Crypto currency transfer

Often this can be as easy as scanning the QR code related to the receiving address and typing in the amount you want to send, but in cases where you don’t have a QR code then copy and pasting the public address is the next best bet.

Top forex bonus list

- Log into a wallet you have funds in.

- Go to the send/receive screen (by clicking the tab or button that says this or shows the proper icon).

- Choose whether you want to send or receive cryptocurrency. TIP: in general you must only send and receive like-coins. Meaning, you can only send/receive bitcoin-to-bitcoin, litecoin-to-litecoin, etc. (you can’t, for example, send bitcoin to an ethereum wallet or even bitcoin to a bitcoin cash wallet).

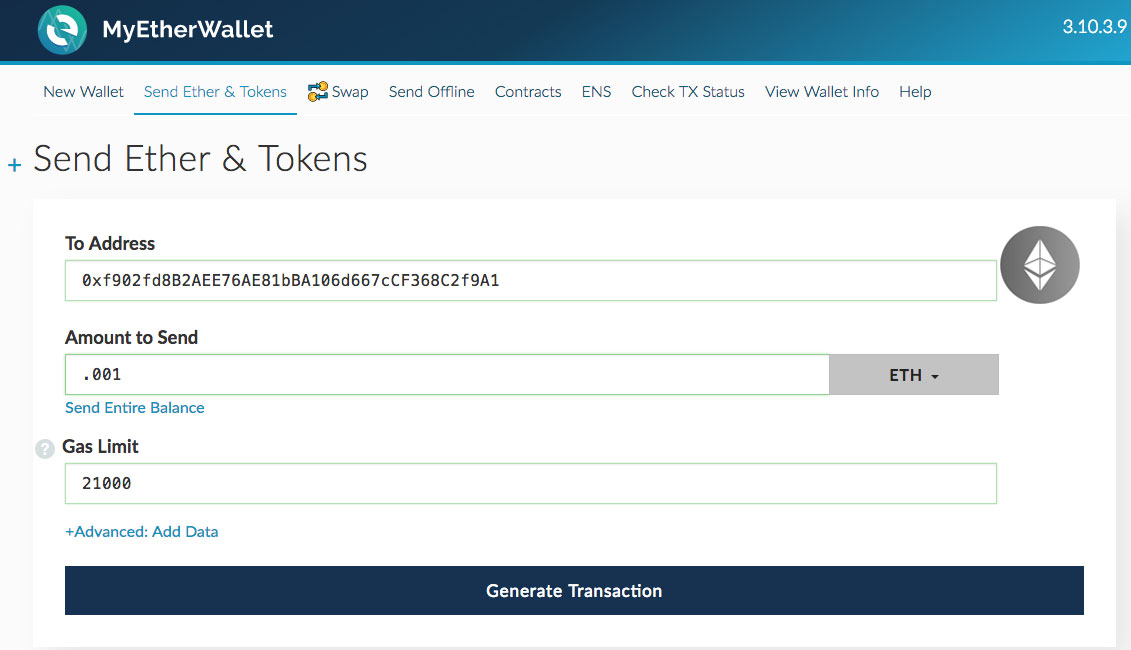

- For sending: enter the public wallet address of the recipient and choose the amount to send (make sure to account for transaction fees, you’ll need enough coins in your wallet to pay the fee). After you confirm the numbers, triple checking them to avoid silly mistakes then hit “send transaction” (or the equivalent) and verify the transaction one last time (confirming your public address and their public address is correct). TIP: you can write a note with your transaction to let the recipient know what transaction is for. TIP: using a QR code to copy an address helps avoid potential mistakes.

- For receiving: you don’t have to do anything except share your public wallet address with the sender. If you are in person, you can do this by letting them scan a QR code (if your wallet offers that).

How to send and receive cryptocurrency

How to transfer cryptocurrency from one wallet to another (i.E. How to send/receive or withdraw/deposit bitcoin, ethereum, and other cryptos)

To send or receive cryptocurrency, first you need a cryptocurrency wallet, then you need to put in the public address of the recipient to send (or give your public address and have someone else put it in to receive).

Often this can be as easy as scanning the QR code related to the receiving address and typing in the amount you want to send, but in cases where you don’t have a QR code then copy and pasting the public address is the next best bet.

From there you just choose the amount you want to send, follow any other wallet-specific instructions (for example adding funds for fees if necessary), and then hit send (or your wallet’s equivalent).

Once that is done the transaction just needs to settle on the blockchain (how long that takes can differ between blockchains and depend on how much you paid in fees).

If you are anxious, you can always check the status of the transaction on the blockchain by using the block explorer of the coin you sent.

Below I’ll walk through the process in a bit more detail to make sure you fully understand each step.

TIP: the above process is sued to send/receive crypto, withdraw/deposit crypto, and buy things with crypto… it is how crypto transactions work regardless of what their purpose is ��

Sending and receiving cryptocurrencies

This process of sending and receiving cryptocurrencies like bitcoin, litecoin, ether, etc. Can differ slightly between wallets (as each coin has its own set of wallet options in which that cryptocurrency can be stored), but in general:

- Log into a wallet you have funds in.

