Fx trading account

When you select a brokerage firm, you take all these factors into account. You need to know whether your would-be broker is a trustworthy destination for traders.

Top forex bonus list

Though fewer these days, rogue operations still exist. Creating a real money account with such a broker is flushing money down the toilet. Micro accounts take this approach a step further. They support micro-lots of $1,000. Such accounts are even more affordable than the mini ones. Like the minis, micro accounts target beginners as well.

Forex trading accounts

To trade online, you need to open a forex trading account. When you sign up, you will likely have to choose among several account types. The best forex trading accounts are those that suit your personal needs perfectly. On this page, we look at the forex trading account options you have. We also discuss ways in which these account options will impact your trading performance. You will learn:

- Which is the best forex trading account?

- Account types. What is a standard account, a funded account, a mini/micro account, a managed account, etc?

- Geographic account type considerations.

Below are the best forex trading accounts in your location:

The top 5 forex trading accounts in the united kingdom

Opening a forex trading account

What do you need to consider when opening a new forex trading account?

- The brokerage firm. Is it reputable or is it a known scammer?

- The services the brokerage firm offers.

- Costs and incentives involved.

- The account type that best suits your needs.

Once you have gotten these issues sorted, there is 3 step process for opening an account:

- Fill out the application forms and provide the information your broker requires.

- Fund your account.

- Start looking for investment opportunities.

When you select a brokerage firm, you take all these factors into account. You need to know whether your would-be broker is a trustworthy destination for traders. Though fewer these days, rogue operations still exist. Creating a real money account with such a broker is flushing money down the toilet.

You also need to know what incentives your broker offers. Match up these incentives with the costs. The broker has to support the account type you prefer and it has to give you access to a proper suite of services. You may even have a preferred account funding method. The broker may or may not accept/support that method.

Services-wise, you are looking for:

- Proper trading platforms, with solid technical analysis tools.

- Access to education and research.

- Trading foreign markets.

- Special features you may want.

- Convenience. Some brokerage firms offer face-to-face guidance. Others do not. It always makes sense from the perspective of trust, to prefer an operator with physical offices close by.

As far as incentives go, some brokers offer commission-free trading. Others may even reward you for certain achievements as a trader. You may even want to keep your savings with the broker if it rewards you for it.

Make sure you read and understand the full pricing schedule/policy of your broker.

Determining the right trading account type to meet your needs depends on what kind of trader you are, and what your objectives are.

When you fill out your application forms, be aware that you will have to provide information on your employment status, investable assets, and net worth. Some find such probing on the part of the broker quite intrusive.

You also have to provide a copy of your ID/driver’s license. If you want to trade options or gain access to margin, you may have to provide additional information.

Brokers accept several account-funding methods.

- Various e-wallets. (neteller, paypal, skrill etc)

- Bank transfer.

- Electronic funds transfer.

- Checks.

Some may accept asset transfers and even paper stock certificates.

Which is the best forex trading account?

As mentioned, the best account type for you is the one that best suits your needs and personal profile. The factors you should consider in this regard fall into two main categories.

Your investment objectives.

The type of trader you are.

Choosing a forex trading account based on your investment objectives

– most “casual” traders invest with a relatively near-term goal. The “make some money” mantra is the main driver behind such efforts. If this mantra describes your investment objectives, you likely need a traditional brokerage account. Such accounts do not offer any tax advantages. On the other hand, they do not tie up your investments long-term either.

You may also be able to trade on margin with such an account. Trading on margin involves borrowing money from the broker. The assets in your account will serve as collateral in this case. Trading on margin carries some obvious risks.

– if your goal is to secure your nest-egg for your retirement, an IRA (individual retirement account) is your option. All IRA options, such as traditional IRA, roth IRA, and rollover IRA offer you tax benefits. On the downside, you will not be able to touch this money before you are old.

Choosing a forex trading account based on what type of investor you are

- – you are an absolute beginner. And as such, not much of an investor. What you need at this stage is education. Possibly some good trading signals as well. In a word, you need an account, through which the broker can hold your hand. It could be that your ambitions are not high. Still, you need to know why you are doing what you are doing. Customer service and user interface are important factors in your account selection.

- – you are a “value” investor. Such investors buy and hold assets, to sell them when they appreciate. Such investors are not active traders. If you are a value investor, you value fundamental analysis. You have little use for charting and fancy technical indicators, however.

- – passive investing. Those who invest in index funds passively do not require much from their broker. Unlike beginners, such traders don’t need their hands held either. They just need access to index funds, and good tradable asset selection within this category.

- – high frequency trader. Active traders do not hold their positions long-term. They buy and sell with high frequency. Thus, they need all the bells and whistles their broker can offer them. They want good trading platforms with superb charting. Outstanding reporting and a highly functional interface are also musts. Technical analysis is the bread and butter of this trader category. Trading costs are also very important for active traders.

Forex trading account types

There are four basic account type categories: standard, funded, mini and managed. We will look at each in turn.

Within these categories, there are a few additional variants, such as the micro accounts. There are a handful of special account types as well, such as islamic accounts, demo accounts, and VIP accounts. Every one of these account options carries some advantages and some disadvantages.

Standard trading accounts

The name of this account option stems from the standard lots to which it gives traders access. A standard currency lot is worth $100,000. Such a lot size seemingly places this account type out of the reach of average traders.

You do not have to have $100,000 in your account to trade, however. The existence of margin and leverage means that you only have to have $1,000 to trade a standard lot.

Leverage varies based on many things. In the EU, forex leverage is capped at 1:30. In other places, brokers may offer leverage up to 1:500 even on standard accounts.

Brokers offer full services for the holders of standard accounts. Such accounts require upfront capital, so these are all depositing traders. The profit potential of this account type is significant as well.

On the downside, the same goes for loss potential. For this reason, you should only trade through a standard account if you are an experienced trader.

Funded trading accounts

Some brokers/other financial organizations fund certain traders. They provide them with starting capital, in exchange for a share of their future profits.

How does such a setup work?

Would-be funded account owners need to pass an evaluation program. If the broker’s analysts consider them to be good candidates, they grant them a funded account.

Funding can run into millions of dollars. Profit splits are in the 50% range. Funded accounts carry monthly profit targets. Traders who fulfill these targets can gain additional funding.

The broker pays out the profits periodically.

What do you need to do to secure such a funded account?

- Your first step is to sign up for the evaluation program.

- Trade through the evaluation account and reach the targets.

- Earn a proper funded account and start making money for you and the account provider.

Mini and micro trading accounts

A standard account features $100,000 lots. For traders who cannot afford to trade in that league, despite margin and leverage, mini accounts offer an alternative. A mini account supports mini lots. These lots are worth $10,000 each. Mini accounts usually accompany standard accounts and they target new traders.

Micro accounts take this approach a step further. They support micro-lots of $1,000. Such accounts are even more affordable than the mini ones. Like the minis, micro accounts target beginners as well.

The main advantage of mini and micro accounts resides in risk-reduction. For a mere $250-$500, you can open such a trading account. Trading in lower increments stretches your funds longer as well. This is one of the reasons why professional traders like to use such accounts. They can test their strategies in a low-risk, real-money environment.

In addition to the inherent risk-minimization benefits, mini and micro accounts let you spread your funds thinner. Thus, you can better micro-risk-manage them.

The obvious downside is that risk/loss minimization reduces profit potential as well. Such accounts are, therefore, hardly suited to cover the profit needs of professional/advanced traders.

Managed trading accounts

Forex trading account management works like this, A managed account is one that holds your funds but excludes you from decision-making. You make your deposit, and someone else – usually a broker-side expert – does the trading for you. You may be able to set objectives, however.

Why would you want to give up control through such a trading account?

– you are not an expert and you feel that the manager will do a better job than you ever could. Thus you let the manager handle your individual trading account.

