Forex trade and earn

To start, you must keep your risk on each trade very small, and 1% or less is typical.

Top forex bonus list

this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below. Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

How much money can I make forex day trading?

:strip_icc()/how-much-money-can-i-make-forex-day-trading-1031013_color-332300f659374e4b897904a35b4d64ae.gif)

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

How to make money with forex?

When am I ready to profit with forex?

Forex market is like any other market where instead of stocks or bonds people trade currencies and make money.

Trading in forex is popular low capital trading but you have to know how to make money with forex. The truth is that you don’t need a huge capital to get started. Also, the forex market is available 24 hours during working days, but you can’t trade over weekends. Maybe the most common truth about every single person that enters the forex market is that they are excited, eager to earn a lot, and fast, but only a few of them know how to make money with forex.

How beginners in forex trading look like?

They are excited by the possibility of quick money earning and becoming rich. Beginners will easily sign up on some platforms without doing the necessary research. They are entering a position like gambling putting money somewhere and somehow, random, without a strategy. Even more, they don’t know how to place a trade, when to enter the position, where to set stop-loss orders or limits, or take profit. Actually they know nothing. And what happens? After several days when everything invested is lost, they will conclude the forex is fraud and it is impossible to make money there. For them it is completely the truth. With this approach, they will never earn because they don’t know how to make money with forex.

The other side of the forex rainbow

Beginners could see successful forex traders. But they are using tested and well-checked strategies. The strategies that they have developed or discovered thanks to a lot of trials and errors made for a long time. Yes, that’s the way! You’ll have to make many trials and mistakes to understand forex trading and understand how to make money with forex.

Forex traders have a unique trading style, a unique system, and their own strategy. But they came up to them after deep research, hundreds of attempts, losing a lot of money before they found a profitable strategy that works for them and became successful traders. Well, we are sure that the most successful traders will never talk about their failures but now and then you can find someone ready to share that unpleasant experience. On the other hand, you’ll find a lot of them sharing their great stories about winning trades. Learn from them. Only the knowledge will allow you to make the proper strategy, consistent profits on it every single day. That is possible, of course. But you have to learn how to make money with forex. And here are some hints.

How to make money with forex?

If you are a complete beginner without knowledge but willing to start forex trading and make money from it, the first thing you have to do is to read reputable books. Sorry folks, but knowledge is MUST. The point with reading books is that you’ll obtain theoretical knowledge. It is extremely important to understand the financial markets, otherwise, you’re not able to trade them especially if you want to stay there for the long run.

Good places for sharing knowledge are social networks. Join as many groups as you can and start the conversation. Don’t be shy to ask whatever you need to get better knowledge. Professional traders are also members of such groups and often, they’ll be glad to answer you. Also, interact with other rookies and share your knowledge but dilemmas also. Ask elite traders about the effects of leverage. That could be a very interesting conversation where you could find that trading with excessive leverage could be dangerous. You don’t believe it? Well, using leverage is good but if you use excessive leverage in your trading strategy that can end up as a failure. Using excessive leverage might mean that you are not realistic in expected returns on your investments.

What is leverage in forex trading, in the first place?

In general, leverage enables you to increase the result of your trading efforts but without developing your resources. Leverage in forex will simply boost your account while you actually don’t have that money. You are borrowing it to trade with even 1.000 times greater amount than your capital is. That is giving you access to the larger volumes than it is possible with your initial capital.

We are sure that you noticed banners on the trading websites that offer trading with 500:1 leverage. Well, it’s time to explain this in more detail. As we said, leverage is a kind of loan that a broker gives you. You use leverage in margin trading. And here we come to an important point. But leverage isn’t quite a loan even if it is one of the highest that traders can take.

This thing goes right this way

When you enter the forex market, the first thing you have to do is to open a margin account with your broker. Depending on the broker, the amount of leverage can be 20:1, 50:1, 200:1, 500:1 even more. Also, the amount of leverage will depend on your position size. For example, a 100:1 leverage ratio indicates that you have to deposit on your margin account, let’s say, $1.000 to be able to trade $100.000 of currency. These 100:1 leverage or 50:1 are for the standard lot size . If your position is at $50,000 or less the leverage would usually be 200:1.

