Tickmill bonus review

To add more security to this as a tickmill bonus feature, they use tier-1 banks.

Top forex bonus list

As you may have gathered, the tier-1 banks are on the official measure of a bank’s financial health and strength. This will ensure that the tickmill bonus feature works as a measure to safeguard your money. Tickmill customer service

Review of tickmill

Tickmill review

In our tickmill review, we cover tickmill bonus, mt4, ttickmill forex, deposit & withdrawal, and tickmill account types. Compare it to other forex brokers before deciding if tickmill has the features you are looking for in a forex broker and give your rating after reading the full reviews. Tickmill broker is a well-known and popular online broker in the currency and CFD markets, which offers competitive differentials in a wide range of assets in global markets. Tickmill was founded in 2007. Tickmill, located in sydney, australia, owns and operates it.

Tickmill bonus offers a cost-effective online trading solution suitable for almost any type of trader when factored with all their great features.

The company's headquarters are located at 6 309 kent street, sydney, NSW 2000. This is mainly because IC markets is trying to close the gap between traders and large institutional investors. Our tickmill review shows they offer investment solutions that were once provided only by investment banks.

They also offer the highest leverage available in australia, low margins and rates, an excellent education center, and much more.

Tickmill MT4

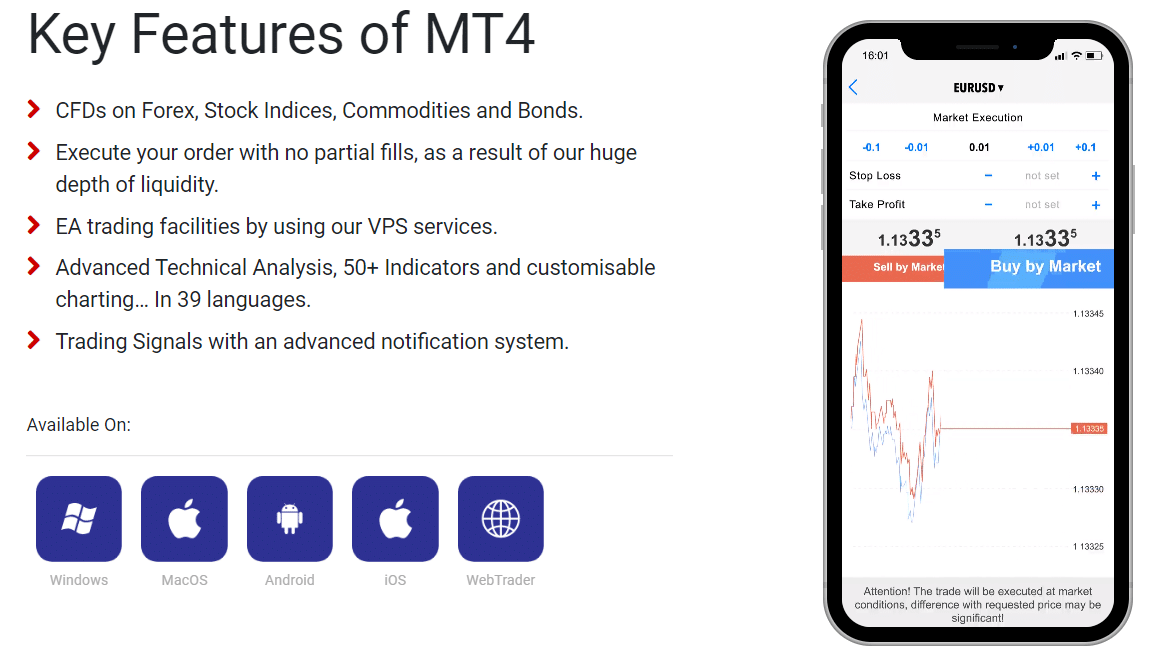

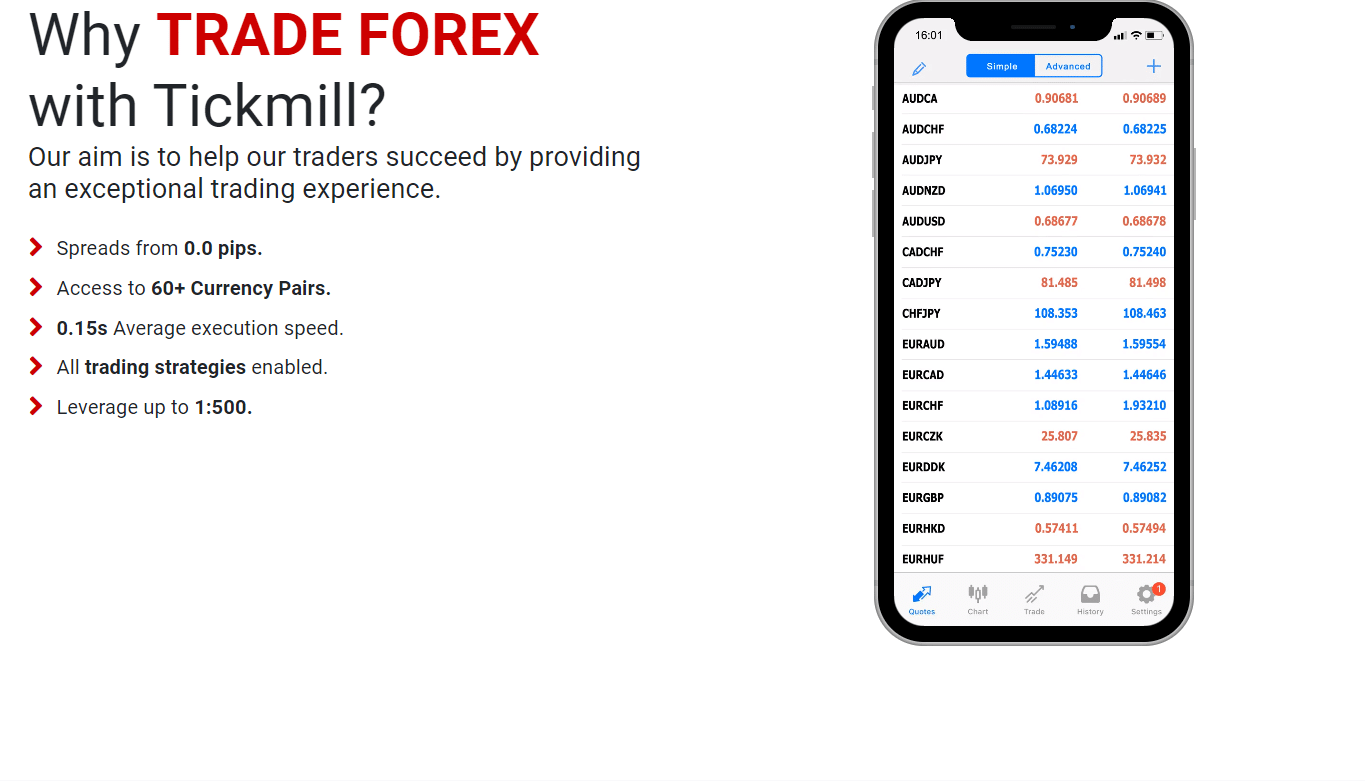

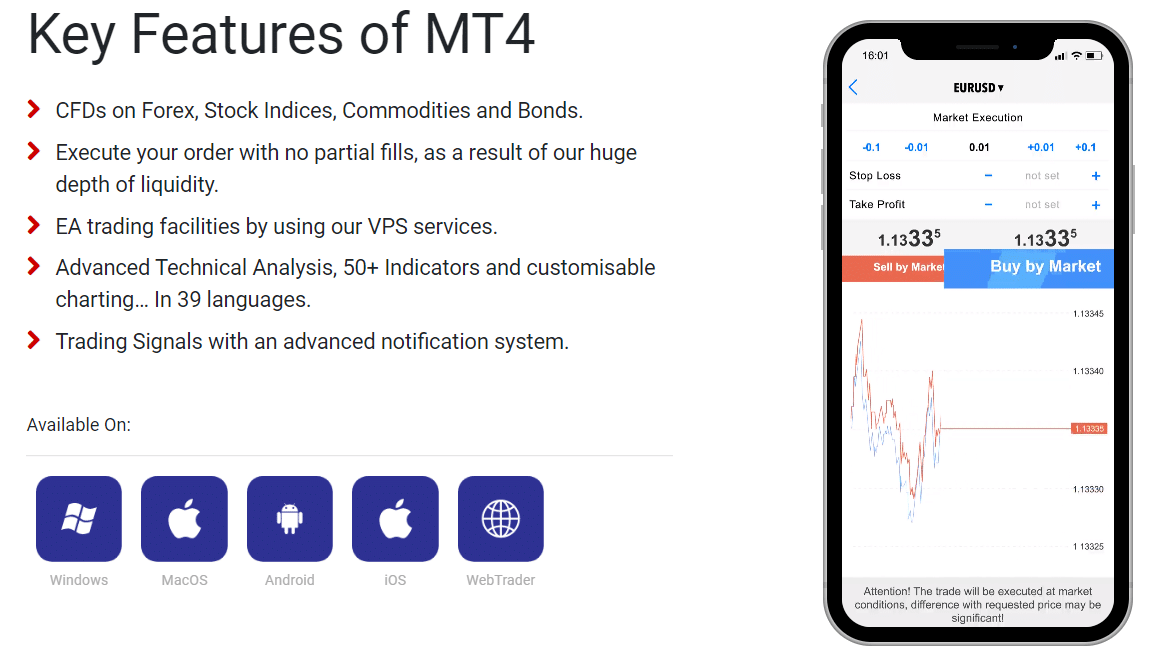

Our tickmill review revealed the following details in terms of platforms you can use. They offer you the globally recognized and accepted MT4 platforms that are available in windows, mac, and webtrader. The features you will get with a platform like this one includes access to:

- Cfds on indices, forex, commodities, and bonds.

- You can execute orders with no partial fills and have more liquidity depth

- EA trading facilities are available using the VPS service

- Advanced technical analysis is available with 50+ indicators and customizable charts in 39 languages.

There is not a lot that is left to be desired when they have the MT4 platform available for you to use. The MT4 mobile app provides as a tickmill bonus feature will give you access to the following things:

- A view of the real-time quotes

- Access to asset classes

- Technical trading indicators

- Trading directly from the chart

You will also have access to autochartist, a plugin for mt4 on windows only that detects key chart patterns and price analysis patterns and other offers.

Tickmill demo

Just like all reputable brokers, our tickmill review shows the broker has provisions for new traders. When you are new in the market, you will need to acclimate to the latest technology that you use when trading.

The demo account tickmill broker providers are what will show you what is available and what you can do with it as a trader. There is a lot to learn, and you will need to know all the details before you get started with live trading.

Ticmill broker

As a broker, our tickmill review shows that they are well-regulated, have no scandals, or other issues, and will serve you well. Any of the payments you make to tickmill accounts are held in a segregated bank account.

To add more security to this as a tickmill bonus feature, they use tier-1 banks. As you may have gathered, the tier-1 banks are on the official measure of a bank’s financial health and strength. This will ensure that the tickmill bonus feature works as a measure to safeguard your money.

