Bitcoin tradingview

Wait. Don't get too comfortable. Remember that one? Retraces and corrections have been non-existent for bitcoin.

Top forex bonus list

Or better yet, short-lived. We are seeing strong consolidation take place near resistance. When prices are going to drop, they drop. Staying near resistance is a signal of strength. Based on this chart, BTCUSD 1H, we are likely to see higher. Trading suggestion: . There is a possibility of temporary retracement to suggested support line (0.0000068). If so, traders can set orders based on price action and expect to reach short-term targets. Technical analysis: . Basic attention token/bitcoin is in a range bound and the beginning of uptrend is expected. . The price is below the 21-day WEMA which.

Bitcoin (cryptocurrency)

Predictions and analysis

What's your thought of BTCUSD? I think the uptrend will continue for a while. It's just taking a breath to get ready and go up with even more power.

BIT coin broke its range and a short term down trend move is possible.

These are the questions that I am now getting very often. If bitcoin will retrace, how far can it go? The potential targets we look at are based on the timeframe we are reading. Even though we have a very strong bearish candle today, with really high volume. It is still very early on this move, here is the daily (D) chart for BTCUSD.

Midterm forecast: while the price is above the support 0.02275, resumption of uptrend is expected. We make sure when the resistance at 0.02965 breaks. If the support at 0.02275 is broken, the short-term forecast -resumption of uptrend- will be invalid. Technical analysis: the RSI bounced from the uptrend #1 and it prevented price from more losses. While the.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (29940). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . Bitcoin/tether is in a uptrend and the continuation of uptrend is expected. . The price is above the 21-day WEMA which acts as a dynamic.

Wait. Don't get too comfortable. Remember that one? Retraces and corrections have been non-existent for bitcoin. Or better yet, short-lived. We are seeing strong consolidation take place near resistance. When prices are going to drop, they drop. Staying near resistance is a signal of strength. Based on this chart, BTCUSD 1H, we are likely to see higher.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.0000057). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . Stellar/bitcoin is in a range bound and the beginning of uptrend is expected. . The price is above the 21-day WEMA which acts as a.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.0233). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . MKR/BITCOIN is in a range bound and the beginning of uptrend is expected. . The price is above the 21-day WEMA which acts as a dynamic.

Trading suggestion: . There is a possibility of temporary retracement to suggested support line (0.0000068). If so, traders can set orders based on price action and expect to reach short-term targets. Technical analysis: . Basic attention token/bitcoin is in a range bound and the beginning of uptrend is expected. . The price is below the 21-day WEMA which.

Second chance trade setup summary: profit targets=26% =

#BPCL bharat petroleum corporation limited. CMP: 399 TARGET: 436 // 478 G-O-I undertaken stock is in limelight, BPCL. As the state run petroleum company plans for divestment, there is going to be a lot of opportunities for retail investors and traders. Govt. Plans to sell off almost 53% stake from the company and it receives MULTIPLE bids. Stock is expected to.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.00000740). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . Cardano/bitcoin is in a range bound and the beginning of uptrend is expected. . The price is above the 21-day WEMA which acts as a.

Trading suggestion: . There is a possibility of temporary retracement to suggested support line (0.000406). If so, traders can set orders based on price action and expect to reach short-term targets. Technical analysis: . Chainlink/bitcoin LINKBTC is in a range bound and the beginning of uptrend is expected. . The price is below the 21-day WEMA which acts as.

In the spirit of 2021 and bitcoin hitting a new high daily. HIT LIKE before getting started! Thanks a lot for your support. We are likely to be witnessing the last monthly bullish candle before bitcoin starts to retrace. How far up will it go? Looking at our fibs. On this chart, based on the monthly timeframe, we have the following resistance levels coming.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.004100). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . Litecoin/bitcoin is in a downtrend and the beginning of uptrend is expected. . The price is below the 21-day WEMA which acts as a.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.000386). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . LINKBTC is in a downtrend and the beginning of uptrend is expected. . The price is below the 21-day WEMA which acts as a dynamic.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.0000888). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . OMGBTC is in a range bound and the beginning of uptrend is expected. . The price is below the 21-day WEMA which acts as a dynamic.

Bitcoin (cryptocurrency)

Predictions and analysis

What's your thought of BTCUSD? I think the uptrend will continue for a while. It's just taking a breath to get ready and go up with even more power.

BIT coin broke its range and a short term down trend move is possible.

These are the questions that I am now getting very often. If bitcoin will retrace, how far can it go? The potential targets we look at are based on the timeframe we are reading. Even though we have a very strong bearish candle today, with really high volume. It is still very early on this move, here is the daily (D) chart for BTCUSD.

