Crypto currency transaction fees

Image source: getty images. But the big question probably on cryptocurrency enthusiasts' minds is this: which virtual currencies offer the lowest transaction fees, on average?

Top forex bonus list

According to data found at bitinfocharts.Com, this was the average transaction fee breakdown for march 26, 2018, presented in order of descending cost:

Which cryptocurrencies have the lowest transaction fees?

Surprise! Investing in virtual currencies could mean paying up to three different types of fees.

Whether you're a fan of cryptocurrency or not, you have to recognize that it's the fastest growing asset class since 2017 began. Whereas the stock market delivered a well-above-average return in 2017 and has vacillated in 2018, the aggregate market cap of virtual currencies has soared from $17.7 billion at the beginning of 2017 to $297 billion as of march 27, according to coinmarketcap.Com. That's an increase in value of close to 1,600%, and it's a big reason retail investors have become enamored with this burgeoning asset class.

The 411 on cryptocurrency transaction fees

However, there's a lot about cryptocurrencies that the average american probably has no clue about. For instance, there's the fact that most virtual currencies have transaction fees attached. We're familiar with the idea of buying and selling stock and paying a brokerage firm for being the facilitator of that transaction, but similar (and additional) fees can be charged in the cryptocurrency market, depending on the token and exchange.

Image source: getty images.

Today, we'll take a brief look at the types of transaction fees you may encounter if you choose to invest in cryptocurrencies, and we'll examine which cryptocurrencies, among the largest by market cap, offer the lowest transaction fees.

In total, there are three transaction fees you could be hit with when dealing with cryptocurrencies:

Exchange fees: this first transaction fee is one we should be familiar with, as it describes the idea of paying a "commission" to complete a buy or sell order. Most cryptocurrency exchanges tend to use a fixed-fee format, but the actual cost of transaction fees can vary by platform. In essence, it's always smart to do some homework and find out which crypto exchanges offer the lowest transaction fees.

However, another model known as maker-taker exists within crypto exchanges that can cause transaction fees to fluctuate, as described by hype.Codes. The maker (seller of cryptocurrency)-taker (buyer of cryptocurrency) model charges a variable fee based on your amount of trading activity. If you're an active trader, or one who has transacted a high dollar amount over, say, a 30-day rolling period, you as the maker may qualify for a reduced transaction fee.

Image source: getty images.

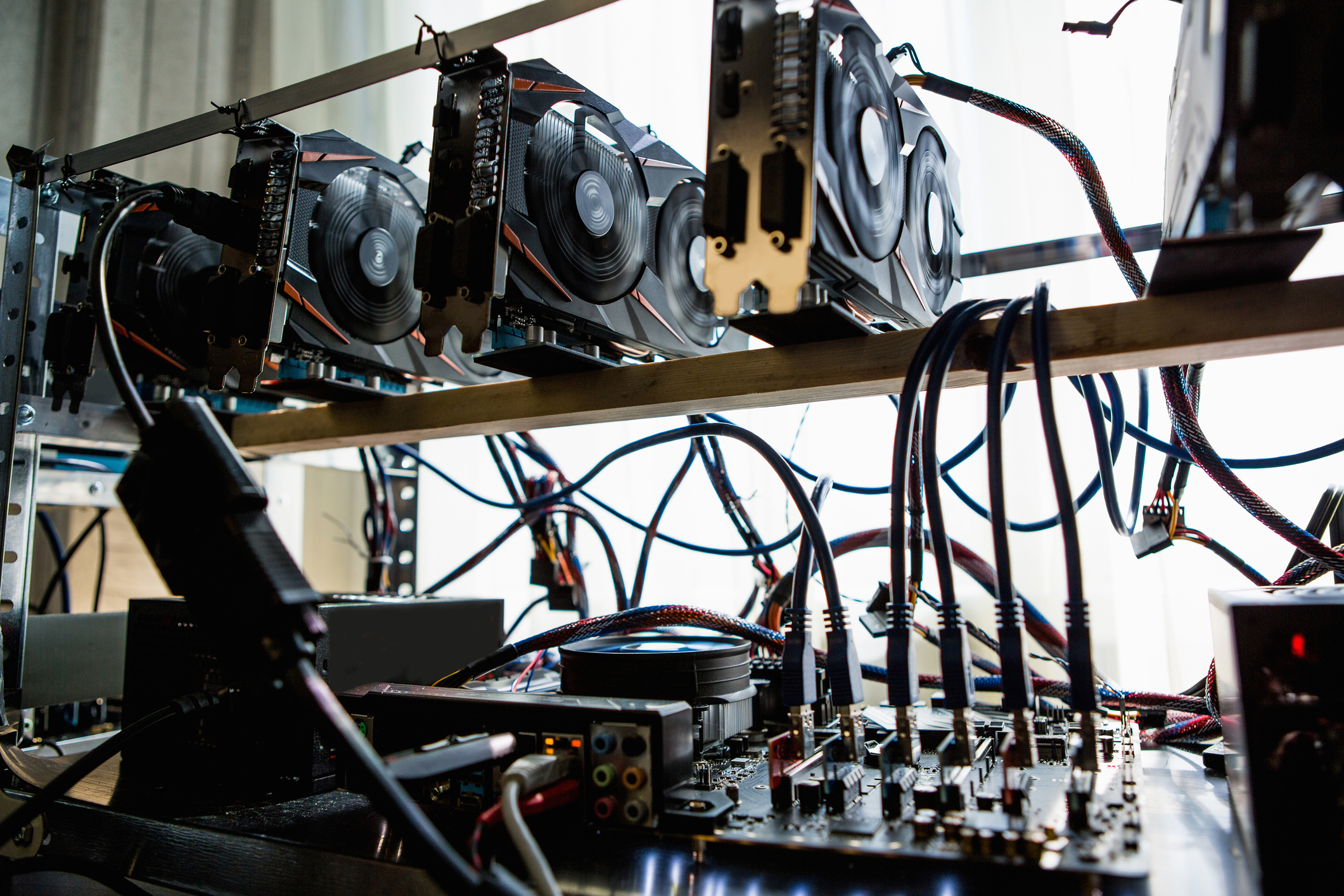

Network fees: next, you may be required to pay transaction fees in order to incentivize cryptocurrency miners. Miners are nothing more than persons with high-powered computers who are charged with verifying and validating transactions to be added to a blockchain. In short, they make sure that tokens weren't spent twice and that transactions are indeed true.

The validation of these transactions can vary by network, with miners setting their own price, and investors or crypto users choosing whether or not to accept it. Of course, the obvious should be stated: the lower transaction fee an investor or crypto user is willing to pay, the longer that transaction could take to be validated, as it'll be a low priority for miners.

Wallet fees: lastly, it's possible you'll pay fees to store your cryptocurrency in a digital wallet. The software used to develop wallets, as well as updates, isn't free, meaning you might owe a nominal amount to store your cryptocurrency.

Which cryptocurrencies sport the lowest average transaction fees?

