Kyc crypto broker

Crypto market vets have spoken out that these users should have realized that part of protecting their bitcoin and altcoins also includes personal data privacy and strong personal opsec.

Top forex bonus list

There’s no telling how the KYC data is stored, or if it is the company or a third-party management solution handling it. In an industry built on trust, transparency, privacy, and decentralization, intervention from the state and negligence from centralized corporations combined with human error and weak security infrastructure will keep personal data at risk for years to come.

How bitcoin and crypto exchange KYC could be the next ledger leak

Social security and driver license cards isolated on white.

A leak of crypto cold storage wallet manufacturer ledger’s customer database has put over a quarter of a million bitcoin and altcoin investors at serious risk. Some have had accounts drained, while others have experienced extreme threats of harm directed to their families and homes.

The situation sheds a light on a serious issue plaguing the cryptocurrency industry, and that issue is personal data privacy and security. As investors are now encouraged to put as much effort into personal data security as they do in protecting their assets, the fact that KYC is enforced on cryptocurrency exchanges means that this risk will never completely disappear. Here’s why KYC could be the source of the next major leak.

Not your keys, not your bitcoin. Not your personal data, either

Even new crypto investors understand the importance of keeping cryptocurrencies off of exchanges and moving them into cold storage for safe-keeping. Ledger, a cold storage manufacturer offers solutions to serve this need for digital asset safety and security.

By moving bitcoin and altcoins offline to a device not connected to the internet, digital assets are safely stored and out of the reach of cybercriminals.

But what ledger users are now learning, is that although cybercriminals can’t touch the crypto stored on the device, real-world criminals can use private and personal data extracted from ledger’s customer database to threaten physical harm if bitcoin and other assets aren’t promptly turned over.

A story just broke involving a reddit user who was threatened by a self-proclaimed meth addict demanding a ransom in XMR, or else they would kidnap them and murder their family members found at the user’s place of residence.

Authorities have been contacted in this case, but a company responsible for selling safety and security has instead put its customers in grave danger.

Why personal opsec and privacy is useless in A world of crypto exchange KYC

Crypto market vets have spoken out that these users should have realized that part of protecting their bitcoin and altcoins also includes personal data privacy and strong personal opsec.

But at the same time, companies need to be far more responsible in preventing situations like this from occurring and should purge customer data periodically.

And if sensitive personal data such as name, address, phone number, must be kept totally private at all times, then what then do investors do about cryptocurrency exchange KYC?

More than a year ago, even binance was claimed to have had its customer KYC data leaked, which included not only identifying info like name or address but ID documentation as well. Such data exposure can lead to identity theft, digital asset theft, hacks, and more.

Due to government regulations, customers in the US are especially vulnerable due to how much personal info is demanded. Consumers are forced to either forget crypto entirely, secure it through unorthodox means which also carries risk, or stick to the mandatory requirements that put them at risk.

There’s no telling how the KYC data is stored, or if it is the company or a third-party management solution handling it. In an industry built on trust, transparency, privacy, and decentralization, intervention from the state and negligence from centralized corporations combined with human error and weak security infrastructure will keep personal data at risk for years to come.

Tony spilotro

I'm tony spilotro. Behind the pseudonym, I'm a digital media executive and global remote work leader with a decade of content experience and excellent. Here, I explore my newfound passions pertaining to privacy, finance, economics, politics, cryptography, property rights, and other libertarian-esque views. I am a bitcoin evangelist, maximalist, and educator whenever I can be, helping to spread its message of freedom from government control, monetary policy mismanagement, and passing the buck - literally – to future generations. My journey from a curious retail crypto investor to a serious bitcoin advocate, trader, and technical analyst is an unusual one, but life-changing nonetheless and has become less about money and more about a long-overdue revolution. While a firm believer in the laws governing math and science, I am profoundly fascinated by the impact of astrology and astronomy including moon and solar cycles and planetary alignment and their ability to influence and potentially predict markets. It hasn't yet clicked for me as to how to put anything to use, but I consider it my current rabbit hole I can't yet dig out of. My perspective of growing up alongside the internet, the dot com era, the great recession, and roots in video games collecting coins and rare items caused bitcoin to immediately make sense to me. Through all of these lenses, I seek to produce content that is educational and entertaining, and I thank you sincerely for taking the time to read what I have to say. Please follow me on twitter and feel free to drop me a line if you would like to work together.

Blockpass provides KYC services for blitz network

HONG KONG, jan 11, 2021 - (ACN newswire) - blockpass is proud to reveal another new partnership, this time with blitz network - a union of miners, cross border traders and early cryptocurrency investors. As part of the financial landscape, blitz network requires KYC certification for larger volume users, which blockpass will provide in a seamless and effective manner through its KYC connect solution. In addition, blitz network has made a strategic investment in blockpass.