Midterm forecast: while the price is above the support 0.02275, resumption of uptrend is expected. We make sure when the resistance at 0.02965 breaks. If the support at 0.02275 is broken, the short-term forecast -resumption of uptrend- will be invalid. Technical analysis: the RSI bounced from the uptrend #1 and it prevented price from more losses. While the.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (29940). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . Bitcoin/tether is in a uptrend and the continuation of uptrend is expected. . The price is above the 21-day WEMA which acts as a dynamic.

Wait. Don't get too comfortable. Remember that one? Retraces and corrections have been non-existent for bitcoin. Or better yet, short-lived. We are seeing strong consolidation take place near resistance. When prices are going to drop, they drop. Staying near resistance is a signal of strength. Based on this chart, BTCUSD 1H, we are likely to see higher.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.0000057). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . Stellar/bitcoin is in a range bound and the beginning of uptrend is expected. . The price is above the 21-day WEMA which acts as a.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.0233). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . MKR/BITCOIN is in a range bound and the beginning of uptrend is expected. . The price is above the 21-day WEMA which acts as a dynamic.

Trading suggestion: . There is a possibility of temporary retracement to suggested support line (0.0000068). If so, traders can set orders based on price action and expect to reach short-term targets. Technical analysis: . Basic attention token/bitcoin is in a range bound and the beginning of uptrend is expected. . The price is below the 21-day WEMA which.

Second chance trade setup summary: profit targets=26% =

#BPCL bharat petroleum corporation limited. CMP: 399 TARGET: 436 // 478 G-O-I undertaken stock is in limelight, BPCL. As the state run petroleum company plans for divestment, there is going to be a lot of opportunities for retail investors and traders. Govt. Plans to sell off almost 53% stake from the company and it receives MULTIPLE bids. Stock is expected to.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.00000740). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . Cardano/bitcoin is in a range bound and the beginning of uptrend is expected. . The price is above the 21-day WEMA which acts as a.

Trading suggestion: . There is a possibility of temporary retracement to suggested support line (0.000406). If so, traders can set orders based on price action and expect to reach short-term targets. Technical analysis: . Chainlink/bitcoin LINKBTC is in a range bound and the beginning of uptrend is expected. . The price is below the 21-day WEMA which acts as.

In the spirit of 2021 and bitcoin hitting a new high daily. HIT LIKE before getting started! Thanks a lot for your support. We are likely to be witnessing the last monthly bullish candle before bitcoin starts to retrace. How far up will it go? Looking at our fibs. On this chart, based on the monthly timeframe, we have the following resistance levels coming.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.004100). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . Litecoin/bitcoin is in a downtrend and the beginning of uptrend is expected. . The price is below the 21-day WEMA which acts as a.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.000386). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . LINKBTC is in a downtrend and the beginning of uptrend is expected. . The price is below the 21-day WEMA which acts as a dynamic.

Trading suggestion: ". There is a possibility of temporary retracement to suggested support line (0.0000888). . If so, traders can set orders based on price action and expect to reach short-term targets." technical analysis: . OMGBTC is in a range bound and the beginning of uptrend is expected. . The price is below the 21-day WEMA which acts as a dynamic.

Bitcoin (kriptopara)

Öngörüler ve analizler

Takip ediliyor takibi kes

Takip ediliyor takibi kes

Takip ediliyor takibi kes

Takip ediliyor takibi kes

Takip ediliyor takibi kes

Takip ediliyor takibi kes

Takip ediliyor takibi kes

Takip ediliyor takibi kes

Takip ediliyor takibi kes

Takip ediliyor takibi kes

Takip ediliyor takibi kes

Takip ediliyor takibi kes

Bitcoin (kriptopara)

Bitcoin (BTC) , 2009 yılında yaratılan merkezi olmayan bir dijital paradır. Açık kaynak kodu üzerinde satoshi nakamoto tarafından icat edilmiştir ve internet üzerinden kullanıcıların doğrudan birbirleri arasında merkezi olmadan genel şekilde kayıt altına alınır. Bitcoin, diğer kriptoparalardan açık ara daha fazla piyasa büyüklüğüne sahiptir, en yakın takipçisi ethereum'dan 19 kat fazla daha büyüktür. 21 milyonla sınırlı ünitenin 16 milyonu kullanılabilir durumdadır. Sınır olmasının nedeni enflasyonun değerlerini düşürmemesi içindir.