But compare these leverages with, for example, the 15:1 leverage in the futures market. Well, you might think this forex leverage is too risky. Keep in mind that currency values normally switch by less than 1% within one-day trading. So, this huge leverage is possible because of small changes in the prices of currencies. If currencies are changing more in price, the broker would never give you that much leverage.

More math on how does forex leverage work

Assume you have a small account with $1.000. A standard lot is 100.000 currency units. If you want to trade mini or micro-lots, this deposit size would allow you to open micro-lots. That is 0.01 of a single lot or 1.000 currency units with no leverage set in place. Nevertheless, you’re looking for a 2% return per trade, which is $20.

So, you decide to employ financial leverage to trade big. Your broker is giving you a leverage 200:1. This means you can open a position as large as 2 lots. To make the long story shorter, let’s do some math .

$1.000 x 200 leverage = $200.000

This equitation shows that you actually have a maximum size position of $200.000. That is 200 times the size of your deposit. So, instead of earning $1, you’ll earn $200. Also, you can lose even faster.

Let’s follow our example, and assume you opened an order with a 1.00 lot. What will happen if the market goes against you? You will have minus 100 pips and lose $1000. Your order will be automatically closed. So, you will lose only your total deposit but you’ll not have money to continue. That’s why it is better to trade a smaller position to reduce the risks.

Use a stop-loss order to reduce risk

This one is probably most important. You can find hundreds of forex courses on the internet that promise you a strategy that will show you how to make money with forex every day. A lot of them are scammers, trust us. They just want your money for the low-quality courses. The better way is to start with some simple and easy strategy . It’s not hard to build a suitable strategy.

For example, you notice that the EUR/USD currency pair will rebound from a current support or resistance level. Your first strategy should be to take the benefit of this trend. Later, you can adjust this first strategy by adding some details that will improve efficiency. For example, set a stop-loss when the price goes down to a particular percentage or number of pips to exit the position.

Here is what you have to look out when creating a forex trading strategy.

Firstly, choose the currency pair. Pick it from the market you know, for instance, avoid currencies from exotic countries if you don’t know them well. If you trade only one currency pair you’ll have better chances to recognize trading signals . Also, your position size will determine the risk you are willing to take in every single position.

Further, find when to set your entry, will you go short or long. Never forget to set the exit level. You must know when to exit the position to maximize your profit and minimize potential losses.

Find when and how to buy or sell your currency pair.

Can you become rich with forex trading?

Some will tell you that it is impossible. And they would be right. The others will tell of course, and they would be right, also. The truth is that the forex market may give you a chance to earn a lot. This market is much bigger than the stock market, for example. Also, it offers the highest leverage possible in any market. Also, you can trade every day. In essence, the forex market is a place where small investors with small capital have a real chance to make fortune.

Trading forex is easy, but trading it with constant profit is difficult.

Opposite to what you’ve heard or read forex trading will not turn your $1.000 account into $1 million. The amount you can earn is determined by how much risk you want to take. If you want to know how to make money with forex, start with education. Sorry guys, it is necessary. When you learn the basics you can develop your skills further and you’ll start to make money for living by trading forex.

There are traders that are targeting even 100% profit per month. Yes, but the risk they are taking on is almost the same as the profit they are aiming for. In short, if you want to make a 100% profit per year, it’s possible to have a loss of 100% per year. Even if you are trading with an edge your profits will be small without leverage. On the other hand, with leverage, you can profit a lot, but you can produce extreme losses. The main point in forex trading is to buy a currency pair at a lower price and sell it at a higher price. The difference between is your profit.

For example, you have $1000 on your trading account and want to trade the EUR/USD pair with the exchange rate at 1.25. That means that for 1 euro you’ll take $1.25. Keep in mind that the prices are changing every day, from minute to minute. But you believe that EUR will increase versus the dollar.

Let’s assume, you buy 800 euros for your $1000. And the exchange rate changed from 1.25 to 1.35. That’s good for you, and you close the trade at this level and you can exchange your 800 EUR back to $1.080, and your profit is $80. But, if you used the leverage of 1:3000 you would get $24.000 in one single trade. So, you invest $1000 and trade $3.000 000! Pretty good!

Always keep in mind, if you want the higher profits you’ll have to take the higher risks.

Bottom line

One thing is completely true. If you never try you’ll never know how to make money with forex. With an account with just $1.000 and leverage of 1:100, it is possible to make a lot of money in a single trade. All you have to do is to have at least 1% of the trade on your margin account to use this leverage which is one of the most profitable. That is how to make money with forex.

