Cryptocurrency trading

Speculate on ten cryptos, or get wider exposure to the market with our crypto 10 index trade rising and falling prices on leverage to make the most of volatility 1

Top forex bonus list

Cryptocurrency trading

Trade eight cryptocurrencies including bitcoin, ether, ripple and litecoin – no wallet needed. Or get broad exposure in a single trade with our crypto 10 index.

Cryptocurrency trading is only available to professional traders.

Find out more about our professional account

Our helpdesk is available 24 hours a day, from 8am saturday to 10pm friday. Call 0800 195 3100 or email newaccounts.Uk@ig.Com .

Contact us: 0800 195 3100

Our helpdesk is available 24 hours a day, from 8am saturday to 10pm friday. Call 0800 195 3100 or email newaccounts.Uk@ig.Com .

Contact us: 0800 195 3100

Why trade cryptocurrencies with us?

If you’re a professional trader looking to trade cryptocurrencies with spread bets or cfds, you’ll be able to:

Trade rising and falling prices on leverage to make the most of volatility 1

Our deep internal liquidity means there’s more chance of executing a trade at your chosen price

Protect your capital with guaranteed stops 2

Safely and easily deposit and withdraw funds. We’re a regulated FTSE 250 company

Speculate on ten cryptos, or get wider exposure to the market with our crypto 10 index

Tax-free profits when you place a spread bet on cryptos 3

Cryptocurrencies you can trade with us

Professional traders can also trade our crypto 10 index, getting simultaneous exposure to the ten largest coins with a single trade.

Live prices on popular cryptos

Prices above are subject to our website terms and conditions. Prices are indicative only.

Ways to trade cryptocurrencies with us in the UK

| crypto spread betting | crypto CFD trading | |

| main benefits | profits are tax-free in the UK 3 | tax-deductible losses are useful for hedging 3 |

| available to | professional clients only | professional clients only |

| traded in | £ (or other base currency) per point | contracts |

| tax status | no capital gains tax (CGT) or stamp duty 3 | no stamp duty, but you do pay CGT. Losses can be offset as a tax deduction 3 |

| commission | commission-free (just pay our spread) | commission-free (just pay our spread) |

| platforms | web, mobile app and advanced crypto trading platforms | web, mobile app and advanced crypto trading platforms |

| learn more | learn more |

What is cryptocurrency trading?

Cryptocurrency trading is a way for professional traders to speculate on the market price of cryptocurrency with financial derivatives like spread bets and cfds.

What are the benefits of cryptocurrency trading?

The main benefits of crypto trading include tax-efficiency, 4 the ability to open a position with leverage, and the option to speculate on prices rising or falling.

Plus, you’ll never need an exchange account or digital wallet.

Who can trade cryptocurrencies?

To trade cryptocurrencies, you’ll need to have a professional trading account.

If you do, then you’ll be able to reap the benefits of trading cryptos with financial derivatives like spread bets or cfds.

How much will I have to pay?

Margins

Spread bets and cfds are traded with leverage. This means you can gain or lose a significant amount more than you deposit. Though not actually a cost to you, the margin you pay makes a big difference to the affordability of your trade.

Spreads

Your key payment for trading cryptocurrencies is the spread – the difference between the buy and the sell price. Essentially, this is our commission for executing your trade – and we work to keep our spreads among the lowest in the business.

| Spot FX | professional margin what is this? | Leverage equivalent |

| bitcoin | 4.5% | 1:22 |

| ether | 4.5% | 1:22 |

| ripple | 4.5% | 1:22 |

| bitcoin cash | 9% | 1:11 |

| litecoin | 9% | 1:11 |

| EOS | 9% | 1:11 |

| stellar | 9% | 1:11 |

| NEO | 9% | 1:11 |

| crypto 10 index | 9% | 1:11 |

| spread betting | cfds | MT4 | |

| bitcoin | 36 | 36 | 36 |

| ether | 1.2 | 1.2 | 1.2 |

| ripple | 0.36 | 0.36 | 0.36 |

| bitcoin cash | 2 | 2 | 2 |

| litecoin | 0.4 | 0.4 | 0.4 |

| EOS | 4 | 4 | 4 |

| stellar | 0.2 | 0.2 | 0.2 |

| crypto 10 index | 38 | 38 | n/a |

How much will I have to pay?

Margins

Spread bets and cfds are traded with leverage. This means you can gain or lose a significant amount more than you deposit. Though not actually a cost to you, the margin you pay makes a big difference to the affordability of your trade.

