Forex account funding

Total damage has been caused by the civilians arounf the new apple store at wall street.

Top forex bonus list

Total damage has been caused by the civilians arounf the new apple store at wall street.

Stop trading small accounts

The world’s best subscriptions based FX trading solution. Fundisus provides all participants with funded accounts to access the spot market.

Who are we?

Fundisus is a revolutionary proprietary trading solution. Fundisus has years of industry knowledge and makes use of cutting-edge proprietary trading techology; thus, we are on active trading firm which understands the needs of traders in the market.

We offer $50,000 to start trading forex market with

Traders are compensated on a profit split basis only.

Our funded accounts are EA compatible

Fundisus

Let us tell you more

Your personal liability is limited to your subscription payment.

As all funding is provided by the firm, traders do not risk any of their own trading capital. Even if losses are incurred, the firm will still bear the costs. There are no other trading accounts available that offer this trading opportunity. Use a real account instead of a practice trading account. Preserve your own capital when speculating in FX trading.

Why choose fundisus?

Anyone can trade forex with a capital now.

4 easy steps

Data collection

Total damage has been caused by the civilians arounf the new apple store at wall street.

Guaranteed ROI

Total damage has been caused by the civilians arounf the new apple store at wall street.

Always online

Total damage has been caused by the civilians arounf the new apple store at wall street.

All professional traders start with a $50K trading book, regardless of their background, experience or track record. We give all our traders an equal opportunity to prove themselves as a profitable trader, or have artificial intelligence trading software manage their account hands-free. Profit withdrawals of 5% blocks are independent from the growth targets of 10%.

If you can make a 10% return on your $50K trading book – growing your account to $55k – we will double your initial funding to $100k, or $105k net. The 10% amount of $5k must be maintained in the account and may not be withdrawn. This is independent of any 5% profit withdrawals. Traders have to separately maintain the 10% for the growth target.

If you can make another 10% return on your $100K trading book – growing your account to $115k net – then we will double your account value once again, up to $200k, or $215k net. Again, the $15k amount must be kept in the account.

For the final stage, you must make 10% once again on your $200K trading book, giving you a net of $235k. If you can succeed here we will allocate $1million to you and you will have the opportunity to interview for a fund manager position.

We fund traders worldwide

Do you have what it takes to get funded?

Become a funded trader at city traders imperium.

We’re funding traders who want to leverage their trading skills and maximise their earning potential.

Pass our evaluation and start trading our fully funded account with potential growth up to $2,000,000.

Do you have the right trading strategy, discipline, and mindset to be our next 7 figure trader?

WHY CTI'S FUNDED TRADER PROGRAM

City traders imperium's mission is to find the top 1% of high-performance traders and start the world’s largest online trading floor.

This mission is much bigger than a chieving financial freedom , s elling generic online courses, or attaining material wealth.

Each and every one of us has a purpose in life. A purpose so powerful that it resonates deep within our entire conscious and subconscious being. The personal dream is a life mission that very few people manage to discover within themselves.

It’s a calling that is beyond material possessions and financial freedom. It provides a reason to rise after each failure and disaster. It stimulates the feelings of joy and gratitude with pain and fear within one experience.

It all boils down to this one question you need to ask yourself:

“why do you want to be a funded trader?”

Join our elite group of the most committed, disciplined funded traders who are all simultaneously taking the CTI funded trader program that will bring the best high-performance funded trader that you know you are.

Unleash the inner trader and choose one of our forex funded accounts. Do you have what it takes to successfully complete the CTI funded trader program challenge and trade up to $2,000,000 of our capital RISK-FREE?

How do you fund a forex account?

The forex (FX) market is where currencies from around the world are traded. A foreign exchange account is typically what is used to trade and hold foreign currencies online. Using these accounts is easier than it has ever been in the past. Typically, you will just need to open a new account, deposit the amount of money you choose in your country’s currency, and then you are free to sell and buy currency pairs as you see fit.

Key takeaways

- Forex accounts are used to hold and trade foreign currencies.

- It is easier than ever for individuals to participate in forex trading, due to the development of margin accounts and electronic trading.

- You can invest in forex with as little as $1,000.

- The biggest difference between trading equities and trading on forex is the amount of leverage required.

- Forex accounts can be funded by credit card, wire transfer, personal check, or bank check.

In the past, currency trading was limited to certain individuals and institutions. That's because the funds required to play were significantly higher than for any other investment instrument. However, with the development of electronic trading networks and margin accounts, requirements have changed. Although nearly 75% of forex trading is still done by large banks and financial institutions, individuals are now able to invest in forex with as little as $1,000—thanks in large part to the use of leverage. Despite these changes, making high returns on highly-leveraged currency trades can be difficult, and will require a good amount of patience and skill.