But the big question probably on cryptocurrency enthusiasts' minds is this: which virtual currencies offer the lowest transaction fees, on average? According to data found at bitinfocharts.Com, this was the average transaction fee breakdown for march 26, 2018, presented in order of descending cost:

- Monero: $2.587

- Bitcoin: $1.184

- Dash: $0.363

- Ethereum: $0.347

- Litecoin: $0.198

- Bitcoin cash: $0.097

- EOS: $0.0105

- Ripple: $0.0037

- TRON: $0.0000901

First of all, yes, there's some arbitrariness to this data. Not all large cryptocurrencies are included in bitinfocharts.Com's data pull, and some virtual currencies over a $1 billion market cap were left off by yours truly to keep this list from growing to be a mile long. However, some very clear trends emerge.

Image source: getty images.

For example, you'll note that privacy coins monero and dash are among the most expensive in terms of transaction fees. Adding extra layers of anonymity to protect sender, receiver, and transaction-amount data from being traced isn't cheap.

You'll also note that some of the most popular networks have comparatively higher transaction costs. Examples include bitcoin at $1.184 and ethereum at $0.347. Miners on these networks understand how popular these virtual currencies are with businesses and consumers, so they have some degree of pricing power when setting their validation fee. If users don't choose to accept this fee, they could be in for a long wait.

By comparison, ripple and TRON have some of the lowest transaction fees around. Ripple's niche focus on financial institutions sort of narrows the XRP token's use as a mainstream currency. However, ripple's blockchain and ability to expedite on-demand liquidity for financial institutions for costs of just a fraction of a penny make it a popular choice for cryptocurrency investors. Not surprisingly, it's currently the third-largest virtual currency by market cap, and briefly surged to no. 2 in january.

Low fees and quick transactions - an intro to bitcoin cash!!

The last few days have been wild for cryptocurrency, and king bitcoin keeps breaking one all time high after another. The good news is that bitcoin breaking aths generates interest and media publicity that draws new users to crypto. Although bitcoin might be one one of the most well known cryptocurrencies (and the first crypto that many people hear of), I also believe that bitcoin cash has a number of interesting features that make it a great introductory or "starter-crypto" for onboarding new users and getting them started.

What is bitcoin?

Since this article is designed for beginners, I want to do an extremely brief recap of what bitcoin is and why it matters. Bitcoin is a decentralized, peer-to-peer, electronic currency that can be sent anywhere in the world without the permission of governments, central banks, or other financial intermediaries. As the first cryptocurrency that was developed, bitcoin gained a huge following, has wide name recognition, and is currently the most valuable cryptocurrency by market cap.

At this point, you may be wondering, “ if bitcoin is such a great cryptocurrency, then why do we need other cryptocurrencies?” the answer to this question is that different cryptocurrencies have built off the basic example of bitcoin and added or removed certain features that are designed to make them more useful for specific purposes. For example, bitcoin cash, which is based on bitcoin, made several changes that are intended to make it more user-friendly for frequent, daily purchases. Hence the “cash” terminology.

What is bitcoin cash?

For those of you who may not know about bitcoin cash, the first question that you may be wondering is ”‘what is bitcoin cash?” the short answer is that bitcoin cash can do most everything that bitcoin can do. In fact, bitcoin cash is a descendant of the original bitcoin and borrows many of the same features. For example, both bitcoin cash (BCH) and bitcoin (BTC) are created by a decentralized mining process that prevents government inflation of the money supply. Both of these cryptocurrencies can be sent anywhere in the world as a peer-to-peer form of payment. Both have a finite cap of 21 million coins. The similarities go on and on.

Although bitcoin cash inherited much of its underlying philosophy and programming from the original bitcoin, there are two key features that I believe make it more well-suited to frequent transactions and introducing people to cryptocurrency.

The first major difference is that bitcoin cash has an extremely low transaction fee. At the time of writing, the transaction fee for an average bitcoin transaction is about $5.30 USD while the BCH transaction fee is about 1/100 th of a USD. I believe the significantly lower transaction fee makes bitcoin cash much more well suited for frequent, small purchases. Can you imagine buying a coffee for $5 with traditional bitcoin and paying a $5 transaction fee? In that scenario, the transaction fee would be almost the same as the total purchase price of the product. That's not convenient at all!

By contrast, the transaction fee with bitcoin cash is so low that not only can you buy a coffee, you can send micropayments as tips. For example, the newly released bitcoin cash based website noise.Cash allows users to send micro-tips as low as .01 USD. This is something that simply wouldn't be possible with traditional bitcoin or even ethereum as the transaction fees would be many times higher than the actual value sent.

The second major difference between bitcoin and bitcoin cash is that because bitcoin cash has such a large block size, it is almost guaranteed that your transaction will be picked up and included in the next block. With traditional BTC, you may wait several hours or days for your transaction to be picked up. Thus, although both bitcoin and bitcoin cash both have a 10-minute block time, a transaction with bitcoin cash will most likely settle far before a transaction from traditional bitcoin.

I think that hands-on experience and learning by doing are two of the best ways for helping beginners get started in cryptocurrency. Ethereum and traditional bitcoin are absolutely fantastic cryptocurrencies, but their transaction fees and high cost make them more costly to play around with for beginners. With bitcoin cash, I can easily send a few cents worth of value to a new crypto-currency user, and they can practice sending this to other people without having to worry about losing a significant amount of money if they send some crypto to the wrong address or if they underbid for an ETH gas fee. It's even possible to create your own SLP token with just a few cents of bitcoin cash - again, that's just one more way that BCH does a good job of giving beginners the ability to experiment and learn about crypto without breaking the bank.

Other benefits

Additionally, having strong community support and encouragement is essential for onboarding new cryptocurrency users, and I have found BCH to be a strong, supportive community. Perhaps most importantly, a new user's first steps into cryptocurrency should be free. What I mean by this is that users who aren't completely sure about cryptocurrency may be worried about losing their funds or being hacked or something like that. Allowing users to earn a little bit of free cryptocurrency maybe the little push that they need to get started and the whole crypto ecosystem.

I know from first-hand experience that I became interested in cryptocurrency after learning that I could receive free cryptocurrency through the brave browser. Had it not been for that small initial push, I may never have ventured into the cryptocurrency ecosystem. Therefore, I think that bitcoin cash based sites like read.Cash and noise.Cash are incredible because they give new users the ability to earn a bit of crypto simply for writing blog posts or tweets without having to put any of their own money on the line.

True, there are other sites such as publish0x and uptrennd that allow users to earn other forms of cryptocurrency. However, as those sites use ERC-20 (ethereum) based tokens, it costs the admin team a significant amount of money to send the payouts which means that a new user will have to wait a while before receiving their first crypto. Although I wholeheartedly recommend sites like publish0x and uptrennd, for someone who is just getting started in crypto, it can be very encouraging to get their first payments almost instantly from a site like noise.Cash.

In summary, there are many different cryptocurrencies each with its own unique advantage. This article is in no way intended to claim that bitcoin cash is the best cryptocurrency, but rather to show that bitcoin cash does have several specific advantages that may be helpful and useful to people who are learning about cryptocurrency for the first time. Specifically, the low transaction fees enable newbies to practice sending, receiving, and earning cryptocurrency without having to worry that they are going to make a mistake and lose a large amount of money.

