until 15 february 2021 and this guidance will be updated by the end of january 2021 with details on how to access the online claim service.

Contacting HMRC

We are receiving very high numbers of calls. Contacting HMRC unnecessarily puts our essential public services at risk during these challenging times.

Get help online

Use HMRC’s digital assistant to find more information about the coronavirus support schemes. You can also contact HMRC if you cannot get the help you need online.

Other help and support

You can watch videos and register for free webinars to learn more about the support available to help you deal with the economic impacts of coronavirus.

Furlough extended until march, job retention bonus scrapped

The furlough scheme has been extended until the end of march 2021, with the government continuing to cover 80% of employees’ wages at firms affected by coronavirus restrictions, the chancellor rishi sunak has announced.

In a statement to the house of commons this afternoon, sunak said employers will only be required to cover national insurance and pension contributions for employees who have been furloughed under the extended coronavirus job retention scheme, which has essentially reverted back to the scheme that was in place between march and august 2020.

Our highest priority remains the same – to protect jobs and livelihoods” – rishi sunak

However, he noted that the level of wage support offered to employers would be reviewed in january, when organisations may be asked to contribute more depending on how the economy is recovering.

Sunak clarified that the support will also apply to employers in scotland, wales and northern ireland, as there had been confusion surrounding whether the extended CJRS was available to devolved nations when it was announced alongside england’s 28-day lockdown last weeked.

“our highest priority remains the same – to protect jobs and livelihoods,” said sunak.

The planned job support scheme will essentially be replaced by the furlough scheme for the time being.

He added that the job retention bonus –a £1,000 one-off payment to firms that had retained previously-furloughed staff until the end of january 2021 – would be scrapped for now and replaced with a new “retention incentive” that would be deployed at an “appropriate time”.

The employment support scheme for the self-employed is being made more generous and will be worth 80% of profits, instead of 40%.

Covid-19 latest

His announcement came just hours after the bank of england launched a £150bn stimulus package designed to lower borrowing costs to help struggling businesses and individuals.

Pressure on the government to extend support for employers has mounted over recent weeks, as coronavirus infections have risen and restrictions were reintroduced in parts of the UK.

The level of financial support offered to employers has gradually fallen since the CJRS was introduced in march, with the government covering 60% of furloughed employees’ wages in october. That changed on saturday when the prime minister announced the lockdown that started in england today, together with an extension of the CJRS “until december”.

In fact, the CJRS has not been extended, but restarted, with the rate of support last seen in august and eligibility applied to all staff, not just those previously furloughed between march and june.

Under the government’s tiered approach to lockdown and the postponed job support scheme, workers in areas subject to the most stringent tier 3 measures receive 67% of their normal salary up to a maximum of £2,100 a month.

Labour’s shadow chancellor anneliese dodds criticised the government’s slow response to the economic fallout of the local lockdowns imposed under the tier system and the uncertainty this had created for businesses, and noted the government hadn’t acted when wales implemented a two-week ‘firebreak’ lockdown.

She also referred to the extensions as the fourth major change to furlough in six weeks.

Sunak responded: “it is not a weakness to be agile and fast-moving in the face of a crisis, but rather a strength.”

Confusion, but relief

Responding the the announcement, CIPD chief executive peter cheese said the frequent changes to the support on offer had left employers confused and many job had been lost unnecessarily.

“employers have been left confused by the government’s plans to protect jobs over the last few weeks, with many redundancies triggered over the uncertainty around the end of the furlough scheme and the introduction of two new job support schemes,” he said.

“jobs have already been lost unnecessarily through short-term thinking because of the lack of longer term certainty of support, and it is crucial policy makers try and look further ahead and work with employers to help them plan forwards and protect employment as much as possible.

“we would also urge government to provide more support for those people who do lose their jobs with funding for training, coaching and support to find alternative work.”

Musab hemsi, a partner at law firm lexleyton said the news would come as a relief to many struggling organisations, but more information was still required to enable firms to plan effectively.

“it will give business leaders the financial assurance and time they need to plan and weigh up their options as they look beyond this lockdown with a view to reopening, in some capacity, for the festive period,” said hemsi.

“now that businesses have this commitment from the chancellor, a period of stability is sorely needed. UK companies have been through a turbulent period and government support has at times been changed at the last minute and announced without sufficient information for businesses. We need to see a treasury direction – ideally this week – to enshrine the new plan and give employers the information they need. From here, businesses should have a solid foothold to firm up their plans for the remainder of the year and looking ahead to 2021.”

A ‘good move’

Neil carberry, chief executive of the recruitment and employment confederation, said: “businesses want support that is stable across the crisis, rather than changing week-to-week. So the extension of the furlough scheme to the end of march is a good move.

