Cryptocurrency brokers and usa

Aside from being a US-friendly trading website, coinut.Com has also the capability of being an anonymous platform for people that prefer anonymous trading.

Top forex bonus list

Coinut pte. Ltd., has been operating since 2013 and has provided trading services for people around the world. The company is located in singapore, which is great since their government is swaying towards the positive side of cryptocurrency trading. Without further delay, let us talk about the best five US-friendly bitcoin brokers!

Best 5 US friendly bitcoin brokers

Getting the chance to purchase BTC through a website that you like is probably the most efficient way to get bitcoins today. But this simple task of logging into a BTC broker with your username details and password isn’t that easy for some people, especially our friends from the united states. As we all know, not all websites accept registrations from the US, making it hard for people that live there to purchase bitcoins.

With this being said, we have provided people that are based in the united sates five options to choose from. These websites sell cryptocurrency and we will try our best to compare them from one another by highlighting important things like payment options, website features, and of course, available crypto for sale.

Top 5 US friendly crypto brokers:

Without further delay, let us talk about the best five US-friendly bitcoin brokers!

Kraken.Com

Kraken accepts customers from the united states and offers cryptocurrency margin trading up to 50x leverage on futures. The exchange was founded in 2011 and by now one of the oldest and largest place to trade bitcoin and other altcoins. With its headquarter in san francisco, california, kraken serves clients worldwide. To sign up, you need to provide name, address, and email.

- Payment options – kraken offers several different options to fund your account, including bank wire transfers, ACH, credit cards and cryptocurrency deposits. Minimum deposit is $20 USD and for certain altcoins, they apply a deposit fee.

- Withdrawal – you can withdraw funds from kraken both in fiat and in crypto, the minimum withdrawal is from 0.005 BTC.

- Website – kraken.Com provides all the necessary information you need to get started with cryptocurrency trading. All the features are listed in the navbar along with prices and if you need any support their in-depth FAQ will certainly have an answer to your question. It is also possible to see the trading interface before signing up.

- Available market – clients can trade fiat/crypto and crypto/crypto trading pairs on kraken.

- Versatile order types

- Several altcoins supported

- Low fees

- Complex fee schedule

- Minimum deposits in some altcoins

- Verification can take some time

Simplefx.Com

Anonymous trading is available in simplefx.Com and they accept US customers. The website was established in 2014 and supports 15 languages! The company is located in saint vincent and the grenadines. To create an account, all you need to have is an email address. What’s great about this website is the trade volume and available pairs you are able to choose from.

- Payment options – what’s awesome about this website is the number of payment options they have available for you to choose from. They have BTC, DASH, ETH, LTC, credit cards, skrill, neteller, wire transfer, fasapay, and megatransfer. Minimum deposit starts from 0.1 USD up to $20 USD.

- Withdrawal – crypto withdrawals do not have any charge when it comes to fees but the minimum request starts from 0.001 BTC up to 0.05 LTC. When it comes to fiat withdrawals, the website charges a minimum fee of $10 USD per transaction request.

- Website – the website is fun and informative. They have all the important tabs tucked on the left-hand side of the account page. They also have training videos that can help a new trader navigate their website easily. They also have a demo account, which is always great to have!

- Available market – users are able to trade with different markets like crypto/fiat pairs, forex, indices, commodities, and a lot more! This website does not joke around when it comes to trading pairs as they have more than enough to go around with.

- Accepts BTC and fiat payments

- Demo account

- Anonymous trading

- Website latency issues

- Some negative feedbacks

Coinut.Com

Aside from being a US-friendly trading website, coinut.Com has also the capability of being an anonymous platform for people that prefer anonymous trading. Coinut pte. Ltd., has been operating since 2013 and has provided trading services for people around the world. The company is located in singapore, which is great since their government is swaying towards the positive side of cryptocurrency trading.

- Payment options – there are more than just a couple of payment options here at coinut.Com since registered users are able to choose from currencies like BTC, LTC, ETH, ETC, USDT, BCH, and an option to go USD after all the requirements have been submitted.

- Withdrawal – withdrawal methods is a mirror image of what they have for deposits. This ensures easy access to your funds whether it is going in or out of the website. Withdrawal fees start from 0.001 BTC per transaction.

- Website – the website is spotless, as expected from a singaporean-based company. There are no lags experienced when we tried to simultaneously open up different tabs. Aside from their spotless website, they also provide referral incentives, which is great.

- Available market – registered account holders are able to trade with different crypto pairs.

There are no maker fees in coinut.Com, which is great since this would be a big saving when it comes to long-time trading plans. They do charge takers, which is 0.1% of the total transaction value which is lesser compared to regular trading websites that reach up to 0.25% on taker fees.

- Account creation is a breeze

- Accepts BTC and USD

- Low trading fees

- Futures and options trading

- Crypto/fiat pairs not available

- Limited number of crypto trades

Evolve.Markets

Founded in 2016, evolve.Markets is a fairly new website amongst the giant crypto-trading websites out there today. The company is based in saint vincent and the grenadines and keeps their BTC funds in cold wallets. In addition, this website just like any most of BTC trading websites is not being regulated by any regulatory body.

- Payment options – the website strictly only accepts BTC payment from your BTC wallets. There are no transfer fees when it comes to deposits here at evolve.Markets.

- Withdrawal – what’s great is their withdrawal fees because they do not exist! Yes! The only withdrawal option here at evolve.Markets would only be BTC but there are no network fees that you need to pay, everything’s covered. They do have a minimum withdrawal amount which is 0.005 BTC per request.

- Website – they do have a demo account here, which is great for people that love to explore trading platforms and try out their features without spending any money. They also have a really flexible leverage system in the website wherein you are able to choose freely depending on what leverage you need.

- Available market – here at evolve.Market they have different trading platforms that you can choose from. This would be their web trader, android, and iphone versions of the platform. Available markets range from crypto/fiat pairs to forex and commodities.

There are two different account types in markets.Evolve, this would be classic and pro. A classic account has commission built into the spread while on the other hand; the pro account has tighter spreads but charges commission per trade.

- BTC focused

- Account creation is fast

- Demo account

- Unregulated trading website

- Only accepts BTC payments

Conclusion

Provided above are five of our preferred website to purchase BTC or any other available crypto for your personal or trading use! Some of these websites also double as a trading platform wherein you are not only able to purchase BTC but trade them as well. As always, this is just a recommendation from us and we urge you to read more about a website before investing money in it.

Best cryptocurrency brokers for 2021

Daniel ‘harris’ major

I have tested 40+ crypto brokers. You can find the best cryptocurrency brokers below. This is by far the easiest way to get started with cryptocurrencies.

Cryptocurrency trading has become really popular in the past years. It’s growing more ever year.

Many big trading brokers have already added some of these cryptocurrencies. Everybody can sign up and start trading bitcoin or other crypto coins. This is the easiest and probably the simplest way to invest in cryptocurrency.

After trying out most brokers, here are the best cryptocurrency brokers:

Best cryptocurrency brokers (non-US traders only)

Plus500 – top rated trading platform

Plus500 is a big name in the trading industry. They have a really low minimum deposit requirement and a great trading site.