– you feel that pooling your money with the funds of other investors offers you a degree of protection. Such managed accounts work like mutual funds. Managers handle the trading and they distribute the profits.

Managers rank these pooled accounts according to risk tolerance. Those looking for higher profits opt for more risky accounts. Those with a lower risk tolerance play it safer, earning less.

The main advantage of a managed account is that it allows you to cash in on the skills of a forex professional. Furthermore, you get to do it hands-off.

The disadvantage is that this forex expert will cut a commission from your profits. Managed accounts require larger deposits than regular ones. Individual accounts may require as much as $10,000. Pooled accounts are slightly cheaper at around $2,000.

Islamic trading accounts

Islam holds trading to be haram (not permitted). There are ways to turn it into halal (permitted), however.

All trading activity has to adhere to the principles of islamic finance.

- There must not be any interest (riba) involved.

- Exchanges involved in trading have to be immediate.

- No gambling is allowed.

- Risks, as well as benefits, have to be distributed.

Islamic accounts are swap-free accounts, through which transactions and the payments of costs associated with them, happen instantly. In the context of islamic trading accounts, the margin, commissions and administrative fees are not riba.

VIP accounts

Brokers reserve their VIP accounts to their most privileged clients. A VIP account holder enjoys special benefits, such as superior trading conditions. Forex brokerages often invite VIP traders to special events, treating them to special rewards.

What do you have to do to gain access to such an account?

You normally need to deposit an unusually large amount of money (often upward of $100,000). You will also need to trade frequently and perhaps meet certain trade volume requirements.

Demo accounts

A demo account is the “play money” simulation of a real account. It allows traders to test the platform and trading conditions. Some may also use such accounts to test-run certain strategies.

When you sign up for a demo account , the broker credits your account with a set amount of virtual funds. Some demo accounts offer the same functionality as a standard/mini/micro account. Others limit their users’ access to certain features.

Geographic considerations

Sometimes, your geographic location should play a role in your account type selection. Some jurisdictions may limit certain trade types. In the US, there is no CFD trading. The practice is against US securities laws.

Leverage varies greatly between EU regulated countries, the UK for example, and other parts of the world. In the EU forex margin is limited to 1:30 by ESMA, the european regulator.

In other parts of world, india and south africa for example, leverage can be offered up to 1:1000 (though 1:400 or 1:500 is more typical)

The taxes you have to pay on your profits also vary from one jurisdiction to another. Read our taxes page for more on that.

FOREX trading accounts

Choose an account type that best suits your trading style.

FOREX.Com account

- Advanced trading platforms with customizable interfaces

- Trade forex, equities and more, all on one account

- Fast, reliable trade executions

Metatrader account

- Dedicated FX trading platform

- Exclusive in-platform market news and analysis

- Trades execute at the best available price

DMA account

- Trade on prices as low as 0.1 on all major FX pairs

- Get commission discounts as low as $20/m traded

- Split the spread and place orders within the top of book spreads

What information do I need when opening an account?

We will need you to provide us with your name and address to establish your identity. Typically, we can verify your identity instantly. For more information, see our account document faqs.

What markets does FOREX.Com offer?

You can trade over 80 currency pairs at FOREX.Com. View our full range of markets.

When is forex market open for trading?

You can trade forex at FOREX.Com 24 hours a day, five days a week. For details, read our forex trading times article.

Is there a charge for central clearing?

We provide central counterparty clearing through an omnibus segregated clearing account (OSCA) free of charge as standard to all clients. If you wish to open an individual segregated clearing account (ISCA), fees apply:

- For an individual these charges are: £13,000 account opening fee, plus account maintenance and transaction charges

- For a corporate entity these charges are: £200,000 account opening fee, plus account maintenance and transaction charges

Try a demo account

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

Try a demo account

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

It's your world. Trade it.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

Fxpro demo trading account

To access the fxpro demo accounts, you need to complete the registration form and provide us with some information, however, you do not need to upload verification document(s) or fund until you are ready to trade live.

A real account will be automatically created upon completion but to activate it, we will need to verify your identity and may need to confirm some additional details with you. In the meantime however, you can immediately open a demo from the ‘accounts’ page in fxpro direct, allowing you to utilise risk-free trading and bringing you one step closer to the start of your trading journey.

- Real-time pricing

- Up to 100k in virtual funds

- Available for all platforms

- 8 base currencies

- Top up via fxpro direct

- 180-day life span

Open a demo account

Opening a demo account through our fxpro mobile app is the perfect option, as after completing the registration, you can immediately start using the demo account, within the very same app!

Alternatively, you can open a demo account from your fxpro direct portal, for any of our platforms and account types. Please click here for a full comparison.

Compliment your demo account trading with our exclusive content & trader tools including:

- Educational material

- Fxpro.News

- Calculators

- Economic calendar

What is demo trading?

A trading demo or simulation essentially allows you to experience the market and platform features, using virtual funds and therefore without risk.

Why open a demo with fxpro?

New to trading? Our free demo forex accounts will allow you to practise and hone in your trading skills risk-free until you feel confident enough to trade live.

You can also make use of it as an experienced trader if you want to test different trading strategies.

Demo faqs

Although demo accounts present real market conditions and prices, please keep in mind that they are simulations and cannot always reasonably reflect all of the market conditions as during highly volatile or illiquid periods (e.G. Market openings, news announcements) they may not behave in the same manner as live accounts.

Margin and leverage settings may vary between your demo and live account and you should not expect any success with the demo account to be replicated in your live trading.

For this reason, it is strongly recommended that demo accounts are viewed solely as a learning tool for inexperienced traders or a place for testing new trading strategies.

Fxdailyreport.Com

The forex market is becoming increasingly popular every day. With over 3.5 trillion dollars traded on a daily basis, the market can be both risky and lucrative. There are many types of live forex trading accounts available in the market. Each of these various accounts come with their own rewards and downsides. Knowing the right trading account is the key to the successful trading experience.

As a beginner, you need to open up an account will a reliable forex trading company. But, how will you know the right account to meet your level of expertise? What is the best trading account suiting your needs? Below is a detailed guide on the different forex trading accounts.

1. Demo account

This is the entry point for all forex traders. This type of trading account is offered nearly by all forex brokers. It gives a trader a virtually equal experience to trade with fewer risks of losing funds. As a trader, you are allowed to test your trading strategy for viability, draw-downs and other performance procedures.

In addition, the demo account allows for an appraisal of the broker company providing the account without the requirement of real funds. A good number of forex trading companies will allow a trader to create a demo account without much commitment. The broker will only require a few personal details to complete the registration process.

- This account enables you to trade with liberty. The absence of actual funds implies you trade without any form of suppression.

- A second chance. In case you lose your trading account, there is a good chance to fix the problem and start trading. The capital risks are simulated and have no actual effect on your income.

- Limits. A demo trading account offers limited funds. In addition, there is a limit on the time you are allowed to trade over the platform. Once it expires, you will have to open up a new one.

- Easy to trade the wrong way. Since it’s a demo account, it’s very easy to mismanage it. Where there is freedom to trade the way you want, chances are you will overdo it.

- Profitable spreads: occasionally this trading account gives impractical spreads that are misleading.

2. Micro forex trading accounts

This type of accounts allows a trader to invest a small amount of capital. You can invest as low as $1-$10 to open up the account.

- Low risks-since you invest low amounts of capital, it becomes easier to control risk factors.

- Minimal profits-with a low investment, you get no benefits from the forex brokers.

3. Mini forex trading accounts

Just like its name suggests, the account is ideal for new traders who want to invest small amounts of money. You can trade with a personal investment ranging as low as$100. A large number of forex brokers provides a 400:1 leverage on this type of trading account. This means you can transact as more as $10000 with fewer risks on personal funds. As a result, a trader is likely to reap big more than their investments. The opposite is also true. You can lose a lot of money more than your personal investments. A trader s also allowed to use leverage with mini trading accounts. With higher leverages, you can easily access a substantial trade size equivalent to the actual funds.