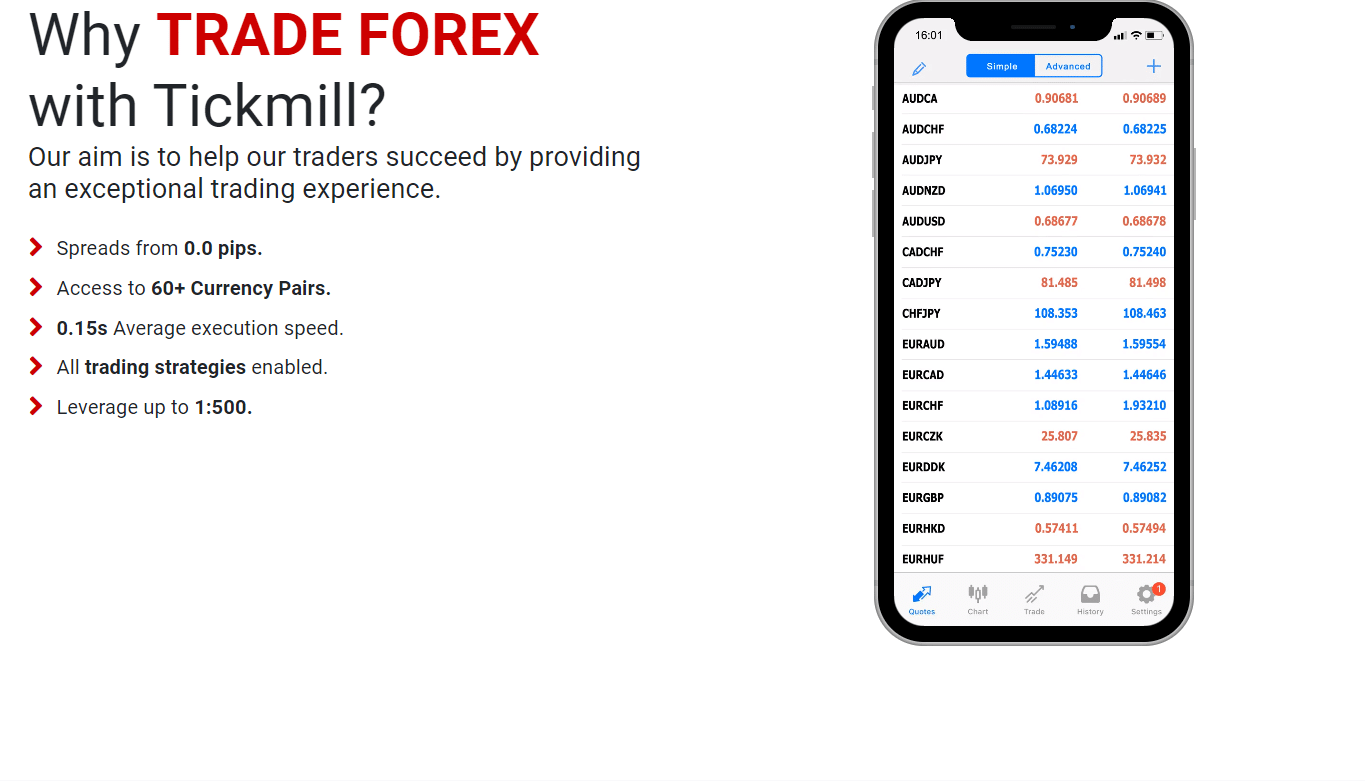

Using tickmill forex, you can trade over 60+ currency pairs. At the moment, there are no tickmill bonus offers or promotions because the EU regulations and other regulators forbid them. However, a tickmill bonus you can get is a trader of the month promo, a $30 welcome bonus, and a few other things.

Tickmill account types

Three core accounts are offered, as shown in our tickmill review. They include a pro account, a classic account, and a VIP account. They all have different minimum balances, maximum leverage, and spreads/commissions.

It all depends on which regulator you opened your account. The details are available here: https://www.Tickmill.Com/trading/accounts-overview.

Tickmill customer service

One of the things in which tickmill stands out is at the level of customer service. Because tickmill is an international online broker, we provide our clients with multilingual assistance 24 hours a day, five days a week.

Tickmill is a secure system that protects your data via encryption. Also, they have many years of experience in the online trade industry. They offer competitive services and provide a wide range of sophisticated commercial platforms.

You can open an account at tickmill by completing the application form via the tickmill website, providing personal details, and topping up a minimum of USD 200 mind.

Tickmill details overview

A comprehensive tickmill review – is this broker trustworthy?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

When setting out to start trading forex, stocks, or other tradable assets, one of the first things every trader should think about is a broker. The internet is full of scam brokerages that you absolutely need to stay away from, however, given how skilled they are at tricking potential customers, it may not be as easy to spot hidden flaws under their platform.

But it doesn’t mean that you have no means of distinguishing legitimate brokers from fraudulent ones. It just takes a little effort and research into the broker’s offerings to assess their credibility and make the right decision.

On forex trading bonus, we’re trying to make the broker selection process a little bit easier by offering our comprehensive reviews about them. And today, we’ll do the same for the tickmill forex broker.

In order to determine whether tickmill is a trustworthy broker or a scam, we will take a look at its website and software support, then move to the licensing, and finish off by talking about the actual trading conditions. So, let’s get started.

Initial overview

Tickmill is a forex broker established in 2015 in seychelles. The broker brings together a team of professional traders whose experience in this field has started off back in the 80s, therefore, the new clients of tickmill are already in good hands.

While the main focus of tickmil forex broker can be gathered from what we’ve just said – forex trading, the broker also offers many other instruments to its traders: stocks, indices, commodities, and bonds. But before we delve deeper into these instruments and what the actual conditions on them are, let’s do a brief overview of everything we’ll talk about in this article.

A brief tickmill.Com review

When you go to tickmill’s website, the first thing you’re going to notice is how slender and simplistic the interface looks. One image here or there, several visual effects, and very decent font make up a visual that is hardly ever distracting the visitor from getting the information.

And information is certainly there. We have seen websites with decent thematic separation but what we saw on tickmill was something else: the broker has divided the website into the sections that answer all the questions effortlessly. For instance, want to know the conditions for spreads? Go to the spreads & swaps section and find out everything about it.

This level of simplicity is definitely an advantage that we will take into account when making a final tickmill rating.

We were also pretty pleased when we came across 5 different account types on the website. All of them are designed for specific users and make trading a once-in-a-lifetime experience for them.

As for trading platforms, tickmill definitely doesn’t invent a bicycle here: it uses metatrader 4 and webtrader for all the trading executions. And to be fair, it doesn’t need to be original because these pieces of software have proven to be the most effective and efficient in this industry.

The license

Next up, we will take a look at the broker’s licensing material. This is the part that actually reveals a lot about the broker’s code of conduct and its legitimacy issues.

So, the very first line that you read when entering the website is this: “authorised and regulated: FSA SC, FCA UK, cysec.” this means that the broker has regulatory obligations to three separate countries and their financial institutions.

And actually going through these institutions can reveal a lot. For instance, when seeing that one of the main regulators of tickmill is the UK’s financial conduct authority, all the tickmill scam suspicions or suggestions are instantly dissipated for us. There’s just no way of being a scam and having this level of regulatory oversight monitoring your activities.

We will talk about this section more further down below.

Actual tickmill promotions

At last, we’ll discuss every important trading condition available on tickmill. We’ll start with the leverage and spreads. On the broker’s website, we can see that the maximum leverage ratio that the traders can use is 1:500, which is definitely a lucrative offering.

As for spreads, the broker offers two different levels of bid-ask price differences on forex pairs: 1.6 pips for classic account and 0 pips for pro and VIP accounts. Both conditions are pretty decent, although, as you can imagine, the 0-pip offering is far more attractive.

As for the tickmill bonus, the broker offers multiple promotions to its clients, ranging from the $30 welcome account, trader of the month, and many more. These bonuses give additional trading funds to the lucky winners who also can withdraw the bonus money to their personal account.