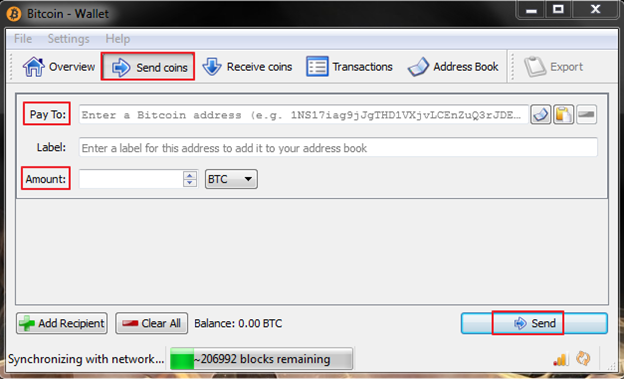

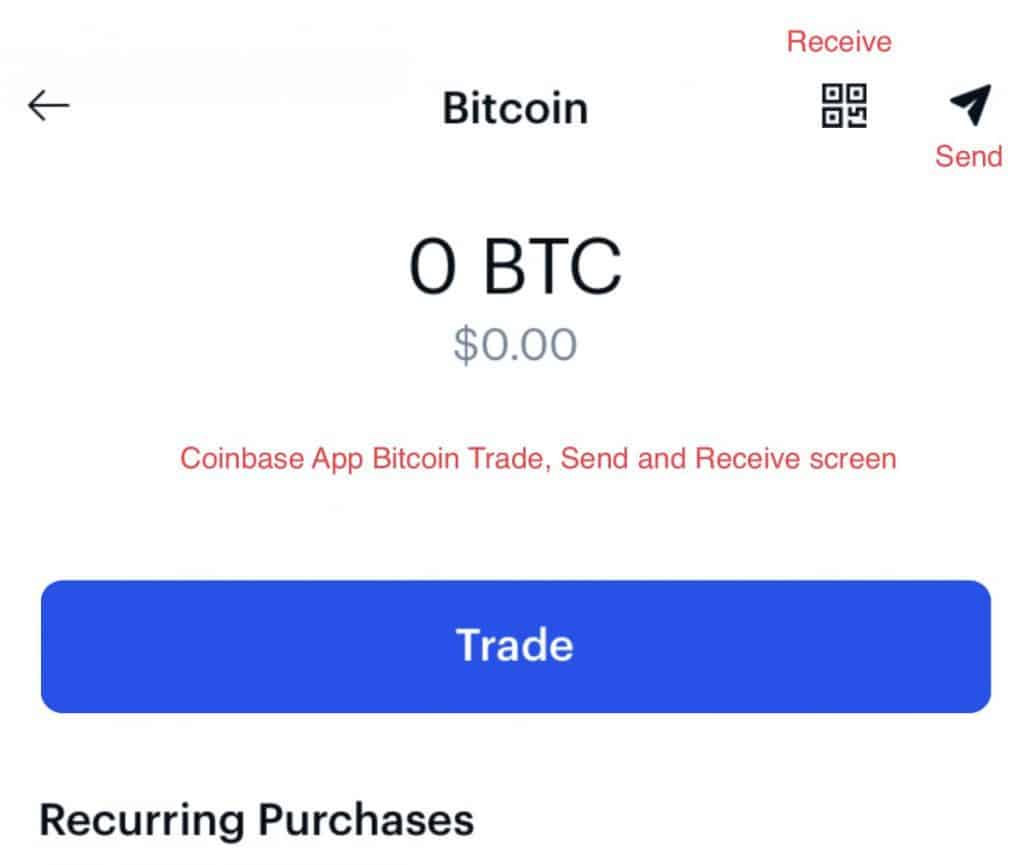

- Go to the send/receive screen (by clicking the tab or button that says this or shows the proper icon).

- Choose whether you want to send or receive cryptocurrency. TIP: in general you must only send and receive like-coins. Meaning, you can only send/receive bitcoin-to-bitcoin, litecoin-to-litecoin, etc. (you can’t, for example, send bitcoin to an ethereum wallet or even bitcoin to a bitcoin cash wallet).

- For sending: enter the public wallet address of the recipient and choose the amount to send (make sure to account for transaction fees; you’ll need enough coins in your wallet to pay the fee). After you confirm the numbers, triple checking them to avoid silly mistakes then hit “send transaction” (or the equivalent) and verify the transaction one last time (confirming your public address and their public address is correct). TIP: you can write a note with your transaction to let the recipient know what transaction is for. TIP: using a QR code to copy an address helps avoid potential mistakes.

- For receiving: you don’t have to do anything except share your public wallet address with the sender. If you are in person, you can do this by letting them scan a QR code (if your wallet offers that).

If you are still uncertain, just look up the FAQ for the wallet you are using to verify you have the steps down. Check out the video below for more.

Tips and tricks for crypto transactions

Below are some more tips and tricks for crypto transactions.

Send a test amount to new addresses: before you send a lot of crypto, try sending a little bit as a test to make sure everything is working.

Using exchanges to send coins: for sending between exchanges you’ll want to use the withdraw and deposit buttons on the exchange next to the token you want to send. You must follow directions carefully, as sometimes you’ll need to follow specific directions. For example you might need to include a message, and sometimes you can only send whole numbers of coins. You may also need to use your authentication codes.

TIP: A wallet’s public address (or “public key”) looks like this: BTC wallet: 1bn9pjwsfwfwllebhagqe9ksusbct2jltm , ETH wallet: 0xf902fd8B2AEE76AE81bBA106d667cCF368C2f9A1 , LTC wallet: ldri8md4bu8icv3gkhv4nfvmoitv3axf6u … private keys look different. You should never share your private key, but as you can tell from our share above, sharing your public wallet address is not a problem. So again, do share the public address that looks like that (the worst that can happen is someone puts coins in it), but never share your private key or password (as that is like handing a stranger your wallet).

Crypto-to-crypto exchange: you can use a platform like shapeshift to turn one type of cryptocurrency into another. That can be helpful if you have bitcoin, but want to do a transaction in another coin.

Why didn’t my transaction go through? After you have sent some coins (AKA tokens AKA cryptocurrency), you’ll need to allow some time for the transaction to go through. It can be nearly instant, or it could take a few minutes, or if traffic is high, it could take hours. In most wallets, you can view pending transactions. Remember, the transaction will be added to the coin’s public blockchain (a digital ledger of transactions), so you’ll always be able to see an encrypted version of it. See etherescan.Io for an example of a website that let’s you view every public action on a blockchain.

What it looks like in a bitcoin wallet.

By continuing to use the site, you agree to the use of cookies. More information accept

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "accept" below then you are consenting to this.

IGT files patent for crypto transfers to gaming accounts

Slot machine maker's patent links online crypto wallets to casinos

International game technology PLC (IGT), the world's biggest maker of slot machines, has filed for a patent that enables gamblers to transfer bitcoin (BTCUSD) from their online wallets to their account at a gambling establishment. "IGT secured this patent to bolster its industry-leading patent portfolio in anticipation of any possible future direction in regulated gaming involving cryptocurrency," a spokesperson from the company told bloomberg.

According to the patent, "… the instructions cause the gaming establishment component processor to escrow the amount of cryptocurrency, establish a line of credit based on the escrowed amount of cryptocurrency, and modify a balance of a gaming establishment account based on the line of credit."

Key takeaways

- IGT has filed for a patent that enables slot machine players to transfer bitcoin from their online wallet to their account at a gaming establishment.

- The move could open up new markets for bitcoin.

In simple words, this means that, until the time that the actual cryptocurrency transfer takes place between the crypto wallet and the player's account, the gambler will be able to fund his gaming by using a line of credit at the establishment. While it details the operational aspects of the transaction, the patent does not provide detail on associated fees and transaction costs for the transfers.

Millennials and those between 18 and 29 years of age comprised a majority of visitors to slot machines in las vegas, according to 2018 statistics. That should be good news for casinos with this technology because the younger demographic is comfortable with bitcoin as a concept and its use as a transaction medium. The proliferation of smartphones also means that it should be relatively easy to implement cashless systems for transfer between two accounts.

IGT's patent could open up new markets for cryptocurrencies. While there are several bitcoin atms in las vegas, casinos have only allowed use of the cryptocurrency for the purchase of food and drink and shied away from allowing it on the casino floor. The nevada gaming commission decided last year to allow transfers from digital wallets (and not bank accounts) to gaming accounts. IGT recently announced a digital wallet, called resort wallet, to enable transfer of money from and to slot machines.

11 best crypto friendly banks [2020 updated]

Written by

I know some of you might be perplexed by the title and thinking, wasn’t crypto invented to shun banks and make a new system.

Well, it was so, and it is still so.

Crypto, specifically bitcoin was born to create a reliable and trustless alternative to traditional banking.

But let’s be honest, without the existing banking structure bitcoin couldn’t have reached the heights it is today, so quickly.

Access to the debit cards and credit cards gave the opportunity to millions of investors to invest in bitcoin. But that’s where their approach also went wrong.

Bitcoin isn’t just an investment vehicle that you buy low or sell high, it is much more, and many of us don’t realize this.

But banks have realized, bitcoin and crypto are an existential threat to them and that’s why many banks around the world have stopped catering to crypto/bitcoin businesses.

Especially, the large banks are quite skeptical about these digital currencies and technology behind them because they have never faced such direct competition from the internet industry on the subject of money.

Several UK, australia, united states banks have now banned using credit/debit cards to buy bitcoin or other cryptocurrencies.