Making money in forex is easy if you know how the bankers trade!

How to make money in forex?

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a chief trader its second knowledge how to extract cash out of the market. It all comes down to understanding how the traders at the banks execute and make trading decisions.

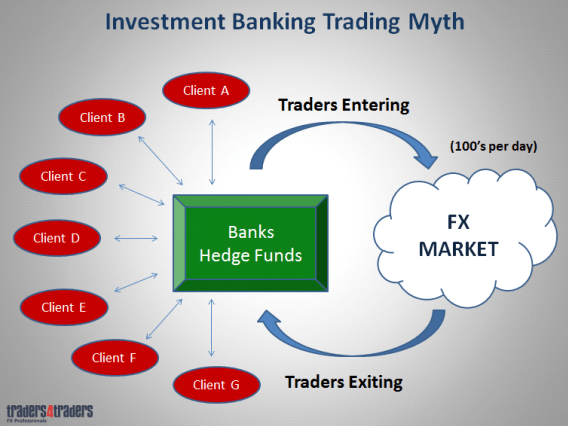

Why? Bank traders only make up 5% of the total number of forex traders with speculators accounting for the other 95%, but more importantly that 5% of bank traders account for 92% of all forex volumes. So if you don’t know how they trade, then you’re simply guessing. First let me bust the first myth about forex traders in institutions. They don’t sit there all day banging away making proprietary trading decisions. Most of the time they are simply transacting on behalf of the banks customers. It’s commonly referred to as ‘clearing the flow”. They may perform a few thousand trades a day but none of these are for their proprietary book

How do banks trade forex?

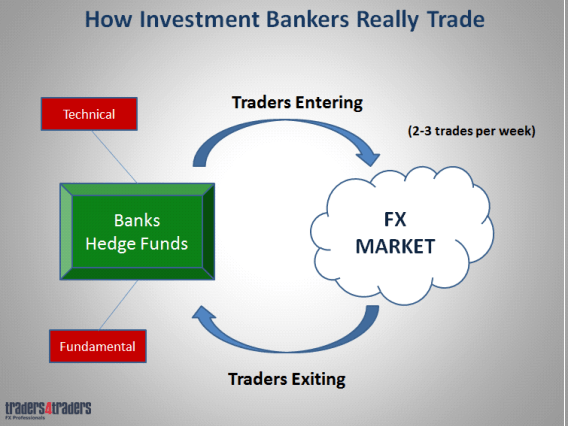

They actually only perform 2-3 trades a week for their own trading account. These trades are the ones they are judged on at the end of the year to see whether they deserve an additional bonus or not.

So as you can see traders at the banks don’t sit there all day trading randomly ‘scalping’ trying to make their budgets. They are extremely methodical in their approach and make trading decisions when everything lines up, technically and fundamentally. That’s what you need to know!

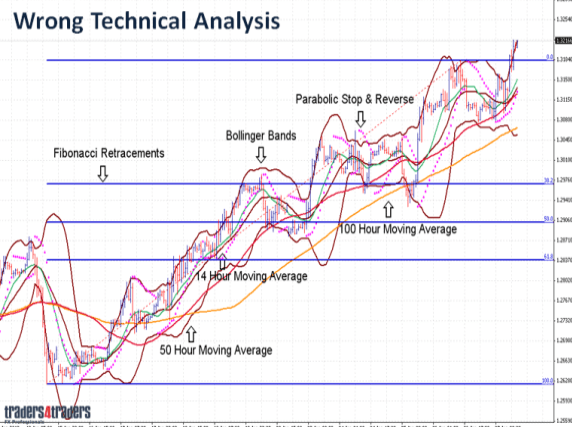

As far as technical analysis goes it is extremely simple. I am often dumbfounded by our client’s charts when they first come to us. They are often littered with mathematical indicators which not only have significant 3-4 hour time lags but also often contradict each other. Trading with these indicators and this approach is the quickest way to rip through your trading capital.