“but there is more to do. The fight against the virus is being compromised by the failure to fund statutory sick pay for every worker if they need to self-isolate. The vast majority of businesses supplying temporary workers, who are vital to sectors like education, logistics and care, are ineligible for SSP support -–and a stand-off over who pays could lead to greater economic damage, as work gets shelved.

“we need to keep hiring demand as high as we can. Lowering the cost of labour by reducing employers national insurance contributions, the biggest business tax, is one measure which will help.”

Jonathan geldart, director general of the institute of directors, said extending furlough was the right call and would give directors more confidence about keeping staff through the winter. But he added that the government was “still failing to fix major gaps” in the support. “many self-employed, including small company directors, continue to be left out in the cold. Grant funding through local authorities could help address this issue.

“it’s clear that the government needs to now reinstate and extend insolvency protections to prevent company collapses,” he said, adding that the chancellor should look to marry defensive measures like furlough with policies to get firms on the front foot to encourage job creation and investment through the tax system.”

Chase is introducing new spending bonuses for 1Q 2021 [targeted]

Some links to products and travel providers on this website will earn traveling for miles a commission that helps contribute to the running of the site. Traveling for miles has partnered with cardratings for our coverage of credit card products. Traveling for miles and cardratings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

Updated 31 january 2020: the chase disney card is also offering a spending bonus

The last quarter of this year saw chase offering a variety of targeted spending bonuses across its co-branded card portfolio, and now the bank appears set to introduce a new wave of targeted spending bonuses for the first quarter of 2021.

Of the three major US card issuers, chase has probably been the one that has gone furthest to ensure that its cards remain relevant during a year that has been like no other that most of us can remember. The additional spending bonuses that we’ve seen offered on the bank’s own cards, the enhanced (temporary) benefits we’ve seen on the sapphire cards, and the bonuses offered on chase’s cobranded cards, have certainly made sure that I’ve been using my chase credit card collection a lot more than I would otherwise had done (given the year we’ve had) so it was great to see frequent miler report that a new set of bonuses are coming our way for 1Q 2021.

New chase spending bonuses

Ordinarily, if you want to see what bonuses chase has targeted you for you should head over to chase.Com/mybonus, enter your name, your zip code and the last 4 digits of your chase credit card and the site will show you if you have any promotions waiting for you. However, right now all that site will show you are the promotions that are set to end tomorrow, 31 december 2020 and they’re not much use to anyone anymore.

The guys at frequent miler (together with one of the site’s readers), however, have been playing around with some of the urls that chase uses for its promotions and they’ve uncovered a number of promotions that are set to launch from friday, 1 january 2021.

Be aware that although there are links available to the registration pages for these new offers, you may have to wait until friday (and use the chase.Com/mybonus website) to register for these offers as chase may not yet have finished targeting cardholders.

If you’ve been targeted for one or more of the new offers, this is what you can expect:

Marriott, ritz-carlton, IHG, disney & united co-branded cards

Earn 5 points per dollar on up to $1,500 in combined spending at grocery stores, gas stations, & at drugstores.

It’s important to note that what’s being offered is a total of 5 points per dollar and not an additional 5 points per dollar so bear that in mind when deciding if you should take chase up on this promotion (assuming you’re targeted).

Avios-earning credit cards (BA, iberia & aer lingus)

Earn 15,000 bonus avios when you spend $5,000 on your avios-earning chase credit card by 31 march 2021.

In the case of this promotion, the avios that are being offered are in addition to the avios a cardholder would earn in the normal course of spending so if any cardholders have any british airways, iberia, or aer lingus spending that they’ll be doing in 1Q, the bonus avios could be earned alongside the solid earnings the cards offer for spending with their respective airlines.

Hyatt co-branded credit cards

Earn 5,000 bonus world of hyatt points when you spend $3,000 on your hyatt co-branded credit card by 31 march 2021.

As with the promotion that’s being targeted at the avios-earning credit cards, the world of hyatt points that this promotion is offering are in addition to the points a cardholder would earn in the normal course of spending.

You may not be able to register yet

As I mentioned earlier, although there are links available to the registration pages for these new offers, you may have to wait until friday (and use the chase.Com/mybonus website) to register as chase may not yet have finished targeting cardholders.

So far, I have been able to register my ritz-carlton credit card for the 1Q bonuses…

…but my IHG rewards credit card and my world of hyatt credit card are both currently giving me a message that indicates that I haven’t been targeted.

Hopefully, come friday this will change – I’m very keen to combine the spending I’m putting on my world of hyatt credit card (as I aim to earn the card’s welcome bonus) with the bonus points that th1q hyatt card promotion appears to be offering.