- Fewer funds at risk. Accessibility is the major benefits of using this account. It’s affordable to many traders and allows for leverage meaning you can make good money even on a small investment.

- Low risk. Once you are done with a demo account, the mini trading account is an excellent option to jump into. It comes with low risks as compared to other live accounts.

• limited proceeds: despite its low risks in forex marketing, the gains are relatively low for an ambitious trader.

4. Standard forex trading accounts

This is the most typical type of forex trading account. Its name is attributed to the fact it allows traders to perform standard kind of transactions usually ranging within $10000. With this amount, you dot necessarily have to invest the whole amount. Instead, this forex trading account has a leverage of 100:1. As a trader, you can start with a capital of $1000. Depending on the brokerage firm, there are different requirements to create this type of account.

- Possible for realistic gain. Since you are required to invest big, there is a potential for a genuine gain.

- Extra services from the forex provider. Standard trading accounts generate good amounts of commissions. As a result, the brokerage firm offers more services as a way of maintaining their clients. For instance, a trader is allowed to access expert FX services, free deposit, bonuses among others.

- Possibility of a huge loss. The same way it’s easy to make huge proceeds, you can also incur huge losses. It’s a two-way traffic kind of trading. The combination of huge capital and leverage makes it ideal for expert traders only. It takes time before you know how to trade well.

- Larger capital investment: the minimal amount of capital required to invest in this type of account ranges from $1000. Only wealthy traders can afford a standard trading account.

5. Managed forex trading accounts

This is an automated type of trading account where a forex broker executes trades on behalf of the account holder. The role of the trader is limited to providing capital requirements only. The trader will contribute all the capital required but the management of the account lies with an expert forex company. Your work is to lay down the goals of trading while the account manager tries to achieve the goals. There are various ways of trading with managed trading accounts starting with social platforms all the way to in-house trader services.

- Potential for success- this account is ideal for both experts and beginners. Even with little knowledge in forex trading, having somebody trade on behalf means the good possibility to make money.

- Freedom: forex trading is complex and time-consuming. Having an expert trade for you means you can focus on other things far from the screen.

- The cost of liberty- you must pay a certain fee for somebody else to manage your trading account.

- Possible to lose. You are trading on someone else’s trust. This means you can incur losses out of a robot or human error.

6. VIP trading accounts

Also known as the premium, this type of trading account is ideal for the high rollers. Only traders who can raise a minimum of $10000 can open a VIP account.

- Lots of bonuses- traders enjoy up to 100% bonus on their deposits

- Additional services- VIP traders get access to other services such as travel benefits, debit cards, technical analyses among other benefits.

- Only loaded traders can afford to open this type of forex trading account.

- Potential for the big losses-the same way you can make big proceeds, you are also likely to lose.

How to spot a forex scam

The spot forex market traded over $6.6 trillion a day as of april 2019, including currency options and futures contracts. with this enormous amount of money floating around in an unregulated spot market that trades instantly, over the counter, with no accountability, forex scams offer unscrupulous operators the lure of earning fortunes in limited amounts of time. While many once-popular scams have ceased—thanks to serious enforcement actions by the commodity futures trading commission (CFTC) and the 1982 formation of the self-regulatory national futures association (NFA)—some old scams linger, and new ones keep popping up.

Back in the day: the point-spread scam

An old point-spread forex scam was based on computer manipulation of bid-ask spreads. The point spread between the bid and ask basically reflects the commission of a back-and-forth transaction processed through a broker. These spreads typically differ between currency pairs. The scam occurs when those point spreads differ widely among brokers.

Key takeaways

- Many scams in the forex market are no longer as pervasive due to tighter regulations, but some problems still exist.

- One shady practice is when forex brokers offer wide bid-ask spreads on certain currency pairs, making it more difficult to earn profits on trades.

- Be careful of any offshore, unregulated broker.

- Individuals and companies that market systems—like signal sellers or robot trading—sometimes sell products that are not tested and do not yield profitable results.

- If the forex broker is commingling funds or limiting customer withdrawals, it could be an indicator that something fishy is going on.

For instance, some brokers do not offer the normal two-point to three-point spread in the EUR/USD but spreads of seven pips or more. (A pip is the smallest price move that a given exchange rate makes based on market convention. Since most major currency pairs are priced to four decimal places, the smallest change is that of the last decimal point.) factor in four or more additional pips on every trade, and any potential gains resulting from a good trade can be eaten away by commissions, depending on how the forex broker structures their fees for trading.

This scam has quieted down over the last 10 years, but be careful of any offshore retail brokers that are not regulated by the CFTC, NFA, or their nation of origin. These tendencies still exist, and it’s quite easy for firms to pack up and disappear with the money when confronted with actions. Many saw a jail cell for these computer manipulations. But the majority of violators have historically been united states-based companies, not the offshore ones.

The signal-seller scam

A popular modern-day scam is the signal seller. Signal sellers are retail firms, pooled asset managers, managed account companies, or individual traders that offer a system—for a daily, weekly, or monthly fee—that claims to identify favorable times to buy or sell a currency pair based on professional recommendations that will make anyone wealthy. They tout their long experience and trading abilities, plus testimonials from people who vouch for how great a trader and friend the person is, and the vast wealth that this person has earned for them. All the unsuspecting trader has to do is hand over X amount of dollars for the privilege of trade recommendations.

Many of signal-seller scammers simply collect money from a certain number of traders and disappear. Some will recommend a good trade now and then, to allow the signal money to perpetuate. This new scam is slowly becoming a wider problem. Although there are signal sellers who are honest and perform trade functions as intended, it pays to be skeptical.

"robot" scamming in today’s market

A persistent scam, old and new, presents itself in some types of forex-developed trading systems. These scammers tout their system’s ability to generate automatic trades that, even while you sleep, earn vast wealth. Today, the new terminology is “robot” because the process is fully automated with computers. Either way, many of these systems have never been submitted for formal review or tested by an independent source.

Examination of a forex robot must include the testing of a trading system’s parameters and optimization codes. If the parameters and optimization codes are invalid, the system will generate random buy and sell signals. This will cause unsuspecting traders to do nothing more than gamble. Although tested systems exist on the market, potential forex traders should do some research before putting money into one of these approaches.

Other factors to consider

Traditionally, many trading systems have been quite costly, up to $5,000 or more. This can be viewed as a scam in itself. No trader should pay more than a few hundred dollars for a proper system today. Be especially careful of system sellers who offer programs at exorbitant prices justified by a guarantee of phenomenal results. Instead, look for legitimate sellers whose systems have been properly tested to potentially earn income.

Another persistent problem is the commingling of funds. Without a record of segregated accounts, individuals cannot track the exact performance of their investments. This makes it easier for retail firms to use an investor’s money to pay exorbitant salaries; buy houses, cars, and planes or just disappear with the funds. Section 4D of the commodity futures modernization act of 2000 addressed the issue of fund segregation; what occurs in other nations is a separate issue.

An important factor to always consider when choosing a broker or a trading system is to be skeptical of promises or promotional material that guarantees a high level of performance.

Other scams and warning signs exist when brokers won’t allow the withdrawal of monies from investor accounts, or when problems exist within the trading platform. For example, can you enter or exit a trade during volatile market action after an economic announcement? If you can’t withdraw money, warning signs should flash. If the trading platform doesn’t operate to your liquidity expectations, warning signs should flash again.