How forex trading works

By using a margin account, investors essentially borrow money from their brokers. Of course, margin accounts can also be used by investors to trade in equity securities. The main difference between trading equities and trading forex on margin is the degree of leverage that is provided.

For equity securities, brokers usually offer a 2:1 leverage to investors. On the other hand, forex traders are offered between 50:1 and 200:1 leverage. This means that traders need to deposit between $250 and $2,000 to trade positions of $50,000 to $100,000.

Learning the ins and outs of investing in a market that contains foreign currencies can be a useful skill to develop in today’s hyper-connected world.

How to fund a forex account

Forex traders are usually given several options when deciding how they will deposit funds into trading accounts. Credit card deposits have by far become the easiest way. Since the development of online payment services, digital credit card payouts have become increasingly efficient and secure. Investors can simply log in to their respective forex accounts, type in their credit card information and the funds will be posted in about one business day.

Investors can also transfer funds into their trading accounts from an existing bank account or send the funds through a wire transfer or online check. When choosing to perform a wire transfer, keep in mind that most banks will charge about $30 per wire, and there may be a delay of two to three days before the amount will show in the recipient’s account for the first transfer performed.

Traders are also usually able to write a personal check or a bank check directly to their forex brokers. The only problem with using these other methods is the amount of time that is needed to process the payments. For example, paper checks can be held for up to 10 business days (depending on the individual’s bank and the state) before being added to a trading account.

Fund your forex account fast

Funding your account couldn't be easier. Select one of four convenient methods.

Ways to fund your account

There are four convenient ways to fund your account. All new accounts must meet the minimum balance requirement: standard accounts $2500 and mini accounts $500.

Debit card

In most cases, funds sent via debit card post to your account immediately. Login to myaccount, our secure client area, to make debit card deposits directly to your ally invest forex trading account.

Echeck

Echecks are a quick and secure way to transfer funds between your bank and ally invest forex account. We accept deposits from US bank accounts only. Echecks may take 2 - 5 business days to clear and be credited to your trading account. Login to myaccount, our secure client area, to make an echeck deposit to your ally invest forex account.

Wire transfer

This is the quickest and easiest way to fund your account. We accept deposits in US dollar, euro, canadian dollar, japanese yen, swiss franc, australian dollar and british pound (sterling). Funds are typically received within 1-2 business days. Wire transfer instructions are available in our secure client area. Click here.

Check deposit

Personal or business checks only drawn on US dollar accounts are accepted. Checks may take 5-10 business days from the day of receipt to clear and be credited to your trading account.

Mailing instructions:

Bank, cashiers' check and cash deposits are not accepted, which includes money orders, traveler's checks or other cash equivalents. Under no circumstances will payments be made or received via third parties.

Looking for account forms? Click here.

Anti-money laundering policy

GAIN capital actively complies with all anti-money laundering and anti-terrorism laws and regulations, including reporting and blocking of assets, to the fullest extent that it can do so under all applicable foreign and domestic laws. On an ongoing basis, GAIN capital shall review account activity for evidence of suspicious transactions that may be indicative of money laundering activities. This review may include surveillance of: 1) money flows into and out of accounts,2) the origin and destination of wire transfers, and 3) other activity outside the normal course of business.

Ally invest forex, LLC. (’ally invest forex") acts as an introducing broker to GAIN capital group, LLC ("GAIN capital"). Your account is held and maintained at GAIN capital who serves as the clearing agent and counterparty to your trades. GAIN capital is a registered futures commission merchant (FCM) and a member of the national futures association (NFA #0339826).

Try ally invest forex with a free $50,000 practice account. Get started below.

No need to practice?

Open a live forex account.

- East-to-use, fully functional ally invest forex trading platform

- Up to 50:1 leverage

- We offer 50 currency pairs

- Powerful charting

- 24-hour news headlines

- Daily and weekly forex research

- 24/6 support by phone and live chart

open forex account

Why ally invest forex?

Trading platforms

Education

Forex support

Foreign exchange (forex) products and services are offered to self-directed investors through ally invest forex LLC. Ally invest forex LLC, NFA member (ID #0408077), acts as an introducing broker to GAIN capital group, LLC ("GAIN capital"), a registered FCM/RFED and NFA member (ID #0339826). Your forex account is held and maintained at GAIN who serves as the clearing agent and counterparty to your trades. GAIN capital, attn: ally invest forex, bedminster one, 135 US highway 202/206, suite 11, bedminster, NJ 07921, USA.

