Earntry.Com forex bonuses

BUY - green upward arrow: like two twins. Is not it?

Master entry - reduce your trading stress to minimum

Top forex bonus list

Master entry is a versatile trading indicator suitable for any type of trading, be it scalping, traditional day trading or swing trading. Accordingly, you can trade on any timeframe. And the ease of use of the indicator makes it convenient and understandable even for a beginner. The official website says that the indicator is not repainted, but I have serious doubts about this. We'll deal with this later .

Characteristics of the forex master_entry

- Platform: metatrader4

- Currency pairs: any currency pairs, recommended major

- Trading time: european and USA trading sessions

- Time frame: M1-D1

- Recommended broker: roboforex, instaforex,forex4you

How it works? Trading rules

The appearance of master entry reminded me of the well-known half trend, on the basis of which many commercial indicators have been developed. Including forex millennium, onyx scalper, forex olympus and others.

Here's a look at half trend with amplitude = 12 and master entry with tradingmode = moderate:

Half trend [amplitude = 12]

Master entry [tradingmode = moderate]

Like two twins. Is not it?

Therefore, I dare to assert that master entry [cost = $97] is a slightly revised version of the half trend [free] indicator. The only difference is in changing the name of one parameter (amplitude – tradingmode).

It is not difficult to trade using this indicator and is reduced to a simple opening of a deal based on its signals.

BUY - green upward arrow:

SELL - red downward arrow:

Stop loss is at the level of the previous local minimum for buy and at the level of the previous local maximum for sell.

Take profit - individually, depending on the volatility of the currency pair, time frame and trading session. Or using the formula: take profit = 2 x stop loss.

Alternatively, to set stop loss and take profit levels, the author recommends using fibonacci levels, stretching them from the nearest price maximum to the price minimum. Watch the video [00:41]:

Earntry.Com forex bonuses

Deposit bonus – A bonus on funding a live account. The bonus credited on percentage of the deposit amount.

No deposit bonus – free bonus on account registration for the new clients to trade live without any risk.

Tradable bonus: A deposit bonus that can be lost and traded as the part of your trading equity.

Volume bonus – most common type of deposit bonus, it allows you to increase your trading volume. Often the bonus can be cashed on trading lot requirement.

Forex gift – A gift for the clients for completing certain requirements, everything from bonus to latest gadget

Freebies – free stuff by forex brokers like ebook, courses, trading materials etc.

Rebate – cash-back withdrawable bonus on each lot traded.

Demo contest – contests held on demo account, win cash/tradable money with no-risk involve!

Live contest – contest held on live account, deposit requires. Win bigger cash/prizes.

Refer – a-friend– refer your friend to your broker, when your friend deposit you will get a special bonus

Free signals – get free trading signals from the broker.

Free VPS – get access to an optimized forex virtual private server for free on maintaining a certain amount of trading balance.

Binary options – binary bets trading on forex instruments

Forum posting: get a small trading bonus for each of your post in forms.

3 affiliate IB: receive a commission from your fellow traders, specially design for the marketers.

Draw bonus: the winners chosen by a draw

Seminars webinars: find the schedule to participate in the online/offline events.

Expos events: inviting to attend the forex events & expos globally.

Forex bonuses and how to get them?

To enhance their popularity and attract new clients, many broker companies offer various bonus programs. Bonuses are meant for receiving additional finances or making your trading conditions better. In this review, we will discuss several interesting bonus programs provided by the roboforex broker company.

What is to be known about bonuses on forex?

A bonus is a sum of money that the company deposits on your account at certain conditions. There are various types of bonuses: welcome bonuses, bonuses for depositing your account, money turnover, and others. Thanks to bonuses, you can try forex without investing substantial sums.

First of all, bonuses seem attractive to beginner traders, but experienced players are also happy to use them – receiving additional income from a large number of trades, for example. Bonuses provide the trader with additional opportunities for making money on the market. You should study the conditions of bonus programs carefully and decide, which type suits you most.

Types of forex bonuses

Let us discuss the three main types of forex bonuses.

Welcome bonus of 30 USD

This is a bonus for new clients of the company. It is available to anybody provided that they have not yet participated in bonus programs of receiving seed money. The size of the bonus is 30 USD or 3,000 cent for cent accounts. The money may be used for trading without limitations.

All the profit from trading and your funds may be withdrawn. The bonus sum may not be withdrawn, it can only be charged off in the case of a stop out or in case you reject the bonus. You can find out more detail about welcome bonus and receive it on the roboforex website.