Blitz network has been trading over-the-counter for high net-worth individuals (whose eligibility is subject to KYC checks and other requirements) since 2013, and pools its liquidity from clients and partners in beijing, hong kong and tokyo. By actively networking with banks, exchanges and brokers, blitz aims to work closely with counter-parties to transfer value globally as fast as possible. It currently supports BCH, BTC, ETH and EOS, and has a USD50,000 requirement for OTC trading.

Blockpass is a digital identity verification provider which provides a one-click compliance gateway to financial services and other regulated industries. From the blockpass mobile app, users can create, store, and manage a data-secure digital identity that can be used for an entire ecosystem of services, token purchases and access to regulated industries. For businesses and merchants, blockpass is a comprehensive KYC & AML saas that requires no integration and no setup cost. You can set up a service in minutes, test the service for free and start verifying and on-boarding users.

"it's always rewarding to see a company in the financial sector embrace blockpass' unique KYC solution," said adam vaziri, CEO of blockpass. "whilst we have shown blockpass' ability to handle high rates of onboarding in the past we can now demonstrate, through our partnership with blitz network, that a lower volume of high net-value individuals can be catered to just as well. We look forward to working with blitz to enable KYC and regulatory compliance in this critical category for compliance."

"at blitz we like to do things fast so we don't waste our client's time. We also like to provide a comprehensive service so we can tailor make solutions. And we prefer to hide the grunt work so our customers just see clean results," stated blitz management team. "blockpass does all of the above, and will prove to be a synergistic partner of ours for years to come."

Blockpass has grown significantly in size and use since its inception, both in the number and range of users and companies it has partnered with, and the scope of its work. Blockpass continues to develop its digital identity protocol with updates and additions to improve the compliance experience. Blockpass has seen rapidly increasing numbers of users in the past year as its identity verification solution is used for icos, stos and ieos, including supporting a number of successful fundraisers in the past few months.

With a current 90%+ discount on its services, a fact made possible due to the unique reusable nature of its verification method, and put in place to help as many people as possible access KYC in the current pandemic, there has never been a better time to explore the potential of blockpass. The blockpass app is available from the app store and google play.

Blockpass is a fast, fully comprehensive KYC & AML screening software-as-a-service for crypto, defi and other regulated industries. With blockpass, you get an unmatched set of benefits for any compliance service that includes pay-as-you-go, no setup cost, no integration necessary, free testing, immediate launch and at the lowest cost. Blockpass' KYC connect(TM) platform enables businesses to select requirements for customer onboarding that can include ID authentication, face-matching, address checking, AML ongoing monitoring and/or screening of sanctions lists, politically exposed persons (PEP), and adverse media. Through blockpass, end-users easily create a verified portable identity that they can control and re-use to onboard with any service instantly.

Blitz network is a proprietary trading firm with a focus on high touch OTC servicing. We have been helping high net worth individuals buy and sell crypto since 2012. Our advantages are competitive pricing, near-instant settlement, and execution services. We also offer assistance with crypto-friendly banking, regular blitz metrics analysis, and tailor-made financial tools for miners.

Best bitcoin brokers to trade bitcoin anonymously – no ID!

Current broker deals for you (no ID required):

The tables below show the brokers which allow bitcoin trading without ID verification – trade cryptos on trading sites which don't ask for your real name proven by photo ID. It's even possible to trade bitcoin completely anonymously on sites which even don't care about data like name or anything personal.

Primebit is a new cryptocurrency margin broker where you can trade perpetual contracts (cfds) with up to 200x leverage. The platform seems to target experienced traders as they have the metatrader 5 trading program integrated and offer the highest leverage available in the industry.

Primebit empraces anonymity as there is no option to get verified at all.

Basefex is a new bitcoin margin broker offering a maximum leverage of up to 100x. Traders can trade bitcoin and a few major altcoins as cfds anonymously, since the account not even asks for a full name or any other personal data.

You can trade bitcoin anonymously at simple FX. Just deposit your bitcoins and start trading without any further verification. Deposits in fiat currencies do require however verification with photo ID and proof of residence.

Bitfinex can be used for trading cryptocurrency anonymously, however in this case the account must be funded by altcoins or bitcoin. Fiat deposits require a photo ID and a verification process.

US traders aren't officially allowed anymore to trade on bitfinex at all, since nov 2017. However it is technically possible to signup for an initial account by using a VPN as inital accounts don't require ID verifications, neither any personal data. Just note that this would be kind of an unauthorized trick.

Up on registration at poloniex, you need to provide your name, your country and an email address, however as level 1 user, you do not need to provide any further proof for these information, so they could even be fake. However in this case the anonymous trading activity is limited to 2000 USD per day.

Trade bitcoin anonymously on specific platforms – no ID verification

Specific bitcoin trading platforms allow you to use their services without ID verification. This means that upon registration you do not have to provide personal details such as name, address, date of birth. At anonymous bitcoin trading sites you can start trading instantly after sign up.

Advantages of anonymous trading

A verification process would also include providing a proof of your identity in a form of a photo ID and a proof of residence - so obviously validating this information may take long. On the other side, you can start trading right away after sign up for anonymous trading within basic accounts, as you do not have to wait until the verification process goes through approval.