The bottom line

Conduct due diligence on the forex broker you’re considering by going to the background affiliation status information center (BASIC), created by the NFA. Many changes have driven out the crooks and the old scams and legitimized the system for the many good firms. However, always be wary of new forex scams; the temptation and allure of huge profits will always bring new and more sophisticated scammers to this market.

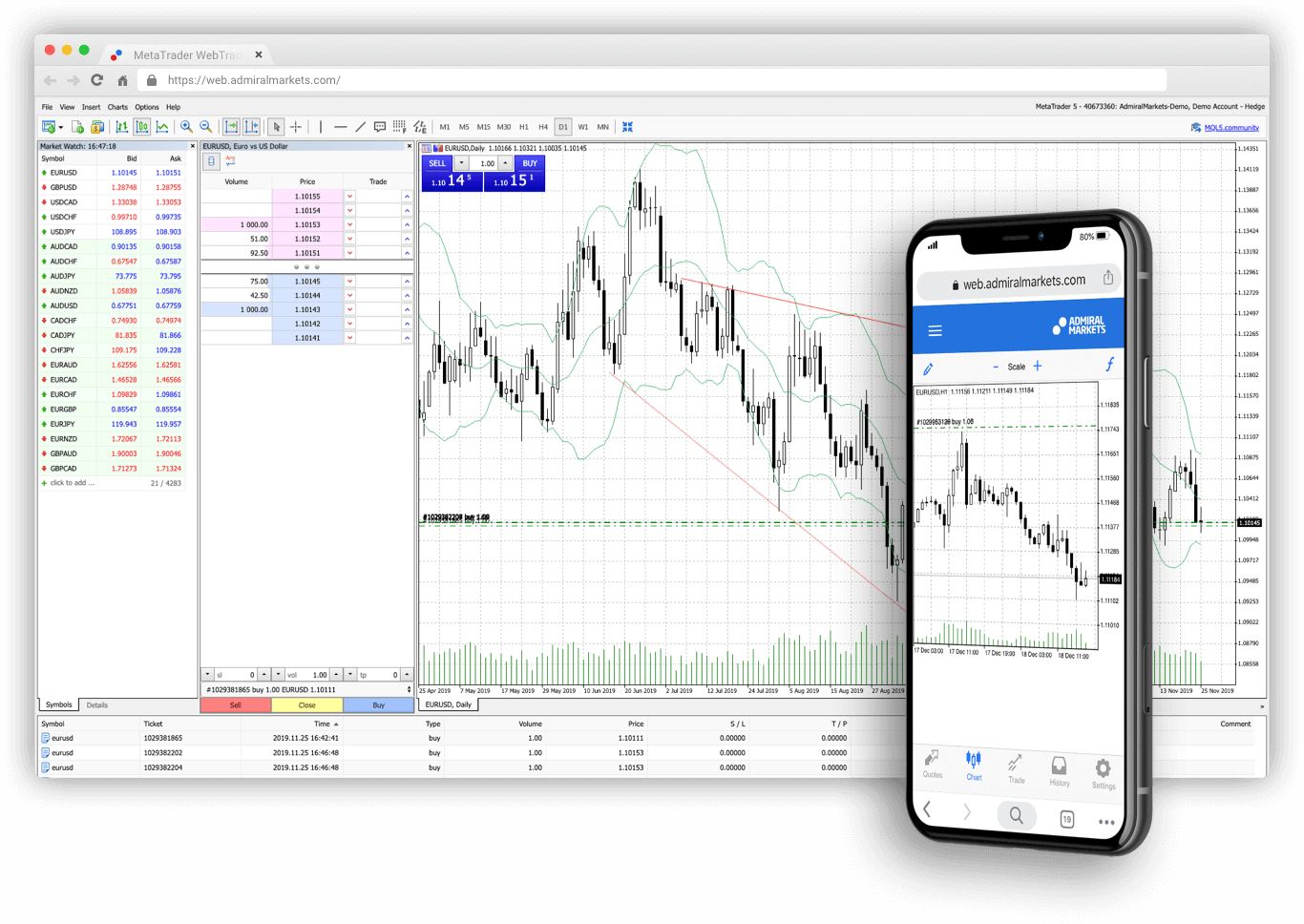

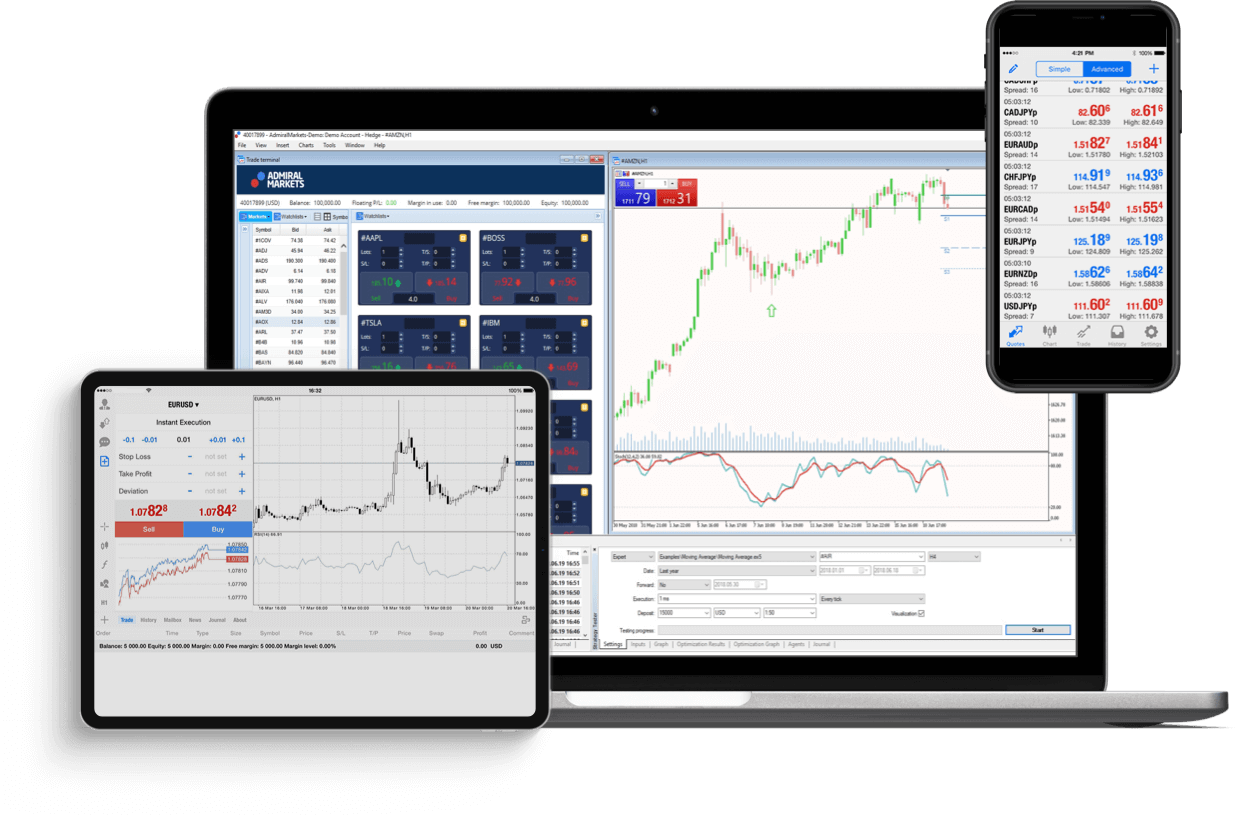

Trade with comfort on any device

Whether it`s windows or mac, android or ios, it doesn`t matter – we`ve got you covered!

Invest from just €1

Sign up for unlimited access to 4,000+ stocks from the new york stock exchange, nasdaq, FTSE and more - all without paying markups, rollovers, management or ticket fees.*

Some of the trademarks reflected on this page might be under trademark protection. Admiral markets does not have any direct relationship with the owners of these trademarks.