Spreads

Your key payment for trading cryptocurrencies is the spread – the difference between the buy and the sell price. Essentially, this is our commission for executing your trade – and we work to keep our spreads among the lowest in the business.

| Spot FX | professional margin | leverage equivalent |

| bitcoin | 4.5% | 1:22 |

| ether | 4.5% | 1:22 |

| ripple | 4.5% | 1:22 |

| bitcoin cash | 9% | 1:11 |

| litecoin | 9% | 1:11 |

| EOS | 9% | 1:11 |

| stellar | 9% | 1:11 |

| NEO | 9% | 1:11 |

| crypto 10 index | 9% | 1:11 |

| spread betting | cfds | MT4 | |

| bitcoin | 36 | 36 | 36 |

| ether | 1.2 | 1.2 | 1.2 |

| ripple | 0.36 | 0.36 | 0.36 |

| bitcoin cash | 2 | 2 | 2 |

| litecoin | 0.4 | 0.4 | 0.4 |

| EOS4 | 4 | 4 | 4 |

| stellar | 0.2 | 0.2 | 0.2 |

| crypto 10 index | 38 | 38 | n/a |

The UK’s best crypto trading platform

Discover crypto opportunity on the UK’s best web-based platform and mobile trading app, 4 as well as popular third-party platforms including metatrader 4.

The latest crypto news

Coinbase IPO: what you need to know on coinbase shares

Ethereum approaches all-time high as whales buy and bitcoin thrives

Bitcoin: is tighter scrutiny likely?

Bitcoin: is a price correction looming in 2021?

Under FCA rules, only professional traders can trade cryptocurrency with derivatives like spread bets and cfds. Learn more about professional trading and check your eligibility on our professional account page.

Our crypto 10 index tracks the price of the top ten cryptocurrencies, changed every quarter:

- Bitcoin

- Ether

- Ripple

- Litecoin

- Bitcoin cash

- EOS

- Bitcoin SV

- Cardano

- Monero

- Stellar

Try these next

Trading bitcoin

Trading litecoin

Bitcoin halving

No exchange account? No problem. Go long or short on bitcoin with spread betting or cfds.

Trade ‘the silver to bitcoin’s gold’ – whether it’s headed up or down, with no need to own coins.

Discover everything you need to know about trading the next bitcoin halving.

1 while leverage magnifies profits, it will also magnify losses.

2 guaranteed stops incur a small premium if triggered.

3 tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

4 best trading platform as awarded at the ADVFN international financial awards and professional trader awards 2019. Best trading app as awarded at the ADVFN international financial awards 2020.

Markets

IG services

Trading platforms

Learn to trade

Contact us

Spread bets and cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and cfds with this provider. You should consider whether you understand how spread bets and cfds work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, etfs and etcs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG markets ltd, spread betting provided by IG index ltd. IG is a trading name of IG markets ltd (a company registered in england and wales under number 04008957) and IG index ltd (a company registered in england and wales under number 01190902). Registered address at cannon bridge house, 25 dowgate hill, london EC4R 2YA. Both IG markets ltd (register number 195355) and IG index ltd (register number 114059) are authorised and regulated by the financial conduct authority.

The information on this site is not directed at residents of the united states, belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Cryptocurrency trading volumes hit record $68.3 billion following bitcoin rally, research shows

Bitcoin hit a record high $34,800 (roughly rs. 25 lakhs) on sunday.

Bitcoin's record high came less than three weeks after it crossed $20,000 (roughly rs. 14.6 lakhs)

- Ethereum also on monday hit its highest level since january 2018

- World's biggest cryptocurrency more than quadrupled in price last year

- Bitcoin's advance reflects expectations it will become mainstream payment

Trading volumes on major cryptocurrency exchanges hit a daily record on monday of over $68 billion (roughly rs. 4,97,200 crores), research showed, highlighting the trading frenzy that has accompanied bitcoin's charge to an all-time high.

Bitcoin hit a record high $34,800 (roughly rs. 25.4 lakhs) on sunday, building on a 2020 rally that saw it more than quadruple as bigger US investors jumped into the market. It then fell sharply on monday amid volatility in highly leveraged futures markets, before recovering losses.

The second-biggest cryptocurrency, ethereum, which tends to trade in tandem with bitcoin, also on monday hit its highest level since january 2018, touching $1,170 (roughly rs. 85,600).

Overall daily trading volumes in cryptocurrencies hit $68.3 billion (roughly rs. 4,99,600 crores), the data from UK research firm cryptocompare showed on tuesday. Daily volumes had averaged $13.1 billion (roughly rs. 95,800 crores) in 2020, the data showed.

Bitcoin's record high came less than three weeks after it crossed $20,000 (roughly rs. 14.6 lakhs) for the first time on december 16.

Fuelling bitcoin's rally has been the perception it can act as a hedge against the risk of inflation as governments and central banks turn on the stimulus taps to counter the COVID-19 pandemic. Its potential for fast gains also attracted demand.

Crypto trading volumes regularly spike during periods of extreme price swings, highlighting the central role for speculative traders in digital currency trading.