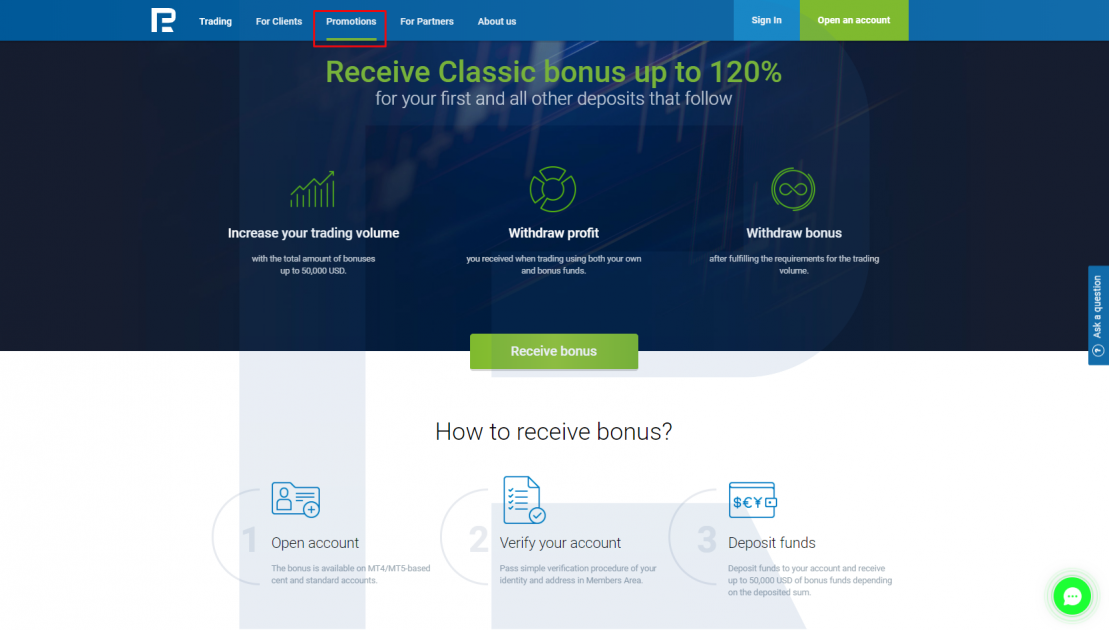

Classic bonus for your deposit

A classic bonus is additional money deposited on your account in a certain ratio with your existing deposit. Currently, you can receive a classic bonus of 25%, 50%, 100%, and 120% from the deposited sum. The classic bonus may not be included in a drawdown: if your equity is less than the sum of your active bonuses, the classic bonus will be withdrawn from your account.

The main advantage of classic bonus is that you may manage it at will (including withdrawing it) if there is a certain money turnover on your account. Until you reach it, the bonus and the sum that it was deposited on may not be withdrawn. The necessary turnover is calculated as:

Number of lots = sum of classic bonus (USD) / 2

You can find out more detail about classic bonus and receive it on the roboforex website.

Advanced profit share bonus

Profit share is additional money deposited on your account. Unlike classic bonus, this one may be part of a drawdown. Currently, the maximum available profit share is 60% of the deposited sum. After the bonus is deposited, the money on your account is divided into shares: your own and bonus money. The profit share will be withdrawn from your account in the case of a stop out or if you reject the sum.

Like classic bonus, profit share may be withdrawn from your trading account after there is the necessary trading turnover. The calculation formula is the same as for classic bonus:

Number of lots = sum of profit share (USD) / 2

You can find out more detail about profit share and receive it on the roboforex website.

How to get roboforex bonuses?

Bonuses are deposited on your trading account, hence, your first step is to open an account on roboforex.

To receive deposit bonuses classic bonus and profit share, open the depositing page, choose your bonus and its % and deposit your account. The bonus will be deposited together with your money.

Bonuses can be received a limitless number of times, but the overall sum of bonuses on one account is limited: 50,000 USD for classic bonus and 20,000 USD for profit share.

The conditions for welcome bonus are slightly different. You will need to:

- Verify your personal data

- Verify your phone number

- Deposit your account by a plastic card for no less than 10 USD or the same sum in any other currency.

After all conditions are fulfilled, you will receive a special code on your email. It must be activated in your personal members area, after which, in a 5 day time, 30 USD (or 3000 cent) will be deposited on your account. Each client may get a welcome bonus only once.

How to choose a bonus?

Bonuses should be chosen based on your necessities. For example, welcome bonus will suit beginners who want to try playing on forex but have limited funds or are not quite sure of their trading system. Also, it will suit those traders who want to get acquainted with the company’s conditions, checking it on bonus money before investing their funds.

Profit share is good for experienced and active traders, especially those who have a highly risky trading style, leading to large drawdowns from time to time. Because it participates in drawdowns, the bonus makes the deposit more survivable and allows receiving an additional profit.

Classic bonus will suit traders who make a lot of trades. Thanks to a large money turnover, they can work off the bonus money and manage it at will. Also, classic bonus will be useful if you decide to trade an instrument with large margin security — the bonus money will help you meet the requirement.

Can you make money using bonuses?

Of course, you can make a profit using bonuses. Welcome bonus will let you start trading virtually without investing your own money. The deposit bonuses classic bonus and profit share will extend your trading opportunities and bring you extra profit if you work them off gradually by increasing your trading turnover.

However, note that the biggest part of your profit is made not thanks to bonuses but your reliable trading system. A bonus is just extra opportunities, the main thing is your ability to trade and discipline. I advise you against trying too hard to work off your bonuses as this may entail breaking the rules of trading and subsequent losses.

Use bonuses rationally, and they will be of great help.

How to find the best forex bonus when you live in south africa?

More than $4 trillion is traded on the forex markets every day. It is the largest financial market on earth. The market is available 24 hours a day, five days a week. As smartphones and tablets have become more abundant brokers have adapted to the digital age by going online and today trading on the forex markets is as easy as pushing a button.

As more people find an interest in trading on global markets many choose to trade in forex. This has created competition amongst forex brokers, many of whom now offer bonuses to new and existing customers as an incentive to use their services.