That’s why now cryptocurrency users need crypto or bitcoin-friendly banks, more than ever for their fiat off & on-ramps.

Because of the denial of the existing infrastructure, many investors, as well as crypto believers, are looking out for more friendly solutions to interact with cryptocurrencies.

Certain pioneers have started building the new infrastructure while in some places old small banks are trying to become more open-minded about this technology.

| ">best cryptocurrency friendly banks | ">quick links |

| ">wirex (UK & euro region) | ">try now |

| ">change (euro) | ">try now |

| ">revolut (UK & euro region) | ">try now |

| ">bankera (euro) | ">try now |

| ">monaize (euro) | ">try now |

| ">the united services automobile association (US) | ">try now |

| ">bitwala (germany) | ">try now |

| ">ally bank (US) | ">try now |

| ">simple bank (US) | ">try now |

| ">the national bank of canada | ">try now |

| ">barclays (UK) | ">try now |

Top bitcoin-friendly banks that allow cryptocurrency in 2020

#1. Wirex (best banking for bitcoin)

Wirex is a cryptocurrency wallet provider and a crypto-friendly banking service for buying/selling cryptocurrencies based out of the UK, london.

The first wirex currency account available will be based in the UK — available to dozens of countries around the world — with a british account number and sort-code, 100% secure and fully registered with the UK financial conduct authority.

They also provide you with their real debit card liked to your account, and it gets even better from here:

With this card whenever you will make in-store retail purchases, you will get 0.5% cashback in the form of BTC (wirex calls it as cryptoback).

And here are some more usps of using this crypto-friendly UK based banking service:

- Buy, store and manage your crypto (BTC, LTC, XRP, ETH) and traditional money (GBP, USD, EUR).

- Add funds using a credit card, debit card or bank transfer.

- Instantly exchange between crypto and traditional currencies at live rates.

- Link to your wirex visa payment card to convert and spend your crypto in-store and online

- Quickly and easily send 18 traditional and digital currencies around the world

- Transfer funds in and out of your account with SEPA/SWIFT/faster payments*

- Enjoy unrestricted access to the world of borderless payments

So you see this is a win-win situation for everyone. You can join wirex from here. (get some free crypto as a reward when you sign up on wirex)

Note: wirex has also started supporting countries like australia, hong kong, malaysia, singapore, south korea, and taiwan.

#2. Change

Change is another crypto-friendly bank in europe, but it is in the making.

Change’s crypto wallet is in place, thanks to their massive funding ($17.5 million) that they received. They also provide in-app trading of bitcoin, ether, litecoin and ripple, that too free of commission.

They have their ios and android apps in place, but right now only european customers can use it.

They also will be launching their native credit/debit card, obtain the european payment license, make fiat wallets & IBAN numbers, and finally to get a full-fledged banking license by 2020.

#3. Revolut

Revolut is a UK registered company that started with no license but now has turned into a full-fledged bank since its launch in 2015 with over 2 million customers.

Their service is available for UK & euro region countries and united states residents cannot use it for now.

Most importantly, it allows businesses and individuals to deal with cryptocurrencies when you use their bank account. Furthermore, it has inbuilt functionalities also to help you buy bitcoin and other cryptocurrencies.

It offers three types of accounts: standard, premium, & metal so you can choose whichever suits you for international banking as well as your crypto needs.

#4. Bankera

Bankera is building a simple bank for the blockchain era.

Bankera aims to be the bridge between the traditional banking world and blockchain technology. And it is very much capable of doing it because they have experience of developing -spectrocoin, (popular crypto wallet and exchange)

Bankera will be like the old brick and mortar banks only but built on the new technology of blockchain/AI combined. The process is still underway, and it is likely to go live soon in a year or so.

#5. Monaize

Monaize is an integrated banking platform for crypto and bank account users.

It is a european e-banking platform that has a mobile-first approach intending to provide current accounts for freelancers and small businesses.

You can think of them as crypto-business bank accounts

They also have an instant KYC check process in place to onboard businesses, and it hardly will take a few minutes to do so, in comparison to traditional banks.

Monaize will also integrate with other third-party services such as professional insurances, payment solutions, and number of crypto-wallets.

Monaize also looks to functions within the current banking infrastructure while opening itself up to the blockchain community and sensitizing users, small businesses, to this exciting new technology.

Monaize will be expanding its services to the united kingdom, germany and the united states for 2019, before rolling out to the other countries in the world.

#6. The united services automobile association (or USAA)

USAA is texas, USA based financial service company for US military citizens. It is a fortune 500 company catering to active, retired and honorably separated officers and enlisted personnel of the U.S. Military.

It also allows civilians to make their bank accounts with them and has invested $150 million in coinbase making it easy for the USAA bank account holders to interact with coinbase’s bitcoin account.

With your USAA account, you can fully track your bitcoin wallet on coinbase and hence can connect USAA with coinbase, view your balance and monitor your transactions

Note: information related to bitcoin wallets is provided by coinbase and is accurate at the time retrieved. USAA does not independently verify the accuracy of this information. Plus USAA is insured by the FDIC so that you can remain at ease.

#7. Bitwala

Bitwala offers the world’s first cryptocurrency simple bank account from where you can manage your everyday banking, trade cryptocurrencies and store bitcoin that too all in one account.

Bitwala understands your pain points because of their own bank account was closed for dealing in cryptos. Thus they have come back with banking solutions that support crypto.

The company is working in this space since 2013 and is registered as bank under the german banking act. So any german resident can easily use their service to get crypto-friendly banking in minutes.

#8. Ally bank

For US customers who are interested in bitcoin and other cryptocurrencies as well as traditional banking, ally bank is for them.

The ally bank is fully regulated by US laws and serves large cryptocurrency exchanges like coinbase. Moreover, it is a totally digital platform with no physical branches and 24-hours of online support which kind-off the best need for crypto lovers.

Only US residents can use ally bank services as of now.

#9. Simple bank

Simple bank started like a fintech startup of the modern-day and has transformed into an FDIC backed/insured bank for US citizens. The bank is based out of oregon, USA and so has worked with US-based numerous cryptocurrency exchanges making it one of the friendliest bitcoin banks for the US residents.

#10. The national bank of canada

National bank of canada is one of the few canadian banks that has kept a relationship with cryptocurrency businesses. If you are a canadian resident, you can use this bank to buy/sell cryptocurrencies like bitcoin.

But though it allows crypto transactions, the bank is heavily regulated and scrutinizes the transactions carefully.

Whereas other canadian banks like royal bank of canada & toronto bank has forbidden its users to use their banking services to buy/sell cryptocurrencies.

#11. Barclays

Barclays-the biggest investment bank of the UK is particularly interested in din cryptocurrencies and blockchain technology. They provide UK residents to buy/sell cryptocurrencies through their banking services in tandem with coinbase.

Furthermore, it is exploring other ways to secure cryptocurrency transactions in the traditional realm using the blockchain technology.

Banks accepting cryptocurrency

So these were some of the crypto/bitcoin-friendly banks that in the making or live. And there have been advocating for more such bitcoin/crypto-friendly banks around the world and wyoming; a western US state is trying to become a hotbed for such banks.

Wyoming is eyeing to create friendly regulations to form blockchain-friendly banks to lure bitcoin startups.

And the main difference between such crypto banks and traditional banks will be, while conventional banks operate on fractional-reserve lending, wyoming’s crypto bank will be 100% backed.