Buy/sell cfds on bitcoin in addition to buying stocks, commodities, forex etc (traded only through cfds). Plus500 is the most complete trading platform.

- Trade cfds on bitcoin & many other cryptos

- Minimum deposit is only $100

- Regulated and trusted platform

- Very fast signup process

- Live chat

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Plus500 disclaimer: 76.4% of retail CFD accounts lose money.

IQ option – lowest minimum deposit ($10)

If you don’t want to make a huge initial investment, then IQ option is the best broker for you. The minimum deposit requirement is only $10. This is by far the lowest in the industry.

- You can trade many cryptocurrencies

- Minimum deposit is only $10

- Best trading platform

- Multiple account currencies

- Free demo account

- Regulated by CYSEC (#247/14)

Etoro – top crypto broker

Etoro is a really popular trading site. They have been around since 2006. Etoro is regulated by CYSEC, FCA and ASIC.

Buy/sell bitcoin on etoro in addition to buying stocks, commodities, forex etc. Etoro is the most complete trading platform.

- Trade bitcoin & many other cryptos

- Minimum deposit is $200

- Regulated and trusted platform

- Australian traders are also accepted

- Great support team

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Etoro disclaimer: 71% of retail CFD accounts lose money.

Highlow – best all-round crypto broker

Due to regulation highlow stopped accepting traders from the EU and UK.

Highlow is an australian trading broker (AFSL no.364264). What I like most about this broker is the intuitive platform. It is so easy to use. Especially new traders will like the clean layout.

I’ve been using highlow for a few years now and I never had a problem. Highlow publishes their number of trades on the homepage. There are millions of trades on this broker each month.

I use the main platform which is web based. This means, that you don’t have to download any software. This platform is stable and safe (they use SSL).

I have also tried the ios app and the android app. They are great, but I just don’t like trading on smartphones in general.

The payouts on highlow are amazing (up to 200%, which is more than on other brokers).

Highlow is a great broker for cryptocurrencies (but only if you are not from EU,UK, US). They have a good reputation, great support team and awesome promotions for new traders.

- Trade bitcoin & other cryptos

- Minimum deposit is only $50

- Regulated and trusted platform

- Fastest signup process (no questionnaires)

- Multiple account currencies

- Free demo account (no registration needed)

Nadex – US traders welcome

Nadex is a CFTC regulated broker. In fact, this is probably the only US broker that has this regulation.

Only US traders are allowed on nadex. Non-US traders check out the next broker.

Update OCTOBER 2019: looks like nadex removed crypto trading. After contacting them I found out that they will add it back soon. Register on nadex now and get updated when they add it.

Recently, nadex started offering bitcoin trading.

- Trade bitcoin, forex or binary options

- Minimum deposit is $250

- CFTC regulated broker

- Great support team

- Many payment methods (even paypal)

Crypto brokers with most cryptocurrencies

Here are the most popular cryptocurrencies offered by cryptocurrency brokers:

- Etoro – bitcoin, ethereum, litecoin, dash, ethereum classic, NEO and ripple.

- Plus500 – bitcoin, ethereum, litecoin, bitcoin cash, ripple, IOTA.

- Avatrade – bitcoin, ethereum, ethereum classic, ripple, dash, bitcoin cash litecoin, monero and NEO.

Lowest minimum deposit brokers

These are the best brokers with low minimum deposit requirements:

- Etoro – $200

- Plus500 – $100

- Avatrade – $100

This is really important because the crypto market itself is unregulated. Depositing on a regulated broker means that your money is safe.

We’ve also looked at the support team and the payment methods. You can deposit easily using multiple payment methods on the brokers below.

Top rated brokers that have cryptocurrencies

While we are all familiar with the broad definition of a broker, is there something more to it when it comes to cryptocurrencies?

Simply put, a cryptocurrency broker refers to a website that traders will visit to trade cryptocurrencies at a set price. In many ways, they are similar to forex brokers whose services are a lot more familiar to the general public.

Etoro disclaimer: 71% of retail CFD accounts lose money.

You still can’t decide which broker is best for you?

How to choose your cryptocurrency broker

Is leverage really necessary? Cryptocurrency markets are volatile in nature with prices fluctuating immensely thereby generating high profits even in the absence of leverage. But for some traders, the desire for more earnings justifies the use of leverage.

Before choosing your broker, settle yourself on whether the already immense profits that come from a cryptocurrency market are enough for you or you would like to use leverage to enhance them even further, bearing in mind, of course, that will also significantly increase the risk factor to your funds.

Negative balance protection: it is always advisable to trade with a broker that affords the negative balance protection facility. That way, you will never be at risk of losing more than what you invested in case you sustain very heavy losses.

How suitable is the required capital for you? This is another subjective part to your decision. Do you prefer trading with a small capital or bigger one to help you zero in on bigger returns? Find out what size trades your broker is offering before you open an account.

Narrow spreads for the win: let us be honest, it is only fair that your broker gets a cut from the money you generated having provided you with the essential facilities for it and all. But let us be honest, you definitely want every last dime for yourself.

A spread refers to the difference between the buying price and selling price of a trade and it varies with each broker. The spread is what counts as fees for your broker so the smaller it is, the lower the cost will be on your part.

Lets go into what aspects you as a trader must consider when choosing a broker to trade cryptocurrencies.

Which cryptocurrencies are you interested in trading?

Make sure you have decided on which cryptocurrencies you want to trade in before signing up with your broker.

If your choice is a prominent cryptocurrency like bitcoin (official site), litecoin (official site), or ethereum(official site), there will be a relatively broad availability of brokers that have trading options for those. However, less prevalent examples like monero, IOTA, or zcash may be a little harder to come by.

So study the cryptocurrencies being offered by a broker before you sign up for an account.

Pros and cons of cryptocurrency brokers

Here are some features that these broker have or don’t:

pros

- Signup up with a crypto broker is probably the fastest way to get started with cryptocurrency trading

- If you are less tech-savvy then a broker is safer for you

- You can start buying cryptocurrency while traditional exchanges don’t always accept this payment method

- Most of the time you can’t withdraw cryptocurrencies from a broker. You have to exchange it back to fiat money (USD/EUR etc.)

Cryptocurrency brokers – what to look for

Here are some of the more understated details about your cryptocurrency broker that could make your trading experiences so much more efficient and successful.

1. What are the weekend hours like?

This is a key detail that distinguishes cryptocurrencies from other prominent trading markets like forex, futures, and equity. Cryptocurrency brokers operate during the weekends as well.

There is virtually no difference in purchasing bitcoin at the end of the week as opposed to the middle of the week during peak hours.

But there is a catch. While digital currency exchanges are available during the weekend, your broker may not (why is the stock market closed on the weekend?). So in effect, if there is considerable movement within your relevant cryptocurrency market during a weekend when your broker is not operating, you may not have the ability to respond in any way.

2. How is it hedging?

Your broker is probably not keen on revealing if it is hedging cryptocurrency traders but it is important information for you to know.

Why is it so important for you to know?

Because, as a trader, you want to be absolutely in the clear regarding the policies for risk management being followed by your broker. Let us not forget that cryptocurrency markets are extremely volatile and an unhedged broker is more easily prone to major losses incurred by its clients. Naturally, those costs will warrant compensation via fatter spreads and additional costs for traders. It will be best to sign up with a broker that will not withhold the relevant information from you.