What will be the most exciting tech launch of 2021? We discussed this on orbital, our weekly technology podcast, which you can subscribe to via apple podcasts, google podcasts, or RSS, download the episode, or just hit the play button below.

Lowest trading costs for popular crypto markets*

Last updated:

Pricing delayed by 15 minutes. For live market pricing login.

Last updated:

| market‡ | spread† | margin rates | overnight finance (long) | overnight finance (short) |

|---|---|---|---|---|

| bitcoin ($) | from 35 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (£) | from 45 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (€) | from 55 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (AUD) | from 55 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin cash ($) | from 2 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| ethereum ($) | from 1.2 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| litecoin ($) | from 0.5 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| ripple ($) | from 0.6 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

† may change due to market conditions

‡ trading hours on cryptocurrencies are 22:00 sun - 22:00 fri

Lowest costs on your crypto trading compared to global competitors

We’re proud to offer the lowest costs on your crypto trading among these global competitors*, with market-leading pricing on bitcoin, ethereum, litecoin and ripple markets.

*table is for comparative purposes only and features representative spreads from global competitors on their websites and platforms, and is correct to the best of our knowledge, as of 23/01/2020 11.00am BST. Trading costs are based on a bitcoin ($) price of 9,000 and a 1 CFD trade, representing a total notional volume of $9,000. Plus 500 costs include the cost of reopening trades due to forced expiration dates. Positive numbers imply charges to client accounts; negative numbers imply credit received by clients.

Why trade cryptos as cfds with FOREX.Com?

Take advantage of crypto volatility

A trading partner you can trust

Trading vs. Owning crypto

| cfds | owning crypto | |

|---|---|---|

| profit from rising crypto prices | ✔ | ✔ |

| profit from falling crypto prices (go short)** | ✔ | |

| trade on margin | ✔ | |

| trade on volatility - no need to own the asset or have an exchange account | ✔ | |

| no exchange fees or complicated digital wallets | ✔ | |

| lock in profits and cap losses with risk management tools | ✔ |

**shorting only available on BTC and ETH.

Please be aware that owning cryptos does not have the same associated cost as trading it, and in some instances, it may be more costly to trade it.

Cryptocurrencies available for trading

Bitcoin

Ethereum

Litecoin

Ripple

How to trade thematic indices

Latest research

- Currency pair of the week: XAU/USD (gold) january 11, 2021 2:14 PM

- Top UK ipos to watch out for in 2021 january 11, 2021 1:05 PM

- US market open: democrats seek to oust trump january 11, 2021 12:17 PM

read latest research

Trade cryptos on metatrader 5

Cryptocurrencies aren’t available on MT4, but they are on MT5. With improved charting, exclusive indicators and the ability to trade 500+ markets including cryptocurrencies, stocks, FX pairs, indices and commodities all on one platform, metatrader 5 offers next-generation trading and tools.

The FOREX.Com advantage

Trade with confidence and benefit from the reliability of a trusted broker with a proven record of stability, security and strength.

Have questions? We've got answers.

What is the minimum trade size for cryptocurrencies

How does FOREX.Com price cryptocurrencies?

Start trading cryptocurrencies with FOREX.Com today.

Try a demo account

It's your world. Trade it.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Is cryptocurrency trading profitable in 2020?

Related

Investors have been using bitcoins and altcoins for quite a while. Thanks to high volatility, one can earn profits more quickly than in more stable markets. But how much can you expect to gain, and is tackling crypto worth it?

This year, coronavirus has made online trading extremely popular. Now, when millions of people are learning to make money remotely, forex and cryptocurrency are more attractive than ever. It is true for south africa and many other countries.

Volatility: friend or foe?

Bitcoin is famous and notorious (depending on who you ask) for its volatility. It means its rate is often so erratic. It can nosedive or skyrocket within a short period. For example, in october 2020, bitcoin reached a 15-month-high above $13,000 after paypal announced support for cryptocurrencies.

For traders, this means they may achieve their goals more quickly by following consistent strategies. However, crypto coins are also risky due to the same characteristic. One may cap potential losses using technical tools and other methods.

Choose broker wisely

since crypto is so popular, it is sometimes used for fraud. Be careful who you trade through. Regulated brokers have official licences and approval from such international organizations as the FCA in the UK, the FSCA in south africa, and the cysec in cyprus.

To comply, providers need to adhere to strict rules concerning client protection. For example, forextime is licensed in different jurisdictions, and it does a lot to educate clients about fundamental cryptocurrency trading strategies.

How to access cryptocurrency trading

the easiest way is through special virtual instruments known as cfds (contracts for difference). These allow you to profit from the dynamics of bitcoin, ethereum, ripple, and other currencies without owning them.