Trading on the forex markets is not for the faint hearted. Millions are earned and lost on the markets every day. It all boils down to doing your research and ensuring that you have a plan and a system and that you choose the right forex broker.

| Best 3 forex bonuses for 2021 | |||||||

|---|---|---|---|---|---|---|---|

| FX brokers | ranking | license | assets | MT4 | MT5 | bonus | website |

| ironfx | 5/5 | FSCA, cysec, FCA, ASIC | 200+ | yes | yes | $4,000 | trade now |

| avatrade | 4.5/5 | FSCA, ASIC, FSC, FFA | 1000+ | yes | yes | $10,000 | trade now |

| 24option | 4.5/5 | cysec, IFSC | 100+ | yes | no | $500 | trade now |

If you’ve decided to opt for a forex bonus should choose one that matches your trading patterns. There are some unscrupulous brokers in the financial markets which is why you should never consider the size of the forex bonus in isolation. First and foremost, you must ensure that your money is in safe hands.

We’ve done the research for you and found the best ways that you can safeguard your money and ensure that you have fun while earning profits on the forex markets using the best forex bonuses on the markets today.

Trading safely

When you trade in forex you buy one currency and sell another at the same time. Only forex brokers may trade pairs of currencies on the markets. So, anyone looking to try their hand at forex trading will have to find themselves a good broker.

Forex trading appeals to people as an investment option, as the barriers to entry are low. You require relatively little money to trade on the markets and they operate around the clock. You can trade from anywhere around the world and you can choose the currencies that you’d like to trade.

Those planning on going into the forex markets should understand, however, that forex trading is risky and there is a possibility that you will lose your hard-earned cash. Never bow to the temptation to trade with money that you can’t afford to lose.

Before you start trading you should commit to treating your trading as a business proposition. You should have a strategy and a systematic approach to trade. Do your research and learn from the most successful traders out there. Don’t allow emotion to drive any of your trades.

Monitor your wins and losses and keep records so that you can use them to as guidelines for future trades. Keeping a journal of your approaches and the results is a fine way to learn from your successes and failures.

How to find the right broker

There are thousands of forex brokers online, not all of them are reputable. It is, of course, essential that you choose the right broker before you hand your hard-earned cash over. So, what qualities should you look for in an online forex broker?

Security

Check your local regulatory authority to ensure that broker is legitimate. Check for online recommendations and reviews. The regulatory bodies create rules that will protect you against rogue brokers. Security is the most important criteria for selecting a broker. Sadly, the financial world is full of charlatans, looking for an opportunity to divest you of your funds.

Transaction costs

Forex trades, like everything else, will cost you. Brokers charge either a commission or a spread. The spread is the difference between the bid and ask price of a currency pair. The spread differs according to the currency pairs traded. Popular pairs such as USD/EUR will have a much tighter spread than pairs that are not as heavily traded. The spread is measured in pips which is a tiny fraction 1% of the value of the currency pair.

Deposits and withdrawals

Choose a forex broker that makes it easy for you to deposit and withdraw funds as you require them. You keep funds in your account so the broker can trade on your behalf. You should be allowed to withdraw your profits quickly and easily whenever you want them. Never choose a forex bonus where withdrawal limitations exist. Find out what your broker’s funding and withdrawal policies are before you sign up.

Trading platform

All of your transactions will take place on the trading platform. This is the gateway to your currency trades. It must be user friendly and quick to download. Check the availability and speed of the website by visiting it during peak hours.

It is preferable that the platform is smartphone friendly. Make sure that it has a simple interface. Complications can make trading costly. The broker’s platform should contain all of the information that you may require. Research tools are important and they should, at the very least, include forex movement graphics and charts.

The best broker platforms continue to evolve to simplify the trade experience. They are easy to navigate, offering an increasing number of features and tools, enhancing the trade experience.

Customer service support

Make sure that you can get assistance when you really need it. Choose a broker who is contactable. They must be capable of dealing with any technical support and account problems that may come up.

Order execution

The speed of order execution is an important consideration in a market where the prices are volatile. In the forex markets minutes can be the difference between making a profit or a loss.

Initial deposit

Some brokers require a much higher deposit than others, so it’ll pay to check what initial outlay you broker requires.

Forex bonuses - all types overview

Forex bonuses are nothing more than a redistribution of the collected commission or spread. Much as airlines will reward you for flights taken, some brokers are happy to give traders a bonus to keep them trading through their brokerage.

Some forex bonuses really could work for you but many more have convoluted terms and conditions that you may find difficult to understand. It is essential that you carefully consider the terms and conditions before you commit yourself to a forex bonus.

There are several different forex bonuses. We’ve discussed a few of them below:

No deposit forex bonus

Newcomers to the forex trading market may find this product useful. You just register and claim your bonus which can range from $5 to $100. You can use the money to trade without incurring any risk yourself.

Many no deposit bonuses set restrictions on when you can withdraw the funds from your account. You cannot draw the bonus straight away and the broker may even place limitations on when you can withdraw your own profits.

Forex welcome bonus

Used to attract newcomers to the market. The welcome bonus may have a deposit or no deposit requirement. The welcome bonus is often called a deposit bonus, since many of them reward you with a percentage of the bonus.