It means it will maintain a cryptocurrency-to-liquid-funds ratio of 100%, essentially making it a “money warehouse” or a “transfer institution” but for crypto-related services only.

Caitlin long, a 22-year long wall street veteran is driving forth this movement and ultimately be building such first bank in wyoming for crypto companies.

Amazing #wyoming #blockchain task force mtg concludes in jackson—we’re moving fwd with a special #bank for #crypto cos, #fintech #sandbox w/ reciprocity, expansion of #utilitytoken bill & bill to attract #crypto miners to WY. More to do but much progress!#theworldneedsmorecowboys pic.Twitter.Com/nlss9ejevn

Furthermore, some services are tracking the traditional banks and their relative friendliness towards crypto. And here is some interesting country-wise data from them:

- Crypto/bitcoin-friendly banks in the US

- Crypto/bitcoin-friendly banks in the UK

- Crypto/bitcoin-friendly banks in europe

- Crypto/bitcoin-friendly banks in malta

Note: these images are sourced from moonbanking.Com, feel free to visit them for more details regarding your country’s situation.

And with that said, I will take leave for today, and I hope this information on crypto-friendly banks helps you make better decisions.

Lastly, do share this post with your friends and family, who want to know about such banks!!

How the blockchain is revolutionizing the money transfer industry

Can the blockchain revolutionize international money transfers by bringing cryptocurrency mainstream?

Since bitcoin was created in 2009, it’s been touted as the future of the global financial industry. The jury’s still out on that, but bitcoin represents a wellspring of potential.

One reason is that bitcoin is completely digital. You can’t touch it like you can touch fiat currency — or government-issued money like US dollars, euros or japanese yen. And in many ways, bitcoin offers advantages that fiat money doesn’t: it’s hard to send $10,000 in cash overseas, but you can send the equivalent amount in bitcoin in just minutes.

If bitcoin is an intriguing subject, so is the blockchain — a digital ledger that records every single bitcoin transaction. Without the blockchain, bitcoin wouldn’t be possible.

Both bitcoin and the blockchain offer tantalizing possibilities for international money transfers. But are they effective now, and will they ever catch on among the wider public?

The promise of cryptocurrency

Let’s talk about what makes cryptocurrency so unique — and so promising.

Consider a fiat currency like the US dollar. It’s printed by the US treasury department and distributed by banks like the federal reserve. If for some reason these institutions decided to stop issuing currency, we couldn’t obtain any new dollars.

Cryptocurrency is different. It’s decentralized, meaning it’s not controlled by governments or banks. That means anyone in the world is free to buy and sell cryptocurrency like bitcoin.

Also consider the notion of storing your money in a bank. At some level, you need to trust that the bank has safeguarded your money and that you can withdraw your funds at any time.

In contrast, cryptocurrency was created so you wouldn’t have to trust any central institution. To make this possible, cryptocurrency uses blockchain technology.The bitcoin blockchain, for example, records every bitcoin transaction ever made. Each trade is publicly displayed for the world to see. Nobody owns the blockchain, and bitcoin’s software is open source, with a source code that’s publicly accessible for inspection, modification or enhancement.

Because bitcoin’s existence doesn’t depend on a central authority, it can theoretically be moved around the world more easily than fiat currency. But “theoretically” is key: in the real world of international money transfers, bitcoin has encountered many challenges that keep it from becoming the universal standard.

Are bitcoin and the blockchain effective for money transfers?

Compared to existing money transfer options, bitcoin is typically more complicated, slower and more expensive. That’s a triple disadvantage against traditional methods like banks and wire services.

Consider these negatives of bitcoin-based overseas money transfers.

- Bitcoin comes with a learning curve. The cryptocurrency isn’t as simple to understand as regular cash. Also, if you want to use bitcoin to convert one fiat currency to another, you have to manage the entire process yourself. (A money transfer provider will do that for you as part of its service.)

- It’s quick to transfer bitcoin, but your overall fiat-to-fiat transfers will be slowed by financial institutions. Bitcoin transfers themselves are quite fast. The problem is that if you’re making a bitcoin money transfer that involves fiat currency at any point, you’ll probably have to use a bank transfer. That instantly eliminates bitcoin as the fastest option for a fiat transfer. If speed is what you’re after, you could skip bitcoin entirely and just send a wire transfer through your bank.

- Exchange rates often make currency conversion expensive — and bitcoin exposes you to them twice. Let’s say you’re converting US dollars to euros. Normally you’ll lose money on the exchange rate once, getting a slightly worse rate when converting dollars to euros. But when you convert through bitcoins, you lose money on both the dollar-to-bitcoin and bitcoin-to-euro conversions.

The potential is out there

Right now, bitcoin isn’t a superior option for fiat-to-fiat money transfers. It’s simply too unwieldy for consumer remittances. But along with the blockchain, it’s quietly working behind the scenes to spark a revolution in the money transfer industry.

As we’ve just discussed, cryptocurrency is decentralized — they don’t rely on governments or financial institutions to exist. That’s a critical advantage, as it means blockchain transactions can fluidly bypass the web of financial middlemen built up over decades.

Innovative startups and financial institutions are taking note, leveraging the blockchain for big wins. Payment app circle, for example, uses the technology to move money swiftly around the world and create savings for its customers. You don’t have to work with cryptocurrency at all — circle manages them in its backend processes while you deal exclusively with fiat. Crucially, using the blockchain allows circle to charge no fees for depositing, sending, receiving or withdrawing money. And it allows circle to charge a minuscule 0.25% to 0.5% markup on the exchange rate.

You can only use circle for US dollars, euros or british pounds. Also, you have to wait a few days for withdrawals to your debit card or bank account. But circle raises tantalizing possibilities for the future of cryptocurrency. Will its competitors keep up?

The blockchain is catching on

As it turns out, the blockchain is being embraced enthusiastically by the financial industry. Many banks are aware that they need to evolve with the changing times — especially when they’re being assaulted by scrappy startups hoping to bring them down.

The blockchain allows banks to upgrade inefficient processes that infuriate customers today. Transactions are expensive, but the blockchain makes them cheaper by cutting out intermediary banking costs. Sending money can be slow, but the blockchain can complete transfers in minutes. Consumers long for confirmation that their remittances are successful, but the blockchain can unequivocally confirm delivery each and every time.

Clearly, the blockchain brings many advantages that will simply be too good to pass up. Financial institutions are well aware of that: according to a recent report from IBM, 15% of banks will be using the blockchain in 2017. Furthermore, IBM expects about two-thirds of banks to be implementing the technology within just four years.

In time, cryptocurrency and the blockchain may have an invisible hand in virtually all of our financial transactions. They’ll serve as the unsung heroes in the fiat system we’ve grown to trust. But are they destined for more?

What’s next for the blockchain?

The blockchain wasn’t originally envisioned to play second fiddle to a fiat system. It was created to take over entirely.

It’s plausible to imagine a far future where this will happen, but this won’t be the case anytime soon. Instead, blockchain technology will continue to grow slowly and steadily in the public’s consciousness.

First, it’ll overhaul the financial industry, as it’s doing now. It’s improving money transfers in every way, and soon it’ll be indispensable for nearly every remittance company in the world.