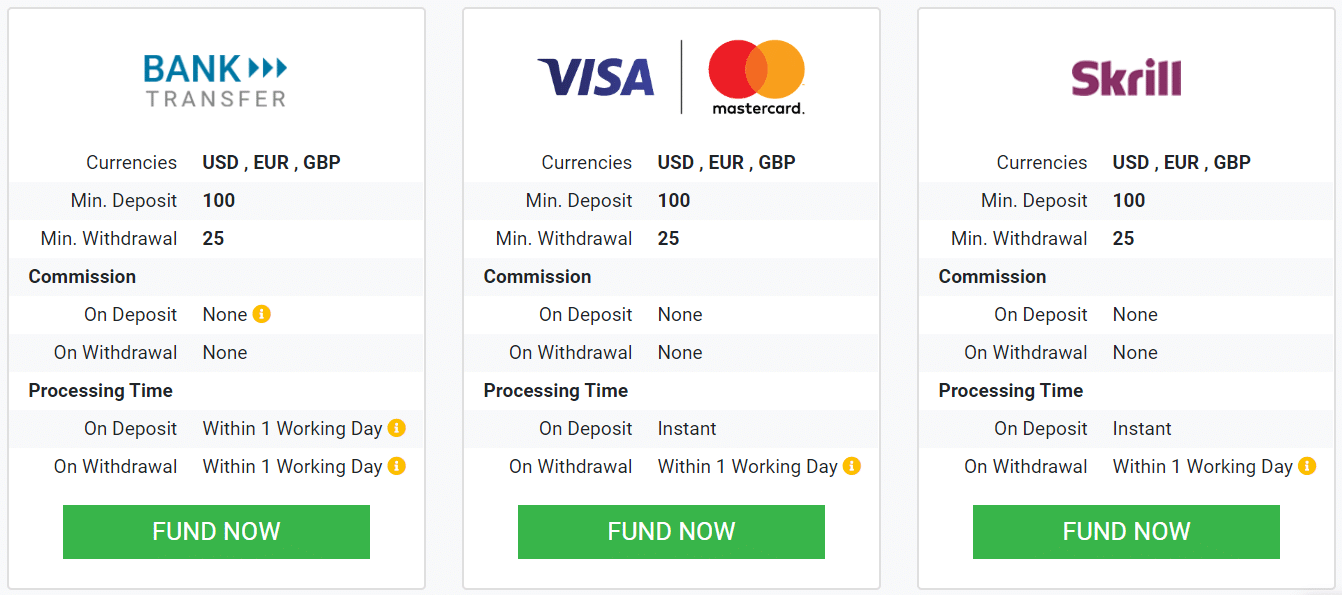

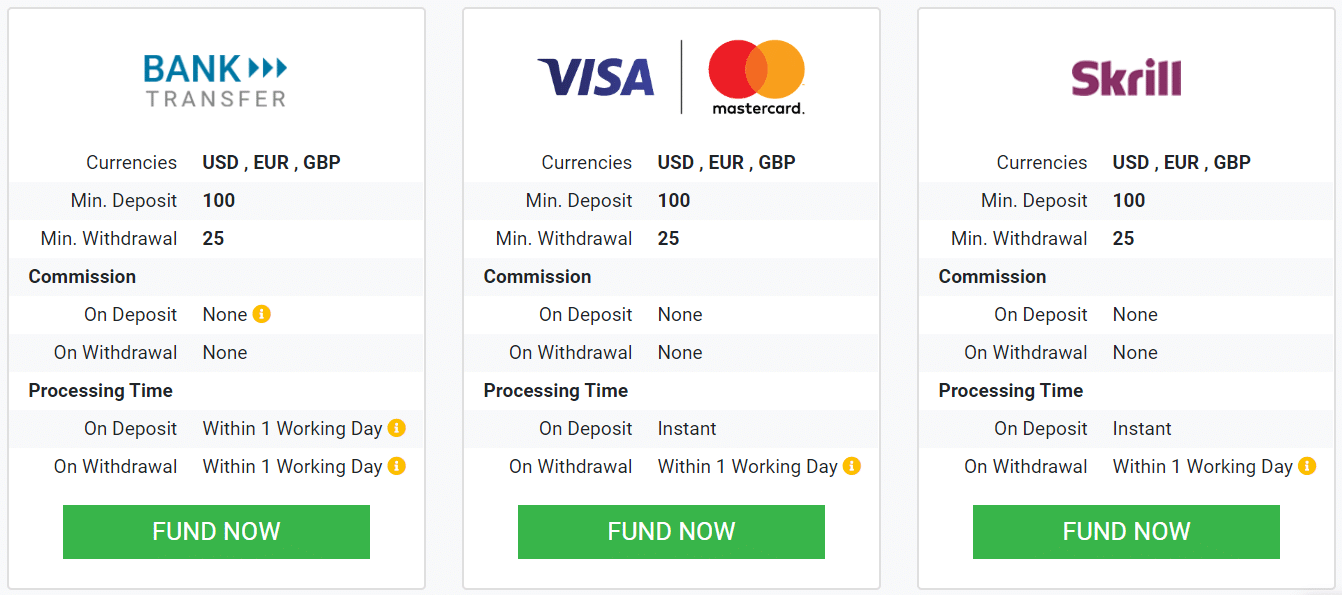

Finally, we’ll take a look at the minimum deposit requirement, as well as how you can make that deposit, as well as withdrawal. On tickmill, the minimum amount you need to deposit in order to set up a classic account is $100. As for financial platforms, the broker supports bank wire, credit/debit cards, as well as many e-wallets like neteller, skrill, etc.

In short, we think that tickmill is a trustworthy brokerage that offers quite impressive trading conditions to its clients. Now, let’s review each of the above-mentioned points more closely.

What’s the software experience like on tickmill?

As per usual, we’ll begin with the website. As we noted earlier, the visual side of the website is pretty spot-on: it’s not overburdened with unnecessary imagery or transition effects; everything is used moderately and adequately. What this achieves is it makes the navigation through the website much easier.

When it comes to finding the actual information on this website, it’s safe to say that all you need is one mouse click to go where you want. The website is separated into six different sections: trading, platforms, clients tools, promotions, partnerships, and about us. Within those sections, you can find anything about the broker’s regulatory measures, trading numbers, platforms, and payment methods.

As for the account types, there are five different packages that fulfill the demand coming from every type of trader: there are three live accounts (classic, pro, and VIP), one islamic, and one demo account. And all of them are special in their own way; some have lower spreads but higher minimum deposit requirements, some come with no swaps, etc. All in all, these accounts are perfect for specific users.

The last point of this section is trading software. Instead of going all fancy and offering proprietary trading software, tickmill chose a safer and more trustworthy route and gone with metatrader 4. MT4 is a well-tested and widely-used platform that has proven to be the most effective software across the board. What’s more, the broker also offers the MT4-based webtrader that works on all major web browsers.