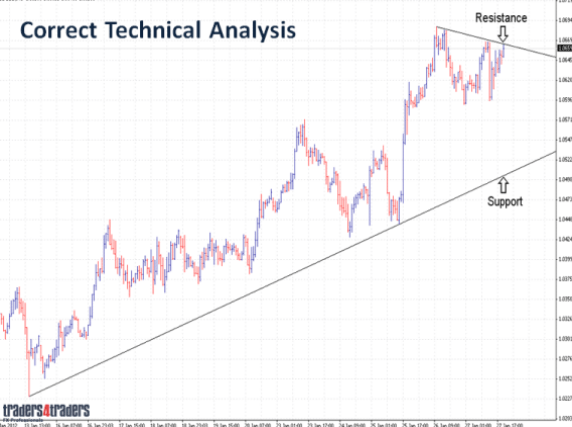

Bank trader’s charts look nothing like this. In fact they are completely the opposite. All they want to know is where the key critical levels. Don’t forget these indicators were developed to try and predict where the market is going. The bank traders are the market. If you understand how they trade then you don’t need any indicators. They make split second decisions based on key technical and fundamental changes. Understanding their technical analysis is the first step to becoming a successful trader. You’ll be trading with the market not against it.

What it all comes down to is simple support and resistance. No clutter, nothing to alter their trading decisions. Simple, effective and highlighting the key levels. I’m not going to go into the ins and outs of where they actually enter the market, but let me say this: it’s not where you think. The trendlines are simply there to indicate key support and resistance. Entering the market is another discussion all together.

How to make money in forex?

The key aspect to their trading decisions is derived from the economic fundamentals. The fundamental backdrop of the market consists of three major areas and that’s why it’s hard to pin point currency direction sometimes.

When you have the political situation countering the central bank announcements currency direction is somewhat disjointed. But when there are no political issues and formulated central bank policy acting in accordance with the economic data, that’s when we get pure currency direction and the big trends emerge. This is what bank traders wait for.

The fundamental aspect of the market is extremely complex and it can take years to master them. This is a major area we concentrate on during our two day workshop to ensure traders have a complete understanding of each area. If you understand them you are set up for long term success as this is where currency direction comes from.

There is a lot of money to be made from trading the economic data releases. The key to trading the releases is twofold. First, having an excellent understanding of the fundamentals and how the various releases impact the market. Secondly, knowing how to execute the trades with precision and without hesitation. If you can get a control of this aspect of trading and have the confidence to trade the events then you’re truly set up to make huge capital advances. After all it is these economic releases which really direct the currencies. These are the same economic releases that central banks formulate policy around. So by following the releases and trading them you not only know what’s going on with regards central bank policy but you’ll also be building your capital at the same time.

Now to be truly successful you need an extremely comprehensive capital management system that not only protects you during periods of uncertainty but also pushes you forward to experience capital expansion. This is your entire business plan so it’s important you get this down pat first.

Our stringent capital management system perfectly encompasses your risk to rewards ratios, capital controls as well as our trade plan – entry and exits. This way when you’re trading, all your concerned about is finding entry levels. Having such a system in place will also alleviate the stresses of trading and allow you to go about your day without spending endless hours monitoring the market.

I can tell you most traders at banks spend most of the day wandering around the dealing room chatting to other traders or going to lunches with brokers. Rarely are they in front of the computer for more than a few hours. You should be taking the same approach. If you understand the technical and fundamental aspects of the market and have a comprehensive professional capital management system then you can.

From here it just takes a simple understanding of the key strategies to apply and where to apply them and away you go. Trust me you will experience more capital growth then you ever have before if you know how the bank traders trade. Many traders have tried to replicate their methods and I’ve seen numerous books on “how to beat the bankers”. But the point is you don’t want to be beating them but joining them. That way you will be trading with the market not against it.

So to conclude let me say this: there are no miraculous secrets to trading forex. There are no special indicators or robots that can mimic the dynamic forex market. You simply need to understand how the major players (bankers) trade and analyse the market. If you get these aspects right then your well on the way to success.

The risk of loss in forex trading can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in the light of your financial condition. The high degree of leverage that is often obtainable in forex trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Past performance is not indicative of future results.

Little panda forex

Little panda forex

There is 5,000+ members within the little panda forex community. Trading can be hard but with a little help, you can stop the losses and start focusing on the profits (just don't give up). There is so many different ways you can succeed, below you will find some of the ways I offer.

Welcome to little panda forex

It's time to unlearn and learn everything from the start. You need to get the correction eduction. Get invovled in community like the one I offer and things will change for the better.

My style is very different, for me risk to reward is KEY. This is how you can be in the top 5% of traders that is winning and not in the 95% that is losing!