Kullanıcılar bitcoin madenciliği için işlemci gücü katkısı yaparlarsa işlem ücretleri ve yeni üretilen coin'lerle ödüllendirilirler. Ünitelerin, diğer kriptoparalar veya USD, EUR gibi resmi paralarla fiziksel para borsaları gibi işletilen bir çok borsa üzerinden alım ve satımları yapılabilir. Mal ve hizmetler için borsalardan kaydedilebilir veya temin edilebilirler. Birçok benzeri firma gibi çevrimiçi ürün ve servislerinin bitcoin ile satın alınmasında, yıllık ödemeler için tradingview de bitcoin kabul eder.

Bitcoin chart views soared along with price in november, tradingview says

Zack voell

Bitcoin chart views soared along with price in november, tradingview says

Bitcoin traders stared at price charts over 3.4 million times in november, watching the leading cryptocurrency pass its record-high price from 2017 late in the month, according to leading charting service tradingview.

In november, bitcoin chart views on tradingview soared 82% from the previous month with similar growth seen in charting of other cryptocurrencies, per user data shared exclusively with coindesk.

Bitcoin’s price rallied 42% over the same period.

Subscribe to blockchain bites, our daily update with the latest stories.

“BTCUSD has consistently been the most popularly viewed symbol this year,” said david belle, the company’s U.K. Growth director, in an email to coindesk, referring to bitcoin and the U.S. Dollar. Tradingview supports price charting tools across stocks, futures, foreign exchange, cryptocurrency and other markets.

“what we’re seeing is that currently there’s simply a massive amount of interest in bitcoin,” belle said.

Beyond charting, rapid growth in attention paid to bitcoin is seen in the use of other products and services including record buying volume on the retail-focused product cashapp by square along with strong demand for new services like paypal’s cryptocurrency features.

Institutional trading activity is also increasing, as evidenced by CME group’s bitcoin futures market hitting record-high open interest shortly before bitcoin’s all-time high in november.

Bitcoin chart views on tradingview are still down roughly 50% from the record highs set in late 2017. But since launching support for bitcoin and other cryptocurrencies in 2016, tradingview’s charting tools have been widely integrated across almost every leading cryptocurrency exchange.

Bitcoin’s price has cooled off a bit in december, dipping about 10% from its monthly open of above $19,700 on coinbase. “the current price does seem a little different to 2017,” belle said. “I’d argue it’s because it’s less of a price discovery phase and the market is less infant than in 2017.”

In 2020, the bellwether cryptocurrency has gained 152%.

Bitcoin and tesla: america's most loved assets on tradingview

Tradingview said friday that bitcoin and tesla, the electric car maker and clean energy firm, are america’s most viewed assets on the charting platform.

Bitcoin (BTC) has climbed over 60% year-to-date, with the price reaching $11,900 at press time. The rise has drawn in thousands of new investors – both retail and institutional – to the cryptocurrency.

Likewise, tesla’s share price more than tripled this year, soaring from $402 on january 1 to $1,650, driven by a positive future outlook on the electric vehicles industry.

“while publicly traded companies like apple are nearing a $2 trillion market cap, it looks like traders and investors still aren’t paying that much attention,” said tradingview, in a statement.

“for now, the data clearly shows that tesla and bitcoin are the two assets everyone is looking at most often,” it added.

Throughout july, tesla was the most viewed stock in 31 U.S. States but bitcoin was not far behind.

“our findings also show the south east favors forex and the west coast states of california, washington, and oregon lean toward bitcoin. The west coast loves crypto the most,” noted tradingview.

Bitcoin has risen sharply in 2020, fuelled by relentless fiat money printing by governments and central banks, keen to keep their economies afloat in the wake of the coronavirus pandemic.

Amidst the economic downturn, investors seeking to hedge against inflation have piled into the top cryptocurrency.

For example, nasdaq-listed microstrategy inc. This week adopted bitcoin as its primary treasury reserve, spending $250 million on 21,444 BTC. The company described bitcoin as a “dependable store of value…superior to cash.”

Tradingview is a cloud-based social platform for traders as well as an independent charting and analysis tool. With millions of users, the platform provides access to educational trading expert ideas and content in the form of notes, charts, pictorials, and videos.

Users can also trade and make orders directly on the site. Almost all cryptocurrency exchanges incorporate tradingview, which makes up the main interface that helps users monitor live crypto activity on an exchange. Additionally, bitcoin.Com’s crypto market aggregator offers professional trading charts that stem from tradingview.

What do you think about the popularity of bitcoin and tesla on tradingview? Let us know in the comments section below.