A note about Other coins

Undoubtedly, many other cryptocurrencies are designed to function as a quick, easy method of payment. Dash and nano specifically come to mind, and although they both offer unique advantages, I chose to focus on bitcon cash for a few reasons. First, it has name recognition due to its lineage that is derived from bitcoin. In my opinion, it is easier to explain to a beginner how some updates were made to a coin they know and trust (bitcoin) than trying to explain a totally new coin that they have never heard of and may not trust. Second, bitcoin cash is currently in the top 10 cryptos while DASH and nano are ranked 40 and 56 respectively. While ranking does not necessarily mean one coin is better or worse than another, the rankings may be helpful for reassuring a beginner that a coin is legitimate. Likewise, I am unaware of any sites where beginners can earn "free" DASH or nano to get started at low cost.

5 hidden costs when acquiring cryptocurrency

@ ks.Shilovkirill shilov

Do you want to make money by investing in cryptocurrencies? “buy low and sell high!” sounds easy, right? Well, the equation is a bit more complex than that, and the volatile price is just one variable in the purchasing process. There are exchange fees, network fees, conversions fees, and even when the broker platform you’re choosing claims zero fees, you might want to check the price rate — it can come at a 5–10% premium than the actual market price. If you want to make sure your math is right and you won’t lose money on an apparently successful investment, you need to be aware of all the hidden charges or pricing strategies of these third parties.

In this article, we’ll reveal five ways in which cryptocurrency brokers are taking their cut while your investment is shrinking all the while. Let’s try to figure out how much it will cost you to get your tokens safely delivered into your wallet.

1. Network fees

Dealing with platform fees is nothing new. Cryptocurrency brokers are working with businesses and paying for the services they provide is to be expected. However, your stake is starting to shrink even before reaching them. Due to the decentralized nature of cryptocurrencies, you have to pay the standard network fee for using the blockchain, known as the transaction fee paid to the miners.

All blockchains have their own system for transaction fees. Although setting the amount you’re willing to pay is in your control in your wallet’s interface, it’s much more limited than you think. The lower the transaction fees you are willing to pay, the longer it will take for your transaction to be verified. Currently, most blockchains have a limited block capacity. Your transaction priority is set by the amount you’re willing to pay, thus miners are financially motivated to solve the block with the highest transaction fees first. So the fee is up to you based on the urgency of your transaction.

Almost all the wallets let you adjust the fee preferences before making a transaction, and most of them also provide a predetermined price that will ensure your transaction will come through within a given time frame. In the case of ethereum, the “gas fee” can range from 1 gwei (a denomination for ETH; 1 gwei = 0.000000001 ether =

$0.00218) per transaction for a waiting time of 30 minutes per block, to 40 gwei (

$0.08736) for a 32 seconds confirmation time. Given that most of the exchanges require a minimum of 36 confirmations, by paying a low amount you might end up initiating the transaction now and making the actual trade after a few hours or even days.

If you’re sending thousands of dollars, the network fees might mean nothing to you. However, trying to convert $5 worth of crypto, these small transaction fees become much more significant.

2. Wallet fees

No, your tokens haven’t reached the broker platform yet and there are still charges on the way. While the previously mentioned network fee is common for everybody, regardless of the way you’re choosing to access the blockchain, the wallet fee is trickier and can be avoided altogether.

Having a cryptocurrency wallet is the same as having a valid blockchain address. The blockchain is a peer-to-peer network run by the people using it. Miners running full nodes are powering the network and they are getting paid for it (the network fee). Creating a wallet (generating the address), receiving some tokens, or sending them to another address is all done on the blockchain network. With enough programming knowledge, you can programmatically access and broadcast these by yourself. But, because technical knowledge shouldn’t be a restriction when using cryptocurrency, user-friendly interfaces have been developed so anyone can handle the basic operations as easy as accessing a website. While you’re safely managing your tokens, the development and updates of these software solutions aren’t free. There are minor fees charged after your first deposit or when making a transaction, and these are going straight to the company that created it. The fees are usually extremely small (around 0.001%) but even if the fees are usually extremely small (

0.001%), there are open-source solutions created by cryptocurrency supporters that come with no fees at all. We can mention the most popular ones, like myetherwallet for ethereum or bitcoin core for bitcoin, but as there are so many other tokens out there, you should always remember that it is your responsibility to choose your wallet carefully so you won’t pay unnecessary fees.

3. Premium rate

If you are new to crypto or occasional investing, you might prefer the simplicity of services like shapeshift or coinbase. But this comes at a price.

While there are community-driven solutions for wallets, third-party exchange services don’t have terribly efficient solutions. The companies who are making it convenient for you to exchange your tokens on their website are charging for it. When you purchase some tokens you aren’t really buying them from a person. You are buying them from this middleman who is willing to always store a certain amount of tokens based on demand in order to make the process instanting for you. How are they getting their cut if most of them are claiming zero commission, no exchange fee, and no service fee? They sell at a higher rate than the open market.

If you want to make the trade instantly, you will need this premium service. If you want to avoid this fee, you need to consider your options a bit more. Take CEX.IO for example. They offer both types of services; buying bitcoin instantly comes with a 7% transaction fee, while trading on their market exchange will cost you only 0.25% per trade. In contrast, the same instant service is offered by mercuryo with no increased rate and with a minimum commission. Big difference!

4. Exchange fees

Going for an exchange must be the way, right? Well, there’s a catch. Not only are they charging a fee on every trade you make on their platform but, in most cases, they’re also taking a cut on each deposit or withdrawal. Exchanges are profitable businesses, as profitable as binance, the biggest exchange by daily trading volume that raked in $446 million in 2018 alone. You might be tempted to follow the crowd and join the most popular option, but usually these companies are riding the popularity wave and their offer is not the best you can get.

Claiming no deposit fees can be reflected in bigger withdrawal fees. No withdrawal fees can bring higher trading fees. And small trading fees might be due to the increased deposit and withdrawal charges. There are many costs to take into consideration and the exchange strategy is usually to flash the apparently smaller ones and hide the non-competitive ones in the fine print.

Coinbase, the most popular choice for newcomers, charges an exchange fee as well as a network fee, and the card payment is as high as 3.99%. It might seem small in comparison with coinmama, which charges 5% for the credit card payments, although coinbase is available only to a few selected countries, while the latter is more widespread. Bitstamp can go as low as 2% for the same type of payment, if you are going to deposit more than $1,000. For less than that, it charges a fixed tax of $10. Definitely not your option if you’re going to invest a low amount.

In regard to the trading fees, bittrex takes a fixed cut of 0.25% for every trade. Buying 1 BTC would result in paying 0.0025 BTC (

$8) as a fee. Might seem a fair price, anyway, compared with binance (mentioned earlier) which has the same fixed rate, but with prices as low as 0.1% we’re beginning to understand how important is to make the right exchange choice. For the same trade, the fee will be 0.001 BTC (

$3). And the offer can become even better if you are considering paying the associated costs in BNB (binance’s internal token), in which case the fees are reduced by 50% to 0.05%. Looking deeper, though, you’re going to realize that binance has a pricey withdrawal system based on what tokens you’re taking out. For some tokens the fees are really cheap while for others are quite expensive. Bittrex, on the other hand, doesn’t charge to withdraw to another wallet. Only the network fee is applied. Needless to say, you need to take every aspect into consideration before making your choice.