The VIP GROUP

Looking for the best forex education, trading ideas & knowledge on the market? Look no further!

The benefits of joining VIP:

Click on below link to start your journey

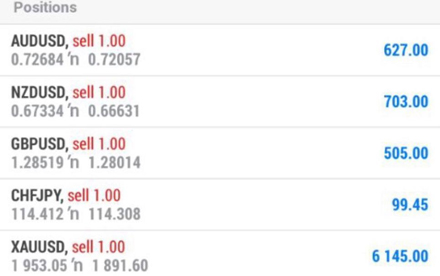

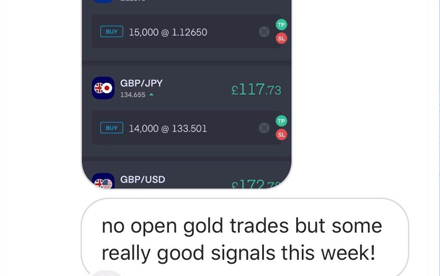

Student results

Check out some of the results of little panda forex students who are winning.

The FREE group

Here you can gain FREE knowledge and see some of my trading ideas! I will also show you why I took a lot of the trades I took so you can learn and earn! VIP members receive trade ideas with reasons, 30+ videos on different topics, trading tips, chart analysis, my support if needed and much more (that is not offered in the FREE channel).

Join me on youtube

See how I made $6,800 in just 4 days with a simple trading strategy!.

Subscribe to the youtube channel to get free forex training and enjoy the the amazing live trades.

(little panda forex is not a signal provider)

the content provided by little panda forex does not include financial advice, guidance or recommendations to take, or not to take, any trades, investments or decisions in relation to any matter. The content provided is impersonal and not adapted to any specific client, trader, or business, therefore little panda forex recommends that you seek professional, financial advice before making any decisions. Trading takes dedication and commitment, success does not happen over night. Results are not guaranteed and may vary from person to person. There are inherent risks involved with trading, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is solely at your own risk, you assume full responsibility.

Fxdailyreport.Com

For beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. The problem is, it takes a lot of time to master all the crucial skills that are required to qualify as a professional. Often times, many novice traders give up without making a dime.

But do you really have to trade to make money on forex? What if there was a way to invest profitably without actually having to trade? The good news is, there is a way. It is called forex copy trading.

What is copy trading ?

As the name suggests, copy trading is a form of forex trading where you copy or replicate the trading patterns of other traders. This is a trend that emerged in the early 2000’s and has over the years proved to be a real savior for inexperienced traders. With copy trading, also known as mirror trading or sometimes social trading, you can make profits as a forex trader even with minimum skills.

The only skills you require is to understand the whole concept of copy trading, that is mostly, how to choose a good trader to follow. You should, however, keep in mind that forex trading, in general, is risky and high returns are not guaranteed. Although copy trading gives you an opportunity to make profits without investing in research and having to understand the ins and outs of forex, the risk is still there and a lot of caution is required.

In most cases, forex copy trading can backfire because of a poor choice of traders to follow. That is why it is important that you carefully analyze your potential “masters” using the stats provided by the copy trading platform of your interest to make good money.

Below are a few tips on how to find a good trader to follow.

How to find A good trader to follow

The following tips will help you land the perfect trading pro:

- Discover the most followed traders

The number of followers often point to the credibility and prowess of that particular trader. If a potential professional is followed or copied by many traders, it usually means that they have consistently recorded outstanding performance.

- Analyze their followers/copiers

Sometimes followers can be fabricated. That is why you should critically analyze the followers to ensure that they are real humans. Another reason for this is to ensure that the follower base is consistently growing. If the number of traders copying your potential professional grows and suddenly drops, it may mean a drop in good performance. However, if the followers are ever increasing, you should add that investor to your list.

- Should have consistent monthly performance

Your search for the perfect trader should not end with the most followed. Sometimes, they might have a lot of traders copying them, but the balance between profits and losses is not promising. That is why it pays to dig deeper and unearth trading gurus who have posted good and consistent monthly performance.

- Number of trades and time on a platform

Traders who have been on the platform for a long are most preferred. They are usually more experienced and know their way around trading. The number of trades conducted is also another indicator. The person you wish to follow should have done a good number of trades with consistent profits.