How it works

Register

Sign up with your name and email address to start trading

Start investing from €1, and start trading from just €100

Trade

Log in and start trading more than 8,000 instruments!

Trading

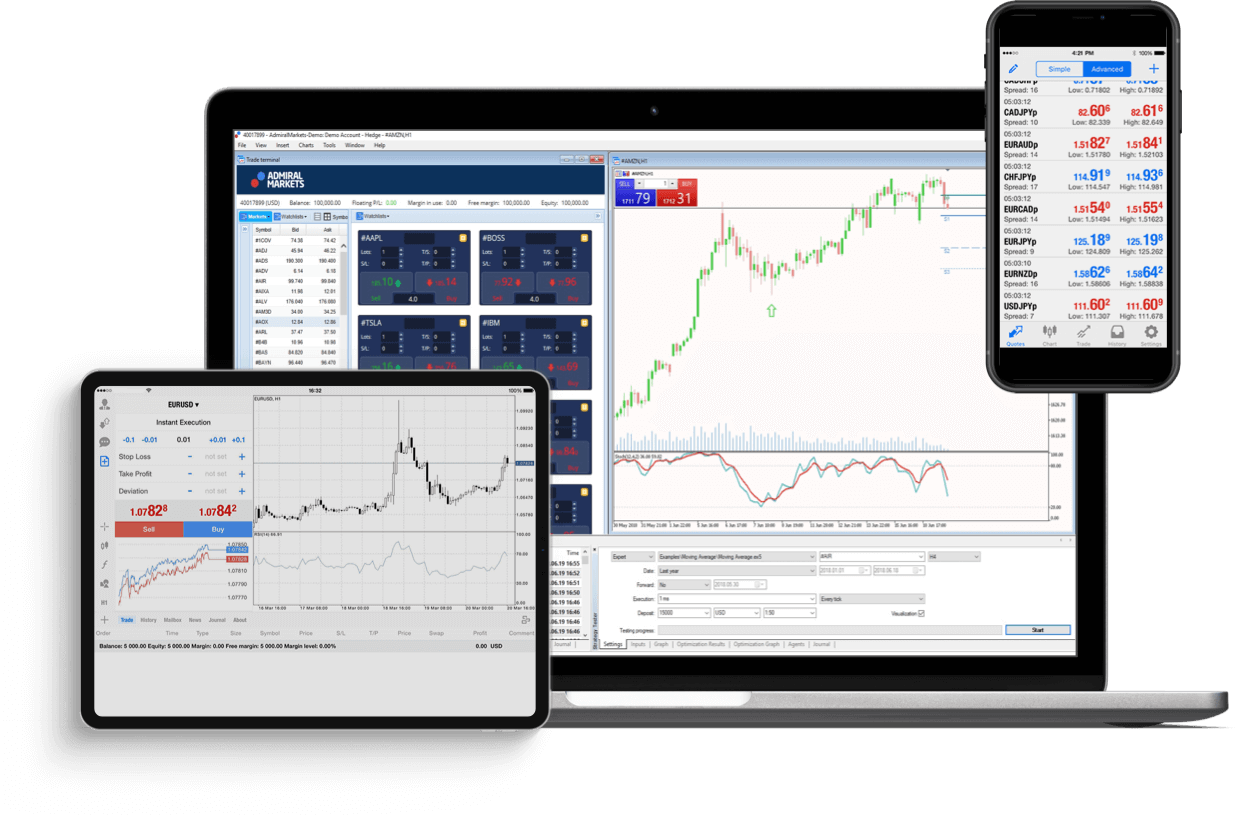

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs or bonds. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