Tradingview

Tradingview is a charting web service with historical and real-time bitcoin data from mtgox, stock and futures data from major world exchanges (AMEX, CBOE, CBOT, CME, COMEX, NASDAQ, NYSE, TSX, TSX venture, eurex, NYMEX, ICE USA, ICE canada, ICE europe, KCBT, MGEX, NYSE LIFFE, MICEX, FORTS and BATS), as well as forex data.

The service is built on HTML5 (this means no flash, java or silverlight). So it will run just fine on a modern browser, no matter what operating system you are using.

The service was created on (date) by programmers from multicharts. The service from the start provided data and charting for the major world exchanges. On june 2013 tradingview added bitcoin data from mtgox for all instruments.

• chart types (with customizable resolutions):

- time based: bars, candles, hollow candles, heiken ashi, area and line (ranging from 1 minute to 1 month)

- non-time based: renko, kagi, pnf and price break

• scales - standard - percentage - logarithmic

• indicators (57) ranging from (i) simple oscillators like stochastic through (ii) geometrical indicators like elliot wave to (ii) correlation coefficient allowing for a cross-currency analysis, e.G. BTCUSD vs EURUSD vs BTCCNY

• drawing tools - line tools - gann tools - fibonacci tools - markers, arrows, balloons - prediction tools - shapes

Social / community features

• publish trading ideas - publish your analysis and insight for your followers, and read ideas published by others. Good trading ideas are featured in the tradingview gallery for all of our visitors. You can easily share any idea that you like further by sending it to twitter, facebook, linkedin or anywhere else.

• instant chart snapshot - forget screenshots and image editors. One button takes an instant snapshot of your chart in PNG format and gives you a unique link that stays live forever. You can save the picture or paste it into chat, email, forum, document, blog, twitter, facebook, skype or instant message. In fast-moving markets the time you save with instant snapshot might make all the difference when sharing an idea!

• community ideas on your chart - popular instruments (like google, EURUSD, BTCUSD) have hundreds of published ideas. Normally you’d have to open them separately to do research – not on tradingview! Published ideas are displayed right on your chart as dots on the time when they were published. You can get a bird's eye view of different opinions over time and easily see who thought what and when (or turn it off if you prefer individual analysis).

• real-time conversation - tradingview is much about reacting quickly to market changes, so the conversation is a real-time chat for talking to other people while the moment lasts. You can instantly share chart snapshots and talk only to the people looking at the same stock, or message the entire community.

Features for institutional users / institutional solutions

Tradingview presents online financial software for use by your employees and/or customers. As a corporate client you can customize our charts and data to your company's requirements and cut your costs comparing to using other financial software. You can brand your own turnkey solution. With tradingview you get a fast technological and functional advantage over your competitors, which will help you win more clients. What we offer:

• no installation and setup - our charts have the quality of desktop applications without the difficulties in setup and installation. A simple user login is all that’s required – you can use them on any number corporate computers just by configuring your firewall.

• accessibility and cross-platform support - in the corporate world, maintaining powerful hardware and compatibility across operating systems can be a nightmare. Our charts work on ANY operating system, on any computer and in any modern browser. No need for powerful computers - our servers do all the hard work on the backend, so you can minimize your hardware costs.

• scalability and cloud power - tradingview has no limits on the number of users. Our servers are in the cloud, and extra processing power is automatically allocated when it’s needed. Setting up another user takes just one click.

• adding your custom content - your employees/customers can use our default data, or we can connect any data or news feed that you need. We can customize the interface for you as part of the white label solution.

• white label and customization - do you want the solution to appear like your own? We can create your own version of tradingview according to your company's technological and branding requirements, and host it in a separate cloud. You get a solution that’s unique to your business and a weapon to beat your competitors.

• tough security and backup protection - forget about losing data - latest security protocols make sure the data and content are safe on our servers.

Features for developers

Through tradingview you can sell any content that will be interesting to the community through the tradingview marketplace. Some examples, but there may be other possibilities:

• indicators/strategies for technical analysis, or any studies that are displayed on the chart

• news, or any other relevant feeds (i.E. Economic events)

• market data subscriptions

• premium ideas. You can mark some ideas as free to attract new followers, and some as paid to monetize your knowledge. Only your subscribers will be able to see your paid ideas

5 easy steps for bitcoin trading for profit and beginners

Bitcoin trading can be extremely profitable for professionals or beginners. The market is new, highly fragmented with huge spreads. Arbitrage and margin trading are widely available. Therefore, many people can make money trading bitcoins.

Bitcoin’s history of bubbles and volatility has perhaps done more to bring in new users and investors than any other aspect of the crpytocurrency.