Bottom line

If you hold a chase co-branded credit card there’s a good chance that you’re about to be targeted for a first-quarter spending bonus. Don’t forget to compare the special bonuses that chase is offering to the value you can get from the other cards in your portfolio as the 1Q bonuses may not be the best deals open to you (cards like amex’s blue cash prefered card still offer a considerably better return at US supermarkets that any of the chase co-branded cards) and don’t forget to visit chase.Com/mybonus on friday if the links above don’t lead you to a targeted offer.

Have you been targeted for any of these bonus offers?

A favorite card with A fantastic welcome bonus

25,000 bonus points after spending $3,000 within the first 3 months + an additional 25,000 bonus points after spending $6,000 (in total) within the first 6 months of account opening.

Our favorite benefits:

- 4 points/dollar at hyatt properties worldwide

- 2 points/dollar at fitness clubs and gyms

- World of hyatt discoverist status for as long as you hold the card

- 5 elite night credits every year

- 2 elite night credits for every $5,000 spent on the world of hyatt credit card

- A free night certificate valid at category 1 – 4 properties every year

Regarding comments

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser or any other advertiser. It is not the bank advertiser’s responsibility or any other advertiser’s responsibility to ensure all posts and/or questions are answered.

3 COMMENTS

The disney card is getting the same 5% cash back offer as well.

Thanks! Post now updated to reflect this.

I want a disney debit card

LEAVE A REPLY cancel reply

Search the site

Subscribe

Credit card news & offers

Why the marriott bonvoy brilliant card is A must-have card if you pay MVCI fees/dues

The best cards to use for grocery spending (right now)

ENDING: get A huge 140,000 points bonus with the IHG rewards club premier card

Deals

7-day american airlines fare sale – europe roundtrip from under $500

FLASH SALE: save 40% on alaska airlines fares (today only)

TODAY ONLY: american airlines sale for US beach locations – roundtrip fares from $83!

Recent comments

Miles & points on sale

United mileage sale: buy miles with A 100% bonus

Ends tonight: buy hilton points & book luxury 5-night stays for just $1,900

LAST CHANCE: save 25% on world of hyatt points (stack with 25% off award bookings)

Air fare deals

7-day american airlines fare sale – europe roundtrip from under $500

FLASH SALE: save 40% on alaska airlines fares (today only)

TODAY ONLY: american airlines sale for US beach locations – roundtrip fares from $83!

Related posts

Why the marriott bonvoy brilliant card is A must-have card if.

The best cards to use for grocery spending (right now)

ENDING: get A huge 140,000 points bonus with the IHG rewards.

Don’t forget to register for (and use) the freedom flex 1Q.

Disclaimers & disclosures

Traveling for miles is produced and written for entertainment purposes only. The contributors to this site are not investment advisors, financial planners, nor legal or tax professionals. All articles here represent an opinion and are general in nature and should not be relied upon for individual circumstances.

Advertiser disclosure: some links to products and travel providers on this website will earn traveling for miles a commission that helps contribute to the running of thesite. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. Traveling for miles has partnered with cardratings for our coverage of credit card products. Traveling for miles and cardratings may receive a commission from card issuers.

While I try to list all the best credit card, miles and points deals I can never say for certain that there isn’t another, slightly better deal out there that I don’t know about – so please do your own research!

Editorial disclosure: the editorial content on the pages of traveling for miles is not provided by any airline, hotel group, bank or credit card company and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Regarding comments: responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser or any other advertiser. It is not the bank advertiser’s responsibility or any other advertiser’s responsibility to ensure all posts and/or questions are answered.

So, let's see, what we have: bonus boss - UK licensed online casino 2021 ✅ up to 100 free spins ✅ no deposit bonus ✅ award winning online slots games ⏩ join now! T&cs apply. At bonus 2021

Contents

- Top forex bonus list

- WITH UP TO 100 FREE SPINS!

- Verification pending

- Wheel of fortune

- Scratch card

- Bonus ball bonanza

- REFER A FRIEND

- DEPOSIT BONUS

- Great games, great rewards.

- Boss bonuses

- Unlock an up to £5 FREE BONUS when you refer your friends to bonus boss!

- UP TO 300% DEPOSIT BOOST & UP TO 100 FREE SPINS AWAIT!

- Play on bonus boss for your chance to win some BOSS BONUSES!

- Bonus boss likes to keep things FRESH, with monthly new releases!

- WELCOME, WITH UP TO 100 FREE SPINS!