You can’t withdraw your bonus, but you can use it to trade, getting you off to a good start. Your broker will restrict you from withdrawing funds from your account until you have reached a specified level of trade. If they didn’t place restrictions on the use of the bonus, they would run at a loss.

The welcome bonus gives new traders a nice leg up, but if you don’t do enough trade you might find that you never get beyond the required trade turnover to collect the bonus. So, you should take this into account when deciding which bonus best suits your needs.

Forex rebate bonus

If you opt for a forex rebate bonus, you’ll receive cashback on the trades you make. There are even rebate bonuses that apply only to losses. If this is the case, when you make a loss, you’ll get a percentage of the trade value back in the form of a bonus. Make sure that you understand the terms and conditions of the forex rebate bonus before you sign up for it, as they can differ substantially from one broker to another.

Forex deposit bonus

These bonuses are typically calculated as a percentage of the deposit. So, if the deposit bonus is 15% and you make a deposit of $1000, your bonus is $150. The offer is open to both new and existing customers, but many novice traders find the deposit bonus particularly useful.

Forex loyalty bonus

Some brokers run loyalty programs under which traders earn loyalty points which you may then use to retrieve cash or rewards such as smartphones, or other forex trading perks. Most newcomers enjoy the rewards bonuses. The more experienced traders typically don’t sign up.

Forex reload bonus

This bonus, intended for existing customers, offers a bonus for making a new deposit. These bonuses are often quite generous, so these offer some of the best deals in the forex bonus arena.

Forex VIP bonus

This bonus is on offer to people who open a VIP account when they start to trade. A VIP account often comes with a number of perks.

Forex trading contests

Contests are designed for existing clients. Brokers run trading contests so that clients can compete against one another. The broker will set up rules and regulations and a period over which the contest will run. In the end of the term the trader who makes the biggest profit will win the prize and get the bonus.

Understand the terms and conditions

It should come as no surprise that these bonuses come with terms and conditions. The broker offers the bonuses with the aim of making money. They contain restrictions on how and when you can use the funds. When you accept this bonus, you may have to commit to spending a fair amount of money.

The sheer number of bonuses on offer can make it difficult to choose. Front of mind when choosing should be your trading conduct. There are three ways to ensure that you get the best deal when trading. They’re listed below:

- Make sure that the broker that you choose is trustworthy – check that the broker is registered with your local regulatory authority. Signing up with a broker just because they offer a good bonus is not a good idea. Make sure that your funds are in safe hands by thoroughly researching the forex broker before handing any money over.

- Understand the broker terms and conditions before you sign up – it pays to understand the withdrawal requirements up front. You’ll usually have to make a certain number of trades before you can withdraw your funds. You should also understand fully what you will pay for the services rendered.

- Choose the bonus that matches your trading needs – some bonuses are geared to new traders and others for existing. There is little point in opting for a bonus that you are unlikely to earn because you have failed to reach the target turnover. Matching the deal with your trading conduct will ensure that you get the best bang for your buck.

Mitigating the risk

Trading in forex can be risky. There are many sad tales of traders losing vast sums of money. If you’re new to trading there is merit in downloading a demo forex tool. A demo tool will allow you to practice on real currency markets using virtual money. Many of the forex brokers will offer free demo accounts to cautious would-be traders.

While you learn the ropes using the demo model, use the time to research the markets and understand the trends and the underlying factors that affect currency price movements.

When you’re comfortable with the markets you can then move on to the real thing. This way you won’t risk your money whilst you’re still learning the ropes. Find a forex broker with a generous bonus offer and you’ll be well set to make a profit from the get go.

Risk warning: trading leveraged products such as forex and cfds may not be suitable for all investors as they carry a high degree of risk to your capital. It is really important that you do not trade any money that you can't afford to lose because regardless of how much research you have done, or how confident you are in your trade, there will always be a time that you lose.

Forex racer

Forex no deposit bonus

The best free forex no-deposit bonuses 2019

Make money in forex without investment

People say that the number one rule of financial trading is that you need a good deal of investment to start. That is no longer true. You can start trading in the forex market with as little as 100 dollars on a part-time basis. The key is to only make trades when you get a profit. If you know the market and study forecast accurately you can make a good steady income even with a small initial investment. Another good way to make money without investment is through a no-deposit forex bonus account. These accounts allow you to trade without investing your own money and still create a regular income stream.

What is a no-deposit bonus?

Whether you are just entering the forex markets or planning to trade in currencies in the future, the no-deposit bonus can help you set up nice and easy. It is the key to understanding the forex without risking any of your own, hard-earned money. If you discover that you have a knack for forex trading and are a natural at it, you can invest your own money and take up forex trading full time. If your trades don’t go as well as you hope, or you realize that forex trading just isn’t for you, you can just close the account without paying anything. No loss, no gain.

The popularity of no-deposit forex bonus

Forex trading platforms are always coming up with new incentives and ways to attract investors to their platforms. They have tried the virtual currency accounts and zero-fee for a month’s accounts. However, the no-deposit forex accounts gained more popularity than any other incentives. No-deposit forex bonus accounts are aimed specifically at new investors who lack experience of the currency markets. They also attract investors who have the time to research markets, but can’t spare enough funds to really get into forex. The no-deposits bonus accounts allow investors to make a significant amount of money with virtually zero risks. This is precisely what makes them better than any other type of incentives.