Forex and other leveraged products involve significant risk of loss and may not be suitable for all investors. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Increasing leverage increases risk. Spot gold and silver contracts are not subject to regulation under the U.S. Commodity exchange act. Please read the full disclosure.

There are risks associated with using an internet-based trading system including, but not limited to, the failure of hardware, software, and internet connection. Ally invest forex is not responsible for communication failures or delays when trading via the internet. Any opinions, news, research, analysis, prices, or other information contained on this website are provided as general market commentary, and do not constitute investment advice. Ally invest forex is not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content on this website is subject to change at any time without notice.

Forex accounts are NOT PROTECTED by the securities investor protection corporation (SIPC), NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE.

Forex account funding

Client funds security is a dominating element of the group’s philosophy alongside unmatched trading conditions and customer support. With global recognition for excellence, solid reputation and multi-award winning services, our clients are assured that their funds are held with security, clarity and integrity.

Ironfx has developed in-house a bespoke interface to make account funding easy and hassle-free using our pioneering client portal, a single interface for all of clients' needs.

Payment and funding authorisation are 100% automatic and the ironfx client portal allows deposits and withdrawals using a simple, easy-to-use single interface. Ironfx does not accept cash deposits.

- Deposit fees:

- None

- Maximum transaction amount:

- USD 50,000 per transaction

- Deposit fees:

- Depends on the corresponding and intermediary banks. Ironfx does not apply any fees.

- Deposit fees:

- None

- Maximum transaction amount:

- USD 50,000 per transaction

- Deposit fees:

- None

- Maximum transaction amount:

- USD 50,000 per transaction

- Deposit fees:

- None

- Maximum transaction amount:

- CNY 360,000 per transaction

© 2020 ironfx. All rights reserved.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.18% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

High risk trading warning:

Our services include products that are traded on margin and carry a risk of losing all your initial deposit. Before deciding on trading on margin products you should consider your investment objectives, risk tolerance and your level of experience on these products. Margin products may not be suitable for everyone. You should ensure that you understand the risks involved and seek independent financial advice, if necessary. Please consider our risk disclosure.This website is owned and operated by ironfx.

Ironfx is a trade name of notesco UK limited. Notesco UK limited is authorized and regulated by the financial conduct authority (FCA no. 585561)

*ironfx BM is operated by notesco limited, registered in bermuda.

INSTANT FUNDING FOR FOREX TRADERS

Take our capital,

Accelerate your funded account up to $1.28 million dollars

What is your trading personality?

LOW RISK

Apply risk measures in your trading to receive a low target for more funding.

AGGRESSIVE

Take the freedom to trade your style with no restrictions.

Trade with high leverage and no mandatory stop orders.

ARE YOU NEW TO THE FUNDING TRADERS' PROGRAM?

Choose your funded account model

Profit target is determined by the profit goal for the current stage, from which the5ers will increase your trading capital responsibility.

Profit is the sum of all realized and unrealized positions including commission and swap charges. Once the target is hit, the trader is requested to close all running trades, and report the achievement to the fund.

It is only for the first stage of the program, the profit target is lower, 6% for the low-risk plans, and 12% for the aggressive programs. With all the rest of the stages, the profit target is 10% for the low risk, and 25% for the aggressive programs.

The equity stopout level is the lowest value of the account allowed. Once the account equity value is below this level, the fund will close all running trades, and disable trading and access.

The stopout level is a fixed value of loss allowance measured from the starting balance account of each level. As much the trader profit in the account, so his/hers loss allowance increases. Example: the starting balance is $10,000, the account is with $200 profit, the equity stopout level is $9,600; this gives the trader $600 loss allowance, if the profit increases to $500, the loss allowance is now $900.

The leverage applied for the trading account. The trader is allowed to utilize the full leverage applied for the account with no further enforcement.

Aggressive programs are set to 1:30 leverage, powers by 30 times the market buying allowance. Low risk programs are set at 1:6 leverage, powers by 6 times the market buying required.

Setting a stoploss for every trade is required when participating in the low risk programs. Only in the low risk plans, each and every position must consist of a proper stoploss at value not greater of 1.5%. The fund risk monitor, allows up to 2 whole minutes for placing a proper stoploss.

Failing to maintain stoploss discipline will result by switching the program to aggressive mode.

The maximum time required to complete the profit target for the first level of the program. To be clear, the maximum expiry time is applied ONLY for the very FIRST stage of the program. In all other progressed levels, there will be NO expiration time limit for active traders.

The maximum number of calendar days is set for 180 for the low risk plans, and 60 calendar days for the aggressive plans.

Once hitting the profit target alone with the rest of the qualification objectives, the5ers will increase your capital responsibility, with all the objectives increased proportionally.