Next, more money transfer providers will offer seamless cryptocurrency-to-fiat conversions — cheap ones too. Many existing cryptocurrency platforms let you convert digital currencies to fiat (and vice versa), but they’re often expensive. Other platforms like circle are content to use bitcoin just to streamline fiat transactions. In time, providers may offer low-cost remittances in both cryptocurrency and fiat — like digital bazaars for any currency you could imagine.

Finally, more and more merchants will start accepting cryptocurrency as payment. This is when the blockchain will begin acquiring mainstream relevance. The process may be arduous, but it’s not much different than a company like apple coaxing retailers to accept apple pay. Merchants need to be convinced of the benefits of cryptocurrency before they’ll adopt new forms of money. Either that, or cryptocurrency needs to become as widespread as credit cards, at which time retailers will have no choice but to keep up.

If this future comes into existence, it’ll have great implications for currency — fiat, digital or otherwise. Sending money back to family overseas would be as easy as giving cash to a friend. And numbers on a smartphone would be as spendable as coins in our pockets. If we achieve that reality, we may finally see the cryptocurrency revolution we’ve long been promised.

IGT files patent for crypto transfers to gaming accounts

Slot machine maker's patent links online crypto wallets to casinos

International game technology PLC (IGT), the world's biggest maker of slot machines, has filed for a patent that enables gamblers to transfer bitcoin (BTCUSD) from their online wallets to their account at a gambling establishment. "IGT secured this patent to bolster its industry-leading patent portfolio in anticipation of any possible future direction in regulated gaming involving cryptocurrency," a spokesperson from the company told bloomberg.

According to the patent, "… the instructions cause the gaming establishment component processor to escrow the amount of cryptocurrency, establish a line of credit based on the escrowed amount of cryptocurrency, and modify a balance of a gaming establishment account based on the line of credit."

Key takeaways

- IGT has filed for a patent that enables slot machine players to transfer bitcoin from their online wallet to their account at a gaming establishment.

- The move could open up new markets for bitcoin.

In simple words, this means that, until the time that the actual cryptocurrency transfer takes place between the crypto wallet and the player's account, the gambler will be able to fund his gaming by using a line of credit at the establishment. While it details the operational aspects of the transaction, the patent does not provide detail on associated fees and transaction costs for the transfers.

Millennials and those between 18 and 29 years of age comprised a majority of visitors to slot machines in las vegas, according to 2018 statistics. That should be good news for casinos with this technology because the younger demographic is comfortable with bitcoin as a concept and its use as a transaction medium. The proliferation of smartphones also means that it should be relatively easy to implement cashless systems for transfer between two accounts.

IGT's patent could open up new markets for cryptocurrencies. While there are several bitcoin atms in las vegas, casinos have only allowed use of the cryptocurrency for the purchase of food and drink and shied away from allowing it on the casino floor. The nevada gaming commission decided last year to allow transfers from digital wallets (and not bank accounts) to gaming accounts. IGT recently announced a digital wallet, called resort wallet, to enable transfer of money from and to slot machines.

Can you transfer cryptocurrency from one wallet to another?

With a digital currency systems rapidly developing, people may soon no longer carry cash, as digital encrypted currency is secure. If you’d like to learn more about using bitcoin, cryptocurrency and transfers, you’ve come to the right place.

Can you transfer cryptocurrency from one wallet to another? Yes, you can easily transfer using a cryptocurrency exchange platform or blockchain technology. This used to be a more complicated process when you had room for human error, but now you simply need a QR code or address to send it to through an exchange platform, from an app or from a software or hardware wallet.

Cryptocurrency technology has evolved greatly since it’s inception in 2009 and has improved greatly despite some volatile set-backs. We are now at a point where using or sending digital payments occurs in seconds rather than hours, as in the early days. Use this guide to understand questions like how to transfer from one wallet to another, how to transfer to yourself, what cryptocurrency exchange applications are highly recommended and legitimate, as well as why cryptocurrency may eventually replace fiat currency. (register for a free forums account and join the discussion)

How to transfer cryptocurrency from one wallet to another?

Since cryptocurrencies rely on peer-to-peer networks, you can now simply send the funds from one wallet to another, regardless of who owns the receiving address. The steps to transfer your cryptocurrency are to:

- Confirm the currency balances in you wallet or exchange account

- Select your wallet or specific currency in an exchange

- Get the receiving wallet code via QR or address copy

- Click ‘send’

- Send to the QR code or crypto address of the other party’s wallet.

- Wait for a confirmation that states the transfer has been completed.

How to transfer into your own wallet?

Besides the initial question of one wallet to another, how do you get money in your wallet in the first place?

To get started and actually have cryptocurrency. You may have received coins from others. If not, you will need to buy crypto on an exchange. The following steps are the general guide to using most exchanges.

- Sign up and log in to your cryptocurrency account

- Access your wallet

- Deposit cash from your linked bank

- Purchase your coins

- Go to the ‘send’ and ‘receive’ options

- Select which you would like to do and input your figure

Again, it is that easy because this is an intuitive, user-friendly platform that will not overcomplicate things. In case you are wondering how to open a new wallet, the steps to follow are:

- Login to your exchange account on whatever platform you are using

- Verify your account if requested

- Link a bank or input credit card info if needed

- Transfer cash to the exchange for buying

- If using credit card, purchases may be instant

- If using coinbase, you can buy via linked account

- In some cases, it may take 4-5 business days to receive purchased coins

After this, you only have to select, “withdraw” or “send” if you wish to move currency around from one holding to another.

Don’t overcomplicate or stress about this process, it’s truly as straightforward as any website that you save your payment to, and all you’ll need to send currency is the receiver’s IP address, QR code, or unique receiving address.

Copy and paste works best to avoid mis-typing the complicated addresses involved. Triple check that you are using the correct type of address for the currency you are using. For example, don’t try to send ethereum to a bitcoin address. You will lose all your funds.

Best cryptocurrency exchange apps

To move your money around, you will need a crypto app, exchange account, software wallet or hardware wallet. I use both the ledger nano S and the trezor model T for my storage, sending and receiving. Both links take you to their official shop sites. I have verified them personally and certify that. (no scam links will appear in our content. I review ALL links.)

The best ones that we recommend, and a bit about each of them are:

- Binance – this is probably the most well-known exchange platform and the largest available worldwide. This is listed as #1 by many sites for a reason, so you can certainly trust binance for quality transfers that will adapt to a variety of cryptos and currencies. They also offer BNB to exchange coin and margin trading for those that are familiar. It also has incredible liquidity and offers a 0.1% trading fee.

- Coinbase – another place where you can sell bitcoins that also allows you to purchase them in-app. By investing $100, coinbase will give you $10 bitcoin dollars for free! This is a great place to start if you are new to the cryptocurrency-game and want to feel things out a bit. What’s nice is being able to buy and trade in one place on any phone type (apple or android). Coinbase is also very secure (as are most to all cryptocurrencies) and even offers stable coins like USDC and DAI that will not fluctuate in this digital economy.

- Huobi. U.S. – and it’s international database huobi pro, are chinese companies that have moved to a global scale in the last 5-years. It is listed as #3 on coin market cap exchange by volume and pairs with an incredible amount of cryptocurrencies (nearly 300 of them). The exchange fee is comparably low, but be sure to use the U.S. One if located in the states as the huobi pro will not work.