5. Conversion fees

What other charges are hidden in the great scheme of things? Conversion fees. If you deposit US dollars into an exchange that only accepts euros you will also need to pay a fee for converting your currency. How bad can the rate be? Well, coinbase adds a spread of between 0 and 200 basis points (0–2%) to the exchange rate. That’s a lot!

If you’re going to cash out in the same account, you’re not going to lose money only once on the exchange rate. You’re going to lose money twice on it. And that’s on top of the requested fees. The service fees can’t be avoided, that’s the company’s imposed commission for using their platform, but the conversion fee can be handled on your part.

How to avoid paying extra fees

Now that you are aware of these hidden costs, we can get to the real question: how can you use this knowledge to avoid paying these fees or, at least, pay the lowest possible amount?

With the new ways of buying cryptocurrency becoming available each year, the offers become better and better. We’ve considered many options and ended up with three distinct ways for you to bypass all of the five stated costs.

- Peer-to-peer websites

peer-to-peer exchanges make it easy for individuals to connect with each other without using the standard middleman. In this category, we’re including localbitcoins and localethereum. There are no fees included, but the process is significantly more troublesome than using a cryptocurrency exchange platform. There are fewer users, it might take a while to find a seller, and once found you must be very careful because there’s no one to handle the transaction for you. - Open-source solutions

we’ve already mentioned community-driven wallet projects, and we can add dexs (decentralized exchanges) here. There are also many other projects that are being developed by talented people and their solutions come with absolutely no fees. There’s no catch. They are just cryptocurrency supporters willing to offer their work for free. The problem is, in most of these cases, the security. The lack of capital is reflected in the lack of testing and audits performed by established companies (who are charging quite a lot for their services). In order for these projects to take off, they need to earn the users’ trust first. - New offers —mercuryo

there’s no surprise that the best deals are coming from the companies who are new to the market. In order to compete with the giants that are leveraging their success, talented teams are willing to make use of blockchain technology. That’s mercuryo, who was able to build a financial tool in the form of a mobile app that makes it possible to buy bitcoin at the market rate with a minimum commission, instantly. Their wallet is tied to a card which can be also virtual, and they have all the legal groundwork covered as the other services previously mentioned. Additionally, the KYC (know your customer) verification being requested only for investments above $1,000 making it quick and efficient for small investments or low amount purchases. That’s right, mercuryo provides crypto acquiring services as well.

Therefore, to become a winner in the fast-shaping crypto market, a project needs to be honest and have its legal status in order. But that’s not the only requirement in today’s digital era where people are overwhelmed by partial solutions to their problems. What’s needed in crypto is a complete solution and, between the three, mercuryo is coming the closest. We all know that spending your cryptocurrency can be a tough task between two parties, customer and merchant. Mercupay, their acquiring service, addresses the needs from both sides:

- As a merchant, you can integrate it as easy as adding a “buy with cryptocurrency” button on your website. Mercupay will automatically generate a unique wallet and an invoice for each purchase, plus the cryptocurrency will be converted for fiat money and sent to your account after a successful confirmation.

- As a customer, you only need to pay by scanning a QR code directly from your wallet. Everything after that is handled by mercupay and the merchant as any other online purchase delivery. Want to test it out? Mercuryo already set up an online t-shirt store as a proof of concept.

Making a cryptocurrency investment, cashing out, spending your tokens; all these operations should be simple. There are many variables you should take into account when choosing a place to buy your cryptocurrency. As the competition ramps up and more projects are being developed, better and better offers will appear. But now you can take advantage of the options available today to lock in the best deals.

As long as you are always speaking to a financial advisor and you’re never investing more than you can afford to lose before making a major investment, the cryptocurrency game can be a profitable one for you!

Cryptocurrency trading fees: all you need to know about transaction fees, wallet fees and exchange fees

When you buy bitcoin or any other cryptocurrency, you would likely find some extra fees attached to the actual cost of the coins. This is not abnormal as there are certain fees associated with different cryptocurrency transactions.

Understanding the purpose of these fees, the paying and receiving parties as well as the range of fees expected would help when making future crypto transactions. While some of these fees serve as incentives, some others are basically third-party service charges like the fees paid for trading stocks and other securities.

Fees associated with cryptocurrency transactions

There are three major fees that go with cryptocurrency transactions which should not be confused. The fees are the transaction fee, the miner fee, and the trading fee. We would concern ourselves mainly with the later (trading fee) but we will first look at the other fees.

The transaction fees (network fees)

This fee is paid for conducting a transaction on a blockchain network hence it is also called, network fee. Network fees are paid to the miners of a cryptocurrency for their work done verifying transactions.

All transactions that take place on the blockchain are verified by a consensus on the network; it is miners who do this work and eventually add the transactions to a block which is in turn added to the blockchain. The transaction fee is usually charged when cryptocurrency is purchased, sold, or transferred, even if it is from an exchange to a personal wallet—any transaction that would be verified by miners.

Blockchains adopt their own system of transactions fees; so what one pays for a transferring a certain cryptocurrency may differ from another cryptocurrency. In some cases, transaction fees are set by the miners themselves. The cryptocurrency sender or receiver will have to accept or reject the transaction cost. For miners to get transactions added their block they are made to set reasonable transaction costs that will be accepted by sending parties.

Most other systems, however, allow senders to set the transaction fee they would pay for the transaction. The miners would have to choose which transaction to add to their block. If a sender includes a low transaction fee, chances are that most miners would avoid the transaction and it would take a longer time to be confirmed. On the flip side, transactions with higher fees are quickly added to a block and verified.

To maintain a balance, some wallet providers use a preset transaction fee which is usually accepted within a reasonable me frame. Cryptocurrency transactions from that wallet, therefore, must pay that stipulated transaction fee.

Wallet fees

Another type of fees cryptocurrency traders may have to face is the wallet fee. This fee is paid to wallet providers who manufacture and maintain digital wallets. The fees are used for security software development to provide latest updates.

Wallet fees are usually charged on the first deposit made on the wallet and may include a network fee for confirming a cryptocurrency address for first-time users. Exchanges which operate wallets may also charge a wallet fee separately.

The trading fee (exchange fees)

Third party cryptocurrency exchanges like coinbase, kraken, gemini etc., are probably the easiest way to purchase and transact cryptocurrency.

This is how crypto exchanges work. They connect cryptocurrency buyers with willing sellers. These trading platforms allow a person to buy cryptocurrency with fiat currency or exchange one cryptocurrency for another.

For their services, cryptocurrency exchanges normally charge a fee—usually a percentage of the value of cryptocurrency being traded. That said, exchanges vary in their approach to service fees. While some have a fixed fee policy, some others operate a flexible pricing model and yet some others even offer a free trading service.

A fixed price policy is prevalent in many exchanges. Bittrex exchange, for instance, charges a 0.25% fixed fee for trading transactions. Similarly, binance maintains a fixed trade fee of 0.1% and a possible 50% fee reduction when you use their native BNB tokens.