At the first stage accomplishment, you will be receiving 4 times greater from initial capital of your first account. For every other steps (but the first one) the growth upscaling is twice of the last initial capital.

The deal with the5ers is that you bring the trading and we bring all the trading capital, we take the full risk for trading loss - but the profits will be shared with you. We will pay you a commission of 50% of the trading profits.

Payout is issued every month starting the second level of the program. Only at the first stage payout is paid once the stage is fully completed.

Good to know, receiving payouts is never being deducted from your forward progression toward the next milestone. With the5ers you get both the growth and the payouts. No need to decide.

A thought about percentage. Some may say a better percentage offer could be found elsewhere. We say, don’t judge by the percentage - judge by the potential money you actually receive. With our fast growth plan, you are increasing your actual money profit potential much faster than anywhere else.

The5ers guarantees maximum trading capital in funding, which is currently a 1.28 million dollars real funded account.

1.28 million is a big account to manage, however, this is not our final offer for you. Once you accomplish your goal on the 1.28 M account, we will discuss with you further growth and targets.

By signing up for the5ers programs you receive an instant funded account right away, with trading access to the fund’s pool account. We give a fair opportunity for every trader to present his/her trading skills on a real-capital-funded account. We take full responsibility to handle potential trading losses, which should be secured by a one-time participation fee.

Your participation fee is not trading securities. We are not a broker, not representing any financial institutes. Your once-off fee is paying you into the most rewarding funding program experience in the industry.

The fee is not refundable once you had made your first action in the funded account. Remember, you are being assigned to a real funded account from the very beginning. Any profits you will be making will be shared with you eventually.

Of course, we provide much more than just funded accounts. Trading with the5ers is a whole trading experience, including funding, accelerated growth with extreme income potential, full dedicated team of professionals ready to cater to your professional and administrative requirements, we provide education, and trading events, a live trading room, and extensive performance statistics dashboard.

Double capital at profit milestone up to 1.28 million guaranteed!

The5ers offer the most extreme and accelerated growth rate. At every milestone you are acquiring, the5ers will double your initial capital handling, also doubling the trading objectives, in terms of maximum loss allowance (aka equity stop out level), leverage, and stoploss (for applicable programs).

Milestones for the low-risk programs are set to 10% net profit, for the aggressive plans, a 25% target is set.

How do you fund a forex account?

The forex (FX) market is where currencies from around the world are traded. A foreign exchange account is typically what is used to trade and hold foreign currencies online. Using these accounts is easier than it has ever been in the past. Typically, you will just need to open a new account, deposit the amount of money you choose in your country’s currency, and then you are free to sell and buy currency pairs as you see fit.

Key takeaways

- Forex accounts are used to hold and trade foreign currencies.

- It is easier than ever for individuals to participate in forex trading, due to the development of margin accounts and electronic trading.

- You can invest in forex with as little as $1,000.

- The biggest difference between trading equities and trading on forex is the amount of leverage required.

- Forex accounts can be funded by credit card, wire transfer, personal check, or bank check.

In the past, currency trading was limited to certain individuals and institutions. That's because the funds required to play were significantly higher than for any other investment instrument. However, with the development of electronic trading networks and margin accounts, requirements have changed. Although nearly 75% of forex trading is still done by large banks and financial institutions, individuals are now able to invest in forex with as little as $1,000—thanks in large part to the use of leverage. Despite these changes, making high returns on highly-leveraged currency trades can be difficult, and will require a good amount of patience and skill.

How forex trading works

By using a margin account, investors essentially borrow money from their brokers. Of course, margin accounts can also be used by investors to trade in equity securities. The main difference between trading equities and trading forex on margin is the degree of leverage that is provided.

For equity securities, brokers usually offer a 2:1 leverage to investors. On the other hand, forex traders are offered between 50:1 and 200:1 leverage. This means that traders need to deposit between $250 and $2,000 to trade positions of $50,000 to $100,000.

Learning the ins and outs of investing in a market that contains foreign currencies can be a useful skill to develop in today’s hyper-connected world.

How to fund a forex account

Forex traders are usually given several options when deciding how they will deposit funds into trading accounts. Credit card deposits have by far become the easiest way. Since the development of online payment services, digital credit card payouts have become increasingly efficient and secure. Investors can simply log in to their respective forex accounts, type in their credit card information and the funds will be posted in about one business day.

Investors can also transfer funds into their trading accounts from an existing bank account or send the funds through a wire transfer or online check. When choosing to perform a wire transfer, keep in mind that most banks will charge about $30 per wire, and there may be a delay of two to three days before the amount will show in the recipient’s account for the first transfer performed.