- Bitfinex – is one of the first crypto-exchange platforms that emerged in the bitcoin scene and is great for novices of the trade. Liquidating is easy and often falls in the top 10 under CMC’s ranking. Another reason to utilize biaffine is that it has a more complicated registration process. This may sound like a deterrence off the bat, but rather, this means the app is more secure because all traders must verify their identity and wait about 20 days to be officially accepted. This authenticates the platform and, on top of easy liquidation, makes it an exchange avenue you can trust.

- Prime XBT – as they state on their site, “trade bitcoin, S&P 500, gold, EURUSD and 30+ assets” with over $375,000, 000 average trading volume per day. What is nice about prime XBT is the user-friendly interface and one of the most ideal leverage equations on the market. In this breakdown by blockonomi, he writes after some arithmetic explanation, “in the same situation, this means you would still make $5,000 but would have only invested $1,000. In other words, you can vastly multiply your profits with the same amount of initial capital.”

- Kraken – last but not least, the other major player that we recommend as reputable is the kraken crypto exchange. It is free to join and allows you to move around your digital assets with ease. It is known for its impeccable security features, customer service available 24/7, and low fees on transactions once you get started. It can be one of the more confusing platforms on this list, so if you are a novice and intimidated by their interface, start with one of the more simplistic layouts like binance or coinbase.

Final tips on cryptocurrency transfers

With over 2,200 cryptocurrencies bounding around the internet’s stratosphere, there are thousands of ways to learn the market and increase your income.

The reason that digital currency is changing the game is due to its high security and requiring the person’s wallet information that you are specifically sending money to. This eliminates a high degree of fraud, hackers, and government intervention as your transfer is kept private.

Some parting words of wisdom for your new future in investing are:

- Keep your private key private! Don’t share this with others. Only share your address and QR code for sending and receiving money.

- Keep in mind that you can only send bitcoins for bitcoins, or ethereum to ethereum. You cannot mix and match currencies, so confirm with your sender/receiver that your currencies match before the transfer attempt.

- If something seems sketchy or off, do not offer up your confidential information, such as your social security number.

Even companies like walmart and intel are beginning to accept bitcoin as they develop blockchains because the digital marketplace is ever-evolving, and they don’t want to get left behind in this digital revolution.

If you don’t want to fall behind in this digital currency revolution, we suggest you read up on these unique form of financial transfers and what advantages decentralized currencies offer. You are well on your way to being a crypto-master and digital investment pro! Keep at it and only trust exchange platforms that are verified, reputable, and easy to use. Happy trading!

- The cryptocurrency forums participates in the following affiliate programs

- Amazon, nordvpn, ledger nano wallets, satoshi labs trezor wallets, coinbase cryptocurrency exchange, WPX hosting

- All links in this disclaimer and in all TCF content are authentic links to official company pages.

- There are no scams or phishing, redirection or counterfeit page links here. Product links in articles pay us a small commission if used to purchase the items listed. There is no additional cost to the buyer for using these links.

TC first began coding on TRS-80’s in high school in 1979. He has been around since the early days where you had to create a function if you wanted your computer to do something. From there to atari, commodore, apple, and PC, he’s written code for them all. Trained in medicine rather than tech, he kept up with the tech world by writing the occasional utility to help with medical training. He also got involved in tech investing early, and managed to avoid the boom/bust cycle in the 90’s because he recognized that many companies didn’t serve a product that consumers needed. Now he applies this background, training and investing approach to cryptocurrency. He shares his thoughts here while providing educational resources for beginner to intermediate cryptocurrency investors and users.

Recent posts

Dash is a peer-to-peer cryptocurrency like bitcoin built on open source software. Their system is built on a two-tiered blockchain. The (buzzword alert) decentralized distributed miner network.

Since the release of bitcoin in 2009, there have been over 6,000 altcoins introduced to the cryptocurrency markets. While the definition of the term “altcoin” is debated within the crypto world.

About us

We explain cryptocurrency and blockchain in understandable terms.

Disclosures

TCF is an affiliate of amazon, trezor, ledger, nordvpn, ezoic and coinbase with others to be added. Ads are provided by ezoic. Note all links in content and in page ads have been verified as authentic by site owner.

HSBC blocks incoming funds from cryptocurrency exchanges

UK investors have been faced with a dilemma after HSBC announced it would no longer support the transfer of funds from crypto exchanges

The sunday times reported on saturday that HSBC had blocked all transactions involving crypto exchanges. Crypto customers will now be unable to transfer their profits to their bank account.

It appears that the multinational bank is taking a heavy-handed approach in dealing with money laundering. HSBC is now the latest bank to impose restrictions on crypto customers. The bank was recently involved in global money-laundering activities, so it has faced some criticism for the move.

Leaked files from the financial crimes enforcement network disclosed the bank’s alleged involvement, leading to HSBC being slapped with a record $1.9 billion fine in money laundering-related charges.

The bank was also the subject of a documentary on netflix that exposed the bank’s $881 million money-laundering scandal. The documentary titled ‘dirty money’ also questions the actions that were taken against the bank.

Many crypto users have cast aspersion on the move by HSBC, considering the bank’s own involvement in the crime. The UK is primarily considered an anti-crypto region, and the move by HSBC to stop processing crypto payments as well as the transfer of funds to & from exchanges will hurt local investors.

Onchain capital’s ran neuner asserted that crypto investors would have to find an alternative if they are to profit off the digital assets.

Responding to the sunday times report, he posted on twitter, “many banks will put themselves out of business like this.”

Jason yanowitz from block works group also shared his views on the same, claiming that banks were trying to hinder cryptocurrencies’ progress.

“HSBC is now blocking transfers to and from crypto exchanges. Legacy financial institutions will do everything in their power to stop this movement. They’re literally denying their customers access to the greatest performing asset of the past decade.”

Yanowitz claims are, however, not baseless as banks have traditionally been known to oppose digital assets as they are a threat to their revenue.

How to use crypto for shopping, charity, gaming, money transfers, bill payments, and more

Share via:

Cryptocurrency isn’t just for hoarding: today you can spend digital assets in your everyday life to pay bills, purchase games, make a charitable donation and much more.

Table of contents

Crypto entering consumer life

Cryptocurrency is gradually becoming a normal part of consumer life, leading large and small retailers and shoppers of all types to take notice.

In this guide, we’re focusing on cryptocurrency utility: aside from using digital assets as an investment, they can be put to various uses – from retail therapy and charitable endeavors to gaming and bill management.

In fact, anything you can do with fiat currency like pounds, euro or dollars you can now do with crypto.

You just have to know where to look for platforms that will receive your crypto in exchange for the goods and services you’re seeking.

Here are 8 of the most practical ways you can actually use cryptocurrency today.

1. Shop with crypto

It would be an overstatement to say that shopping with cryptocurrency is as easy as using cash or a bank card — but it’s certainly not difficult.

Over 18,500 venues worldwide accept cryptocurrency directly, from restaurants, cafes and bars to airlines, hotels, retailers, sports arenas and transport providers.

It’s simply a case of entering the merchant’s wallet address (usually represented by a QR code, particularly at brick-and-mortar establishments) and hitting send.

There are various other ways to shop with cryptocurrency, including:

- Gift cards — such as egifter, gift off, etc, purchased using cryptocurrency, or by exchanging crypto for an amazon gift card using purse.Io .

- Crypto-payment apps — such as mobiepay or bitpay.

- Paypal — to spend crypto at its 26 million worldwide merchants .