More great features you could be interested in

Commissions and trading on margin – an important thing to note while trading cryptocurrencies is that their prices tend to be more similar to equities than they are to real currencies. So your broker could be charging you commissions in addition to a wide spread on each trade. That, of course, raises the cost probably a bit much for your liking.

Another similarity with equities is that the margin conditions with cryptocurrencies are significantly more than they are with forex or cfds. Consequently, leverage is usually up to 10x. How considerable the margin rate will be for traders is down to what trading strategies and risk management they subscribe to.

Authenticity of market data – aside from merely evaluating how it influences spreads, market data for cryptocurrency CFD prices can be a good indicator of how the quality of the product will be in the future.

One of the more recent examples of this is BTC-e which was an immensely popular platform for trading bitcoin before it was shut down by feds. BTC-e was the first bitcoin exchange to incorporate forex trades and so made their exchange accessible via MT4 and supplied cryptocurrency liquidity for brokers.

But once it was shut down, every broker that depended squarely upon BTC-e was left with no hedging options or market data to put a price on its crypto cfds.

Are short sales available? For many traders, shorting is a crucial strategy option, the lack of which can be a deal breaker with a potential broker. Many brokers tend to offer ‘long’ only since there are only a few hedging solutions when opening short trades.

As you see, investing in cryptocurrencies can be a truly lucrative venture for you but only if you get it right.

And a lot of that is down to which broker you decide to trade with.

Ready to start trading?

Trade with the cryptocurrency brokers listed above to make sure that your money is safe, you pick a broker with a stellar reputation and you keep the fees low. Excel at trading bitcoin by creating your own trading strategy.

These cryptocurrency brokers make it really easy to trade bitcoin and other coins. You don’t have to be a trading expert. It helps if you know what a blockchain is or how the ledger and transactions work, but this is all optional.

Sign up now and see for yourself how easy it is to get started.

Best bitcoin brokers for USA

If you are from the USA you might have experienced certain restrictions on many internet platforms concerning US citizens. On some sites people from the USA cant even signup, on others there are restrictions in terms of money transfers and payment options.

On this page you find the bitcoin brokers where you are officially allowed to trade as a US citizen and/or resident.

Brokers / exchanges where US traders are allowed:

- Bitcoin purchase

- Altcoin purchase

- USD, EUR supported

- Regulated & secure

- No margin trading

- Bitcoin purchase

- Crypto trading

- No service for:

NY & WA state - 5x leverage

- Bitcoin purchase

- Bitcoin trading

- Altcoin trading

- USD, EUR, GBP, RUR

- No margin trading

- Bitcoin purchase

- Altcoin purchase

- USD,EUR,GBP

- High liquidity

- No margin trading

- Bitcoin purchase

- Altcoin purchase

- USD, EUR supported

- Trusted exchange

- No margin trading

In the USA there is no uniform legislation for trading and brokerage services. However, there are general national supervisory authorities through which companies offering money services must be registered and licensed. The extent to which these services may then be offered in the individual states is again subject to the legislation of the respective state.

In some states companies need a money transmitter license to be allowed to bring certain services to the market, in others not. Also, the requirements for such licenses differ from state to state.

Especially with regard to derivatives trading and cryptocurrencies, however, there are the national supervisory authorities CFTC, SEC and FINCEN. The former is the authority that generally approves and classifies cryptocurrencies. Currently, cryptocurrencies are classified as commodities by the CFTC.

The SEC, in turn, is responsible for regulations within the futures and derivatives trading market and allows US americans to trade cryptocurrencies only with low leverage. This generally applies to the whole USA.

The FINCEN is the anti-money laundering supervisory authority, which is primarily responsible for ensuring that all financial transactions are registered and transparently traceable. Therefore, US americans, no matter from which state, are only allowed to use trading platforms and exchanges with full ID verification, also with regard to cryptocurrencies.

A separate problem in the area of brokerage services are corresponding fees, which can be charged by the individual US states. In some cases, the fees are simply so high that it is not financially worthwhile for cryptocurrency trading companies to offer their services there. Especially because the brokers are also not allowed to offer trading with higher leverage, which would bring them higher turnover that could potentially cover the high fees more easily.

Let's take a closer look at the trading opportunities and background of bitcoin brokers available for people from the USA.

Best cryptocurrency broker USA

Etoro

Etoro is one of the largest and best-known trading platforms for financial products, which can be used by retail traders in particular.

Etoro's offer is particularly comprehensive as the broker is known for its social trading concept among many other interesting features. Traders can share trading strategies and imitate successful traders.

Etoro may be used in the USA. However, there is one major restriction: the leverage of up to 1:2 which etoro offers for crypto trading is unfortunately not valid in the USA as the broker doesn't offer CFD margin trading in the united states.

However, investors can easily buy and sell cryptocurrencies (spot market trades). Bitcoin and other cryptos can be stored on etoro's secure in-house crypto wallet or they can get sent away from etoro's custody service to any external wallet of the user's choice. So in contrast to couple of years ago traders can now actually buy the underlying assets on etoro.

The cryptocurrencies available on etoro are BTC, ETH, EOS, LTC, XRP, BCH, DASH, NEO, ETC, ZEC, ADA, XLM, BNB, TRX, MIOTA

The international broker generally has relatively low fees compared to other large international brokers.

- Payment methods: ACH / wire transfer

- Leverage: none

- Trading fees: spread only*

- Deposit/withdrawal fees: no fees!

- Demo accounts!

*etoro maintains a transparent pricing policy — you will never be charged hidden fees. The spreads below are the minimal spreads and are not guaranteed, and will vary according to market conditions and liquidity. Spread updates will always apply to open positions. The cost generated from the spread will be charged at the closing of a position.

- BTC: 0.75 %

- ETH: 1.90 %

- BCH: 1.90 %

- BCH: 2.45 %

- BCH: 2.90 %

- BCH: 1.90 %

- BCH: 1.90 %

- BCH: 2.90 %

- BCH: 4.50 %

- BCH: 2.45 %

Kraken.Com

Kraken is one of the oldest bitcoin trading platforms at all (already founded in 2011). Today, in addition to bitcoin, a variety of altcoins can be bought there and traded for profit. Kraken is one of the few platforms that are available to US americans, although this is not yet true for all states, but for most.

The big cryptocurrency exchange which is available in countries all over the world has spared no effort to offer its services in the USA. Due to the adversities mentioned above, kraken is not yet available in 100% of all US states, but in many. Residents and citizens of the USA are allowed to use the trading services of kraken.Com, with the exception of new york (NY) and washington (WA) as stated here.

Kraken is commonly considered the safest bitcoin exchange in the world.

- Payment methods: bank transfer

- Leverage: up to 1:5

- Trading fees: 0.0% to 0.26%

- Deposit/withdrawal fees: may occur depending on payment method

Cex.Io

Cex is a large bitcoin exchange founded in 2013 which has been operational in a few US states since 2015. In the meantime, however, CEX has already acquired a license in about 30 countries. The goal is to reach all states in the next years.