Traders are also usually able to write a personal check or a bank check directly to their forex brokers. The only problem with using these other methods is the amount of time that is needed to process the payments. For example, paper checks can be held for up to 10 business days (depending on the individual’s bank and the state) before being added to a trading account.

From $10k to $160k – funded forex account with the5ers – have a look!

Tim is on the way to gain 10% profit and double his funded account to $320k!

Tim.H from the united states is one of the5ers funded traders. He’s been with us for almost a year, and he is already trading a $160k funded account, his next mission is to gain 10% and double the account to $320k.

Tim successfully passed our evaluation program on a $10K real live account and started trading a $40K forex funded account on our platform.

His next mission was to reach 10% gain profit and double his funds to $80K.

Tim succeeded, and after meeting the target, he doubled his funded account to $80k, but it didn’t end there, tim did it again, he reached a 10% gain profit, and now he is funded with a $160k account.

If that wasn’t enough, at the end of every profitable month he got paid 50% of the profits which was not deducted from the account balance, and therefore not affected the 10% target mission. Yes, he got paid and kept growing his account at the same time, the best of both worlds.

His next mission is to reach 10% gain profit and double his funds to $320K.

Coming soon – a live interview on video with tim, where he will tell about his journey, and he reveals his strategy and other tips for forex traders, you will not want to miss this!

In the meantime, you have a chance to take a peek at his trading performance and some interesting statistics from the5ers dashboard-

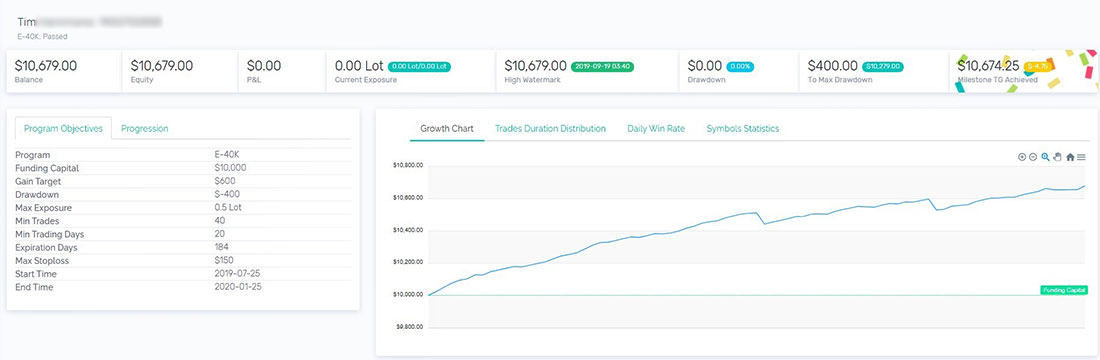

Tim H. Evaluation statistics – $10k

The5ers evaluation conducted on a real live account, tim completed the evaluation process in less than two months by reaching the 6% target (the5ers evaluation qualifying target is 6%/7% which can be achieved within 6 months).

In the image below you can see how smooth and nice tim’s equity curve is, and his profit factor 5.14, which is an amazing score.

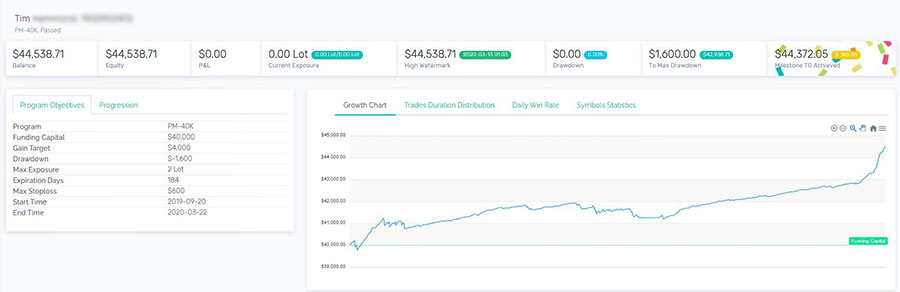

Tim’s $40K funded account (pm1)

This is tim’s first pm account, a $40k funded account. The image shows us tim’s ability to stay consistent and steady, even in less profitable periods.

Eventually, tim reached the 10% target and doubled his funded account to $80k according to the5ers growth program.