Downsides of bitcoin trading without ID verification

Withdrawal limitations

The biggest drawback of trading anonymously on certain platforms is certain thresholds which apply to unverified users both in terms of trading volume and daily or lifetime withdrawals. This can cause potential problems to those who would like to engage into trading activity anonymously with a high amount of funds.

However, this only applies to certain brokers, as shown in the list above. There are enough other bitcoin trading sites that do not require ID verification by default. So there are no restrictions for certain accounts as there is only one kind of account.

Lack of deposit ensurances

A disadvantage that some traders will perceive as such is the lack of security. While deposits with legally regulated brokers are insured up to a relatively high value in case the company goes bankrupt, modern bitcoin brokers do not provide such security. Especially not the ones on which you can trade anonymously.

On the other hand, state-regulated licensed brokerage platforms that operate on the basis of fiat money deposits usually hold these deposits with external banks. This is because trading companies usually do not have a banking license and therefore have to deposit client funds with banks. If the trading company itself goes bankrupt, the customer funds are still safely deposited with the banks.

Many crypto traders have already experienced that their coins were lost when a cryptocurrency exchange was hacked. For such cases there is mostly no insurance in the area of crypto brokers.

In the case of losses due to platform hackings, however, trustworthy brokers try to make up for the damage. Bitfinex has provided a great example of this in the past. Many traders lost their coins in a hack. The platform then decided to pay back the lost coins piece by piece by giving the affected traders a share in future profits. Binance also suffered from a quite big hack when a lot of BTC got stolen, but the company bore the damage themselves, so none of their users were affected.

However, because of this lack of deposit insurances traders are adviced never to leave their coins on a cryptocurrency exchange or broker site, when they aren't actively trading. Trading platforms should never be used as a wallet to store one's cryptocurrency long term.

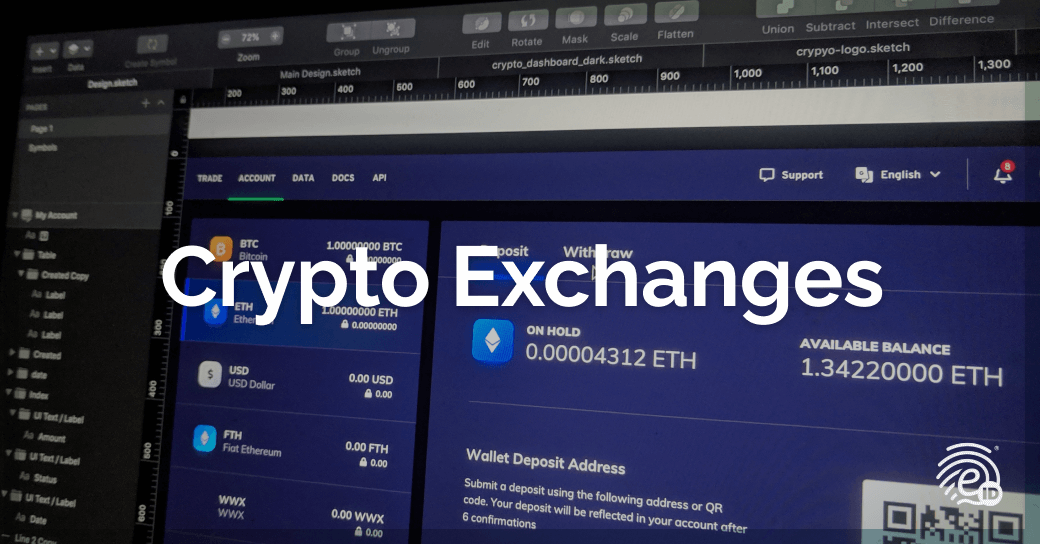

Crypto exchanges and their compliance / KYC framework

As well as all types of online agents, from ecommerce to banking, crypto exchanges must meet the same requirements of all those regulations affecting them on AML and customer identity verification.

However, not all crypto exchanges comply in the same way with their responsibilities in terms of compliance. The implementation of AML (anti-money laundering) controls and KYC processes is essential for these platforms to operate online with guarantees and security.

What is a crypto exchange

Cryptocurrency exchanges or crypto exchanges are the online tools and platforms that allow and facilitate the sale of bitcoin or any type of cryptocurrency.

Generally, this name or category corresponds to a virtual space as if it were a common trading platform, but it is specialized in cryptocurrencies. The user, also known as a trader in these cases, is allowed to trade in the crypto market.

Since bitcoin appeared in 2009, the evolution of this area has been impressive and its extension and expansion, as well as the appearance of different platforms that have made them more and more accessible to a wider public, have fully affected economy and global finance.

That is why identity verification and KYC processes have become the focus of attention for both cryptocurrency exchanges and users of these platforms.

Find out all the details about wealthtech here and how it has transformed the investment industry and boosted trading.