On CEX.Io bitcoin (BTC) can be bought with money. As far as we know they used to have a slight leverage of up to 1:3, but we can't find this feature anymore at the moment.

Arkansas, arizona, alaska, colorado, california, district of columbia, delaware, iowa, indiana, kentucky, kansas, maryland, michigan, massachusetts, mississippi, minnesota, montana, missouri, nevada, new mexico, new hampshire, pennsylvania, oklahoma, south dakota, rhode island, utah, wyoming, wisconsin and west virginia.

- Payment methods: credit card, bank transfer, cryptocurrencies

- Leverage: none

- Trading fees: 0.1% to 0.2%

- Deposit/withdrawal fees: 1% to 5 %

Coinbase

Coinbase is certainly one of the most famous names among the bitcoin exchanges. The US-based company can apparently be used by USA americans with only a few restrictions, we can't find any exact information about excluded states, except hawaii. There coinbase seems not to be licensed.

In general the stock exchange can be used in the USA, canada and europe. The platform does not offer margin trading, but this is available on its separate broker platform coinbase pro. Coinbase pro is available in 23 states and offers a leverage of up to 3x. The states supported by coinbase pro are currently:

Florida, texas, illinois, new jersey, virginia, georgia, arkansas, arizona, oregon, connecticut, new hampshire, massachusetts, nebraska, north carolina, oklahoma, colorado, kansas, maine, south carolina, utah, wisconsin, wyoming, west virginia.

- Payment methods: bank transfer, credit card, debit card

- Leverage: none

- Trading fees: 1%

- Deposit/withdrawal fees: may occur depending on payment method

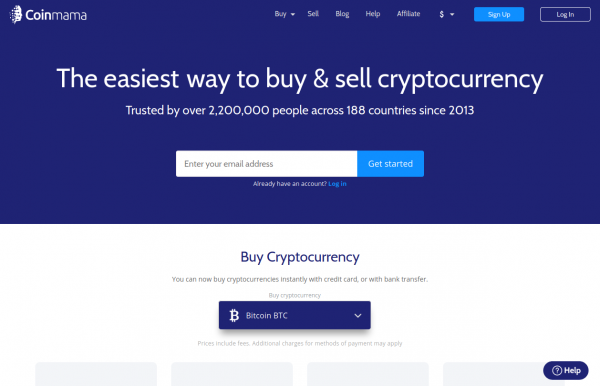

Coinmama

Coinmama is also an exchange with many years of experience, it has been operating since 2013, and in the USA the exchange is only available in a few states, which according to coinmama include alaska, delaware, georgia, north dakota, ohio, oklahoma, rhode island, wyoming. Apparently there are more states, but they are not mentioned by name on the website of the exchange, only in a suggestive way.

On coinmama, bitcoin and the 9 largest altcoins can be bought and sold (spot market trading). Coinmama does not offer leverage or margin buying.

The altcoins available for purchase are EHT, BCH, ETC, ADA, LTC, QTUM, XRP, XTZ und EOS.

Coinmama enjoys a high level of user confidence due to its experience and seriousness. However, the fees are extremely high.

- Payment methods: bank transfer, credit card, debit card

- Leverage: none

- Trading fees: 5.9% (already included in prices)

- Deposit/withdrawal fees: 5% credit card fee

Is cryptocurrency regulated in the USA?

In the USA bitcoin and cryptocurrencies are so far not strictly regulated. Fiscal and by the financial supervisory authorities bitcoin and/or cryptocurrency is classified as commodity. Fiscal revenues and conversions by cryptocurrencies are thus treated like commodities. The acquisition, possession and sale of crypto currencies is accordingly likewise completely legal. What is not legal, however, is the trade of bitcoin and cryptocurrencies as CFD, which excludes the trade with high leverage in the USA.

As the simple buying and selling as well as the possession of crypto currencies are allowed in the USA, crypto exchanges can also offer their services to US americans. Only CFD brokers are not allowed to accept US citizens for the reasons mentioned above.

The U.S. Senate is currently discussing the regulation of bitcoin and crypto currencies, but no further legislation has yet been agreed upon. For the upcoming next term of office of the new government, however, further regulatory legislation is planned with regard to bitcoin and other crypto currencies.

It is currently being discussed that the crypto industry is to be generally supported in order to be able to take on a leading role here on the world market. On the other hand, however, stricter regulations are planned with regard to the prevention of money laundering and the secrecy of assets.

Websites in the field of financial services often have restrictions for US citizens

But many people think that the real reason is rather that the authorities want to make sure that those massive amounts of gambling and trading money stays within the country. This of course has to do with getting the taxes concerning such transactions, but also to keep the money within american companies on US territory and not to lose it to the chinese or russian market or whatever.

Bitcoin trading sites for USA

This reason sounds fairly possible – but whatever the reason may truely be – you want to be able to trade bitcoin without any limitations. Fortunately there are quite a few bitcoin brokers which allow US citizens to signup, deposit and trade, exactly like people with any other nationality. So just check out the broker list above and compare their different features according to your needs.

Best cryptocurrency brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best crypto platform for most people is definitely etoro.

Many people believe that cryptocurrencies are the future of finance. When you’re ready to leap into crypto, choosing a broker to trade or invest in cryptocurrencies is one of the most important steps to your success in the crypto market.

Get started now with benzinga’s picks for the best cryptocurrency brokers to choose the right one for you.

Best crypto brokers and trading platforms:

- Best for social trading: etoro

- Best for ease-of-use: gemini

- Best for new investors: coinbase

- Best for gold investments: itrustcapital

- Best for high volume forex traders: cryptorocket

- Best for accessibility: altrady

- Best for multiple exchanges: voyager

Best crypto brokers

Since different brokers have different strengths, you need to figure out what kind of broker best suits your cryptocurrency interests. Some brokers provide a social trading platform where you copy other cryptocurrency traders’ trades in your own account. Others can offer the ability to make transactions in a broader selection of altcoins.

Choosing the best crypto broker depends largely on addressing your needs as an investor or trader. The following list crypto brokers been selected for different reasons to meet the needs of differing cryptocurrency trading and investing styles.

Commissions

Account minimum

1. Best for social trading: etoro

Etoro fundamentally changed the way many people trade and invest with its social trading platform. Social trading involves mirroring another trader or investor’s transactions in a special social trading account. While you make the same amount proportionally as the trader you’re copying, you also take the same percentage of losses the trader takes in their account.

In addition to its regular crypto trading platform, etoro offers an advanced cryptocurrency exchange platform called etorox. This platform is designed for algorithmic traders and institutional grade investors. It offers traders access to tight-dealing spreads, and its algox application programming interface (API) can be used to create custom automated trading tools.

Commissions

Account minimum

2. Best for ease-of-use: gemini

Stay on top of market trends, build your crypto portfolio and execute your trading strategy with gemini’s easy-to-use tools. The gemini app is available on all the major app stores, and it puts the industry’s best crypto exchange and wallet in your hands.

Gemini’s app is easy to use. You can track asset prices and real-time market prices and set price alerts so you can act fast on price movements for individual assets. You can also schedule recurring buys on bitcoin and other cryptocurrencies.