Each bitcoin bubble creates hype that puts bitcoin’s name in the news. The media attention causes more to become interested, and the price rises until the hype fades.

Each time bitcoin’s price rises, new investors and speculators want their share of profits. Because bitcoin is global and easy to send anywhere, trading bitcoin is simple.

Compared to other financial instruments, bitcoin trading has very little barrier to entry. If you already own bitcoins, you can start trading almost instantly. In many cases, verification isn’t even required in order to trade.

If you are interested in trading bitcoin then there are many online trading companies offering this product usually as a contract for difference or CFD.

Avatrade offers 20 to 1 leverage and good trading conditions on its bitcoin CFD trading program.

Why trade bitcoin?

Before we show you how to trade bitcoin, it’s important to understand why bitcoin trading is both exciting and unique.

Bitcoin is global

Bitcoin isn’t fiat currency, meaning its price isn’t directly related to the economy or policies of any single country. Throughout its history, bitcoin’s price has reacted to a wide range of events, from china’s devaluation of the yuan to greek capital controls.

General economic uncertainty and panic has driven some of bitcoin’s past price increases. Some claim, for example, that cyprus’s capital controls brought attention to bitcoin and caused the price to rise during the 2013 bubble.

Bitcoin trades 24/7

Unlike stock markets, there are no official bitcoin exchanges. Instead, there are hundreds of exchanges around the world that operate 24/7. Because there is no official bitcoin exchange, there is also no official bitcoin price. This can create arbitrage opportunities, but most of the time exchanges stay within the same general price range.

Bitcoin is volatile

Bitcoin is known for its rapid and frequent price movements. Looking at this daily chart from the coindesk BPI, it’s easy to spot multiple days with swings of 5% or more:

Bitcoin’s volatility creates exciting opportunities for traders who can reap quick benefits at anytime.

Find an exchange

As mentioned earlier, there is no official bitcoin exchange. Users have many choices and should consider the following factors when deciding on an exchange:

Regulation & trust – is the exchange trustworthy? Could the exchange run away with customer funds?

Location – if you must deposit fiat currency, and exchange that accepts payments from your country is required.

Fees - what percent of each trade is charged?

Liquidity – large traders will need a bitcoin exchange with high liquidity and good market depth.

Based on the factors above, the following exchanges dominate the bitcoin exchange market:

Bitfinex - bitfinex is the world’s #1 bitcoin exchange in terms of USD trading volume, with about 25,000 BTC traded per day. Customers can trade with no verification if cryptocurrency is used as the deposit method.

Bitstamp - bitstamp was founded in 2011 making it one of bitcoin’s oldest exchanges. It’s currently the world’s second largest exchange based on USD volume, with a little under 10,000 BTC traded per day.

Okcoin - bitcoin exchange based in china but trades in USD.

Coinbase -

Coinbase - coinbase exchange was the first regulated bitcoin exchange in the united states. With about 8,000 BTC traded daily, it’s the world’s 4 th largest exchange based on USD volume.

Kraken - kraken is the #1 exchange in terms of EUR trading volume at

6,000 BTC per day. It’s currently a top-15 exchange in terms of USD volume.

Bitcoin trading in china

Global bitcoin trading data shows that a very large percent of the global price trading volume comes from china. It’s important to understand that the chinese exchanges lead the market, while the exchanges above simply follow china’s lead.

The main reason china dominates bitcoin trading is because financial regulations in china are less strict than in other countries. Therefor, chinese exchanges can offer leverage, lending, and futures options that exchanges in other countries can’t. Additionally, chinese exchanges charge no fees so bots are free to trade back and forth to create volume.

If you’d like to learn more about bitcoin trading in china, this video from bitmain’s jihan wu provides additional insight.

How to trade bitcoin

Kraken will be used as an example for this guide. The process and basic principles remain the same across all exchanges.

First, create an account on kraken by clicking the black sign up box in the right corner:

You’ll have to confirm your account via email. Once your account is confirmed and you’ve logged in, you must verify your personal information. All bitcoin exchanges require varying levels of verification as required by AML and KYC laws. Below you can find the first three verification levels:

Once your account is verified, head over to the “funding” tab. You should see something similar to the screenshot below. Select your funding method from the left side:

Kraken offers many deposit methods, which are listed here:

EUR SEPA deposit (free) - EEA countries only

EUR bank wire deposit (€5) - EEA countries only

USD bank wire deposit (free until 3/1/2016, then $5 USD) - US only

USD SEPA and SWIFT deposit (0.19%, $20 minimum)

GBP SEPA and SWIFT deposit (0.19%, £10 minimum)

JPY bank deposit (free, ¥5,000 deposit minimum) - japan only

CAD interac deposit (free until 3/1/2016, then 1%, $10 CAD fee minimum, $5,000 CAD deposit maximum)

CAD EFT deposit (free until 3/1/2016, then 1%, $10 CAD fee minimum, $50 CAD fee maximum, $10,000 CAD deposit maximum)

Deposits made using the traditional banking system will take anywhere from one to three days. Bitcoin deposits require six confirmations, which is about one hour.