Is tickmill legit?

Moving on, let’s talk about how legit the broker is based on its licensing materials. As we have already mentioned earlier, there are three separate regulatory pieces that monitor and even direct the broker’s financial activities, and all of them are pretty significant.

These licenses include: FSA from seychelles, FCA from the UK, and cysec from cyprus. Now, if there only was the FSA license, we would at least acknowledge the legitimacy of the tickmill scam suspicions. That’s because for some traders, seychelles isn’t the country with the biggest political or economic prowess to hold the broker accountable for its actions.

However, when we see the licensing materials from the UK and cyprus, all the suspicions are instantly dissipated. Just take a look at the FCA from the UK. Do you think that any brokerage would engage in fraudulent activity and be forgiven by this institution? We certainly don’t think that.

And then there’s the cysec license as some sort of cherry topping as it’s also a very strong licensing material from within the EU. In short, all three of the licenses make sure that the broker abides by the strictest financial rules.

Trading terms and conditions

Finally, let’s talk about what the actual offerings on tickmill are. As noted earlier, the leverage goes as high as 1:500, which is a very impressive and lucrative offering. With it, traders can increase their initial deposits by x500 times, increasing profits by the same multiplication rate.

As for the spreads, the bid-ask price difference for forex pairs is different on different account but the minimum spread can go as low as 0 pips, meaning there’s no actual price difference and traders can buy the same amount of assets as they sell.

When it comes to the bonuses, tickmill FX brokerage offers at least five different promotions: the trader of the month, tickmill’s NFP machine, $30 welcome account, IB contest, and rebate promotion. All of them offer money prizes to the traders, making the experience on tickmill so much better.

And finally, let’s talk about the minimum deposit requirements and financial platforms backing those deposits. On tickmill, the least amount of money you can deposit to your account is $100. This means that even the beginner traders can fire off their career on tickmill without breaking the bank.

The payment platforms that drive those deposits, as well as withdrawals, are also very attractive: the broker offers both traditional (bank wire, debit/credit cards) and e-wallet platforms (neteller, skrill, fasapay, etc). As for tickmill withdrawals, the same platforms can be used for taking out the money you have earned. And transactions are secured with the SSL protocol, which is the highest security standard in the industry.

Should you trade with tickmill?

So, what is our final tickmill opinion? Should you use its services and platforms to trade forex, stocks, and commodities?

Judging from what we’ve just said in this review, it is safe to say that the broker offers some of the most exciting trading conditions you can find on the market right now. Whether you want to leverage large trading positions with fewer of your own money, shallow spreads, or sophisticated financial mechanisms, you can never go wrong by choosing tickmill.

Besides, the broker has three separate licensing materials that ensure that there’s no tickmill fraud going on. In short, we freely recommend this broker with all its offerings and requirements.

Welcome account

Experience one of the best trading environments in the industry risk-free with our $30 welcome account.

A special welcome to the world of trading

and our superior services

Jump-start an exciting trading journey with tickmill and explore our world-class services with the $30 welcome account.

New clients have the opportunity to trade with free trading funds, without having to make a deposit. The welcome account is very easy to open and the profit earned is yours to keep.

Enjoy a seamless trading experience with lightning-fast execution, while getting access to award-winning trading tools and resources.

Your perfect start

with tickmill

NO RISK

PROFITABLE

- The “welcome account” campaign is held by tickmill ltd (FSA SC regulated).

- The welcome account is for introductory purposes and only for new clients from non-restricted countries, who are interested in opening a live trading account with tickmill ltd (FSA SC regulated).

- The welcome account is not available in algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, lebanon, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, san marino, south africa, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

- European union citizens cannot apply for a welcome account.

- Expert advisors (eas) are not allowed on welcome accounts.

- Existing clients cannot apply for a welcome account.

- Each client can open only one welcome account.

- The welcome account has identical trading conditions to the live pro account type.

- The client has the option to either raise or lower the leverage on the welcome account.

- The welcome account is available for trading for 60 days from the day of opening. Once 60 days have passed, trading will be disabled but the welcome account will still be accessible for an additional 14 days to claim the earned profit.

- The welcome account is available in the USD currency.

- The welcome account is created automatically after the client completes the registration form on the web page and the application has been approved. Login details will be sent automatically to the email address provided in the registration form. Please note that these credentials may only be used to create a welcome account, not to access the client area.

- A 30 USD initial complimentary deposit is added automatically to the welcome account.

- Tickmill reserves the right to reject a bonus request or block the welcome account, if there is a partial or complete match of IP address or other signs of welcome accounts belonging to the same person.

- The initial deposit cannot be withdrawn or transferred from the welcome account.

- A minimum of 30 USD and a maximum of 100 USD of profit can be transferred from the welcome account to a live MT4 trading account (classic, pro or VIP account type) with tickmill ltd (FSA SC regulated).

- Each client can make only one request to transfer profit from the welcome account to a live MT4 trading account.

- In order to make a transfer of profit from the welcome account to a live MT4 account, the client must:

- Register a client area account, using the same information provided during the welcome account registration (name, surname, email, date of birth, etc.);

- Provide the necessary identification documents required to validate the client area account;

- Open a live MT4 trading account inside the client area and deposit a minimum of $100 (or equivalent in other currencies);

- New live MT4 trading account should not be connected to any other promotions (e.G. Rebate campaign).

- After a deposit is made to a live MT4 account, the client should send an email to funding@tickmill.Com and request a transfer of profit from the welcome account to the live MT4 account. Transfer of profits should be requested to the same trading account where an initial deposit was made.

- If initial deposit was made to rebate promotion trading account, transfer of profit should be requested to another live account which is not designated for the rebate promotion.

- It is not allowed to make third party deposits and tickmill reserves the right to cancel bonus at any time upon detecting third party payment.

- Once the profit transfer is completed, the welcome account will be disabled and no further trading will be possible.

- The profit of the welcome account will be added to the balance of the live trading account with tickmill ltd (FSA SC regulated) and can be withdrawn immediately by using any of the available withdrawal options available in the client area.

- All profits earned and transferred from the welcome account campaign are deemed to be null and void, if the welcome account or live MT4 tickmill ltd account holder (FSA SC regulated) has provided incorrect, false or misleading information during the registration process.

- No deposits can be made to the welcome account.

- Tickmill reserves the right to disqualify any user, if there is a suspicion of misuse or abuse of fair rules.

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse.

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse.