The risks in forex trading

Forex is a risky investment market that is not meant for people who cannot handle losses. There are millions of individual, retail and institutional traders trading daily in the forex market but only a handful of traders actually find success. Beginners can use demo trading, and it does help them understand the risks in the market. However, demo trading does not replicate the real-life emotions and risks of live forex trading. Many people turn apprehensive when they switch to real trading from demo accounts which affect their trading tactics. New traders are often unwilling to make trades because they don’t want to take the risk. This is where a forex no-deposit bonus can be useful. It works for both amateurs and more experienced traders. The no-deposit bonuses are in high demand in the FX market, but there are only a few online brokers that actually offer this facility for new accounts. Let’s take a closer look at how no-deposit bonus accounts work, and which platforms currently offer the best no-deposit forex trading in the market.

How do forex no-deposit accounts work?

Traditional forex accounts require you to deposit a sum of money into the account before you can start trading. The minimum balance can be $500, $1,000 or $5,000 depending on the broker. Once an investor has deposited the balance, the broker makes a commission on every trade that’s carried out through that account. This commission is the main source of income for the broker. In this type of traditional account, the depositor bears all the risk while the broker is guaranteed a return through commission. In no-deposit bonus accounts, the investor is not required to make an initial deposit and receives a bonus amount from the broker. This balance can be used for trading normally as if the investor deposited the money. You can also withdraw the balance without verification under the terms of the broker. If the depositor makes a profit through their trades, it belongs entirely to them. If they make a significant loss and lose all the initial deposit, they don’t have to pay anything. The broker bears the trading loss. The broker still collects a commission on the transactions which can compensate some of the costs for giving out the initial bonus to depositors.

Why forex brokers offer no-deposit bonus?

It is evident from the model that brokers have everything to lose from the no-deposit bonus and very little to gain. If a new investor makes risky trades for a greater return and the bet pays off, they can increase their balance significantly. If the bet fails, the broker bears the cost and they walk away without losing anything. So why do brokers offer the no-deposit bonus? There are two main reasons. The first is from a marketing perspective. Brokers that offer a no-deposit bonus usually get higher visibility on broker comparison platforms. No-deposit bonus is a huge attraction for both new and seasoned traders. The bonus brings more traders to the broker’s platform and increases their earning potential compared to its competitors. The second reason is that of all the traders that invest through the broker, some win and some lose. Brokers hopes that the big winners will continue trading through the platform while earning them commission in the process. People who win the first few trades are also likely to deposit their own funds into the accounts to scale their winnings.

How to find the best forex bonus when you live in south africa?

More than $4 trillion is traded on the forex markets every day. It is the largest financial market on earth. The market is available 24 hours a day, five days a week. As smartphones and tablets have become more abundant brokers have adapted to the digital age by going online and today trading on the forex markets is as easy as pushing a button.

As more people find an interest in trading on global markets many choose to trade in forex. This has created competition amongst forex brokers, many of whom now offer bonuses to new and existing customers as an incentive to use their services.

Trading on the forex markets is not for the faint hearted. Millions are earned and lost on the markets every day. It all boils down to doing your research and ensuring that you have a plan and a system and that you choose the right forex broker.

| Best 3 forex bonuses for 2021 | |||||||

|---|---|---|---|---|---|---|---|

| FX brokers | ranking | license | assets | MT4 | MT5 | bonus | website |

| ironfx | 5/5 | FSCA, cysec, FCA, ASIC | 200+ | yes | yes | $4,000 | trade now |

| avatrade | 4.5/5 | FSCA, ASIC, FSC, FFA | 1000+ | yes | yes | $10,000 | trade now |

| 24option | 4.5/5 | cysec, IFSC | 100+ | yes | no | $500 | trade now |

If you’ve decided to opt for a forex bonus should choose one that matches your trading patterns. There are some unscrupulous brokers in the financial markets which is why you should never consider the size of the forex bonus in isolation. First and foremost, you must ensure that your money is in safe hands.

We’ve done the research for you and found the best ways that you can safeguard your money and ensure that you have fun while earning profits on the forex markets using the best forex bonuses on the markets today.

Trading safely

When you trade in forex you buy one currency and sell another at the same time. Only forex brokers may trade pairs of currencies on the markets. So, anyone looking to try their hand at forex trading will have to find themselves a good broker.

Forex trading appeals to people as an investment option, as the barriers to entry are low. You require relatively little money to trade on the markets and they operate around the clock. You can trade from anywhere around the world and you can choose the currencies that you’d like to trade.

Those planning on going into the forex markets should understand, however, that forex trading is risky and there is a possibility that you will lose your hard-earned cash. Never bow to the temptation to trade with money that you can’t afford to lose.

Before you start trading you should commit to treating your trading as a business proposition. You should have a strategy and a systematic approach to trade. Do your research and learn from the most successful traders out there. Don’t allow emotion to drive any of your trades.

Monitor your wins and losses and keep records so that you can use them to as guidelines for future trades. Keeping a journal of your approaches and the results is a fine way to learn from your successes and failures.

How to find the right broker

There are thousands of forex brokers online, not all of them are reputable. It is, of course, essential that you choose the right broker before you hand your hard-earned cash over. So, what qualities should you look for in an online forex broker?