Some other trading platforms offer flexibility with their trading fees. Popular exchanges like bitfinex, poloniex and kraken use a ‘maker-taker’ pricing model. In this case, both the maker (the selling party) and the take (the receiving party) are charged for the transaction. Exchanges can also vary the trade fees depending on the volume of trade to encourage more trades.

Finally, some exchanges offer free trading services. Cobinhood exchange is notable for offering this service. Many exchanges also offer free deposit transactions, withdrawal transactions or both. Note, however, that free trading services do not necessarily mean users wouldn’t have to pay network fees or wallet fees.

The 5 cryptocurrency exchanges with the lowest fees

Share article

Although fees should be just one of several considerations made when selecting the right cryptocurrency exchange for you, it can be one of the most important — since, the lower your fees, the higher your profits usually are.

Generally, the industry standard for cryptocurrency exchanges is around 0.25 percent for both market makers and market takers — though there are several well-reputed platforms that charge less than this while still offering an excellent range of features.

Whether you are a new investor or trading veteran, there is always room for improvement — and reducing your trading fees is often one of the surest ways to maximize your cryptocurrency trading profits.

With a plethora of exchanges promising the lowest fees, it is often hard to determine which are genuinely worth using and which are full of empty promises. To help you choose a winning exchange that is best for you, we have scoured the internet to find five of the best low fee exchanges available.

Binance

Renowned for its legitimate trading volume and the large variety of cryptocurrency trade pairs it offers, binance has quickly found itself the most popular cryptocurrency exchange platform — despite launching in just 2017.

In addition to its impressive liquidity, binance also features very relaxed KYC requirements, allowing users to withdraw as much as two bitcoins per day after providing minimal personal information.

By default, binance trading fees start at 0.1 percent for market makers and market takers. However, this can be reduced to as little as 0.02 percent and 0.04 percent respectively for traders that reach VIP 8 status by trading more than 150,000 BTC per month and holding over 11,000 binance coin (BNB).

As it stands, paying binance trading fees in BNB attracts a 25 percent discount. However, this discount is halved every year and will be reduced to 12.5 percent in july 2019, and 6.25 percent in july 2020.

Stormgain

Despite being a brand new exchange platform, stormgain has all the features needed to distinguish itself from the competition and become a leader in the space.

For one, stormgain has some of the lowest trading fees in the business — with just a 0.15 percent trading fee for most of its instruments. Couple this with its extremely low daily rate for swaps and completely free deposits and withdrawals, and it’s clear that stormgain isn’t playing around.

Unlike some of the other options on this list, stormgain offers these fees without requiring users to hold any exchange tokens or reach extraordinary monthly trade volumes.

Besides its extremely low trading fees, stormgain also benefits from several features that make it an attractive alternative to other platforms — particularly for lower volume and new cryptocurrency traders.

One of these features is trading with multipliers, allowing traders to multiply their exposure to the market. Offering a multiplier of up to 100x, users are given the opportunity to vastly grow their investment while risking only the principal amount.

Stormgain allows users to do all of this in complete privacy by completely doing away with KYC requirements and intrusive verification steps.

Huobi global

Featuring incredible liquidity for bitcoin, ethereum, and EOS, huobi global is one of the most popular exchanges for those looking to trade against tether (USDT). Beyond this, huobi global also features a large range of altcoin trade pairs — many of which also have impressive trading volume and low spreads.

Founded in china and based in singapore, huobi global is known for its high-speed matching engine, extremely user-friendly user interface, and easy on-ramp for retail investors through its fiat-to-crypto trading zone.

Similar to binance, huobi global features a tiered fee structure with the potential for further discounts by achieving higher trade volumes — starting when users exceed 5 million USDT in 30-day trade volume.

On huobi global, the base trading fee is 0.2 percent for both maker and taker trades — but these are reduced significantly for high volume traders. Beyond this, huobi also allows users to further reduce their trading fees by purchasing VIP member using huobi tokens (HT), with six different VIP levels offering up to an additional 50 percent fee discount.

Hitbtc

Since its launch in 2014, hitbtc has maintained a relatively strong position as an exchange, regularly finding itself placed in the top 20 exchanges by reported trade volume.

Though it may not necessarily be the “world’s most advanced bitcoin exchange” as it claims, hitbtc is still a solid option for many cryptocurrency traders. With its advanced order matching system, multiple account security layers and powerful API, hitbtc is a certainly worth a look.

Like many other modern cryptocurrency exchanges, hitbtc operates on a tiered fee schedule — which sees users rewarded with lower trading fees after achieving a certain trade volume per 30 days. Currently, base (tier 0) trading fees are 0.1 percent for makers and 0.2 percent for takers, reducing -0.01 percent and 0.055 percent respectively for tier 15 traders.

However, very poor customer support and reports of the exchange freezing user accounts may deter some users from an otherwise competent exchange.

Bitfinex

As one of the most well-reputed names in the business, bitfinex has stood the test of time and remained one of the leading cryptocurrency exchange platforms for more than six years.

The exchange is best known for its high liquidity crypto-fiat trade pairs, allowing users to trade against four different fiat currencies, including USD, EUR, and GBP. Beyond this, the exchange also offers dozens of crypto-crypto trade pairs — though fiat trading is its clear standout feature.

In addition to its impressive volume, bitfinex is also one of just a handful of cryptocurrency margin trading exchanges — allowing users to trade with up to 3.3x leverage.

For most users, bitfinex charges a 0.1 percent maker and 0.2 percent taker fee, with further reductions possible when trading in excess of $500,000 per 30-day period.

Like an increasing number of exchange platforms, bitfinex also gives users the opportunity to reduce their trading fees by holding fixed amounts of the native exchange token — unus sed LEO. As it stands, holders of more than 5,000 USDT worth of LEO receive a 25 percent fee discount.

Which exchange is best for you?

Overall, of the hundreds of exchange platforms available, these are the ones that offer a full-feature set while still keeping fees low.

Ultimately, you will need to make the decision for yourself by choosing which trading platform offers the best mix of features you are looking for. Although low trading fees is certainly a desirable feature, it is certainly not the only one that should be considered.

Whether you choose stormgain, hitbtc or another platform as your exchange of choice, it is important to do your research before trading at any platform, as many benefits often come with hidden caveats.

Did we miss any from our list? Are there any other up and coming exchanges platforms that are worth a look? Let us know your thoughts in the comments below!

[full disclosure: stormgain is a partner exchange of beincrypto.]

How much does it cost to buy cryptocurrency at exchanges?

What does it cost to trade bitcoin? Apart from the price of bitcoin itself, each cryptocurrency exchange adds a fee for trading, when customers purchase and sell coins. These fees include maker (which add to the order book liquidity through limit orders) and taker (which subtract liquidity from an order book through market orders) fees. In some cases, cryptocurrency traders can incur maker as well as trader fees, if the limit order is already present in the order book.

Cryptocurrency exchanges mainly calculate fees in two ways: as a flat fee per trade or as a percentage of the 30-day trading volume for an account. In both cases, they’ve adopted a tiered structure that depends on the amount being traded.