How cryptocurrency exchanges work

The basic operation of a cryptocurrency exchange consists, as we have been advancing in its definition, in carrying out both buying and selling operations of the different cryptographic currencies available: bitcoin, ethereum, XRP, tether…

However, despite crypto trading being the central axis of crypto exchanges, one of the most delicate and important processes with respect to their operation is the one that occurs when deposits, withdrawals, or purchases of cryptocurrencies are made with fiat currency, such as the euro or the dollar. This is where a key situation arises that increases the need for AML and KYC control and management of cryptocurrency exchanges.

Types of exchanges:

The different types of crypto exchanges define their operation and present a series of needs and characteristics that affect their operations and the way in which they are carried out:

- Traditional exchanges: they are trading platforms in which the purchase and sale are carried out according to the market price. They are usually regulated and have very specific KYC, AML, and identity verification needs.

- Cryptocurrency brokers: these platforms are focused on the sale and purchase of cryptocurrencies at fixed prices; that is, the exchange of some currencies for others at market prices.

- Direct trading platforms (OTC):over-the-counter platforms connect buyers and sellers who offer exchanges at a set price by themselves and not by the market.

- Cryptocurrency funds: more than platforms, these are initiatives for the management of investments in crypto. Users do not have the need to actually store or buy the currencies. Negotiations of a part of the investment portfolio and participation are proposed. Generally managed by finance professionals, they typically meet AML and KYC requirements.

- Decentralized exchanges (DEX): they are the automated and autonomous evolution of traditional exchanges. Some of them are only supported by their programming and can be somewhat insecure if they do not meet the appropriate standards in terms of compliance.

The best cryptocurrency exchanges

We can notice how articles with lists of the best cryptocurrency exchanges can be found on the internet. These rankings are basically made from data on the popularity and number of users of the different platforms.

Although they can be very useful, the reality is that the vast majority do not take into account the main aspect for which one should choose one cryptocurrency exchange over another: security and their commitment to an adequate compliance policy.

Safest crypto exchanges

We will know that we are facing a baseline cryptocurrency exchange when it complies with current regulations and regulatory standards. This implies having established processes and controls oriented towards:

- A KYC (know your customer) process suitable for customer onboarding.

- AML controls and checks.

- A high-security identity verification process.

- SCA(strong customer authentication) protocols on multiple-factor authentication strategies.

According to a recent study by ciphertrace, more than half of all crypto exchanges of various types have weak or no identity verification methods. This makes them vulnerable to attacks by potential offenders, at the same time that endangers users of the platform.

The importance of digital identity and KYC

Although it seems that even, in some areas, more than 60% of crypto exchanges are not complying with the proper guidelines, establishing digital identity procedures and KYC process would not only make them comply with the current regulations but would grant them a series of additional benefits that would boost their activity and legitimacy.

That the agents of the cryptocurrency sector, including crypto exchanges, comply in terms of compliance and adapt to the pertinent regulations will cause cryptocurrencies to finally generalize their use.

Eid, regtech partner for crypto exchanges

Electronic identification works with clients in the sector such as onyze to promote crypto exchange platforms from a safe, guaranteed, and quality perspective.

The development of our videoid, smileid, and signatureid solutions responds to the compliance need of online agents to operate safely for both themselves and their clients while increasing their user acquisition.

Eid is committed to the definitive impulse of the crypto exchange sector and develops solutions to enhance its expansion through scalability with advanced customer acquisition tools both at the normative and regulatory level as well as commercial improvement.

Trustworthy cryptobrokers with MT5 platform

The latest years, traditional forex brokers offer cryptocurrency margin trading. For example, plus500 (a leading CFD provider) offers crypto CFD trdading but cannot be counted as cryptobroker. A newbie trader deposits normally, using USD or EUR and has to follow the KYC requirements.

Why crypto margin trading is so popular among traders?

There are 2 main reasons for this…

- Βitcoin price volatility: cryptos and mostly bitcoin are the most fluctuate assets in the world. Bitcoin volatility can be more than 30-40% between minutes. This offers technical analysis traders to follow the trend and gain lots of money in shorterm.

- High leverage: leverage is a tool used by traders and trading professionals to increase the potential return of an investment by using borrowed capital. High leverage is very risky, but is the only way to earn significant amount of money through trading.

Multiplying these two effects makes an explosive combination scenario for a trader. That makes crypto margin trading very attractive, potential earnings exceed traditional FX trading.

Crypto – leverage can be very high. Some margin trading brokers offer 200: 1 leverage, while others offer leverage up to 100:1.

Metatrader5 (MT5) trading platform

Metatrader is a famous easy- to – use trading platform used be many brokers worldwide, mostly because it supports many functions and functionalities, including 3rd party app like copy trading, expert avisors, indicators, a great amount of charting patterns etc.

Major metatrader 5 advantages:

- Platorm is free

- Metatrader 5 is available on apple devices (MT5 OS) and windows

- Mobile & tablet friendly (MT5 android, MT5 OS)

- Easy to use even for newbies. Most of the traders use it, so there is a community to answer any possible question.