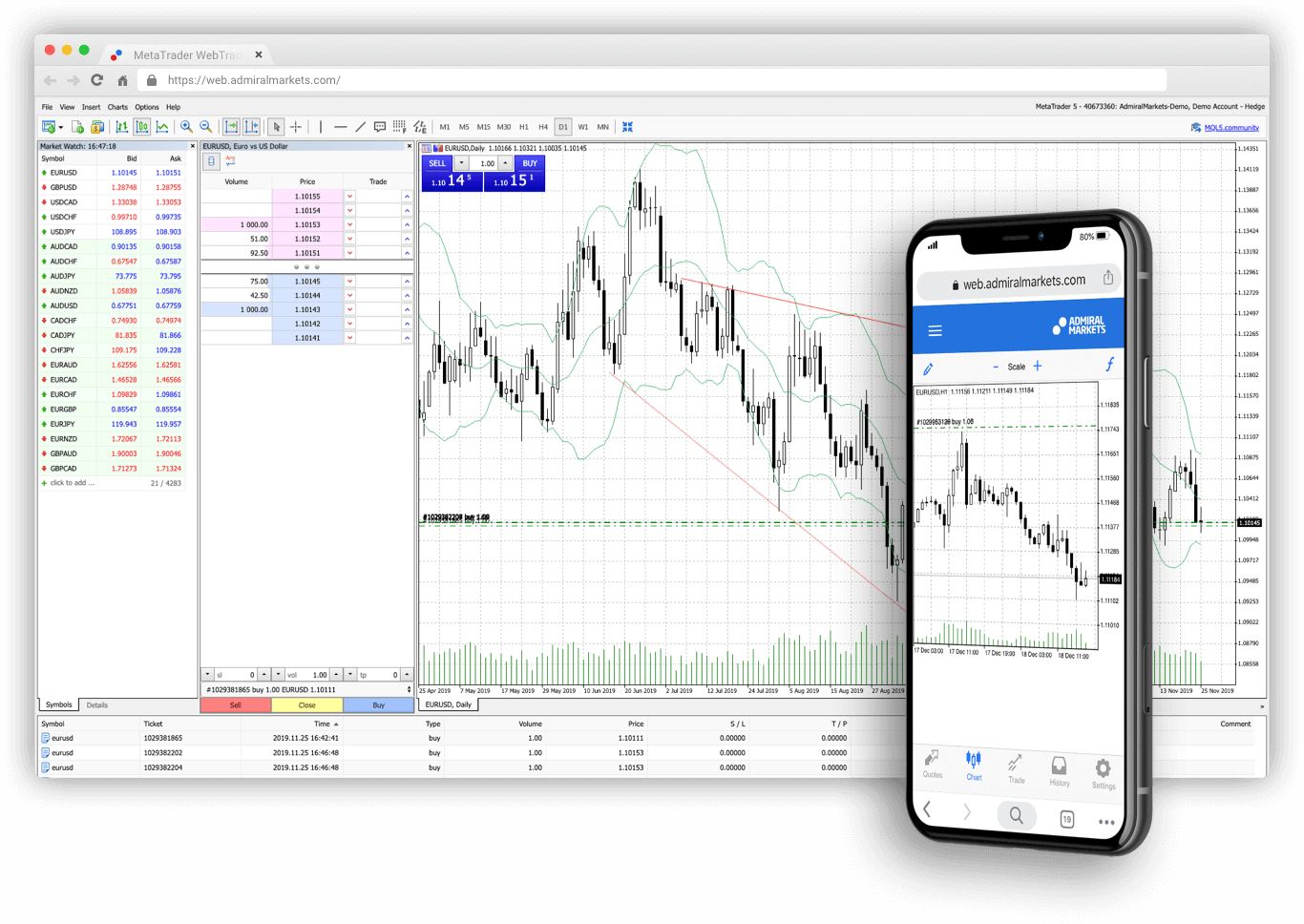

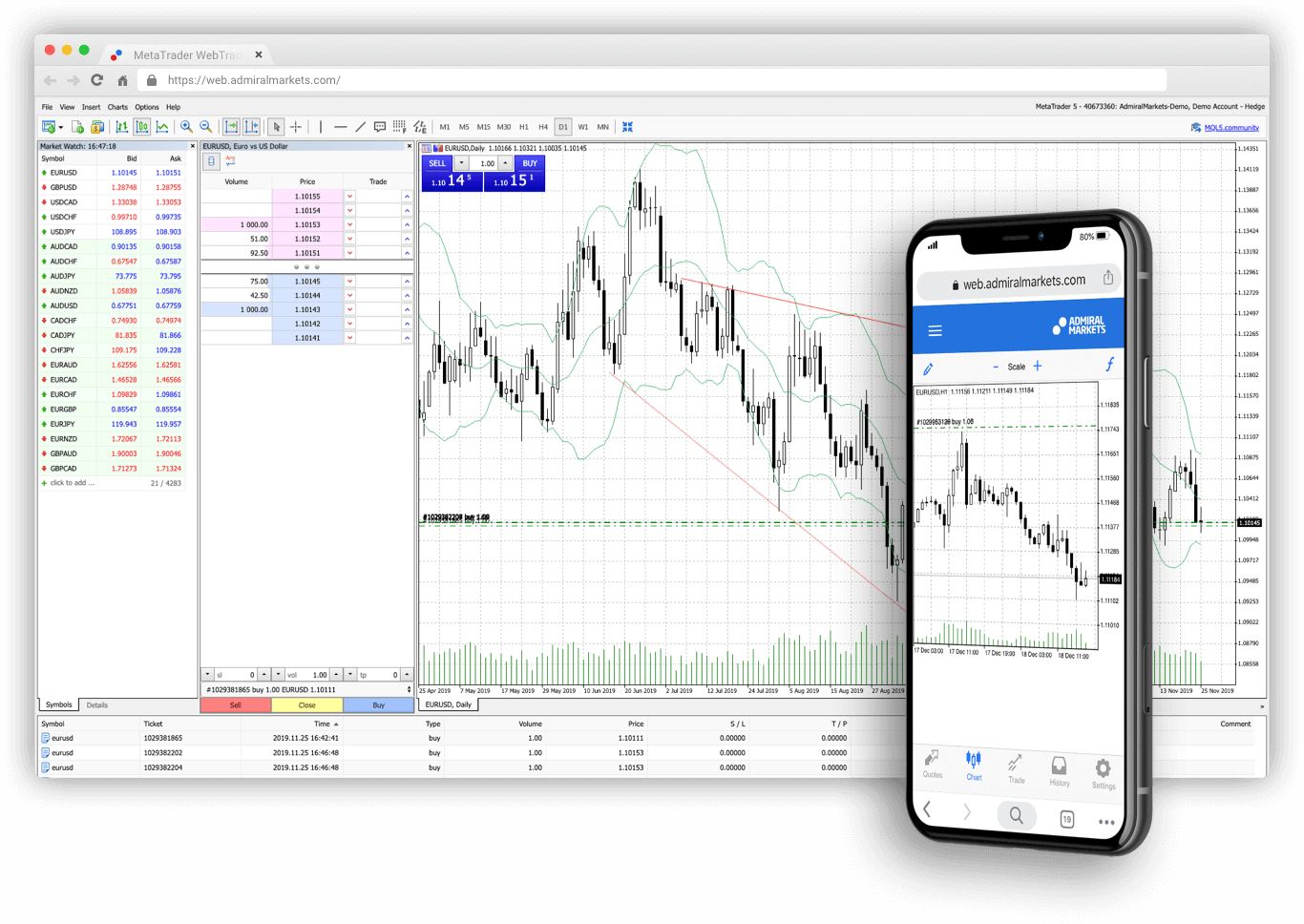

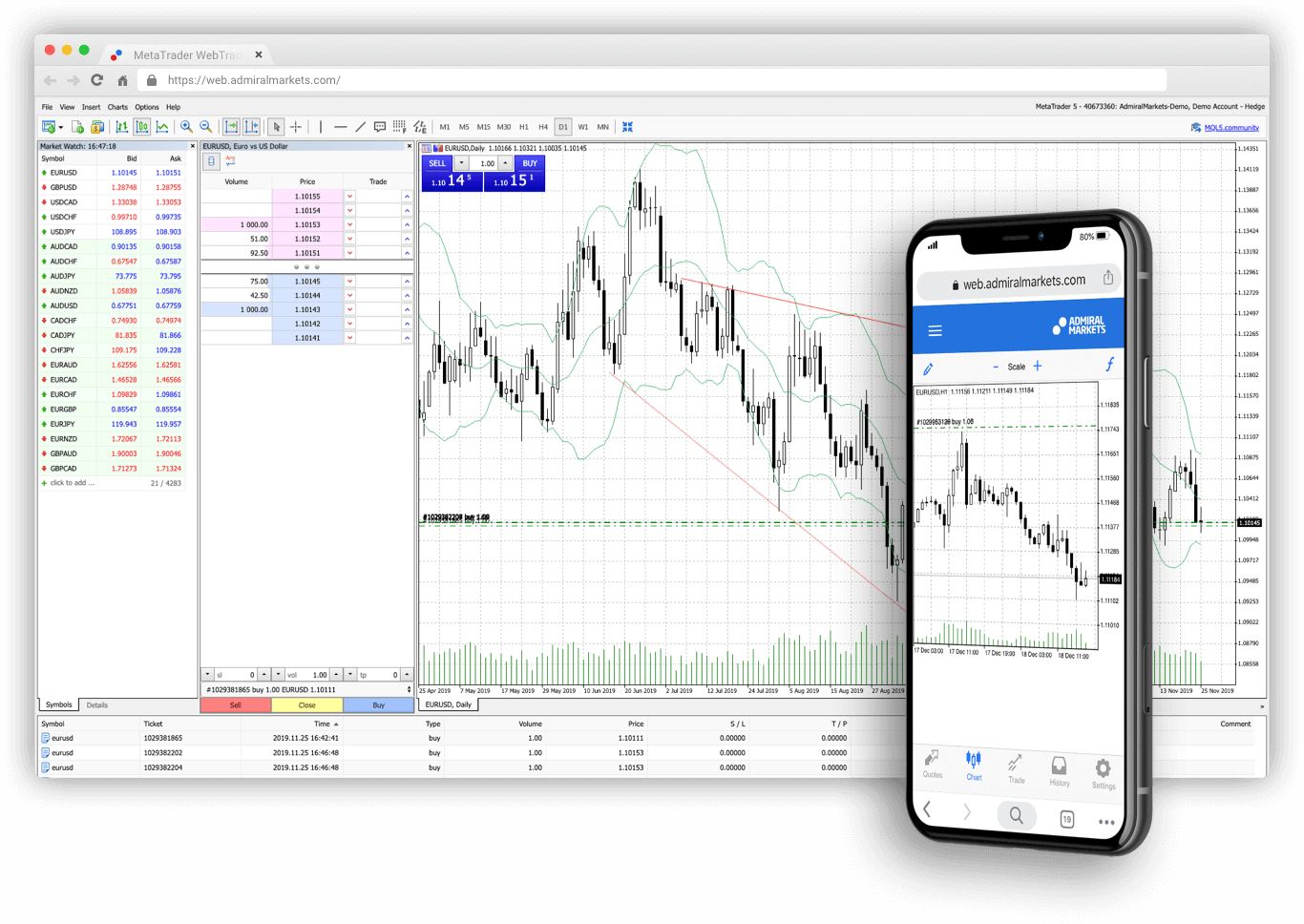

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs or bonds. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Trade and invest in 8,000+ markets today

Forex

47 cfds on currency pairs

Indices

20 index cfds, including cash cfds and index futures

Shares

3000+ share cfds, as well as the ability to invest in thousands of shares

Commodities

Cfds on metals, energies and agriculture commodities

Bonds

US treasuries and germany bund cfds

380+ ETF cfds, plus hundreds of etfs available through invest.MT5

Top trading conditions

Trade our best conditions yet, including some of the market`s most competitive spreads!