Key takeaways

- Buying and selling cryptocurrencies has become increasingly popular since bitcoin first debuted back in 2009.

- Dozens of online exchanges now exist to help buy and sell digital currencies as well as to trade cryptocurrencies against one another.

- The typical costs involved include trading commissions paid to exchanges, the width of the bid-ask spread, and a fee to transfer funds to/from your bank account.

Four things to consider while trading on cryptocurrency exchanges

There are four important things that traders must consider while purchasing cryptocurrencies.

- First, cryptocurrency exchanges are unregulated in most jurisdictions. Most regulators in countries around the world have taken a hands-off approach to cryptocurrency regulation in some of its biggest trading markets. For example, cryptocurrency exchanges are governed by a patchwork of regulations in the united states—among the largest markets for cryptocurrency trading. Some types of cryptocurrency trading are banned in china, which accounted for as much as 90% of overall trading up until the beginning of 2017. nonetheless, several prominent chinese exchanges are still operational and have simply shifted base to seychelles or malta since the government crackdown.

- Second, fee schedules at cryptocurrency exchanges are designed to encourage frequent trading in large transaction amounts worth thousands of dollars. Fees often decrease with an increase in amount and frequency of trades. As such, small and infrequent orders are not cost-efficient at cryptocurrency exchanges. For example, some exchanges charge no fee for trades worth $10,000,000 and over.

- Third, exchanges encourage trading with coins. Fiat currencies generally incur deposit and withdrawal fees at exchanges, depending on the payment mode. But purchasing cryptos with other coins, for the most part, is free. In some cases, a small fee may be charged to set up a wallet for the required cryptocurrency.

- Fourth, most well-known cryptocurrency exchanges do not offer access to all coins. But, in many cases, traders can transfer funds from one wallet to another and fund their trading accounts using either fiat currencies or cryptocurrencies. For example, traders wishing to buy cardano (ADA), a top-15 cryptocurrency by market cap, are not currently able to do so directly on the popular coinbase exchange. however, traders can use fiat currency to purchase bitcoin at coinbase. Binance, another exchange, already offers users the facility to import coins from other wallets. Once they have bitcoin in their binance account, they can use it to buy ADA listed on the exchange. The transfer between multiple wallets at different exchanges incurs small charges at each end.

Here is a brief comparison of trading fees for bitcoin at the current list of most popular exchanges by trade volume. This comparison does not take into account margin and leverage fees.

Hcoin

Seychelles-based hcoin is one of the newest entrants into the cryptocurrency exchange field as of january 2020. Launched in august 2018, hcoin offers customers the opportunity to trade in a list of cryptocurrencies and fiat currencies including bitcoin, ether, XRP, litecoin, bitcoin cash, EOS, USDT, and HKDT, among many others.

Hcoin's fees are dependent on the base currency and volume and are listed in a chart on the exchange's website. the company does not appear to list any fees for funding an account through transfer of digital assets from another wallet, nor is it clear whether the transaction fees change depending upon the size of each trade.

Coinsbit

Estonian platform coinsbit has a focus on security and on innovative offerings such as investbox, a low-cost, low-risk way for investors to make exploratory transactions involving new altcoins. when it comes to fees, coinsbit charges a flat 0.2% fee for trading. The exchange also has variable fees for deposit and withdrawal, depending upon the cryptocurrency, and with different minimums for each token as well. As of january 11, 2020, the fee to deposit USD was 0.8% and the fee to withdraw USD was 0.4%. Some of the cryptocurrencies are free to deposit (i.E. ETH, ARK, ATB, and others), and others are free to withdraw.

Additionally, new accounts are initially prohibited from making withdrawals. Later, basic accounts have a withdrawal limit of USD$500 or equivalent per 24-hour period, while enhanced accounts can withdraw up to USD$100,000 or equivalent in a 24-hour span.

Bitforex

The third most popular cryptocurrency exchange by trade volume is bitforex, an exchange headquartered in singapore and registered in seychelles. Bitforex offers a host of trading options, including margin trading, derivatives, and more. As such, this exchange has a more complex fee schedule than some of its peers on this list.

For spot trades, bitforex charges 0.1% for both maker and taker feeds. For perpetual trades, there is a maker fee of 0.04% and a taker fee of 0.06%. Discounted rates are available for specialized market maker accounts on the platform. Deposits to bitforex are free, while withdrawals vary depending upon the currency involved. There are also minimum and 24-hour maximum withdrawal levels associated with each cryptocurrency.

Lbank

Besides being a popular cryptocurrency exchange, lbank also supports innovation in the altcoin space through its "LBK voting listing" event, which pits 8 new cryptocurrency projects against one another for a chance to be listed on lbank for free.

Lbank charges a taker fee of 0.2% and a maker fee of -0.05%, meaning that makers earn a portion of the generated trade fee on the transaction. Different cryptocurrencies are associated with various withdrawal rates set at fixed quantities of those cryptocurrencies themselves. For instance, a user withdrawing bitcoin from lbank will be charged a flat fee of 0.0005 BTC. There are also withdrawal minimums for each cryptocurrency that are also set as fixed quantities of the token in question. Interestingly, lbank does not indicate a maximum withdrawal over a 24-hour period.

P2PB2B

Including one of the most extensive lists of trading pairs, with more than 700 possible combinations P2PB2B regularly sees daily trade volumes close to $1 billion. Like coinsbit, P2PB2B charges a flat 0.2% fee for trades. Users can deposit most cryptocurrencies, including BTC and ETH, for free. However, there is a charge of either 4% or 5% (with a minimum of either USD$5 or USD$10) to deposit USD into an account, depending upon the method of deposit. P2PB2B also sets minimum deposits and withdrawals in most cases and charges a variable withdrawal fee depending upon the cryptocurrency. Like lbank, withdrawal fees vary from token to token but are assessed as fixed quantities of tokens.

Introduction to cryptocurrency transaction fees

Introduction to cryptocurrency transaction fees

Cryptocurrency transaction fees – like most things in life, there’s a fee attached to cryptocurrency transactions. Every time you send any cryptocurrency, from your address to another, you incur a network transaction fee.

This fee is either added on top of the value of crypto you are sending. Deducted from the end cryptocurrency, depending on the wallet or exchange you are using.

The actual fee you pay will vary according to the network you use. A bitcoin transaction will warrant a different fee to transactions placed on the bitcoin cash, ethereum or litecoin network and so on and so forth.

Crucially, the fee you pay is not a consistent figure. It can fluctuate depending on market demand and network capacity for confirmations. Average transaction fees on the bitcoin network, have been progressively increasing since the cryptocurrency’s inception in 2009. Due to transaction capacity becoming an artificially scarce resource.

Why are there cryptocurrency transaction fees? Who benefits?

The fees are received by miners. More specifically, the fee is received by the miner who verifies the block on the network which contains your particular transaction.

Miners receive the fees because they use their computing power to verify transactions and uphold the security of the network. Miners receive these fees in addition to the new cryptocurrency that is released when a new block is mined. In other words, they are doubly incentivised to do the work they do because they receive both fees and the ‘block reward’.

How are cryptocurrency transaction fees calculated?