- Plenty and accurate technical analysis tools and charts.

- Supports copy trading and forex automated trading. Everyone can create his own expert advisor, by using the programming language MQL

- Stop loss, take profit and other tools

- Server stability (thousands of trades simioutanesly, minimal CPU resources, security (prevents the hacker threats)

- Changing from broker to broker, the platform remains the same.

Trusted cryptobrokers with MT5 platform

The following brokers offer anonumous margin trading through MT5 trading platform…

Blockpass to provide blockchain-powered KYC services for blitz network

Blockpass, a blockchain-powered KYC/AML platform, today announced its newest partnership, this time with blitz network, a union of miners, cross border traders, and early cryptocurrency investors.

As part of the financial landscape, blitz network requires KYC certification for larger volume users, which blockpass will provide in a seamless and effective manner through its KYC connect solution. In addition, blitz network has made a strategic investment in blockpass.

Blitz network has been trading over-the-counter for high net-worth individuals (whose eligibility is subject to KYC checks and other requirements) since 2013, and pools its liquidity from clients and partners in beijing, hong kong, and tokyo. By actively networking with banks, exchanges, and brokers, blitz aims to work closely with counter-parties to transfer value globally as fast as possible. It currently supports BCH, BTC, ETH, and EOS, and has a USD $50,000 requirement for OTC trading.

Blockpass is a digital identity verification provider that provides a one-click compliance gateway to financial services and other regulated industries. From the blockpass mobile app, users can create, store, and manage a data-secure digital identity that can be used for an entire ecosystem of services, token purchases, and access to regulated industries. For businesses and merchants, blockpass is a comprehensive KYC & AML saas that requires no integration and no setup cost. You can set up a service in minutes, test the service for free, and start verifying and onboarding users.

“it’s always rewarding to see a company in the financial sector embrace blockpass’ unique KYC solution. Whilst we have shown blockpass’ ability to handle high rates of onboarding in the past we can now demonstrate, through our partnership with blitz network, that a lower volume of high net-value individuals can be catered to just as well. We look forward to working with blitz to enable KYC and regulatory compliance in this critical category for compliance.”

– adam vaziri, CEO of blockpass

Blockpass has grown significantly in size and use since its inception, both in the number and range of users and companies it has partnered with, and the scope of its work. Blockpass continues to develop its digital identity protocol with updates and additions to improve the compliance experience. Blockpass has seen rapidly increasing numbers of users in the past year as its identity verification solution is used for icos, stos, and ieos, including supporting a number of successful fundraisers in the past few months.

“at blitz, we like to do things fast so we don’t waste our client’s time. We also like to provide a comprehensive service so we can tailor-make solutions. And we prefer to hide the grunt work so our customers just see clean results. Blockpass does all of the above, and will prove to be a synergistic partner of ours for years to come.”

– the blitz management team

Best anonymous bitcoin trading brokers

On the internet today, we have a lot of bitcoin brokers that provide anonymous trading. But this does not help us in any way if we want to find a website that we would be trading at. Do you guys know why? That is because a lot of websites today pose as “anonymous” websites but would grab all your personal information right from the start (account creation). These websites ask for your personal information like DOB, complete name, phone number, and some would ask for photo ID’s when they require certain account levels to trade larger quantities.

What we will be sharing with you guys, would be the websites that let you create an account without going through the fuss of providing any personal information. Please be advised that the listed websites below are in no particular order.

The top 5 anonymous crypto brokers:

Without further delay, let’s talk about the best five anonymous bitcoin brokers!

Primexbt.Com

Primexbt has no section for ID verification, so it is simply never required. At signup there are only 3 fields – for email, password and a nickname of the user’s choice. So new users can start trading right after their BTC deposit has been confirmed.

- Deposit and withdrawal methods – the derivatives margin broker only accept BTC deposits, no other cryptocurrencies and of course no fiat money. The latter would force them to claim ID verifications and follow a rigorous KYC policy. But fortunately this is not the case with primexbt. The only fee occurring with BTC deposits and withdrawals is the bitcoin network fee.

- Website features – A specialty of primexbt is that they have more trading instruments than just cryptocurrencies. So traders can also trade indices, forex and commodities, of course all in the form of perpetual contracts for difference. On primexbt you never really buy or sell the underlying asset as it is the case with CFD trading instruments in general.

- Available cryptocurrencies and market – primexbt offers BTC, ETH, XRP, LTC and EOS, each in the form of derivative contracts. In addition, the broker offers the most popular indices, such as S&P500, FTSE100, JAPAN, and much more. Regarding forex primexbt offers the 25 forex majors, and last but not least commodities such as gold, oil and other majors that can be traded in the form of cfds.

- Cryptos and traditional products

- High leverage

- Good liquidity

- Anonymous trading

- We don’t really find a downside so far, even customer service is quick and well engaged.

Basefex.Com

Basefex is one of the crypto margin trading brokers that offer high leverage and don’t ask for any ID verification. So traders can quickly signup and start trading right away.