It makes the process more secure and accessible. All you need is a trading platform, a registered account, and support from a broker. The initial investment may be very modest — for example, $100 to open a live account.

CFD trading is, to a degree, like sports betting — you open positions based on predictions. Every CFD is your agreement with the broker. Cfds may bring profit when they are sold, and the closing price is higher than their initial value.

Therefore, you need to spot the moment when the value of your underlying asset is the highest. You may achieve this through analysis of fundamental or technical indicators — pretty much like in the currency market.

CFD trading is not gambling. It is a process based on rigorous analysis and objective data. If you take high risks, you may reap greater profits within a short period. Still, it is advisable to keep potential losses under control. Use technical tools like stop loss, and consider diversifying.

How to make higher profit

high profits are achievable in two situations. You may take high risks or trade large volumes (with or without leverage). The leverage system allows you to use a share of your broker’s funds to open larger positions. It is also known as trading on margin, where margin refers to the percentage of your investment.

Cryptocurrency cfds may have different leverage — for instance, 1:100. It means you may open a position worth $100,000 when there is just $1,000 in your account. If the broker is regulated, it must adhere to the unfavourable balance protection requirements. If you fail, you will never end up in the red, as you may only lose your balance. Still, leverage is extremely risky, and all respectable companies emphasize this aspect.

Do not expect to make a million in a month, or get rich quickly. Traders need to follow strict strategies with rigorous risk management limitations. In general, you should not risk more than 1% of your capital per trade. This limits your potential profits, but they will still accumulate over time if you are persistent and circumspect.

What are the chances of success?

It is advisable to spend time in the demo mode, using your platform as a simulator. Make sure your strategy is detailed, so you know what to do during ups and downs. Keep a trading journal and record all primary aspects of every trade: the volume, the instrument, the price at entry and exit, volatility, liquidity, and your feelings about it.

Perform regular reviews and see the root cause of your shortcomings. Traders learn all the time. They never stop improving their strategies.

According to the official statistics released by brokers, every third trader walks away a winner. So, why doesn’t everyone succeed? Common mistakes are emotional behaviour, a reckless attitude to risk, and imperfect strategies. That is why preparation is paramount.

Cryptocurrency stocks trade in all directions today, even as bitcoin climbs above $34,000

These stocks reminded investors that day trading stocks based on the price of bitcoin can be an unpredictable game to play.

What happened

Bitcoin was rising again on tuesday. As of 4:15 p.M. EST, bitcoin was up 8% over the previous 24 hours and had briefly surpassed $34,000 per token earlier in the afternoon, according to coindesk. Its daily high of $34,221 was within 1% of its all-time high, which was hit over this past weekend.

Most days when bitcoin is up, cryptocurrency stocks track higher, as well. There's some fundamental basis for this (as we'll see in a moment). But other factors impact stock prices, as well. Indeed, crypto stocks showed no real correlation to the price of bitcoin today. Some were up, some were down, and some traded sideways.

- Going up today were shares of bitcoin mining companies like marathon patent group (NASDAQ:MARA) and riot blockchain (NASDAQ:RIOT) , up 23% and 12%, respectively.

- Down a little were shares of bitcoin mining company bit digital (NASDAQ:BTBT) , along with shares of canaan (NASDAQ:CAN) , a company that manufactures equipment for mining bitcoin. These both fell a mere 5%.

- Finally, ebang international holdings (NASDAQ:EBON) is another company manufacturing bitcoin mining hardware, and its stock was down a painful 13%.

Image source: getty images.

So what

Bitcoin miners run the bitcoin blockchain network and are paid in bitcoin. These companies pay for workers, computers, real estate, and electricity in fiat money. Therefore, they have to sell their bitcoin tokens to non-miners who want to own bitcoin. Therefore, revenue potential for marathon, bit digital, and riot blockchain is subject to the market price of bitcoin. As it rises, so does the revenue potential for these companies.

This explains why investors get excited about bitcoin mining when the price of the cryptocurrency goes up. But what about hardware companies like ebang and canaan? Sales for these two companies were largely down in 2020. But as bitcoin mining becomes more profitable, there's greater potential for a new bitcoin mining craze, which could cause sales to rise again for ebang and canaan.

When bitcoin goes up, it's good for these stocks. But this is only generally speaking. Investors should not just trade in and out of these stocks based solely on the price of bitcoin.

Image source: getty images.

Now what

Trading solely based on the price of bitcoin is a bad idea because in the short term, anything can happen with stocks. Consider that these are all small-cap stocks and are easily manipulated.

Sure, you could get lucky on a day trade. For example, anyone trading in and out of bit digital recently is clearly happy, considering it's nearly tripled over the past five trading days alone. However, these stocks could easily become the target of a famous short-seller. Given how easily these can be manipulated, these stocks would likely plummet on a development like that -- at least in the short term.