Security

Check your local regulatory authority to ensure that broker is legitimate. Check for online recommendations and reviews. The regulatory bodies create rules that will protect you against rogue brokers. Security is the most important criteria for selecting a broker. Sadly, the financial world is full of charlatans, looking for an opportunity to divest you of your funds.

Transaction costs

Forex trades, like everything else, will cost you. Brokers charge either a commission or a spread. The spread is the difference between the bid and ask price of a currency pair. The spread differs according to the currency pairs traded. Popular pairs such as USD/EUR will have a much tighter spread than pairs that are not as heavily traded. The spread is measured in pips which is a tiny fraction 1% of the value of the currency pair.

Deposits and withdrawals

Choose a forex broker that makes it easy for you to deposit and withdraw funds as you require them. You keep funds in your account so the broker can trade on your behalf. You should be allowed to withdraw your profits quickly and easily whenever you want them. Never choose a forex bonus where withdrawal limitations exist. Find out what your broker’s funding and withdrawal policies are before you sign up.

Trading platform

All of your transactions will take place on the trading platform. This is the gateway to your currency trades. It must be user friendly and quick to download. Check the availability and speed of the website by visiting it during peak hours.

It is preferable that the platform is smartphone friendly. Make sure that it has a simple interface. Complications can make trading costly. The broker’s platform should contain all of the information that you may require. Research tools are important and they should, at the very least, include forex movement graphics and charts.

The best broker platforms continue to evolve to simplify the trade experience. They are easy to navigate, offering an increasing number of features and tools, enhancing the trade experience.

Customer service support

Make sure that you can get assistance when you really need it. Choose a broker who is contactable. They must be capable of dealing with any technical support and account problems that may come up.

Order execution

The speed of order execution is an important consideration in a market where the prices are volatile. In the forex markets minutes can be the difference between making a profit or a loss.

Initial deposit

Some brokers require a much higher deposit than others, so it’ll pay to check what initial outlay you broker requires.

Forex bonuses - all types overview

Forex bonuses are nothing more than a redistribution of the collected commission or spread. Much as airlines will reward you for flights taken, some brokers are happy to give traders a bonus to keep them trading through their brokerage.

Some forex bonuses really could work for you but many more have convoluted terms and conditions that you may find difficult to understand. It is essential that you carefully consider the terms and conditions before you commit yourself to a forex bonus.

There are several different forex bonuses. We’ve discussed a few of them below:

No deposit forex bonus

Newcomers to the forex trading market may find this product useful. You just register and claim your bonus which can range from $5 to $100. You can use the money to trade without incurring any risk yourself.

Many no deposit bonuses set restrictions on when you can withdraw the funds from your account. You cannot draw the bonus straight away and the broker may even place limitations on when you can withdraw your own profits.

Forex welcome bonus

Used to attract newcomers to the market. The welcome bonus may have a deposit or no deposit requirement. The welcome bonus is often called a deposit bonus, since many of them reward you with a percentage of the bonus.

You can’t withdraw your bonus, but you can use it to trade, getting you off to a good start. Your broker will restrict you from withdrawing funds from your account until you have reached a specified level of trade. If they didn’t place restrictions on the use of the bonus, they would run at a loss.

The welcome bonus gives new traders a nice leg up, but if you don’t do enough trade you might find that you never get beyond the required trade turnover to collect the bonus. So, you should take this into account when deciding which bonus best suits your needs.

Forex rebate bonus

If you opt for a forex rebate bonus, you’ll receive cashback on the trades you make. There are even rebate bonuses that apply only to losses. If this is the case, when you make a loss, you’ll get a percentage of the trade value back in the form of a bonus. Make sure that you understand the terms and conditions of the forex rebate bonus before you sign up for it, as they can differ substantially from one broker to another.

Forex deposit bonus

These bonuses are typically calculated as a percentage of the deposit. So, if the deposit bonus is 15% and you make a deposit of $1000, your bonus is $150. The offer is open to both new and existing customers, but many novice traders find the deposit bonus particularly useful.

Forex loyalty bonus

Some brokers run loyalty programs under which traders earn loyalty points which you may then use to retrieve cash or rewards such as smartphones, or other forex trading perks. Most newcomers enjoy the rewards bonuses. The more experienced traders typically don’t sign up.

Forex reload bonus

This bonus, intended for existing customers, offers a bonus for making a new deposit. These bonuses are often quite generous, so these offer some of the best deals in the forex bonus arena.

Forex VIP bonus

This bonus is on offer to people who open a VIP account when they start to trade. A VIP account often comes with a number of perks.

Forex trading contests

Contests are designed for existing clients. Brokers run trading contests so that clients can compete against one another. The broker will set up rules and regulations and a period over which the contest will run. In the end of the term the trader who makes the biggest profit will win the prize and get the bonus.

Understand the terms and conditions

It should come as no surprise that these bonuses come with terms and conditions. The broker offers the bonuses with the aim of making money. They contain restrictions on how and when you can use the funds. When you accept this bonus, you may have to commit to spending a fair amount of money.

The sheer number of bonuses on offer can make it difficult to choose. Front of mind when choosing should be your trading conduct. There are three ways to ensure that you get the best deal when trading. They’re listed below:

- Make sure that the broker that you choose is trustworthy – check that the broker is registered with your local regulatory authority. Signing up with a broker just because they offer a good bonus is not a good idea. Make sure that your funds are in safe hands by thoroughly researching the forex broker before handing any money over.