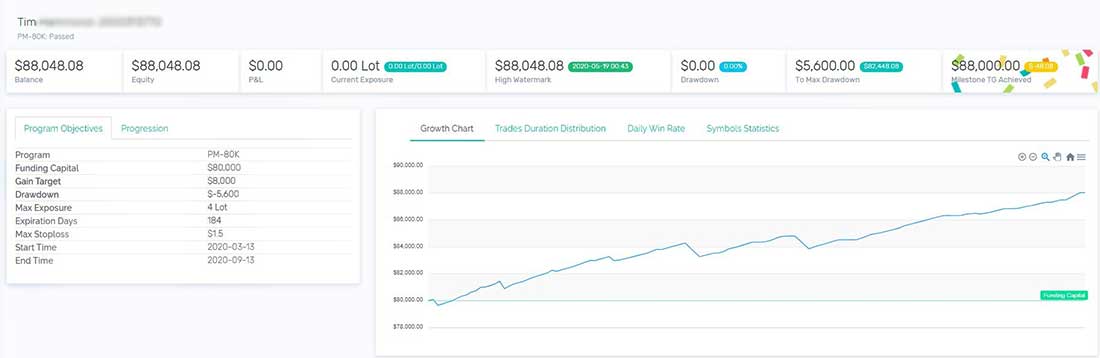

Tim’s $80K funded account (pm2)

In this image, you can see the $80k account, and how easy and safe tim achieved the 10% target again.

It took him only two months to complete this stage and move forward to a $160k funded account.

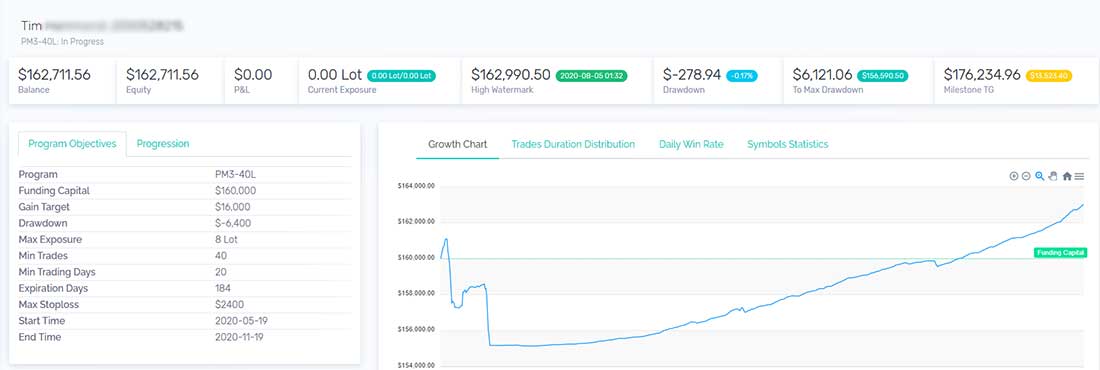

Tim’s $160K funded account (pm3)

At the moment tim is trading the $160k funded account.

As you can see, the beginning was not that successful, but tim’s experience along with professional risk management helped him to make an amazing recovery.

Now it seems that tim is back on track to reach the next 10% target and double his funded account to $320k.

Well done tim! We are happy to have you with us!

Want to trade like tim? Get a funded forex account with the5ers-

Best funding programs – always trading with a real live account.

Lowest participation cost – only one-time fee.

Our funding programs are flexible and fair, easy to meet targets, clear and simplified objectives.

We welcome all trading styles and strategies – just incorporate our money management requirements.

Trading 24/5 – trade overnight and over the weekend.

Monthly payout guaranteed – get paid for profits every month, and get paid for profits, while keeping your account growth.

Growth program – double your account size every 10% gain.

Live trading room – we are forex traders, come trade with us

Portfolio analyst – schedule an online appointment with a portfolio analyst.

Support – we are backing you up with any support you need, live chat, via telephone, email, or form submit.

Friendly dashboard – advanced system to track your trading progress and next objectives.

If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our newsletter.

Live trading capital: funded forex account, forex funding

Forex traders can obtain live trading capital and funded trading accounts from third party providers. Thousands of traders are receiving funding for their trading account every year from the various capital providers. Any forex trader who has a great trading system and is competent, skilled and profitable, but lacks the funds to trade live should investigate these funding companies. This article will provide lots of details on what programs are available to get forex account funding. We will also present a low drawdown, profitable trading system to use with the capital and funding providers. Traders can earn strong commissions, like 80%, to be paid for their trading skills using these funded accounts.

Companies that provide live trading capital

Several companies provide live trading capital for forex traders. Here is a partial list: topstep, FTMO, the5ers, blufx, maverickfx, fidelcrest, audacity, traders4traders, fundisus, traders4traders, skilledmarkets and enfoid. We also found a handful of forex brokers who have capital referral programs.

There are also private entities and individuals on places like linkedin that advertise funding available for forex traders. Some of these capital providers have been in business over 5 years. You can supplement this list with some google searches for “forex funding” or “funded forex account”.