Invest with peace of mind with gemini’s solid cybersecurity and custody solutions. Create a free account and make your 1st buy in as little as 3 minutes.

Commissions

Account minimum

3. Best for new investors: coinbase

Coinbase is 1 of the largest and oldest cryptocurrency exchanges. It currently services 35 million customers worldwide. Coinbase has extensive educational resources and an intuitive interface ideal for new traders and investors.

The exchange also provides clients with a hosted wallet and offers global customer support. Coinbase is an excellent choice for those new to the cryptocurrency market who do not wish to use social trading services.

Commissions

Account minimum

4. Best for gold investments: itrustcapital

Itrustcapital is 1 of the few cryptocurrency brokers that lets you trade and hold physical gold in your individual retirement account (IRA). You can also trade bitcoin (BTC), ethereum (ETH), litecoin (LTC) and bitcoin cash (BTH) in your IRA. Itrustcapital provides you with a personal wallet by curv for your crypto transactions.

While itrustcapital has no minimum trade or account size, the company charges account holders a flat fee of $29.95 per month. This amount includes all IRA fees, asset custody charges and access to its trading platform, although all cryptocurrency trades carry an additional 1% transaction charge based on the trade size.

If you’re planning for your retirement and want to add physical gold to your cryptocurrency portfolio as an inflation hedge, then itrustcapital is a solid choice.

5. Best for high volume forex traders: cryptorocket

Cryptorocket offers straight through processing (STP) to its trading clients. This means you deal directly with the crypto and forex markets and not through intermediaries or market makers. This broker model is ideal for high volume forex traders who tend to be sensitive to dealing spreads.

In addition to the 35 crypto pairs offered, you can trade 55 fiat currency pairs, 64 major stocks and 11 indices. If you are based in a jurisdiction with relatively lax retail forex trading regulatory oversight, you may even be able to take advantage of cryptorocket’s 500:1 maximum leverage ratio for forex trades.

Cryptorocket also supports the popular 3rd-party metatrader4 trading platform.

6. Best for accessibility: altrady

Altrady is built by crypto traders for crypto traders. It makes cryptocurrency trading accessible for beginner, intermediate and advanced traders.

You can get the tools that professional crypto traders use without the expensive price tag. Altrady’s platform is intuitive and easy-to-use. Its crypto trading software platform adapts to your needs.

It combines 10 connected exchanges. It also offers immediate price alerts, portfolio manager, break-even calculator, and customizable trading pages by allowing traders to manipulate widgets to create preferred layout in order to trade comfortably, limit ladder order, gain quick access to market tabs, and integrated market scanners.

Commissions

Account minimum

7. Best for multiple exchanges: voyager

Voyager connects to more than a dozen of the most trusted and secure crypto exchanges so you have access to the largest crypto trading market available anywhere. Voyager gives you faster, more reliable execution, plus:

- Access to multiple exchanges: voyager partnered with over a dozen of the most trusted and secure crypto exchanges and liquidity providers. Voyager’s exchange connectivity offers you competitive prices on your trades and faster, more reliable execution.

- Commission-free trading: voyager operates commission free to save you money. You save money on trades through its extensive crypto market and best execution technology. Voyager achieves price improvement on over 90% of customer orders.

Start trading at a better price today! Download the voyager app today.

Crypto advantages vs. Disadvantages

Trading and investing in cryptocurrencies often carry a considerable degree of risk, as you may have observed given the volatility of bitcoin and some other digital currencies. Despite the disadvantages currently associated with cryptos versus fiat currencies (like lower liquidity and minimal payment options), the advantages of holding cryptocurrencies will increase as they become a more common form of payment.

Here’s a quick shot of crypto advantages and disadvantages.

Advantages

- Security. Technology advances typically lead to increased intrusion into your privacy. In contrast, all identities and transactions are strictly secured in the digital currency environment. While most cryptocurrency transactions are very secure, you still could be vulnerable to cybercriminal actions, like hacking.

- Low transaction fees. Because of the elimination of intermediaries like financial institutions, cryptocurrency transaction fees are generally quite low.

- Decentralized. The lack of a central exchange or authority overseeing cryptocurrencies is one of their defining characteristics. Many people consider this among the biggest advantages of cryptocurrencies and blockchain technology.

- High potential returns. You only have to look at a long-term bitcoin price chart to get an idea of the returns you can make investing wisely in digital currencies. The crypto world is still developing and expanding, so investing in the right digital currency now could translate into considerable returns in the future.

Disadvantages

- Acceptance. Because digital currencies have not yet become mainstream, most businesses will not accept them as payment for goods or services. This situation will eventually change as public perception makes digital currencies more acceptable as forms of payment. For example, paypal has recently allowed customers to hold bitcoin balances and has plans to allow payments using that cryptocurrency by early 2021.

- Volatility. The market volatility observed in some digital currencies can lead to large gains or large losses. Trading and investing in crypto is not for everyone, especially those with a low pain threshold or aversion to risk.

- Taxes. The internal revenue service (IRS) states on its official website that “virtual currency transactions are taxable by law just like transactions in any other property.” that IRS web page also links to a guide about how existing general tax principles apply to transactions made using digital currencies.

- Illegal activities. Due to the fact that digital currency transactions generally provide identity security, many people operating outside the law are thought to use digital currency for illegal activities. These activities could include money laundering, “dark web” transactions, and drug and human trafficking.

Cryptocurrency vocabulary

Like many other financial markets, the cryptocurrency market has evolved its own jargon. Some of the key terms used by market operators are defined below.

- Block. A collection of transactions permanently recorded on a digital ledger that occur regularly in every time period on a blockchain.

- Blockchain. A constantly growing list of blocks in a peer-to-peer network that records transactions.

- Cryptocurrency exchanges. Also called digital currency exchanges, these generally consist of online businesses that allow customers to exchange cryptocurrencies for fiat currencies or other cryptocurrencies.

- Cryptocurrency wallet. A secure digital account used to send, receive and store digital currencies. Crypto wallets can either be cold wallets that are used for storing cryptos in an offline environment or hosted wallets that are hosted by 3rd parties. Hosted wallets store your private keys and provide security for your digital currency balances.

- Distributed ledger. A network of decentralized nodes or computers that connect to a network where transaction data is stored. Distributed ledgers do not have to involve cryptocurrencies and can be either private or permissioned.

- Fork. Also known as a “chain split,” a fork is a split that creates an alternate version of a blockchain that then leaves 2 blockchains running simultaneously. For example, bitcoin and bitcoin cash came about due to a fork in the original bitcoin blockchain. Another type of fork is known as a “project” or “software fork.” this occurs when cryptocurrency developers take the source code of an existing altcoin project and create a new project. For example, litecoin is a project fork of bitcoin.

- ICO. An initial coin offering (ICO) occurs when a new digital currency or token is sold, typically at a discount, to its first set of investors. An ICO lets issuing cryptocurrency companies raise funds from the public to support their coin’s development and maintenance.

- Mining. A computationally-intensive process performed within a cryptocurrency network where blocks are added to the blockchain by verifying transactions on its distributed ledger. Miners are rewarded with digital coins as compensation for their successful computational efforts.

Are you ready for the future?