The amount you pay per transaction is determined by how much you’re willing to spend. There is often a degree of outbidding involved. The more you pay, the more people you outbid and the faster your transaction is processed. The transactions of those people you’ve outbid are deprioritised.

Outbidding makes sense for larger transactions that are worth thousands or even millions of pounds worth of bitcoin. Most people who are sending transactions of this size won’t mind paying a fee which is minimal by comparison. Of course, there is no point paying a fee of five pounds worth of bitcoin. If your transaction involves buying a coffee that amounts to two pounds worth of bitcoin!

This isn’t to say smaller transactions aren’t processed at all. However, they’re likely to be processed slower, should the network be congested. As people are less likely to pay higher fees on them.

Sometimes the digital wallet software that you use will give you a suggested bid – but it’s worth doing your own research instead of simply going along with what you are told. There are resources available that allow you to track the average fees that are being paid for transactions of different sizes (in bytes). Brushing up on this information may save you money in fees.

Why have cryptocurrency transaction fees increased?

Fees typically increase in accordance with the growing usage and popularity of cryptocurrency networks. Bitcoin is the best example of this. As bitcoin has surged in popularity, more people are seeking to place transactions within the network. The pressure on the network is increasing as resource is scarce.

Making matters worse is bitcoin’s scalability problem. Its block sizes are limited to 1MB each, which restricts the number of transactions. Bitcoin can process to approximately 7 per second. . More and more transactions are occurring, due to increased demand, yet the block size remains the same. The result is that transactions are taking more time to process, and people are paying higher fees to get their transactions processed first.

Solutions to the problem of increased fees

The simplest way to tackle the problem of increased fees on the bitcoin network (and other networks for that matter) is, to make it possible for more transactions to be processed faster. Solutions are currently in the works to address these scalability issues. The segwit soft fork (we covered soft forks and hard forks in a previous lesson) is a good example. In short, segwit aims to free up more space in the block for transactions by removing signature data and moving it elsewhere.

Another example of a solution is the bitcoin cash hard fork. This has increased the block size to 8MB. In doing so, has created its own separate blockchain and corresponding cryptocurrency. As solutions are being worked on, newcomers in the cryptoverse should be made aware of transaction fees. Before initiating a transaction, consider the fees as well as the time involved to process your transfer. If you’re diligent and dedicate the right time and effort to doing the necessary research, you can be more cost-efficient with regards to the fees you pay on your crypto transactions – and save money in the process.

Cryptocurrency exchange fees

Read our guide to the fees and charges that apply when you buy and sell digital currency.

If you want to buy and sell bitcoin and other cryptocurrencies on an exchange, you’ll need to be aware of the fees that apply to trading. From deposit and trading fees to the charges that apply when you withdraw funds from your account, the fees imposed by your chosen platform can have a big impact on the overall cost of your trades.

In this guide, we’ll explore the different charges that apply, how they vary between exchanges and how you can save money when buying and selling digital currency.

Exchange fee comparison

How much does it cost to deposit, trade and withdraw funds from a crypto exchange? Check out the table below for a comparison of the fees charged by a handful of popular exchanges.

Deposit fees

While many exchanges won’t charge a fee whenever you transfer funds into your account, some will. However, it’s worth pointing out that the amount charged may vary depending on the payment method you choose or the currency you deposit. If you’re using an exchange that accepts deposits in fiat currency, a different fee may apply to credit card and bank transfer deposits.

For example, US exchange coinbase charges deposit fees as follows (at the time of writing):

- Online bank transfer: 1.49%

- Wire transfers: $10

- Credit card/debit card deposits: 3.99%

- ACH transfers: $0

If you’re transferring digital currency into your exchange account, the fee could change depending on the coin you deposit. For instance, bitcoin deposits may attract a fee of 0.001 BTC, while ether deposits might be charged at a rate of 0.01 ETH.

Trading fees

When you’re ready to buy or sell digital currency through an exchange, you’ll need to consider the trading fee that will apply to your transaction. Trading fees are expressed as a percentage of the total value of your transaction.

Some exchanges will impose a flat fee, for example, 0.2% of the transaction value, on all trades. However, many exchanges split their trading fees into two separate fees:

Maker fees

The maker fee applies when your order is not immediately matched against a trade already on the exchange’s order book. This means you’re adding liquidity to the order book, so most exchanges will reward you with lower fees.

If you place a limit order on a crypto exchange, you specify that you want to buy or sell but only at a particular price point. If your order isn’t matched immediately, for example, if the limit price on your buy order is below the current market price, you’ll be charged the maker fee when your order is eventually matched.

Because market makers add liquidity to the order book, some exchanges will even offer them fee rebates when trading. For example, market makers on hitbtc receive a 0.01% rebate on their trade.

Taker fees

The taker fee applies to trades that are executed against another trade already in the exchange’s order book. This removes liquidity from the market, so taker fees are usually higher than maker fees.

When you place a market order on a crypto exchange, this means you want to buy or sell a particular coin as soon as possible and, as a result, the taker fee applies.

Withdrawal fees

Once you’ve acquired the coins and tokens you want, you’ll most likely want to transfer them off the exchange and into a secure, private wallet. However, when you do so, you’ll almost always be hit with a withdrawal fee.

Just like deposit fees, withdrawal fees vary depending on the following:

- The currency being transferred if making a crypto withdrawal

- The withdrawal method being used if transferring fiat currency

Crypto withdrawals tend to attract a flat fee, whereas fiat withdrawals can be slugged with a flat fee or a percentage-based fee. For example, CEX.IO doesn’t charge any withdrawal fees for USD transfers at the time of writing.

It’s easy to forget about withdrawal fees when choosing an exchange, but being slugged with a hefty transfer fee when moving your funds into a wallet can make a big difference to the overall cost of your transaction. With this in mind, remember to check the fine print to find out what withdrawal fees apply before choosing an exchange.

Fee scaling

Cryptocurrency exchange fees can also vary from one account to the next, with some customers able to access reduced costs based on a number of factors, including the following:

- Account verification. By providing additional information to verify your account, such as personal details and proof of ID, you may be able to access smaller fees.

- Trading volume. Some exchanges offer tiered fee structures based on the amount of cryptocurrency each user trades per month — the higher your trading volume, the lower your fees. As an example, bitfinex’s tiered fee structure ranges from 0.1% maker and 0.2% taker fees for users with a 30-day trading volume of less than $500,000 through to 0% maker and 0.1% taker fees for users with a 30-day trading volume of $30 million or more.

- Length of membership. You may also find that the longer you hold and use an account on a particular exchange, the less you’ll need to pay in fees.

Crypto exchange fees: what you need to know

The most important thing to remember when calculating the cost of trading cryptocurrency is to read the fine print. Fees vary not only from one exchange to the next but also within a single exchange — from your account verification status to the volume of trades you place per month to the currency you’re trading, there are several factors that can affect how much you’ll need to pay in fees. Check with your exchange so that you’re familiar with all the fees that apply to your account.

Fee discounts

It’s also worth keeping an eye out for any fee discounts you may be able to take advantage of. For example, some exchanges will offer discounted fees to new customers for a fixed promotional period after they first register for an account.