How much money is available for my funded forex account

Traders who qualiyy are eligible to receive up to $2,000,000 or more USD in buying power, including leverage, from many of the available capital provider programs. Example, a funding company might offer a trader a $5,000 account with 100:1 leverage, which is $500,000 USD in buying power. Some companies will fund traders in euros rather than US dollars. Be sure to ask what leverage is being used from the providers.

If you start with a small amount of capital, you can easily qualify for more funding quickly just by increasing your account balance by a small amount. Each forex funding provider has their own guidelines for qualifying for more money. Important tip >> if you want more funding for your forex trading account, then open two accounts with two different capital providers.

Fees for obtaining forex funding

If you are seeking funding for your forex trading account, check the fee structure. Some forex funding and capital providers do not charge any fee at all, but the profit split percentages for the trader are lower. Some funding providers charge one time up front fees or monthly fees. In some cases the fees are 100% refundable out of the trading profits. So this is a wide range of possibilities. We consider most of the fees to be reasonable, since the funding providers are covering any trading losses for the end user.

When evaluating a forex funding provider, we would question each provider if the trading platform they provide has institutional spreads or direct access spreads. Inquire if the brokerage platform they provide is also a profit center for their introducing broker operation. Most funding providers likely also make money off of each trade as an introducing broker. Don’t pay for high spreads on top of the fees they charge.

How do I get A funded forex trading account

Each capital and funding provider has a qualification program to obtain funding. The rules vary quite a bit. Each qulification program has a demonstration or qualification period to obtain the funding. It can be a one or two step process. During the qualification period you must abide by the capital provider’s rules like profit targets, position size, daily and weekly total loss or drawdown limits, maximum number of positions open and position size, etc. Each capital and funding provider has their rules and guidelines are they in writing, so read them carefully. If you break the rules you might be liable for paying more fees to restartthe process to get more funding. The demonstration period can very from one month to several months to hit the profit targets. All of the providers we found cover all trading losses up to the specified loss limits. Don’t be intimidated by the funding qualification process, under some programs you can qualify for funding in as little as one day with just 2 or 3 positive trades.

Important tip >> you access much more capital quickly. Some capital providers will increase the amount of capital they make available to a trader for trading profitably. Some capital providers will double the amount of capital you can access for increasing your account balance by only 10%, which is a modest amount of profit. For example if you get a $5,000 trading account and you increase the account to $5,500 with positive trades, you will be able to access $5,000 more trading capital. We view this as quite generous, since this can be done with just one swing trade.

More criteria for selecting A live trading capital provider

Profit splits range from 50/50 to 80/20, with the traders keeping 80%. Topstepfx allows traders to keep the first 100% of $5,000 in profits. 50% seems pretty low for a profit split, in our opinion. Profits can be withdrawn via bank wire and in some cases, paypal. Transfer fees may apply to small withdrawals. Withdrawals are usually available at the end of the month.

All of the capital providers have drawdown limits. The drawdown is usually measured as the amount of loss of capital from the previous and most recent high balance. Drawdown limits can be weekly or monthly, and range from between 1% and 10% of the high balance, which is a very wide variation. Continue reading this article and we can show you a trading system that can be used that has very little drawdown on each trade entry. This system will minimize drawdown so the tighter drawdown rules can be met.

When selecting a live trading capital provider make sure they show you a list of the available pairs that you can trade with their brokerage platform. We recommend checking their offerings against the 28 most actively traded pairs, which are combinations of the 8 most frequently traded currencies. The USD, CAD, EUR, CHF, GBP, JPY, AUD and NZD are the 8 most frequently traded currencies.

Some capital providers only allow trading on 22 or 24 of these pairs, some providers allow the full 28 pairs. Some providers offer a choice of a lot of pairs to trade, but these pairs are outside the 8 most frequently traded currencies. These spreads on these pairs are very high and should not be traded inside of these programs.

Traders should inquire as to what trading platform is offered by the capital provider that you are evaluating. If all of your trading experience is on metatrader 4, but the capital provider may not offer that platform. If you are seeking their capital might have to download the platform they offer for executing trades and managing the account, so make sure you ask this important question. Being experienced using a new platform is very important before applying for funding.

Some capital providers offer expensive training programs, costing thousands of dollars up front, before you can qualify for capital. We would avoid these capital providers all together. Forexearlywarning can provide a complete training program, our 35 illustrated forex lessons, to teach you everything you need to know about our complete, profitable trading system.

Most of the capital providers we reviewed were offering 100:1 leverage. If you are used to trading at 50:1 or some other leverage rate, remember to keep this in mind as it will affect your margin balances on each trade.