Now, navigate to the “trade” tab. Using the black bar at the top of the page, you can switch trading pairs. In this example we’ll use XBT/USD. We want to buy bitcoins, so let’s put in an order. Navigate to the “new order” tab.

Let’s say I’ve deposited $300 into my account with a USD bank wire. In the example below, I’ve submitted an order to buy 0.5 bitcoins (XBT) at a price of $370 per bitcoin.

Check the black bar at the top, and you’ll notice that the last trade price was $383.17.

Why submit an order to buy at $370 per bitcoin (XBT) and not $383.17? One may submit an order lower than the current price if one expects the price of bitcoin to fall. In this case, since my order is lower than other offers in the orderbook, I won’t receive my order for 0.5 bitcoin immediately. Placing an order at a specified price is called a _limit order._ before placing an order, be sure to check the orderbook for your trading pair.

In the example orderbook below, you can see that the highest buy offer is for $382.5 per bitcoin, while the lowest sell order is at $384.07 per bitcoin.

Using the order form there’s also an option for “market”.

A market order in this case would submit a buy order for XBT at the price of the lowest available sell order. Using the orderbook above, a market order for 0.5 XBT would purchase 0.5 XBT at $384.07 per XBT. If selling bitcoins, a market order would sell bitcoins for the highest available price based on the current buy orderbook—in this case $382.5.

Trading risks

Bitcoin trading is exciting because of bitcoin’s price movements, global nature, and 24/7 trading. It’s important, however, to understand the many risks that come with trading bitcoin.

Leaving money on an exchange

Perhaps one of the most famous events in bitcoin’s history is the collapse of mt. Gox. In bitcoin’s early days, gox was the largest bitcoin exchange and the easiest way to buy bitcoins. Customers from all over the world were happy to wire money to mt. Gox’s japanese bank account just to get their hands on some bitcoins.

Many users forgot one of the most important features of bitcoin—controlling your own money—and left more than 800,000 bitcoins in gox accounts. In february 2014, gox halted withdrawals and customers were unable to withdrawal their funds. The company’s CEO claimed that the majority of bitcoins were lost due to a bug in the bitcoin software. Customers still have not received any of their funds from gox accounts.

Gox’s catastrophic collapse highlights the risk that any trader takes by leaving money on an exchange. Using a regulated bitcoin exchange like kraken can decrease your risk.

Your capital is at risk

Remember that as with any type of trading, your capital is at risk. New traders should start trading with small amounts or trade on paper to practice. Beginners should also learn bitcoin trading strategies and understand market signals.

Bitcoin trading tools & resources

Cryptowatch & bitcoin wisdom – live price charts of all major bitcoin exchanges.

Bitcoin charts – more price charts to help you understand bitcoin’s price history.

Bitcoinmarkets – A bitcoin trading sub-reddit. New users can ask questions and receive guidance on trading techniques and strategy.

Tradingview – trading community and a great resource for trading charts and ideas.

Tradingview

Tradingview is a charting web service with historical and real-time bitcoin data from mtgox, stock and futures data from major world exchanges (AMEX, CBOE, CBOT, CME, COMEX, NASDAQ, NYSE, TSX, TSX venture, eurex, NYMEX, ICE USA, ICE canada, ICE europe, KCBT, MGEX, NYSE LIFFE, MICEX, FORTS and BATS), as well as forex data.

The service is built on HTML5 (this means no flash, java or silverlight). So it will run just fine on a modern browser, no matter what operating system you are using.

The service was created on (date) by programmers from multicharts. The service from the start provided data and charting for the major world exchanges. On june 2013 tradingview added bitcoin data from mtgox for all instruments.

• chart types (with customizable resolutions):

- time based: bars, candles, hollow candles, heiken ashi, area and line (ranging from 1 minute to 1 month)

- non-time based: renko, kagi, pnf and price break

• scales - standard - percentage - logarithmic

• indicators (57) ranging from (i) simple oscillators like stochastic through (ii) geometrical indicators like elliot wave to (ii) correlation coefficient allowing for a cross-currency analysis, e.G. BTCUSD vs EURUSD vs BTCCNY

• drawing tools - line tools - gann tools - fibonacci tools - markers, arrows, balloons - prediction tools - shapes

Social / community features

• publish trading ideas - publish your analysis and insight for your followers, and read ideas published by others. Good trading ideas are featured in the tradingview gallery for all of our visitors. You can easily share any idea that you like further by sending it to twitter, facebook, linkedin or anywhere else.