Digital currency and the blockchain appear to be the future of finance. Despite their current typical volatility and lack of widespread acceptance as a payment method, cryptocurrencies seem destined to become increasingly used for online payments. They could therefore make an interesting long-term investment, especially if you have a strong appetite for risk.

Where we will be in 20 years is anyone’s guess, but cryptocurrencies and blockchain technology show growing promise as forces to be reckoned with in the financial world. Get started today with 1 of our recommended crypto brokers.

Try gemini

Gemini builds crypto products to help you buy, sell, and store your bitcoin and cryptocurrency. You can buy bitcoin and crypto instantly and access all the tools you need to understand the crypto market and start investing, all through one clear, attractive interface. Gemini crypto platform offers excellent account management options. You can manage your account at a glance, view your account balance 24-hour changes and percent changes. Get started with gemini now.

Top 10 online cryptocurrency trading brokers

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

- World's leading social trading platform

- Proven track record of security

- Unlimited daily withdrawals

- Min. Deposit of $200 to get started

- Instant trade execution

With over 30 years of trading experience and trades in over 50 countries, city index is a leader in spread betting, CFD and forex trading. Trade in 12,000+ global markets including bitcoin, indices, shares, forex and much more.

- Trade on 12,000+ markets including bitcoin

- Trade anytime, anywhere. Across all devices

- Risk management & transparent pricing

- Fast execution on every trade

Thanks to an excellent reputation, high trading standards, and multilingual customer care, avatrade has become one of the industries leading brokers. Offering highly competitive spreads on a wide variety of trading investments.

- Get up to

14,000 bonus - No commission/no exchange fees

- Trade a wide variety of crypto cfds

With markets.Com get ZERO commission trading on cryptocurrency, forex and commodity cfds with one of the most sophisticated trading platforms in the industry.

- No commission trading

- Use paypal to trade bitcoin futures

- Advanced innovative trading platforms

Easymarkets was formed by bankers and forex experts and has been serving the forex market for 16 years, with transparent pricing, fixed spreads and no commissions on deposits or withdrawals. Now with cryptocurrency cfds!

- Demo account is unlimited

- Trade bitcoin with no slippage - ever!

- No commissions or sneaky fees

T&C's apply to each of the offers above, click "visit site" for more details.

Risk warning: users should be aware that all investment markets carry inherent risks, and past performance does not assure future results. Trading of any kind is a high-risk activity, and you could lose more than you initially deposited. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 73-89% of retail investor accounts lose money when trading cfds. Please be sure you thoroughly understand the risks involved and do not invest money you cannot afford to lose. Your capital is at risk. Advertiser disclosure: topbrokers.Trade is an independent professional comparison site funded by referral fees. The compensation topbrokers.Trade receives is derived from the companies and advertisements featured on the site. Due to this compensation, we can provide our users with a free comparison tool. Unfortunately we are unable to list every broker or exchange available, however, we do our best to review as many as possible.

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

With over 30 years of trading experience and trades in over 50 countries, city index is a leader in spread betting, CFD and forex trading. Trade in 12,000+ global markets including bitcoin, indices, shares, forex and much more.

Thanks to an excellent reputation, high trading standards, and multilingual customer care, avatrade has become one of the industries leading brokers. Offering highly competitive spreads on a wide variety of trading investments.

How to get started in cryptocurrency trading

As the trade volumes are reaching billions of dollars a day and the market caps are hitting tens of billions of dollars, it is no wonder that cryptocurrencies fuel the modern day gold rush. Today is an age of digital currencies, with hundreds of cryptocurrencies birthed within the decade. There are already more than a thousand cryptocurrencies in the market, and almost daily a new initial coin offering (ICO) appears.

What is cryptocurrency?

Today, the most famous cryptocurrency is bitcoin. Its inventor attempted to build a “peer-to-peer electronic cash system”. Many have tried this system many times before. However, the main difference between bitcoin and the previous efforts, like digicash, was that it was to be entirely decentralized. Since no overarching entity is controlling the currency, the notion of “trust” would be eliminated from the system.

To combat “double spending”, the major problem in all the digital cash systems at that point, satoshi nakamoto, bitcoin’s inventor, proposed the blockchain technology. The blockchain technology is a revolutionary technology that records all the transactions made with this currency.

For any single balance, transaction, or change to the network to take place, there needs to be a consensus amongst those who validate the network – the miners. Since the invention of bitcoin, many programmers have attempted to use the model and change it to provide what they consider a more functional form of digital cash.

The other kinds of cryptocurrencies include monero, new economy movement, litecoin, and ether. Many of these cryptocurrency efforts tailor their currency for an individual and particular purpose. Some of the most common purposes are speed, privacy, and price.

What are cryptocurrencies used for?

Since cryptocurrency is such a new technology, it may be that people have not used it yet for its eventual use. Still, today people utilize it for many various purposes. These purposes include, but aren’t limited to the following: trading, remittances, payment for goods and services, investment, gambling, private monetary transactions, and as a hedge against national currencies which are suffering from rapid devaluation (greece, venezuela for example).

As the whole cryptocurrency space begins to expand, it’s likely that we will see some additional applications joining the list of purposes for the crypto currency. There are already young services such as steemit, which aims to revolutionize the way people pay for content on social media, in addition to services like musicoin which attempts to find a more equitable way to pay artists without the need for a middleman.

What is the difference between bitcoin and ethereum?

All cryptocurrencies have their own characteristics. However, recently one coin has come to challenge bitcoin more than ever before. Ethereum is the new player on the market. The reasons that it is a challenge to bitcoin are easy to understand.

Ethereum emerged as an effort to try to correct some of the main criticisms made towards bitcoin – especially regarding security.

What ethereum has accomplished to do was to provide transactions that are safer, more flexible contracts that are compatible with any wallet, with short block times for negotiating (where the confirmations are easier). Also, ethereum is available more than bitcoin. Whereas more than two-thirds of bitcoin has already been mined, access to ethereum is still widely available. Another main difference between these two cryptocurrencies is that ethereum allows for different developers to raise funds for their projects. It can, therefore, be in itself a kickstarter for some projects.

One of the main advantages to ethereum is that it’s a more secure, easy to use, flexible, and transact coin. In addition to this advantage, it has brought innovations in terms of entrepreneurship and investment. And this is posing a serious challenge to bitcoin’s market cap.

What is the difference between a cryptocurrency exchange and a cryptocurrency broker?

You can invest in cryptocurrency in two ways. First, cryptocurrency can be bought and sold at a cryptocurrency exchange and stored in a digital wallet. The second method would be to invest in crypto as a CFD with regulated cryptocurrency brokers. With CFD cryptocurrency trading, the digital currency is treated as a speculative investment and traded as a contract for difference (or CFD), through brokers.

Platforms that allow traders to buy and sell cryptocurrencies are cryptocurrency exchanges. Dues to the fact that it is a very recent – and booming – market, the majority of these platforms are relatively new. But, of course, one of the essential questions that people ask is how to know if a particular platform is safe or not.

The only way that you can find out is to check if the exchange provides transparent data of the coins that are in cold storage. What this means is, whether it has the reserves that it requires to provide liquidity to its activities. You can find check this easily by checking whether an exchange is regulated or not.