Other exchanges will also offer reduced fees to customers who hold a balance of the exchange’s native currency. This discount reduces over time and is 50% during the first year, 25% during the second year and so on.

Elsewhere, huobi users can use huobi tokens (HT) to purchase a VIP membership. There are five membership levels available — the most basic level costs 120 HT a month and entitles you to a 10% fee discount, while the premium membership costs 12,000 HT per month and allows you to save 50% on fees.

Choosing an exchange

Fees will no doubt be one of the factors you consider when comparing and choosing crypto exchanges, but they shouldn’t be the only one. You’ll also need to take into account the security measures a platform has in place, the currencies it supports and the customer support available.

Cryptocurrency transaction fees

For the normal operation of the blockchain, some efforts are needed from a certain group of users. And they must somehow be compensated, otherwise, people will not be motivated to act in the interests of the network. And one of the easiest ways to ensure this is material compensation in the form of transaction fees.

On most exchanges and services, it is fixed, but in some situations, it can change - both increase and decrease. This is usually done in order to change the priority of placing a record on the blockchain. However, everything is not as simple as it seems at first glance.

Why does this phenomenon even exist?

Transaction fees appeared in the very first bitcoin blockchain, only then they had a slightly different task - to prevent network congestion. After all, if you have to pay for each message, the attacker will have neither the motivation nor the opportunity to use a spam attack. As for the motivation of the participants, the reward for the production of a new block coped with this quite well. This mechanism was based on adam black's hash caching, which was then modified to become a full-fledged pow mechanism.

The system was put into operation, started working, gaining popularity, and the price of bitcoin, accordingly, grows. And about 2 years later, one of the developers, gavin andersen, noticed that the bitcoin rules stipulate a stable payment for transfers - exactly 0.01 BTC. And while the price of the world's first cryptocurrency was small, there were no problems.

But soon the situation changed - this commission began to exceed the size of transactions that had to be paid. Therefore, the protocol had to be modified. As part of the segwit2x update, there was not only a significant increase in block size, but also a decrease in the cost of the base commission. The blockchain has become much more convenient and cheaper to use.

How does it work?

It all depends on the characteristics of a particular blockchain.

- Bitcoin. All transactions go to mempool or "memory pool", from where they are taken when forming blocks. Moreover, priority is given to those of them that are accompanied by higher commissions. So the user has a choice - either pay the standard price and wait in line, or manually raise it - and complete the transaction faster.

- Ethereum. Here the role of a means of payment for transfers is played by the so-called “gas”, measured in small shares of ETH. And since the functions of this blockchain are more complex and are regulated not only by basic protocols, but also by a bunch of smart contracts, then prioritization by increasing or decreasing fees becomes an extremely important element of the work.

- Ripple. Since there are no miners or stakers, there is no need to further encourage anyone, so the fees on this blockchain are practically zero.

- Various stablecoins. Everything is individual here. For example, in tether, there is no commission when transferring USDT from one wallet to another. But when converting a token into a classic currency, there is.

What factors affect its value?

The point is that each block of the blockchain contains as many transactions as its size allows. And if many users start simultaneously transferring their currencies to other accounts, there may simply not be enough space, so they will have to wait for a new block to form.

This, by the way, is one of the sides of the scalability problem - if there are a lot of users, then they will either have to wait a long time for their turn, or provide their transactions with a higher priority due to the commission. But it soon turns out that you are not the only one willing to pay more - and the places in the block are almost distributed according to the principle of an auction.

The size of the transaction also matters, but it is usually standard and limited by the underlying protocols. But if it is reduced at this level, as it was, at one time, in the bitcoin blockchain, then the network bandwidth will increase.

How do you compare different networks in terms of their transaction fees?

In short, the more transactions the network can process at once, the lower the base payment for each. Let's look at a couple of examples.

The already mentioned ripple network has a standard fee of 0.00001 XRP, but in 2017, at the peak of the popularity and download of the project, it reached 0.40 XRP. But even that is not enough, since each token costs less than 25 cents.

In ethererum, the base payment for transfers is higher, but also tends to increase during peak activity. This was the case in 2017, 2018 and 2020 (due to the rise in popularity of defi apps). In august 2020, the cost record was broken, and a month later - again. So that you roughly understand - there are officially registered situations in which the commission was $ 99. The only ones who like this situation are miners. On september 1, 2020, due to such an increase in prices, they were able to get a total profit of 500 thousand US dollars in just an hour, purely due to commissions. The developers, however, believe that the transition to ethereum 2.0 will correct this state of affairs and make the situation more stable.

As for bitcoin, there is also a steady increase in payments for transfers - already up to $ 10 at the end of october 2020. Still, blockchain does not handle the scaling problem very well.

The situation is much better in second-tier solutions and in various sidechains. In litecoin, bitcoin cash, cardano, and ethereum classic, transaction fees are less than a cent. And in some new projects, such as ilcoin - even less, even with a successful solution to the scaling problem.

Be that as it may, transaction fees remain one of the easiest and most convenient ways to get users interested in ensuring the operation of various blockchains, so they are unlikely to be abandoned. But to work in the direction of decreasing the size, but increasing the number - very likely.

So, let's see, what we have: surprise! Investing in virtual currencies could mean paying up to three different types of fees. At crypto currency transaction fees

Contents

- Top forex bonus list

- Which cryptocurrencies have the lowest transaction fees?

- Surprise! Investing in virtual currencies could mean paying up to three different types of fees.

- The 411 on cryptocurrency transaction fees

- Which cryptocurrencies sport the lowest average transaction fees?

- Low fees and quick transactions - an intro to bitcoin cash!!

- 5 hidden costs when acquiring cryptocurrency

- @ ks.Shilovkirill shilov

- 1. Network fees

- 2. Wallet fees

- 3. Premium rate

- 4. Exchange fees

- 5. Conversion fees

- How to avoid paying extra fees

- Cryptocurrency trading fees: all you need to know about transaction fees, wallet fees and exchange...

- Fees associated with cryptocurrency transactions

- The 5 cryptocurrency exchanges with the lowest fees

- Binance

- Stormgain

- Huobi global

- Hitbtc

- Bitfinex

- Which exchange is best for you?

- How much does it cost to buy cryptocurrency at exchanges?

- Four things to consider while trading on cryptocurrency exchanges

- Hcoin

- Coinsbit

- Bitforex

- Lbank

- P2PB2B

- Introduction to cryptocurrency transaction fees

- Introduction to cryptocurrency transaction fees

- Why are there cryptocurrency transaction fees? Who benefits?

- How are cryptocurrency transaction fees calculated?

- Why have cryptocurrency transaction fees increased?

- Solutions to the problem of increased fees

- Cryptocurrency exchange fees

- Read our guide to the fees and charges that apply when you buy and sell digital currency.

- Exchange fee comparison

- Deposit fees

- Trading fees

- Withdrawal fees

- Fee scaling

- Fee discounts

- Choosing an exchange

- Cryptocurrency transaction fees

- Why does this phenomenon even exist?

- How does it work?

- What factors affect its value?

- How do you compare different networks in terms of their transaction fees?

No comments:

Post a Comment