- Tickmill reserves the right to change the terms of the campaign or cancel it at any time.

- Any disputes or likely misunderstandings that may occur as a result of the campaign terms will be resolved by the tickmill management in a way that presents the fairest solution to all parties involved. Once such a decision has been made, it shall be regarded as final and/or binding for all parties.

- Clients agree that information provided during the registration process may be used by the company both within the context of the welcome account campaign and for any other marketing purposes.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

A comprehensive tickmill review – is this broker trustworthy?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

When setting out to start trading forex, stocks, or other tradable assets, one of the first things every trader should think about is a broker. The internet is full of scam brokerages that you absolutely need to stay away from, however, given how skilled they are at tricking potential customers, it may not be as easy to spot hidden flaws under their platform.

But it doesn’t mean that you have no means of distinguishing legitimate brokers from fraudulent ones. It just takes a little effort and research into the broker’s offerings to assess their credibility and make the right decision.

On forex trading bonus, we’re trying to make the broker selection process a little bit easier by offering our comprehensive reviews about them. And today, we’ll do the same for the tickmill forex broker.

In order to determine whether tickmill is a trustworthy broker or a scam, we will take a look at its website and software support, then move to the licensing, and finish off by talking about the actual trading conditions. So, let’s get started.

Initial overview

Tickmill is a forex broker established in 2015 in seychelles. The broker brings together a team of professional traders whose experience in this field has started off back in the 80s, therefore, the new clients of tickmill are already in good hands.

While the main focus of tickmil forex broker can be gathered from what we’ve just said – forex trading, the broker also offers many other instruments to its traders: stocks, indices, commodities, and bonds. But before we delve deeper into these instruments and what the actual conditions on them are, let’s do a brief overview of everything we’ll talk about in this article.

A brief tickmill.Com review

When you go to tickmill’s website, the first thing you’re going to notice is how slender and simplistic the interface looks. One image here or there, several visual effects, and very decent font make up a visual that is hardly ever distracting the visitor from getting the information.

And information is certainly there. We have seen websites with decent thematic separation but what we saw on tickmill was something else: the broker has divided the website into the sections that answer all the questions effortlessly. For instance, want to know the conditions for spreads? Go to the spreads & swaps section and find out everything about it.

This level of simplicity is definitely an advantage that we will take into account when making a final tickmill rating.

We were also pretty pleased when we came across 5 different account types on the website. All of them are designed for specific users and make trading a once-in-a-lifetime experience for them.

As for trading platforms, tickmill definitely doesn’t invent a bicycle here: it uses metatrader 4 and webtrader for all the trading executions. And to be fair, it doesn’t need to be original because these pieces of software have proven to be the most effective and efficient in this industry.

The license

Next up, we will take a look at the broker’s licensing material. This is the part that actually reveals a lot about the broker’s code of conduct and its legitimacy issues.

So, the very first line that you read when entering the website is this: “authorised and regulated: FSA SC, FCA UK, cysec.” this means that the broker has regulatory obligations to three separate countries and their financial institutions.

And actually going through these institutions can reveal a lot. For instance, when seeing that one of the main regulators of tickmill is the UK’s financial conduct authority, all the tickmill scam suspicions or suggestions are instantly dissipated for us. There’s just no way of being a scam and having this level of regulatory oversight monitoring your activities.

We will talk about this section more further down below.

Actual tickmill promotions

At last, we’ll discuss every important trading condition available on tickmill. We’ll start with the leverage and spreads. On the broker’s website, we can see that the maximum leverage ratio that the traders can use is 1:500, which is definitely a lucrative offering.

As for spreads, the broker offers two different levels of bid-ask price differences on forex pairs: 1.6 pips for classic account and 0 pips for pro and VIP accounts. Both conditions are pretty decent, although, as you can imagine, the 0-pip offering is far more attractive.

As for the tickmill bonus, the broker offers multiple promotions to its clients, ranging from the $30 welcome account, trader of the month, and many more. These bonuses give additional trading funds to the lucky winners who also can withdraw the bonus money to their personal account.

Finally, we’ll take a look at the minimum deposit requirement, as well as how you can make that deposit, as well as withdrawal. On tickmill, the minimum amount you need to deposit in order to set up a classic account is $100. As for financial platforms, the broker supports bank wire, credit/debit cards, as well as many e-wallets like neteller, skrill, etc.

In short, we think that tickmill is a trustworthy brokerage that offers quite impressive trading conditions to its clients. Now, let’s review each of the above-mentioned points more closely.

What’s the software experience like on tickmill?

As per usual, we’ll begin with the website. As we noted earlier, the visual side of the website is pretty spot-on: it’s not overburdened with unnecessary imagery or transition effects; everything is used moderately and adequately. What this achieves is it makes the navigation through the website much easier.

When it comes to finding the actual information on this website, it’s safe to say that all you need is one mouse click to go where you want. The website is separated into six different sections: trading, platforms, clients tools, promotions, partnerships, and about us. Within those sections, you can find anything about the broker’s regulatory measures, trading numbers, platforms, and payment methods.

As for the account types, there are five different packages that fulfill the demand coming from every type of trader: there are three live accounts (classic, pro, and VIP), one islamic, and one demo account. And all of them are special in their own way; some have lower spreads but higher minimum deposit requirements, some come with no swaps, etc. All in all, these accounts are perfect for specific users.

The last point of this section is trading software. Instead of going all fancy and offering proprietary trading software, tickmill chose a safer and more trustworthy route and gone with metatrader 4. MT4 is a well-tested and widely-used platform that has proven to be the most effective software across the board. What’s more, the broker also offers the MT4-based webtrader that works on all major web browsers.

Is tickmill legit?

Moving on, let’s talk about how legit the broker is based on its licensing materials. As we have already mentioned earlier, there are three separate regulatory pieces that monitor and even direct the broker’s financial activities, and all of them are pretty significant.

These licenses include: FSA from seychelles, FCA from the UK, and cysec from cyprus. Now, if there only was the FSA license, we would at least acknowledge the legitimacy of the tickmill scam suspicions. That’s because for some traders, seychelles isn’t the country with the biggest political or economic prowess to hold the broker accountable for its actions.

However, when we see the licensing materials from the UK and cyprus, all the suspicions are instantly dissipated. Just take a look at the FCA from the UK. Do you think that any brokerage would engage in fraudulent activity and be forgiven by this institution? We certainly don’t think that.

And then there’s the cysec license as some sort of cherry topping as it’s also a very strong licensing material from within the EU. In short, all three of the licenses make sure that the broker abides by the strictest financial rules.