- Deposit and withdrawal methods – the broker only allow BTC and USDT deposits and withdrawals, which is why they aren’t forced to practice a KYC policy.

- Website features – the website is super simple, a very clean design reduced to just those elements that are needed for traders in order to start trading. We like the simplicity of the trading interface.

- Available cryptocurrencies and market – basefex offers BTC trading against the usdollar, and, in addition, 11 altcoins that can be traded against BTC. Nearly all altcoins come with a maximum leverage of 50:1, except 3, which come with only 20x maximum leverage.

- Bitcoin and 11 altcoins tradable

- High leverage

- Anonymous trading

- Could offer more trading products

- 100x leverage only for BTC

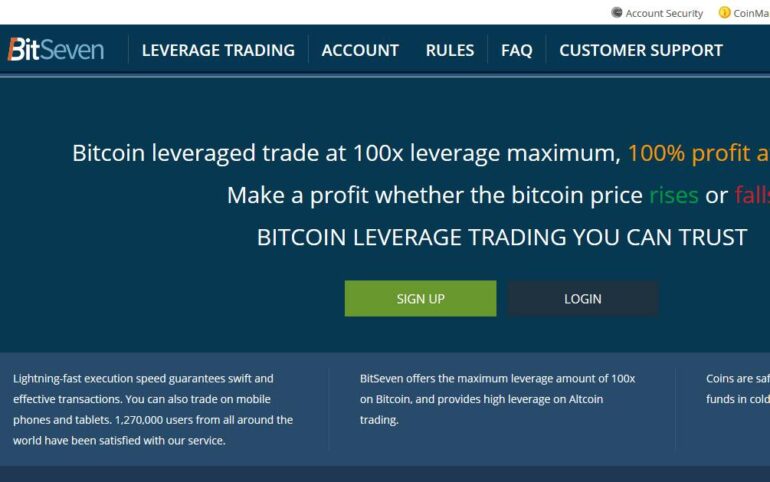

Bitseven.Com

Bitseven is a new cryptocurrency margin trading broker established in the end of 2018. The platform is very professional so the company behind the trading platform seems to consist of a highly professional team of trading experts and developers.

Bitseven is not exactly as anonymous as the other brokers mentioned on this page, since the signup form asks for full name and a phone number (for 2FA authentication), but at least after signup no ID verification is requested before you’re allowed to start trading.

- Deposit and withdrawal methods – bitseven allows BTC deposits and withdrawals only, which allows them not to claim ids from their customers by default. However, the maximum daily withdrawal is 10 BTC.

- Website features – the trading interface is simple and clear and also allows new users to get along quickly. The trading engine allows bi-directional trading, meaning long and short positions for the same product at the same time.

- Available cryptocurrencies and market – on bitseven you can trade bitcoin, ethereum (50x leverage), litecoin (40x leverage) and ripple (30x leverage) in the form of derivatives.

- Bitcoin and 3 altcoins tradable

- High leverage for BTC

- Anonymous trading

- Could offer more trading products

- 100x leverage only for BTC

Simplefx.Com

Indeed, creating an account is “simple”! To create an account with simplefx.Com, all you need to have is an active email and you’re good to go! This is awesome since you can maintain that level of anonymity until you decide you want to use fiat. Deposits in fiat require photo ID and proof of residence. If you want to be an anonymous trader, we suggest sticking with crypto deposits.

- Deposits and withdrawals – the website operates within the boundaries of crypto trade if you want to maintain anonymity. They accept anonymous deposits from BTC, DASH, ETH, LTC, and fiat options like credit cards, skrill, neteller, wire transfer, and a couple more.

- Website features – what’s great about this website aside from the fact that it is super simple to create an account, they also offer margin trading! In addition, the website supports users from the united states. They also have a live chat feature wherein registered users are able to talk to each other. Aside from that, the website also has a demo account feature where you are able to test the features of their trading platform without spending any money.

- Available cryptocurrencies and market – here at simplefx.Com, a registered trader can be able to trade crypto like BTC, ETC, ETH, LTC, and XRP. Aside from that, you are also able to trade forex, indices, commodities, precious metals, equities, and stocks!

- Demo account

- Accepts crypto payment

- High leverage

- Anonymous trading

- Website latency issues

- Negative reviews

Coinut.Com

To create an account here at coinut, you only need to have an active email account and a phone number, that’s all you need! The website operates from singapore and has been providing trading services since 2013. Here at coinut.Com, you are able to remain anonymous by choosing to transact with BTC or the available crypto selection under the deposit tab. USD deposit is possible but this would require additional identification.

- Deposits and withdrawals – registered users of the website are able to deposit BTC, LTC, ETH, ETCH, USDT, BCH, and an option to do USD.

- Website features – compared to other websites that have demo accounts, or “copy trade” features, here at coinut.Com, they do not have anything like that. All they can offer is the fact that their website does not have any lags, and operates exceptionally.