- Leverage up to:

- Retail clients: 1:30 - 1:20

- Forex typical spreads from 0.5 pips (EURUSD), micro lots and fractional shares

- Commission-free stocks and funds via cfds

- Free real-time charts, market news and research

- 4,000+ cfds on currencies, energies, metals, agricultures, indices, bonds, etfs & stocks.

- 4,500+ single shares and etfs

try it on demo

Why choose admiral markets?

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

Try demo trading

Not sure how to start? We`ve got you! Start practicing trading with virtual funds on the admiral markets demo trading account.

Get in touch

More questions? Contact us today!

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Contract specifications

- Margin requirements

- Volatility protection

- Invest.MT5

- Admiral markets card

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

All references on this site to ‘admiral markets’ refer jointly to admiral markets UK ltd, admiral markets cyprus ltd and admiral markets PTY ltd. Admiral markets’ investment firms are fully owned by admiral markets group AS.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Fxdailyreport.Com

The forex market is becoming increasingly popular every day. With over 3.5 trillion dollars traded on a daily basis, the market can be both risky and lucrative. There are many types of live forex trading accounts available in the market. Each of these various accounts come with their own rewards and downsides. Knowing the right trading account is the key to the successful trading experience.

As a beginner, you need to open up an account will a reliable forex trading company. But, how will you know the right account to meet your level of expertise? What is the best trading account suiting your needs? Below is a detailed guide on the different forex trading accounts.

1. Demo account

This is the entry point for all forex traders. This type of trading account is offered nearly by all forex brokers. It gives a trader a virtually equal experience to trade with fewer risks of losing funds. As a trader, you are allowed to test your trading strategy for viability, draw-downs and other performance procedures.

In addition, the demo account allows for an appraisal of the broker company providing the account without the requirement of real funds. A good number of forex trading companies will allow a trader to create a demo account without much commitment. The broker will only require a few personal details to complete the registration process.

- This account enables you to trade with liberty. The absence of actual funds implies you trade without any form of suppression.

- A second chance. In case you lose your trading account, there is a good chance to fix the problem and start trading. The capital risks are simulated and have no actual effect on your income.

- Limits. A demo trading account offers limited funds. In addition, there is a limit on the time you are allowed to trade over the platform. Once it expires, you will have to open up a new one.

- Easy to trade the wrong way. Since it’s a demo account, it’s very easy to mismanage it. Where there is freedom to trade the way you want, chances are you will overdo it.

- Profitable spreads: occasionally this trading account gives impractical spreads that are misleading.

2. Micro forex trading accounts

This type of accounts allows a trader to invest a small amount of capital. You can invest as low as $1-$10 to open up the account.

- Low risks-since you invest low amounts of capital, it becomes easier to control risk factors.

- Minimal profits-with a low investment, you get no benefits from the forex brokers.

3. Mini forex trading accounts

Just like its name suggests, the account is ideal for new traders who want to invest small amounts of money. You can trade with a personal investment ranging as low as$100. A large number of forex brokers provides a 400:1 leverage on this type of trading account. This means you can transact as more as $10000 with fewer risks on personal funds. As a result, a trader is likely to reap big more than their investments. The opposite is also true. You can lose a lot of money more than your personal investments. A trader s also allowed to use leverage with mini trading accounts. With higher leverages, you can easily access a substantial trade size equivalent to the actual funds.

- Fewer funds at risk. Accessibility is the major benefits of using this account. It’s affordable to many traders and allows for leverage meaning you can make good money even on a small investment.

- Low risk. Once you are done with a demo account, the mini trading account is an excellent option to jump into. It comes with low risks as compared to other live accounts.

• limited proceeds: despite its low risks in forex marketing, the gains are relatively low for an ambitious trader.

4. Standard forex trading accounts

This is the most typical type of forex trading account. Its name is attributed to the fact it allows traders to perform standard kind of transactions usually ranging within $10000. With this amount, you dot necessarily have to invest the whole amount. Instead, this forex trading account has a leverage of 100:1. As a trader, you can start with a capital of $1000. Depending on the brokerage firm, there are different requirements to create this type of account.

- Possible for realistic gain. Since you are required to invest big, there is a potential for a genuine gain.

- Extra services from the forex provider. Standard trading accounts generate good amounts of commissions. As a result, the brokerage firm offers more services as a way of maintaining their clients. For instance, a trader is allowed to access expert FX services, free deposit, bonuses among others.

- Possibility of a huge loss. The same way it’s easy to make huge proceeds, you can also incur huge losses. It’s a two-way traffic kind of trading. The combination of huge capital and leverage makes it ideal for expert traders only. It takes time before you know how to trade well.

- Larger capital investment: the minimal amount of capital required to invest in this type of account ranges from $1000. Only wealthy traders can afford a standard trading account.

5. Managed forex trading accounts

This is an automated type of trading account where a forex broker executes trades on behalf of the account holder. The role of the trader is limited to providing capital requirements only. The trader will contribute all the capital required but the management of the account lies with an expert forex company. Your work is to lay down the goals of trading while the account manager tries to achieve the goals. There are various ways of trading with managed trading accounts starting with social platforms all the way to in-house trader services.

- Potential for success- this account is ideal for both experts and beginners. Even with little knowledge in forex trading, having somebody trade on behalf means the good possibility to make money.

- Freedom: forex trading is complex and time-consuming. Having an expert trade for you means you can focus on other things far from the screen.

- The cost of liberty- you must pay a certain fee for somebody else to manage your trading account.

- Possible to lose. You are trading on someone else’s trust. This means you can incur losses out of a robot or human error.

6. VIP trading accounts

Also known as the premium, this type of trading account is ideal for the high rollers. Only traders who can raise a minimum of $10000 can open a VIP account.

- Lots of bonuses- traders enjoy up to 100% bonus on their deposits

- Additional services- VIP traders get access to other services such as travel benefits, debit cards, technical analyses among other benefits.

- Only loaded traders can afford to open this type of forex trading account.

- Potential for the big losses-the same way you can make big proceeds, you are also likely to lose.

Discover our

trading accounts

Choose the trading account that fits your trading goals

We offer a wide selection of standard and ECN accounts

Are you an experienced trader looking for market execution, competitive spreads and no requotes? Our ECN, ECN zero and pro accounts feature a range of benefits that are sure to fulfill your trading needs.

The standard account is our most traditional account, offering tight floating spreads, no commissions and instant execution. Under standard trading conditions, we also offer the cent account for anyone who wishes to invest the very minimum amount of capital.

Should your interests lie in the stock markets, our stocks cfds account offers the opportunity to trade major company names such facebook, apple and hundreds more. Have a closer look at our trading accounts below – we’re confident that you’ll find what you’re looking for.

Standard

Enjoy tight floating spreads and instant execution.

Standard account

- Tight floating spreads 1

- Leverage fixed per instrument

- Instant execution

- Hedging allowed

- Available in EUR, GBP, USD

- No hidden commissions

- SWAP-free option available

Cent account

- Tight floating spreads 1

- Leverage fixed per instrument

- Instant execution

- Available in EUR cents, GB pence, USD cents

- Min deposit only 10 EUR/USD/GBP

- Cent lots

- SWAP-free option available

Stock cfds account

- 120+ US shares

- 40+ european shares

- Fixed leverage 1:5 for US shares and 1:3 for european shares

- Instant execution

- Hedging allowed

- Available in EUR, GBP, USD

- No commissions

- SWAP-free option available

Get market execution and no requotes.