Trading terms and conditions

Finally, let’s talk about what the actual offerings on tickmill are. As noted earlier, the leverage goes as high as 1:500, which is a very impressive and lucrative offering. With it, traders can increase their initial deposits by x500 times, increasing profits by the same multiplication rate.

As for the spreads, the bid-ask price difference for forex pairs is different on different account but the minimum spread can go as low as 0 pips, meaning there’s no actual price difference and traders can buy the same amount of assets as they sell.

When it comes to the bonuses, tickmill FX brokerage offers at least five different promotions: the trader of the month, tickmill’s NFP machine, $30 welcome account, IB contest, and rebate promotion. All of them offer money prizes to the traders, making the experience on tickmill so much better.

And finally, let’s talk about the minimum deposit requirements and financial platforms backing those deposits. On tickmill, the least amount of money you can deposit to your account is $100. This means that even the beginner traders can fire off their career on tickmill without breaking the bank.

The payment platforms that drive those deposits, as well as withdrawals, are also very attractive: the broker offers both traditional (bank wire, debit/credit cards) and e-wallet platforms (neteller, skrill, fasapay, etc). As for tickmill withdrawals, the same platforms can be used for taking out the money you have earned. And transactions are secured with the SSL protocol, which is the highest security standard in the industry.

Should you trade with tickmill?

So, what is our final tickmill opinion? Should you use its services and platforms to trade forex, stocks, and commodities?

Judging from what we’ve just said in this review, it is safe to say that the broker offers some of the most exciting trading conditions you can find on the market right now. Whether you want to leverage large trading positions with fewer of your own money, shallow spreads, or sophisticated financial mechanisms, you can never go wrong by choosing tickmill.

Besides, the broker has three separate licensing materials that ensure that there’s no tickmill fraud going on. In short, we freely recommend this broker with all its offerings and requirements.

Tickmill bonus review

Tickmill reviews and ratings

| Website | https://tickmill.Com/ |

| live chat | YES |

| telephone | +852 5808 2921 |

| broker type | non deal desk (NDD) |

| regulations | FCA and FSA |

| min deposit | $100.00 |

| account base currency | USD, EUR, GBP, PNL |

| max leverage | 500:1 |

| trading platforms | metatrader 4, webtrader |

| markets | forex, index CFD trading, precious metals, energy, cryptocurrencies, bonds |

| bonus offered | $30.00 welcome bonus |

| funding options | credit / debit card, china union pay, bank transfer, dotpay, skrill, neteller, fasa pay |

Tickmill review 2021

Overview

This UK-based FCA and FSA-regulated brokerage firm based in the republic of seychelles offers trading to institutions and retail clients globally. Its forex business offers gold and silver as well as 62 currency pairs (including cryptocurrency) for trading. The broker have a lower minimum deposit compared to some of the other brokers on this list. It is a great broker firm for beginners to try their hand.

Accounts

Tickmill offers various types of accounts for various trader profiles. Commission-free classic accounts for beginners, pro accounts, VIP accounts for those who trade a lot and want special service, and islamic accounts. Traders will be thrilled to find the demo account offers metatrader 4 for testing, and includes real-time prices and volatility.

Minimum deposit

$100 in classic and pro accounts, 50,000 minimum balance in VIP accounts.

Maximum leverage

Features

Tickmill offers two platforms to trade on. Metatrader 4 is the main platform. For those who want to trade quickly through their browsers without downloading any software, there is the web trader.

Tickmill also offers a variety of tools including forex margin and currency calculators, autochartist for technical analysis, forex calendar, and myfxbook autotrade. The tickmill VPS keeps the MT4 eas and signals running when the customer is offline. One-click trading option enables quicker real-time trading.

Promotions like the introducing broker service allows traders to earn commissions on reference. A multi account manager is also available.

Educa tion

Webinars and video tutorials are available.

Deposits/withdrawals

Several funding options are available to customers, and withdrawals are processed within one working day.

Customer service

24/7 via online chat or email, and support lines on weekdays.

Tickmill review

Overview

One of the startup forex brokers, successfully providing a trader with low spreads, STP and DMA technologies etc.

Details

| broker | tickmill |

|---|---|

| website URL | tickmill.Com |

| founded | 2014 |

| headquarters | trop-X securities exchange building, 3 F28-F29 eden plaza, eden island, mahe, republic of seychelles |

| support number | + 852-5808-2921, + 65-3163-0958 (seychelles), + 44-203-608-6100 (united kingdom) |

| support types | chat, phone, email |

| languages | english, russian, indonesian, spanish, italian, thai, malaysian, portuguese, chinese, etc. |

| Trading platform | metatrader 4, web trader |

| minimum 1st deposit | $100 |

| minimum trade amount | 0,1$ |

| bonus | 2 kinds of bonuses |

| leverage | 1:500 |

| spread | from 0.0 points |

| free demo account | open demo |

| regulated |  |

| regulation | FCA (№ SD008) |

| account types | demo, classic, pro, VIP |

| deposit methods | bank transfers, credit, debit cards visa, mastercard, neteller, skrill |

| withdrawal methods | bank transfers, credit, debit cards visa, mastercard, neteller, skrill |

| number of assets | 60+ |

| types of assets | forex, CFD, valuable metals, indices, bonds, cryptocurrency (bitcoin) |

| account currency | USD, EUR, GBP, PLN |

| US traders allowed |  |

| mobile trading |  |

| overall score | 3/10 |

Full review

And yet, is tickmill a scam or a dignified startup broker, which is certainly worth to be looked at? We answer this question in the detailed broker review.

Terms of trade with tickmill

Tickmill is a trending broker with headquarters in UK and representational offices in estonia, on seychelles etc., successfully providing services in trading currencies and precious metals to retail clients and marquee investors in the forex market. Today the company, despite of being yet a very startup, is a technology-packed ECN-broker created by traders for traders, making online trading gainful and comfortable. For the company work the top-sawyers only, forex trading in financial markets from asia to north america since 1994, this experience helps the broker in effective enhancement of the really quality service, providing the best and differing from its competitors.

Due to DMA, NDD, ECN and STP technologies traders get the direct access to the best liquidity suppliers with favorable prices (commerzbank, HSBC, credit suisse, jpmorgan, BNP paribas etc.). Please note among the advantages of the broker also the scalping option, along with automated trading, hedging, phone dealing, up-to-date trading services (autochartist, VPS-hosting, swap-free account, autotrade etc.).