• instant chart snapshot - forget screenshots and image editors. One button takes an instant snapshot of your chart in PNG format and gives you a unique link that stays live forever. You can save the picture or paste it into chat, email, forum, document, blog, twitter, facebook, skype or instant message. In fast-moving markets the time you save with instant snapshot might make all the difference when sharing an idea!

• community ideas on your chart - popular instruments (like google, EURUSD, BTCUSD) have hundreds of published ideas. Normally you’d have to open them separately to do research – not on tradingview! Published ideas are displayed right on your chart as dots on the time when they were published. You can get a bird's eye view of different opinions over time and easily see who thought what and when (or turn it off if you prefer individual analysis).

• real-time conversation - tradingview is much about reacting quickly to market changes, so the conversation is a real-time chat for talking to other people while the moment lasts. You can instantly share chart snapshots and talk only to the people looking at the same stock, or message the entire community.

Features for institutional users / institutional solutions

Tradingview presents online financial software for use by your employees and/or customers. As a corporate client you can customize our charts and data to your company's requirements and cut your costs comparing to using other financial software. You can brand your own turnkey solution. With tradingview you get a fast technological and functional advantage over your competitors, which will help you win more clients. What we offer:

• no installation and setup - our charts have the quality of desktop applications without the difficulties in setup and installation. A simple user login is all that’s required – you can use them on any number corporate computers just by configuring your firewall.

• accessibility and cross-platform support - in the corporate world, maintaining powerful hardware and compatibility across operating systems can be a nightmare. Our charts work on ANY operating system, on any computer and in any modern browser. No need for powerful computers - our servers do all the hard work on the backend, so you can minimize your hardware costs.

• scalability and cloud power - tradingview has no limits on the number of users. Our servers are in the cloud, and extra processing power is automatically allocated when it’s needed. Setting up another user takes just one click.

• adding your custom content - your employees/customers can use our default data, or we can connect any data or news feed that you need. We can customize the interface for you as part of the white label solution.

• white label and customization - do you want the solution to appear like your own? We can create your own version of tradingview according to your company's technological and branding requirements, and host it in a separate cloud. You get a solution that’s unique to your business and a weapon to beat your competitors.

• tough security and backup protection - forget about losing data - latest security protocols make sure the data and content are safe on our servers.

Features for developers

Through tradingview you can sell any content that will be interesting to the community through the tradingview marketplace. Some examples, but there may be other possibilities:

• indicators/strategies for technical analysis, or any studies that are displayed on the chart

• news, or any other relevant feeds (i.E. Economic events)

• market data subscriptions

• premium ideas. You can mark some ideas as free to attract new followers, and some as paid to monetize your knowledge. Only your subscribers will be able to see your paid ideas