Trade cryptocurrency online using CFD services

If you are interested in trading because of the opportunity to profit from the incredible volatility of cryptocurrency, your best option is to use an online trading platform that allows CFD services. Currently, there are very few CFD platforms that allow this kind of trade, so to see available options refer to our recommendations above.

CFD brokers are a great option if you want to trade cryptocurrencies with the option to accept multiple forms of payment. If you want to buy cryptocurrency with paypal, you can, and these forums also accept major credit cards and wire transfers as well. Furthermore, if you choose to trade through a forex or CFD platform, you will pay the lowest commissions possible. That is in comparison to other investment alternatives. CFD and forex companies use an exchange rate that is an aggregate of different crypto exchanges.

Trading cryptocurrencies – getting started with cfds (contracts for differences)

Cryptocurrency cfds allow you to trade digital coins without actually owning any. Crypto cfds were generated to give traders exposure to the cryptocurrency market without the need for ownership.

Contracts for differences, also known as “cfds,” represent a contract between trader and exchange. Cfds declare that the difference between the price on entry and the price on exit will be a trader’s profit or loss. Basically, cfds are an agreement held between two parties that simulate an actual asset.

How to make money trading crypto

There are several ways to make money cryptocurrency trading. The most popular is trading bitcoin against the US dollar, known in market terms as the BTC/USD pair. The first method is to find a top cryptocurrency broker and to invest in a digital currency in the same way that you would do with a physical currency – by buying low and selling high. Since cryptocurrency is highly volatile, you should be able to identify the dip with studying and market research.

Read on to learn how to find the best cryptocurrency brokers. Be sure to review the platforms we suggest above, all are fully-registered and come highly recommended. For additional information regarding trading cryptocurrency as a CFD, check out our guide on “the basics of cfds“. It’s important that you remember that leverage works both ways and it will magnify the gains and losses.

How to choose the best cryptocurrency trading broker online

Because there’s so much competition in the market as well as having countless cryptocurrency brokers to choose from, it can be difficult to know which option will be best for you. Here are a few key points we suggest keeping in mind when deciding how to best invest:

Regulation

Each country has its own regulatory body. The regulatory body develops rules, services and programs to protect the integrity of the market. The regulators protect traders, and investors as well as the cryptocurrency brokers themselves. Their main obligation is to help members meet regulatory responsibilities. Due to potential safety concerns regarding deposit, you should exclusively open accounts with regulated firms.

Customer service

Cryptocurrency trading takes place 24 hrs a day, so customer support should be available at all times. Ideally, you will want to speak with a live support person rather than a time-consuming auto-attendant. Give a call to the customer service centre to get an idea of the type of customer service provided. Check on wait times and find out the representative’s ability to answer questions regarding spreads and leverage, trade volume, and company details.

Account types

Your ideal cryptocurrency trading broker should be able to offer either multiple account options or an element of customizability. Look for cryptocurrency brokers that offer competitive spreads and easy deposits/withdrawals.

Currency pairs

Cryptocurrency brokers can provide a selection of cryptocurrency pairs. However, it is most important is that they provide the variety of pairs that interest you. While there are many digital currencies available for trading, there are only a few get the majority of the attention, and as the result, trade with the highest liquidity.

Platform type

The trading platform is the investor’s portal to the markets. With that in mind, look for a platform that’s easy to use, straightforward and offers an advanced collection of analytical and technical and tools. These features will help to enhance your trading experience.

Here at topbrokers.Trade, we take pride in providing the best possible trading brokers comparison, reviews and ratings. These reviews enable you to select the best trading platform for your needs. We don’t just help you to pick a great place to trade, but also do everything that we can, to show you how to get started. For more information on cryptocurrencies, please see our tutorial: the basics of cryptocurrency

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

Fxdailyreport.Com

Over the last few years, cryptocurrency trading has become one of the most attractive niches in forex trading. Other than it being extremely profitable, the lack of regulation is its biggest appeal. Still, cryptocurrencies like bitcoin, ethereum ripple, dash, and litecoin are dynamic, unstable instruments that need to be handled cautiously and in the most optimal way. To achieve this, you need to choose a trustworthy, well-established broker to carry out your cryptocurrency trading.

This is crucial to getting on the right track from the beginning when trading cryptocurrencies. When choosing a broker, it is important to note that not all are the same. A broker that meets the needs of another trader may not meet yours. Here are a few tips to help you choose the best forex broker for cryptocurrency trading:

- Regulation and reputation

To avoid dealing with an unprofessional broker and being scammed, you need to make sure all your crypto trades are made solely with a regulated broker. When choosing a forex broker to work with, make sure they are regulated within your jurisdiction to legally offer you their services. Regulated forex brokers are under constant supervision of the regulatory body. If you are in the UK, make sure to trade with a broker that is regulated by the FCA. If in europe, ensure they are regulated by the cysec. In case you are in australia, they should be regulated by the ASIC.

- An efficient trading platform

It is important to note that cryptocurrency trading is more volatile than forex. Therefore, it demands that the platform is superbly responsive to be able to make moves in time. A good broker’s platform should be efficient to use. To beat the competition, the best cryptocurrency brokers work to attract clients by creating an intuitive trading platform that is suitable for both experienced and new traders. They offer technical analysis tools and basic risk management features like take profit or stop loss. Other sites also offer additional features, including price alerts, social trading networks or advanced educational centers. The crypto trading platform should allow you to trade in the market manage your accounts, perform technical analysis, and receive the latest news on all cryptocurrencies.

Top recommended crypto forex brokers in 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: 0 spread: non-spread, fee 0.1% per trade leverage: non-leverage regulation: - | visit broker | ||

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $50 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

- Transparent fees and commissions

All brokers, whether trading crypto coins or forex, charge commissions and offer margin accounts to traders. A reliable forex broker for crypto coins should inform you precisely the type of fees and commissions they charge as well as the risks involved. The common fees and charges made by brokers include:

• wallet fees

• transaction fees

• trading fees

- Competitive technology

The last thing you want as a crypto trader is to get margin called simply because you could not log in to close an order. The cryptocurrency trading market is a 24/7 global market. The prices keep moving and are not limited to your time zone. Hence, when choosing a broker, you need to choose one whose platform offers full-time access.

For instance, when trading cryptocurrencies, mobile apps are a necessity as you may need to make or break deal-critical decisions throughout the day. If possible, consider using a reputable broker with a mobile app so that you are able to make successful trading decisions even while in transit.

- Access to crowd wisdom

Today, there are some broker platforms that let you leverage the wisdom of seasoned cryptocurrency traders. This feature can go a long way in improving your returns on investment. Such a trading platform lets you observe the hottest trading trends of other seasoned and successful traders in the market.

Digital currencies trading keeps growing in popularity by the day. More and more people, be it speculators or beginner traders want to be able to make key decisions on time, every minute. Therefore, they need to have a setup ready as soon as they are verified by a broker. When choosing a cryptocurrency broker to trade with, consider one that can quickly get you started so that you can begin trading with minimal downtime.