- Understand the broker terms and conditions before you sign up – it pays to understand the withdrawal requirements up front. You’ll usually have to make a certain number of trades before you can withdraw your funds. You should also understand fully what you will pay for the services rendered.

- Choose the bonus that matches your trading needs – some bonuses are geared to new traders and others for existing. There is little point in opting for a bonus that you are unlikely to earn because you have failed to reach the target turnover. Matching the deal with your trading conduct will ensure that you get the best bang for your buck.

Mitigating the risk

Trading in forex can be risky. There are many sad tales of traders losing vast sums of money. If you’re new to trading there is merit in downloading a demo forex tool. A demo tool will allow you to practice on real currency markets using virtual money. Many of the forex brokers will offer free demo accounts to cautious would-be traders.

While you learn the ropes using the demo model, use the time to research the markets and understand the trends and the underlying factors that affect currency price movements.

When you’re comfortable with the markets you can then move on to the real thing. This way you won’t risk your money whilst you’re still learning the ropes. Find a forex broker with a generous bonus offer and you’ll be well set to make a profit from the get go.

Risk warning: trading leveraged products such as forex and cfds may not be suitable for all investors as they carry a high degree of risk to your capital. It is really important that you do not trade any money that you can't afford to lose because regardless of how much research you have done, or how confident you are in your trade, there will always be a time that you lose.

How to get no deposit bonus

There are many brokers represented in the forex market, and each of them may offer different terms to get the bonus. However, in general, the first step is a client verification. After the bonus funds are credited to trading account, client may use them for trading. No deposit bonus is ideal option to get started, because it allows client to make sure the system really works. Also, the bonus may be used for testing a new trading strategy, and allows trader to find out how profitable this strategy is. No deposit forex bonuses are the real money, which can be received if a number of specified terms are fulfilled.

No deposit bonuses benefits

No deposit forex bonus is a strong tool that assists the broker to attract new clients. Therefore, it’s beneficial for everybody. With the right approach, trader can use this bonus to trigger his further trading activity.

The main advantages are obvious:

- Forex trading without deposits;

- Chance to test yourself in trading;

- Chance to try out trading strategy;

- Real opportunity to earn.

No deposit forex bonus types:

There are several types of no deposit forex bonuses:

- Sign-up bonus. The bonus funds are credited to the new clients, and the risks are equal to zero. To get reward a trader should only sign up.

- Welcome-bonus. To get these bonus funds a client should verify personal data.

- Conditional no deposit bonus. It’s the most common bonus type, you can find its features in this article.

Common mistakes of novice traders

To make profit with the bonus help, take it seriously. The bonus is an excellent basis for successful trading. Use these bonus funds as your own funds.

Some advices to get forex bonus:

To get the most beneficial forex bonus, take some advices:

- Read the broker’s cooperation terms closely. The careful reading in advance allows you to understand the terms of bonus use and withdrawal, and whether they’re convenient to you or not.

- Be prepared to verify your personal data. You needn't worry about official verification. Conversely, it reflects the broker seriousness. So don’t be afraid to provide broker with your real contact details and ID scan.

- Use a fast profitable strategy to work the bonus off. The correct strategy is important not only for working off the bonus, but also for the further trading work. Develop your trading strategy responsibly.

No deposit forex bonus is the chance to earn without risks and investments!

Welcome bonus up to $500

Welcome bonus - a bonus which is equal to 100% of the first deposit, but does not exceed $500. It is credited automatically. The profit can be withdrawn without any limitations, and the bonus itself can be withdrawn after required trading turnover completed.

Welcome bonus advantages

How to get the welcome bonus

Terms and conditions

- To credit a welcome bonus, it is required to open a live account MT4.Directfx, MT4.Classic+, MT5.Directfx or MT5.Classic+. Please note, "cent" accounts are not allowed. Welcome bonus can be credited only to standard account.

- Welcome bonus can be obtained only once with the first deposit of at least $50. For this purpose, check “enroll welcome bonus” option on the replenishment form.

- Bonus amount is equal to 100% of the deposit sum, but can not exceed $500 (or equivalent in the account currency).

- The profit can be withdrawn at any time, but the welcome bonus can be withdrawn only after the required trading turnover is achieved. The required trading turnover can be calculated upon the formula: .

Example:

The trader made a deposit $200 and received welcome bonus $200. Required turnover = 200 * 50,000 = $10,000,000 (which is equivalent to 44 lots of EURUSD in metatrader)

Examples:

BUY 1 lot EURUSD (1 lot = 100,000 EUR) position opened at a price of 1.1257 and closed at 1.1283.

SELL 5 lot USDJPY (1 lot = 100,000 USD) position opened at a price of 109.806 and closed at 109.352.

BUY 3.5 lot GBPUSD (1 lot = 100,000 GBP) position opened at a price of 1.2978 and closed at 1.2985.

Example:

The trader made a deposit $500 and received welcome bonus $500. In case the equity goes down to $500 (value in the credit field), welcome bonus will be automatically cancelled, and all positions will be closed forcibly (stop out).

© 2014-2021, forexchief ltd

Risk warning: trading with complex financial instruments such as stocks, futures, currency pairs, contracts for difference (CFD), indexes, options, and other derivative financial instruments involves a high level of risk and is not suitable for all categories of investors. You must realize that there is a probability of partial or complete loss of your initial investments and you should not invest facilities that you can't afford to lose. Until you begin to carry out trading transactions, make sure that you fully realize the risks associated with this type of activity.