ECN zero account

- Now available:

FXTM invest4 new - No commission

- Tight floating spreads 1

- Leverage fixed per instrument 2

- Market execution – no re-quotes

- Hedging and scalping allowed

- Available in EUR, GBP and USD

- SWAP-free option available 3

ECN account

- Now available:

FXTM invest4 new - Spreads from 0.1 1

- Leverage fixed per instrument 2

- Market execution – no re-quotes

- Hedging and scalping allowed

- Available in EUR, GBP and USD

- Low commission starting from $4

- SWAP-free option available 3

FXTM pro account

- Tight spreads from 0 pips 1

- No commissions

- Ultra-fast market execution – no requotes

- Leverage fixed per instrument 2

- Deep liquidity directly from our tier-1 providers

- No last-look pricing

- SWAP-free option available 3

Trading leveraged products has the potential to increase losses as well as profits. Click here to read more and please trade carefully.

New FXTM invest allows investors to connect with your strategy for a fee. Read more about FXTM invest.

1 spread may increase depending on market conditions.

2 leverage is offered based on your knowledge and experience. The leverage / margin requirements may be subject to change as a result of applicable regulations in your country of residence.

3 swap-free option is not available for MT5 accounts.

4 FXTM invest is not available for MT5 accounts.

Policies & regulation

Policies & regulation

FXTM brand is authorized and regulated in various jurisdictions.

Forextime limited (www.Forextime.Com/eu) is regulated by the cyprus securities and exchange commission with CIF license number 185/12, licensed by the financial sector conduct authority (FSCA) of south africa, with FSP no. 46614. The company is also registered with the financial conduct authority of the UK with number 600475.

Forextime (www.Forextime.Com/uk) is authorised and regulated by the financial conduct authority with license number 777911.

Exinity limited (www.Forextime.Com) is regulated by the financial services commission of the republic of mauritius with an investment dealer license bearing license number C113012295.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Regional restrictions: FXTM brand does not provide services to residents of the USA, mauritius, japan, canada, haiti, suriname, the democratic republic of korea, puerto rico, brazil, the occupied area of cyprus and hong kong. Find out more in the regulations section of our faqs.

Trade with comfort on any device

Whether it`s windows or mac, android or ios, it doesn`t matter – we`ve got you covered!

Invest from just €1

Sign up for unlimited access to 4,000+ stocks from the new york stock exchange, nasdaq, FTSE and more - all without paying markups, rollovers, management or ticket fees.*

Some of the trademarks reflected on this page might be under trademark protection. Admiral markets does not have any direct relationship with the owners of these trademarks.

How it works

Register

Sign up with your name and email address to start trading

Start investing from €1, and start trading from just €100

Trade

Log in and start trading more than 8,000 instruments!

Trading

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs or bonds. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Metatrader: the #1 tool for traders and investors worldwide

Trade or invest in 8,000+ trading instruments: forex pairs and cfds on indices, commodities, shares, etfs or bonds. Available on both windows and mac.

Trade with admiral markets mobile app

Trade on-the-go with the admiral markets mobile trading app! You can monitor the markets, access charts, open and close trades and more from your gadget. Available for ios and android.

Metatrader webtrader platform

Trade anywhere, any time, without having to download any software. Whether you use a mac or a PC, you can tap into to the markets via your browser hassle-free, with the webtrader trading platform.

Trade and invest in 8,000+ markets today

Forex

47 cfds on currency pairs

Indices

20 index cfds, including cash cfds and index futures

Shares

3000+ share cfds, as well as the ability to invest in thousands of shares

Commodities

Cfds on metals, energies and agriculture commodities

Bonds

US treasuries and germany bund cfds

380+ ETF cfds, plus hundreds of etfs available through invest.MT5

Top trading conditions

Trade our best conditions yet, including some of the market`s most competitive spreads!

- Leverage up to:

- Retail clients: 1:30 - 1:20

- Forex typical spreads from 0.5 pips (EURUSD), micro lots and fractional shares

- Commission-free stocks and funds via cfds

- Free real-time charts, market news and research

- 4,000+ cfds on currencies, energies, metals, agricultures, indices, bonds, etfs & stocks.

- 4,500+ single shares and etfs

try it on demo

Why choose admiral markets?

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

We are global

Get support in your language, with 16 local offices and multilingual client support via phone, email and live chat

We are regulated

We are licensed by the world`s top regulators, in the UK, estonia, cyprus and australia

Funds are secured

All client deposits are kept separate from our own operating funds, plus we offer extra protection in a volatile market

Start from €1

You can invest in stocks from just €1, and start trading from just €100

Try demo trading

Not sure how to start? We`ve got you! Start practicing trading with virtual funds on the admiral markets demo trading account.

Get in touch

More questions? Contact us today!

- Account types

- Deposits & withdrawals

- Admiral markets pro

- Professional trading terms

- Demo account

- Stocks and etfs cfds

- Islamic forex account

- Trading calculator

- Fees

- Documents & policies

- Trading app

- Forex

- Commodities

- Indices

- Shares

- Etfs

- Bonds

- Contract specifications

- Margin requirements

- Volatility protection

- Invest.MT5

- Admiral markets card

- Forex & CFD webinars

- FAQ

- Trader`s glossary

- Forex & CFD seminars

- Risk management

- Articles & tutorials

- Zero to hero

- Forex 101

- Trading videos

- E-books

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets cyprus ltd or admiral markets PTY ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

All references on this site to ‘admiral markets’ refer jointly to admiral markets UK ltd, admiral markets cyprus ltd and admiral markets PTY ltd. Admiral markets’ investment firms are fully owned by admiral markets group AS.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

So, let's see, what we have: guide to forex trading accounts with top list and comparison of different types. A must read if you want to open an online forex trading account. At fx trading account

Contents

- Top forex bonus list

- Forex trading accounts

- The top 5 forex trading accounts in the united kingdom

- Which is the best forex trading account?

- Choosing a forex trading account based on your investment objectives

- Choosing a forex trading account based on what type of investor you are

- Forex trading account types

- Standard trading accounts

- Funded trading accounts

- Mini and micro trading accounts

- Managed trading accounts

- Islamic trading accounts

- VIP accounts

- Demo accounts

- Geographic considerations

- FOREX trading accounts

- Try a demo account

- Try a demo account

- Fxpro demo trading account

- Open a demo account

- Fxdailyreport.Com

- How to spot a forex scam

- Back in the day: the point-spread scam

- The signal-seller scam

- "robot" scamming in today’s market

- Other factors to consider

- The bottom line

- Trade with comfort on any device

- Invest from just €1

- How it works

- Register

- Trade

- Trading

- Metatrader: the #1 tool for traders and investors worldwide

- Trade with admiral markets mobile app

- Metatrader webtrader platform

- Metatrader: the #1 tool for traders and investors worldwide

- Trade with admiral markets mobile app

- Metatrader webtrader platform

- Trade and invest in 8,000+ markets today

- Top trading conditions

- Why choose admiral markets?

- We are global

- We are regulated

- Funds are secured

- Start from €1

- We are global

- We are regulated

- Funds are secured

- Start from €1

- Try demo trading

- Get in touch

- Fxdailyreport.Com

- Discover ourtrading accounts

- We offer a wide selection of standard and ECN accounts

- Standard

- Trade with comfort on any device

- Invest from just €1

- How it works

- Register

- Trade

- Trading

- Metatrader: the #1 tool for traders and investors worldwide

- Trade with admiral markets mobile app

- Metatrader webtrader platform

- Metatrader: the #1 tool for traders and investors worldwide

- Trade with admiral markets mobile app

- Metatrader webtrader platform

- Trade and invest in 8,000+ markets today

- Top trading conditions

- Why choose admiral markets?

- We are global

- We are regulated

- Funds are secured

- Start from €1

- We are global

- We are regulated

- Funds are secured

- Start from €1

- Try demo trading

- Get in touch

No comments:

Post a Comment