Safe software provision is one of the main company focuses. So the broker provides its customer with the latest online trading technologies only: the popular terminal metatrader4, which won the trust and can continuously process any amount of trader’s orders in various market conditions. Both, newcomers of the market and professionals will be concerned about quality training materials, customized trading training, video lessons, webinars.

Deposit and withdrawal

Tickmill offers various deposit and withdrawal ways. To deposit you need to sign up by broker and replenish the sum by any convenient way (minimal deposit is 100$) of the list of the payment systems offered by company:

- Bank transfers,

- Credit, debit cards visa, mastercard,

- Payment terminal (neteller, skrill).

Please note that there are yet just a few ways for deposit and withdrawal, there is no even webmoney, which is so popular by traders. The account may be opened in any of currencies at option: USD, EUR, GBP. The withdrawal is possible for recognized and verified traders only, through the payment system used for deposit, too. The withdrawal speed: within one business day. There is no commission for all withdrawal options, just the extra pay may be charged by payment systems.

Tickmill bonuses

Any trader of the company can get 2 kinds of bonuses:

The broker offers a gainful welcome bonus of 30$ for the newcomers of the platform. Taking part on the offer will let you test the potential of dealing with the company with no risk for your own funds. The bonus may be used just once, you also can create just one query for transfer of funds from the bonus trading. Ask your account manager about the criteria of taking part on the offer.

- Traders of the month: 1 000$ for a winner

The profitable contest with a solid prize pool takes place every month, 1 000$ may be won by two best traders, by selecting a winner not only profit, but also risk management system is considered. All real accounts take part on the contest automatically. The contest participation results are published and publicly available on the «fame wall». Ask your account manager about the criteria of taking part on the contest.

Complaints about tickmill

Tickmill is a startup forex broker, yet has enough various references in internet. Some traders point the transparency, solid track record and reliability among the advantages of the broker, providing one of the cheap trading accesses, quality technical support, stable terminal operation (no re-quotations and slippages), favorable trading terms (low spreads, quick orders execution, nice liquidity, stable quotations), numerous materials on the website, deposit and withdrawal procedures in due time fixed by broker, user friendly personal account, quick verification procedure, insightful fundamental reviews and quality analytics, no withdrawal commissions, scalping options. Traders trust the company, recommend it.

There are also negative comments concerning withdrawal issues, inconvenient personal account, no contact with technical support, terminal deadlocks, slippages. Besides, the broker’s agent is rarely to see on forums, to resolve the negative issues and users problems. To avoid the negative dealing with the company, ask your account manager about the account verification terms, guideline for using bonuses and withdrawal aspects. Please point also that the broker has yet to find and win its audience, which means there will be more references about it and its early to draw any conclusions now.

If we find complaints about tickmill, we will post it on social media. Follow us to be well informed:

Tickmill broker regulator

Tickmill possess some solid licenses, which make trading with the company safe and secured. The broker is a member of the company tmill UK limited, which is subject to regulation of the financial supervision agency of UK (FCA, № 717270). The company possesses also the FSA license of seychelles (tickmill ltd seychelles, № SD008), is registered in estonian ministry of economic affairs (№ VVT000289).

Is tickmill a scam?

Despite the fact that tickmill is a startup company in the market of forex-services and has yet to show its potential and capacities, it already won the user’s trust, has the image of safe and stable company, which differs it from paper brokers (truth about forex). There is a large number of references about the broker in internet, besides they are more positive, this proves the commitment of the company, which main concern is to provide its user with the best conditions only (low spreads, accurate quotations, automated trading option, low entry threshold etc.). Traders recommend the broker, point the company as one of the main lowcosters of trading, which also describes it positive. Please note also that there is a company representative working on negative feedback, he is inactive though.

The quality service issue is of great importance for the company. So the broker offers for trading the terminal metatrader 4, tested by millions of traders, securing the stable trade, which got positive references from the company customers. Among the advantages of the broker are provision of trading tools, services, bonuses, professional technical support, this is to say about the well considered strategy of cooperation with the customer.

Also worth noting is that the tickmill official website, which is user friendly, contains a lot of helpful materials about the company, trading terms, licenses, analytics and training information. The solid certification of tickmill is also a significant point of confidence for a user.

Shall we say that tickmill is a scam lottery and a bucket shop? Despite of the fact that the broker is the one of the startup brokers in forex market, it managed to give a solid performance already, proving its stability and commitment to stated aims. And yet, at this stage of the company growth it is too early to draw conclusions, if tickmill is a scam artist or not, but you can protect yourself properly dealing with your account manager.

Summary

The forex broker tickmill is a startup, rapidly growing company with all chances for the leadership among its competitors. Even now it has the image of a successful and stable company, numerous positive comments (about favorable trading terms, quality service, professional support service etc.) and references from customers, this is in a lot of ways to say that the broker is on the right path of development.

The safe terminal, gainful bonuses, quality analytics, training option – all this also describes the broker in a positive way. The company has negative references, too, not that much though, besides there is a broker’s agent working on forums. It is to be hoped that the company plans to attend to customers references and enhance its service keeping the pace of its successful start. It is fair to say that tickmill didn’t yet profile itself at full breath, it is early to appraise it as a reliable or a fraudulent company. Yet the feedback from traders, which we expect to this review, may not only change broker ratings significantly, but caution users against possible problems, too.

So, let's see, what we have: read our exquisite tickmill review covering tickmill bonus, mt4, ttickmill forex, deposit & withdrawal and tickmill account types. At tickmill bonus review

Contents

- Top forex bonus list

- Review of tickmill

- Tickmill review

- A comprehensive tickmill review – is this broker trustworthy?

- Initial overview

- What’s the software experience like on tickmill?

- Is tickmill legit?

- Trading terms and conditions

- Should you trade with tickmill?

- Welcome account

- A special welcome to the world of trading and our superior services

- Your perfect start with tickmill

- NO RISK

- PROFITABLE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- A comprehensive tickmill review – is this broker trustworthy?

- Initial overview

- What’s the software experience like on tickmill?

- Is tickmill legit?

- Trading terms and conditions

- Should you trade with tickmill?

- Tickmill bonus review

- Tickmill reviews and ratings

- Tickmill review 2021

- Overview

- Accounts

- Minimum deposit

- Maximum leverage

- Features

- Educa tion

- Deposits/withdrawals

- Customer service

- Tickmill review

- Overview

- Details

- Full review

- Terms of trade with tickmill

- Deposit and withdrawal

- Tickmill bonuses

- Complaints about tickmill

- Tickmill broker regulator

- Is tickmill a scam?

- Summary

No comments:

Post a Comment