- Online slots and casino games

- The best casino bonuses

- Security and privacy

- Helpful links

- Promotional terms and conditions

- Furlough extended until march, job retention bonus scrapped

- Covid-19 latest

- Confusion, but relief

- A ‘good move’

- Chase is introducing new spending bonuses for 1Q 2021 [targeted]

- New chase spending bonuses

- Marriott, ritz-carlton, IHG, disney & united co-branded cards

- Avios-earning credit cards (BA, iberia & aer lingus)

- Hyatt co-branded credit cards

- You may not be able to register yet

- Bottom line

- A favorite card with A fantastic welcome bonus

- Regarding comments

- 3 COMMENTS

- LEAVE A REPLY cancel reply

- Why the marriott bonvoy brilliant card is A must-have card if you pay MVCI fees/dues

- The best cards to use for grocery spending (right now)

- ENDING: get A huge 140,000 points bonus with the IHG rewards club premier card

- 7-day american airlines fare sale – europe roundtrip from under $500

- FLASH SALE: save 40% on alaska airlines fares (today only)

- TODAY ONLY: american airlines sale for US beach locations – roundtrip fares from $83!

- United mileage sale: buy miles with A 100% bonus

- Ends tonight: buy hilton points & book luxury 5-night stays for just $1,900

- LAST CHANCE: save 25% on world of hyatt points (stack with 25% off award bookings)

- 7-day american airlines fare sale – europe roundtrip from under $500

- FLASH SALE: save 40% on alaska airlines fares (today only)

- TODAY ONLY: american airlines sale for US beach locations – roundtrip fares from $83!

- Why the marriott bonvoy brilliant card is A must-have card if.

- The best cards to use for grocery spending (right now)

- ENDING: get A huge 140,000 points bonus with the IHG rewards.

- Don’t forget to register for (and use) the freedom flex 1Q.

- Best brokerage account bonuses in january 2021

- Best brokerage account bonuses in january 2021

- Ally invest: $50, $200, $300, $600, $1,200, $2,500 or $3,500 bonus

- Merrill edge: $150, $225, $375 or $900 bonus

- Charles schwab: $100, $200, $300 or $500 (if you’re referred by a friend)

- E-trade: $50, $100, $150, $200, $300, $600, $1,200 or $2,500 bonus

- Christmas bonus: DWP urged to increase £10 sum to £130 in 2021 - 'people deserve better'

- CHRISTMAS BONUS payments have meant many britons have received a one-off tax-free £10 payment this...

- Universal credit: DWP rollout 'confirm your identity' service

- READ MORE

- Related articles

- READ MORE

- Related articles

- Check if you can claim the job retention bonus from 15 february 2021

- This guidance was withdrawn on 5 november 2020

- Who can claim

- Employees you can claim for

- Employees who have been transferred to you under TUPE or due to a change in ownership

- Claiming for an individual who’s not an employee

- The minimum income threshold

- Get ready to claim

- Using an agent to do PAYE online and claim the job retention bonus

- Tax treatment of the job retention bonus

- When the government ends the scheme

- Contacting HMRC

- Furlough extended until march, job retention bonus scrapped

- Covid-19 latest

- Confusion, but relief

- A ‘good move’

- Chase is introducing new spending bonuses for 1Q 2021 [targeted]

- New chase spending bonuses

- Marriott, ritz-carlton, IHG, disney & united co-branded cards

- Avios-earning credit cards (BA, iberia & aer lingus)

- Hyatt co-branded credit cards

- You may not be able to register yet

- Bottom line

- A favorite card with A fantastic welcome bonus

- Regarding comments

- 3 COMMENTS

- LEAVE A REPLY cancel reply

- Why the marriott bonvoy brilliant card is A must-have card if you pay MVCI fees/dues

- The best cards to use for grocery spending (right now)

- ENDING: get A huge 140,000 points bonus with the IHG rewards club premier card

- 7-day american airlines fare sale – europe roundtrip from under $500

- FLASH SALE: save 40% on alaska airlines fares (today only)

- TODAY ONLY: american airlines sale for US beach locations – roundtrip fares from $83!

- United mileage sale: buy miles with A 100% bonus

- Ends tonight: buy hilton points & book luxury 5-night stays for just $1,900

- LAST CHANCE: save 25% on world of hyatt points (stack with 25% off award bookings)

- 7-day american airlines fare sale – europe roundtrip from under $500

- FLASH SALE: save 40% on alaska airlines fares (today only)

- TODAY ONLY: american airlines sale for US beach locations – roundtrip fares from $83!

- Why the marriott bonvoy brilliant card is A must-have card if.

- The best cards to use for grocery spending (right now)

- ENDING: get A huge 140,000 points bonus with the IHG rewards.

- Don’t forget to register for (and use) the freedom flex 1Q.

No comments:

Post a Comment