More importantly, these are all real-life businesses that could, at any time, report things unique to their companies. Sometimes it's good news; sometimes it's bad news.

For example, yesterday the price of bitcoin was mostly rising, whereas marathon stock was mostly falling. It spiked at the open and finished up for the day. But it steadily declined from early session highs. This is likely because of its announced capital raise of $200 million to help purchase additional equipment from bitmain, increasing its mining capability. That's good.

However, because of this, the company's share count is rising at an alarming pace, eroding shareholder value. Currently, marathon has almost 75 million shares outstanding. For perspective, it had less than 8.7 million on march 31, 2020.

Considering how overvalued these stocks appear to be, you can't blame marathon for taking advantage of its high stock price. Indeed, $200 million from selling its stock is lightyears beyond what its business is capable of generating in revenue right now. In fact, I wouldn't be surprised if all of these companies announce more dilutive moves in the near future. If any do make such an announcement, their stock will likely fall, regardless of what the price of bitcoin happens to be doing that day.

These are just a couple of reasons why eyeing short-term gains can be a dangerous game when it comes to stocks. It's hard to predict. However, in the long term, stocks strongly correlate with business fundamentals like revenue and profits, which is much easier for average investors like you and me to envision.

Cryptocurrency trading a lifeline for some in northern syria

Syrians in northern syria are taking to trading in cryptocurrencies as a way of securing an income, amid difficult economic conditions reports iqtissad.

From his makeshift camp in northern syria, taha zeid has been working in cryptocurrency trading for a while, after learning how to trade on specialized platforms.

Zeid, 28, couldn’t take advantage of bitcoin’s recent jumps because his trading is depending on other currencies, he told iqtissad.

“my ‘capital’ is very modest and I can’t buy bitcoin, which has a high value compared to other cryptocurrencies,” he said.

Taha uses his mobile phone to register with platforms and websites specialized in trading virtual currencies such as ethereum, OX, tether, and NEM, and keeps a close watch on their market movement in order to secure some profits.

Mohamed halawa, 35, another displaced syrian and a computer sciences graduate, has also followed training courses to enter the cryptocurrency market in the last rebel-held stronghold in idleb region.

Halawa told iqtissad that dealing in cryptocurrencies has become very easy “as we rely on well-known platforms to buy and sell through.”

Halawa adds that there is no specific capital requirement to enter the trading market but it is better to have at least 100 dollars to collect a good profits.

Halawa also explains that the process of buying and selling is not arbitrary but by following the methods of cryptocurrency analysis, and using classical and technical analysis of each currency, indicators for up and down movement can be determined.

This article was edited by the syrian observer. The syrian observer has not verified the content of this story. Responsibility for the information and views set out in this article lies entirely with the author.

Lowest trading costs for popular crypto markets*

Last updated:

Pricing delayed by 15 minutes. For live market pricing login.

Last updated:

| market‡ | spread† | margin rates | overnight finance (long) | overnight finance (short) |

|---|---|---|---|---|

| bitcoin ($) | from 35 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (£) | from 45 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (€) | from 55 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin (AUD) | from 55 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| bitcoin cash ($) | from 2 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| ethereum ($) | from 1.2 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| litecoin ($) | from 0.5 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

| ripple ($) | from 0.6 | from 25% | 0.0411% (pay) | 0.0136% (receive) |

† may change due to market conditions

‡ trading hours on cryptocurrencies are 22:00 sun - 22:00 fri

Lowest costs on your crypto trading compared to global competitors

We’re proud to offer the lowest costs on your crypto trading among these global competitors*, with market-leading pricing on bitcoin, ethereum, litecoin and ripple markets.

*table is for comparative purposes only and features representative spreads from global competitors on their websites and platforms, and is correct to the best of our knowledge, as of 23/01/2020 11.00am BST. Trading costs are based on a bitcoin ($) price of 9,000 and a 1 CFD trade, representing a total notional volume of $9,000. Plus 500 costs include the cost of reopening trades due to forced expiration dates. Positive numbers imply charges to client accounts; negative numbers imply credit received by clients.

Why trade cryptos as cfds with FOREX.Com?

Take advantage of crypto volatility

A trading partner you can trust

Trading vs. Owning crypto

| cfds | owning crypto | |

|---|---|---|

| profit from rising crypto prices | ✔ | ✔ |

| profit from falling crypto prices (go short)** | ✔ | |

| trade on margin | ✔ | |

| trade on volatility - no need to own the asset or have an exchange account | ✔ | |

| no exchange fees or complicated digital wallets | ✔ | |

| lock in profits and cap losses with risk management tools | ✔ |

**shorting only available on BTC and ETH.

Please be aware that owning cryptos does not have the same associated cost as trading it, and in some instances, it may be more costly to trade it.