- User-friendly platform

This is one of the most important features to consider when choosing a trading platform to trade with. Digital money trading can be unclear, especially when a technical language is used. Also, because digital money works a little bit differently from any traditional money system. A good broker should be able to understand blockchain and cryptography terms. They should make an effort to explain it in their platform to make it easy to understand by a layman.

They should include clear notifications about the spreads offers, leverage available, deposit methods, the minimum cryptocurrency deposit to trade and the least amount that can be placed in a trade. Make sure you are able to establish all these details before registering with a broker.

- High-quality customer service

Cryptocurrency trading occurs 24/7. This demands the need for round the clock customer support. Better still, live support is highly preferred over auto attendants taking into consideration the intricacies involved in trading digital currencies.

- Deposits and withdrawals

Make sure to choose a broker that allows deposits and withdrawals through multiple platforms such as wire transfer, credit/debit card e-payment among others.

- Good financial backing

A good FX broker for cryptocurrency should have a sound financial backing. This ensures that your digital coins are safe and that the forex broker will not go bankrupt soon after signing up with them.

Cryptocurrency trading is a risky investment. New and fraudulent forex brokers for cryptocurrency trading are emerging every month, launching with crafty marketing campaigns intended to prey on an innocent investor. Therefore, ensure you proceed with caution. Cryptocurrencies are extremely volatile instruments to trade. So, ensure you are in the know of any breaking news, regulatory matters, and rumors which all dictate the market behavior. Above all, make sure you are working with a reputable, reliable and experienced broker.

While it would be easier to point a finger and tell you the best crypto broker, we know and understand that each client has different preferences. Be knowledgeable about all your options and think about how you can spot a broker that is safe now, and in the long-run.

Best online brokers for buying and selling cryptocurrency in january 2021

Advertiser disclosure

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How we make money.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure.

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

Share

At bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here’s an explanation for how we make money.

Editorial integrity

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.Com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, bankrate does not include information about every financial or credit product or service.

Cryptocurrency, especially bitcoin, has proven to be a popular trading vehicle, even if legendary investors such as warren buffett think it’s as good as worthless. Part of cryptocurrency’s popularity is due to its volatility, since these swings allow traders to make money on the price moves.

For example, at the start of 2017, the price of bitcoin broke through the $1,000 barrier. By the end of the year, the digital currency had reached nearly $20,000. Almost a year later, bitcoin was hovering around $3,200. But it sprung back to life in 2019, rising to more than $10,000 and has continued significantly higher since then — crossing the $20,000 level toward the end of 2020.

It’s this kind of price movement that has attracted traders looking to ride the waves to profit. While some traders like to own the currency directly, others turn to the futures market. Futures may be an even more attractive way to play the volatility of digital currencies such as bitcoin, because they allow traders to use leverage to magnify their gains (but also magnify losses).

Where can you buy and sell cryptocurrencies?

Traditional brokers have the advantage of offering a wide selection of investible securities, though typically you can’t trade bitcoin directly, only futures. Meanwhile, crypto exchanges are limited to digital currencies, though you can own the currencies directly and can often buy several, rather than simply bitcoin or bitcoin futures, as you would with a general broker. And paypal has also gotten in on the act, allowing U.S. Users to buy and sell cryptocurrencies.

Here are the best brokers for cryptocurrency trading, including traditional online brokers, as well as a new specialized cryptocurrency exchange. You might also want to check out which brokers offer the best bonuses for opening an account to determine where you can get a little extra.

Overview: best brokers for cryptocurrency trading

Robinhood

Robinhood is a great option for buying cryptocurrency directly. Not only that, you’ll get to take advantage of the broker’s wildly popular trading commissions: $0 per trade, or commission-free. And if you’re into more than just cryptocurrency, you can stick around for stock and ETF trades for the same low price. Robinhood’s slick app makes trading so easy, though those looking for a full-featured trading experience will be disappointed.

Commission: $0

Account minimum: $0

TD ameritrade

TD ameritrade is one of the top full-service brokers on the market, and not only does it offer access to traditional products such as stocks and bonds, but it’s expanded its offering to include bitcoin futures. However, TD ameritrade does not allow trading directly in the digital currency. You’ll need to meet the account minimum to get started with bitcoin futures. (charles schwab has purchased TD ameritrade, and will eventually integrate the two companies.)

Commission: $2.25 per contract

Account minimum: $25,000 for futures

Interactive brokers

Interactive brokers allows you to buy bitcoin futures rather than owning the currency directly. And in this broker’s case, you can actually buy futures on the chicago mercantile exchange, with all-in contracts costing $15.01 with five bitcoins per contract. In addition, interactive brokers brings its full suite of investment offerings, so you can buy almost anything that trades on an exchange.

Commission: $15.01 per contract

Account minimum: $0

Charles schwab

Charles schwab is routinely one of bankrate’s picks for top broker, and this investor-friendly company offers trading in bitcoin futures. Schwab also has no account minimum, but any futures contracts you trade will require some minimum margin to hold them open. Schwab offers an attractive commission of $1.50 per contract, and if you’re able to bring big money to the table, you’ll receive a welcome bonus, too.

Commission: $1.50 per contract

Account minimum: $0, futures margin depends on contract

Tradestation

Traders have a couple options at this broker, which has rolled out direct currency trading via tradestation crypto, with commission-based pricing for traders. Pricing is based on your account balance with the broker and whether your order is directly marketable. Normally pricing ranges from 0.25 percent of your order to 1 percent. Traders can also buy and sell bitcoin futures as well as take advantage of substantial volume trading discounts.

Commission: 0.25-1 percent

Account minimum: $0, but futures margin depends on contract

Coinbase

Coinbase is a specialized cryptocurrency-focused platform that allows you to trade digital currencies directly, including bitcoin, ethereum, litecoin and bitcoin cash. In total, you’ll have access to more than three dozen cryptocurrencies. You’ll also be able to store your coins in a vault with time-delayed withdrawals for additional protection. The exchange’s commission structure is steep. It charges a spread markup of about 0.5 percent and adds a transaction fee depending on the size of the transaction and the funding source.

Commission: at least 1.99 percent of the transaction value

Account minimum: $0

Bottom line

Whenever you’re selecting a broker, it’s important to consider all of your needs. And for new traders in cryptocurrency, you’ll want to figure out whether you want to own the virtual currency directly or whether you want to trade futures, which offer higher reward, but also higher risk.

You’ll also need to consider whether you want to trade more than bitcoin, which is what the majority of traditional brokers restrict you to. If not, you may want to turn to a cryptocurrency exchange, since they offer more choice of tradable cryptocurrency.

Fxdailyreport.Com

Over the last few years, cryptocurrency trading has become one of the most attractive niches in forex trading. Other than it being extremely profitable, the lack of regulation is its biggest appeal. Still, cryptocurrencies like bitcoin, ethereum ripple, dash, and litecoin are dynamic, unstable instruments that need to be handled cautiously and in the most optimal way. To achieve this, you need to choose a trustworthy, well-established broker to carry out your cryptocurrency trading.

This is crucial to getting on the right track from the beginning when trading cryptocurrencies. When choosing a broker, it is important to note that not all are the same. A broker that meets the needs of another trader may not meet yours. Here are a few tips to help you choose the best forex broker for cryptocurrency trading:

- Regulation and reputation