- Available cryptocurrencies and market – the only market available to trade here at coinut.Com would be the crypto market. It is quite sad since we were expecting more than just crypto trade, but if you want a pure crypto website from deposit to markets, then this website is perfect for you!

- Easy account creation

- Accepts BTC and USD (optional)

- Futures and options available

- Crypto-market only

- Limited number of pairs

Conclusion

Mentioned above are the best five anonymous trading websites in our opinion. We have talked about their main features and their differences along with their pros and cons per website. What we’ve noticed is that these mentioned websites above have similarities when it comes to being anonymous but have different features, fees and a whole lot more if you look into them closely. Again, we would just like to let you know that this is our own opinion and that the final decision will still be up to the trader. We would like to wish you guys good luck and happy trading!

Kyc crypto broker

Fully compliant platforms

Download the blockpass app

The faster, safer, and easier way to manage your identity and access regulated industries. Take back control of your identity

With the blockpass KYC connect™ platform, onboarding new customers is easy.

KYC connect

KYC connect

KYC connect

KYC connect

KYC connect

KYC connect

Media

Blockpass provides KYC services for blitz network

For immediate release - 11 january 2021 - as we start 2021, blockpass is proud to reveal another new partnership, this time with blitz network - a union of miners, cross border traders and early cryptocurrency investors. As part of the financial landscape, blitz network requires KYC certification suitable for larger volume users, which blockpass will provide in a seamless and effective manner through its KYC connect solution. In addition, blitz network has made a strategic investment in blockpass.

As a group, blitz network has been trading over-the-counter for high net-worth individuals (whose eligibility is subject to KYC checks and other requirements) since 2013, and pools its liquidity from clients and partners in beijing, hong kong and tokyo. By actively networking with banks, exchanges and brokers, blitz aims to work closely with counterparties to transfer value globally as fast as possible. It currently supports BCH, BTC, ETH and EOS, and has a USD50,000 requirement for OTC trading.

Blockpass is a digital identity verification provider which provides a one-click compliance gateway to financial services and other regulated industries. From the blockpass mobile app, users can create, store, and manage a data-secure digital identity that can be used for an entire ecosystem of services, token purchases and access to regulated industries. For businesses and merchants, blockpass is a comprehensive KYC & AML saas that requires no integration and no setup cost. You can set up a service in minutes, test the service for free and start verifying and on-boarding users.

“it’s always rewarding to see a company in the financial sector embrace blockpass’ unique KYC solution.” said adam vaziri, CEO of blockpass. “whilst we have shown blockpass’ ability to handle high rates of onboarding in the past we can now demonstrate, through our partnership with blitz network, that a lower volume of high net-value individuals can be catered to just as well. We look forward to working with blitz to enable KYC and regulatory compliance in this critical category for compliance.”

“at blitz we like to do things fast so we don’t waste our client’s time. We also like to provide a comprehensive service so we can tailor make solutions. And we prefer to hide the grunt work so our customers just see clean results.” stated blitz management team . “blockpass does all of the above, and will prove to be a synergistic partner of ours for years to come.”

Blockpass has grown significantly in size and use since its inception, both in the number and range of users and companies it has partnered with, and the scope of its work. Blockpass continues to develop its digital identity protocol with updates and additions to improve the compliance experience. Blockpass has seen rapidly increasing numbers of users in the past year as its identity verification solution is used for icos, stos and ieos, including supporting a number of successful fundraisers in the past few months.

With a current 90%+ discount on its services, a fact made possible due to the unique reusable nature of its verification method, and put in place to help as many people as possible access KYC in the current pandemic, there has never been a better time to explore the potential of blockpass. The blockpass app is available from the app store and google play.

Blockpass is a fast, fully comprehensive KYC & AML screening software-as-a-service for crypto, defi and other regulated industries. With blockpass, you get an unmatched set of benefits for any compliance service that includes pay-as-you-go, no setup cost, no integration necessary, free testing, immediate launch and at the lowest cost. Blockpass’ KYC connect™ platform enables businesses to select requirements for customer onboarding that can include ID authentication, face-matching, address checking, AML ongoing monitoring and/or screening of sanctions lists, politically exposed persons (PEP), and adverse media. Through blockpass, end-users easily create a verified portable identity that they can control and re-use to onboard with any service instantly.

For more information and updates, please visit and sign up to the following:

Blitz network is a proprietary trading firm with a focus on high touch OTC servicing. We have been helping high networth individuals buy and sell crypto since 2012. Our advantages are competitive pricing, near instant settlement, and execution services. We also offer assistance with crypto friendly banking, regular blitz metrics analysis, and tailor made financial tools for miners.

Reputable anonymous forex brokers 2021 (no KYC required)

Whatever forex broker you select to start a real trading account, a KYC process is required.

KYC means know your customer and is a common process of a forex who asks proof to identify and verify the identity of its clients (individual traders).

In a few words KYC process means that some sensitive personal data must be provided to the broker, in order to sign up a new trading account and start trading. Failure to meet these requirements may occur to deposit and withdrawls problems.