Cryptocurrencies available for trading

Bitcoin

Ethereum

Litecoin

Ripple

How to trade thematic indices

Latest research

- Currency pair of the week: XAU/USD (gold) january 11, 2021 2:14 PM

- Top UK ipos to watch out for in 2021 january 11, 2021 1:05 PM

- US market open: democrats seek to oust trump january 11, 2021 12:17 PM

read latest research

Trade cryptos on metatrader 5

Cryptocurrencies aren’t available on MT4, but they are on MT5. With improved charting, exclusive indicators and the ability to trade 500+ markets including cryptocurrencies, stocks, FX pairs, indices and commodities all on one platform, metatrader 5 offers next-generation trading and tools.

The FOREX.Com advantage

Trade with confidence and benefit from the reliability of a trusted broker with a proven record of stability, security and strength.

Have questions? We've got answers.

What is the minimum trade size for cryptocurrencies

How does FOREX.Com price cryptocurrencies?

Start trading cryptocurrencies with FOREX.Com today.

Try a demo account

It's your world. Trade it.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Cryptocurrency trading volumes hit record $68.3 billion following bitcoin rally, research shows

Bitcoin hit a record high $34,800 (roughly rs. 25 lakhs) on sunday.

Bitcoin's record high came less than three weeks after it crossed $20,000 (roughly rs. 14.6 lakhs)

- Ethereum also on monday hit its highest level since january 2018

- World's biggest cryptocurrency more than quadrupled in price last year

- Bitcoin's advance reflects expectations it will become mainstream payment

Trading volumes on major cryptocurrency exchanges hit a daily record on monday of over $68 billion (roughly rs. 4,97,200 crores), research showed, highlighting the trading frenzy that has accompanied bitcoin's charge to an all-time high.

Bitcoin hit a record high $34,800 (roughly rs. 25.4 lakhs) on sunday, building on a 2020 rally that saw it more than quadruple as bigger US investors jumped into the market. It then fell sharply on monday amid volatility in highly leveraged futures markets, before recovering losses.

The second-biggest cryptocurrency, ethereum, which tends to trade in tandem with bitcoin, also on monday hit its highest level since january 2018, touching $1,170 (roughly rs. 85,600).

Overall daily trading volumes in cryptocurrencies hit $68.3 billion (roughly rs. 4,99,600 crores), the data from UK research firm cryptocompare showed on tuesday. Daily volumes had averaged $13.1 billion (roughly rs. 95,800 crores) in 2020, the data showed.

Bitcoin's record high came less than three weeks after it crossed $20,000 (roughly rs. 14.6 lakhs) for the first time on december 16.

Fuelling bitcoin's rally has been the perception it can act as a hedge against the risk of inflation as governments and central banks turn on the stimulus taps to counter the COVID-19 pandemic. Its potential for fast gains also attracted demand.

Crypto trading volumes regularly spike during periods of extreme price swings, highlighting the central role for speculative traders in digital currency trading.

What will be the most exciting tech launch of 2021? We discussed this on orbital, our weekly technology podcast, which you can subscribe to via apple podcasts, google podcasts, or RSS, download the episode, or just hit the play button below.

Three common mistakes that will get your cryptocurrency trading account rekt

It’s not surprising to see many new and young investors joining the cryptocurrency market. This industry offers volatility and the chance to make profits that you can’t find in the traditional stock market. However, it also has its downsides, mainly the risks associated with trading cryptocurrencies. Today, we are going to take a look at some of the most common errors from new traders and how to avoid them.

Avoid these 3 common mistakes to keep your account growing

Although there are plenty of mistakes one can make when trading, we have chosen three of the most common ones to help you avoid them. It’s important to note that even experienced traders make mistakes, but it’s crucial that you learn from them and understand how to avoid them in the future.

Trading with no set plan

One of the most common mistakes new traders make is initiate a trade without an established plan. Perhaps a coin looks extremely promising, and you might be right, but what happens after? Before jumping into any position, you need to have stablished exit points and other potential entry points.

The most critical aspect of trading is to establish clear exit points to take profit and to stop your position from crashing too hard. Once you enter a position, it’s crucial to set a stop loss as soon as possible as the cryptocurrency market is extremely volatile. 5-10% moves are not uncommon and can literally happen in minutes.

Failing to take profit or cut losses

Besides the critical stop-loss we have discussed above, you will also need to know when to take profits. If you are too greedy and expect the asset to go up indefinitely, you will most likely make less money or perhaps end up hitting your stop-loss. It’s important to establish several ‘take profit orders’ along the way to minimize risk.