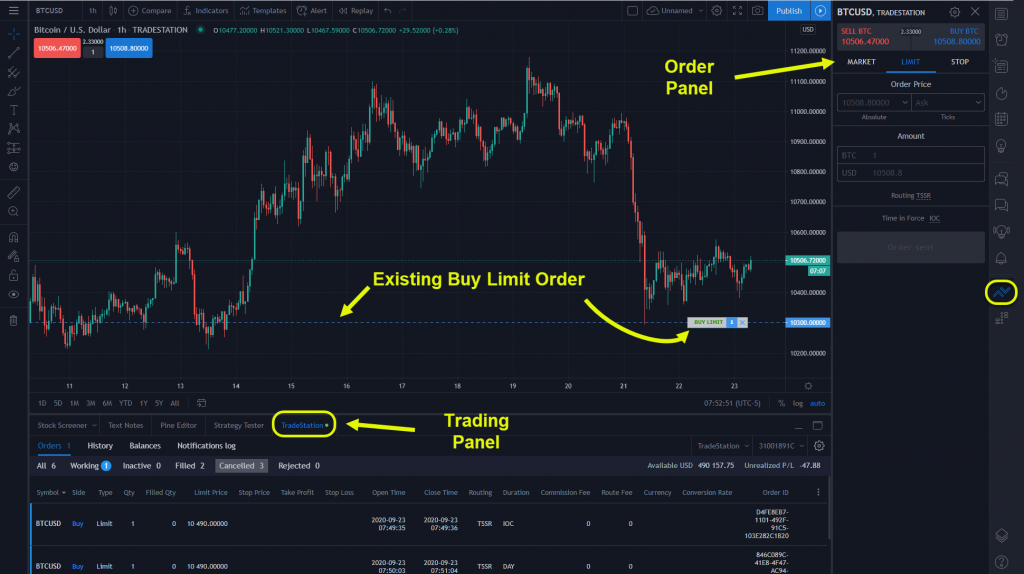

Tradestation crypto is now available on tradingview

Tradestation securities customers have been able to trade stocks and futures on the popular charting site tradingview for the last year. Now cryptocurrencies join the list through tradestation crypto.

Starting today, tradestation crypto clients can buy and sell virtual currencies like bitcoin and ethereum without leaving tradingview’s charts. The new functionality uses the existing web API to access tradestation crypto accounts.

Here’s an overview of the service.

First, tradestation clients need to have an account with tradestation crypto.

Second, you’ll need a free login to tradingview. It already has about 20 million users.

Once you’re logged in to a tradingview chart, you can click on the “trading panel” tab at the bottom of the window. Select tradestation from the list.

The prompts will check your user name and password. Account information will populate once the credentials are confirmed. The trading panel’s name will also switch to “tradestation.”

Trading cryptos

Want to place a trade? Click on the order panel icon on the right of the tradingview chart.

Users can select between market, limit and stop orders with the buttons near the top. Further down they can input size and price.

Once orders are sent, they will appear on the price chart. Traders can also track them using the orders sub-tab in the tradestation trading panel below the chart.

Some other aspects of the integration include:

- Viewing existing account positions in the trading panel, even if they weren’t opened on tradingview.

- Earning interest on cryptocurrency balances.

RELATED ARTICLESMORE FROM AUTHOR

Crypto market joins the trillion dollar club thanks to bitcoin’s stunning rally

New year, new ways to manage your trading

Crypto sentiment was rising even before the breakout: monex investor survey

MOST POPULAR

How much would $1,000 invested in tesla’s IPO be worth today?

Tesla leads a new year breakout with stock investors eager for.

Market pulse: has zoom lost its zip?

Bitcoin breaks out as market prepares for more easy money from.

TAKE ACTION

Cryptocurrencies score gains as payment giant enters market

Bitcoin rips higher on square news

Major cryptocurrencies form hammer pattern

Choppy price action is still the trend in cryptocurrencies

Market insights, its pages and content are hosted by tradestation group, inc.

Tradestation securities, inc., tradestation crypto, inc., and tradestation technologies, inc. Are each wholly owned subsidiaries of tradestation group, inc., all operating, and providing products and services, under thetradestation brand and trademark. You can trade, inc. Is also a wholly owned subsidiary of tradestation group, inc., operating under its own brand and trademarks. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the important documents page, including the document titled characteristics and risks of standardized options if you are interested in trading equity or index options. Online trading is not suitable for all investors. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, internet traffic, outages and other factors.

So, let's see, what we have: tradingview india. Bitcoin (cryptocurrency) — check out the trading ideas, strategies, opinions, analytics at absolutely no cost! At bitcoin tradingview

Contents

- Top forex bonus list

- Bitcoin (cryptocurrency)

- Predictions and analysis

- Bitcoin (cryptocurrency)

- Predictions and analysis

- Bitcoin (kriptopara)

- Öngörüler ve analizler

- Bitcoin chart views soared along with price in november, tradingview says

- Bitcoin chart views soared along with price in november, tradingview says

- Bitcoin and tesla: america's most loved assets on tradingview

- Tradingview

- 5 easy steps for bitcoin trading for profit and beginners

- Why trade bitcoin?

- Find an exchange

- How to trade bitcoin

- Trading risks

- Bitcoin trading tools & resources

- Tradingview

- Tradestation crypto is now available on tradingview

- Trading cryptos

- Crypto market joins the trillion dollar club thanks to bitcoin’s stunning rally

- New year, new ways to manage your trading

- Crypto sentiment was rising even before the breakout: monex investor survey

- How much would $1,000 invested in tesla’s IPO be worth today?

- Tesla leads a new year breakout with stock investors eager for.

- Market pulse: has zoom lost its zip?

- Bitcoin breaks out as market prepares for more easy money from.

- Cryptocurrencies score gains as payment giant enters market

- Bitcoin rips higher on square news

- Major cryptocurrencies form hammer pattern

- Choppy price action is still the trend in cryptocurrencies

- Trading cryptos

No comments:

Post a Comment