You might not find the perfect trader to follow, but as you gain more useful skills, you will be able to make more constructive analysis and choose wisely. The type of copy trading platform you choose also matters. A lot of seasoned traders use credible forex brokers and you will hardly see them on new platforms or those with a bad reputation.

Benefits of forex copy trading

Copy trading presents a lot of good opportunities for both those who copy others and those who are copied.

- You gain invaluable trading skills from professionals you follow

- There is a lot of transparency as the trading history of the trader is publicly disclosed to followers

- You can make passive income without actively trading

- You don’t have to understand all the aspects of forex trading

With forex copy trading, you can make good money without having to actively trade. The point is to choose the right trader to follow by carefully analyzing their profiles and utilizing the stats provided by the various platforms.

How much money can I make forex day trading?

:strip_icc()/how-much-money-can-i-make-forex-day-trading-1031013_color-332300f659374e4b897904a35b4d64ae.gif)

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Forex trading information

Forex — the foreign exchange (currency or FOREX, or FX) market is the biggest and the most liquid financial market in the world. It boasts a daily volume of more than $6.6 trillion . Trading in this market involves buying and selling world currencies, taking profit from the exchange rates difference. FX trading can yield high profits but is also a very risky endeavor.

Getting into forex trading is easy:

1. Start with our free forex course.

2. Open an account with a broker.

3. Learn from other traders at the forum.

Latest in forex

I was looking for ctrader brokerage, as I wanted to try copy-trading. Well, the idea with copy-trading was the wrong one, I understand that I can earn much more with self-trading, than relying or another trader to copy its signals.

I think that brokerage is good for those, who are looking for high-leveraged trading. At least, I don't know any other brokerage to provide such good trading conditions in terms of high-leveraged trading. So, imo, that's one of the best brokers in th.

All key information about forexchief is present on their website. This is an honest broker with no hidden charges. Some of the issues I had was because I did not read through the account type pages to know what features are present in each account ty.

Started live with this broker around 9 months back. The experience has been above satisfactory so far.

Support team – quite helpful

Have got all my withdrawals in time, just 1-2 took some extra processing time, may be due to .

Forex blog

EUR/AUD consolidates in a bearish flag pattern

Forex brokers update — january 10th, 2021

Weekly forex technical analysis (jan 11 — jan 15, 2021)

EUR/USD

Floor pivot points

Woodie's pivot points

Forex news

Euro edges higher against dollar reversing 3-day slump on upbeat mood

The euro today inched higher against the US dollar reversing a 3-day downtrend fueled by the positive investor sentiment but posted slight gains. The EUR/USD currency pair ended up trading largely sideways albeit with a bullish bias amid rising coronavirus cases as euro area countries extend lockdowns.

Chinese yuan strengthens as pboc signals policy tightening in 2021

The chinese yuan is adding to its strong start to 2021 against the US dollar on tuesday. The yuan, which has been one of the top-performing currencies in foreign exchange markets over the last eight months, is finding support on policy support stabilization, highlighting that officials are confident that the recovery is occurring at a good pace.

Pound firms as boe members comment on negative interest rates

The great britain pound rallied today, trading as the strongest major currency on the forex market. Analysts explained the rally by comments from central bank's officials regarding the outlook for negative interest rates.

Commodity blog

Glassnode: bitcoin whales bought monday’s price dip

After opening day trading above $38,100, bitcoin (BTC) suffered heavy losses on january 11. As a result, the price of .

Copper rises 1% amid weaker US dollar, fund bullishness

Copper futures topped the $3.60 threshold on tuesday as the industrial metal found additional support from institutional investors and funds. After a little bit of .

Video: bitcoin price prediction for january 2021 - 20% drop a buying opportunity?

In the present video, david jones from capital.Com provides his forecast for bitcoin in january 2021, trying to answer the question: can bitcoin recover after.

Forex video zone

Forex channel stop-loss placing

In this video, you will learn about placing a after the price breaks out of a channel. There are two ways to enter a short position after a channel breakout. You can enter after the candle that breaks the support or the lower line of the channel. A better way to place the trade which offers a great ratio is to wait for a retrace to the upside and retest of the broken support or the lower.

USD/INR forecast — january 12th 2021

In this video, the trader guy looks at the USD/INR pair for the january 12th session. USD/INR — the dollar rallied against the rupee on monday session, but gave back the gains to form a bearish candlestick. So, a pullback looks more likely, and the next support could be located at the 73.00 level. So, you can sell exhaustion at the moment. This is an emerging market currency. So, pay attention to the US dollar .