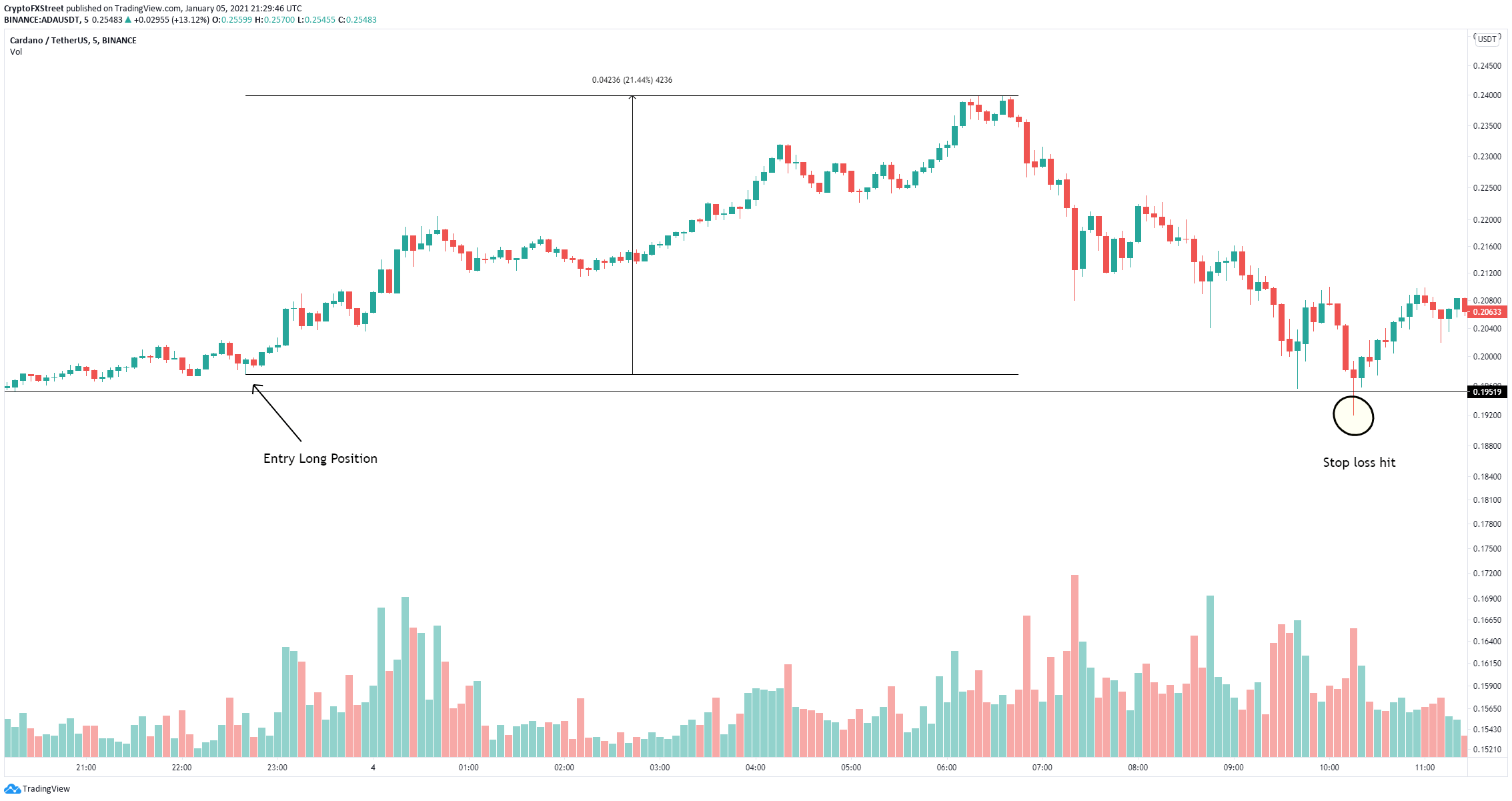

In the example above, a trader made an amazing entry at $0.197 on cardano which then had a 21.4% move to the upside. The trader placed his stop loss at $0.195 because it was a previous support level. Unfortunately, he didn’t take any profits on the way up, expecting cardano to continue rising and eventually hit the stop-loss. What’s worse here is that besides that short dip, cardano price continued climbing higher and it’s currently trading at $0.255.

This can easily happen to the downside as well. New traders will feel the temptation to let losing trades run. Even with a stop-loss in place, some traders might have the urge of canceling it and let it ride longer in the hopes of a recovery. You need to understand that even professional traders will lose many trades as the most important factor for a profitable trader is the risk/reward ratio. For instance, a professional trader might lose 60% of the times but every positive trade is three times as profitable as any loss which puts him at a gain overall.

Risking too much using leverage

Although leverage is a great tool for experienced traders, it is extremely risky for new traders, especially in the cryptocurrency market. Most exchanges will offer up to 125x leverage on some assets.