- Crypto debit cards — such as those offered by wirex, revolut, and coinbase. These can be “topped up” with crypto using a linked bank account and used to spend local currency anywhere that accepts visa/mastercard.

As you can see, there are many options available if you’d like to spend cryptocurrency the same way you do cash.

Of course, many crypto users prefer to hodl* their digital currency and grow their portfolio. Even speculators appreciate the ease at which crypto can be swapped for goods and services.

*by the way, the word ‘hodl’ (in case you’re new to crypto) was made popular by the crypto community to mean ‘hold’ (keep for long-term) sometimes translated as ‘hold on for dear life’.

2. Game with crypto

It’s easy to see why the worlds of crypto and gaming have collided, particularly given their shared tech-savvy demographic.

In the online gaming world, the use of cryptocurrency can eliminate handling and exchange fees due to the peer-to-peer nature of transactions between users. This is the case with decentralized applications (dapps), which run on a decentralized P2P network and include interactive games, many of which feature their own utility tokens.

A thriving market exists for gamers keen to buy and sell unique skins and non-fungible tokens (nfts) too. Such items are created by games developers and made available for purchase in-app using cryptocurrencies like ETH.

The most popular gaming-focused cryptocurrency is enjin coin (ENJ) , which boasts a market cap of $100 million and 24-hour volume exceeding $4.4 million. Decentraland (MANA), meanwhile, has a market cap of $98 million and 24-hour volume of $15.1 million. Each of these ethereum-based cryptocurrencies enable users to interact with the respective virtual reality platforms.

3. Transfer money with crypto

Crypto remittance solutions cut out the middlemen (central banks, third-party financial service providers) and facilitate speedy transfer of cryptocurrencies between two parties.

If required, the recipient can convert the cryptocurrency to fiat, a process known as “cashing out.”

Platforms such as circle and metalpay can be used for this purpose. Transferring digital assets between two accounts is remarkably simple: to send funds from your wallet, all you need is the recipient’s address.

Major money transfer firms like moneygram are also exploring integration of blockchain technology. In 2019, moneygram partnered with crypto-transfer startup ripple (XRP), integrating ripple’s on demand liquidity product to trade FX at a corporate level using XRP.

Moneygram CEO kamila chytil is also on record as saying that blockchain is the future of global cross-border payments and money transfers.

4. Pay bills with crypto

In the past, when a bill or invoice had to be paid, there was only one option: fiat. For crypto natives, this meant selling some of their coins, and missing out on the potential upside to hodling.

Thanks to platforms like piixpay , that’s no longer the case. The service allows you to use crypto to cover invoices, bills and other recurring payments. Naturally, piixpay handles the crypto-fiat exchange. The company operates in over 100 countries and charges a small fee (€1 + 1.75%) for transactions funded with crypto. Cointree is another option worth considering.

As for the 18,000+ global merchants who accept cryptocurrency directly, many allow customers to settle bills and invoices (for electricity, rent, subscriptions, etc) in their choice of digital asset.

5. Give with crypto

In the last few years, charities have come to realize that barring crypto donations is leaving money on the table. Many nonprofits are now following the lead of wikileaks, which became one of the first organizations to accept bitcoin donations way back in 2011.

There are benefits from the donor’s standpoint, too: generally speaking, giving a gift of crypto does not constitute a taxable event, either to the donor or the charity itself.

Several of the world’s best-known charities accept donations made in cryptocurrency, including UNICEF, save the children, american red cross, no kid hungry, united way, the royal national lifeboat institution (RNLI), the water project and the lupus foundation of america.

Numerous blockchain platforms, ripple and binance among them, have made substantial cryptocurrency contributions to worthy causes over the years. Other startups have developed blockchain-based donations platforms .

6. Turning crypto into cash

We’ve established that it’s easy to use cryptocurrency to pay for goods, services and bills, and to make donations to charitable causes that are close to your heart. It’s also a cinch to send crypto to friends and family, and to receive it in turn.

But what if you just want to turn your BTC, ETH or XRP into USD, GBP or EUR?

Well, one way of “cashing out” would be to use a bitcoin ATM, of which there are over 11,000 worldwide . However, it should be noted that some only allow users to purchase bitcoin rather than sell it. The highest number of batms are located in the united states (83%).

The most private way of selling crypto would be to find a cash buyer. However, both buyer and seller could be understandably nervous about this sort of transaction. The alternative is to sell online via a P2P marketplace like localcryptos , using any of the supported payment methods such as venmo or bank transfer. The platform matches buyers with sellers and utilizes an escrow account to ensure no-one gets ripped off.

Many crypto-fiat platforms also allow users to convert crypto into fiat in-app, and to then use this currency to make payments using their card or mobile app.

It’s also possible to sell cryptocurrency on a third-party exchange platform, and to then withdraw cash. However, some exchanges impose strict withdrawal limits.

With kriptomat, selling bitcoin, ethereum, and other cryptocurrencies takes less than three minutes. After creating a kriptomat account, you can buy instantly with visa or mastercard.

Simply select your cryptocurrency and the amount you’d like to purchase, enter your card details, preview the transaction and click to confirm. Other supported payment methods include SEPA bank transfer, neteller, skrill, and sofort.

7. Distribute content with crypto

Youtube helped content creators monetize their output, and a slew of blockchain-based digital content distribution systems are following suit.

Theta is just one example. A decentralized, peer-to-peer network, the blockchain is powered by its own token (THETA), with viewers earning rewards for sharing excess bandwidth and resources. Content creators also earn more, with lower streaming costs. Theta supports multiple content verticals including music, TV, e-sports and live streaming.

Flixxo is another decentralized content distribution service, wherein users earn digital assets for sharing videos across the network. Content creators can also fund their projects by accepting investment from fans and followers.

The world’s best-known decentralized file-sharing protocol is, of course, bittorrent . In 2019, after the company was taken over by the tron foundation, a native token (BTT) was launched to power features of the network’s protocols and applications. Dapps powered by the TRC10 token include bittorrent speed, bittorrent file system, and dlive, with others in the works. You can buy tron’s TRX token inside the kriptomat app.

8. Cruise with crypto

To round off the rapidly expanding list of crypto’s uses for consumer life, a cruise ship named after bitcoin creator satoshi nakamoto is to be equipped with restaurants, casinos, medical services, a water park and offices for crypto companies and entrepreneurs. The preferred mode of payment? BTC.

Crypto — A modern kind of money

The next time you hear someone try to complain that “you can’t do anything with crypto,” direct them to this page.

The fact is, bitcoin and other digital assets are excellent mediums of exchange, suitable for paying bills, buying electronics, making donations, playing games, placing wagers or funding projects.

Whether you want to save, spend or do a bit of both, it’s entirely possible to do so using your favorite crypto.

This is a far cry from the crypto industry’s early days when bitcoin was traded by cypherpunks frequenting online message boards, caught up in passionate debates about liberty, privacy and economic freedom — although those things are as important today as ever!

Satoshi nakamoto’s decentralized currency has been joined by thousands of other digital assets, many of them widely available to buy, sell, transfer, save and spend. Find out how to buy cryptocurrency and keep it in a secure wallet .

What is a cryptocurrency transaction fee

The cryptocurrency transaction fee (also known as a blockchain commission, blockchain fee, or network fee) is a fee one pays for transferring cryptocurrency to the particular address by miners. Blockchain is a chain of blocks controlled by miners. Each block consists of a certain number of transactions. Confirmation is a specific number of blocks that are added to the blockchain after the block with information about your transaction. In other words, in order for the cryptocurrency transfer process to complete successfully, it is necessary to confirm this process in the blockchain.