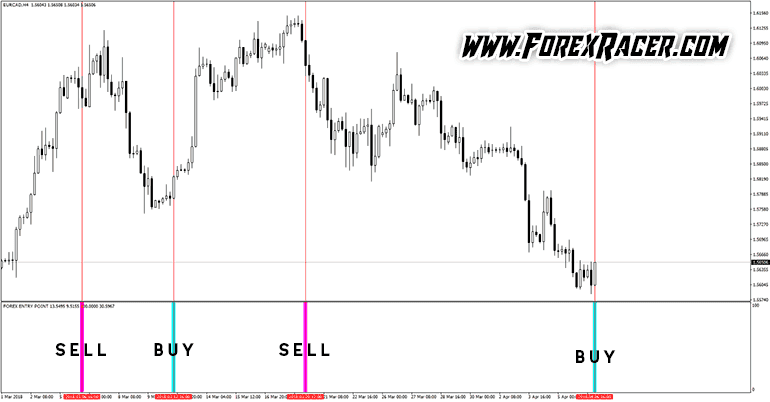

Forex entry point indicator

Forex entry point indicator was designed to give traders the best possible entry for their long and short trades and it displays pink and turquoise vertical lines in a lower window of metatrader 4 terminal. These color lines of forex entry point indicator are used to predict possible changes of the market trend direction. The forex entry point can be used for different trading systems and strategies – it is suitable for 5min scalping and longer term trading on 1h, 4h, daily charts. This indicator can be used with any currency pair, however the forex entry point indicator gives the best results with high volatility pairs like GBP/JPY.

Attributes of forex entry point MT4 indicator:

platform: metatrader4

currency pairs: all, we recommend major pairs

trading time: whole day

timeframe: all, we recommend H1 or higher

How to trade with the forex entry point indicator strategy no repaint?

These are trading rules for the forex entry point indicator.

Buy entry signal

Open long trade (buy) with forex entry point indicator when there was a vertical line of color turquoise and the bar has closed. Exit with the appearance of vertical lines of the opposite color as it forecast trend change.

Sell entry signal

Open short trade (sell) with forex entry point indicator when there was a vertical line of color pink and the bar has closed. Exit with the appearance of vertical lines of the opposite color forecast trend change.

Important note: we have conducted tests to check if forex entry point is no repaint indicator. Our research proved that the indicator sometimes repaints, so changes its past signals. Please take that into consideration and be careful trading with it. The signals of the forex entry point looks that good only on historical data. Many traders still like it and use it for example in 5 min scalping or support/resistance rebound.

In the package forexentrypoint.Rar you will get following files:

- FX ENTRY POINT.Ex4

- FX ENTRY POINT.Mq4

- FX entry point.Tpl

Download free forex entry point indicator for metatrader 4.

To download the forex entry point indicator for metatrader 4 (MT4) for free just click the button below:

so, let's see, what we have: master entry is a versatile trading indicator suitable for any type of trading, be it scalping, traditional day trading or swing trading. Accordingly, you can trade on any timeframe at earntry.Com forex bonuses

Contents

- Master entry - reduce your trading stress to minimum

- Top forex bonus list

- Earntry.Com forex bonuses

- Forex bonuses and how to get them?

- What is to be known about bonuses on forex?

- Types of forex bonuses

- How to get roboforex bonuses?

- How to choose a bonus?

- Can you make money using bonuses?

- How to find the best forex bonus when you live in south africa?

- Trading safely

- How to find the right broker

- Security

- Transaction costs

- Deposits and withdrawals

- Trading platform

- Customer service support

- Order execution

- Initial deposit

- Forex bonuses - all types overview

- No deposit forex bonus

- Forex welcome bonus

- Forex rebate bonus

- Forex deposit bonus

- Forex loyalty bonus

- Forex reload bonus

- Forex VIP bonus

- Forex trading contests

- Understand the terms and conditions

- Mitigating the risk

- How to find the right broker

- Forex racer

- Forex no deposit bonus

- The best free forex no-deposit bonuses 2019

- Make money in forex without investment

- What is a no-deposit bonus?

- The risks in forex trading

- How do forex no-deposit accounts work?

- Why forex brokers offer no-deposit bonus?

- How to find the best forex bonus when you live in south africa?

- Trading safely

- How to find the right broker

- Security

- Transaction costs

- Deposits and withdrawals

- Trading platform

- Customer service support

- Order execution

- Initial deposit

- Forex bonuses - all types overview

- No deposit forex bonus

- Forex welcome bonus

- Forex rebate bonus

- Forex deposit bonus

- Forex loyalty bonus

- Forex reload bonus

- Forex VIP bonus

- Forex trading contests

- Understand the terms and conditions

- Mitigating the risk

- How to find the right broker

- How to get no deposit bonus

- No deposit bonuses benefits

- Common mistakes of novice traders

- Welcome bonus up to $500

- Welcome bonus advantages

- How to get the welcome bonus

- Terms and conditions

- Forex entry point indicator

- How to trade with the forex entry point indicator strategy no repaint?

- Download free forex entry point indicator for metatrader 4.

No comments:

Post a Comment