The main idea behind leverage is simply, it’s a tool that allows you to enter more sizable positions without investing more money. Basically, at a 50x leverage, you can buy $50,000 worth of an asset using only $1,000.

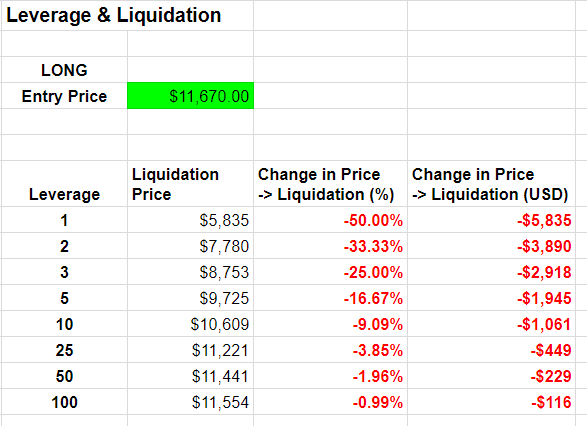

But leveraging is a double-edged sword as it also implies greater losses. Exchanges use a mechanism called liquidation which will be automatically triggered if your position doesn’t go in your favor, wiping out your entire account. Without leveraging your position, you will only lose everything if somehow the asset drops to $0. However, using leverage can quickly liquidate your account.

The image above shows the percentage move required for your position to get liquidated depending on the amount of leverage. As you can see, using 100x leverage is extremely risk and a 0.99% change in price is enough to fully liquidate your position. Keep in mind that a 1% move can happen within minutes or even seconds in the cryptocurrency market.

Conclusion

You should always have a plan when you start trading and you must absolutely stick to it even if it’s hard at first. Everyone makes mistakes and it’s ok to lose as long as you have good stop-losses in place. Although emotions can quickly cloud your decision-making skills, you must try your best to ignore them.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Fxstreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in open markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of fxstreet nor its advertisers.

So, let's see, what we have: learn more about cryptocurrency trading for pro traders with IG. Find out how you could trade rising and falling prices with a regulated FTSE 250 company. At cryptocurrency trading

Contents

- Top forex bonus list

- Cryptocurrency trading

- Why trade cryptocurrencies with us?

- Cryptocurrencies you can trade with us

- Ways to trade cryptocurrencies with us in the UK

- What is cryptocurrency trading?

- What are the benefits of cryptocurrency trading?

- Who can trade cryptocurrencies?

- How much will I have to pay?

- How much will I have to pay?

- The UK’s best crypto trading platform

- The latest crypto news

- Coinbase IPO: what you need to know on coinbase shares

- Ethereum approaches all-time high as whales buy and bitcoin thrives

- Bitcoin: is tighter scrutiny likely?

- Bitcoin: is a price correction looming in 2021?

- Try these next

- Trading bitcoin

- Trading litecoin

- Bitcoin halving

- Markets

- IG services

- Trading platforms

- Learn to trade

- Contact us

- Cryptocurrency trading volumes hit record $68.3 billion following bitcoin rally, research shows

- Bitcoin hit a record high $34,800 (roughly rs. 25 lakhs) on sunday.

- Lowest trading costs for popular crypto markets*

- Lowest costs on your crypto trading compared to global competitors

- Why trade cryptos as cfds with FOREX.Com?

- Trading vs. Owning crypto

- Cryptocurrencies available for trading

- How to trade thematic indices

- Trade cryptos on metatrader 5

- The FOREX.Com advantage

- Have questions? We've got answers.

- Start trading cryptocurrencies with FOREX.Com today.

- Try a demo account

- Is cryptocurrency trading profitable in 2020?

- Related

- Cryptocurrency stocks trade in all directions today, even as bitcoin climbs above $34,000

- These stocks reminded investors that day trading stocks based on the price of bitcoin can be an...

- What happened

- So what

- Now what

- Cryptocurrency trading a lifeline for some in northern syria

- Lowest trading costs for popular crypto markets*

- Lowest costs on your crypto trading compared to global competitors

- Why trade cryptos as cfds with FOREX.Com?

- Trading vs. Owning crypto

- Cryptocurrencies available for trading

- How to trade thematic indices

- Trade cryptos on metatrader 5

- The FOREX.Com advantage

- Have questions? We've got answers.

- Start trading cryptocurrencies with FOREX.Com today.

- Try a demo account

- Cryptocurrency trading volumes hit record $68.3 billion following bitcoin rally, research shows

- Bitcoin hit a record high $34,800 (roughly rs. 25 lakhs) on sunday.

- Three common mistakes that will get your cryptocurrency trading account rekt

- Avoid these 3 common mistakes to keep your account growing

- Trading with no set plan

- Failing to take profit or cut losses

- Risking too much using leverage

- Conclusion

No comments:

Post a Comment