Do you know how to transfer cryptocurrency faster? A huge number of people make crypto transactions every day. If you want to speed up the transfer of payments on the blockchain, then you need to pay a fee for the transfer. In this case, miners include your payment in the most “profitable” ones (the higher the commission, the higher the priority of adding a transaction to the blockchain).

The blockchain fee is debited from the user’s account in excess of the transfer. For example, if a user wants to transfer 0.1 BTC and is charged a network fee of 0.0004 BTC, then 0.1004 BTC will be deducted from the user’s account.

The amount of the network fee is indicated by the user at the stage of all the transaction parameters settings – the amount of transfer, etc. In the fee field a person can put “a zero value” or “arbitrary” – the amount that he/she is willing to pay.

There are “recommended” commissions (fees) which exist for users who don’t know how the blockchain fee is calculated. The recommended commission is the commission which provides a high probability that the transaction will be included in the next blocks.

Recommended blockchain commissions are set by special services or wallets. The recommended cryptocurrency transaction fees are indicated in the fee field so one can notice it when filling out the transaction parameters in crypto wallets. Moreover, in some wallets, this value can be changed, shifted to the lowest one, but in some wallets it is impossible.

How is the cryptocurrency transaction fee calculated?

All sent cryptocurrency transactions are added to the mempool (mempool is a cloud of all transactions that haven’t entered the block yet). Information about the blockchain is publicly available, that is, you can analyze the latest transactions that have been added to the block. You can see the amount of the network fee and how quickly the transaction was added to the block. Analyzing the latest transactions you can predict the minimum blockchain fee which will allow your transaction to be added to the block. This is a way to find out the amount of the commission manually.

You can also use the recommendations of wallets or other resources. They process this information automatically, but may inflate the amount of the on was added to the block. Analyzing the latest transactions you can try to predict the minimum blockchain commission in order to protect yourself from frozen transactions.

As it was mentioned before, sometimes the crypto wallet software that is used by a person may offer the recommended fee – but everyone can do their own research on the lowest crypto transaction fees and doesn’t have to accept these recommendations. There are some resources that help to track average fees that are paid for transactions of various sizes (in bytes). Checking this information people can save their money.

Why has the cryptocurrency transaction fee increased?

Every person would like to pay the lowest fee, but the more popular cryptocurrencies, the higher their transaction fees. This is due to an increase in the network load. For example, bitcoin block size is limited to 1 MB that limits the number of transactions. One block is produced approximately every 10 minutes, this is a special network restriction that ensures the stability of the blockchain. The more transactions, the more fees increase. This is because miners primarily select transactions with the highest rewards. Therefore, users are forced to pay higher transaction processing fees.

How to avoid paying extra blockchain transaction fees?

Let’s see how to avoid paying extra fees in the bitcoin network. To do so, you should remember some important moments:

- The amount of blockchain transaction fee is not fixed. There may be different commission rates at different times of the day. The resources which check commissions don’t always keep an eye on this variability and show non-actual “recommended” fees sometimes.

- Do not make transactions during the blockchain overload. During this period, users inflate blockchain commissions to speed up the cryptocurrency transfer process. You can make a transaction later, during a period of low network load and pay a lower commission.

- Use segwit (separated witness) wallets. Segwit is an update to the bitcoin protocol to streamline transaction data and reduce file size. Segwit was activated on the bitcoin network on august 24, 2017. It appeared as a software fork compatible with previous bitcoin transactions. Here are the wallets that support segwit: ledger X, trezor model T, electrum, greenaddress wallet, and many others.

- Group inputs. The amount of the blockchain commission depends on the size of the input data. You can combine small transactions and send them during a period of low network load, so that the commission is lower. In this case, for the next payment, you will have only one record, and the cryptocurrency transaction will be cheaper.

Different crypto services may inflate commissions, set limits, block the possibility of lowering and changing commissions, etc.

You can set the amount of the bitcoin transaction fee on your own, which may allow you to transfer BTC coins without any delay.

Also, choose a crypto wallet carefully. Good wallets allow users to change recommended blockchain transaction fees at their discretion. However, you should remember that transactions with a small commission can take a very long time in the BTC network.

Just like some services provide you with the standard bitcoin price or compare crypto exchange withdrawal fees, some websites may help you to make the bitcoin transaction fee calculation. There is one of these sites which promises to predict bitcoin fees for transactions: https://bitcoinfees.Earn.Com. You can also check any similar resources.

We described the basic principles of the fee calculation using bitcoin as an example. There may be different ways to calculate the fee for other cryptocurrency transactions, be careful, don’t pay high commissions and save your money!

We hope that this article was helpful for you. See you soon!

Feel free to follow our updates & news on twitter, facebook, reddit, telegram, and bitcointalk.

Read what the customers say about simpleswap on trustpilot.

Don’t hesitate to contact us with any questions you may have via [email protected]

so, let's see, what we have: to send or receive cryptocurrency, first you need a cryptocurrency wallet, then you need to put in the public address of the recipient to send (or give your public address and have someone else put it in to receive). At crypto currency transfer

Contents

- Top forex bonus list

- How to send and receive cryptocurrency

- How to transfer cryptocurrency from one wallet to another (i.E. How to send/receive or...

- Tips and tricks for crypto transactions

- IGT files patent for crypto transfers to gaming accounts

- Slot machine maker's patent links online crypto wallets to casinos

- 11 best crypto friendly banks [2020 updated]

- Top bitcoin-friendly banks that allow cryptocurrency in 2020

- #1. Wirex (best banking for bitcoin)

- #2. Change

- #3. Revolut

- #4. Bankera

- #5. Monaize

- #6. The united services automobile association (or USAA)

- #7. Bitwala

- #8. Ally bank

- #9. Simple bank

- #10. The national bank of canada

- #11. Barclays

- Banks accepting cryptocurrency

- How the blockchain is revolutionizing the money transfer industry

- Can the blockchain revolutionize international money transfers by bringing cryptocurrency...

- The promise of cryptocurrency

- Are bitcoin and the blockchain effective for money transfers?

- The potential is out there

- The blockchain is catching on

- What’s next for the blockchain?

- IGT files patent for crypto transfers to gaming accounts

- Slot machine maker's patent links online crypto wallets to casinos

- Can you transfer cryptocurrency from one wallet to another?

- How to transfer cryptocurrency from one wallet to another?

- How to transfer into your own wallet?

- Best cryptocurrency exchange apps

- Final tips on cryptocurrency transfers

- About us

- Disclosures

- HSBC blocks incoming funds from cryptocurrency exchanges

- How to use crypto for shopping, charity, gaming, money transfers, bill payments, and more

- Table of contents

- Crypto entering consumer life

- 1. Shop with crypto

- 2. Game with crypto

- 3. Transfer money with crypto

- 4. Pay bills with crypto

- 5. Give with crypto

- 6. Turning crypto into cash

- 7. Distribute content with crypto

- 8. Cruise with crypto

- Crypto — A modern kind of money

- What is a cryptocurrency transaction fee

- How is the cryptocurrency transaction fee calculated?

- Why has the cryptocurrency transaction fee increased?

- How to avoid paying extra blockchain transaction fees?

No comments:

Post a Comment