It depends to the brokerage company what kind of documents will be asked from a new trader. Some brokers have strict KYC requirements while others are more flexible.

For example cysec regulated brokers (which is a common license for a forex broker that operates in european union) are becoming stricter these days, mainly because mifid II directive, while offshore forex brokers are not asking so much information.

Common KYC requirements

Most brokers ask verification documents for:

- Passport or national ID card (to prove the true name of the trader, date and place of birth)

- A recent telephone utility bill (to prove current permanent address, home and mobile phone number)

- Email address

- Educational status, profession and/or occupation

- Purpose of opening investment services account with the company

- Estimated levels of turnover from the account and the source of funds

- Sample signatures

As you can see, the first two are in bold because they are sensitive personal data, and although the top trusted forex brokers claim to offer the maximum possible protection tothese data, i strongly believe that they dont!

Answer: all of us thought so! Until we met cambridge analytica…

And i am not reffering to terostits, fanatic muslims etc… i am reffering to the biggest threatens of this world: the governments (and in some cases the tax authorities).

How to stay anonymous

Reading this article you will learn how to trade forex using only an email address…

- A forex broker that accepts bitcoin deposits and withdrawls, and have no KYC process

Here is the list of forex brokers that offer anonymous forex trading. Using the bitcoin as deposit currency, you can enjoy forex trading with leverage, commodities trading, crypto trading etc.

Read carefully the list and select the broker that fits better your needs.

Key facts for the future

- The world is going forward and anonymity is going to be struck. Today there are some trading brokers that do not have KYC process (for the moment)!

- In the future more and more brokers will add KYC verification as obligatory step to start trading.

- Anonymous forex brokers plan to add KYC proccess in the future, such as evolve markets. Evolve markets introduces a quick and simple know your customer (KYC) verification. For now, it is not mandatory, but in 2021 it will be for every trader uses evolve markets services.

- Basefex has a no KYC promise. More specific, they write into their website: “we promise there will never be KYC checks. As believers of cryptocurrency and its anonymity spirit, we respect our users’ privacy and will never require KYC checks from our users. Users can use all of our services with just an email address.” can this statement become true? No is the answer. Nobody can promise for the future, because noone knows how things will be in 5 or 10 years! If a KYC proccess becomes mandatory for all countries worldwide, then what will basefex do? They will shut down their company, or just a add a KYC verification? Thats a great question, in fact we believe that they will add a KYC.

Primexbt

- Anonymous trading accounts (no KYC)

- High variety of widgets, great user experience

- 4-level referral system

- Brilliant charting software for comprehensive technical analysis

- Low commissions, tight spreads

- High leverage up to 1000:1

- Easy to use, even for a newbie

Prime XBT is an modern bitcoin trading platform with high leverage.

Anonymous trading, no KYC required, no personal data shared.

Start an anonymous bitcoin trading account, take advantage of 100:1 leverage and of ultra-fast order execution (

- Cryptocurrency derivative & margin exchange

- No KYC, no IP blocks, trade anonymously

- Highest level of security

- Low trading fees

- 24/7 live chat support

- Stable server with no breakdowns

- Leverage up to 100:1 in BTC

- Leverage up to 20:1 to all other trading instruments

- Listed on coinmarketcap.

Basefex is an anonymous margin trading broker, launched in october 2018.

No KYC required, keep your personal data safe! Basefex is the broker that has no KYC promise, the declare that they will never add a KYC verification!

So, let's see, what we have: A leak of crypto cold storage wallet manufacturer ledger's customer database has put over a quarter of a million bitcoin and altcoin investors at serious at kyc crypto broker

Contents

- Top forex bonus list

- How bitcoin and crypto exchange KYC could be the next ledger leak

- Not your keys, not your bitcoin. Not your personal data, either

- Why personal opsec and privacy is useless in A world of crypto exchange KYC

- Blockpass provides KYC services for blitz network

- Best bitcoin brokers to trade bitcoin anonymously – no ID!

- Trade bitcoin anonymously on specific platforms – no ID verification

- Advantages of anonymous trading

- Downsides of bitcoin trading without ID verification

- Crypto exchanges and their compliance / KYC framework

- What is a crypto exchange

- How cryptocurrency exchanges work

- The best cryptocurrency exchanges

- The importance of digital identity and KYC

- Eid, regtech partner for crypto exchanges

- Trustworthy cryptobrokers with MT5 platform

- Why crypto margin trading is so popular among traders?

- Metatrader5 (MT5) trading platform

- Trusted cryptobrokers with MT5 platform

- Blockpass to provide blockchain-powered KYC services for blitz network

- Best anonymous bitcoin trading brokers

- The top 5 anonymous crypto brokers:

- Kyc crypto broker

- Download the blockpass app

- Media

- Blockpass provides KYC services for blitz network

- Reputable anonymous forex brokers 2021 (no KYC required)

- Common KYC requirements

- How to stay anonymous

- Key facts for the future

No comments:

Post a Comment