Some capital providers do not let you hold trades over the weekend, or even overnight. This is not good at all. It makes it impossible to swing trade or do any trend based trading on the higher time frames. Avoid these types of restrictions, if possible.

Some capital providers offer a free trial, which is excellent.

Live trading capital forex traders

Trader profile for live trading capital

If you are a forex trader, and would like to have access to live trading capital, here are some characteristics we think you should have:

First of all you should have a rules based trading system, and you are able to consistently make positive pips when you use it, week after week. You must like your trading system and understand it well via demo trading or micro lot trading. You must be skilled at entering trades and managing trades with stops and scaling out lots. We advise using a complete trading system like the forexearlywarning trading system. We offer thorough market analysis, more exact trade entry points across 28 pairs, and very little drawdown on trade entries. The low drawdown will comply with most capital programs. If you are a rookie trader with little experience, you should avoid all live trading capital programs, you are not ready yet.

Trading system to use with your funded forex trading account

If you are a trader who is seeking capital, and you need a profitable trading system with a low drawdown, check out the forexearlywarning trading system. You can demo trade our trading system and get consistent trades prior to applying for a funded account..

Forexearlywarning provides daily trading plans for 28 pairs, and we focus on the higher time frames. The higher time frames will get you more pips and profits than scalping the same pairs over and over with indicators. Forexearlywarning also has reliable alert systems and an excellent trade entry management system, the forex heatmap®. Do not use any trading system with ambiguous or random trade entries or rules for entry that are unclear.

Live trading capital for forex traders

An example trade signal for the GBP pairs on the heatmap is shown above, consistent, clear signals like this for trading are powerful and traders will have very little drawdown on trade entries, as to fully comply with the drawdown rules from most capital providers.

By offering 28 pairs, the forexearlywarning trading system matches or exceeds the most and most liquid pairs to trade offered in most capital programs. The heatmap system will provide traders with much lower drawdown on trade entry points so almost any capital program can be used. With the forexearlywarning trading system, you can easily make 10% on your account balance on one swing trade based on the H4 time frame. This will qualify you for more capital on some of the capital providers programs.

Other advantages of using the forexearlywarning trading system are that is can be easily demo traded. You must like your trading system and enjoy using it before you apply for any third party funded account.

Conclusions about live trading capital programs: A large amount of capital is available to forex traders to fund their live accounts, and we predict that even more capital will be available going forward. Any program that offers a fully funded forex trading account, that also covers your trading losses sound like a great offer. Traders who have no capital or just a small amount of capital, who are skilled at making positive trades, should evaluate these capital providers. Traders should remember that the trading rules vary between providers, so read each capital providers’ rules carefully, get everything in writing, like the fee structure and ongoing drawdown limits.

So, let's see, what we have: stop trading small accounts the world’s best subscriptions based FX trading solution. Fundisus provides all participants with funded accounts to access the spot market. Who are we? Fundisus at forex account funding

Contents

- Top forex bonus list

- Stop trading small accounts

- Let us tell you more

- We fund traders worldwide

- Do you have what it takes to get funded?

- WHY CTI'S FUNDED TRADER PROGRAM

- How do you fund a forex account?

- How forex trading works

- How to fund a forex account

- Fund your forex account fast

- Funding your account couldn't be easier. Select one of four convenient methods.

- Ways to fund your account

- Debit card

- Echeck

- Wire transfer

- Check deposit

- Anti-money laundering policy

- Try ally invest forex with a free $50,000 practice account. Get started below.

- No need to practice?Open a live forex account.

- Funding your account couldn't be easier. Select one of four convenient methods.

- Forex account funding

- INSTANT FUNDING FOR FOREX TRADERS

- What is your trading personality?

- ARE YOU NEW TO THE FUNDING TRADERS' PROGRAM?

- Choose your funded account model

- How do you fund a forex account?

- How forex trading works

- How to fund a forex account

- From $10k to $160k – funded forex account with the5ers – have a look!

- Tim is on the way to gain 10% profit and double his funded account to $320k!

- Tim H. Evaluation statistics – $10k

- Tim’s $40K funded account (pm1)

- Tim’s $80K funded account (pm2)

- Tim’s $160K funded account (pm3)

- Want to trade like tim? Get a funded forex account with the5ers-

- Live trading capital: funded forex account, forex funding

- Companies that provide live trading capital

- How much money is available for my funded forex account

- Fees for obtaining forex funding

- How do I get A funded forex trading account

- More criteria for selecting A live trading capital provider

- Trader profile for live trading capital

- Trading system to use with your funded forex trading account

No comments:

Post a Comment