EUR/USD and GBP/USD forecast — january 12th 2021

In this video, the trader guy looks at the currency pairs EUR/USD and GBP/USD for the january 12th session. EUR/USD — the euro pulled back towards the 1.2150 level on monday session, which is also above the 50-day EMA. Also, the 1.20 level below is supportive. The US dollar is strengthening at the moment and this sentiment could continue for a while. So, dips are buying opportunities at the moment. GBP/USD — the pound has.

Welcome to forex learn & earn

Ready to bid your way to financial freedom? Your journey starts here.

Forex trading has the potential and holds the key to lifelong financial success.

Trading is never without risk – always trade with caution.

Disclaimer – trading is at own risk

What is forex trading?

The foreign exchange market allows two currencies to be exchanged, at an exchange rate which is floating or fixed. This allows businesses from around the world to complete transactions across currencies.

Currencies need to be exchanged to import produce from different countries, for example: a wine merchant in england exchanges their pound sterling (GBP) for rand (ZAR) in order to purchase wine from south africa. Exchanging currencies is the basis for all international trades.

Unlike the stock market, the forex market is decentralised – this means that there is no central trading area. Most foreign exchange transactions are executed over-the-counter (OTC) by banks, on behalf of their clients.

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

Learn to trade futures

Complete educational bundle from basics all the way to the professional topics. Learn how to trade futures. Trade in the market with real time data without risking real money. Trade in the futures markets.

Take your futures education to the next level.

What is

earn 2 trade?

Earn2trade is an education company that teaches futures trading, and matches its successful students with proprietary trading firms. We recruit and train futures traders and offer personalized education, mentoring sessions and live webinars, as well as hands-on experience with a trading simulator. Students who successfully complete our bootcamp or gauntlet™ evaluation program will receive a guaranteed offer from our partner. Our team consists of experienced traders, accomplished educators, and outstanding developers.

Pass

the gauntlet mini™

Examination focused on intraday traders

Pass

the gauntlet™

Maximum trader flexibility

Learn to trade

beginner crash course

Comprehensive trading education

62 video lessons from basics all the way to professional topics. Learn to trade futures.

50+ webinars with over 40 hours of content delving deep into specific topics traders need to know.

Continuous testing to strengthen your market knowledge.

Your entry point to becoming a professional trader is here

so, let's see, what we have: here is a scenario for how much money a simple and risk-controlled forex day trading strategy can make, and guidance on how to achieve that level of success. At forex trade and earn

Contents

- Top forex bonus list

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- How to make money with forex?

- When am I ready to profit with forex?

- How beginners in forex trading look like?

- How to make money with forex?

- What is leverage in forex trading, in the first place?

- Use a stop-loss order to reduce risk

- Can you become rich with forex trading?

- Making money in forex is easy if you know how the bankers trade!

- How to make money in forex?

- How do banks trade forex?

- How to make money in forex?

- Little panda forex

- Little panda forex

- Welcome to little panda forex

- The VIP GROUP

- Student results

- The FREE group

- Join me on youtube

- Fxdailyreport.Com

- What is copy trading ?

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- Forex trading information

- Latest in forex

- Forex blog

- EUR/AUD consolidates in a bearish flag pattern

- Forex brokers update — january 10th, 2021

- Weekly forex technical analysis (jan 11 — jan 15, 2021)

- EUR/USD

- Forex news

- Euro edges higher against dollar reversing 3-day slump on upbeat mood

- Chinese yuan strengthens as pboc signals policy tightening in 2021

- Pound firms as boe members comment on negative interest rates

- Commodity blog

- Glassnode: bitcoin whales bought monday’s price dip

- Copper rises 1% amid weaker US dollar, fund bullishness

- Video: bitcoin price prediction for january 2021 - 20% drop a buying opportunity?

- Forex video zone

- Forex channel stop-loss placing

- USD/INR forecast — january 12th 2021

- EUR/USD and GBP/USD forecast — january 12th 2021

- Welcome to forex learn & earn

- What is forex trading?

- Learn to trade futures

- What is earn 2 trade?

- Pass the gauntlet mini™

- Pass the gauntlet™

- Learn to trade beginner crash course

No comments:

Post a Comment